15 May 2023

// HEALTH ET

01 Dec 2022

// ECONOMICTIMES

09 Sep 2022

// EXPRESS PHARMA

KEY PRODUCTS

KEY PRODUCTS

Biophore is a research-driven global pharmaceutical company focused on niche APIs for the generic industry.

About

Industry Trade Show

Attending

23-26 March, 2026

Industry Trade Show

Attending

21-23 April, 2026

Industry Trade Show

Exhibiting

16-18 May, 2026

CONTACT DETAILS

Events

Webinars & Exhibitions

Industry Trade Show

Attending

23-26 March, 2026

Industry Trade Show

Attending

21-23 April, 2026

Industry Trade Show

Exhibiting

16-18 May, 2026

https://www.pharmacompass.com/speak-pharma/we-want-to-emerge-as-the-most-trusted-api-firm-in-complex-drug-molecule-segments

VLOG #PharmaReel

CORPORATE CONTENT #SupplierSpotlight

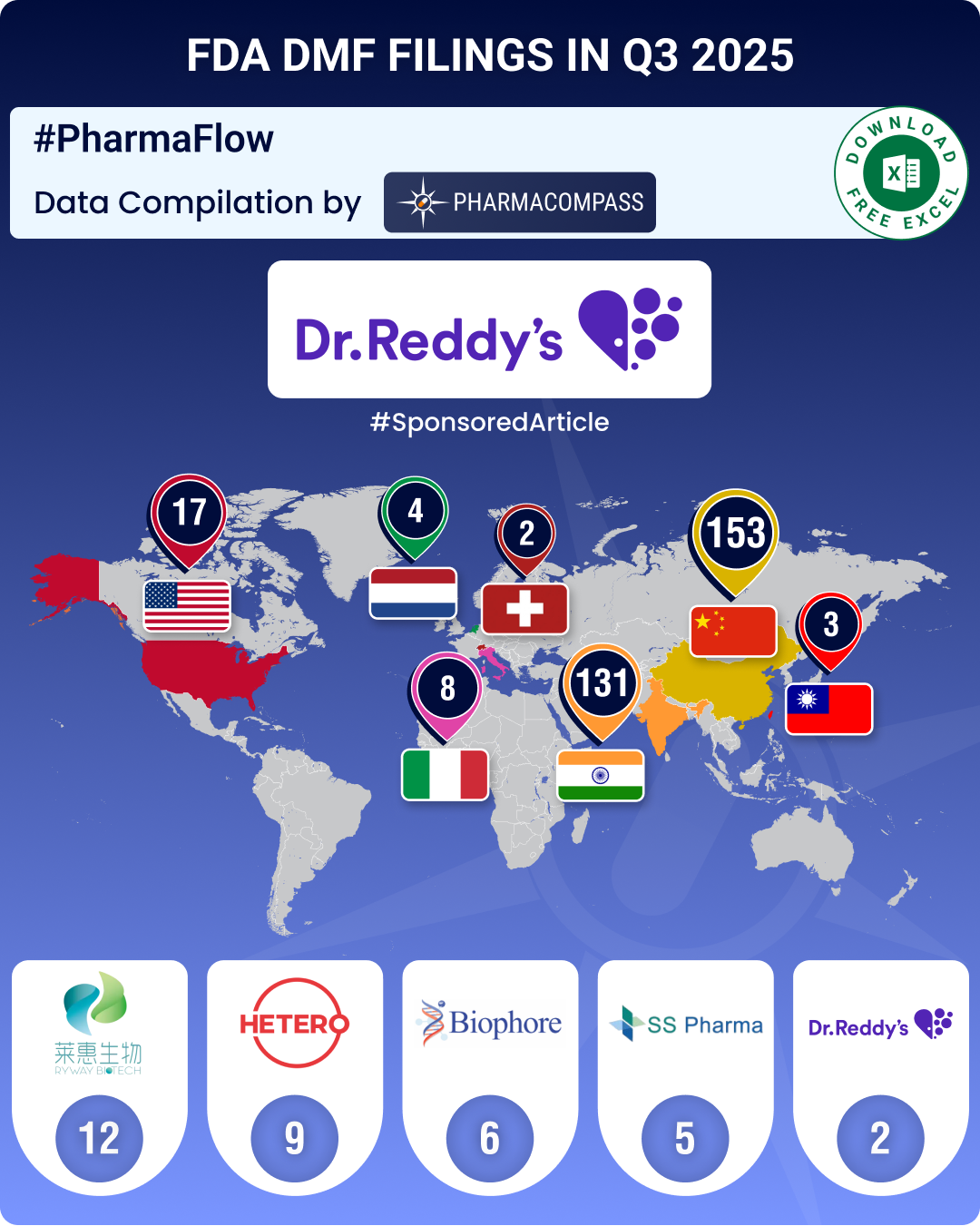

https://www.pharmacompass.com/radio-compass-blog/dmf-filings-rise-4-5-in-q3-2025-china-holds-lead-india-records-20-growth-in-submissions

