Acquisitions and spin-offs dominated headlines in 2019 and the tone was set very early with Bristol-Myers Squibb acquiring

New Jersey-based cancer drug company Celgene in a US$ 74 billion deal announced on

January 3, 2019. After factoring

in debt, the deal value ballooned to about US$ 95 billion, which according

to data compiled by Refinitiv, made it the largest healthcare deal on

record.

In the summer, AbbVie Inc,

which sells the world’s best-selling drug Humira, announced its acquisition of Allergan Plc, known for Botox and other cosmetic

treatments, for US$ 63 billion. While the companies are still awaiting

regulatory approval for their deal, with US$ 49 billion in combined 2019

revenues, the merged entity would rank amongst the biggest in the industry.

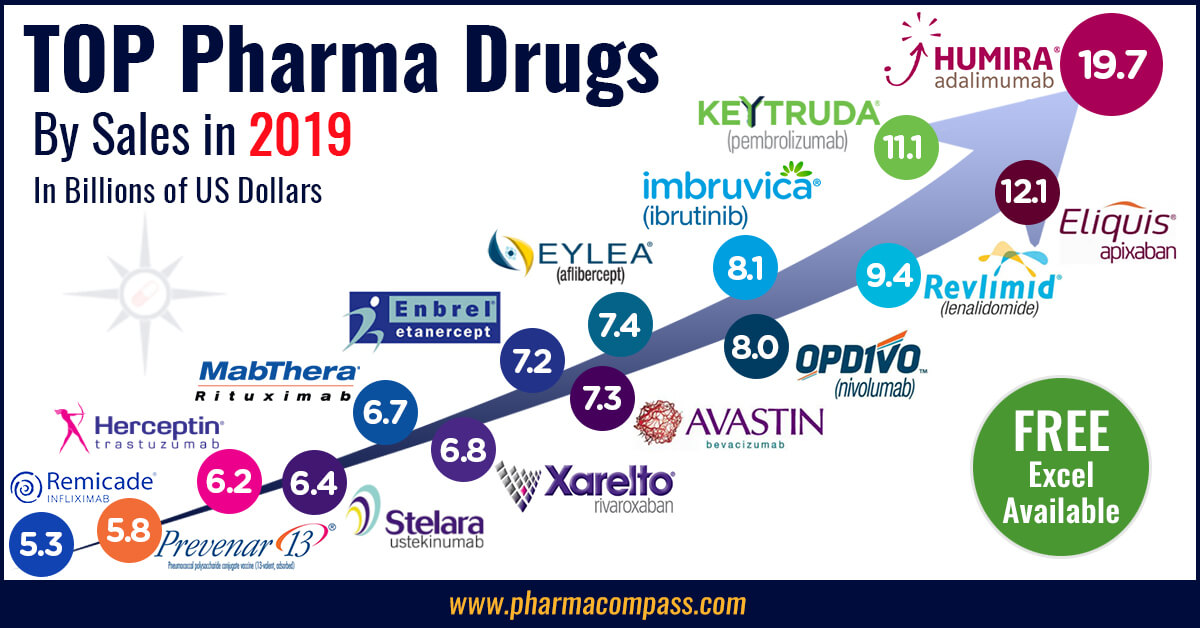

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

The big five by pharmaceutical sales — Pfizer,

Roche, J&J, Novartis and Merck

Pfizer

continued

to lead companies by pharmaceutical sales by reporting annual 2019 revenues of

US$ 51.8 billion, a decrease of US$ 1.9 billion, or 4 percent, compared to

2018. The decline was primarily attributed to the loss of exclusivity of Lyrica in 2019,

which witnessed its sales drop from US$ 5 billion in 2018 to US$ 3.3 billion in

2019.

In 2018, Pfizer’s then incoming CEO Albert Bourla had mentioned that the company did not see the need for any large-scale M&A activity as Pfizer had “the best pipeline” in its history, which needed the company to focus on deploying its capital to keep its pipeline flowing and execute on its drug launches.

Bourla stayed true to his word and barring the acquisition of Array Biopharma for US$ 11.4 billion and a spin-off to merge Upjohn, Pfizer’s off-patent branded and generic established medicines business with

Mylan, there weren’t any other big ticket deals which were announced.

The

Upjohn-Mylan merged entity will be called Viatris and is expected to have 2020

revenues between US$ 19 and US$ 20 billion

and could outpace Teva to

become the largest generic company in the world, in term of revenues.

