By PharmaCompass

2020-08-05

Impressions: 3855

The year 2020 will be remembered as the year when life as we knew it came to a grinding halt and countries around the world struggled to respond to the pandemic caused by the novel coronavirus — SARS-CoV2. The pharma and biotech industry was in the spotlight, as the world turned to it for solutions to respond to Covid-19.

The age-old antimalarial drug — hydroxychloroquine — became a household name as a potential magic bullet against the novel coronavirus. This was followed by Gilead’s remdesivir, whose entire first few months of production was purchased by the US government. As the world eagerly awaits a vaccine, America’s Biomedical Advanced Research and Development Authority (BARDA) has granted millions of dollars to multiple companies to secure doses of vaccines.

The pandemic also brought the vulnerability of the global supply chain for pharmaceuticals to the forefront. Policy makers in the United States, Europe, Japan and India recognized the supply chain’s dependence on China. India even drove a policy to promote the domestic manufacturing of essential pharmaceutical ingredients. The US government, on the other hand, granted millions of dollars to companies like Phlow and Kodak to revive local production of pharmaceutical ingredients.

As key industry players channelized their resources towards developing vaccines and treatments for Covid-19, inorganic deal making was muted in the first half of 2020, especially when compared to last year which witnessed the acquisition of New Jersey-based cancer drug company Celgene by Bristol-Myers Squibb. After factoring in debt, the deal valued at about US$ 95 billion, was the largest healthcare deal on record, according to data compiled by Refinitiv.

Access the Pipeline Prospector Dashboard for All Deals & Development Updates

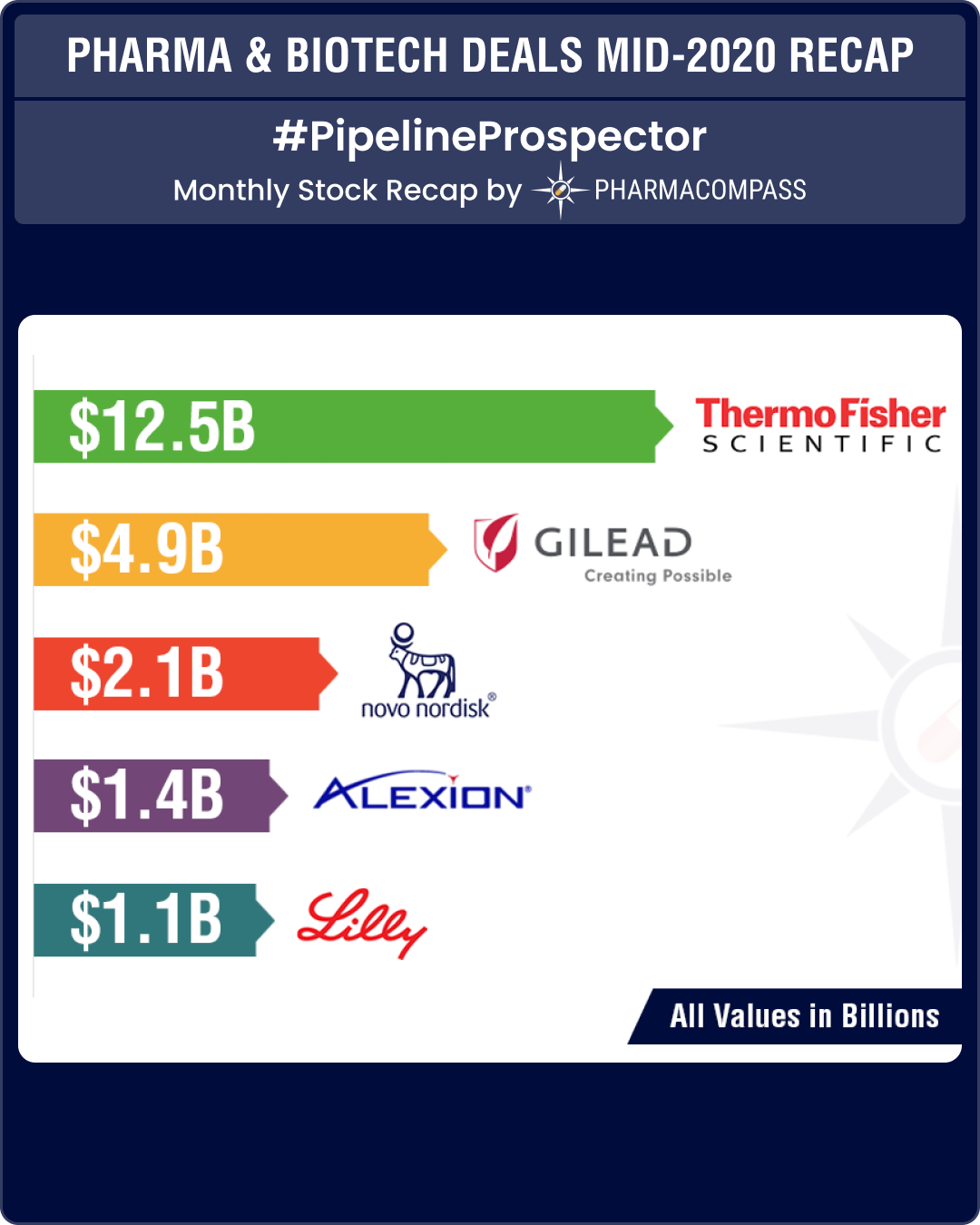

Thermo Fisher offers US$ 12.5 billion for Qiagen

This year saw only a limited number of big ticket deals. The largest healthcare acquisition announced so far has been American laboratory equipment maker Thermo Fisher Scientific Inc’s acquisition of Dutch test maker Qiagen for about US$ 12.5 billion (Euro 10.5 billion).

