Acquisitions and spin-offs dominated headlines in 2019 and the tone was set very early with Bristol-Myers Squibb acquiring

New Jersey-based cancer drug company Celgene in a US$ 74 billion deal announced on

January 3, 2019. After factoring

in debt, the deal value ballooned to about US$ 95 billion, which according

to data compiled by Refinitiv, made it the largest healthcare deal on

record.

In the summer, AbbVie Inc,

which sells the world’s best-selling drug Humira, announced its acquisition of Allergan Plc, known for Botox and other cosmetic

treatments, for US$ 63 billion. While the companies are still awaiting

regulatory approval for their deal, with US$ 49 billion in combined 2019

revenues, the merged entity would rank amongst the biggest in the industry.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

The big five by pharmaceutical sales — Pfizer,

Roche, J&J, Novartis and Merck

Pfizer

continued

to lead companies by pharmaceutical sales by reporting annual 2019 revenues of

US$ 51.8 billion, a decrease of US$ 1.9 billion, or 4 percent, compared to

2018. The decline was primarily attributed to the loss of exclusivity of Lyrica in 2019,

which witnessed its sales drop from US$ 5 billion in 2018 to US$ 3.3 billion in

2019.

In 2018, Pfizer’s then incoming CEO Albert Bourla had mentioned that the company did not see the need for any large-scale M&A activity as Pfizer had “the best pipeline” in its history, which needed the company to focus on deploying its capital to keep its pipeline flowing and execute on its drug launches.

Bourla stayed true to his word and barring the acquisition of Array Biopharma for US$ 11.4 billion and a spin-off to merge Upjohn, Pfizer’s off-patent branded and generic established medicines business with

Mylan, there weren’t any other big ticket deals which were announced.

The

Upjohn-Mylan merged entity will be called Viatris and is expected to have 2020

revenues between US$ 19 and US$ 20 billion

and could outpace Teva to

become the largest generic company in the world, in term of revenues.

Novartis, which had

followed Pfizer with the second largest revenues in the pharmaceutical industry

in 2018, reported its first full year earnings after spinning off its Alcon eye

care devices business division that

had US$ 7.15 billion in 2018 sales.

In 2019,

Novartis slipped two spots in the ranking after reporting total sales of US$

47.4 billion and its CEO Vas Narasimhan continued his deal-making spree by buying New

Jersey-headquartered The Medicines Company (MedCo) for US$ 9.7

billion to acquire a late-stage cholesterol-lowering

therapy named inclisiran.

As Takeda Pharmaceutical Co was

busy in 2019 on working to reduce its debt burden incurred due to its US$ 62

billion purchase of Shire Plc, which was announced in 2018, Novartis also purchased

the eye-disease medicine, Xiidra, from the Japanese drugmaker for US$ 5.3 billion.

Novartis’ management also spent a considerable part of 2019 dealing with data-integrity concerns which emerged from its 2018 buyout of AveXis, the

gene-therapy maker Novartis had acquired for US$ 8.7 billion.

The deal gave Novartis rights to Zolgensma,

a novel treatment intended for children less than two years of age with the

most severe form of spinal muscular atrophy (SMA). Priced at US$ 2.1 million,

Zolgensma is currently the world’s most expensive drug.

However,

in a shocking announcement, a month after approving the drug, the US Food and

Drug Administration (FDA) issued a press release on

data accuracy issues as the agency was informed by AveXis that

its personnel had manipulated data which

the FDA used to evaluate product comparability and nonclinical (animal)

pharmacology as part of the biologics license application (BLA), which was

submitted and reviewed by the FDA.

With US$

50.0 billion (CHF 48.5 billion) in annual pharmaceutical sales, Swiss drugmaker

Roche came in at number two position in 2019

as its sales grew 11 percent driven by

its multiple sclerosis medicine Ocrevus, haemophilia drug Hemlibra and cancer medicines Tecentriq and Perjeta.

Roche’s newly introduced medicines generated US$ 5.53 billion (CHF 5.4 billion) in growth, helping offset the impact of the competition from biosimilars for its three best-selling drugs MabThera/Rituxan, Herceptin and Avastin.

In late 2019, after months of increased

antitrust scrutiny, Roche completed

its US$ 5.1 billion acquisition of Spark Therapeutics to strengthen its presence in

gene therapy.

Last year, J&J reported almost flat worldwide sales of US$ 82.1 billion. J&J’s pharmaceutical division generated US$ 42.20 billion and its medical devices and consumer health divisions brought in US$ 25.96 billion and US$ 13.89 billion respectively.

Since J&J’s consumer health division sells analgesics, digestive health along with beauty and oral care products, the US$ 5.43 billion in consumer health sales from over-the-counter drugs and women’s health products was only used in our assessment of J&J’s total pharmaceutical revenues. With combined pharmaceutical sales of US$ 47.63 billion, J&J made it to number three on our list.

While the sales of products like Stelara, Darzalex, Imbruvica, Invega Sustenna drove J&J’s pharmaceutical business to grow by 4 percent over 2018, the firm had to contend with generic competition against key revenue contributors Remicade and Zytiga.

US-headquartered Merck, which is known as

MSD (short for Merck Sharp & Dohme) outside the United States and

Canada, is set to significantly move up the rankings next year fueled by its

cancer drug Keytruda, which witnessed a 55

percent increase in sales to US$ 11.1 billion.

Merck reported total revenues of US$ 41.75 billion and also

announced it will spin off its women’s health drugs,

biosimilar drugs and older products to create a new pharmaceutical

company with US$ 6.5 billion in annual revenues.

The firm had anticipated 2020 sales between US$ 48.8 billion and US$ 50.3 billion however this week it announced that the coronavirus pandemic will reduce 2020 sales by more than $2 billion.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

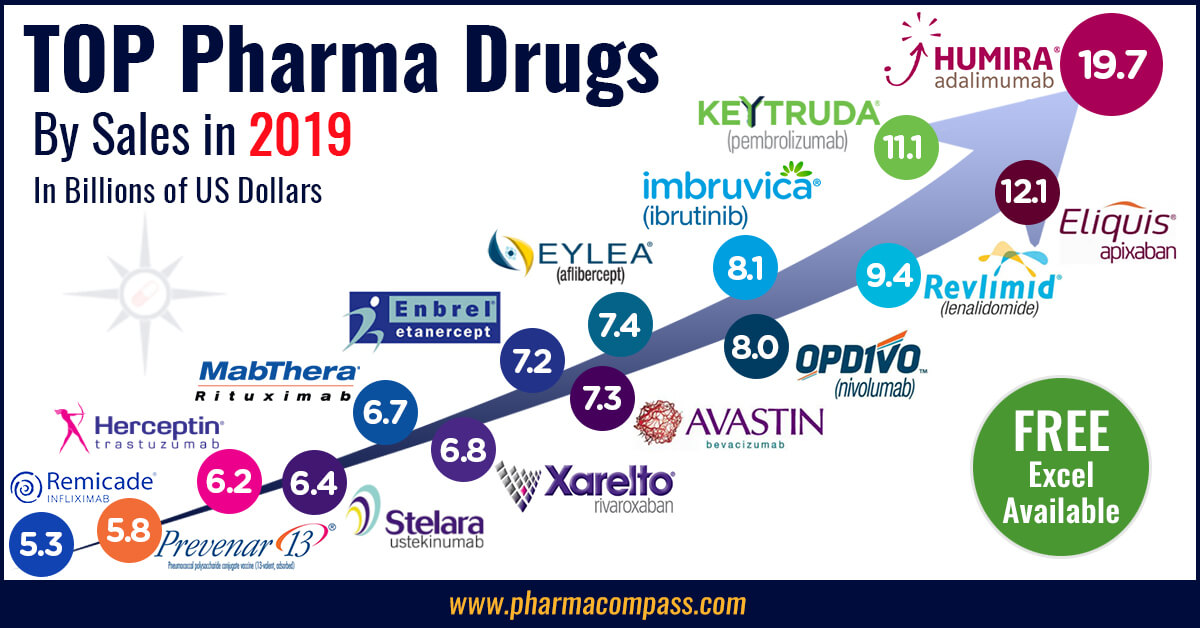

Humira holds on to remain world’s best-selling drug

AbbVie’s acquisition of Allergan comes as the firm faces the expiration of patent protection for Humira, which brought in a staggering US$ 19.2 billion in sales last year for

the company. AbbVie has failed to successfully acquire or develop a major new

product to replace the sales generated by its flagship drug.

In 2019, Humira’s US revenues increased 8.6 percent to US$ 14.86 billion while internationally, due

to biosimilar competition, the sales dropped 31.1 percent to US$ 4.30 billion.

Bristol Myers Squibb’s Eliquis, which is also marketed by Pfizer, maintained its number two position

and posted total sales of US$ 12.1 billion, a 23 percent increase over 2018.

While Bristol Myers Squibb’s immunotherapy treatment Opdivo, sold in partnership with Ono in Japan, saw sales increase from US$ 7.57 billion to US$ 8.0 billion, the growth paled in comparison to the US$ 3.9

billion revenue increase of Opdivo’s key immunotherapy competitor Merck’s Keytruda.

