Stock Recap #PipelineProspector

Pipeline Prospector Jan 2026 highlights: Astra, CSPC sign up to US$ 18.5 bn obesity deal; Wegovy’s pill version debuts in US

The

year 2026 began amid heightened geopolitical tensions, particularly over

Greenland. The US Pre

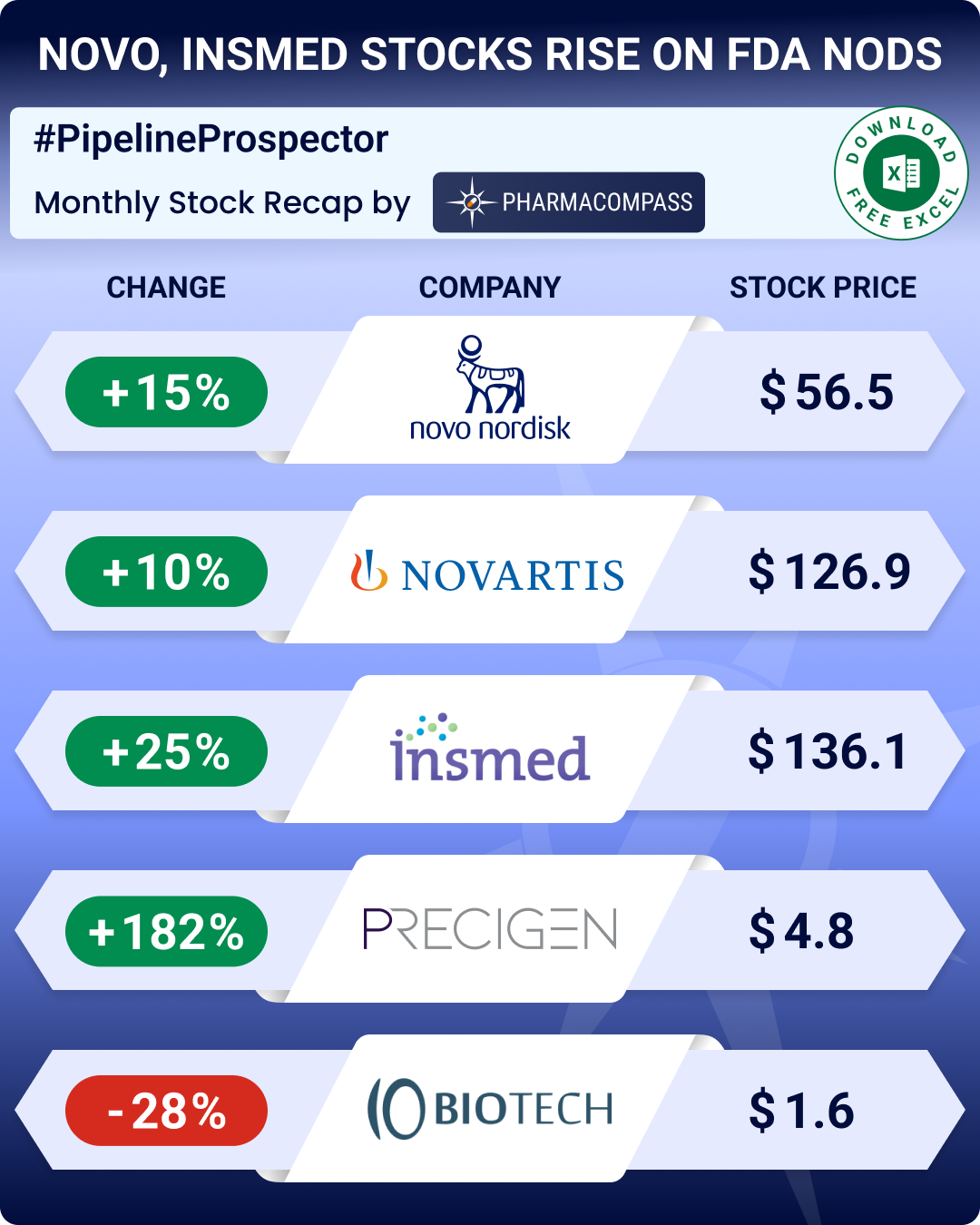

Pipeline Prospector 2025 highlights: FDA approves pill version of Novo’s Wegovy; BioMarin acquires Amicus for US$ 4.8 bn