When Covid-19 emerged out of China, Qiagen got down to developing a test that detected the virus in bodily fluids and gave results in about one hour. However, since the deal was announced in March, the Dutch test-maker’s outlook has improved so much during the coronavirus pandemic that in July, Thermo Fisher upped its offer to Euro 43 per share from its initial bid of Euro 39.

Access the Pipeline Prospector Dashboard for All Deals & Development Updates

Gilead buys biotech Forty Seven for its cancer drug

While Gilead Sciences Inc, gained a lot of media attention for its coronavirus treatment remdesivir, it also bought cancer biotech, Forty Seven Inc, for US$ 4.9 billion in cash. The acquisition added another experimental treatment that targets blood cancer to Gilead’s portfolio of oncology drugs.

Through the acquisition, Gilead will have access to Forty Seven’s lead drug, magrolimab, that targets CD47 — a molecule often known as the “don’t eat me signal”. Cancer cells use this signal to avoid the immune system. The biotech has shown a 50 percent response rate from its lead drug magrolimab in Myelodysplastic syndrome and a 40 percent complete response rate in acute myeloid leukemia in small trials. Forty Seven also has programs in lymphoma and bladder, colorectal and ovarian cancers.

Access the Pipeline Prospector Dashboard for All Deals & Development Updates

Sofinnova Partners sells Corvidia to Novo Nordisk

In June, European Lifesciences venture capital firm, Sofinnova Partners, announced the sale of its portfolio company, Corvidia Therapeutics, to Novo Nordisk for US$ 2.1 billion, including an upfront payment of US$ 725 million.

Founded in 2015, Corvidia is an AstraZeneca spin-off and a clinical-stage company focused on the research, development and commercialization of therapies for cardio-renal diseases.

At the heart of the deal is Corvidia’s lead experimental drug — an IL-6 inhibitor, ziltivekimab — carved out of AstraZeneca’s pipeline. It is currently in mid-stage development to reduce the risk of major cardiovascular events in patients with chronic kidney disease.

Access the Pipeline Prospector Dashboard for All Deals & Development Updates

Alexion buys out rival Portola

Drugmaker Alexion Pharmaceuticals Inc acquired its rival, Portola Pharmaceuticals Inc, in a US$ 1.4 billion deal in order to gain access to a treatment for reversing the effects of blood thinners.

With this deal, Alexion gets Portola’s Factor Xa inhibitor reversal agent — Andexxa — that will mark a change in focus for Alexion. Andexxa was approved in the United States in 2018 and had brought in sales of US$ 111.5 million in 2019. The treatment reverses the effects of drugs Eliquis and Xarelto in cases of life-threatening or uncontrolled bleeding.

At present, Alexion’s treatment portfolio consists of drugs targeting the C5 protein, which makes up part of the immune system that can sometimes attack the body’s own healthy cells.

“The acquisition of Portola represents an important next step in our strategy to diversify beyond C5. Andexxa is a strategic fit with our existing portfolio of transformative medicines and is well-aligned with our demonstrated expertise in hematology, neurology and critical care,” Alexion CEO Ludwig Hantson had said this in May.

Alexion has been striving to maintain its leadership in treating certain rare blood disorders and has embarked on a string of acquisitions to boost its pipeline of rare disease drugs.

Last year, Alexion agreed to buy Achillion Pharmaceuticals Inc for US$ 930 million to gain access to its rare blood disorder treatments. Before that, it had bought Sweden’s Wilson Therapeutics for US$ 855 million and followed that up with the purchase of Syntimmune for a total value of up to US$ 1.2 billion.

Access the Pipeline Prospector Dashboard for All Deals & Development Updates

Eli Lilly acquires Dermira

One of the first major deals announced this year was Eli Lilly’s all-cash acquisition of California-based Dermira Inc. The acquisition will allow Eli Lilly to expand its immunology pipeline with a late-stage treatment for atopic dermatitis.

The acquisition gives Lilly two key Dermira assets — lebrikizumab and Qbrexza (glycopyrronium) cloth. Lebrikizumab is a novel, investigational, monoclonal antibody designed to bind IL-13, which is believed to be a driver of signs and symptoms of atopic dermatitis. It is currently in two Phase 3 trials for the treatment of moderate-to-severe atopic dermatitis in adolescent and adult patients, aged 12 years and older.

