By PharmaCompass

2022-03-10

Impressions: 3556

Our January 2022 update of the Pipeline Prospector highlighted how the Omicron variant of the novel coronavirus drove the pharma and biotech stocks down. In February too, the bearish trend continued. The ongoing Russia-Ukraine war further spooked the global markets.

The Nasdaq Biotechnology Index (NBI) sank by 5.5 percent to US$ 3,996 last month. In January, NBI had dropped 11 percent to US$ 4,187.

Similarly, the S&P Biotechnology Select Industry Index (SPSIBI) sank by 5.4 percent to US$ 6,992. In comparison, the S&P 500 Index (SPX) fell 3.8 percent to US$ 4,373.94.

On the earnings side, several drug companies have already reported their fourth quarter (Q4) results. Broadly, the medical sector posted mixed results, with Q4 earnings expected to rise 25.8 percent on a sales increase of 13.9 percent.

Access the Pipeline Prospector Dashboard for February 2022 Newsmakers

Biotechs’ hopes to raise fresh funds hampered by market rout

Over the last two years, several loss-making biotechs raised a record US$ 32.7 billion in initial public offerings (IPOs). Today, 83 percent of the recently listed US biotech and pharma stocks are trading below their IPO price, says a report published in Financial Times.

Biotech groups that listed in 2021 are trading on average 37 percent below their IPO price, as compared to a 22 percent fall for all newly US-listed companies. Many of these companies were hoping to raise fresh funds from their investors through a subsequent share sale with their drugs marching ahead on the R&D cycle. But their ability to do so has been hampered by a market rout for biotech stocks. Retail investors and generalist money managers have turned sour towards the industry.

There is a “complete bloodbath across the board,” says Geraldine O’Keeffe, a partner at healthcare investment firm LSP. As a result, dozens of biotech companies are running low on cash and face an uphill task to raise fresh funds. However, experts feel biotech stocks still hold plenty of attraction, because the right ones can make investors wealthy.

Access the Pipeline Prospector Dashboard for February 2022 Newsmakers

Covid drug, vaccine makers continue to see drop in stock prices

Covid-19 vaccine and drugmakers — such as Pfizer, BioNTech, Merck, Moderna Therapeutics, J&J and Roche — continued to see a drop in their stock prices last month. With Covid cases plummeting from all-time highs, experts have been questioning whether vaccines will be a sustainable revenue stream in the years to come.

On February 14, shares of Moderna touched its lowest level in nearly a year. The reason — a slew of regulatory filings revealed four Moderna executives — including billionaire CEO Stéphane Bancel — had sold 23,281 shares for about US$ 3.6 million in early February. Out of this, Bancel had offloaded 19,000 shares. Bancel had reportedly been selling shares of Moderna since late 2019. However, suspicions of insider trading were raised when he cancelled his Twitter account without prior warning.

Similarly, Pfizer and BioNTech saw a drop in their shares by 2 percent and over 9 percent respectively around mid-February as the duo delayed their FDA application for an emergency use authorization (EUA) of their Covid-19 vaccine in children aged between six months and four years.

Late last year, Johnson & Johnson had temporarily halted the production of its Covid-19 vaccine at its Leiden facility in the Netherlands. More negative news last month on J&J’s Covid vaccine led to a further 1.07 percent drop in its shares. According to a paper published in the New England Journal of Medicine, final analysis of a phase 3 study revealed that the vaccine provided only 52.9 percent protection against moderate to severe-critical Covid-19, and may be even less effective in the longer term.

In the case of Merck, FDA’s revision of the EUA for Merck’s Covid-19 pill molnupiravir sent its shares down by 0.42 percent. The agency said it should only be used as a last line of defense if other treatments are available.

Access the Pipeline Prospector Dashboard for February 2022 Newsmakers

AbbVie, Astra, BMS, Lilly, Sanofi, Regeneron score wins

When we look at mega cap gainers, AbbVie emerges as one of the top performers. AbbVie’s fortunes have hinged on Humira, and this autoimmune-disease drug is slated to face competition from biosimilars in the US market soon. However, experts are of the view that Humira won’t lose its mega-blockbuster tag anytime soon.

Moreover, Humira’s successors — Rinvoq and Skyrizi — brought in sales of nearly US$ 4.6 billion in 2021. AbbVie projects combined global sales of US$ 15 billion from the two drugs in 2025, and the net increase could be enough to offset sales declines for Humira.

