By PharmaCompass

2022-09-08

Impressions: 3171

Biotech stocks have been looking up since June this year. The trend continued through August with the Nasdaq Biotechnology Index (NBI) rising 0.6 percent to US$ 3,861. In July, it had gained 2 percent. Similarly, the S&P Biotechnology Select Industry Index (SPSIBI) rose by 5.4 percent to US$ 6,510. In July, it had risen by 6 percent. And the SPDR S&P Biotech ETF (XBI) rose by 5.3 percent, compared to a 6.5 percent rise in July. Despite these gains, the year-to-date (YTD) performance of NBI is still down 18 percent.

These gains were overshadowed by the Inflation Reduction Act of 2022 (IRA) in the US. The US President, Joe Biden, signed a US$750 billion health care, tax and climate bill last month. This law aims to curb inflation by reducing the budget deficit, lowering prescription drug prices, and investing in the domestic production of energy while promoting clean energy.

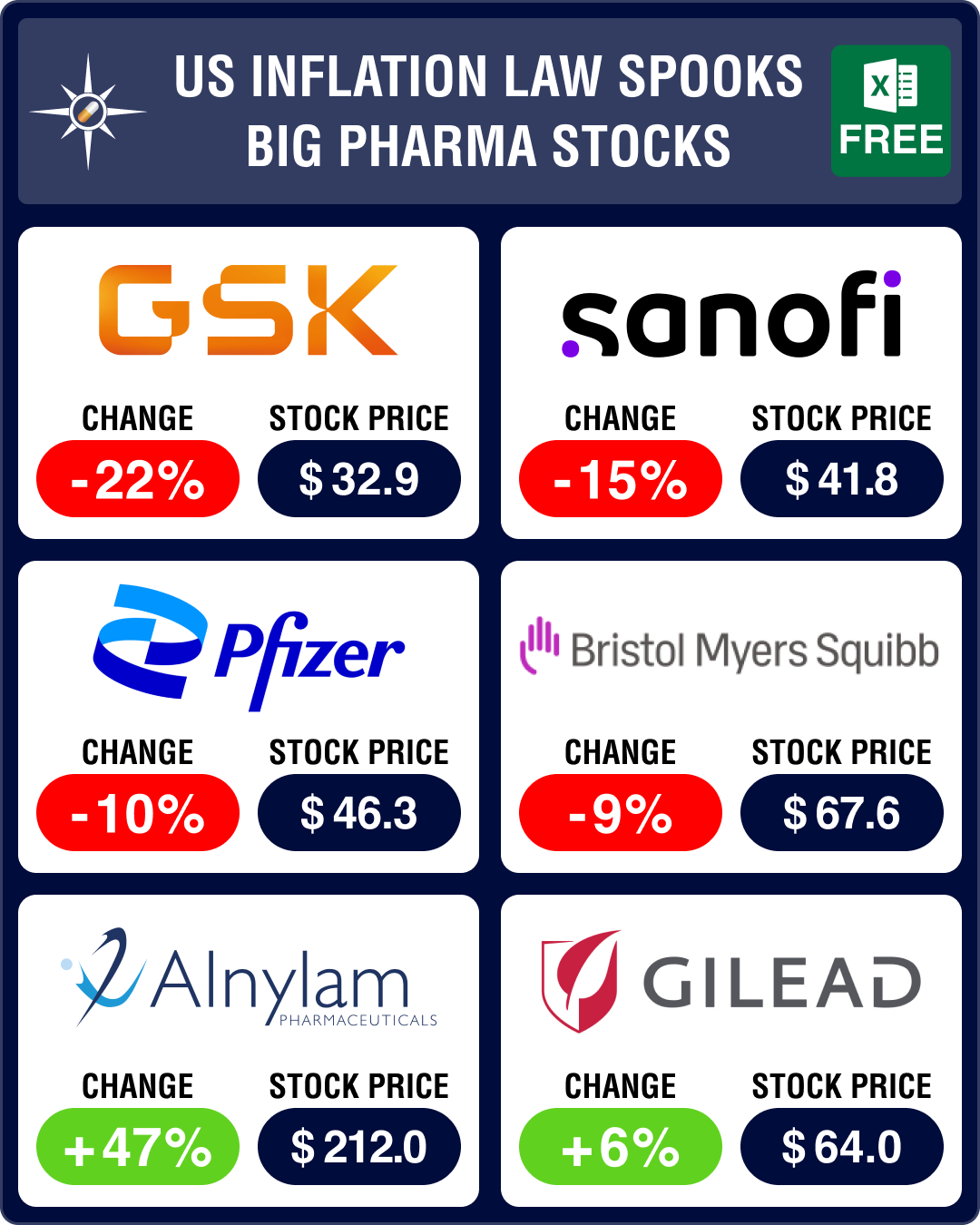

The IRA, which is being termed as the “most significant law” in recent US history, spooked the industry and several mega cap companies saw their stock prices take a hit.

