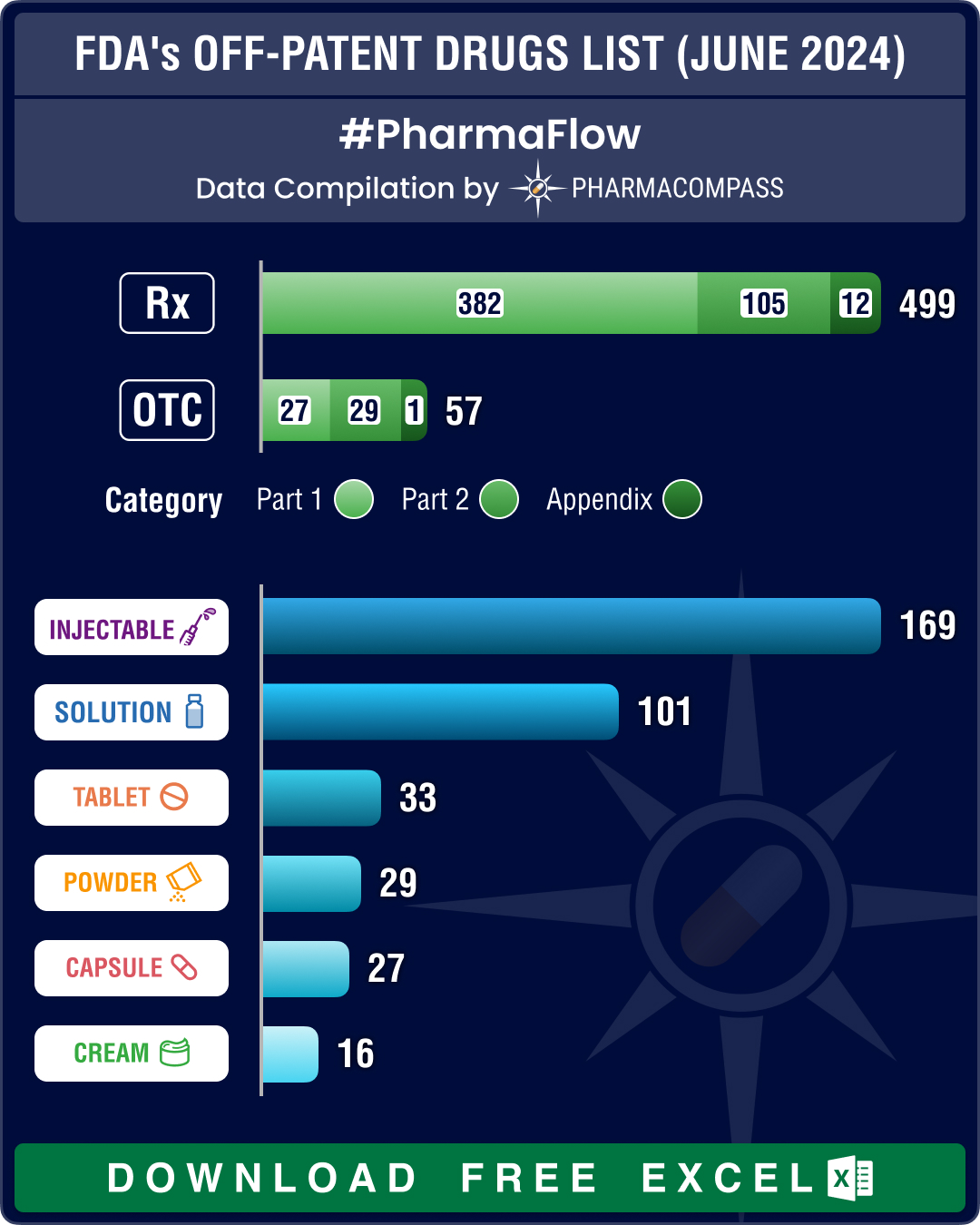

FDA’s December 2025 OPOE list features 784 prescription drugs, 73 OTC drugs

This

week, PharmaCompass brings you key highlights of the US Food and Drug Administration’s D

