24 Oct 2025

// PRESS RELEASE

25 Jun 2025

// PRESS RELEASE

25 Jun 2025

// PRESS RELEASE

KEY PRODUCTS

KEY PRODUCTS KEY SERVICES

KEY SERVICES

European CDMO and Gx manufacturer with 75 years of experience in delivering premium APIs to pharmaceutical partners worldwide.

About

Industry Trade Show

The Benjamin Royal Sonesta

23-26 March, 2026

Industry Trade Show

Attending

21-23 April, 2026

Industry Trade Show

Attending

16-18 May, 2026

CONTACT DETAILS

Events

Webinars & Exhibitions

Industry Trade Show

The Benjamin Royal Sonesta

23-26 March, 2026

Industry Trade Show

Attending

21-23 April, 2026

Industry Trade Show

Attending

16-18 May, 2026

https://www.pharmacompass.com/speak-pharma/expert-take-on-cep-2-0-a-new-era-of-transparency-in-pharmaceutical-regulation

VLOG #PharmaReel

CORPORATE CONTENT #SupplierSpotlight

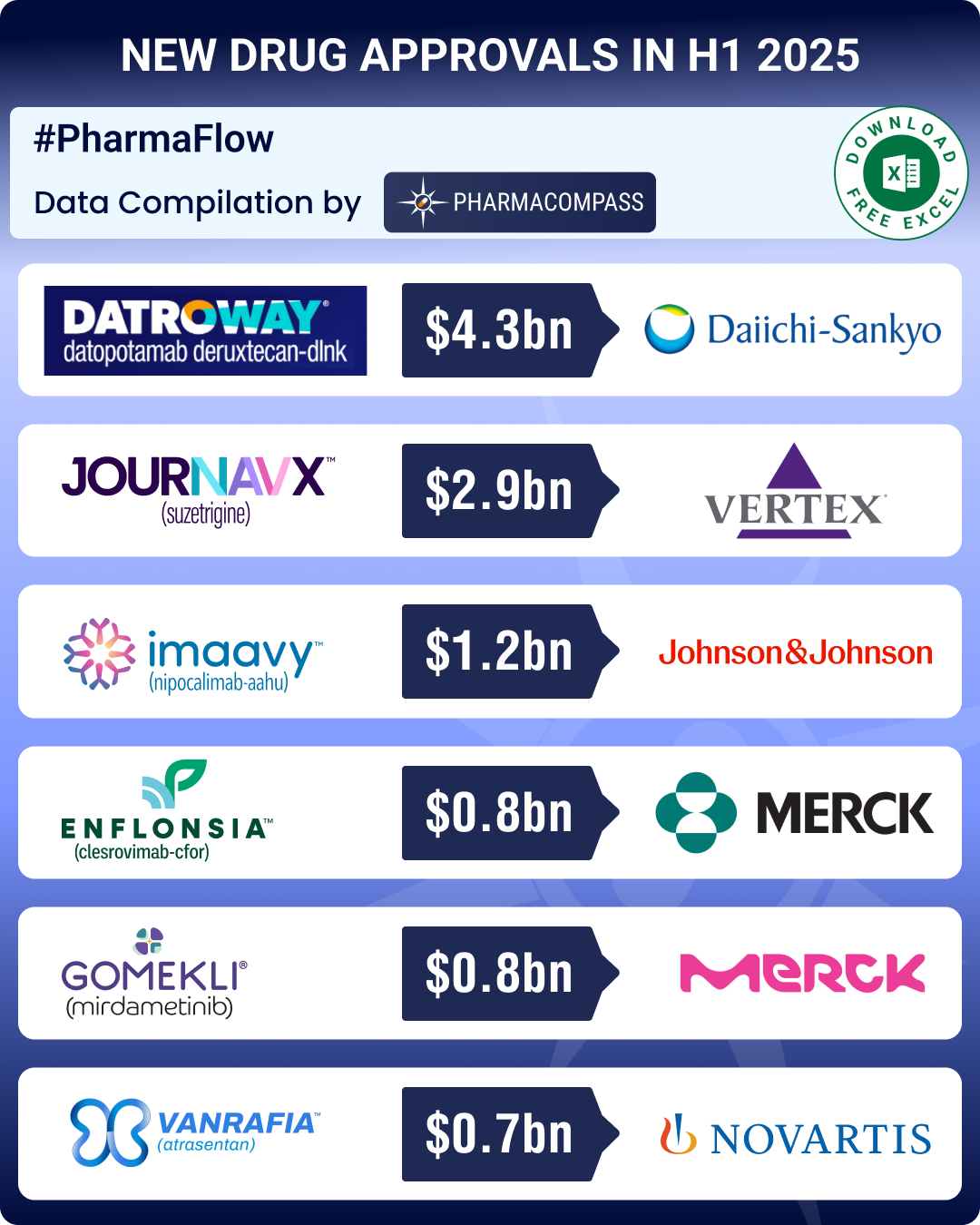

https://www.pharmacompass.com/radio-compass-blog/fda-approvals-drop-24-in-h1-2025-gsk-s-uti-med-vertex-s-non-opioid-painkiller-lead-pack-of-first-in-class-meds