Access the Pipeline Prospector Dashboard for August 2022 Newsmakers

Concerns over profits weigh down big pharma stocks

Americans spend a lot more on prescription drugs than people anywhere in the world. Drug prices have been in the eye of the storm for many years now, with previous administrations not being able to do much to control them. While the IRA finally delivers on the promise of lowering the cost of prescription drugs, big pharma executives are worried that one part of the IRA will reduce their companies’ profits, while also hampering innovation.

These concerns were also reflected on the bourses, and stocks of most mega cap drugmakers such as Merck (-3 percent), Pfizer (-10 percent), Eli Lilly (-7 percent) and Johnson & Johnson (-7 percent) were weighed down by the IRA.

According to this new regulation, the secretary of Health and Human Services will be responsible for identifying the drugs for which price negotiations will be conducted. It will allow Medicare to control the prices of 10 drugs in 2026, which will grow to 60 by 2029. In 2026 and 2027, Medicare will only control Part D drug prices. But by 2028, it can also negotiate prices in Part B.

Business leaders of companies such as Gilead Sciences, J&J, Novartis and Bristol Myers Squibb (BMS) have voiced concerns over this new legislation.

“In reality, it’s not a price negotiation because they are forcing their will by implementing a 95 percent tax, according to previous guidance. That will cost the industry significant – we estimate US$ 270 billion over 10 years,” Pfizer CEO Albert Bourla has said. Of the 10 drugs that Medicare Part D spent the most on in 2020, two were marketed by Pfizer (Eliquis and Ibrance).

Merck’s cancer immunotherapy Keytruda was Medicare Part B's costliest drug in 2020. The company’s president, Rob Davis, has said the ability of Medicare to negotiate drug prices “will be highly chilling on future innovation.”

Access the Pipeline Prospector Dashboard for August 2022 Newsmakers

Zantac lawsuits bring stock market losses for Sanofi, GSK

August was the roughest month for Sanofi this year, as its stock tumbled 15 percent due to multiple reasons. One, the FDA had put a partial clinical hold on trials of its promising multiple sclerosis candidate — tolebrutinib — which it had acquired through the US$ 3.7 billion buyout of Principia in 2020.

Two, Sanofi faced increased public attention due to the impending Zantac lawsuits. In fact, Sanofi, GSK and Haleon have together lost around US$ 40 billion in market value amid mounting concerns over these litigations. In 2019, regulators had launched a safety review amid concern that the drug contains a probable carcinogen — N-nitrosodimethylamine (NDMA). By 2020, regulators in the US and Europe had requested all versions of the treatment to be withdrawn from the market.

People who took Zantac and ranitidine contaminated with NDMA and later developed cancer have filed lawsuits seeking compensation from the drug’s manufacturers. GSK faces over 3,000 Zantac lawsuits, while Sanofi has to contend with around 2,850.

The Zantac lawsuits have caused a 22 percent drop in GSK’s stock. However, there was a breather for both GSK and Sanofi as the plaintiff in the first Zantac trial scheduled in the US moved for a voluntary dismissal of the lawsuit.

Sanofi has also stopped further work on its experimental drug, amcenestrant, once considered a promising candidate to treat breast cancer, following failure of a second clinical trial.

However, all news for Sanofi was not negative. Sanofi’s rare disease drug Xenpozyme (olipudase alfa) bagged FDA approval to treat adult and pediatric patients with non-central nervous system (non-CNS) manifestations of acid sphingomyelinase deficiency (ASMD) – a rare, progressive and potentially life-threatening genetic disease. Moreover, Sanofi and its partner Sobi’s investigational hemophilia A drug — efanesoctocog alfa — has received a priority review from the FDA. The agency is slated to review the drug by February 28, 2023.

There was some good news from GSK as well — FDA accepted its new drug application for momelotinib. And the British drugmaker entered into a collaboration with Mersana to co-develop and commercialize the biotech’s antibody drug conjugate (ADC) asset, XMT-2056.

Access the Pipeline Prospector Dashboard for August 2022 Newsmakers

Messenger RNA lawsuits filed by Moderna bring down Pfizer’s share price

Pfizer’s stock was down 10 percent as Moderna filed two lawsuits – one in the US and another in Germany – against the New York-based drugmaker and its German partner BioNTech alleging that they copied its patented messenger RNA technology to create their Covid-19 shot.

