By PharmaCompass

2022-07-21

Impressions: 3935

This week, PharmaCompass brings you the key highlights of the US Food and Drug Administration’s June 2022 list of Off-Patent, Off-Exclusivity (OPOE) Drugs with No Approved Generics. The OPOE list gets updated every six months.

Since 2017, the FDA has been publishing the OPOE list of drugs without an approved generic. With the December 2021 update, the FDA has started publishing two versions of the OPOE list — one for prescription drug products and one for over-the-counter (OTC) drug products that are approved and marketed under a new drug approval (NDA).

With this list, the FDA hopes to bolster competitiveness in the generics market. Such updates are a part of FDA’s initiative to improve transparency and encourage the development and submission of abbreviated new drug applications (ANDAs) in markets with little competition.

View FDA's List of Off-Patent, Off-Exclusivity Drugs (Mid-2022 Recap)

A steep rise in new drug applications on OPOE list

While the December 2021 list had only 16 new applications (as opposed to 35 in June 2021), the June 2022 OPOE list has 98 new applications of prescription drugs. These include dobutamine hydrochloride (a drug used to treat cardiac decompensation), mannitol (a medicine to treat symptoms of elevated intracranial or intraocular pressure), alprostadil (a drug used to treat erectile dysfunction), dopamine hydrochloride (a med used to correct low blood pressure) and heparin sodium (a drug used to treat blood clots).