https://www.pharmacompass.com/radio-compass-blog/dmf-filings-hit-all-time-high-in-q3-2024-china-tops-list-with-58-increase-in-type-ii-submissions

15 May 2023

// HEALTH ET

https://health.economictimes.indiatimes.com/news/pharma/drug-approvals-launches/biophore-its-subsidiary-zenara-pharma-receive-first-approval-for-cannabidiol-in-india/100251790

01 Dec 2022

// ECONOMICTIMES

https://health.economictimes.indiatimes.com/news/pharma/akums-enters-into-a-joint-association-with-leiutis-and-biophore-for-introducing-first-of-its-kind-therapeutics/95898429

09 Sep 2022

// EXPRESS PHARMA

https://www.expresspharma.in/zenara-pharma-launches-paxlovid-generic-for-covid-19-in-india/

29 Aug 2022

// BUSINESSWIRE

21 Jan 2022

// PHARMABIZ

21 Jan 2022

// BIOSPECTRUM

https://www.biospectrumindia.com/news/95/20420/biophore-to-manufacture-indigenous-ingredients-of-pfizers-covid-19-drug.html

GDUFA

DMF Review : Complete

Rev. Date : 2015-12-15

Pay. Date : 2015-09-29

DMF Number : 29830

Submission : 2015-09-29

Status : Active

Type : II

GDUFA

DMF Review : Complete

Rev. Date : 2014-02-28

Pay. Date : 2013-09-25

DMF Number : 27470

Submission : 2013-09-23

Status : Active

Type : II

GDUFA

DMF Review : Complete

Rev. Date : 2017-05-16

Pay. Date : 2017-04-27

DMF Number : 31478

Submission : 2017-04-26

Status : Active

Type : II

GDUFA

DMF Review : Complete

Rev. Date : 2025-06-20

Pay. Date : 2025-05-29

DMF Number : 41014

Submission : 2024-12-31

Status : Active

Type : II

GDUFA

DMF Review : Complete

Rev. Date : 2025-06-25

Pay. Date : 2025-05-29

DMF Number : 41393

Submission : 2025-02-28

Status : Active

Type : II

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 42714

Submission : 2025-09-30

Status : Active

Type : II

GDUFA

DMF Review : Complete

Rev. Date : 2025-10-22

Pay. Date : 2025-09-17

DMF Number : 41015

Submission : 2024-12-28

Status : Active

Type : II

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 32405

Submission : 2018-04-11

Status : Active

Type : II

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 38786

Submission : 2023-12-28

Status : Active

Type : II

GDUFA

DMF Review : Complete

Rev. Date : 2014-02-24

Pay. Date : 2013-09-25

DMF Number : 27483

Submission : 2013-09-20

Status : Active

Type : II

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results] Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Details:

Sertraline HCl, a miscellaneous product targeting SSR, shows promising results in treating undisclosed Key Focus Area.

Lead Product(s): Sertraline Hydrochloride

Therapeutic Area: Psychiatry/Psychology Brand Name: Sertraline-HCl

Study Phase: Approved FDFProduct Type: Miscellaneous

Sponsor: Undisclosed

Deal Size: Inapplicable Upfront Cash: Inapplicable

Deal Type: Inapplicable August 01, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Lead Product(s) : Sertraline Hydrochloride

Therapeutic Area : Psychiatry/Psychology

Highest Development Status : Approved FDF

Partner/Sponsor/Collaborator : Undisclosed

Deal Size : Inapplicable

Deal Type : Inapplicable

Details : Sertraline HCl, a miscellaneous product targeting SSR, shows promising results in treating undisclosed Key Focus Area.