In other negative news, Pfizer has decided to stop work on the cardiovascular disease candidate PF-07265803, after the drug failed a phase 3 trial. Pfizer had picked up this asset through its US$ 11.4 billion takeover of Array BioPharma three years ago.

In positive news, Pfizer-BioNTech and Moderna have received emergency use authorizations (EUAs) from the FDA for their bivalent booster shots targeting Omicron and the original coronavirus strain. The UK’s Medicines and Healthcare Products Regulatory Agency has also authorized Moderna’s bivalent Covid-19 booster targeting the Omicron variant along with the original strain.

Pfizer has played catch-up with Merck and has come out with positive data from a late-stage trial of its 20-valent pneumococcal vaccine, Prevnar 20, for infants.

Stocks of BMS fell 9 percent in August. BMS and its partner J&J are planning to advance their blood thinner candidate, milvexian, into late-stage testing despite the drug reporting mixed results in a phase 2 trial. Milvexian is a key component of the company’s strategy to power through several upcoming patent expirations.

In positive news, BMS completed the acquisition of Turning Point Therapeutics, thereby expanding its precision oncology portfolio. Additionally, BMS and its partner 2Seventy Bio have said their CAR-T cell therapy — Abecma — has outperformed standard drug regimens in a study on relapsed and refractory multiple myeloma.

J&J’s stock was down 7 percent over concerns that the IRA will impact its blockbuster drug Darzalex. The company also announced it will stop selling its baby talc powder globally from 2023 and focus on cornstarch-based powder. The company is facing 38,000 lawsuits related to its talc-based products claiming that they cause cancer.

Access the Pipeline Prospector Dashboard for August 2022 Newsmakers

Disappointing sales pull down Lilly; Novartis hit by Zolgensma deaths, lawsuits

Eli Lilly’s stocks fell 7 percent in August. The pharma reported disappointing Q2 sales figures for its migraine prevention drug Emgality, which the FDA had approved four years ago. The drug generated sales worth US$ 157.5 million, an increase of just 1 percent compared to Q2 2021. Lilly’s other migraine treatment — Reyvow — has also posted weak sales amid concerns of side effects.

AstraZeneca informed its partner Innate Pharma that a phase 3 study sponsored by it — Interlink-1 — will be discontinued. The drugs monalizumab plus cetuximab, which were being tested against cetuximab for patients with recurrent or metastatic head and neck squamous cell carcinoma (HNSCC), did not meet a pre-defined threshold of efficacy.

Similarly AbbVie called off a phase 1 trial for I-Mab’s CD47 to test lemzoparlimab in combination with azacitidine and venetoclax in patients with acute myeloid leukemia and myelodysplastic syndrome. The partnership will continue with “certain new anti-CD47 antibodies” or “other licensed products,” I-Mab said.

In positive news, a US appeals court ruled that pharma giant AbbVie did nothing unlawful by building up a patent thicket around its mega blockbuster drug Humira to block competition.

Novartis stocks plummeted 5 percent on news that two children with spinal muscular atrophy died after receiving its gene therapy Zolgensma. Both patients – in Russia and Kazakhstan – died of acute liver failure. The Swiss drugmaker was also hit by a patent infringement lawsuit filed by the University of Michigan and the University of South Florida. The two institutions alleged that Novartis’ Entresto infringed a co-crystal patent held by these institutions.

Access the Pipeline Prospector Dashboard for August 2022 Newsmakers

Alnylam stock rises 47 percent on trial news; Moderna, Bayer stocks plummet

Among the large cap gainers was Alnylam Pharma whose stocks rose 47 percent after the company reported that its phase 3 clinical trial of Onpattro (patisiran) was effective in improving the quality of life of transthyretin-mediated amyloidosis (ATTR) patients. The company tested the RNAi therapy in patients with ATTR affecting the heart. Pfizer’s Vyndaqel (global sales of US$ 2 billion in 2021) is the only treatment currently available for the above indication.

Gilead’s investment in oncology has begun to provide good returns with sales of cancer therapies reaching the US$ 500 million threshold for the first time in Q2 2022. Gilead also announced the acquisition of MiroBio for approximately US$ 405 million cash. As a result of these positive developments, Gilead stocks rose 6 percent, despite only 1 percent increase in its Q2 revenue.

Among large cap losers was Moderna, whose stocks plummeted 16 percent. This was despite the news that its bivalent Covid-19 booster had received regulatory go-ahead in the UK and US. The biotech’s stocks plummeted after David Meline, who had served as the CFO since the start of the coronavirus pandemic, stepped down in August.