Even though the biotech indices delivered strong gains through 2025, December closed on a muted note

Pipeline Prospector November 2025: Kimberly-Clark to buy Kenvue for US$ 48.7 bn; FDA approves Novartis’ gene therapy

November saw several big ticket

acquisitions across the consumer health and biopharma space, includ

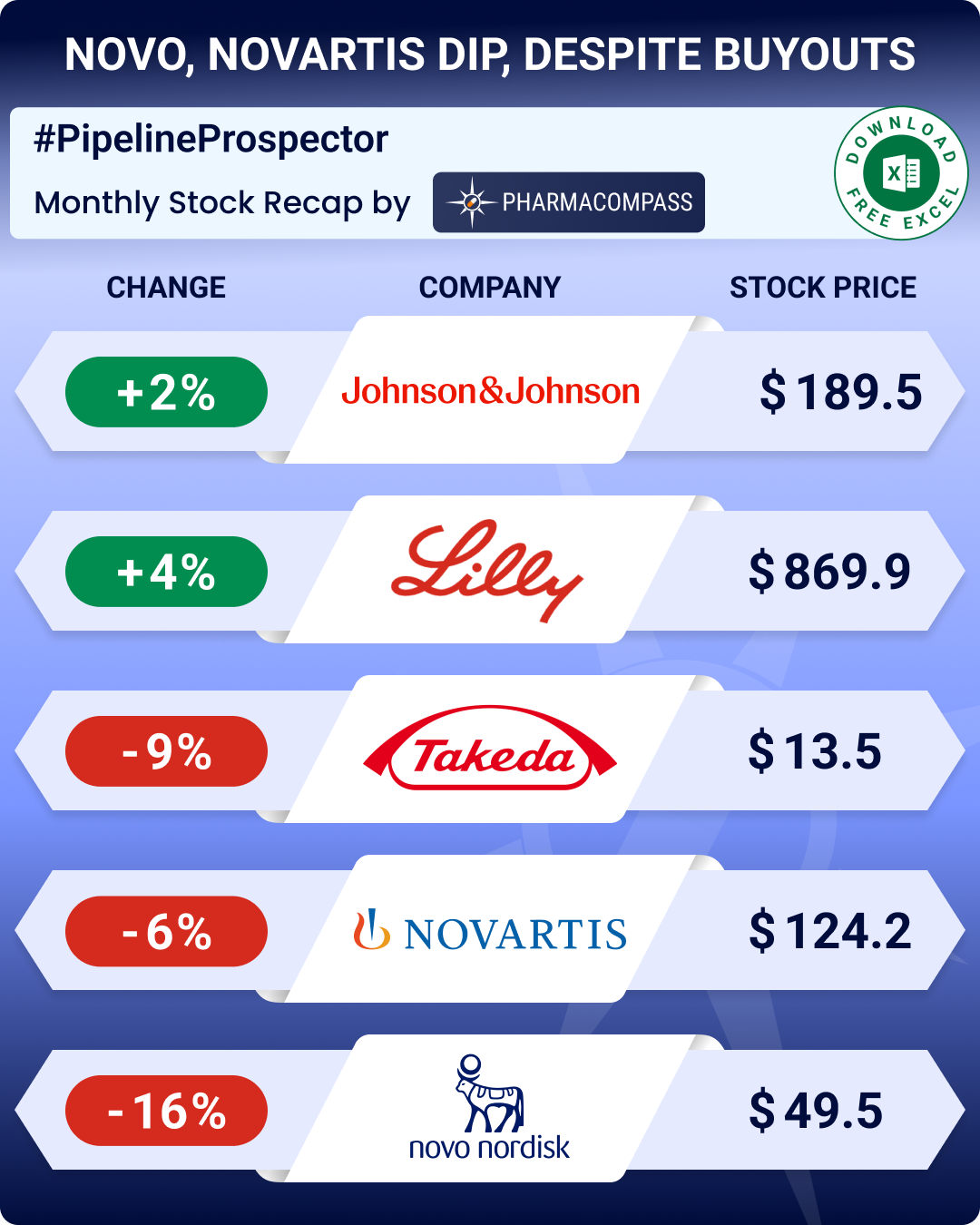

Pipeline Prospector October 2025: Novartis to buy Avidity for US$ 12 bn; FDA approves Bayer’s med to treat hot flashes