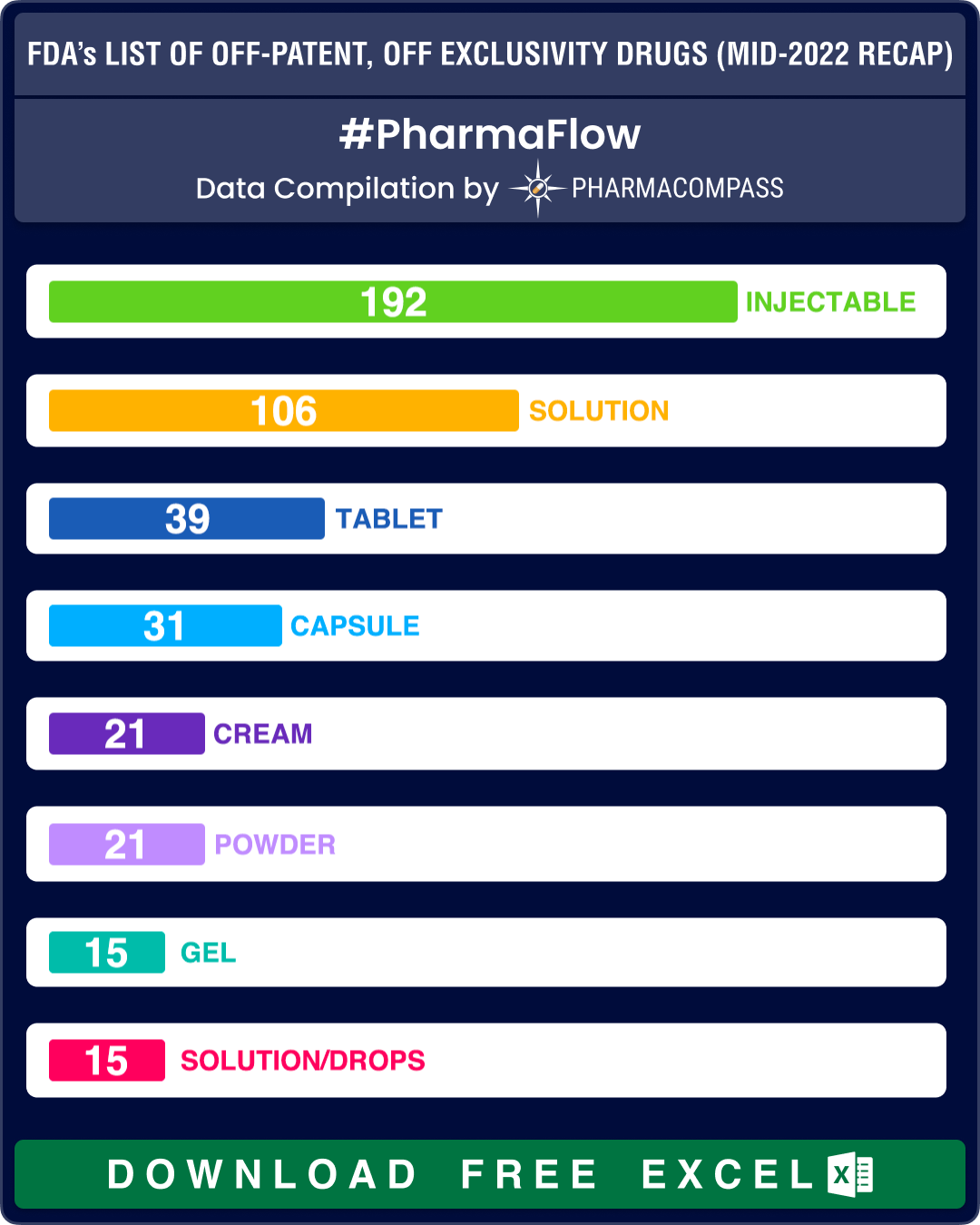

Almost one-third of the prescription products – 192 out of 517 – continue to be drug products delivered as injectables while there are 70 entries on the list that are delivered as oral solid dosage forms (such as tablets, capsules and modified release forms).

A total of 60 OTC drug products figured in the OPOE list. These include non-steroidal anti-inflammatory drug ibuprofen, anti-allergy drug loratadine, pain killer acetaminophen and stomach ulcer drug famotidine. Out of the 60 OTC drug products on the list, 19 are delivered as oral solid dosage forms (such as tablets, capsules, modified release forms, etc.).

View FDA's List of Off-Patent, Off-Exclusivity Drugs (Mid-2022 Recap)

Diabetes drug sitagliptin goes off patent

This month, diabetes drug sitagliptin has gone off patent. It is sold under the brand name Januvia by Merck, Sharp & Dohme (MSD). MSD also sells a fixed dose combination (FDC) of sitagliptin and metformin under the brand name Janumet, whose patent has also expired.

With Januvia and Janumet going off patent, the oral diabetes drug market is likely to be in for a major shake-up. Analysts expect prices to drop by 60 percent with the entry of generics. These copycats will also intensify competition for vildagliptin and teneligliptin, two molecules of the same class that went off-patent in 2019 and 2015, respectively.

Earlier this month, two Indian drugmakers – Zydus Lifesciences and Glenmark Pharmaceuticals – launched sitagliptin products in India. While Glenmark launched sitagliptin and its FDCs at affordable prices for adults with type 2 diabetes in India, Zydus launched sitagliptin under the brand names Sitaglyn and Siglyn. In all, Glenmark has introduced eight different combinations of sitagliptin based drugs under the brand name Sitazit and its variants at affordable prices.

Sitagliptin was approved by the FDA in 2006. It is the first approved anti-diabetic treatment that enhances the body’s own ability to lower elevated blood sugar.

View FDA's List of Off-Patent, Off-Exclusivity Drugs (Mid-2022 Recap)

AbbVie’s Restasis finally faces generic competition

In February, AbbVie’s controversial chronic dry eye drug — Restasis — finally faced competition from a generic. The FDA has approved Viatris’ generic to Restasis, a drug that generated US$ 1.23 billion in US sales for AbbVie in 2021. Viatris was formed through the merger of generic drugmaker Mylan Pharmaceuticals and Pfizer’s off-patent drug business in 2020.

Even though patents on Restasis began expiring in 2014, the drug didn’t have any generics until February. The drug has been embroiled in controversies ever since it was owned by Allergan. In 2017, Allergan had licensed Restasis patents to a native American tribe in a bid to protect the drug from generic competition. The deal had earned the company widespread criticism.

In March, FDA had also approved the first generic of GSK’s Symbicort (budesonide and formoterol fumarate dihydrate) for the treatment of two common pulmonary health conditions — asthma and chronic obstructive pulmonary disease (COPD), including chronic bronchitis and/or emphysema.

“First generics” are the first approval by FDA which permits a manufacturer to market a generic drug product in the United States.

View FDA's List of Off-Patent, Off-Exclusivity Drugs (Mid-2022 Recap)

Our view

In the US, legislators have been pushing for lower drug prices for quite some time. With the FDA putting 98 new applications of prescription drugs in the OPOE list for June 2022, the agency’s intent to bring down drug prices appears firm. The US government is also likely to implement an aggressive wave of new drug-pricing regulations to address the high drug prices.

In China, the Volume-Based Procurement (VBP) program has brought down drug prices for public hospitals with volume commitments. According to a recent report published in the People’s Daily, more than 200 companies making the generics of 60 off-patent drugs have slashed prices of these drugs by an average 48 percent to win supply contracts with China’s public hospitals.

The ongoing Russia-Ukraine war, inflation and supply chain constrains point to a heightened risk of a recession. “This perfect storm scenario will have an impact on investment in innovation and could accelerate downward pressure on drug pricing,” Christophe Weber, chief executive of Takeda, had said in May.

Moreover, over the next few years, several biologics are going off-patent that would open up huge opportunities for cost-efficient generic drug manufacturers. For now, it seems like the drop in drug prices are here to stay.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : FDA’s list of off-patent by PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”