02 Mar 2026

// ECONOMICTIMES

25 Feb 2026

// FDA

25 Feb 2026

// ECONOMICTIMES

KEY PRODUCTS

KEY PRODUCTS

DRL offers a portfolio of products & services, including APIs, CMO services, generics, biosimilars & differentiated formulations.

About

Product(s) under patent(s) are offered only for R&D purposes U/S 107A of the Patent Act and not for commercial sale

Industry Trade Show

Lotte New York Palace

23-26 March, 2026

MAGHREB Pharma ExpoMAGHREB Pharma Expo

Industry Trade Show

Attending

21-23 April, 2026

Industry Trade Show

Exhibiting

21-23 April, 2026

CONTACT DETAILS

Events

Webinars & Exhibitions

Industry Trade Show

Lotte New York Palace

23-26 March, 2026

MAGHREB Pharma ExpoMAGHREB Pharma Expo

Industry Trade Show

Attending

21-23 April, 2026

Industry Trade Show

Exhibiting

21-23 April, 2026

VLOG #PharmaReel

CORPORATE CONTENT #SupplierSpotlight

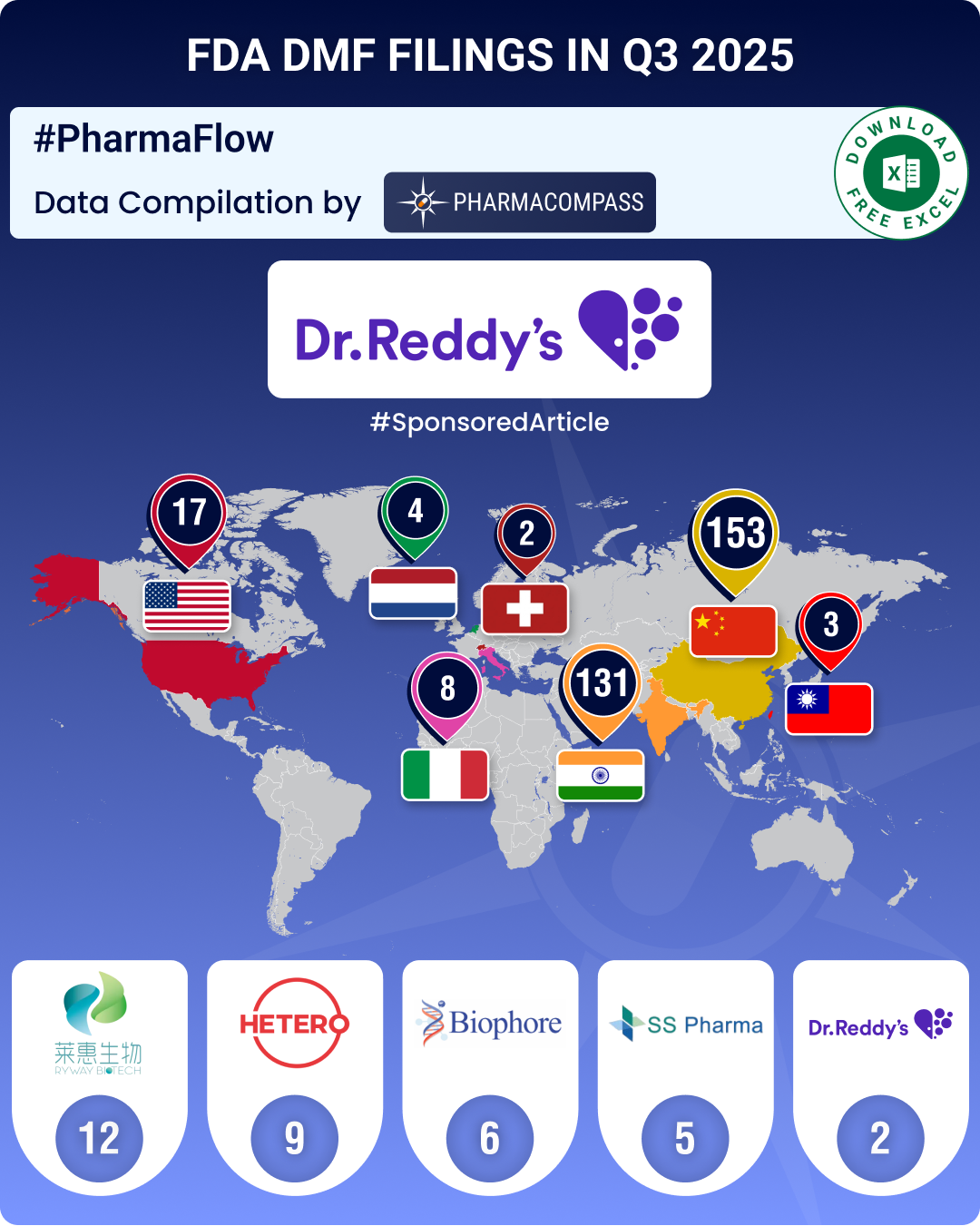

https://www.pharmacompass.com/radio-compass-blog/dmf-filings-rise-4-5-in-q3-2025-china-holds-lead-india-records-20-growth-in-submissions