Moreover, analysts see a lot of promise in its anti-psychotic drug Vraylar, which is awaiting add-on FDA approval for patients with major depressive disorder (MDD) who are already on antidepressants. Such an approval could take Vraylar beyond the expected US$ 4 billion in peak sales. In 2021, Vraylar generated just over US$ 1.7 billion in sales.

Similarly, there was positive news from AstraZeneca, as the British-Swedish drugmaker and its Japanese partner Daiichi Sankyo scored a crucial win for their breast cancer drug Enhertu. Results from a phase 3 trial showed Enhertu boosted survival in patients with a type of tumor called HER2-low that had spread widely or couldn't be removed surgically. It’s the first time such a therapy has shown mortality benefit in patients with this kind of relatively common breast cancer.

Riding on the success of its Covid vaccine, Astra reported 41 percent growth in its 2021 revenues. Its Covid-19 vaccine generated US$ 4 billion in 2021.

Despite the FDA showing its unwillingness to approve Eli Lilly and its partner Innovent Biologics’ cancer treatment — Tyvyt — as the drug’s clinical data is solely from China, Lilly posted gains in February. The reasons were three-fold. One, the FDA issued an EUA for Eli Lilly’s antibody bebtelovimab to treat mild-to-moderate Covid-19 in patients above the age of 12. The company has claimed that bebtelovimab can neutralize the Omicron variant of coronavirus. Two, Lilly entered into an agreement with the US government to supply 600,000 doses of bebtelovimab for US$ 720 million. And three, the FDA approved Lilly and its partner Boehringer Ingelheim's drug, Jardiance, for expanded use in reducing the risk of death and hospitalization for all patients with heart failure.

Other major gainers were Bristol Myers Squibb, Sanofi and Regeneron. While BMS announced a US$ 5 billion accelerated share buyback program, Sanofi bagged FDA approval for cold agglutinin disease (CAD) drug Enjaymo (sutimlimab). The disease affects around 5,000 people in the US. The French drugmaker also unveiled a new corporate identity. And Regeneron announced encouraging phase 2 results for high-dose aflibercept 8 mg in wet age-related macular degeneration (wet AMD).

Among mid cap companies, Maravai LifeSciences’ stocks gained 30 percent after sources claimed that Germany-headquartered Sartorius has placed a US$ 11 billion bid for the Covid vaccine reagent vendor. Both the companies refused to comment about the bid.

Access the Pipeline Prospector Dashboard for February 2022 Newsmakers

Biocon acquires Viatris’ biosimilars business

The biggest deal of the month was Biocon Biologics’ acquisition of Viatris’ biosimilars business for up to US$ 3.3 billion. The deal will be funded through a debt of US$ 1.2 billion, apart from stocks and cash. Biocon Biologics will acquire Viatris’ global commercial infrastructure in developed and emerging markets, its global biosimilars business and rights to Viatris’ biosimilar assets.

Massachusetts-based Collegium Pharmaceutical acquired specialty pharmaceutical company BioDelivery Sciences International (BDSI) in a US$ 604 million all-cash transaction. BDSI has a portfolio of pain and neurology products that address serious and debilitating conditions.

Other deals of February include Mersana Therapeutics’ research collaboration and license agreement worth US$ 1.04 billion with Janssen to advance antibody-drug conjugates (ADCs) targeting cancers, and Remix Therapeutics’ US$ 1.045 billion strategic collaboration with Janssen for the discovery and development of small molecule therapeutics.

Similarly, ImmunoGen, a leader in ADCs for the treatment of cancer, announced a global, multi-year definitive licensing agreement with Eli Lilly. Under the deal, ImmunoGen is eligible to receive up to US$ 1.7 billion in potential target program exercise fees and milestone payments. And Takeda signed a US$ 2 billion biobucks deal with Code Biotherapeutics across four programs.

In other major developments, Gilead reached a US$ 1.25 billion settlement with ViiV Healthcare to resolve a litigation pertaining to Biktarvy and ViiV’s Dolutegravir patents.

In IPOs, Nuvectis Pharma, an oncology-focused biopharmaceutical company, announced the closing of its IPO of 3.2 million shares.

Access the Pipeline Prospector Dashboard for February 2022 Newsmakers

Our view

The year 2022 began on a muted note, with bearish trends being witnessed due to the Omicron variant of the coronavirus. While there is hope that Covid-19 won’t play more havoc with our lives, the ongoing war between Russia and Ukraine has taken oil prices to record highs and sent stock markets into a tizzy. The war will have an impact on clinical trials — according to the FDA, 251 clinical trials for drugs and devices are underway in Ukraine. The war is also likely to impact the financial performance of drug companies across the world.

