19 Dec 2025

// PRESS RELEASE

18 Dec 2025

// PRESS RELEASE

18 Dec 2025

// PRESS RELEASE

KEY PRODUCTS

KEY PRODUCTS KEY SERVICES

KEY SERVICES

Aspen API. More than just an API™

About

Industry Trade Show

Attending

23-26 March, 2026

Industry Trade Show

Attending

21-23 April, 2026

Industry Trade Show

Booth #814 Level 2

11-14 May, 2026

CONTACT DETAILS

Events

Webinars & Exhibitions

Industry Trade Show

Attending

23-26 March, 2026

Industry Trade Show

Attending

21-23 April, 2026

Industry Trade Show

Booth #814 Level 2

11-14 May, 2026

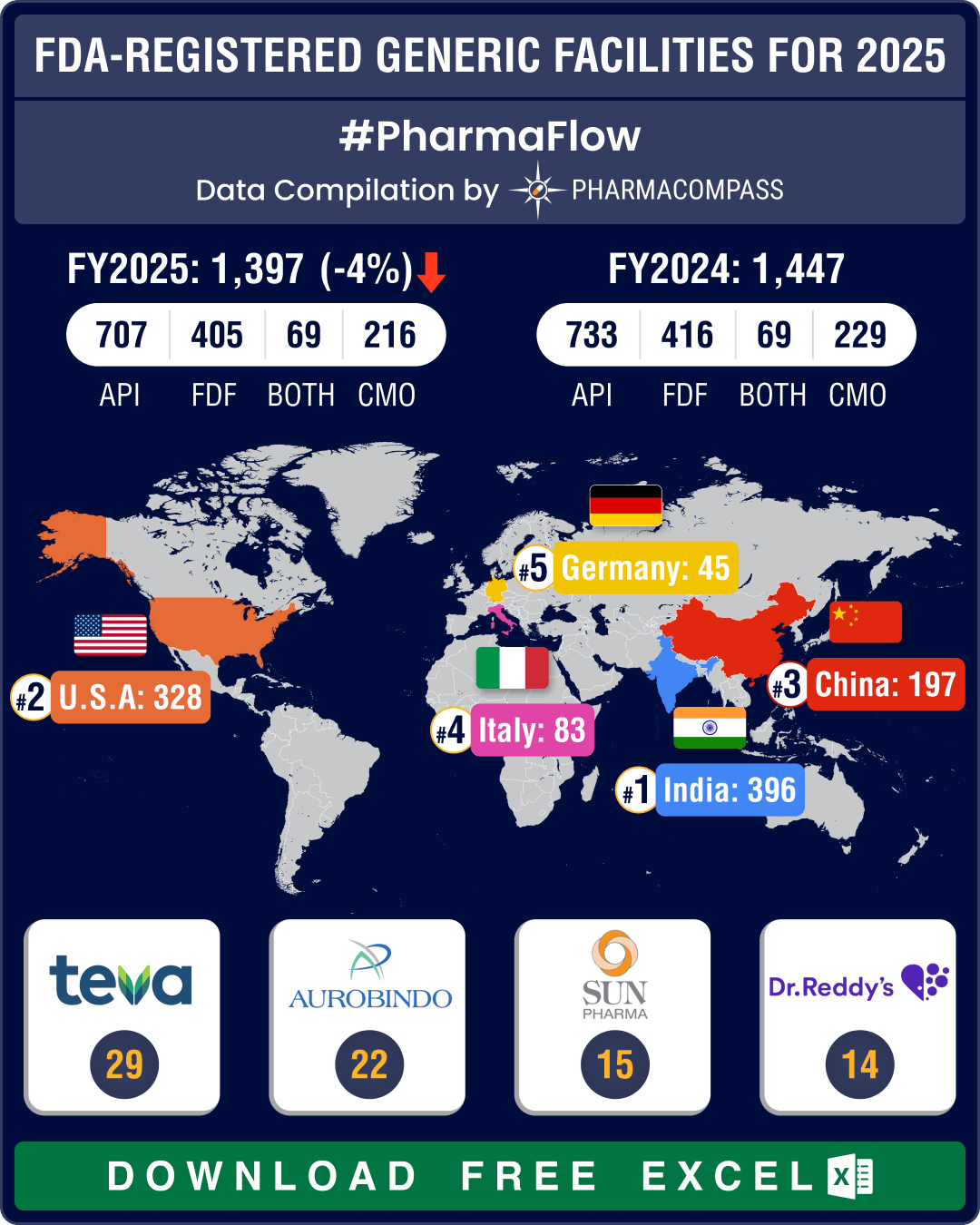

CORPORATE CONTENT #SupplierSpotlight

https://www.pharmacompass.com/radio-compass-blog/chinese-fda-registered-generic-facilities-gain-steam-india-maintains-lead-with-396-facilities

https://www.pharmacompass.com/radio-compass-blog/cdmo-activity-tracker-novo-s-parent-buys-catalent-for-us-16-5-bn-fujifilm-merck-kgaa-axplora-lonza-expand-capabilities