https://www.pharmacompass.com/radio-compass-blog/us-drug-shortages-reduce-16-yoy-in-q1-2025-cns-drugs-antimicrobials-face-highest-scarcities

https://www.pharmacompass.com/radio-compass-blog/dmf-filings-surge-44-in-q1-2025-india-tops-list-with-51-rise-in-year-on-year-submissions

https://www.pharmacompass.com/radio-compass-blog/fda-s-first-generic-approvals-slump-21-in-2024-novartis-top-seller-entresto-cancer-blockbuster-tasigna-lead-2024-patent-cliff

https://www.pharmacompass.com/radio-compass-blog/fda-okays-50-new-drugs-in-2024-bms-cobenfy-lilly-s-kisunla-lead-pack-of-breakthrough-therapies

https://www.pharmacompass.com/radio-compass-blog/cdmo-activity-tracker-bora-polpharma-make-acquisitions-evonik-euroapi-porton-announce-technological-expansions

https://www.pharmacompass.com/radio-compass-blog/chinese-fda-registered-generic-facilities-gain-steam-india-maintains-lead-with-396-facilities

https://www.pharmacompass.com/radio-compass-blog/dmf-filings-hit-all-time-high-in-q3-2024-china-tops-list-with-58-increase-in-type-ii-submissions

https://www.pharmacompass.com/radio-compass-blog/cdmo-activity-tracker-novo-s-parent-buys-catalent-for-us-16-5-bn-fujifilm-merck-kgaa-axplora-lonza-expand-capabilities

https://www.pharmacompass.com/radio-compass-blog/fda-approves-record-eight-biosimilars-in-h1-2024-okays-first-interchangeable-biosimilars-for-eylea

https://www.pharmacompass.com/radio-compass-blog/dmf-submissions-from-china-jump-42-as-india-continues-to-top-list-in-q1-2024

02 Mar 2026

// ECONOMICTIMES

https://economictimes.indiatimes.com/industry/healthcare/biotech/pharmaceuticals/glenmark-set-to-join-peers-in-semaglutide-push/articleshow/128925002.cms

25 Feb 2026

// FDA

https://www.accessdata.fda.gov/scripts/cder/daf/index.cfm?event=overview.process&ApplNo=220315

25 Feb 2026

// ECONOMICTIMES

https://economictimes.indiatimes.com/industry/healthcare/biotech/pharmaceuticals/indias-weight-loss-drugs-to-get-cheaper-as-semaglutide-patent-expires/articleshow/128776176.cms

23 Feb 2026

// ECONOMICTIMES

https://economictimes.indiatimes.com/industry/healthcare/biotech/pharmaceuticals/biosimilars-innovation-are-dr-reddys-growth-pill-generics-to-remain-core-business-says-co-chairman-md-gv-prasad/articleshow/128687416.cms

20 Feb 2026

// PRESS RELEASE

https://www.drreddys.com/cms/sites/default/files/2026-02/FinalPressRelease_USFDAAcceptsAbataceptFiling2_19_26vrsn4.pdf

18 Feb 2026

// ECONOMICTIMES

https://economictimes.indiatimes.com/industry/healthcare/biotech/pharmaceuticals/dr-reddys-readies-day-1-launch-of-semaglutide-generic/articleshow/128523906.cms