Novartis, which had

followed Pfizer with the second largest revenues in the pharmaceutical industry

in 2018, reported its first full year earnings after spinning off its Alcon eye

care devices business division that

had US$ 7.15 billion in 2018 sales.

In 2019,

Novartis slipped two spots in the ranking after reporting total sales of US$

47.4 billion and its CEO Vas Narasimhan continued his deal-making spree by buying New

Jersey-headquartered The Medicines Company (MedCo) for US$ 9.7

billion to acquire a late-stage cholesterol-lowering

therapy named inclisiran.

As Takeda Pharmaceutical Co was

busy in 2019 on working to reduce its debt burden incurred due to its US$ 62

billion purchase of Shire Plc, which was announced in 2018, Novartis also purchased

the eye-disease medicine, Xiidra, from the Japanese drugmaker for US$ 5.3 billion.

Novartis’ management also spent a considerable part of 2019 dealing with data-integrity concerns which emerged from its 2018 buyout of AveXis, the

gene-therapy maker Novartis had acquired for US$ 8.7 billion.

The deal gave Novartis rights to Zolgensma,

a novel treatment intended for children less than two years of age with the

most severe form of spinal muscular atrophy (SMA). Priced at US$ 2.1 million,

Zolgensma is currently the world’s most expensive drug.

However,

in a shocking announcement, a month after approving the drug, the US Food and

Drug Administration (FDA) issued a press release on

data accuracy issues as the agency was informed by AveXis that

its personnel had manipulated data which

the FDA used to evaluate product comparability and nonclinical (animal)

pharmacology as part of the biologics license application (BLA), which was

submitted and reviewed by the FDA.

With US$

50.0 billion (CHF 48.5 billion) in annual pharmaceutical sales, Swiss drugmaker

Roche came in at number two position in 2019

as its sales grew 11 percent driven by

its multiple sclerosis medicine Ocrevus, haemophilia drug Hemlibra and cancer medicines Tecentriq and Perjeta.

Roche’s newly introduced medicines generated US$ 5.53 billion (CHF 5.4 billion) in growth, helping offset the impact of the competition from biosimilars for its three best-selling drugs MabThera/Rituxan, Herceptin and Avastin.

In late 2019, after months of increased

antitrust scrutiny, Roche completed

its US$ 5.1 billion acquisition of Spark Therapeutics to strengthen its presence in

gene therapy.

Last year, J&J reported almost flat worldwide sales of US$ 82.1 billion. J&J’s pharmaceutical division generated US$ 42.20 billion and its medical devices and consumer health divisions brought in US$ 25.96 billion and US$ 13.89 billion respectively.

Since J&J’s consumer health division sells analgesics, digestive health along with beauty and oral care products, the US$ 5.43 billion in consumer health sales from over-the-counter drugs and women’s health products was only used in our assessment of J&J’s total pharmaceutical revenues. With combined pharmaceutical sales of US$ 47.63 billion, J&J made it to number three on our list.

While the sales of products like Stelara, Darzalex, Imbruvica, Invega Sustenna drove J&J’s pharmaceutical business to grow by 4 percent over 2018, the firm had to contend with generic competition against key revenue contributors Remicade and Zytiga.

US-headquartered Merck, which is known as

MSD (short for Merck Sharp & Dohme) outside the United States and

Canada, is set to significantly move up the rankings next year fueled by its

cancer drug Keytruda, which witnessed a 55

percent increase in sales to US$ 11.1 billion.

Merck reported total revenues of US$ 41.75 billion and also

announced it will spin off its women’s health drugs,

biosimilar drugs and older products to create a new pharmaceutical

company with US$ 6.5 billion in annual revenues.

The firm had anticipated 2020 sales between US$ 48.8 billion and US$ 50.3 billion however this week it announced that the coronavirus pandemic will reduce 2020 sales by more than $2 billion.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Humira holds on to remain world’s best-selling drug

AbbVie’s acquisition of Allergan comes as the firm faces the expiration of patent protection for Humira, which brought in a staggering US$ 19.2 billion in sales last year for

the company. AbbVie has failed to successfully acquire or develop a major new

product to replace the sales generated by its flagship drug.

In 2019, Humira’s US revenues increased 8.6 percent to US$ 14.86 billion while internationally, due

to biosimilar competition, the sales dropped 31.1 percent to US$ 4.30 billion.

Bristol Myers Squibb’s Eliquis, which is also marketed by Pfizer, maintained its number two position

and posted total sales of US$ 12.1 billion, a 23 percent increase over 2018.