Keytruda took the number three spot in drug sales that

previously belonged to Celgene’s Revlimid, which witnessed a sales decline from US$ 9.69 billion to US$ 9.4 billion.

Cancer treatment Imbruvica, which is marketed

by J&J and AbbVie, witnessed a 30 percent increase in sales. With US$ 8.1

billion in 2019 revenues, it took the number five position.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Vaccines – Covid-19 turns competitors into partners

This year has been dominated by the single biggest health emergency in years — the novel coronavirus (Covid-19) pandemic. As drugs continue to fail to meet expectations, vaccine development has received a lot of attention.

GSK reported the highest vaccine sales of all drugmakers with

total sales of US$ 8.4 billion (GBP 7.16 billion), a significant portion of its

total sales of US$ 41.8 billion (GBP 33.754 billion).

US-based Merck’s vaccine division also reported a significant increase in sales to US$ 8.0 billion and in 2019 received FDA and EU approval to market its Ebola vaccine Ervebo.

This is the first FDA-authorized vaccine against the deadly virus which causes

hemorrhagic fever and spreads from person to person through direct contact with

body fluids.

Pfizer and Sanofi also reported an increase in their vaccine sales to US$ 6.4

billion and US$ 6.2 billion respectively and the Covid-19 pandemic has recently

pushed drugmakers to move faster than ever before and has also converted

competitors into partners.

In a rare move, drug behemoths — Sanofi and GlaxoSmithKline (GSK) —joined hands to develop a vaccine for the novel coronavirus.

The two companies plan to start human trials

in the second half of this year, and if things go right, they will file

for potential approvals by the second half of 2021.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Our view

Covid-19 has brought the world economy to a grinding halt and shifted the global attention to the pharmaceutical industry’s capability to deliver solutions to address this pandemic.

Our compilation shows that vaccines and drugs

for infectious diseases currently form a tiny fraction of the total sales of

pharmaceutical companies and few drugs against infectious diseases rank high on

the sales list.

This could well explain the limited range of

options currently available to fight Covid-19. With the pandemic currently infecting

over 3 million people spread across more than 200 countries, we can safely

conclude that the scenario in 2020 will change substantially. And so should our

compilation of top drugs for the year.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Impressions: 54752

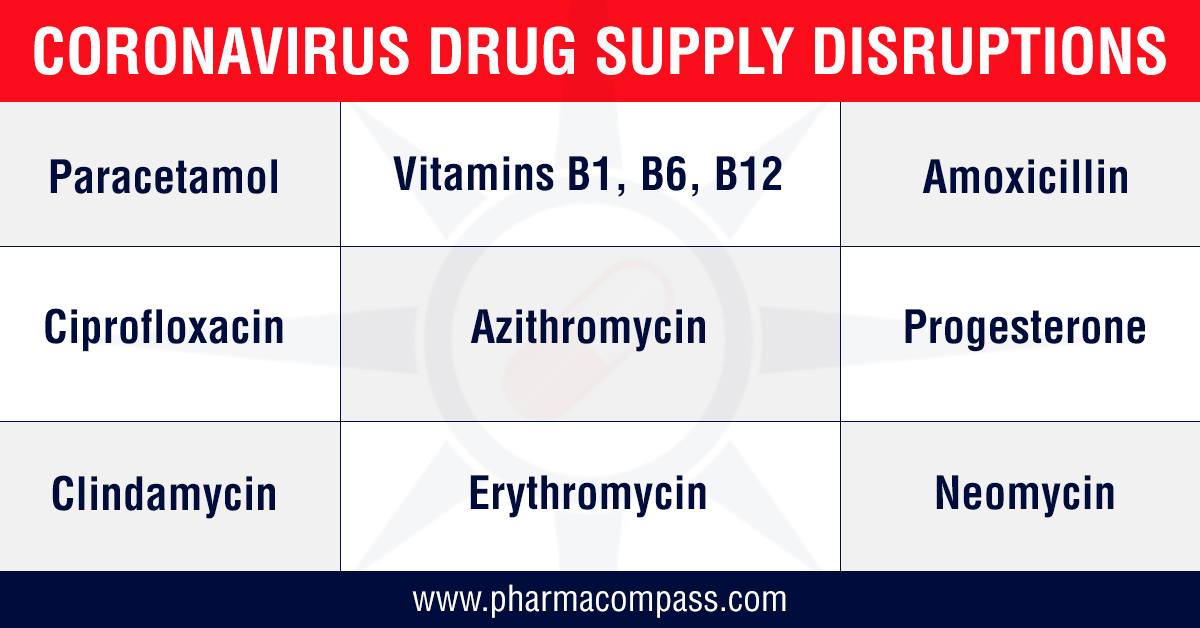

Now that it has been

established that the novel coronavirus is going to globally impact the drug

supply chain, it becomes imperative to analyze the extent of the impact.

Since the outbreak of

the novel coronavirus — COVID-19 — in December, PharmaCompass has been constantly reaching out to

manufacturers around the world to assess the current state of the drug supply

chain. This week, we share our preliminary analysis based on the feedback we

have received from drug manufacturers around the world.

Drug shortages are

for real

Last week, the US

Food and Drug Administration (FDA) announced the first human drug shortage

as a result of the coronavirus outbreak. In addition, the FDA announced it was

tracking 20 drugs that could face shortages. Some generic drugmakers are predicting shortages

as early as in June or July, due to the novel coronavirus.

The FDA did not disclose the name of the drug in shortage or the 20 drugs it is tracking, as this is considered ‘confidential commercial information’.

In India, a committee constituted by the country’s Department of Pharmaceuticals started monitoring the availability of 58 active pharmaceutical ingredients (APIs) to take preventive measures

against illegal hoarding and black-marketing in the country.

According to a report published in The Economic Times, after

reviewing the list of drugs, 34 were found to have no alternatives which

include critical and essential drugs like potassium clavulanate, ceftriaxone sodium sterile, piperacillin tazobactam, meropenem, vancomycin, gentamycin and ciprofloxacin.

This was immediately

followed by the Indian government restricting the exports of 13

APIs along with some of their finished formulations. The list includes paracetamol, tinidazole, metronidazole, acyclovir, vitamin B1, vitamin B6, vitamin B12, progesterone, chloramphenicol and neomycin. For most

of the products on this list, India is a net importer, as there is little

domestic manufacturing of these APIs.

COVID-19 is also

likely to impact bottomlines. Leading generic drugmaker Mylan said it expects the coronavirus outbreak to impact its financial results

while some of the largest drugmakers — including AstraZeneca, Merck and Pfizer — have said that the coronavirus outbreak could affect their supplies or sales.

Paracetamol

affected; prices double in less regulated markets

The decline in industrial activity in China is certainly taking its toll, as drugs which are on the World Health Organization’s Model list of Essential Medicines are beginning to face significant price increases in the wake of disruption of key starting raw materials for bulk drugs.

The export

restriction out of India on commonly used analgesic, Paracetamol — sold under the brand names such as Tylenol (in the US), Panadol (in the UK), Dafalgan (France) and Crocin

(India) — is not surprising as the API has witnessed almost doubling of prices in less regulated markets because exports of its key building block para-amino phenol (PAP) have dramatically reduced from China.

While there are only

a few manufacturers who produce paracetamol without being dependent on Chinese

PAP, a few major manufacturers in India depend almost completely on Chinese PAP

for their paracetamol production and usually only keep three to four months of

inventory.

By the end of

February, their inventory stockpiles had halved and in the event of a continued

supply disruption, their entire inventory pipeline is likely to dry out. In

addition, Chinese paracetamol manufacturers, who export a significant amount of

their bulk ingredient production globally, including to India, are also

currently unable to export. This is beginning to create the potential of panic

among sourcing executives across the world.

Several

antibiotics also in danger of acute shortages

While paracetamol was listed on the API watch list circulated by India’s Department of Pharmaceuticals, our survey has revealed that other products on the list like ciprofloxacin, amoxicillin and azithromycin are also facing severe raw material

shortages. As a result, the prices of these bulk drugs have also increased

sharply.

In a statement to The Economic Times, leading Indian generic manufacturer Mankind Pharma’s chairman and managing director said

amoxicillin is the most commonly used API to manufacture antibiotics and the

company has invested Rs 1 billion (US$ 14 million) in placing irregular orders

with vendors to try and address the potential shortage that is expected. He

went on to say that if the situation continues until April, there will be an

acute shortage.

In a statement to the US House of Representatives last October, Janet Woodcock, the FDA’s Director of Center of Drug Evaluation and Research, said the FDA has determined that there are three WHO Essential Medicines whose API manufacturers are based only in China. The three medicines are: capreomycin, streptomycin (both indicated to treat Mycobacterium

tuberculosis) and sulfadiazine (used to treat chancroid and trachoma).

Streptomycin is also on the watch list published by India’s Department of Pharmaceuticals along with commonly used anti-hypertensives like losartan, valsartan, telmisartan and olmesartan and diabetes treatment metformin.