In late 2019, the FDA granted fast-track designation to lebrikizumab, and analysts are of the view that the drug could be a challenger to Dupixent, a dermatological drug made by Regeneron and Sanofi that is expected to bring in over US$ 11 billion in annual sales.

Access the Pipeline Prospector Dashboard for All Deals & Development Updates

AbbVie-Allergan merger approved, to create fourth-largest drugmaker

In May, after waiting for nearly a year, AbbVie and Allergan finally bagged the approval of the Federal Trade Commission (FTC) in the US, for their US$ 63 billion merger. The FTC approval came nearly two months after the deal passed scrutiny by the European regulator.

The delay happened due to pushback from consumer groups and tight scrutiny by regulators. As part of the agreement, AbbVie and Allergan will offload Allergan's late-stage gastrointestinal candidate, brazikumab, to AstraZeneca as well as two pancreatic replacement enzymes — Zenpep and Viokace — to Nestlé.

Once cleared, the merger will create the fourth-largest drugmaker in the world.

Access the Pipeline Prospector Dashboard for All Deals & Development Updates

Sanofi, Merck announce major divestments

In a major announcement, French drugmaker Sanofi SA said it was selling most of its long-held stake in Regeneron Pharmaceuticals Inc. The sale is expected to give Sanofi a war chest of around US$ 13 billion to help the drugmaker reshape its drug pipeline as it plans to focus more on rare diseases and oncology drugs.

American drugmaker Regeneron said it had agreed to repurchase approximately US$ 5 billion of its shares directly from Sanofi. The French drugmaker had bought the stake in early 2013.

Another divestment announcement came from US-headquartered Merck, which is known as MSD (short for Merck Sharp & Dohme) outside the United States and Canada. The company said it will spin off its women’s health drugs, biosimilar drugs and older products to create a new pharmaceutical company with US$ 6.5 billion in annual sales.

Financial powerhouse, Blackstone launched a fund for life sciences, known as Blackstone Life Sciences. The fund was oversubscribed and closed at US$ 4.6 billion in total capital commitments — the largest life sciences private fund raised to date.

Access the Pipeline Prospector Dashboard for All Deals & Development Updates

Generics: BI exits Hikma; Akorn files for bankruptcy; Sandoz-Aurobindo deal gets nixed

In the generics business, Boehringer Ingelheim Invest GmbH announced its intention to exit, in full, its investment in Hikma Pharmaceuticals Plc valued at US$ 1.24 billion (GBP 1 billion).

In June, Boehringer Ingelheim said it is selling its stake to institutional investors and the rest back to the company. A book-runner for the deal said Boehringer would sell 28 million shares, worth about US$ 872.90 million (GBP 700 million), while Hikma said it would purchase the remaining shares for not more than US$ 366.6 million (GBP 295 million).

In April 2018, Fresenius had walked away from a US$ 4 billion takeover of Akorn, citing an investigation wherein Akorn had materially breached FDA’s data integrity requirements. Following the break-up, Akorn, faced a series of problems and in May it had filed its Chapter 11 petition in the Delaware bankruptcy court.

A few weeks before the announcement, the specialty drugmaker had said it has given up on finding itself a buyer due to the broader uncertainty brought about by the Covid-19 pandemic.

The Illinois-based company listed as much as US$ 10 billion of debt and US$ 10 billion of assets in its Chapter 11 petition.

In April, Novartis AG said it terminated its US$ 1 billion deal to sell the Sandoz US generic oral solids and dermatology businesses to Aurobindo Pharma USA Inc. The decision was taken mutually by Aurobindo Pharma USA Inc and Novartis.

According to the statement, the decision had to be taken because approval from the US Federal Trade Commission for the transaction was not obtained within the anticipated timelines.

Had the deal been cleared, it would have created the second-largest generics player in the US. According to news reports, there was no breakup fee associated with the termination and Sandoz will continue to operate its oral solids and dermatology business as part of the Sandoz US business.

Originally, Novartis was hoping to close the deal in 2019, but the US antitrust review caused significant delays. The regulators had requested for more information on a lawsuit against Aurobindo, a development that pushed the planned closure to 2020.

Access the Pipeline Prospector Dashboard for All Deals & Development Updates

Our view

While there weren’t too many big ticket deals announced in the first half of 2020, the US Food and Drug Administration (FDA) seemed more active than ever before with respect to New Drug Approvals (NDAs). By the end of June, FDA had already approved 33 new drugs which put the approval activities within the ballpark of the past two years — 62 novel drugs were approved in 2018, while 54 were approved in 2019.

Pipeline Prospector, our free access database of global drug development deals and development updates uncovered a spike in the number of alliances, joint ventures, licensing agreements, and collaborations announced in response to Covid-19.

While companies worked towards preserving capital and private equity remained largely inactive as a result of Covid-19, deal making is expected to rebound in the second half of the year.

As the focus on drug development constantly evolves, use the Pipeline Prospector, our free access database of global drug development deals and development updates, to get the insights necessary to drive your business forward.

Email us at support@pipelineprospector.com to learn more.

Access the Pipeline Prospector Dashboard for All Deals & Development Updates

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Pharma-&-Biotech-Deals by PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”