https://www.pharmacompass.com/radio-compass-blog/cdmo-activity-tracker-veranova-carbogen-lead-adc-investments-axplora-polfa-tarchomin-famar-expand-european-footprint

https://www.pharmacompass.com/radio-compass-blog/cdmo-activity-tracker-bora-polpharma-make-acquisitions-evonik-euroapi-porton-announce-technological-expansions

https://www.pharmacompass.com/radio-compass-blog/fda-approves-record-eight-biosimilars-in-h1-2024-okays-first-interchangeable-biosimilars-for-eylea

24 Oct 2025

// PRESS RELEASE

https://polpharma.pl/en/polpharma-group-announces-leadership-transition-sebastian-szymanek-appointed-as-its-new-president/#:~:text=At%20the%20same%20time%2C%20Polpharma,Farmaceutyczne%20Polpharma%20S.A.%20in%20Poland.

25 Jun 2025

// PRESS RELEASE

https://www.api.polpharma.com/articles/rising-to-the-solubility-challenge-collaborative-solutions-in-api-development

25 Jun 2025

// PRESS RELEASE

https://www.api.polpharma.com/articles/rising-to-the-solubility-challenge-collaborative-solutions-in-api-development

14 May 2025

// PRESS RELEASE

https://polpharma.pl/en/polpharma-group-joins-the-call-to-action-to-finalize-pharmaceutical-reform-and-secure-early-and-sustainable-healthcare-for-european-patients/

01 Jan 2025

// PRESS RELEASE

https://www.api.polpharma.com/articles/antibody-drug-conjugates-adcs-revolutionizing-cancer-treatment

10 Oct 2024

// PRESS RELEASE

https://www.api.polpharma.com/articles/an-overview-of-breast-cancer-understanding-risks-treatments-and-market-trends

Regulatory Info : Deregistered

Registration Country : Sweden

Dosage Form : Film Coated Tablet

Brand Name : Sertralin Polpharma

Dosage Strength : 50mg

Packaging :

Approval Date : 23-03-2007

Application Number : 2.01E+13

Regulatory Info : Deregistered

Registration Country : Sweden

Regulatory Info : Deregistered

Registration Country : Sweden

Dosage Form : Film Coated Tablet

Brand Name : Sertralin Polpharma

Dosage Strength : 100mg

Packaging :

Approval Date : 23-03-2007

Application Number : 2.01E+13

Regulatory Info : Deregistered

Registration Country : Sweden

Regulatory Info : Authorized

Registration Country : Spain

Dosage Form : Injectable Solution In V...

Brand Name : Eiyzey

Dosage Strength : 40MG

Packaging :

Approval Date : 28-08-2025

Application Number : 1251963002

Regulatory Info : Authorized

Registration Country : Spain

Regulatory Info : Authorized

Registration Country : Spain

Dosage Form : Injectable Solution In P...

Brand Name : Eiyzey

Dosage Strength : 40MG

Packaging :

Approval Date : 28-08-2025

Application Number : 1251963001

Regulatory Info : Authorized

Registration Country : Spain

Regulatory Info : Approved

Registration Country : Sweden

Dosage Form : Injection Solution

Brand Name : Eiyzey

Dosage Strength : 40mg/ml

Packaging :

Approval Date : 14-08-2025

Application Number : 2.02E+13

Regulatory Info : Approved

Registration Country : Sweden

Regulatory Info : Approved

Registration Country : Sweden

Dosage Form : Solution For Injection

Brand Name : Eiyzey

Dosage Strength : 40mg/ml

Packaging :

Approval Date : 14-08-2025

Application Number : 2.02E+13

Regulatory Info : Approved

Registration Country : Sweden

Regulatory Info : Approved

Registration Country : Sweden

Dosage Form : Injection Solution

Brand Name : Vgenfli

Dosage Strength : 40mg/ml

Packaging :

Approval Date : 14-08-2025

Application Number : 2.02E+13

Regulatory Info : Approved

Registration Country : Sweden

Regulatory Info : Approved

Registration Country : Sweden

Dosage Form : Solution For Injection

Brand Name : Vgenfli

Dosage Strength : 40mg/ml

Packaging :

Approval Date : 14-08-2025

Application Number : 2.02E+13

Regulatory Info : Approved

Registration Country : Sweden

Regulatory Info : Deregistered

Registration Country : Sweden

Dosage Form : Tablet

Brand Name : Clatexo

Dosage Strength : 20mg

Packaging :