Product Name : Sertraline-HCl

Product Type : Miscellaneous

Upfront Cash : Inapplicable

August 01, 2025

Details:

Alinia-Generic (nitazoxanide) is an antiprotozoal indicated for the treatment of diarrhea caused by giardia lamblia or cryptosporidium parvum.

Lead Product(s): Nitazoxanide

Therapeutic Area: Gastroenterology Brand Name: Alinia-Generic

Study Phase: Approved FDFProduct Type: Miscellaneous

Recipient: ANI Pharmaceuticals Inc

Deal Size: Inapplicable Upfront Cash: Inapplicable

Deal Type: Inapplicable March 19, 2025

Lead Product(s) : Nitazoxanide

Therapeutic Area : Gastroenterology

Highest Development Status : Approved FDF

Recipient : ANI Pharmaceuticals Inc

Deal Size : Inapplicable

Deal Type : Inapplicable

ANI Pharmaceuticals Announces the Launch of Nitazoxanide Tablets

Details : Alinia-Generic (nitazoxanide) is an antiprotozoal indicated for the treatment of diarrhea caused by giardia lamblia or cryptosporidium parvum.

Product Name : Alinia-Generic

Product Type : Miscellaneous

Upfront Cash : Inapplicable

March 19, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Details:

Cannabinoid oral solution has received approval for the treatment of several neurological disorders. It functions by stimulating two receptors, cannabinoid receptor type 1 and type 2, within the endocannabinoid system, maintaining body's homeostatis.

Lead Product(s): Cannabidiol

Therapeutic Area: Rare Diseases and Disorders Brand Name: Undisclosed

Study Phase: Approved FDFProduct Type: Controlled Substance

Sponsor: Undisclosed

Deal Size: Inapplicable Upfront Cash: Inapplicable

Deal Type: Inapplicable May 15, 2023

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Lead Product(s) : Cannabidiol

Therapeutic Area : Rare Diseases and Disorders

Highest Development Status : Approved FDF

Partner/Sponsor/Collaborator : Undisclosed

Deal Size : Inapplicable

Deal Type : Inapplicable

Biophore, Its Subsidiary Zenara Pharma, Receive First Approval for Cannabidiol in India

Details : Cannabinoid oral solution has received approval for the treatment of several neurological disorders. It functions by stimulating two receptors, cannabinoid receptor type 1 and type 2, within the endocannabinoid system, maintaining body's homeostatis.

Product Name : Undisclosed

Product Type : Controlled Substance

Upfront Cash : Inapplicable

May 15, 2023

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Details:

Paxzen (nirmatrelvir) is an oral protease inhibitor that is active against MPRO, a viral protease that plays an essential role in viral replication by cleaving the 2 viral polyproteins.

Lead Product(s): Nirmatrelvir,Ritonavir

Therapeutic Area: Infections and Infectious Diseases Brand Name: Paxzen

Study Phase: Approved FDFProduct Type: Miscellaneous

Sponsor: Undisclosed

Deal Size: Inapplicable Upfront Cash: Inapplicable

Deal Type: Inapplicable September 09, 2022

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Lead Product(s) : Nirmatrelvir,Ritonavir

Therapeutic Area : Infections and Infectious Diseases

Highest Development Status : Approved FDF

Partner/Sponsor/Collaborator : Undisclosed

Deal Size : Inapplicable

Deal Type : Inapplicable

Zenara Launches Generic Version Of Pfizer Covid Drug Paxlovid

Details : Paxzen (nirmatrelvir) is an oral protease inhibitor that is active against MPRO, a viral protease that plays an essential role in viral replication by cleaving the 2 viral polyproteins.

Product Name : Paxzen

Product Type : Miscellaneous

Upfront Cash : Inapplicable

September 09, 2022

Details:

The current annual U.S. market for Prochlorperazine Maleate Tablets USP, 5 mg and 10 mg is approximately $30.0 million, according to IQVIA/IMS Health, a leading healthcare data and analytics provider.

Lead Product(s): Prochlorperazine Maleate

Therapeutic Area: Psychiatry/Psychology Brand Name: Prochlorperazine Maleate-Generic

Study Phase: Approved FDFProduct Type: Miscellaneous

Recipient: ANI Pharmaceuticals Inc

Deal Size: Inapplicable Upfront Cash: Inapplicable

Deal Type: Inapplicable August 29, 2022

Lead Product(s) : Prochlorperazine Maleate

Therapeutic Area : Psychiatry/Psychology

Highest Development Status : Approved FDF

Recipient : ANI Pharmaceuticals Inc

Deal Size : Inapplicable

Deal Type : Inapplicable

ANI Pharmaceuticals Announces the Launch of Prochlorperazine Maleate Tablets USP

Details : The current annual U.S. market for Prochlorperazine Maleate Tablets USP, 5 mg and 10 mg is approximately $30.0 million, according to IQVIA/IMS Health, a leading healthcare data and analytics provider.