Intermediates

becoming a problem for generic drugmakers

PharmaCompass’ discussions have also revealed that in many cases while API manufacturing factories in China have returned to work, there are disruptions in the availability of raw materials and/or logistics at sea ports and airports which have led to unavailability of supplies.

While the FDA has a

list of the number of API facilities in China which are in a position to supply

to the United States, Woodcock said in her statement that the FDA “cannot determine with any precision the volume of API that China is actually producing, or the volume of APIs manufactured in China that is entering the US market.”

This visibility

reduces drastically when one has to assess the dependence of each API

manufacturer around the world on China for intermediates. Our discussions have

revealed that it is these intermediates which are becoming a problem for most

API manufacturers, even those based in India.

It was worth

highlighting that a manufacturing process change at an intermediate stage of

commonly used blood pressure medicine valsartan resulted in the recall of

millions of pills as it was found to contain a cancer causing impurity above

acceptable levels. Similarly, in 2008, the adulteration of heparin in China,

which killed 81 people and left 785 severely injured, was an outcome of the

subcontracting of precursor chemicals of Heparin.

Our view

The over-dependence

on China for key starting materials has been the subject of discussion ever

since we launched PharmaCompass. Rosemary Gibson explored this subject

in detail in her book China Rx: Exposing the Risks of America’s Dependence on

China for Medicine.

The restrictions imposed on industrial activity and transportation in China in the first two months of this year has resulted in NASA’s satellite images showing a decline in pollution levels over China.

While China works

towards getting its industrial and transportation engine up and running to 2019

levels, the outbreak has spread to other countries which will further increase

the demand for drugs to fight the virus.

This is a time when

the pharmaceutical industry needs to act responsibly and make decisions which

are in the best interests of patients globally.

Sharing information is one such step — it will allow for drug stockpiles and inventories that exist to be re-distributed to areas which need them most. For, in the event of an urgent need, drugs will become available to those who are most in need.

Impressions: 8184

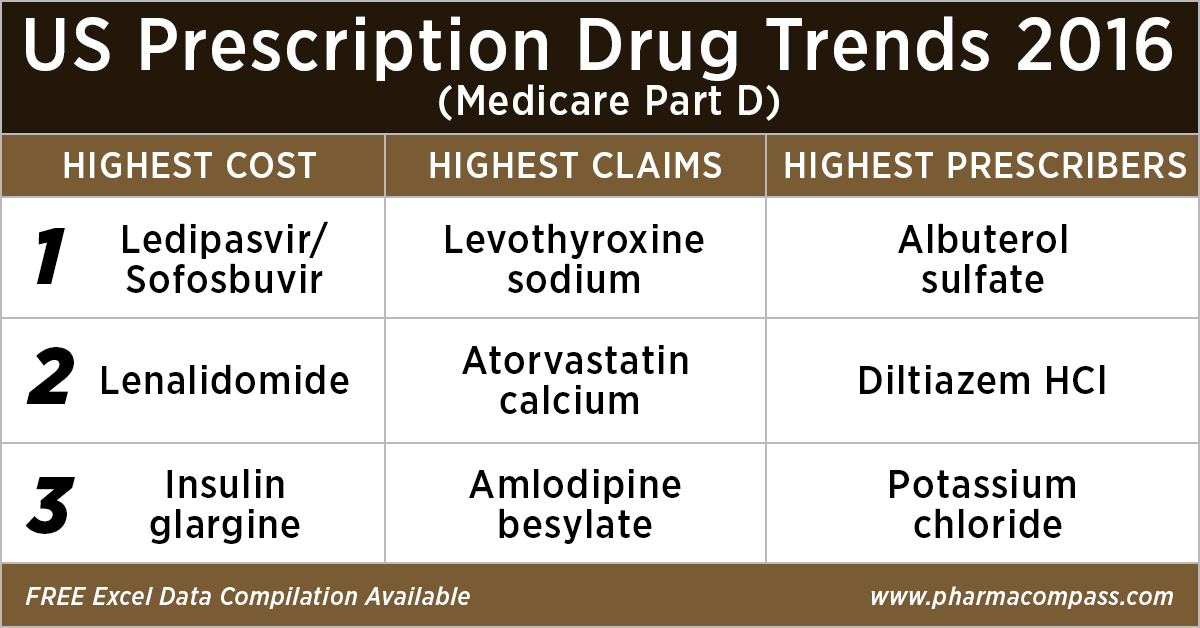

This week, PharmaCompass

reviews the recently released data on prescription drugs paid for under the

Medicare Part D Prescription Drug Program in the United States in calendar year

2016.

But first, let’s understand what is Medicare.

Medicare is the federal health insurance program in the US. In 2017, it covered 58.4 million people — 49.5 million aged 65 and older, and 8.9 million disabled.

Prescription drug coverage under this

program was started in 2006, and is known as Medicare Part D.

As part of this

coverage, the Centers for Medicare & Medicaid Services (CMS) contracts insurance

companies and other private companies, known as plan sponsors, that offer

prescription drug plans to their beneficiaries with varying drug coverage and

cost-sharing requirements.

In

2017, the Congressional Budget Office (CBO) had estimated that spending on

Medicare Part D would reach US$ 94 billion, or about 16 percent of all Medicare

expenditures for the year.

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

According

to the CBO, Medicare Part D is the most significant expansion of the Medicare

program since it was created by Congress in 1965.

With

more than 1.48 billion claims from beneficiaries enrolled under the Part D

prescription drug benefit program under its umbrella, our analysis of Medicare

Part D provides valuable insights into how elderly Americans use prescription

drugs.

Top 10 drugs by

cost: The ones that bore the highest cost burden for Medicare

As in 2015, in 2016

too Gilead’s Hepatitis C treatment — Ledipasvir/Sofosbuvir (Harvoni) — remained the single drug highest payout under the Medicare Part D Prescription Drug Program with a total cost of US$ 4.4 billion.

As Gilead continued

to face competition from AbbVie and Merck in the Hepatitis C space, the spending on Harvoni was down

37 percent from US$ 7.03 billion in 2015.

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Celgene’s cancer treatment, Lenalidomide (Revlimid), Sanofi and Merck’s diabetes treatments and AstraZeneca’s Crestor (Rosuvastatin Calcium) for

cholesterol followed Harvoni. All together, they cost the Medicare program over US$ 10 billion.

Generic Name

Number of Medicare Part D Claims

Number of Medicare Beneficiaries

Number of Prescribers

Aggregate Cost Paid for Part D

Claims (In USD)

LEDIPASVIR/ SOFOSBUVIR (HARVONI)

141,665

52,782

12,097

4,398,534,465

LENALIDOMIDE

239,049

35,368

10,382

2,661,106,127

LANTUS SOLOSTAR (INSULIN

GLARGINE, HUM.REC.ANLOG )

5,028,485

1,075,248

245,447

2,526,048,766

SITAGLIPTIN PHOSPHATE

4,742,505

864,442

206,223

2,440,013,513

ROSUVASTATIN CALCIUM

6,012,444

1,560,050

249,981

2,322,724,007

FLUTICASONE/SALMETEROL

5,194,391

1,196,007

275,442

2,319,808,482

PREGABALIN

4,940,115

852,497

267,532

2,098,953,250

RIVAROXABAN

4,403,332

807,820

252,141

1,954,748,890

APIXABAN

4,455,782

826,969

231,631

1,926,107,484

TIOTROPIUM BROMIDE

4,153,162

903,494

235,564

1,818,857,361

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Top 10 drugs by claims: The most commonly

used drugs of 2016

With 46.6 million claims, the thyroid hormone deficiency treatment — Levothyroxine Sodium — retained its position of being the most claimed product under Medicare’s Part D Prescription Drug Program in 2016.

The number of

Medicare Part D claims includes original prescriptions and refills.

Following Levothyroxine Sodium was the lipid-lowering agent — Atorvastatin Calcium — which had 44.5 million Medicare Part D claims that

were filed by almost 9.4 million beneficiaries.

Generic

Name

Number

of Prescribers

Number

of Medicare Part D Claims

Number

of Medicare Beneficiaries

LEVOTHYROXINE SODIUM

669,999

46,617,109

8,091,785

ATORVASTATIN CALCIUM

494,973

44,595,686

9,435,633

AMLODIPINE BESYLATE

497,017

39,913,468

7,802,905

LISINOPRIL

490,452

39,469,840

8,009,954

OMEPRAZOLE

492,951

32,909,236

7,001,160

METFORMIN HCL

611,700

31,007,932

6,394,014

SIMVASTATIN

380,560

29,687,947

6,201,911

HYDROCODONE/ACETAMINOPHEN

660,617

28,595,150

7,265,882

FUROSEMIDE

488,352

27,878,243

5,421,598

GABAPENTIN

555,997

27,627,466

5,363,382

Click here

to access the compilation of Medicare Part D Prescriber Summary Report

Top 10 drugs by prescribers: Medicines that were most popular with

doctors

Among the prescribers, albuterol sulfate (salbutamol) and Diltiazem had

over 900,000 unique providers (or

doctors) prescribing the drug.

Albuterol (salbutamol) is

used to provide quick relief from wheezing and shortness

of breath while Diltiazem is used to prevent chest

pain (angina).

