In our continuous endeavor to share business intelligence that can help grow your pharmaceutical business, PharmaCompass is happy to introduce its latest monthly roundup on deals and investments across the globe – PharmaFlow.

Each month, PharmaFlow will track major deals, investments and mergers and acquisitions in the global pharmaceutical industry that made headlines in the month gone by. Tracking financial investments will also provide our readers an insight into the breakthrough technologies and business trends of tomorrow.

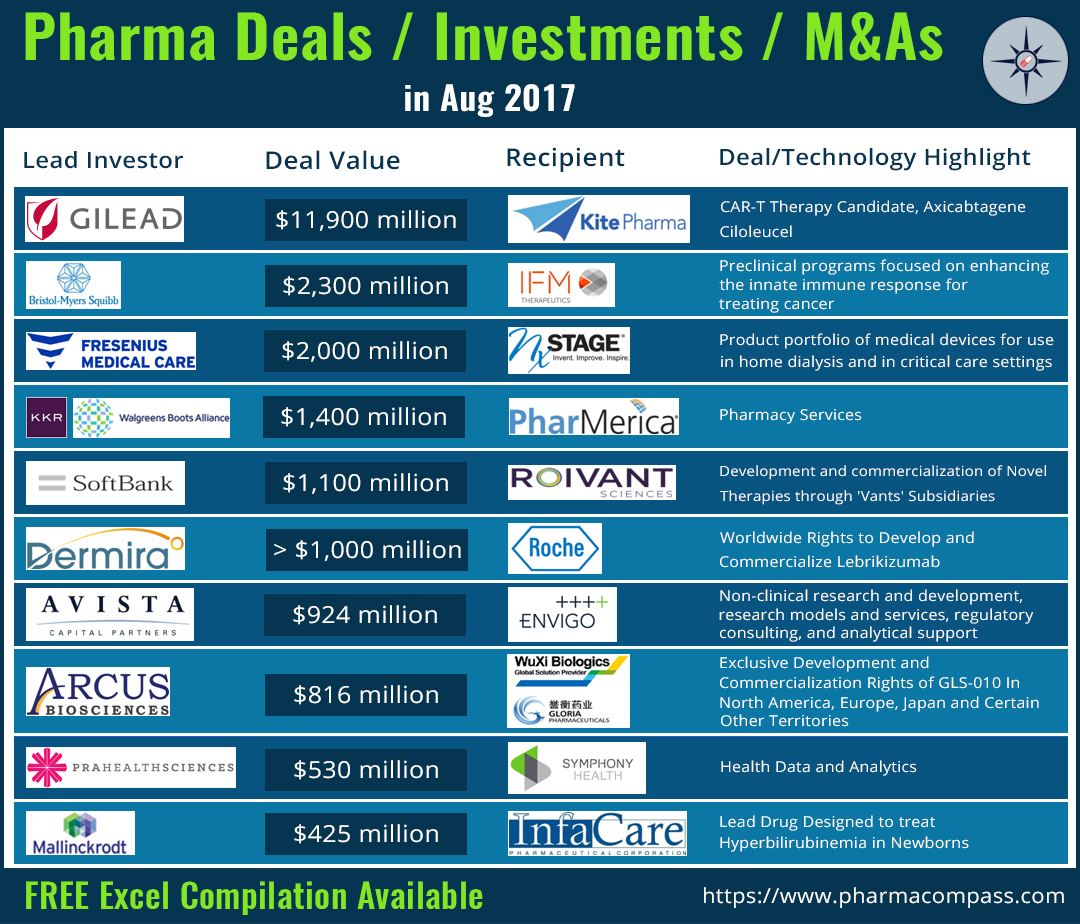

Click here to view the major deals in August 2017 (Excel version available) for FREE!

CAR-T

therapy for cancer is our technology of the month

The approval of Novartis’ Kymriah: Last month, the US Food and Drug Administration (USFDA) approved Novartis’ Kymriah (tisagenlecleucel), the first-ever gene therapy — known as CAR-T (short for chimeric antigen receptor T-cell) — for certain pediatric and young adult patients with a form of acute lymphoblastic leukemia (ALL). In its press statement, the FDA described this as a “historic action”.

CAR-T is a type of cancer immunotherapy that harnesses the body’s immune system to fight cancer cells. In this case, the therapy removes a person’s cells, reengineers them and then puts them back in their body to attack cancer cells.

In CAR-T therapy, every single dose of a treatment is unique and completely personalized to the patient. The drug comes with a list price of US$ 475,000 for a one-time treatment.

Click here to view the major deals in August 2017 (Excel version available) for FREE!