Product Name : Prochlorperazine Maleate-Generic

Product Type : Miscellaneous

Upfront Cash : Inapplicable

August 29, 2022

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Details:

Zenara said Nirmatrelvir and Ritonavir tablets will soon be available in a combi-pack, sold under the brand name Paxzen, as a treatment of mild-to-moderate Covid-19 in adults.

Lead Product(s): Nirmatrelvir,Ritonavir

Therapeutic Area: Infections and Infectious Diseases Brand Name: Paxzen

Study Phase: Approved FDFProduct Type: Miscellaneous

Sponsor: Pfizer Inc

Deal Size: Inapplicable Upfront Cash: Inapplicable

Deal Type: Inapplicable July 28, 2022

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Lead Product(s) : Nirmatrelvir,Ritonavir

Therapeutic Area : Infections and Infectious Diseases

Highest Development Status : Approved FDF

Partner/Sponsor/Collaborator : Pfizer Inc

Deal Size : Inapplicable

Deal Type : Inapplicable

Zenara Pharma to Launch Generic Paxlovid Soon

Details : Zenara said Nirmatrelvir and Ritonavir tablets will soon be available in a combi-pack, sold under the brand name Paxzen, as a treatment of mild-to-moderate Covid-19 in adults.

Product Name : Paxzen

Product Type : Miscellaneous

Upfront Cash : Inapplicable

July 28, 2022

Details:

The licences are applicable for both molnupiravir (API) and finished product in capsules form. It enables the company to launch the product within India as well as export to 104 other countries around the world, Biophore India Pharmaceuticals said in a statement.

Lead Product(s): Molnupiravir

Therapeutic Area: Infections and Infectious Diseases Brand Name: Undisclosed

Study Phase: Approved FDFProduct Type: Miscellaneous

Sponsor: The Medicines Patent Pool

Deal Size: Undisclosed Upfront Cash: Undisclosed

Deal Type: Licensing Agreement January 20, 2022

Lead Product(s) : Molnupiravir

Therapeutic Area : Infections and Infectious Diseases

Highest Development Status : Approved FDF

Partner/Sponsor/Collaborator : The Medicines Patent Pool

Deal Size : Undisclosed

Deal Type : Licensing Agreement

Biophore Receives Sub-License From MPP to Manufacture and Market Molnupiravir for Covid Treatment

Details : The licences are applicable for both molnupiravir (API) and finished product in capsules form. It enables the company to launch the product within India as well as export to 104 other countries around the world, Biophore India Pharmaceuticals said in a s...

Product Name : Undisclosed

Product Type : Miscellaneous

Upfront Cash : Undisclosed

January 20, 2022

Details:

Biophore has developed Aviptadil and is backward integrated with in-house API. The company has also informed that it will be commencing commercial production immediately after the approval is received.

Lead Product(s): Aviptadil Acetate

Therapeutic Area: Infections and Infectious Diseases Brand Name: Undisclosed

Study Phase: Phase IIIProduct Type: Peptide, Unconjugated

Sponsor: Undisclosed

Deal Size: Inapplicable Upfront Cash: Inapplicable

Deal Type: Inapplicable June 11, 2021

Lead Product(s) : Aviptadil Acetate

Therapeutic Area : Infections and Infectious Diseases

Highest Development Status : Phase III

Partner/Sponsor/Collaborator : Undisclosed

Deal Size : Inapplicable

Deal Type : Inapplicable

Biophore Applies For DCGI Approval for Emergency Use of Aviptadil to Treat COVID-19

Details : Biophore has developed Aviptadil and is backward integrated with in-house API. The company has also informed that it will be commencing commercial production immediately after the approval is received.

Product Name : Undisclosed

Product Type : Peptide, Unconjugated

Upfront Cash : Inapplicable

June 11, 2021

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Details:

Favipiravir tablets will be sold under the brand name ‘Favizen’, is being manufactured at Zenara’s US FDA approved facility in Hyderabad.