Bayer’s stock was down 9 percent as its blood thinner — Xarelto — continued to feel the squeeze from an aggressive drug discounting program in China. Xarelto’s sales were also down 6 percent to € 1.11 billion (about US$ 1.1 billion) from the € 1.16 billion (US$ 1.15 billion) it had posted in Q2 of 2021. The drug is marketed by J&J in the US, where it recorded a 7 percent increase in Q2 revenues (at US$ 609 million).

Bayer also ended its collaboration with Exscientia, following the achievement of a drug discovery milestone. The two companies had signed a deal in January 2020.

Access the Pipeline Prospector Dashboard for August 2022 Newsmakers

Novavax’s stock drops 36 percent, Bavarian Nordic’s falls 33 percent

Despite news that the US, the UK and New Zealand have approved the use of Novavax’s Covid-19 vaccine for adolescents, the company’s stock plummeted 36 percent in August as sales of this shot had dropped by over 90 percent in Q2. Incidentally, Japan and Australia had also approved the use of the vaccine in adolescents in July. Due to the lackluster performance, Novavax expects between US$ 2 to 2.3 billion in 2022 sales, down from a previous estimate of US$ 4 to 5 billion.

Another drugmaker that saw a steep drop in its stock was Bavarian Nordic. The FDA has allowed a single vaccine to be split among five people, while also considering the use of expired monkeypox jabs. Emergent BioSolutions’ stock was down 31 percent as it reported a 39 percent drop in Q2 revenues at US$ 242.7 million. The pharma has also received an FDA warning letter citing certain deficiencies at its Baltimore plant.

Among small to mid cap gainers were Minerva Neurosciences, whose stocks soared 463 percent after the announcement that it has submitted the NDA for its schizophrenia candidate — roluperidone. Stocks of Applied DNA Sciences gained 358 percent as the company initiated analytical validation of a company-developed, PCR-based monkeypox virus test. Axsome Therapeutics’ stock rose 66 percent on news of its depression drug Auvelity bagging FDA approval.

Access the Pipeline Prospector Dashboard for August 2022 Newsmakers

Pfizer picks up GBT for US$ 5.4 billion; Amgen buys ChemoCentryx

August saw some mid-size deals. Cash-rich Pfizer continued to acquire companies to strengthen its portfolio. It acquired Global Blood Therapeutics for US$ 5.4 billion to enhance its presence in rare hematology. The buyout has added GBT’s approved drug, Oxbryta, along with two other investigational sickle cell medicines, into Pfizer’s portfolio.

Amgen acquired Californian biotech ChemoCentryx for US$ 3.7 billion to help broaden its portfolio of inflammation and kidney drugs. The deal will give the pharma access to ChemoCentryx’s potential blockbuster treatment for inflammatory disorders — Tavneos (avacopan).

Merck forged a potential US$ 3.65 billion biobucks deal with circular RNA start-up Orna Therapeutics to develop and commercialize multiple programs, including engineered circular RNA (oRNA) vaccines and therapeutics against infectious diseases and cancers. Merck has also signed a potential US$ 1.1 billion research collaboration with Boston-based Cerevance to find new targets for Alzheimer’s disease.

AbbVie has entered into a new drug discovery partnership with Sosei Heptares for the discovery, development and marketing of therapies for neurological ailments. And Sanofi inked a US$ 1.02 billion bio bucks deal with San Francisco-based Atomwise. The deal centers on leveraging Atomwise’s AtomNet platform to research small molecules.

GentiBio signed a collaboration with BMS to pioneer engineered regulatory T cells for inflammatory bowel diseases. Ipsen entered into a potential US$ 1.6 billion partnership with US biotech Marengo Therapeutics for two experimental T cell receptor therapies.

Access the Pipeline Prospector Dashboard for August 2022 Newsmakers

Our view

With the US being the world’s largest market for pharmaceuticals, the bourses were bound to react to the IRA. There are many positives to this regulation. For instance, the IRA will reduce uncertainty in the US drug market and establish a more predictable pricing outlook. Similarly, the insurance subsidies should expand, making prescription drugs more affordable and bringing about an increase in sales.

Since the regulation to check rising drug prices was imminent, we are hopeful that the stocks of mega cap drugmakers would not be impacted for long. What’s equally important to note is that biotech indices have been rising despite the ongoing Russia-Ukraine war, inflation and talks of a global recession. Things should only get better from here.

Access the Pipeline Prospector Dashboard for August 2022 Newsmakers

Pharma & Biotech Newsmakers in August 2022

| Company | Country | Currency | Market Cap (Bn) | Change In Market Cap (M) | Stock Price | Change In Price |

|---|

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Pharma & Biotech Recap by PharmaCompass license under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”