While Bristol Myers Squibb’s immunotherapy treatment Opdivo, sold in partnership with Ono in Japan, saw sales increase from US$ 7.57 billion to US$ 8.0 billion, the growth paled in comparison to the US$ 3.9

billion revenue increase of Opdivo’s key immunotherapy competitor Merck’s Keytruda.

Keytruda took the number three spot in drug sales that

previously belonged to Celgene’s Revlimid, which witnessed a sales decline from US$ 9.69 billion to US$ 9.4 billion.

Cancer treatment Imbruvica, which is marketed

by J&J and AbbVie, witnessed a 30 percent increase in sales. With US$ 8.1

billion in 2019 revenues, it took the number five position.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Vaccines – Covid-19 turns competitors into partners

This year has been dominated by the single biggest health emergency in years — the novel coronavirus (Covid-19) pandemic. As drugs continue to fail to meet expectations, vaccine development has received a lot of attention.

GSK reported the highest vaccine sales of all drugmakers with

total sales of US$ 8.4 billion (GBP 7.16 billion), a significant portion of its

total sales of US$ 41.8 billion (GBP 33.754 billion).

US-based Merck’s vaccine division also reported a significant increase in sales to US$ 8.0 billion and in 2019 received FDA and EU approval to market its Ebola vaccine Ervebo.

This is the first FDA-authorized vaccine against the deadly virus which causes

hemorrhagic fever and spreads from person to person through direct contact with

body fluids.

Pfizer and Sanofi also reported an increase in their vaccine sales to US$ 6.4

billion and US$ 6.2 billion respectively and the Covid-19 pandemic has recently

pushed drugmakers to move faster than ever before and has also converted

competitors into partners.

In a rare move, drug behemoths — Sanofi and GlaxoSmithKline (GSK) —joined hands to develop a vaccine for the novel coronavirus.

The two companies plan to start human trials

in the second half of this year, and if things go right, they will file

for potential approvals by the second half of 2021.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Our view

Covid-19 has brought the world economy to a grinding halt and shifted the global attention to the pharmaceutical industry’s capability to deliver solutions to address this pandemic.

Our compilation shows that vaccines and drugs

for infectious diseases currently form a tiny fraction of the total sales of

pharmaceutical companies and few drugs against infectious diseases rank high on

the sales list.

This could well explain the limited range of

options currently available to fight Covid-19. With the pandemic currently infecting

over 3 million people spread across more than 200 countries, we can safely

conclude that the scenario in 2020 will change substantially. And so should our

compilation of top drugs for the year.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Impressions: 54752

This week, Mylan and Pfizer announced the merger of Upjohn, Pfizer’s off-patent branded and generic established medicines business with Mylan, to create a yet to be named new global pharmaceutical company.

The new company is expected to

have 2020 revenues between US$ 19 and US$ 20 billion. What’s of even more significance is the fact that the new entity could outpace Teva to

become the largest generic company in the world, in term of revenues.

Under the terms of the agreement, Pfizer’s shareholders would own 57 percent of the combined new company, and Mylan’s shareholders would own 43 percent.

The new company will be led by Mylan’s current chairman Robert J. Coury, who will serve as its executive chairman.

Michael Goettler, who is currently the group president, will serve as the new company’s chief executive officer (CEO). And Mylan’s current president Rajiv Malik will continue to serve at the same post. Heather Bresch, Mylan’s current CEO, will retire from Mylan upon the close of this transaction.

Mylan was worth four times as

much four years ago

While the future of this amalgamation remains to be seen, it’s incredible how things have changed over the last four years. In 2015, Mylan had rejected a buyout offer from Teva at US$ 82 per share, which was a mix of approximately 50 percent cash and 50 percent in Teva stock, saying it was grossly undervalued. At the time, when Mylan’s executive chairman Coury had rejected Teva’s deal, he had written a 3,000 word letter saying that financially Teva’s offer did not even come close to qualifying as a proposal worth pursuing (the starting point of discussion for Mylan was a value in excess of US$ 100 per share).

Mylan was internally known to refer to Teva’s stock as “toilet paper” which did eventually get a junk rating.

As luck would have it, Mylan’s stock too has tanked significantly since Teva made that offer in 2015. This week, when Mylan announced its deal with Pfizer, Mylan’s shares were trading at around US$ 20 per share.

Mylan’s failed endeavors to become a leading consolidator in generics

At the time of rejecting Teva’s offer, Mylan had launched its own hostile bid to acquire Perrigo.