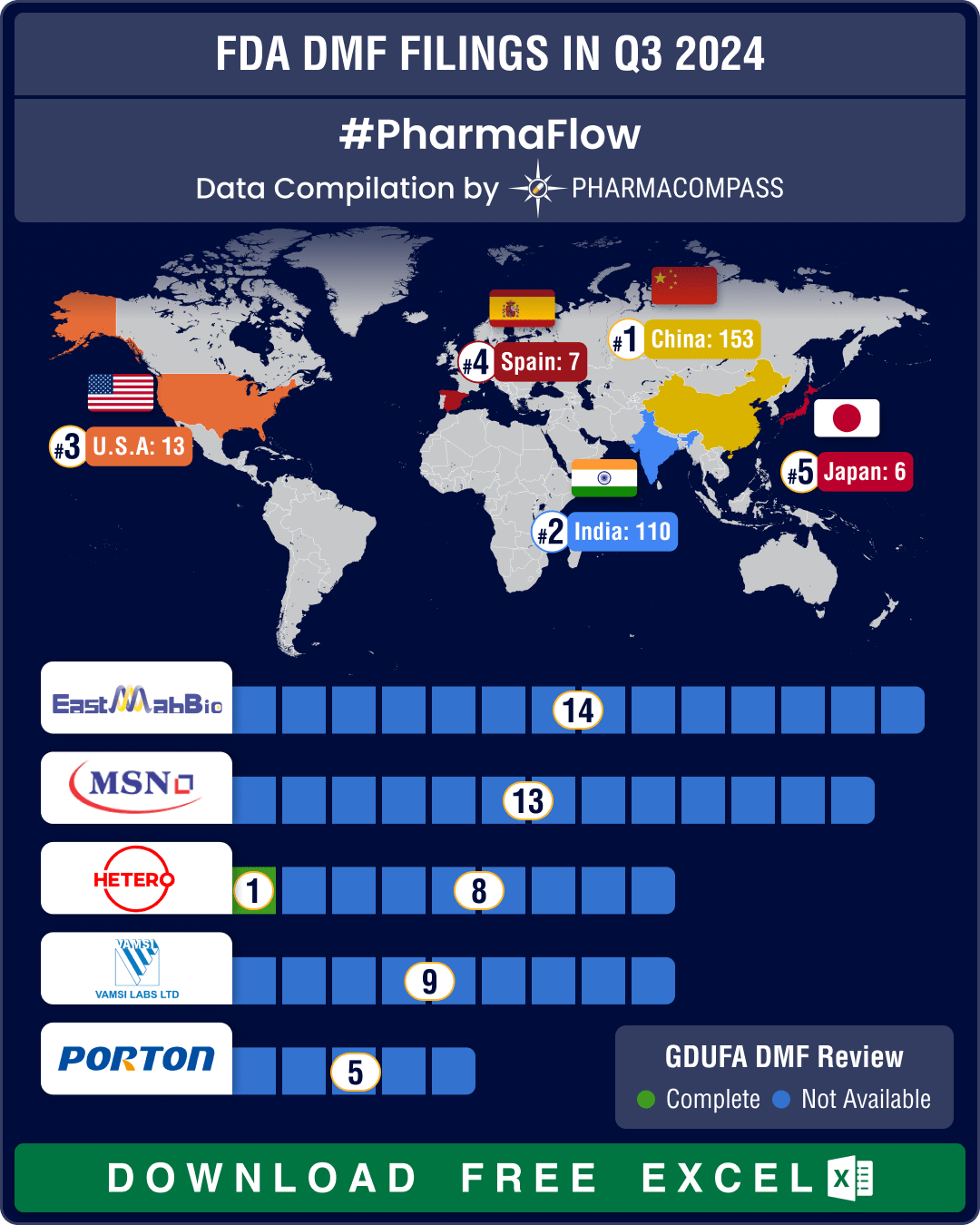

DMF filings hit all-time high in Q3 2024; China tops list with 58% increase in Type II submissions

Drug Master Files, or DMFs, are confidential documents that play a crucial role in the pharmaceutica

Market Place

Market Place Sourcing Support

Sourcing Support