Approval Date : 26-04-2021

Application Number : 2.02E+13

Regulatory Info : Deregistered

Registration Country : Sweden

Regulatory Info : Approved

Registration Country : Sweden

Dosage Form : Tablet

Brand Name : Bilastine Polpharma

Dosage Strength : 20mg

Packaging :

Approval Date : 27-03-2025

Application Number : 2.02E+13

Regulatory Info : Approved

Registration Country : Sweden

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Regulatory Info : Deregistered

Registration Country : Sweden

Dosage Form : Film Coated Tablet

Dosage Strength : 50mg

Packaging :

Brand Name : Sertralin Polpharma

Approval Date : 23-03-2007

Application Number : 2.01E+13

Regulatory Info : Deregistered

Registration Country : Sweden

Regulatory Info : Deregistered

Registration Country : Sweden

Dosage Form : Film Coated Tablet

Dosage Strength : 100mg

Packaging :

Brand Name : Sertralin Polpharma

Approval Date : 23-03-2007

Application Number : 2.01E+13

Regulatory Info : Deregistered

Registration Country : Sweden

Regulatory Info : Authorized

Registration Country : Spain

Dosage Form : Injectable Solution In Vial

Dosage Strength : 40MG

Packaging :

Brand Name : Eiyzey

Approval Date : 28-08-2025

Application Number : 1251963002

Regulatory Info : Authorized

Registration Country : Spain

Regulatory Info : Authorized

Registration Country : Spain

Dosage Form : Injectable Solution In Pre-Fil...

Dosage Strength : 40MG

Packaging :

Brand Name : Eiyzey

Approval Date : 28-08-2025

Application Number : 1251963001

Regulatory Info : Authorized

Registration Country : Spain

Regulatory Info : Approved

Registration Country : Sweden

Dosage Form : Injection Solution

Dosage Strength : 40mg/ml

Packaging :

Brand Name : Eiyzey

Approval Date : 14-08-2025

Application Number : 2.02E+13

Regulatory Info : Approved

Registration Country : Sweden

Regulatory Info : Approved

Registration Country : Sweden

Dosage Form : Solution For Injection

Dosage Strength : 40mg/ml

Packaging :

Brand Name : Eiyzey

Approval Date : 14-08-2025

Application Number : 2.02E+13

Regulatory Info : Approved

Registration Country : Sweden

Regulatory Info : Approved

Registration Country : Sweden

Dosage Form : Injection Solution

Dosage Strength : 40mg/ml

Packaging :

Brand Name : Vgenfli

Approval Date : 14-08-2025

Application Number : 2.02E+13

Regulatory Info : Approved

Registration Country : Sweden

Regulatory Info : Approved

Registration Country : Sweden

Dosage Form : Solution For Injection

Dosage Strength : 40mg/ml

Packaging :

Brand Name : Vgenfli

Approval Date : 14-08-2025

Application Number : 2.02E+13

Regulatory Info : Approved

Registration Country : Sweden

Regulatory Info : Deregistered

Registration Country : Sweden

Dosage Form : Tablet

Dosage Strength : 20mg

Packaging :

Brand Name : Clatexo

Approval Date : 26-04-2021

Application Number : 2.02E+13

Regulatory Info : Deregistered

Registration Country : Sweden

Regulatory Info : Approved

Registration Country : Sweden

Dosage Form : Tablet

Dosage Strength : 20mg

Packaging :

Brand Name : Bilastine Polpharma

Approval Date : 27-03-2025

Application Number : 2.02E+13

Regulatory Info : Approved

Registration Country : Sweden

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Services

API Manufacturing

API & Drug Product Development

Inspections and registrations

Country : Poland

City/Region : Sieradz

Audit Date : 2025-10-14

Audit Type : On-Site

Country : Poland

City/Region : Starogard Gdański

Audit Date : 2023-09-19

Audit Type : On-Site

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]ABOUT THIS PAGE

Polpharma is a supplier offers 76 products (APIs, Excipients or Intermediates).

Find a price of Acetazolamide bulk with DMF, CEP, JDMF offered by Polpharma

Find a price of Alendronate Sodium bulk with DMF, CEP, JDMF offered by Polpharma

Find a price of Hydrochlorothiazide bulk with DMF, CEP, JDMF offered by Polpharma

Find a price of Ibandronate Sodium bulk with DMF, CEP, JDMF offered by Polpharma

Find a price of Lamotrigine bulk with DMF, CEP, JDMF offered by Polpharma

Find a price of Risedronate Sodium bulk with DMF, CEP, JDMF offered by Polpharma

Find a price of Sildenafil Citrate bulk with DMF, CEP, JDMF offered by Polpharma

Find a price of Tadalafil bulk with DMF, CEP, JDMF offered by Polpharma

Find a price of Vardenafil Hydrochloride bulk with DMF, CEP, JDMF offered by Polpharma