October was abuzz

with dealmaking. Pharma majors such as Novartis, Novo Nordisk, and Bristol Myers

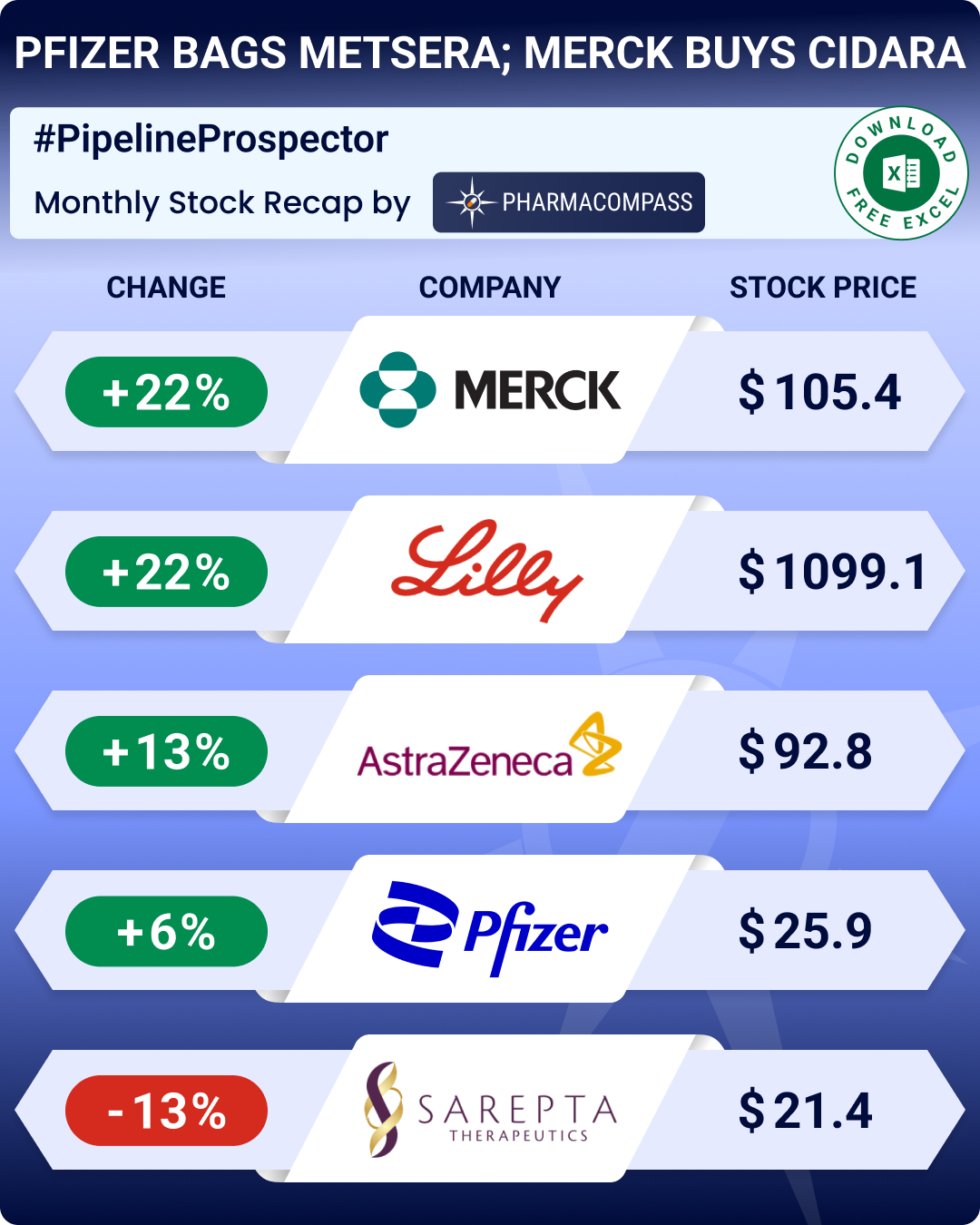

Pipeline Prospector September 2025: Genmab buys Merus for ~US$ 8 billion, Pfizer buys Metsera to enter obesity race