Certificate Numbers : CEP 2011-222 - Rev 02

Status : Valid

Issue Date : 2023-09-11

Type : Chemical

Substance Number : 2191

Certificate Numbers : R1-CEP 2014-109 - Rev 02

Status : Valid

Issue Date : 2022-09-13

Type : Chemical

Substance Number : 2762

Certificate Numbers : R1-CEP 2014-203 - Rev 00

Status : Withdrawn by Holder

Issue Date : 2020-05-07

Type : Chemical

Substance Number : 2762

Certificate Numbers : R1-CEP 2003-049 - Rev 07

Status : Valid

Issue Date : 2018-10-01

Type : Chemical

Substance Number : 1084

Certificate Numbers : R1-CEP 2009-206 - Rev 03

Status : Valid

Issue Date : 2020-01-08

Type : Chemical

Substance Number : 1084

Certificate Numbers : R0-CEP 2021-052 - Rev 01

Status : Valid

Issue Date : 2023-02-20

Type : Chemical

Substance Number : 2531

Certificate Numbers : R1-CEP 2012-395 - Rev 01

Status : Valid

Issue Date : 2023-06-05

Type : Chemical

Substance Number : 2372

Certificate Numbers : R0-CEP 2023-070 - Rev 00

Status : Valid

Issue Date : 2023-06-15

Type : Chemical

Substance Number : 2372

Certificate Numbers : R0-CEP 2021-243 - Rev 00

Status : Valid

Issue Date : 2022-01-03

Type : Chemical

Substance Number : 2372

Certificate Numbers : R1-CEP 2009-161 - Rev 01

Status : Valid

Issue Date : 2023-05-31

Type : Chemical

Substance Number : 1012

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Excipients

Inspections and registrations

Country : India

City/Region : Bollaram Village

Audit Date : 2024-06-05

Audit Type : On-Site

Country : Mexico

City/Region : Jiutepec

Audit Date : 2024-03-05

Audit Type : On-Site

Country : India

City/Region : Ranasthalam Mandal

Audit Date : 2023-04-13

Audit Type : On-Site

Country : India

City/Region : Ranasthalam Mandal

Audit Date : 2022-12-06

Audit Type : On-Site

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]ABOUT THIS PAGE

Dr. Reddy's Laboratories is a supplier offers 208 products (APIs, Excipients or Intermediates).

Find a price of Capecitabine bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Clopidogrel bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Fexofenadine Hydrochloride bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Gemcitabine bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Montelukast Sodium bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Nizatidine bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Ondansetron Hydrochloride bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Quetiapine Hemifumarate bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Rabeprazole Sodium bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Risperidone bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Rivaroxaban bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Valsartan bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Atorvastatin bulk with DMF, CEP, JDMF offered by Dr. Reddy's Laboratories

Find a price of Amlodipine Besylate bulk with DMF, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Azacitidine bulk with DMF, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Carfilzomib bulk with DMF, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Cetirizine Dihydrochloride bulk with DMF, CEP, WC offered by Dr. Reddy's Laboratories

Find a price of Clopidogrel bulk with DMF, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Dasatinib bulk with DMF, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Esomeprazole Magnesium bulk with DMF, CEP, WC offered by Dr. Reddy's Laboratories

Find a price of Famotidine bulk with DMF, CEP, WC offered by Dr. Reddy's Laboratories

Find a price of Finasteride bulk with DMF, CEP, JDMF offered by Dr. Reddy's Laboratories

Find a price of Lenalidomide bulk with DMF, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Levetiracetam bulk with DMF, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Losartan Potassium bulk with DMF, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Naproxen bulk with DMF, CEP, JDMF offered by Dr. Reddy's Laboratories

Find a price of Naratriptan Hydrochloride bulk with DMF, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Omeprazole bulk with DMF, CEP, WC offered by Dr. Reddy's Laboratories

Find a price of Omeprazole Magnesium bulk with DMF, CEP, WC offered by Dr. Reddy's Laboratories

Find a price of Pantoprazole Sodium bulk with DMF, CEP, WC offered by Dr. Reddy's Laboratories

Find a price of Pioglitazone Hydrochloride bulk with DMF, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Rabeprazole Sodium bulk with DMF, CEP, WC offered by Dr. Reddy's Laboratories

Find a price of Rivastigmine Tartrate bulk with DMF, CEP, WC offered by Dr. Reddy's Laboratories

Find a price of Sugammadex Sodium bulk with DMF, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Ticagrelor bulk with DMF, CEP, WC offered by Dr. Reddy's Laboratories

Find a price of Atorvastatin bulk with DMF, JDMF offered by Dr. Reddy's Laboratories

Find a price of Ketorolac Trometamol bulk with DMF, CEP offered by Dr. Reddy's Laboratories

Find a price of Abiraterone Acetate bulk with DMF, JDMF offered by Dr. Reddy's Laboratories

Find a price of Bendamustine Hydrochloride bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Bortezomib bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Cabazitaxel bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Cinacalcet Hydrochloride bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Dabigatran Etexilate Mesylate bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Dasatinib bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Decitabine bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Enzalutamide bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Eslicarbazepine Acetate bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Eszopiclone bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Gatifloxacin bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Glimepiride bulk with DMF, CEP offered by Dr. Reddy's Laboratories