Also

on the list of popular drugs with prescribers is Hydrocodone-Acetaminophen.

With more doctors prescribing Hydrocodone-Acetaminophen (an

opioid) than commonly used antibiotics, such as Cephalexin, Ciprofloxacin and Amoxicillin, the

series of new FDA initiatives to combat the epidemic of opioid misuse and abuse

should change the position of opioids in the top 10 drugs by prescribers in the

coming years.

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Generic

Name

Number of

Prescribers

Number of

Medicare Part D Claims

Number of

Medicare Beneficiaries

ALBUTEROL SULFATE

985,427

13,100,354

5,417,718

DILTIAZEM HCL

931,159

8,142,004

1,982,550

POTASSIUM CHLORIDE

879,491

18,945,969

4,278,000

PEN NEEDLE, DIABETIC

677,210

5,281,778

1,795,046

LEVOTHYROXINE SODIUM

669,999

46,617,109

8,091,785

HYDROCODONE/ACETAMINOPHEN

660,617

28,595,150

7,265,882

METFORMIN HCL

611,700

31,007,932

6,394,014

CEPHALEXIN

597,647

5,603,879

3,933,373

CIPROFLOXACIN HCL

594,129

7,000,081

4,851,657

AZITHROMYCIN

591,028

7,958,625

5,734,122

What does the

future hold?

Although the Part D Prescriber PUF (public use file) has a wealth of information on payment and utilization for Medicare Part D prescriptions, the dataset has a number of limitations. Of particular importance is the fact that the data may not be representative of a physician’s entire practice or all of Medicare as it only includes information on beneficiaries enrolled in the Medicare Part D prescription drug program (i.e., approximately two-thirds of all Medicare beneficiaries).

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Last

month, the Office of the Inspector General (OIG)

reviewed

the Part D claims data for the years 2011 to 2015 for brand-name drugs.

The OIG’s report found that the total reimbursement for all brand-name drugs in Part D increased 77 percent from 2011 to 2015, despite a 17-percent decrease in the number of prescriptions for these drugs.

With soaring drug prices being an issue for

regular debate in the Unites States and President Trump announcing that his

team will use strategies to strengthen the negotiating powers under

Medicare Part D and Part B, it remains to be seen how the data on prescription drugs paid for under

the Medicare Part D Prescription Drug Program will change in the coming years.

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Impressions: 2500

This week in Phispers, we bring you news on J&J’s Invokana, a drug that reduces heart risk while increasing the risk of amputation of toes. There is news from Google, which is tying up with India’s Aravind Eye Care System for its artificial intelligence eye doctor initiative. And WHO takes a step towards reducing antibiotic resistance by grouping antibiotics into ‘Access’, ‘Watch’ and ‘Reserve’.

Manufacturing errors trigger drug recalls by Lupin and Dr. Reddy’s in the US

Earlier this month,

we carried an article on the end of India’s pharma honeymoon.

News this week from Lupin and Cipla added another dimension to the problem as manufacturing

errors triggered drug recalls in the United States.

Lupin voluntarily recalled a lot of its birth control pills — Mibelas 24 Fe — in the US. A market complaint indicated a packaging error, making the lot number and expiration

date no longer visible. This product is an oral contraceptive for women.

As a result of the

packaging error, the FDA says the first four days of the birth control packet have four

non-hormonal placebo tablets as opposed to the active tablets. This may place

the user at risk for contraceptive failure and unintended pregnancy.

Similarly, Dr. Reddy’s had to recall hundreds of thousands of cartons of a popular acne medicine — Zenatane — manufactured by Cipla’s plant in Pune.

According to FDA enforcement reports, Dr. Reddy’s is recalling 190 lots, consisting of 778,279 cartons of its Zenatane brand isotretinoin capsules, in four dose sizes. The voluntary Class II recall was initiated in late May after the products failed dissolution testing.

During this period of

turmoil, the Indian company which is generating a lot of positive press is Cadila Healthcare.

Cadila’s US

division Zydus Pharmaceuticals’ subsidiary Nesher Pharmaceuticals has received final FDA approval to

market Nystatin Topical Powder, an anti-fungal

antibiotic used to treat skin infections caused by yeast.

There is more good

news from Zydus Cadila. After years of patent battles, the FDA has approved Zydus Cadila’s generic version

of Shire’s ulcerative colitis drug Lialda.

This came as a rude

shock to Shire investors who had believed the US$ 800 million drug was safe for

a few more years. However, there is a chance that instead of a flood of

generics, the Zydus' generic may be the only competition for Lialda for sometime.

Zydus Cadilla has indicated that its version will have a six-month exclusivity.

J&J’s diabetes

drug saves heart at the cost of toes; Sanofi’s insulin slashes hypoglycemia risks for seniors

Would you like to

sacrifice your toes to save yourself from a heart attack? Well, a diabetes drug

made by Johnson & Johnson (J&J), does just that. The drug — Invokana — decreases the risk of heart attacks and strokes, while increasing the risk of amputation,

particularly of toes.

According to the

results of the 10,142-patient study, funded by J&J, for every three heart

attacks, strokes, or cardiovascular deaths prevented by Invokana, there were

two amputations, 71 percent of them of toes or the lower foot.

While this is a setback to J&J, its rivals — Eli Lilly and Boehringer Ingelheim — who make a similar drug called Jardiance, may be cheering the findings of this

study, performed on sodium-glucose co-transporter 2 (SGLT2) inhibitors. These

drugs prevent the kidney from absorbing sugar from the blood.

But scientists are not sure why the drugs would prevent cardiovascular disease, and it’s unclear why one of them would lead to amputations. “It justifies the need to test each medicine,” Harlan Krumholz of Yale University said.

Another study

examining an at-risk population of seniors who

had switched to basal insulin found Sanofi’s Toujeo to outdo its peers at cutting the risk of

hypoglycemia in older patients.

During a six-month follow-up, the study found that amongst the ‘at-risk’ seniors, those taking Toujeo were 57 percent less likely to experience hypoglycemia than those who switched to competing insulins—such as Novo Nordisk’s Tresiba and Levemir, and Toujeo’s predecessor, Lantus.

Google ties up

with Indian hospital chain for artificial intelligence eye doctor initiative

Google will soon begin

work on a grand experiment that would use machines to widen access of

healthcare. If successful, this initiative will protect millions of diabetes patients

from an eye disease that leads to blindness.

Last year, researchers at Google had said they had trained image recognition algorithms to detect signs of diabetic retinopathy roughly as accurately as human experts. Left untreated, diabetic retinopathy causes blindness. The software examines photos of a patient’s retina to spot tiny aneurisms that would help detect early stages of the disease.

Google is working

with the Aravind Eye Care System in India, a network of eye hospitals, in order

to integrate this technology.

“This kind of blindness is completely preventable, but because people can’t get screened, half suffer vision loss before they’re detected,” Lily Peng, a product manager with the Google Brain AI research group, said. “One of the promises of this technology is being able to make healthcare more accessible.” There are more than 400 million people worldwide with diabetes, including 70 million in India.

FDA tells Endo to

pull out its opioid pain medication, as Gottlieb attacks addiction

Last week, the US FDA

asked drugmaker Endo Pharmaceuticals to remove its powerful opioid pain medication — Opana ER — from the market, due to “the public health consequences of abuse”.

“We are facing an opioid epidemic — a public health crisis — and we must take all necessary steps to reduce the scope of opioid misuse and abuse,” FDA Commissioner Dr. Scott Gottlieb said. “We will continue to take regulatory steps when we see situations where an opioid product’s risks outweigh its benefits, not only for its intended patient population but also in regard to its potential for misuse and abuse,” he added.

Opioid overdoses killed 33,000

Americans in 2015, with half of those involving a prescription opioid.

Opana ER, which is oxymorphone hydrochloride, is used to manage severe pain. The FDA

approved it for this use in 2006. The drug is about twice as powerful as OxyContin, another often abused opioid.

In 2012, Endo

reformulated the drug to make it more resistant to physical and chemical

tampering. While the drug met the standards for approval, FDA says Endo never

showed that the reformulation would reduce abuse.

Amgen loses bid to delay Novartis’ biosimilar; FDA rejects Coherus’ biosimilar for Neulasta

Amgen lost a case in the Supreme Court of the United States that

sought to delay biosimilars of its rivals. Amgen had argued that its biosimilar rivals

should be forced to delay their 180-day marketing notices until the FDA had

made up its mind on the marketing application.

However, on Monday, the Supreme Court took a decision by determining that the law never imposed a two-tier timing system for these notices. Therefore “the applicant may provide notice either before or after receiving FDA approval.”

This has proven to be

a clear win for Sandoz — the generic unit of Novartis that is fielding an array of copycat biologics. The group is launching a copy of Amgen’s Neupogen. And in the process, Sandoz has

unleashed a fresh wave of biosimilars hitting the US market.

However, Amgen won somewhere else — the FDA rejected Coherus Biosciences’ application for a biosimilar of Amgen’s blockbuster Neulasta (a drug that fights infections in cancer

patients). This action effectively delays any rival until 2018, at the

earliest.