Lead Product(s): Favipiravir

Therapeutic Area: Infections and Infectious Diseases Brand Name: Favizen

Study Phase: Approved FDFProduct Type: Miscellaneous

Sponsor: Undisclosed

Deal Size: Inapplicable Upfront Cash: Inapplicable

Deal Type: Inapplicable August 05, 2020

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Lead Product(s) : Favipiravir

Therapeutic Area : Infections and Infectious Diseases

Highest Development Status : Approved FDF

Partner/Sponsor/Collaborator : Undisclosed

Deal Size : Inapplicable

Deal Type : Inapplicable

Zenara Pharma, a Biophore Subsidiary, Gets DCGI Nod for Favipiravir Tablets

Details : Favipiravir tablets will be sold under the brand name ‘Favizen’, is being manufactured at Zenara’s US FDA approved facility in Hyderabad.

Product Name : Favizen

Product Type : Miscellaneous

Upfront Cash : Inapplicable

August 05, 2020

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Regulatory Info :

Registration Country : India

Biophore India Pharmaceuticals Pvt Ltd

Dosage Form : Capsule

Brand Name :

Dosage Strength : 8MG

Packaging :

Approval Date :

Application Number :

Regulatory Info :

Registration Country : India

Regulatory Info :

Registration Country : India

Biophore India Pharmaceuticals Pvt Ltd

Dosage Form : Capsule

Brand Name :

Dosage Strength : 60MG

Packaging :

Approval Date :

Application Number :

Regulatory Info :

Registration Country : India

Regulatory Info :

Registration Country : India

Biophore India Pharmaceuticals Pvt Ltd

Dosage Form : Capsule

Brand Name :

Dosage Strength : 250MG

Packaging :

Approval Date :

Application Number :

Regulatory Info :

Registration Country : India

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Regulatory Info :

Registration Country : USA

Dosage Form : TABLET;ORAL

Brand Name : BREXPIPRAZOLE

Dosage Strength : 0.25MG

Packaging :

Approval Date :

Application Number : 213477

Regulatory Info :

Registration Country : USA

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Regulatory Info :

Registration Country : USA

Dosage Form : TABLET;ORAL

Brand Name : BREXPIPRAZOLE

Dosage Strength : 0.5MG

Packaging :

Approval Date :

Application Number : 213477

Regulatory Info :

Registration Country : USA

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Regulatory Info :

Registration Country : USA

Dosage Form : TABLET;ORAL

Brand Name : BREXPIPRAZOLE

Dosage Strength : 1MG

Packaging :

Approval Date :

Application Number : 213477

Regulatory Info :

Registration Country : USA

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Regulatory Info :

Registration Country : USA

Dosage Form : TABLET;ORAL

Brand Name : BREXPIPRAZOLE

Dosage Strength : 2MG

Packaging :

Approval Date :

Application Number : 213477

Regulatory Info :

Registration Country : USA

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Regulatory Info :

Registration Country : USA

Dosage Form : TABLET;ORAL

Brand Name : BREXPIPRAZOLE

Dosage Strength : 3MG

Packaging :

Approval Date :

Application Number : 213477

Regulatory Info :

Registration Country : USA

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Regulatory Info :

Registration Country : USA

Dosage Form : TABLET;ORAL

Brand Name : BREXPIPRAZOLE

Dosage Strength : 4MG

Packaging :

Approval Date :

Application Number : 213477

Regulatory Info :

Registration Country : USA

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Regulatory Info :

Registration Country : USA

Dosage Form : TABLET

Brand Name : CENOBAMATE

Dosage Strength : 50MG

Packaging :

Approval Date :

Application Number : 219403

Regulatory Info :

Registration Country : USA

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results] Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD :

TE Code :

Dosage Form : TABLET; ORAL

Proprietary Name : BREXPIPRAZOLE

Dosage Strength : 0.25MG

Approval Date :

Application Number : 213477

RX/OTC/DISCN :

RLD :

TE Code :

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD :

TE Code :

Dosage Form : TABLET; ORAL

Proprietary Name : BREXPIPRAZOLE

Dosage Strength : 0.5MG

Approval Date :

Application Number : 213477

RX/OTC/DISCN :

RLD :

TE Code :

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD :

TE Code :

Dosage Form : TABLET; ORAL

Proprietary Name : BREXPIPRAZOLE

Dosage Strength : 1MG

Approval Date :