Find a price of Zoledronic Acid bulk with DMF, CEP, JDMF offered by Polpharma

Find a price of Baclofen bulk with DMF, JDMF offered by Polpharma

Find a price of Carbamazepine bulk with DMF, CEP offered by Polpharma

Find a price of Dapagliflozin bulk with DMF, JDMF offered by Polpharma

Find a price of Etodolac bulk with DMF, JDMF offered by Polpharma

Find a price of Pentoxifylline bulk with DMF, CEP offered by Polpharma

Find a price of Rivaroxaban bulk with DMF, CEP offered by Polpharma

Find a price of Sodium Salicylate bulk with DMF, JDMF offered by Polpharma

Find a price of Abemaciclib bulk with DMF offered by Polpharma

Find a price of Apixaban bulk with DMF offered by Polpharma

Find a price of Apremilast bulk with DMF offered by Polpharma

Find a price of Aripiprazole bulk with DMF offered by Polpharma

Find a price of Baricitinib bulk with DMF offered by Polpharma

Find a price of Brexpiprazole bulk with DMF offered by Polpharma

Find a price of Carbamazepine bulk with CEP offered by Polpharma

Find a price of Carvedilol bulk with DMF offered by Polpharma

Find a price of Carvedilol Phosphate bulk with DMF offered by Polpharma

Find a price of Dapagliflozin Propanediol Monohydrate bulk with DMF offered by Polpharma

Find a price of Empagliflozin bulk with DMF offered by Polpharma

Find a price of Enzalutamide bulk with DMF offered by Polpharma

Find a price of Ibandronate Sodium bulk with CEP offered by Polpharma

Find a price of Isavuconazonium Sulfate bulk with DMF offered by Polpharma

Find a price of Lamotrigine bulk with JDMF offered by Polpharma

Find a price of Molsidomine bulk with CEP offered by Polpharma

Find a price of Palbociclib bulk with DMF offered by Polpharma

Find a price of Pimavanserin Tartrate bulk with DMF offered by Polpharma

Find a price of Piracetam bulk with CEP offered by Polpharma

Find a price of Sacubitril-Valsartan bulk with DMF offered by Polpharma

Find a price of Safinamide Methanesulfonate bulk with DMF offered by Polpharma

Find a price of Sildenafil Citrate bulk with CEP offered by Polpharma

Find a price of Sitagliptin Hydrochloride bulk with DMF offered by Polpharma

Find a price of Ticagrelor bulk with DMF offered by Polpharma

Find a price of Tolterodine Tartrate bulk with CEP offered by Polpharma

Find a price of Topiramate bulk with DMF offered by Polpharma

Find a price of Trametinib bulk with DMF offered by Polpharma

Find a price of Xylometazoline Hydrochloride bulk with CEP offered by Polpharma

Find a price of Acenocoumarol bulk offered by Polpharma

Find a price of Alendronate Sodium bulk offered by Polpharma

Find a price of Aniracetam bulk offered by Polpharma

Find a price of Antazoline HCl bulk offered by Polpharma

Find a price of Antazoline Mesylate bulk offered by Polpharma

Find a price of Antazoline Sulfate bulk offered by Polpharma

Find a price of Apixaban bulk offered by Polpharma

Find a price of Aripiprazole bulk offered by Polpharma

Find a price of Baclofen bulk offered by Polpharma

Find a price of Carbamazepine bulk offered by Polpharma

Find a price of Carvedilol bulk offered by Polpharma

Find a price of Carvedilol Phosphate bulk offered by Polpharma

Find a price of CAS 66376-36-1 bulk offered by Polpharma

Find a price of Clemastine bulk offered by Polpharma

Find a price of Clopamide bulk offered by Polpharma

Find a price of Denotivir bulk offered by Polpharma

Find a price of Etodolac bulk offered by Polpharma

Find a price of Hydrochlorothiazide bulk offered by Polpharma

Find a price of Nefopam Hydrochloride bulk offered by Polpharma

Find a price of Opipramol Dihydrochloride bulk offered by Polpharma

Find a price of Pentoxifylline bulk offered by Polpharma

Find a price of Phenyl Salicylate bulk offered by Polpharma

Find a price of Risdiplam bulk offered by Polpharma

Find a price of Risedronate Sodium bulk offered by Polpharma

Find a price of Rivaroxaban bulk offered by Polpharma

Find a price of Salicylamide bulk offered by Polpharma

Find a price of Sulfiram bulk offered by Polpharma

Find a price of Talazoparib bulk offered by Polpharma

Find a price of Ticagrelor bulk offered by Polpharma

Find a price of Topiramate bulk offered by Polpharma

Find a price of Vismodegib bulk offered by Polpharma

Polpharma

Polpharma