The earlier the war ends, the better it is for everyone. For now, we can safely assume that next month’s Pipeline Prospector is unlikely to bring much cheer from the bourses. Though we certainly hope we are proved wrong.

Access the Pipeline Prospector Dashboard for February 2022 Newsmakers

Pharma & Biotech Newsmakers February 2022

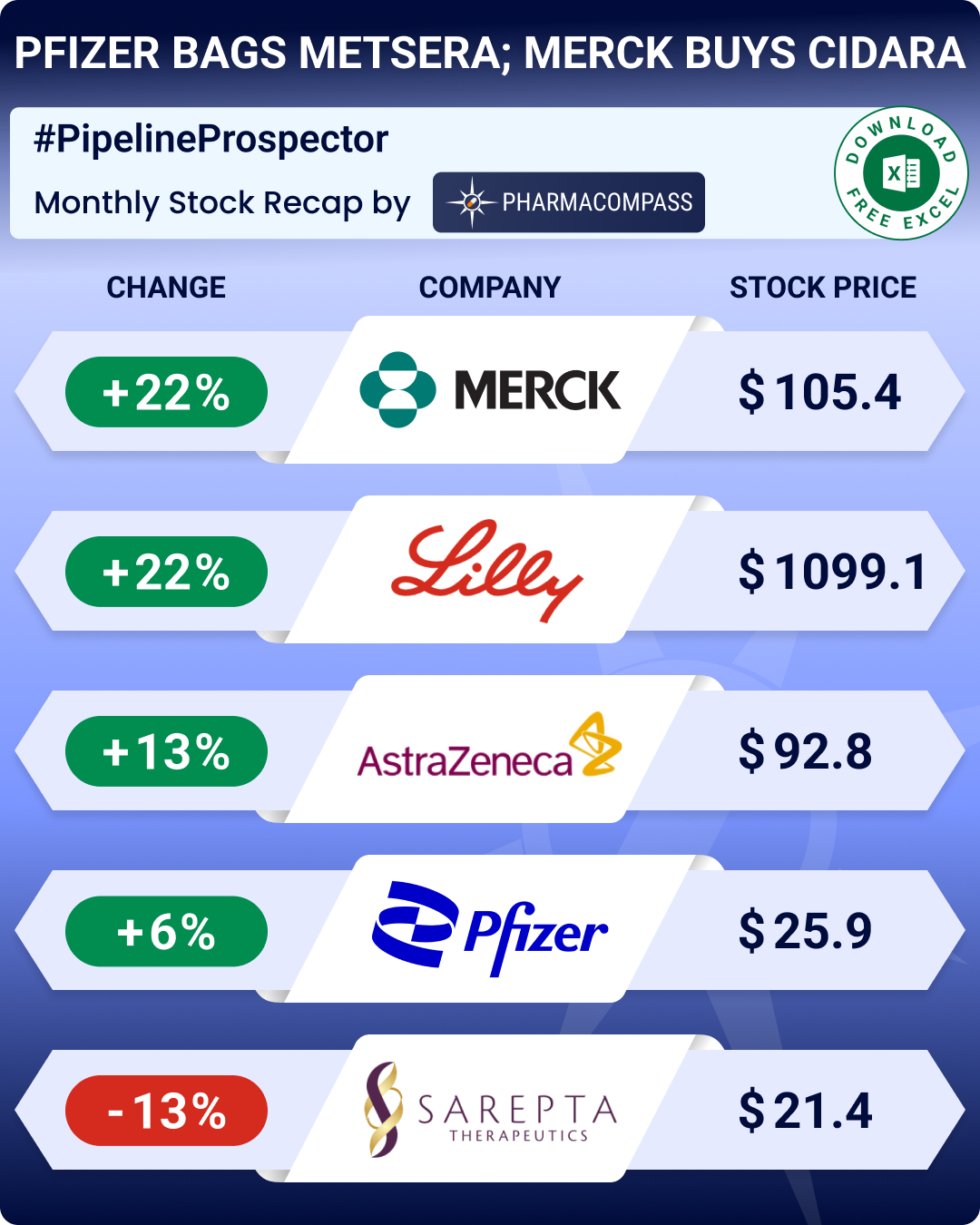

| Company | Country | Currency | Market Cap (Bn) | Change In Market Cap (M) | Stock Price | Change In Price |

|---|

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Pharma-&-Biotech-Recap-February-2022 by PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”