That turned out unsuccessful, and Mylan’s stock value started to drop.

After Mylan failed to acquire Perrigo, Mylan’s CEO Heather Bresch had said when asked what she would do if Pfizer’s established products business became available: “We absolutely would look at it.” She further went on to say that as in the past, Mylan was seeking to become a leading consolidator in the generics drug industry.

The year 2015 was a tough year for

Mylan. It had acquired nine injectable plants from Agila in

2013. Within four months of Mylan announcing its US$ 1.6 billion acquisition, a

US Food and Drug Administration (FDA) inspection found problems in the manufacturing operations at an Agila

plant in Bengaluru (India) and issued it a warning letter. Mylan continued with the acquisition and the deal was closed in December 2013.

The acquisition ran into more

trouble with the FDA in 2015, when Mylan received another warning letter, which indicated that the problems had expanded to

two other plants. The Bengaluru plant (cited in 2013) was not able to address

the concerns of the FDA inspectors and had also been included in the warning

letter.

By December 2015,

Mylan sent claims to Strides Shasun, the former owner of Agila Specialties, seeking compensation

towards remedial measures it had initiated at the three Indian manufacturing

facilities.

And then came its

EpiPen price-gouging faux pas

A year later, things started deteriorating even further as the firm faced much flak for raising the price of its blockbuster product — the life-saving epinephrine auto-injector EpiPen. During questioning by the House’s Oversight Committee, CEO Bresch’s ethics were questioned and her US$ 19 million pay package was also in the

spotlight.

Following this, the Mylan president Rajiv Malik, who leads all global commercial and operational activities at the company, was personally named as a defendant in a lawsuit that had pointed allegations against Mylan for taking part in an alleged generic price-fixing scheme.

Deteriorating

quality compliance standards

Post that,

compliance became a key concern as its facilities in the United States and

India were cited for data-integrity issues. Mylan also ran into additional

problems over its manufacturing of valsartan, a commonly used blood pressure

medicine that was found to contain cancer-causing impurities and had to be

recalled.

Meanwhile, Mylan’s EpiPen manufacturing partner — Pfizer — was battling its own quality problems and received a request from the US Attorney for Southern District of New York to provide documents as part of a probe into quality

control issues at Meridian Medical Technologies for a failure to investigate “serious” problems associated with an unspecified number of patient deaths.

In 2017, Pfizer’s Meridian unit (that manufactures EpiPens for Mylan) had received a warning letter from the FDA, in which the agency

said Meridian had failed to thoroughly investigate product failures, including

EpiPen products that were associated with patient deaths and severe illnesses.

The quality challenges have also led to continued shortages of the life saving

device.

By August last

year, as Mylan continued to post disappointing results and slashed its

full-year guidance, the company said it has formed a strategic review committee

to look at every available option, given the fall in its US operations by 22

percent due to lower volumes on existing products.

Pfizer’s ordeals with compliance issues at its generic units

When it comes to data-integrity issues at its generic drug businesses, Pfizer’s side of the story is equally sordid. Even today, it is far from its goal of becoming a major player in generics.

In 2012, the firm announced a joint venture with China’s Hisun Pharmaceuticals, an API manufacturer founded in 1956. The Hisun-Pfizer joint venture, similar

to its deal with Mylan signed this week, gave the firm a portfolio that

included branded generic drugs in therapeutic areas such as infectious

diseases, cardiovascular diseases and mental health.

In 2015, Hisun

ran into serious trouble with the FDA as data-integrity concerns emerged which

resulted in the FDA issuing an import alert to its API factory. After a

year of rumors swirling that Pfizer would exit the joint venture, it finally sold its 49 percent equity in late

2017.

In February 2015, a few months before Hisun got placed on FDA’s import alert list,

Pfizer’s Global Established Pharmaceutical (GEP) Business announced a US$ 17 billion acquisition of Hospira. When the deal was struck, Pfizer was aware of Hospira's manufacturing record as the company

was issued FDA warning letters in four out of seven continents (Europe, North America, Asia and Australia).

The executives of Pfizer had assured investors and regulators that they would quickly resolve issues at the plants. However, the problems persisted and in a 2017 earnings call, Pfizer’s CEO at the time Ian Read had said, “Within our Essential Health portfolio, we have been experiencing supply shortages with some products. The shortages are primarily for products from the legacy Hospira portfolio and are largely driven by capacity constraints and technical issues”.