The FDA's response

comes as Amgen gears up for biosimilar competition for Neulasta, which

generated about US$ 4.6 billion in sales last year. The FDA requested Coherus

for a re-analysis of certain data and asked the drug developer for more

manufacturing information.

WHO updates list

of essential medicines; groups antibiotics into three categories

Last week, the World

Health Organization (WHO) released its Essential Medicines List (EML), with a

new advice on which antibiotics to use for common infections and which to

preserve for serious circumstances. Amongst the additions to the WHO Model list of essential medicines

for 2017 are medicines for HIV, hepatitis C, tuberculosis and leukaemia.

The EML is used by

many countries to increase access to medicines. The updated list has added 30

drugs for adults and 25 for children, and specifies new uses for 9

already-listed products. In all, it contains 433 drugs deemed essential to

address the most important public health needs.

This time, WHO has grouped antibiotics into three categories – ACCESS, WATCH and RESERVE – with recommendations on when each category should be used.

Initially, the new

categories apply only to antibiotics used to treat 21 of the most common

general infections. If found useful, it could be broadened in future versions

of the EML to apply to drugs to treat other infections.

Antibiotics in the

ACCESS group must be available at all times as treatments for a wide range of

common infections. It includes drugs like amoxicillin, an antibiotic used to treat infections such as

pneumonia.

The WATCH group

includes antibiotics that are recommended as first- or second-choice treatments

for a small number of infections. For example, the use of ciprofloxacin, used to treat cystitis (a type of

urinary tract infection) and upper respiratory tract infections (such as

bacterial sinusitis and bacterial bronchitis), should be dramatically reduced

to avoid further development of resistance.

The third group, RESERVE, includes antibiotics that should be considered as last resorts, such as colistin and some cephalosporins. These must be used

only in the most severe circumstances when all other alternatives have failed.

Impressions: 3373

This week, Phispers brings you an update on Teva’s continuing woes that include fines, plant closures and layoffs. With Laurus Labs’ Vizag unit clearing the US FDA inspection, we evaluate what Laurus’ expansion plans could mean for Mylan. And then there is some bad news on Pfizer, Amgen and AbbVie. While arthritis patients in Scotland sued Pfizer for its anti-inflammatory painkiller, Amgen suffered a setback over its osteoporosis drug and AbbVie’s Humira lost a patent battle. Read on.

Teva

fined in India; may get foreign CEO; to shut down Hungary plant and layoff 500

Teva’s woes are continuing unabated. On Monday, India’s National Green Tribunal (NGT) slapped a fine of US$ 23,139 (INR 1.5 million) on Teva API India Limited for discharging untreated effluents into the Bagad river. The tribunal found the discharge from the sewage treatment plant of Teva API’s Gajraula-based plant in Uttar Pradesh to be below the permissible

standards.

Last month, the

NGT had ordered closure of 13 industrial units in

Uttar Pradesh, including the Gajraula plant of Teva API.

Globally, the

Israel-based generic giant may get a foreigner as its CEO. During a call with analysts recently, Teva’s chairman Sol Barer said: “We are looking around the world for the best candidate.”

Teva’s CEO Erez Vigodman had stepped down in February this year. The company’s CFO Eyal

Desheh has said he is resigning at the end of June. Teva’s Israeli board members are demanding that an Israeli be appointed CFO

if the CEO is a foreigner.

And then there is

more trouble for Teva in Hungary. Last year, PharmaCompass had reported

on Teva’s newly built sterile manufacturing facility in Godollo, Hungary, the issues highlighted by the

FDA in its warning letter and the product recalls

from this unit. Well, Teva is now

winding

up its sterile injectables plant in Godollo,

and laying off 500 workers

in the next few months.

The plant had halted production last year after the FDA found manufacturing shortcomings. According to a Reuters

report, Teva plans to close down or sell the Godollo plant

by 2018-end. The company says its plans do not affect its other two Hungarian

plants in Debrecen and Sajobabony.

However, Teva isn’t the only one cutting jobs. Novartis announced it will cut 500 traditional production and development roles in Switzerland and another 250 job cuts are planned in the United States. This is part of Novartis’ global restructuring efforts.

As

G20 meets on antibiotic resistance, DSM wins an amoxicillin patent battle in

India

Last week, health ministers of the G20 leading economies met for the first time

and agreed to work together to combat issues such as a growing resistance to

antibiotics. They also agreed on implementing national action plans by the end

of 2018.

According to the member countries, infectious diseases were spreading more quickly than before due to increased globalization. The 20 nations pledged to strengthen health systems and improve their ability to react to pandemics and other health risks. The results of the meeting will provide key inputs for a G20 leaders’ summit in Hamburg in July.

A report last year

found that newly resistant strains of bacteria were responsible for more than

25,000 deaths a year in the 28 member nations in the European Union.

Meanwhile, the

Delhi High Court granted a permanent injunction against Sinopharm Weiqida Pharmaceutical for patent infringement in

India. This was announced by DSM Sinochem

Pharmaceuticals (DSP), a

leading company in the production and commercialization of sustainable,

enzymatic antibiotics, next generation statins and anti-fungals,

This patent, which

is owned by DSP, relates to amoxicillin trihydrate having a low free water content and

processes for the manufacture thereof.

The permanent injunction prevents the manufacture, use, importation, offering for sale and sale of Weiqida’s amoxicillin trihydrate API in India, as well as any drug product that utilizes the API.

Pfizer sued by

70 arthritis patients; study reveals safety risks after drug approvals

The world’s biggest pharma company Pfizer is being sued by 70 arthritis patients in Scotland,

who say they were hit with terrible side effects from Celebrex, an anti-inflammatory painkiller touted

as a wonder drug.

The patients — both men and women in the age group of 60 to 90 years — are collectively seeking US$ 4.54 million (£3.5 million) in damages from the New York-headquartered pharma giant.

They began taking

Celebrex in 2002 to combat the effects of arthritis and muscle and joint

stiffness. However, they went on to suffer health problems, including heart

attacks and strokes.

The Scottish

patients hold good chances of winning the case. A recent study — titled Postmarket Safety Events Among Novel Therapeutics Approved by the US Food and Drug Administration Between 2001 and 2010 — claims that almost a third of drugs cleared

by the American regulator pose safety risks that are identified only after

their approval.

The study, that appeared in The Jama Network

last week, says there is need for ongoing monitoring of new treatments years

after they hit the market.

Among 222 novel therapeutics approved by the FDA from 2001 through 2010, 71 (or 32 percent) were affected by a post-market safety event. Post-market safety events were more frequent among biologics, therapeutics indicated for the treatment of psychiatric disease, those receiving accelerated approval, and those with near–regulatory deadline approval, the study said.

After

Roche and AstraZeneca, Amgen suffers a setback on its osteoporosis drug

Earlier this

month, both Roche and AstraZeneca had faced setbacks in the late-stage

study of their drugs. Roche had

reported its Tecentriq drug failed

to significantly improve overall survival in a late-stage bladder cancer study.

And an experimental biotech drug for severe asthma

from AstraZeneca failed to meet its goal of significantly reducing attacks in a

late-stage study.

As if to continue

the trend, last week Amgen’s top-stage drug prospect aimed at treatment of osteoporosis — romosozumab — faced some serious setbacks.

What initially seemed like happy news — that the late-stage trial comparing romosozumab to Fosamax hit its primary and key secondary endpoints — turned into some serious questions about the future of romosozamub.

The first big setback was a prominent cardio risk imbalance between romosozumab and Fosamax — 2.5 percent for romosozumab and 1.9 percent for Fosamax.

The second big

setback came from the FDA,

which wants to evaluate the new set of head-to-head data before approving

romosozumab. And that means no decision is expected this summer!

Humira loses key patent battle as J&J tries to block Samsung’s Remicade biosimilar

AbbVie’s Humira — the world’s best selling drug which is a treatment for rheumatoid arthritis — received a setback when the US Patent and Trademark Office’s Patent Trial and Appeal Board (PTAB) handed down a verdict in favor of Coherus BioSciences, a biopharma company in the US.

The verdict struck

down AbbVie’s ‘135 methods patent on Humira after an inter partes review. The patent had been labelled as a shield and “one of the cornerstones of the Humira IP estate,” by Barclays analysts.

However, all IPR

decisions are subject to appeal. In a statement, AbbVie said it does plan to

appeal against the verdict.

Meanwhile, a unit

of Johnson & Johnson filed a lawsuit to block the sale of a copy of its rheumatoid arthritis drug Remicade made by South Korea's Samsung Bioepis in the US. Remicade is J&J’s biggest selling drug, with US sales of about US$ 5 billion a year.

Through the law suit, the J&J company — Janssen Biotech Inc — has sought a preliminary or permanent injunction to block Samsung Bioepis' biosimilar of Remicade, from sale in the US.

Frontida BioPharm gets FDA’s ‘all clear’ for Philadelphia plant bought from Sun

In June last year,

Frontida BioPharm had bought Sun Pharmaceuticals’ finished pharmaceutical plant in

Philadelphia. And barely eight months back, it received an FDA warning letter

for this plant, based on an inspection that took place in 2015.