19 Dec 2025

// PRESS RELEASE

https://www.aspenapi.com/news/aspen-api-pioneering-sustainable-peptide-manufacturing/

18 Dec 2025

// PRESS RELEASE

https://www.aspenapi.com/news/strong-reinforcement-of-the-oss-pharma-cluster-through-the-arrival-of-aspen-oss-at-pivot-park/

18 Dec 2025

// PRESS RELEASE

https://www.aspenapi.com/news/clascoterone-and-segesterone-new-development-opportunities-in-our-aspen-api-steroid-portfolio/

30 Sep 2025

// PRESS RELEASE

https://www.aspenapi.com/news/yes-hashtagestradiol-is-added-to-our-list-of-approved-cadifas/

28 Feb 2025

// PRESS RELEASE

11 Feb 2025

// PRESS RELEASE

https://www.aspenapi.com/news/this-project-aimed-to-optimize-the-purification-process-of-desogestrel/

Certificate Numbers : R1-CEP 2017-171 - Rev 00

Status : Valid

Issue Date : 2023-02-13

Type : Chemical

Substance Number : 369

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Fine Chemicals Corporation PTY Ltd

Certificate Numbers : R1-CEP 2010-052 - Rev 01

Status : Valid

Issue Date : 2019-01-18

Type : Chemical

Substance Number : 74

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Fine Chemicals Corporation PTY Ltd

Certificate Numbers : CEP 2021-385 - Rev 01

Status : Valid

Issue Date : 2024-02-06

Type : Chemical

Substance Number : 74

Certificate Numbers : R1-CEP 2009-300 - Rev 00

Status : Valid

Issue Date : 2016-03-16

Type : Chemical

Substance Number : 1717

Certificate Numbers : R2-CEP 1995-001 - Rev 03

Status : Valid

Issue Date : 2014-01-30

Type : Chemical

Substance Number : 821

Certificate Numbers : CEP 2009-171 - Rev 02

Status : Valid

Issue Date : 2025-04-25

Type : Chemical

Substance Number : 1614

Certificate Numbers : R1-CEP 1999-179 - Rev 05

Status : Valid

Issue Date : 2017-03-29

Type : Chemical

Substance Number : 1203

Certificate Numbers : CEP 2020-208 - Rev 03

Status : Valid

Issue Date : 2025-08-29

Type : Chemical

Substance Number : 1203

Certificate Numbers : R2-CEP 1995-022 - Rev 05

Status : Valid

Issue Date : 2014-01-30

Type : Chemical

Substance Number : 140

Certificate Numbers : R1-CEP 2005-233 - Rev 03

Status : Valid

Issue Date : 2018-10-04

Type : Chemical

Substance Number : 1210

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Registration Number : 303MF10070

Registrant's Address : Kloosterstraat 6, 5349 AB Oss, the Netherlands

Initial Date of Registration : 2021-04-22

Latest Date of Registration : 2021-04-22

Registration Number : 218MF10586

Registrant's Address : Kloosterstraat 6, 5349 AB Oss, the Netherlands

Initial Date of Registration : 2006-06-22

Latest Date of Registration : 2022-04-20

Registration Number : 218MF10506

Registrant's Address : Kloosterstraat 6, 5349 AB Oss, the Netherlands

Initial Date of Registration : 2006-05-15

Latest Date of Registration : 2024-11-13

Registration Number : 218MF10848

Registrant's Address : Kloosterstraat 6, 5349 AB Oss, the Netherlands

Initial Date of Registration : 2006-10-20

Latest Date of Registration : 2007-07-26

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Fine Chemicals Corporation PTY Ltd

Registration Number : 227MF10059

Registrant's Address : 15 Hawkins Avenue, Epping 1,7460, Cape Town, South Africa

Initial Date of Registration : 2015-03-06

Latest Date of Registration : 2024-03-13

Registration Number : 224MF10165

Registrant's Address : Kloosterstraat 6, 5349 AB Oss, the Netherlands

Initial Date of Registration : 2012-08-16

Latest Date of Registration : 2012-08-16

Registration Number : 219MF10237

Registrant's Address : Kloosterstraat 6, 5349 AB Oss, the Netherlands

Initial Date of Registration : 2007-07-17

Latest Date of Registration : 2020-01-31

Registration Number : 227MF10021

Registrant's Address : Kloosterstraat 6, 5349 AB Oss, the Netherlands

Initial Date of Registration : 2015-01-05

Latest Date of Registration : 2021-09-17

Registration Number : 227MF10199

Registrant's Address : Kloosterstraat 6, 5349 AB Oss, the Netherlands

Initial Date of Registration : 2015-08-06

Latest Date of Registration : 2020-10-01

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Fine Chemicals Corporation PTY Ltd