One operation that continued to bother the company was a facility in McPherson, Kansas. In 2017, Pfizer’s fill/finish manufacturing facility in McPherson received a warning letter from the FDA. The manufacturing problems at the McPherson plant also derailed the launch of a generic version of Teva’s

Copaxone, which

was being developed by Sandoz and Momenta. The drug was being

finished at the McPherson plant, which was slapped the FDA warning letter.

In January

2019, Pfizer went on to announce that two

manufacturing sites in India, which were part of the Hospira acquisition,

will cease manufacturing operations. At the time of the

announcement, the sites located near Chennai (Irungattukottai) and Aurangabad

employed 1,700 people.

The FDA warning letter for the operations at the Irungattukottai site stated that the agency had found the site’s microbiology laboratory was inaccurately reporting test results.

Our view

Against an

industry backdrop of lowering prices and increased competitiveness,

mega-mergers drawn out in boardrooms have visions of an industry transformation

with manufacturing and compliance coming across as mundane necessities.

Post this deal, and also Pfizer’s previously announced consumer deal with GSK , it is clear that the big pharma giant is shifting its focus to become a “smaller, more focused, science-based company with a singular focus on innovative pharma”.

However, Pfizer’s endeavor to build a global generic powerhouse needs to be seen in light of Daiichi’s disastrous Indian adventure with its failed

acquisition of Ranbaxy, Teva’s failure in Mexico with Rimsa and the more recent walk out of its acquisition of

Akorn by Fresenius Kabi

over data-integrity concerns. These instances indicate that manufacturing

compliance has become critical to the success of these deals.

Moreover, we also

need to take note of Pfizer’s failed attempts to turnaround Hospira facilities, Mylan’s own stumbles with Agila, coupled with the ongoing compliance problems at Mylan’s US facility in Morgantown and Pfizer’s facility which manufactures the EpiPen. Given these instances, it would be safe to conclude that manufacturing compliance will play a pivotal role in deciding the outcome of the Mylan-Pfizer deal.

Impressions: 3434

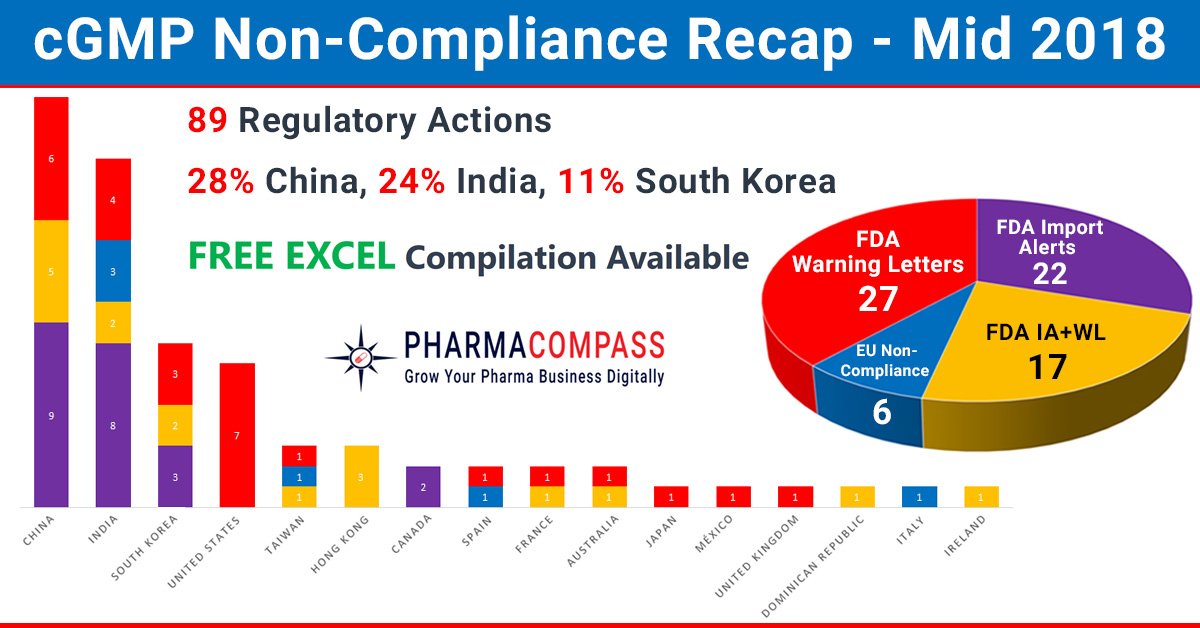

In our mid-2018 compliance review, we look at inspection challenges

faced by companies across the world. In the first half of this year,

manufacturing compliance challenges dominated headlines. But we also saw

shortcomings at major pharmaceutical companies like Pfizer, Bayer

and Akorn

generate news.