Application Number : 213477

RX/OTC/DISCN :

RLD :

TE Code :

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD :

TE Code :

Dosage Form : TABLET; ORAL

Proprietary Name : BREXPIPRAZOLE

Dosage Strength : 2MG

Approval Date :

Application Number : 213477

RX/OTC/DISCN :

RLD :

TE Code :

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD :

TE Code :

Dosage Form : TABLET; ORAL

Proprietary Name : BREXPIPRAZOLE

Dosage Strength : 3MG

Approval Date :

Application Number : 213477

RX/OTC/DISCN :

RLD :

TE Code :

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD :

TE Code :

Dosage Form : TABLET; ORAL

Proprietary Name : BREXPIPRAZOLE

Dosage Strength : 4MG

Approval Date :

Application Number : 213477

RX/OTC/DISCN :

RLD :

TE Code :

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD :

TE Code :

Dosage Form : TABLET

Proprietary Name : CENOBAMATE

Dosage Strength : 50MG

Approval Date :

Application Number : 219403

RX/OTC/DISCN :

RLD :

TE Code :

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD :

TE Code :

Dosage Form : TABLET

Proprietary Name : CENOBAMATE

Dosage Strength : 200MG

Approval Date :

Application Number : 219403

RX/OTC/DISCN :

RLD :

TE Code :

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD :

TE Code :

Dosage Form : TABLET

Proprietary Name : CENOBAMATE

Dosage Strength : 100MG

Approval Date :

Application Number : 219403

RX/OTC/DISCN :

RLD :

TE Code :

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD :

TE Code :

Dosage Form : TABLET

Proprietary Name : CENOBAMATE

Dosage Strength : 25MG

Approval Date :

Application Number : 219403

RX/OTC/DISCN :

RLD :

TE Code :

Regulatory Info :

Registration Country : India

Biophore India Pharmaceuticals Pvt Ltd

Dosage Form : Capsule

Brand Name :

Dosage Strength : 8MG

Packaging :

Approval Date :

Application Number :

Regulatory Info :

Registration Country : India

Regulatory Info :

Registration Country : India

Biophore India Pharmaceuticals Pvt Ltd

Dosage Form : Capsule

Brand Name :

Dosage Strength : 60MG

Packaging :

Approval Date :

Application Number :

Regulatory Info :

Registration Country : India

Regulatory Info :

Registration Country : India

Biophore India Pharmaceuticals Pvt Ltd

Dosage Form : Capsule

Brand Name :

Dosage Strength : 250MG

Packaging :

Approval Date :

Application Number :

Regulatory Info :

Registration Country : India

Regulatory Info :

Registration Country : India

Biophore India Pharmaceuticals Pvt Ltd

Dosage Form : Tablet

Brand Name :

Dosage Strength : 25MG

Packaging :

Approval Date :

Application Number :

Regulatory Info :

Registration Country : India

Regulatory Info :

Registration Country : India

Biophore India Pharmaceuticals Pvt Ltd

Dosage Form : Tablet

Brand Name :

Dosage Strength : 50MG

Packaging :

Approval Date :

Application Number :

Regulatory Info :

Registration Country : India

Regulatory Info :

Registration Country : India

Biophore India Pharmaceuticals Pvt Ltd

Dosage Form : Tablet

Brand Name :

Dosage Strength : 100MG

Packaging :

Approval Date :

Application Number :

Regulatory Info :

Registration Country : India

Regulatory Info :

Registration Country : India

Biophore India Pharmaceuticals Pvt Ltd

Dosage Form : Tablet

Brand Name :

Dosage Strength : 200MG

Packaging :

Approval Date :

Application Number :

Regulatory Info :

Registration Country : India

Regulatory Info :

Registration Country : India

Biophore India Pharmaceuticals Pvt Ltd

Dosage Form : Tablet

Brand Name :

Dosage Strength : 250MG

Packaging :

Approval Date :

Application Number :

Regulatory Info :

Registration Country : India

Regulatory Info :

Registration Country : India

Biophore India Pharmaceuticals Pvt Ltd

Dosage Form : Tablet

Brand Name :

Dosage Strength : 375MG

Packaging :

Approval Date :

Application Number :

Regulatory Info :

Registration Country : India

Regulatory Info :

Registration Country : India

Biophore India Pharmaceuticals Pvt Ltd

Dosage Form : Tablet

Brand Name :

Dosage Strength : 500MG

Packaging :

Approval Date :

Application Number :

Regulatory Info :

Registration Country : India

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Biophore India Pharmaceuticals Pvt Ltd

CAS Number : 294-90-6

End Use API : Gadobutrol

About the Company : Biophore, founded in 2007, develops and manufactures niche and complex pharmaceutical products. With USFDA- and EU-appro...