Registration Number : 306MF10066

Registrant's Address : 15 Hawkins Avenue, Epping 1,7460, Cape Town, South Africa

Initial Date of Registration : 2024-05-15

Latest Date of Registration : 2024-05-15

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results] Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Regulatory Info :

Registration Country : South Africa

Testosterone Propionate; Testosterone Phenylpropionate; Testosterone Isocaproate; Testosterone Decanoate

Dosage Form : Injection

Brand Name : SUSTANON 250

Dosage Strength : 30MG; 60MG; 60MG; 100M...

Packaging :

Approval Date :

Application Number :

Regulatory Info :

Registration Country : South Africa

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Services

Analytical

API Manufacturing

Pharma Service : API Manufacturing

Category : Clinical Supply

Sub Category : Overview

Pharma Service : API Manufacturing

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]API & Drug Product Development

Excipients

District Decision : Voluntary Action Indicated

Inspection End Date : 2025-04-04

Fine Chemicals Corporation PTY Ltd

City : Goodwood

State :

Country/Area : South Africa

Zip :

District :

Center :

Project Area : Drug Quality Assurance

District Decision : Voluntary Action Indicated

Inspection End Date : 2025-04-04

District Decision : Official Action Indicated

Inspection End Date : 2024-09-17

City : Port Elizabeth

State :

Country/Area : South Africa

Zip :

District :

Center :

Project Area : Drug Quality Assurance

District Decision : Official Action Indicated

Inspection End Date : 2024-09-17

District Decision : Voluntary Action Indicated

Inspection End Date : 2022-11-24

City : Oss

State :

Country/Area : Netherlands

Zip :

District :

Center :

Project Area : Drug Quality Assurance

District Decision : Voluntary Action Indicated

Inspection End Date : 2022-11-24

District Decision : Voluntary Action Indicated

Inspection End Date : 2022-11-24

City : Oss

State :

Country/Area : Netherlands

Zip :

District :

Center :

Project Area : Drug Quality Assurance

District Decision : Voluntary Action Indicated

Inspection End Date : 2022-11-24

District Decision : Voluntary Action Indicated

Inspection End Date : 2021-04-16

City : Notre Dame de Bondeville

State :

Country/Area : France

Zip :

District :

Center :

Project Area : Drug Quality Assurance

District Decision : Voluntary Action Indicated

Inspection End Date : 2021-04-16

District Decision : Voluntary Action Indicated

Inspection End Date : 2019-09-13

City : Oss

State :

Country/Area : Netherlands

Zip :

District :

Center :

Project Area : Drug Quality Assurance

District Decision : Voluntary Action Indicated

Inspection End Date : 2019-09-13

District Decision : Voluntary Action Indicated

Inspection End Date : 2019-09-13

City : Oss

State :

Country/Area : Netherlands

Zip :

District :

Center :

Project Area : Drug Quality Assurance

District Decision : Voluntary Action Indicated

Inspection End Date : 2019-09-13

District Decision : Voluntary Action Indicated

Inspection End Date : 2018-12-04

City : Port Elizabeth

State :

Country/Area : South Africa

Zip :

District :

Center :

Project Area : Drug Quality Assurance

District Decision : Voluntary Action Indicated

Inspection End Date : 2018-12-04

District Decision : No Action Indicated

Inspection End Date : 2018-07-06

Fine Chemicals Corporation PTY Ltd

City : Goodwood

State :

Country/Area : South Africa

Zip :

District :

Center :

Project Area : Drug Quality Assurance

District Decision : No Action Indicated

Inspection End Date : 2018-07-06

District Decision : No Action Indicated

Inspection End Date : 2018-05-31

City : Notre Dame de Bondeville

State :

Country/Area : France

Zip :

District :

Center :

Project Area : Drug Quality Assurance

District Decision : No Action Indicated

Inspection End Date : 2018-05-31

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]ABOUT THIS PAGE

Aspen API is a supplier offers 63 products (APIs, Excipients or Intermediates).