Find a price of Lenvatinib Mesylate bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Levocetirizine Dihydrochloride bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Linagliptin bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Lomustine bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Lurasidone Hydrochloride bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Midostaurin bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Naproxen bulk with DMF, CEP offered by Dr. Reddy's Laboratories

Find a price of Naproxen Sodium bulk with DMF, CEP offered by Dr. Reddy's Laboratories

Find a price of Nilotinib bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Omeprazole bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Omeprazole Magnesium bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Ondansetron bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Ondansetron Hydrochloride bulk with JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Palonosetron bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Pantoprazole Sodium bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Pemetrexed Disodium bulk with DMF, CEP offered by Dr. Reddy's Laboratories

Find a price of Permethrin bulk with DMF, CEP offered by Dr. Reddy's Laboratories

Find a price of Pomalidomide bulk with DMF, JDMF offered by Dr. Reddy's Laboratories

Find a price of Pregabalin bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Rabeprazole Sodium bulk with CEP, WC offered by Dr. Reddy's Laboratories

Find a price of Raloxifene Hydrochloride bulk with DMF, CEP offered by Dr. Reddy's Laboratories

Find a price of Ramipril bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Roxadustat bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Sitagliptin Phosphate bulk with DMF, CEP offered by Dr. Reddy's Laboratories

Find a price of Sumatriptan bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Terbinafine Hydrochloride bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Tizanidine Hydrochloride bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Ziprasidone Hydrochloride bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Zoledronic Acid bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Apalutamide bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Apixaban bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Apremilast bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Atomoxetin Hydrochloride bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Bempedoic Acid bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Cabozantinib bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Dapagliflozin bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Dapagliflozin Propanediol Monohydrate bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Edaravone bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Elagolix Sodium bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Empagliflozin bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Ferric Carboxymaltose bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Fosaprepitant bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Iron Sucrose bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Levofloxacin Hemihydrate bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Lumateperone Tosylate bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Metoprolol Succinate bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Olaparib bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Posaconazole bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Sacubitril-Valsartan bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Tofacitinib Citrate bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Ziprasidone Hydrochloride bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Atorvastatin bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Benztropine bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Cetirizine Dihydrochloride bulk with CEP offered by Dr. Reddy's Laboratories

Find a price of Clopidogrel bulk with WC offered by Dr. Reddy's Laboratories

Find a price of Dabigatran Etexilate Mesylate bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Decitabine bulk with WC offered by Dr. Reddy's Laboratories

Find a price of Deucravacitinib bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Donepezil bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Doxazosin Mesylate bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Dutasteride bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Edoxaban Tosylate bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Enzalutamide bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Eribulin bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Esomeprazole Magnesium bulk with WC offered by Dr. Reddy's Laboratories

Find a price of Ezetimibe bulk with WC offered by Dr. Reddy's Laboratories

Find a price of Fexofenadine Hydrochloride bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Fondaparinux Sodium bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Granisetron bulk with WC offered by Dr. Reddy's Laboratories

Find a price of Lacidipine bulk with WC offered by Dr. Reddy's Laboratories

Find a price of Lenalidomide bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Lifitegrast bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Liraglutide bulk with WC offered by Dr. Reddy's Laboratories

Find a price of Memantine Hydrochloride bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Mirabegron bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Moxifloxacin Hydrochloride bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Naproxen bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Nilotinib bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Omeprazole bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Palbociclib bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Pantoprazole Sodium bulk with WC offered by Dr. Reddy's Laboratories

Find a price of Pazopanib Hydrochloride bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Pregabalin bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Relugolix bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Ripretinib bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Rivaroxaban bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Roxadustat bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Sitagliptin Hydrochloride bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Sitagliptin Phosphate bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Sumatriptan bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Tafamidis Meglumine bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Testosterone bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Tizanidine Hydrochloride bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Travoprost bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Tucatinib bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Valsartan bulk with JDMF offered by Dr. Reddy's Laboratories

Find a price of Varenicline Tartrate bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Venetoclax bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Voclosporin bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Vonoprazan Fumarate bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Sumatriptan Succinate “CTO5” bulk with JDMF offered by Dr. Reddy's Laboratories

Find a price of Capecitabine bulk offered by Dr. Reddy's Laboratories

Find a price of Dimethyl Fumarate bulk offered by Dr. Reddy's Laboratories

Find a price of Ketorolac Trometamol bulk offered by Dr. Reddy's Laboratories

Find a price of Metoprolol Succinate bulk offered by Dr. Reddy's Laboratories

Find a price of Siponimod fumarate bulk offered by Dr. Reddy's Laboratories

Find a price of Acalabrutinib bulk offered by Dr. Reddy's Laboratories

Find a price of Acoramidis Hydrochloride bulk offered by Dr. Reddy's Laboratories