The warning letter had mentioned that Sun Pharma’s quality unit at the time had knowingly released 27 lots of

various strengths of clonidine HCl tablets, despite evidence that the API

used in manufacturing was potentially contaminated.

The warning letter

had been issued in August 2016, and Frontida knew about the regulatory issues

when it acquired the facilities last year from Sun Pharma, India’s largest drugmaker.

The good news is

that Frontida BioPharm says

the US FDA has given the plant an all-clear. Frontida says Sun helped it address these issues.

With the

regulatory issues behind it, Frontida can now move forward with its expansion

plans.

“The positive resolution of our regulatory status with the FDA will stimulate Frontida’s expansion and growth, and enable Frontida to better support our partners to bring new products to the market,” Frontida CEO Song Li said in a statement.

FDA

warns drug makers to check water systems for BCC contamination

The US FDA has warned manufacturers of non-sterile, water-based drug products

of Burkholderia

cepacia complex (BCC

or B cepacia) contamination,

as there have been recent product recalls due to this and other water-borne

opportunistic pathogens found in pharmaceutical water systems.

The regulator’s warning stems from multi-state outbreak of infections. In March this year, Phispers had carried a news item on

Badrivishal Chemicals & Pharmaceuticals, a manufacturer of docusate sodium. It had been placed on FDA’s import alert list in December last.

The FDA warning

letter issued to Badrivishal talks about adulteration with BCC. The facility

used water as a drug component and for cleaning the facility and equipment. The

water source was a river in the vicinity which passes through farmland, where

it is subject to agricultural runoff and animal waste, before it reaches the

Badrivishal manufacturing site.

FDA’s concern was that contaminated water has been the root cause of multi-state outbreak of infections and multiple recalls by other drug manufacturers of non-sterile liquids, including instances of adulteration with BCC.

“BCC can survive or multiply in a variety of non-sterile and water-based products because it is resistant to certain preservatives and antimicrobial agents,” the FDA said.

Detecting BCC

bacteria is a challenge and requires validated testing methods that take into

consideration the unique characteristics of different BCC strains.

Laurus Labs to enter the US generics market;

how will this impact Mylan?

Last week, Laurus Labs

announced that its API facility at Unit 2 in Vizag (India) cleared the US FDA inspection without any Form 483 observations. The unit

manufactures APIs and finished dosage formulations (FDFs).

This successful inspection will help the company

as it plans to foray into the highly regulated US generics market.

Does this suggest trouble for US generic drug

giant Mylan? We think so.

Laurus was started by Dr Satyanarayana Chava in 2007, and is a key manufacturer and supplier of APIs.

With almost US $ 300 million in revenues, it holds its own against better-known

competitors like Mylan.

In fact, Laurus and Mylan have a lot in common.

Both the companies are headed by men who worked together at Matrix

Laboratories. Mylan acquired a controlling stake in Matrix around the time

Chava founded Laurus Labs. Until then, Chava was the chief operating officer of

Matrix, which was being headed by Rajiv Malik, the current president of Mylan.

Laurus has also carved a niche for itself by

supplying antiretroviral or ARVs (used to fight infections caused by

retroviruses like HIV), hepatitis C and oncology drugs. And despite being a relatively new player, its clients include giants like

Pfizer, Teva and Merck.

APIs generally make up for 20 to 35 percent of

the total cost of a drug, but the ones that Laurus develops, like ARVs,

constitute 70 to 75 percent of the cost of the drug.

Both companies have a stronghold in the treatment

of AIDS. Globally, Laurus has achieved a leadership in the manufacture of ARV

APIs. And in the case of Mylan, nearly 50 percent of patients receiving treatment for HIV/AIDS in

the developing world rely on its product, all of which are made in India. In

fact, Mylan is India's third largest pharmaceutical exporter.

So seems like Mylan should watch out for Laurus as

it forward integrates into making finished formulations. Laurus recently filed

2 Abbreviated New Drug Applications in the United States and submitted a

dossier to the WHO (World Health Organization).

Impressions: 4081

In less than three weeks, Donald Trump will assume office as the

President of the United States. He has mentioned that he wants Medicare (a

national social insurance program) to directly negotiate the price it pays for prescription drugs.

Medicare provides health insurance to Americans aged 65 or more, who

have worked and paid into the system through the payroll tax. It also provides

health insurance to younger people with some disabilities or end-stage renal

disease and amyotrophic lateral sclerosis.

In 2015, Medicare provided health insurance to over 55 million Americans — including 46 million people aged 65 or more, and nine million younger people.

As we flag off the New Year, PharmaCompass

provides insights into drug prices and prescription patterns in the US in order

to help professionals make informed decisions. We believe that the cost of

medicines in the US, which have been a subject of much public outcry and

discussions in the recent years, will continue to be scrutinized during 2017.

Medicare data for 2014

Medicare Part D, also known as the Medicare prescription drug benefit — the program which subsidizes the costs of prescription drugs and prescription drug insurance premiums for Medicare beneficiaries — published a data set (for calendar year 2014) which contains information from over one million healthcare providers

who collectively prescribed approximately US $121 billion worth of prescription

drugs paid for under this program.

For each prescriber and drug, the dataset

includes the total number of prescriptions that were dispensed (including

original prescriptions and any refills), and the total drug cost.

The total drug cost includes the ingredient cost of the medication, dispensing fees, sales tax, and any applicable administration fees. It’s based on the amounts paid by the Part D plan, the Medicare beneficiary, other government subsidies, and any other third-party payers (such as employers and liability insurers).

The total drug cost does not reflect any manufacturer rebates paid to Part D plan sponsors through direct and indirect remuneration or point-of sale rebates. In order to protect the beneficiary’s privacy, the Centers for Medicare & Medicaid Services (CMS) did not

include information in cases where 10 or fewer prescriptions were dispensed.

Top

Ten Drugs by Cost, 2014 [Most expensive for Medicare]

Drug Name

Total Claim Count

Beneficiary Count

Prescriber Count

Total Drug Cost

Sofosbuvir

109,543

33,028

7,323

$3,106,589,192

Esomeprazole Magnesium

7,537,736

1,405,570

286,927

$2,660,052,054

Rosuvastatin Calcium

9,072,799

1,752,423

266,499

$2,543,475,142

Aripiprazole

2,963,457

405,048

130,933

$2,526,731,476

Fluticasone/Salmeterol

6,093,354

1,420,515

281,775

$2,276,060,161

Tiotropium Bromide

5,852,258

1,211,919

253,277

$2,158,219,163

Lantus

Solostar

(Insulin Glargine)

4,441,782

972,882

224,710

$2,016,728,436

Sitagliptin Phosphate

4,495,964

789,828

190,741

$1,775,094,282

Lantus

(Insulin Glargine)

4,284,173

787,077

223,502

$1,725,391,907

Lenalidomide

178,373

27,142

9,337

$1,671,610,362

View the Medicare Part D National Prescriber Summary Report, Calendar Year 2014 (Excel version available) for FREE!

Top

Ten Drugs by Average Cost per Claim, 2014 [Most expensive drugs]

Drug Name

Total Claim Count

Beneficiary Count

Prescriber Count

Total Drug Cost

Average Cost Per Claim

Adagen

13

$1,224,835

$94,218

Elaprase

100

$6,560,225

$65,602

Cinryze

1,820

194

196

$96,155,785

$52,833

Carbaglu

60

$2,901,115

$48,352

Naglazyme

129

$6,189,045

$47,977

Berinert

538

73

68

$25,685,311

$47,742

Firazyr

1,568

269

232

$70,948,143

$45,248

H.P. Acthar

9,611

2,932

1,621

$391,189,653

$40,702

Procysbi

314

41

47

$12,542,911

$39,946

Folotyn

15

$598,210

$39,881

Top

Ten Drugs by Claims, 2014 [Most Commonly Used by Patients]

Generic Name

Total Claim Count

Beneficiary Count

Prescriber Count

Total Drug Cost

Lisinopril

38,278,860

7,454,940

464,747

$281,614,340

Levothyroxine Sodium

37,711,869

6,245,507

416,518

$631,855,415

Amlodipine Besylate

36,344,166

6,750,062

451,350

$303,779,661

Simvastatin

34,092,548

6,768,159

387,651

$346,677,118

Hydrocodone-Acetaminophen

33,446,696

8,005,790

677,865

$676,296,988

Omeprazole

33,032,770

6,707,964

475,122

$529,050,385

Atorvastatin Calcium

32,603,055

6,740,061

419,327

$747,635,818

Furosemide

27,133,430

5,176,582

456,047

$135,710,772

Metformin HCl

23,475,787

4,509,978

364,273

$203,948,989

Gabapentin

22,143,641

4,298,609

486,754

$492,557,255

View the Medicare Part D National Prescriber Summary Report, Calendar Year 2014 (Excel version available) for FREE!