Find a price of Desogestrel bulk with DMF, CEP, JDMF offered by Aspen API

Find a price of Estradiol bulk with DMF, CEP, JDMF offered by Aspen API

Find a price of Estriol bulk with DMF, CEP, JDMF offered by Aspen API

Find a price of Ethinyl Estradiol bulk with DMF, CEP, JDMF offered by Aspen API

Find a price of Leuprolide Acetate bulk with DMF, CEP, JDMF offered by Aspen API

Find a price of Mirtazapine bulk with DMF, CEP, JDMF offered by Aspen API

Find a price of Progesterone bulk with DMF, CEP, JDMF offered by Aspen API

Find a price of Rocuronium Bromide bulk with DMF, CEP, JDMF offered by Aspen API

Find a price of Azathioprine bulk with DMF, CEP offered by Aspen API

Find a price of Estradiol Valerate bulk with DMF, CEP offered by Aspen API

Find a price of Norethisterone bulk with DMF, CEP offered by Aspen API

Find a price of Norethisterone Acetate bulk with DMF, CEP offered by Aspen API

Find a price of Oxytocin bulk with DMF, CEP offered by Aspen API

Find a price of Ropivacaine Hydrochloride bulk with DMF, CEP offered by Aspen API

Find a price of Scopolamine bulk with DMF, CEP offered by Aspen API

Find a price of Testosterone bulk with DMF, CEP offered by Aspen API

Find a price of Baclofen bulk with DMF offered by Aspen API

Find a price of Benztropine bulk with DMF offered by Aspen API

Find a price of Conjugated Estrogens bulk with DMF offered by Aspen API

Find a price of Estriol bulk with CEP offered by Aspen API

Find a price of Ethynodiol Diacetate bulk with DMF offered by Aspen API

Find a price of Etonogestrel bulk with DMF offered by Aspen API

Find a price of Fentanyl bulk with CEP offered by Aspen API

Find a price of Fentanyl Citrate bulk with CEP offered by Aspen API

Find a price of Fluphenazine bulk with DMF offered by Aspen API

Find a price of Fluphenazine Decanoate bulk with DMF offered by Aspen API

Find a price of Ganirelix bulk with DMF offered by Aspen API

Find a price of Gonadorelin Acetate bulk with DMF offered by Aspen API

Find a price of Human Chorionic Gonadotropin bulk with DMF offered by Aspen API

Find a price of Leuprolide Acetate bulk with CEP offered by Aspen API

Find a price of Nandrolone Decanoate bulk with DMF offered by Aspen API

Find a price of Remifentanil bulk with DMF offered by Aspen API

Find a price of Ropivacaine Hydrochloride bulk with DMF offered by Aspen API

Find a price of Testosterone bulk with CEP offered by Aspen API

Find a price of Testosterone Cypionate bulk with DMF offered by Aspen API

Find a price of Testosterone Enanthate bulk with DMF offered by Aspen API

Find a price of Testosterone Undecanoate bulk with DMF offered by Aspen API

Find a price of Thiothixene bulk with DMF offered by Aspen API

Find a price of Tibolone bulk with CEP offered by Aspen API

Find a price of Vincristine Sulfate bulk with DMF offered by Aspen API

Find a price of Cidofovir bulk offered by Aspen API

Find a price of Clascoterone bulk offered by Aspen API

Find a price of Codeine bulk offered by Aspen API

Find a price of Codeine Phosphate bulk offered by Aspen API

Find a price of Conjugated Estrogens bulk offered by Aspen API

Find a price of Dihydrotestosterone bulk offered by Aspen API

Find a price of Estradiol bulk offered by Aspen API

Find a price of Fentanyl Hydrochloride bulk offered by Aspen API

Find a price of Goserelin Acetate bulk offered by Aspen API

Find a price of Hyoscine Butyl Bromide bulk offered by Aspen API

Find a price of Lanreotide Acetate bulk offered by Aspen API

Find a price of Leuprolide Acetate bulk offered by Aspen API

Find a price of Lynestrenol bulk offered by Aspen API

Find a price of Morphine Hydrochloride bulk offered by Aspen API

Find a price of Morphine Sulfate bulk offered by Aspen API

Find a price of Morphine Tartrate bulk offered by Aspen API

Find a price of Nusinersen bulk offered by Aspen API

Find a price of Pegcetacoplan bulk offered by Aspen API

Find a price of Segesterone Acetate bulk offered by Aspen API

Find a price of Semaglutide bulk offered by Aspen API

Find a price of Sugammadex Sodium bulk offered by Aspen API

Find a price of Testosterone Propionate bulk offered by Aspen API

Find a price of Vinblastine Sulfate bulk offered by Aspen API

Aspen API

Aspen API