Biophore India Pharmaceuticals Pvt Ltd

CAS Number : 294-90-6

End Use API : Gadoterate Meglumine

About the Company : Biophore, founded in 2007, develops and manufactures niche and complex pharmaceutical products. With USFDA- and EU-appro...

Biophore India Pharmaceuticals Pvt Ltd

CAS Number : 294-90-6

End Use API : Gadoteridol

About the Company : Biophore, founded in 2007, develops and manufactures niche and complex pharmaceutical products. With USFDA- and EU-appro...

Biophore India Pharmaceuticals Pvt Ltd

CAS Number : 60239-18-1

End Use API : Gadoterate Meglumine

About the Company : Biophore, founded in 2007, develops and manufactures niche and complex pharmaceutical products. With USFDA- and EU-appro...

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Services

API Manufacturing

Pharma Service : API Manufacturing

Pharma Service : API Manufacturing

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Pharma Service : API Manufacturing

Pharma Service : API Manufacturing

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Pharma Service : API Manufacturing

Pharma Service : API Manufacturing

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Drug Product Manufacturing

API & Drug Product Development

Pharma Service : API & Drug Product Development

Pharma Service : API & Drug Product Development

Pharma Service : API & Drug Product Development

Pharma Service : API & Drug Product Development

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Excipients

Inspections and registrations

ABOUT THIS PAGE

Biophore India Pharmaceuticals Pvt Ltd is a supplier offers 213 products (APIs, Excipients or Intermediates).