September saw a major clampdown on imports of “branded or patented drugs” into the US, t

Pipeline Prospector August 2025: Novo’s Wegovy approved for MASH, Tonix Pharma’s fibromyalgia drug okayed

In

August, the global pharmaceutical industry witnessed several regulatory

upheavals and policy sh

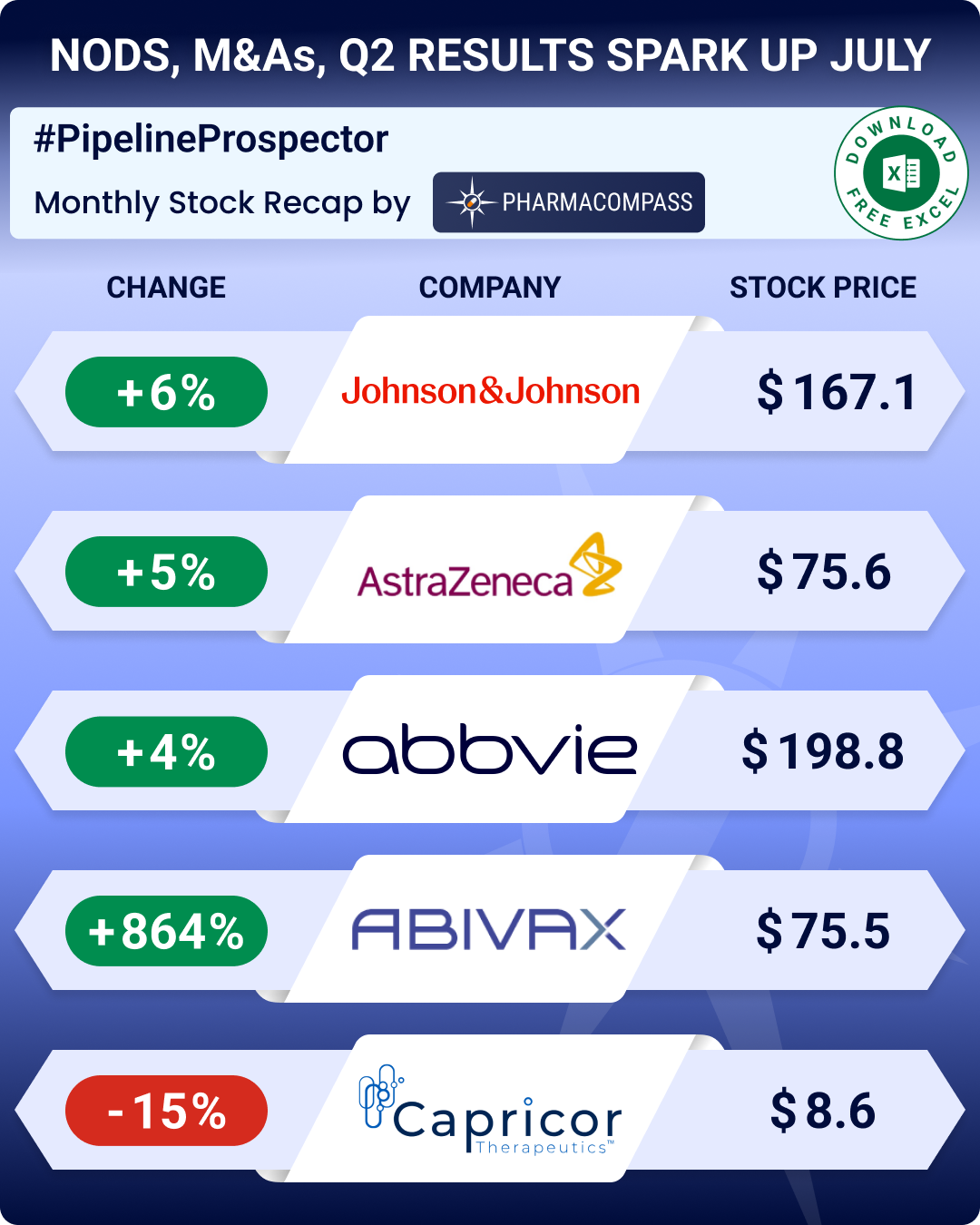

Pipeline Prospector July 2025: Merck to acquire Verona for US$ 10 bn; FDA okays Regeneron’s blood cancer med