Top

Ten Drugs by Prescribers, 2014 [Most Popular with Doctors]

Generic Name

Total Claim Count

Beneficiary Count

Prescriber Count

Total Drug Cost

Hydrocodone/Acetaminophen

33,446,696

8,005,790

677,865

$676,296,988

Ciprofloxacin HCl

7,253,018

4,926,835

568,201

$46,728,353

Amoxicillin

6,298,980

4,384,899

557,614

$31,193,739

Cephalexin

5,040,219

3,529,303

557,048

$36,987,401

Azithromycin

7,339,954

5,274,010

544,625

$70,699,119

Prednisone

11,032,986

4,505,821

536,108

$86,537,932

Tramadol HCl

14,250,227

4,272,724

515,816

$125,343,514

Sulfamethoxazole /Trimethoprim

4,833,758

3,090,944

500,790

$29,231,511

Gabapentin

22,143,641

4,298,609

486,754

$492,557,255

Amoxicillin/Potassium Clav

3,551,452

2,710,244

478,361

$61,713,432

The findings from CMS

data

The CY 2014 data represented a 17 percent

increase compared to the 2013 data set and a substantial part of the total estimated prescription drug spending (as estimated by the Department of Health and Human Services Office of the Assistant Secretary for Planning and Evaluation, or ASPE) in the United States — at about US $ 457 billion in 2015, which was 16.7 percent of the overall personal healthcare services.

Of that US $ 457 billion, US $ 328 billion (71.9 percent) was for retail

drugs and US $ 128 billion (28.1 percent) was for non-retail drugs.

The drug pricing process in the US is complex and

reflects the influence of numerous factors, including manufacturer list prices,

confidential negotiated discounts and rebates, insurance plan benefit designs,

and patient choices.

An IMS study found that across 12 therapy classes widely used in Medicare Part D,

medicine costs to plans and patients in Medicare Part D are 35 percent below

list prices.

View the Medicare Part D National Prescriber Summary Report, Calendar Year 2014 (Excel version available) for FREE!

While the CMS does not

currently have an established formulary, Part D drug coverage excludes drugs

not approved by the US Food and Drug Administration, those prescribed for off-label

use, drugs not available by prescription for

purchase in the US, and drugs for which payments would be available under Parts

A or B of Medicare.

Part D coverage

excludes drugs or classes of drugs excluded from Medicaid coverage,

such as:

Drugs used for anorexia, weight loss, or weight gain

Drugs used to promote fertility

Drugs used for erectile dysfunction

Drugs used for cosmetic purposes (hair growth, etc.)

Drugs used for the symptomatic relief of cough and colds

Prescription vitamins and mineral products, except prenatal vitamins and fluoride preparations

Drugs where the manufacturer requires (as a condition of sale) any associated tests or monitoring services to be purchased exclusively from that manufacturer or its designee

Our view

The Medicare program is designed such that the

federal government is not permitted to negotiate prices of drugs with the drug

companies, as federal agencies do under other programs.

For instance, the Department of Veterans Affairs — which is allowed to negotiate drug prices and establish a formulary — has been estimated to pay (on an average) between 40 to 58 percent less for drugs, as opposed to Medicare Part D.

If Trump administration kick starts direct

negotiations on Medicare drug prices with drug companies, 2017 will surely turn

out to be a year for the pharmaceutical industry to remember.

View the Medicare Part D National Prescriber Summary Report, Calendar Year 2014 (Excel version available) for FREE!

Impressions: 7923

This week, Phispers has lots on generics. While the global leader Teva has more troubles at hand, generic players in the US face fresh lawsuits, and Sanofi plans to sell its European generic unit. There is also talk of Novartis buying America’s generic-drugs maker Amneal. In other news, oncologists find problem with clinical trials, and China shuts plants to curb pollution

Teva braces declining sales, lawsuits

and closure of its Mexico plant

There is more bad news from Israel’s Teva Pharmaceutical Industries. First, its Rimsa plant in Mexico is said to be shut, and a lot of employees have been (reportedly) laid off. As per a news report, it’s difficult to make the Rimsa

plant operational anytime soon.

Teva had invested US $ 2.3 billion in the facility. There are reports that the company may

make a write-down on its investment in Rimsa. In September, the global leader

in generics had claimed that the Espinosa brothers, who had controlled Rimsa

until its sale to Teva, had deceived the regulatory authorities and patients

for years and sold defective and illegal drugs.

Teva’s troubles don’t end there. The company is also setting aside US $ 520 million in its bid to settle allegations of paying bribes in Russia, Mexico and Ukraine. In its latest earnings report released Tuesday, Teva noted that “advanced discussions” are under way with the federal courts in the US to resolve the incidents, which took place between 2007 and 2013.

Teva has

completed 12 acquisitions worth US $ 46 billion in the last four years. Teva’s blockbuster Copaxone,

which brings in 19 percent of its overall sales, has lost several patent

challenges in the US and is likely to face generic competition early next year,

putting more than US $ 4 billion in sales at risk. Even without a generic

competitor, sales declined 2.2 percent year-on-year in the third quarter this

year.

To control

pollution, north China industrial hub curbs drug production

If you live in Delhi, and are coping with the hazardous pollution levels, here’s something that will interest you. A wide-ranging ban has

been imposed in a northern Chinese industrial hub on production at drug plants,

steel mills and other businesses.

This is a

last-ditch attempt by the government of Shijiazhuang city to meet this year’s pollution control target — to reduce the levels of PM 2.5 (fine particles that pose a risk to human health) by 10 percent. Shijiazhuang is the capital of the northern Hebei province, which reported economic growth of 6.8 percent in the first three quarters of this year.

Last week,

the government of Shijiazhuang city said for the remaining 45 days of the year,

it will curb output at thermal power plants, halt all production at industries

such as steel and cement, and limit manufacturing of pharmaceuticals, chemicals

and even furniture.

In 2014,

President Xi Jinping had responded to public outrage over high smog levels. As

a result, local officials are trying hard to strike a balance between pollution

control and economic growth.

Shijiazhuang

is home to major active pharmaceutical ingredient (API) producers such as North China Pharmaceutical, CSPC Zhongnuo Pharmaceutical, CSPC Ouyi Pharmaceutical and many others. These companies are critical to the

global antibiotic supply chain as they provide the building blocks for

antibiotic manufacturing, such as 6-APA and 7-ACA, along with commonly used

antibiotics such as Penicillin, Amoxicillin, Amipicillin and Azithromycin.

PharmaCompass has been routinely

covering the Chinese bulk drug industry and its impact on the environment. In April this year, PharmaCompass

had reported how school children in China were wearing gas masks due to pollution concerns. And prior to that, we had

carried an article on how dependent the world has become on bulk drugs from China.

More trouble

for generic drug-makers in the US as unions file lawsuits

In a fresh

salvo at the generic drug industry, a union representing sergeants of the New

York Police Department is attempting to hit some companies with civil penalties. The generic industry is already facing charges from a

two-year US Justice Department antitrust probe.

The union

has filed two lawsuits against two groups of drug-makers, which includes Novartis AG’s generic drug unit, Ireland-based Perrigo Co., India’s Wockhardt and Taro Pharmaceutical Industries (Israeli subsidiary of India’s Sun Pharma). The union has alleged that the companies colluded to

raise prices of two dermatological creams by as much as 1,000 percent since

2013.

Besides

this, at least four other unions

have filed lawsuits of their own, with two of them adding Actavis Inc., acquired in August by Teva, to the list of

defendants. All the unions manage health benefits for their members. The

unions say they overpaid for the drugs due to the price collusion. They point

to data that the drug-makers took price hikes on certain medicines by nearly

the same amounts within months of each other.

A lawyer for

the New York sergeants’ union said he expects a judge will call a conference in December

to decide if the cases can be combined.

Novartis may

buy generic drug-maker Amneal for US $ 8 billion

Swiss

healthcare major Novartis AG is in talks to acquire American generic-drugs maker Amneal Pharmaceuticals. Through this acquisition, Novartis plans to strengthen

its Sandoz

business. According to Bloomberg, Novartis and Amneal may reach an agreement soon. Amneal

makes the antiviral acyclovir (to treat herpes) and gabapentin (for epilepsy and pain). The

acquisition could cost Novartis around US $ 8 billion. Amneal is a family-owned

business led by co-founders Chintu and Chirag Patel and has operations in North

America, Australia, Europe and Asia. Its portfolio of generic treatments

includes around 115 approved molecules in the US.

Sanofi to

sell off European generic drug unit

French drug

maker Sanofi

confirmed it has decided to sell off its generic drug unit in Europe. The decision will affect two

manufacturing plants in the Czech Republic and Romania.

Sanofi CEO Olivier Brandicourt recently informed investors that the company has “made a definitive decision to initiate a carve-out process and divest the generics portfolio in Europe.” The move is part of the company’s 2020 strategic roadmap. He, however, did not provide details.

Sanofi had

acquired Zentiva, a Czech generic business, in 2008 for US $ 2.6 billion. And Sanofi’s generic business is centered around this acquisition. The business is particularly strong in the Czech Republic, Romania and Turkey.

On Monday, Zentiva Romania informed

the Bucharest Stock Exchange that its majority shareholder Sanofi has decided

to sell its Romanian generic drug plant as part of a major divestment plan of

its EU generic drugs business.