Find a price of Mexiletine bulk with DMF, CEP, WC offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Naphazoline Hydrochloride bulk with DMF, CEP, WC offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Cannabidiol bulk with DMF, WC offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Chlorambucil bulk with DMF, CEP offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Chlorpromazine Hydrochloride bulk with DMF, CEP offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Cladribine bulk with DMF, CEP offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Clomipramine Hydrochloride bulk with DMF, CEP offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Diazoxide bulk with DMF, CEP offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Dichlorphenamide bulk with DMF, WC offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Ethacrynic Acid bulk with DMF, CEP offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Favipiravir bulk with DMF, WC offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Fenoprofen Calcium bulk with DMF, WC offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Gadobutrol bulk with DMF, CEP offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Gadoteridol bulk with DMF, WC offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Isoproterenol Hydrochloride bulk with DMF, CEP offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Melphalan bulk with DMF, CEP offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Metolazone bulk with DMF, CEP offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Nadolol bulk with DMF, CEP offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Nilutamide bulk with DMF, CEP offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Nimodipine bulk with DMF, CEP offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Permethrin bulk with DMF, CEP offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Primidone bulk with DMF, CEP offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Procainamide Hydrochloride bulk with DMF, CEP offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Prochlorperazine Maleate bulk with DMF, CEP offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Ramelteon bulk with DMF, WC offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Safinamide Methanesulfonate bulk with DMF, WC offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Sapropterin Hydrochloride bulk with DMF, WC offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Tretinoin bulk with DMF, CEP offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Valsartan bulk with DMF, CEP offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Vitamin K1 bulk with DMF, CEP offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Acrivastine bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Alosetron Hydrochloride bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Aminocaproic Acid bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Asciminib bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Ataluren bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Avatrombopag Maleate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Belinostat bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Bempedoic Acid bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Bendamustine Hydrochloride bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Benserazide Hydrochloride bulk with CEP offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Bilastine bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Bortezomib bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Brexpiprazole bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Cannabidiol bulk with WC offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Carfilzomib bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Cariprazine Hydrochloride bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Cenobamate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Cetrorelix Acetate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Chlorzoxazone bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Cladribine bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Clofarabine bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Copper Sulphate Pentahydrate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Crisaborole bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Cyclen bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Cysteamine Bitartrate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Dantrolene bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Decitabine bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Diatrizoate Meglumine bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Diatrizoate Sodium bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Dichlorphenamide bulk with WC offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Dimethyl Fumarate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Disodium Hydrogen Phosphate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Docosanol bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of DOTA bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Edaravone bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Edoxaban Tosylate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Elagolix Sodium bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Eliglustat bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Eltrombopag bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Ertugliflozin bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Erythromycin Lactobionate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Ethacrynic Acid bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Ethiodized Oil bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Favipiravir bulk with WC offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Fenfluramine Hydrochloride bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Fenoprofen Calcium bulk with WC offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Ferric Citrate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Fluorescein bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Fluphenazine bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Fosaprepitant bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Frovatriptan Succinate Hydrate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Gadolinium Dtpa bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Gadolinium Ethoxybenzyl Dtpa bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Gadoterate Meglumine bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Gadoteridol bulk with WC offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Icatibant Acetate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Indapamide bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Indigo Carmine bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Indocyanine Green bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Iron Sucrose bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Isavuconazonium Sulfate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Isosulfan Blue bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Isotretinoin bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of L-Glutamine bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Letermovir bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Lotilaner bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Manganese Sulfate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Maralixibat Chloride bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Mavacamten bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Melphalan Hydrochloride bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Methazolamide bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Methyltyrosine bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Mexiletine bulk with WC offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Mitapivat bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Molnupiravir bulk with WC offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Monosodium Phosphate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Naphazoline Hydrochloride bulk with WC offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Naphazoline Nitrate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Nelarabine bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Niraparib Tosylate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Nitazoxanide bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Nitisinone bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Obeticholic Acid bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Olaparib bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Palbociclib bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Penicillamine bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Pentetic Acid bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Pimavanserin Tartrate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Pitolisant Hydrochloride bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Plerixafor bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Potassium Dihydrogen Phosphate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Potassium Phosphate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Prochlorperazine bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Prochlorperazine Edisylate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Prucalopride Succinate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Ramelteon bulk with WC offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Regadenoson Monohydrate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Resmetirom bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Riociguat bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Risdiplam bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Rucaparib Camsylate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Rupatadine Fumarate bulk with CEP offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Ruxolitinib Phosphate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Safinamide Methanesulfonate bulk with WC offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Sapropterin Hydrochloride bulk with WC offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Selenious Acid bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Selexipag bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Sincalide bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Sodium Nitroprusside bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Sodium Thiosulfate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Sugammadex Sodium bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Suvorexant bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Tafamidis bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Tafamidis Meglumine bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Tavaborole bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Tegaserod bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Temozolomide bulk with CEP offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Terazosin HCl bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Thiamine Hydrochloride bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Tiopronin bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Tipiracil Hydrochloride bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Tolvaptan bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Trientine Hydrochloride bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Trientine Tetrahydrochloride bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Trifluridine bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Urapidil Hydrochloride bulk with WC offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Viloxazine Hydrochloride bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Vitamin K1 bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Zileuton bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Zinc Sulfate Heptahydrate bulk with DMF offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Abemaciclib bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Acitretin bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Acoramidis Hydrochloride bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Adagrasib bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Agomelatine bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Amorolfine Hydrochloride bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Apomorphine Hydrochloride bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Avapritinib bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Calcium Gluconate bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Calcobutrol bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Capivasertib bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Copper Sulfate bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Darolutamide bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Delgocitinib bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Dofetilide bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Elacestrant bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Elafibranor bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Ethacrynate Sodium bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Fezolinetant bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Fluorescein Sodium bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Fruquintinib bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Gadobenic Acid bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Iodixanol bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Iohexol bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Iopamidol bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Lanreotide Acetate bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Lazertinib bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Lercanidipine Hydrochloride bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Levothyroxine Sodium bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Liothyronine Sodium bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Lorlatinib bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Melatonin bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Methylene Blue bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Momelotinib Hydrochloride bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Nirmatrelvir bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Osilodrostat Phosphate bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Potassium Phosphate bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Ribociclib bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Ritlecitinib bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Seladelpar Lysine bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Selumetinib bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Sepiapterin bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Sildenafil Citrate bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Sparsentan bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Sulfobutylether-β-Cydodextrin (SBECD) bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Suzetrigine bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Taurolidine bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Trofinetide bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Vigabatrin bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Vismodegib bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Xanomeline bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Zinc Sulphate bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Find a price of Zofenopril Calcium bulk offered by Biophore India Pharmaceuticals Pvt Ltd

Biophore India Pharmaceuticals Pvt Ltd

Biophore India Pharmaceuticals Pvt Ltd