In July, the pharmaceutical industry witnessed several deals and mergers and acquisitions (M&As). Bi

Pipeline Prospector June 2025: Sanofi, AbbVie, Eli Lilly, BioNTech lead pharma M&A spree; BMS, Astra ink major collaborations

In June, the pharmaceutical industry continued to witness more merger and acquisitions, deals, and g

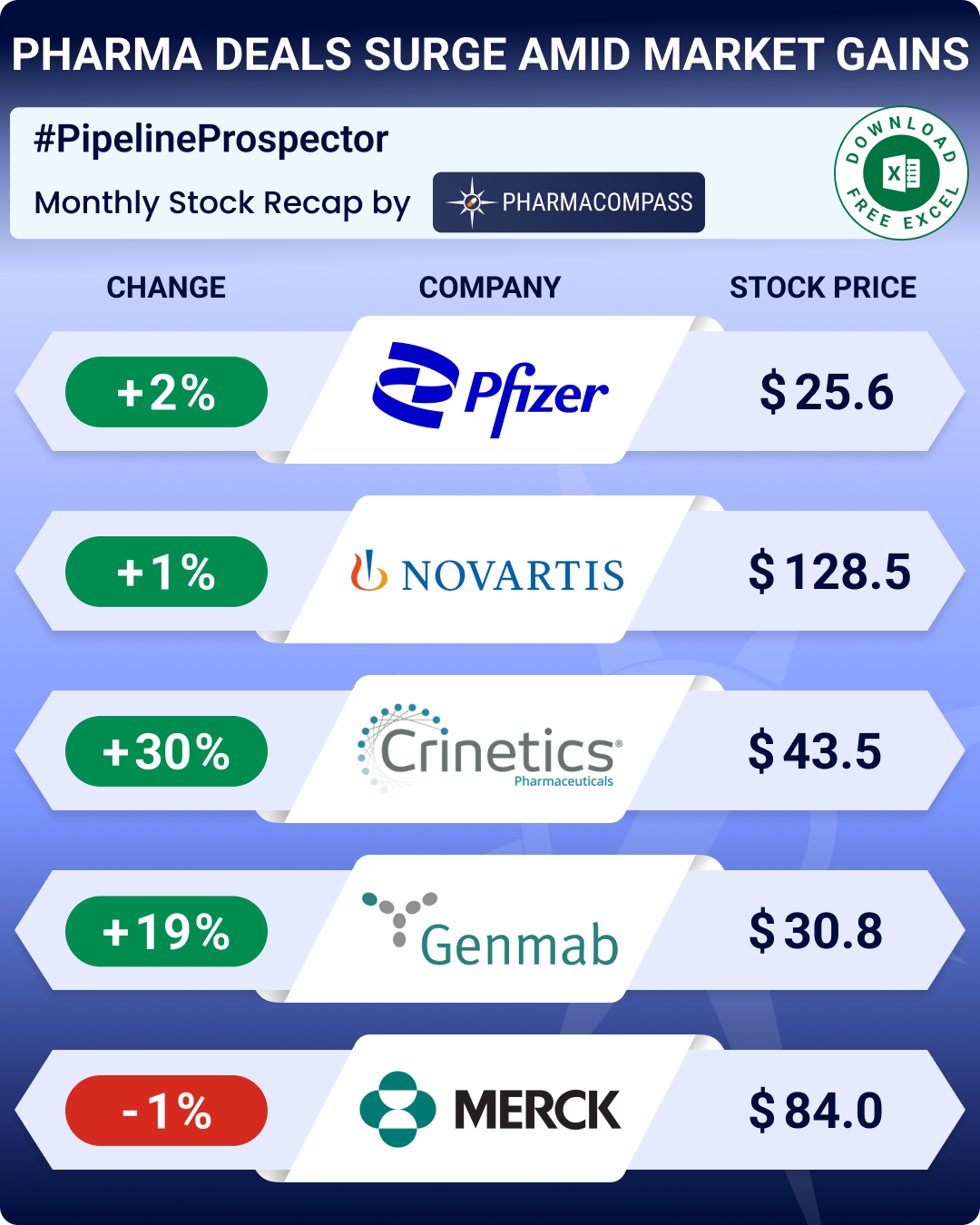

Pipeline Prospector May 2025: Pfizer strikes US$ 6 bn oncology pact; Lilly diversifies pipeline with US$ 2.3 bn in deals