Novartis has adopted an outcomes-based approach for this therapy. If children and young adult patients with ALL don’t respond to Kymriah by the end of the first month after treatment, Novartis won't receive payment for the drug.

The man who led Kymriah therapy becomes Novartis CEO: This week, Novartis’ board of directors followed up on the Kymriah approval by appointing the man who led its development — Vasant (Vas) Narasimhan, Novartis’ global head of drug development and chief medical officer — as the CEO of the company.

Click here to view the major deals in August 2017 (Excel version available) for FREE!

Gilead acquires Kite over its CAR-T candidate: In addition to the first FDA approval, CAR-T cell therapy also got a vote of confidence when Gilead Sciences announced it is acquiring Kite Pharma for US$ 11.9 billion. Kite’s most advanced CAR-T therapy candidate — axicabtagene ciloleucel (axe-cel) — is currently under priority review by the USFDA. The FDA has set a target action date of November 29, 2017, under the Prescription Drug User Fee Act (PDUFA).

In a tweet, FDA commissioner Scott Gottlieb said: “The FDA has granted more than 550 active INDs (investigational new drug applications) related to gene therapy products and 76 active INDs related to CAR-T cell products”.

However, success is far from certain as French company Cellectis, which is developing its own CAR-T therapy, was recently forced to suspend testing following the death of a patient.

The

billion-dollar plus deals

Of late, we have been seeing generic pharmaceutical companies struggle as customers in the US have been consolidating and negotiating lower prices for generic drugs. This trend was reflected in a report published earlier this year, wherein the big six pharmacies — CVS Health, Walgreens Boots Alliance (WBA), Express Scripts, Walmart, Rite Aid, and OptumRx (UnitedHealth) — accounted for around 62 percent of the US prescription dispensing revenues in 2016.

Click here to view the major deals in August 2017 (Excel version available) for FREE!

PharMerica’s US$ 1.4 billion merger agreement: As part of the continued industry consolidation, PharMerica (a hospital pharmacy manager in the US) announced it has entered into a definitive merger agreement with private equity firm KKR for US$ 1.4 billion, which includes US$ 909 million in cash and US$ 490 million in debt. Walgreens Boots Alliance is a minority investor in this deal. “Upon completion of the transaction, PharMerica will become a private company,” a press statement said.

SoftBanks’s US$ 1.1 billion investment in Roivant: A little over two years ago, PharmaCompass had asked if a 29 year-old had shown GlaxoSmithKline that it made a billion dollar mistake?

Now 31, Vivek Ramaswamy’s holding company Roivant Sciences is continuing to launch subsidiaries, with names ending with ‘vants’ — such as Axovant (neurology), Myovant (women's health and endocrine diseases), Dermavant (dermatology), Enzyvant (rare diseases), and Urovant (urology). And SoftBank Vision Fund has made a US$ 1.1 billion investment in Roivant Sciences.

Click here to view the major deals in August 2017 (Excel version available) for FREE!

BMS acquires IFM Therapeutics: Bristol-Myers Squibb (BMS) has been a leader in the field of cancer immunotherapy. Last month, it acquired IFM Therapeutics in a deal which could fetch IFM shareholders up to US$ 2.32 billion. Through the acquisition, BMS will gain full rights to two of IFM’s preclinical programs that focus on enhancing the innate immune response for treating cancer.

As per the terms of the deal, IFM Therapeutics will receive US$ 300 million upfront with potential of up to US$ 1.01 billion in milestones for each of the first products from the two programs.

Smaller deals in the pharma world

August also saw several smaller deals, including some deals where the valuations weren’t disclosed.

A company about which we will hear more in the future is Armo Biosciences. It raised US$ 67 million from Chinese investors for the late-stage development of some of its immuno-oncology assets.

CF PharmTech, headquartered in Suzhou, China, which develops metered dose inhaler, inhalation powder, nasal spray and blow-fill-seal products, raised US$ 65 million to expedite the submission of its product pipeline to global regulators and also to expand its contract development and manufacturing organization (CDMO) services.

Click here to view the major deals in August 2017 (Excel version available) for FREE!

The other investments in August ranged from various biotechnologies, medical devices, diagnostics to digital healthcare solutions.

Though these investments may sound promising, one mustn’t forget that healthcare businesses have long gestation periods. It remains to be seen which one of these businesses will eventually thrive in the marketplace.

As David Hung, now the CEO of Axovant, astutely said this week, “There are plenty of great assets, but with the wrong team they’ll never come to fruition.”

Click here to view the major deals in August 2017 (Excel version available) for FREE!

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Pharma Deals / Investments / M&As in August 2017 by PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”