Data integrity was a hot topic of discussion in the pharmaceutical industry throughout 2016. Largely, it was a year when non-compliances made headlines — regulators were turned away by drug companies, contract research organisations (CROs) faced serious charges of data manipulation and warning letters and import alerts were issued due to data integrity concerns.

Interestingly, non-compliances weren’t limited to India and China. The year also saw a lot of cross border activity as EU regulators issued non-compliance notifications to American firms, while the FDA had issues with companies across Europe.

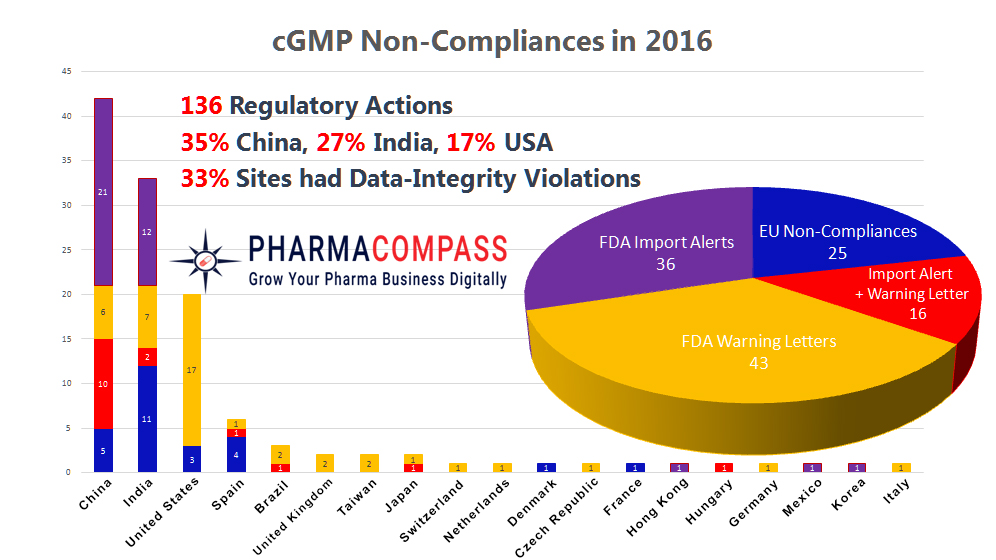

PharmaCompass analyzed the activities of the US and EU regulators to summarize the events that happened last year.

Data integrity issues hog limelight

In 2016, data integrity issues triggered more than one third of all regulatory actions. While US Food and Drug Administration (FDA) took maximum action against companies based in China, India led the pack when it came to non-compliance reports issued by European regulators.

In 16 instances, the FDA determined the issues were severe enough and the company was issued a warning letter and was also placed on the import alert list.

Click here to access the compilation

of all non-compliances (Excel version available) for FREE!

Problems not limited to Asia, data manipulation at major drug companies

While Indian and Chinese companies dominated ‘non-compliance news’, 2016 proved that data integrity concerns are not limited to these two countries. European operations of major drug companies like GlaxoSmithKline, Teva and Otsuka were found to have serious non-compliance concerns.

A case in point is Teva’s Hungary plant, where USFDA investigators found “quality-related documents in a waste bin”. They also found Teva’s “stand-alone computer systems” to have lacked controls to prevent analysts from deleting data.

Similarly, data manipulation was uncovered at a Czech-based subsidiary of Otsuka Pharmaceuticals, which received a warning letter from the US FDA.

In the UK, GSK’s API operation, which had previously recalled more than 425,000 Bacroban antibiotic products after an FDA inspection, received a stern warning letter from the American drug regulator in July 2016 for penicillin cross contamination.

When inspections got ugly

Several companies landed on FDA’s red list for refusing regulatory inspections last year — such as India-based Cheryl Laboratories, Phalanx Labs, Divis Pharmaceutical, Amphray Laboratories, Megafine Pharma and Laxachem Organics.

In some cases the inspection got ugly, such as in Hyogo (Japan) where the employees of Nippon Fine Chemical formed a “shoulder-to-shoulder” barricade to prevent FDA investigators from entering the quality control laboratory.

In June last year, it seemed like the European and the American regulators were trying to outdo one another in terms of proving the rigor in their inspections. Three of the seven non-compliance reports Eudra GMP posted addressed sites in the US, while the remaining four were located in India.

Similarly, the US FDA imposed an import alert on a Teva site in Hungary and issued warning letters to Germany’s BBT Biotech, Italy’s Corden Pharma and Spain’s Interquim.

Click here to access the compilation of all non-compliances (Excel version available) for FREE!

Concerns over clinical trial falsification

For the generic drug industry, life became a lot more challenging in 2016. Clinical data-integrity — though not a manufacturing compliance issue — also made headlines as labs across India had their data invalidated due to data-integrity concerns.

While clinical trial falsification issues at the laboratories of Quest Life Sciences and GVK Biosciences in India had made headlines previously, data integrity problems uncovered by US and European regulators at Alkem Laboratories, Semler Research Center and Micro Therapeutics Research Labs indicated that a sustained supply of generics can no longer be taken for granted.

The most talked about case though was that of Semler Research Centre, a CRO in Bengaluru. Semler’s data integrity concerns made regulators question the equivalency of over 110 generic drug applications. Concerns were raised by the US FDA, European Medicines Agency (EMA) and the WHO.

And the year ended with concerns being raised by the EMA over another CRO in India — Micro Therapeutics Research Labs, which has regulators now reviewing the data of over 300 generic medicines being sold across Europe.

Manufacturing issues dramatically reduced new drug approvals

The generics business wasn’t the only one to suffer as the number of new drug approvals for major pharmaceutical companies reduced dramatically due to manufacturing lapses.

In 2014 and 2015, while reviewing new drug applications, the FDA had raised manufacturing questions in only one complete response letter sent to the applicant. However, by mid-December, 2016 “an astonishing 40 percent, were specifically tied to questions the agency raised about the manufacturing capabilities of a drugmaker or its contractor.”

Manufacturing issues derailed sales forecasts through new drug approvals of Sanofi, AstraZeneca, Valeant, Bristol-Myers Squibb, Pfizer and many others.

Our view

The year 2016 was a year when the spotlight was clearly on the approach taken towards drug manufacturing and clinical trials as various problems came to the surface.

If last year is any indicator for the future, things certainly don’t look all that good in 2017. But a lot depends on how things pan out under the Trump administration.

PharmaCompass’ 2016 Recap of FDA Warning Letters, Import Alerts & EU Non-Compliances is an easy way to evaluate companies that have run into compliance challenges so that appropriate risk mitigation strategies can be adopted.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”