The month of May saw investors grow increasingly cautious. This resulted in a dip in the biotech ind

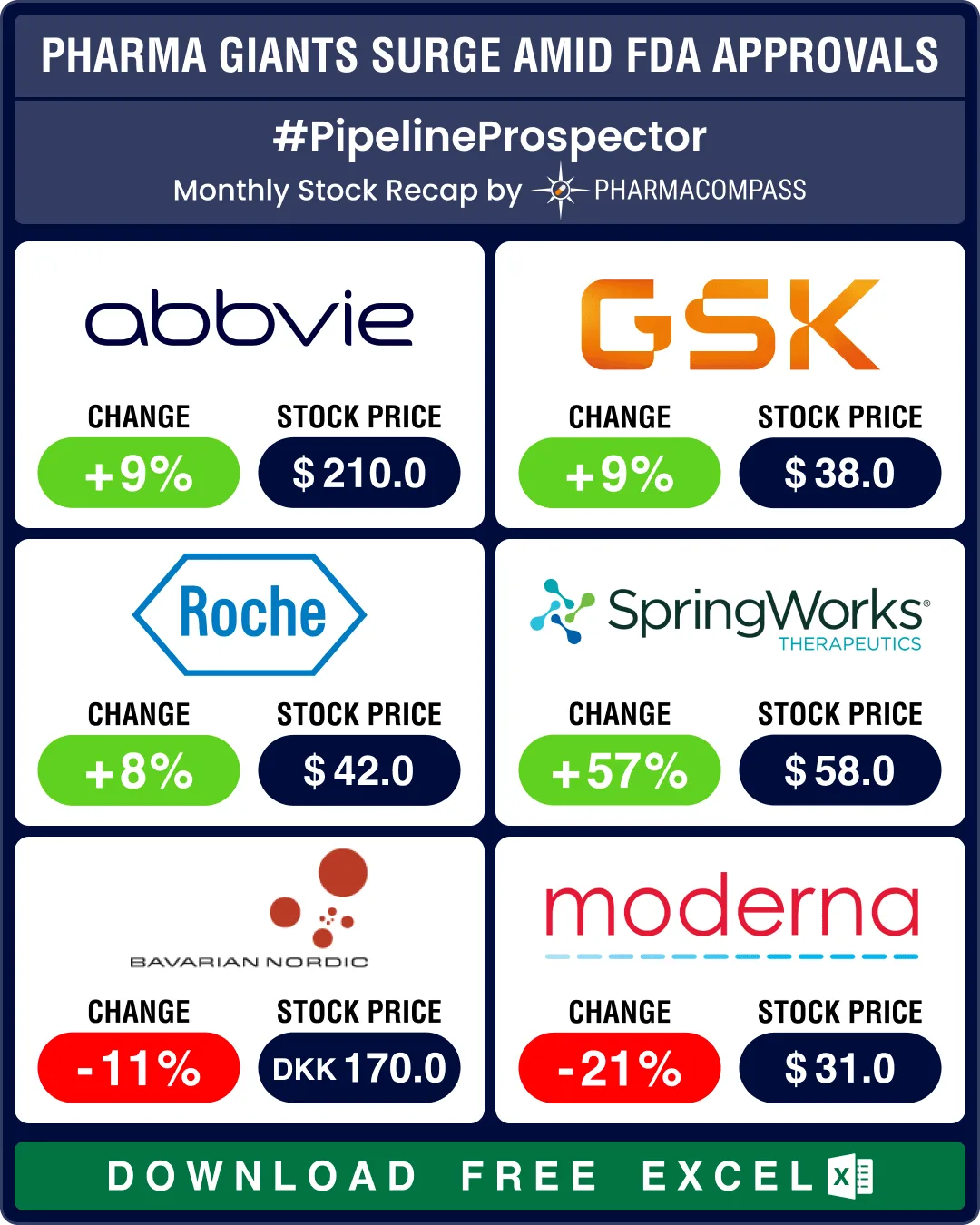

Pipeline Prospector April 2025: Merck KGaA buys SpringWorks for US$ 3.9 bn; Swiss giants lead pharma migration to US soil