Find a price of Adagrasib bulk offered by Dr. Reddy's Laboratories

Find a price of Aficamten bulk offered by Dr. Reddy's Laboratories

Find a price of Amlodipine Besylate bulk offered by Dr. Reddy's Laboratories

Find a price of Apixaban bulk offered by Dr. Reddy's Laboratories

Find a price of Atorvastatin bulk offered by Dr. Reddy's Laboratories

Find a price of Brensocatib bulk offered by Dr. Reddy's Laboratories

Find a price of Capivasertib bulk offered by Dr. Reddy's Laboratories

Find a price of CAS 654671-77-9 bulk offered by Dr. Reddy's Laboratories

Find a price of Cetirizine Dihydrochloride bulk offered by Dr. Reddy's Laboratories

Find a price of Ciprofloxacin Hydrochloride bulk offered by Dr. Reddy's Laboratories

Find a price of Clopidogrel bulk offered by Dr. Reddy's Laboratories

Find a price of Clopidogrel Besylate bulk offered by Dr. Reddy's Laboratories

Find a price of Clopidogrel Hydrochloride bulk offered by Dr. Reddy's Laboratories

Find a price of Dapagliflozin Propanediol Monohydrate bulk offered by Dr. Reddy's Laboratories

Find a price of Darolutamide bulk offered by Dr. Reddy's Laboratories

Find a price of Dutasteride bulk offered by Dr. Reddy's Laboratories

Find a price of Elinzanetant bulk offered by Dr. Reddy's Laboratories

Find a price of Empagliflozin bulk offered by Dr. Reddy's Laboratories

Find a price of Enalapril Maleate bulk offered by Dr. Reddy's Laboratories

Find a price of Enzalutamide bulk offered by Dr. Reddy's Laboratories

Find a price of Fluoxetine Hydrochloride bulk offered by Dr. Reddy's Laboratories

Find a price of Fruquintinib bulk offered by Dr. Reddy's Laboratories

Find a price of Gemcitabine bulk offered by Dr. Reddy's Laboratories

Find a price of Hydroxychloroquine Sulphate bulk offered by Dr. Reddy's Laboratories

Find a price of Iptacopan Hydrochloride bulk offered by Dr. Reddy's Laboratories

Find a price of Moxifloxacin Hydrochloride bulk offered by Dr. Reddy's Laboratories

Find a price of Naproxen Sodium bulk offered by Dr. Reddy's Laboratories

Find a price of Nizatidine bulk offered by Dr. Reddy's Laboratories

Find a price of Olanzapine bulk offered by Dr. Reddy's Laboratories

Find a price of Omeprazole bulk offered by Dr. Reddy's Laboratories

Find a price of Perfluorohexyloctane bulk offered by Dr. Reddy's Laboratories

Find a price of Pioglitazone bulk offered by Dr. Reddy's Laboratories

Find a price of Pirtobrutinib bulk offered by Dr. Reddy's Laboratories

Find a price of Pregabalin bulk offered by Dr. Reddy's Laboratories

Find a price of Resmetirom bulk offered by Dr. Reddy's Laboratories

Find a price of Risperidone bulk offered by Dr. Reddy's Laboratories

Find a price of Ropinirole bulk offered by Dr. Reddy's Laboratories

Find a price of Sacubitril-Valsartan bulk offered by Dr. Reddy's Laboratories

Find a price of Seladelpar Lysine bulk offered by Dr. Reddy's Laboratories

Find a price of Sitagliptin Hydrochloride bulk offered by Dr. Reddy's Laboratories

Find a price of Sitagliptin Malate bulk offered by Dr. Reddy's Laboratories

Find a price of Sugammadex Sodium bulk offered by Dr. Reddy's Laboratories

Find a price of Suzetrigine bulk offered by Dr. Reddy's Laboratories

Find a price of Tafamidis bulk offered by Dr. Reddy's Laboratories

Find a price of Terbinafine Hydrochloride bulk offered by Dr. Reddy's Laboratories

Find a price of Ticagrelor bulk offered by Dr. Reddy's Laboratories

Find a price of Treprostinil Sodium bulk offered by Dr. Reddy's Laboratories

Find a price of Upadacitinib bulk offered by Dr. Reddy's Laboratories

Find a price of Valsartan bulk offered by Dr. Reddy's Laboratories

Find a price of Xanomeline bulk offered by Dr. Reddy's Laboratories

Dr. Reddy's Laboratories

Dr. Reddy's Laboratories