A company spokesperson said the planned scope of the divestment is the generics business “related to Europe,” so it excludes Russia, the Commonwealth of Independent States (CIS) and Turkey. And it includes the two “dedicated manufacturing sites producing and distributing generics for the European market,” one in Prague (Czech Republic), and the other in Bucharest (Romania).

Former

Valeant executives arrested for fraud

Last week,

two former executives of Valeant Pharmaceuticals — Gary Tanner and Andrew Davenport, who had been the CEO of Philidor — were arrested on charges of running a fraud scheme that swindled millions of dollars out of Valeant. The fraud was allegedly conducted with the help of a mail-order pharmacy, that is now defunct.

According to

Preet Bharara, US Attorney for the Southern District of New York, the arrests

were part of an ongoing probe of the scheme.

The criminal

complaint alleges that Tanner and Davenport conspired to enrich themselves with

Valeant funds. The two helped Valeant set up Philidor in early 2013, which was primarily a vehicle to market and distribute

Valeant drugs.

According to

the complaint, Tanner focused on building Philidor’s business, resisted his superiors’ directives to line up other distributors for Valeant’s products and ultimately received a US $10 million kickback from Davenport.

The complaint alleges that in 2014, the two orchestrated Valeant’s agreement to buy an option to purchase Philidor, which cost Valeant at least US $ 133 million. More than US $ 40 million of that went to shell companies controlled by Davenport. One such shell company — called ‘End Game LP — gave a kickback of US $10 million to Tanner.

Homeopathy

products in the US may carry caveats soon

In a report on homeopathic advertising, the Federal Trade Commission (FTC) in the US said that homeopathic drugs should “be held to the same truth-in-advertising standards as other products claiming health benefits.”

Only the US

Food and Drug Administration (FDA) can prevent homeopathic marketers from

selling their products. The FTC has no teeth in the matter.

But very soon, homeopathic products could include statements such as ‘there is no scientific evidence backing homeopathic health claims’ and ‘homeopathic claims are based only on theories from the 1700s that are not accepted by modern medical experts.’

However, this may not affect sales of homeopathic products. There are claims that such statements could backfire because homeopaths and those who believe in homoeopathy don’t trust modern medicine. They could also believe that if

homeopathy has been around for that long, it must work.

This is not the first-time homeopathic medicines would carry caveats. In 1988, the FDA had struck a deal where it agreed that homeopaths could be self-regulating, if they include a disclaimer that their claims haven’t been evaluated by the FDA.

In February

this year, PharmaCompass had carried a news nugget on Professor

Paul Glasziou, a leading academic in evidence-based medicine at Bond

University, who had declared homeopathy as a “therapeutic dead-end”

after a systematic review concluded the controversial treatment was no more

effective than placebo drugs.

Cancer

clinical trials exaggerate benefits of new drugs, say oncologists

Two cancer physicians argue that large clinical trials — required for approval of new cancer drugs in the US — often overstate the effectiveness of the treatment in the real world.

During

cancer clinical trials, some volunteers take the experimental drug, while

others receive standard care with existing drugs. The groups are then compared

to see if their tumors have shrunk, how long it takes for the tumors to return,

and how long do the patients survive. This way, the trial sees whether the

experimental drug is safe and effective and can be sold to patients in the US.

The process

is based on the premise that trials give an accurate indication of safety

and efficacy among cancer patients in general, and not only those who are

eligible for and selected for the trial.

The trouble

is, participants in clinical trials are unlike the overall cancer population,

point out oncologists Dr. Sham Mailankody of Memorial Sloan Kettering Cancer

Center and Dr. Vinay Prasad of the Oregon Health and Science University in JAMA

Oncology. They’re younger, healthier, wealthier, better plugged in to the healthcare system, and better educated.

According to

these oncologists, if cancer patients are similar in age, socio-economic

status, have presence of other (similar) illnesses, and other

characteristics as those in a clinical trial, they might do as well. But for

everyone else, the trial results probably promise more than the drug can

deliver.

Impressions: 4478

This week, Phispers takes you through the EpiPen price hike controversy, and the Indian government’s decision not to adopt a bulk drug policy. There is more news pertaining to Teva’s divestitures, GSK’s new drug for HIV treatment and drug recalls by Cadila, Teva and Sagent. A setback to Indian pharma as minister

says govt against bulk drug policy Earlier this year PharmaCompass had highlighted the ‘inconvenient

truth about Chinese drug manufacturing’ – that a serious imbalance exists in the global supply chain with regard to its dependence on China. India had declared 2015 as the Year of the API, under the ‘Make in India ‘programme. A Cabinet note for a bulk drug policy, based on the recommendations of the Katoch committee, had been floated

earlier this year. Such a policy would have helped the Indian

pharmaceutical sector turn into a US $ 200-billion industry by 2030, and

shifted global dependence away from China.However, the plan suffered a setback as the chemical and fertiliser minister Ananth Kumar announced this week that

the government was against

a bulk drug policy. Instead, states will have to come up with “bulk drug parks” which will help boost manufacturing of bulk drugs.This news comes at a time when a Bloomberg

analysis concluded that China

drug sales grow despite safety concerns at home. Around 700 Chinese firms were told by regulators in China to review their pending applications to sell new drugs and voluntarily withdraw those that were false or incomplete. “Within months, about 75 percent had been retracted by the manufacturers or rejected by Chinese officials,” the Bloomberg report said.Currently, India is dependent on China for APIs. More than 75 per cent of India’s bulk drug imports come from China. And there is concern over quality. Mylan CEO blames system for EpiPen price hike,

announces launch of generic versionLast week, Mylan made headlines as its 400 percent price increase of EpiPen auto-injector came under scrutiny. The furor continued,

even as the Mylan CEO Heather Bresch tried her best to justify the price hikes

in an interview, which generated more negative publicity. In the interview, Bresch blamed the healthcare system for the price hike. According to her, the price of US $ 608 for the life-saving EpiPen reflects a system where there are “four or five hands that the product touches and companies that it goes through before it ever gets to that patient at the counter.” This week, Mylan tried to suppress the furor by

announcing it would launch an authorized generic version of EpiPen for half the price of the brand-name product. The identical generic two-pack of EpiPens, expected to launch in several weeks, will have a list price of US $ 300. This is still significantly higher than the price of the auto-injector prior to Mylan’s acquisition of the EpiPen in 2007. In Canada, the twin pack costs US $ 200, in France it is around US $ 100.In the interview, Bresch acknowledged that the high

retail price in the US was used to subsidize the price of EpiPens in Europe, where

they sold at just US $ 100 or US $ 150.Bresch went onto say: “Congress and the leaders of this country need to quit putting their toe in this topic and really fix this — we have an outdated system.”After the interview, pharma bad boy Martin Shkreli defended the price increase while some Americans turned to Canada for cheaper EpiPens. And Senators questioned if the FDA was to blame for the high drug prices. Meanwhile, analysts said the authorized generic

version of EpiPen may actually make more money for Mylan! Aurobindo, Intas in race to buyout UK and Irish

portfolios of TevaLast week, two Indian drug makers – Aurobindo Pharma and Intas Pharmaceuticals – emerged as the final contenders to buyout the UK and Irish portfolios of Teva. These portfolios of the Israeli generics behemoth have been put up for

sale to comply with the European anti-trust regulations.Both Aurobindo and Intas put

up binding offers of around US $ 1 billion, along with firm financing

commitments, The Economic Times

reported. Last year, Teva had acquired

Allergan Plc’s generic business for US $ 40.5 billion. Teva

is selling assets as part of a broader divestiture process to comply with the

anti-trust regulations for this acquisition.In order to comply with

these regulations, Teva has already sold 80 products in the US to drug makers

like Dr Reddy’s, Sagent, Cipla, Zydus Cadila, Aurobindo, Impax and Perrigo. Glaxo plans to shake up HIV treatment with new drugGlaxoSmithKline plans to capsize the decade-old strategy for treating HIV. Executives at GSK are hoping that the company’s latest HIV pill is powerful enough to suppress the virus, with the help of just one more drug. The drug – Dolutegravir – belongs to a class of HIV drugs known as integrase inhibitors that rapidly reduces the level of virus in the blood. It has already been approved for use as part of traditional triple therapy and hasn’t reported cases of the virus developing resistance to dolutegravir in patients who are new to the treatment.Since the mid-1990s, the treatment of HIV – a virus that causes AIDS – hasn’t changed much. In the mid-1990s, a new class of antiretroviral drugs were introduced. One drug from the new class, along with two other drugs from an earlier class, hindered the virus from developing resistance. This three-drug regimen has been the standard approach for treating HIV for the last two decades.Dolutegravir, according to GSK CEO Andrew Witty, would

be the game changer because taking fewer drugs will lead to fewer side effects.GSK’s majority-owned HIV business – ViiV Healthcare – is undergoing the long process of proving the efficacy of the Dolutegravir. Pfizer and Japan’s Shionogi & Co hold minority shares

in ViiV Healthcare. Japanese wholesaler arrested for illegally selling drugs to Chinese