April witnessed considerable volatility in pharmaceutical stocks as the US President Donald Trump&rs

Pipeline Prospector March 2025: Trump’s FDA overhaul spooks biotech stocks; Roche, AbbVie, Novo ink obesity drug deals

March ended with news that the top vaccine regulator of the US

Food and Drug Administration (FDA),

Pipeline Prospector Feb 2025: Bain buys Mitsubishi Tanabe for US$ 3.4 bn; Japan’s Ono gets FDA nod for rare joint tumor drug

February was a mixed bag for biopharma indices, underscoring the volatility and uncertainty in the s

Pipeline Prospector Jan 2025: J&J’s US$ 14.6 bn Intra-Cellular buyout kicks off deal frenzy; Ozempic clinches FDA nod for CKD

January was a busy month that saw several deals being announced at the JP Morgan Healthcare Conferen

Pipeline Prospector 2024 highlights: Rise in new breed of biotechs with maiden approvals; GLP-1 meds show promise beyond obesity

December proved to be one of the most bearish months of 2024 for the biopharma sector. The Nasdaq Bi

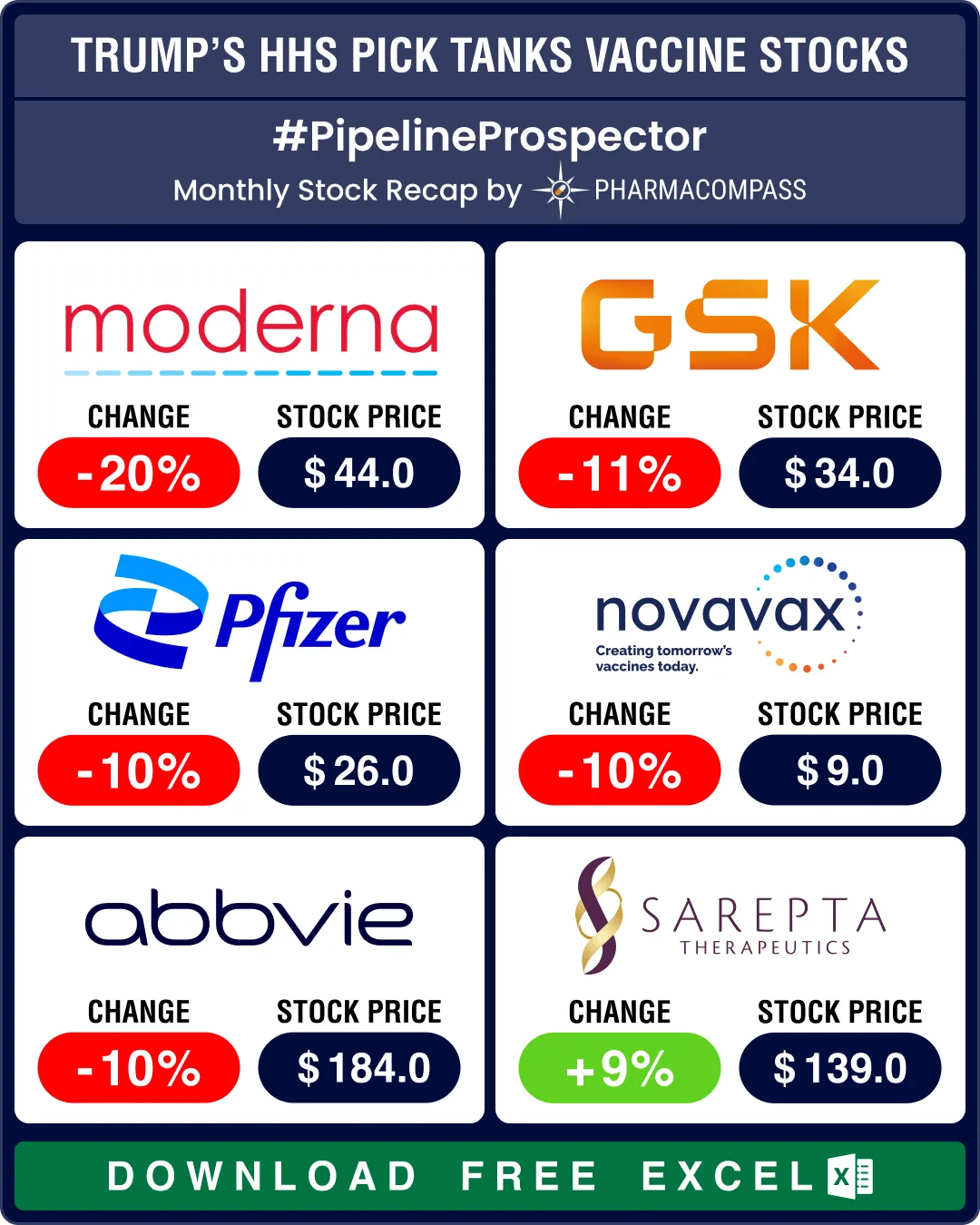

Pipeline Prospector Nov 2024: Trump’s HHS pick drags down jab makers’ stocks; Novartis, Merck, Roche ink billion-dollar deals

In November, the markets responded to US President-elect Donald Trump’s picks, particularly th

Pipeline Prospector Oct 2024: Lundbeck acquires Longboard for US$ 2.6 bn; molecular glue degrader tech witnesses dealmaking

In October, several pharma companies posted their third quarter (Q3) results. Drugmakers like Pfizer

Pipeline Prospector Sept 2024: BMS wins landmark FDA approval for schizophrenia med; Sanofi’s Dupixent okayed for COPD

Pharma indices settled slightly lower in September after four months of solid gains. The three major

Pipeline Prospector Aug 2024: Otsuka buys Jnana, Lilly’s market cap gains by over US$ 108 bn post new guidance

As summer draws to a close, pharma and biotech indices posted their fourth consecutive month in the

Pipeline Prospector July 2024: Indices continue to climb; Lilly buys Morphic for US$ 3.2 bn, Kisunla bags FDA nod

The biotechnology sector ended in the green for the third month in a row in July, significantly outp

Pipeline Prospector June 2024: FDA approves Merck’s next-gen pneumococcal vaccine, Verona’s COPD therapy

The pharma indices were back in the black in May, and the good streak continued through June with th

Pipeline Prospector May 2024: J&J inks two deals for eczema drugs; Novo scores trial wins in hemophilia, kidney disease

Pharma indices have rebounded after ending March and April in the red. May saw the Nasdaq Biotechnol

Pipeline Prospector April 2024: Indices dip amid muted Q1 results; Vertex acquires Alpine Immune for US$ 4.9 bn

Pharma indices had begun to recede in March. Their red streak accelerated in April with the Nasdaq B

Pipeline Prospector March 2024: FDA approves pathbreaking NASH drug from Madrigal, two meds for PAH

March was clearly a month of drug approvals, as the US Food and

Drug Administration (FDA) went on a

Pipeline Prospector Feb 2024: Novo’s parent buys Catalent for US$ 16.5 bn, FDA okays Iovance’s cell therapy

February was a good month for the pharma sector, complete with some important deals, successes from

Pipeline Prospector Jan 2024: Vertex’s non-opioid painkiller succeeds in trials; Sanofi buys Inhibrx for US$ 2.2 bn

The New Year got off to a stable start, with some good news

trickling in from clinical trials and B

Pipeline Prospector 2023 highlights: Obesity drugs perk up Lilly, Novo sales; ADCs spur dealmaking

The year 2023 was marked by volatility. The good news is that despite factors like inflation, intere

Pipeline Prospector Nov 2023: Lilly, Novo post sharp rise in Q3 sales; AbbVie buys ImmunoGen for US$ 10.1 billion

Through much of 2023, markets remained volatile, with pharma indices managing to inch up only in som

Market Place

Market Place Sourcing Support

Sourcing Support