While China, India and the US continued to be the top three countries

where regulators uncovered compliance issues, this year has also seen the FDA

take action against many South Korean companies. The European authorities found

concerns in India, Taiwan, Italy and Spain. However, there were no

non-compliance reports issued to firms in China until the end of June 2018.

While data-integrity violations and a failure to thoroughly

investigate deviations continued to remain a major concern for inspectors, this

year the real concern emanated from the supply of product to market (which had

the potential to impact product quality or patient safety).

Click here to access

all Mid-Year Non-Compliances in 2018 (Excel version) for FREE!

China: API with a cancerous impurity, vaccine scandal and data-integrity

woes

The most recent regulatory non-compliance issue pertains to the

European Medicines Agency (EMA) raising concern over the active pharmaceutical

ingredient (API) valsartan supplied by China’s Zhejiang Huahai Pharmaceuticals.

The concern was the impurity — nitrosodimethylamine (or NDMA) — detected by the company in their valsartan API. NDMA is

classified as a probable human carcinogen and its presence was unexpected as it was not detected by routine tests carried out by

Zhejiang Huahai.

Zhejiang Huahai sold over US$ 50 million of

the API in 2017 and supplies to most major manufacturers producing valsartan

medicines available in the EU and United States.

While a review is underway, national

authorities across the EU, US and Asia are recalling medicines containing

valsartan supplied by Zhejiang Huahai.

Click here to access all Mid-Year Non-Compliances

in 2018 (Excel version) for FREE!

Vaccine scandal: A major vaccination scandal has sparked off a huge outcry in China as vaccine

maker Changsheng Biotechnology was found to have falsified production data for

its rabies vaccine.

Changchun

Changsheng Bio-tech Co, in Changchun, reported serious irregularities, including fabricating

production records in the manufacture of rabies vaccines for human use, during

an inspection by the State Drug Administration, China FDA said in a statement.

Although there has been no evidence of harm

from the vaccine, the firm has been ordered to halt production and recall

rabies vaccines. And Chinese Premier Li Keqiang has urged severe punishment for the people involved, saying the incident had “crossed a moral line”.

Data-integrity violations: This year, the FDA also posted

the warning letter issued to Henan Lihua Pharmaceutical in China, a company that produces steroid APIs

like hydrocortisone and prednisone.

The warning letter

highlighted data integrity concerns that landed Henan on FDA’s import alert list in March 2018.

Click here to access all Mid-Year Non-Compliances

in 2018 (Excel version) for FREE!

During the inspection, the FDA investigator observed numerous blank batch manufacturing records in an open cabinet in the firm’s manufacturing workshop office.

Among these was multiple blank, product release forms marked with a red quality assurance release stamp stating ‘Permitted to Leave [the] Factory’.

The FDA also posted a warning letter issued to Jilin Shulan Synthetic Pharmaceutical, a manufacturer of caffeine API in China. The letter revealed

flagrant data-integrity violations.

Another warning letter was

issued by the FDA to API manufacturer Lijiang Yinghua Biochemical and Pharmaceutical, following

an October 2017 inspection.

Click here to access all Mid-Year Non-Compliances

in 2018 (Excel version) for FREE!

United States: Drug shortages due to Pfizer’s manufacturing problems

Drug

major Pfizer’s production problems continued to make headlines this year. An article in Fortune put the blame on Pfizer’s much-touted US$ 17 billion acquisition of Hospira in 2015 for turning the United States’ chronic drug shortage into a full-blown crisis.

According to the article, as of May 11 this year, Pfizer — which is the world’s largest maker of sterile injectable drugs — had 370 products that are depleted or in limited supply, 102 of which the company has indicated will not be available until 2019.

“The simple answer to why America currently has so many shortages of generic sterile injectable drugs: America’s leading manufacturer of generic sterile injectable drugs hasn’t been making them,” the article said.

Mylan’s flagship product EpiPen is also likely to face shortages due to problems at Pfizer. Although Mylan owns the rights to the EpiPen, it subcontracts manufacturing of the auto-injector to Meridian Medical Technologies, a division of Pfizer.

Click here to access all Mid-Year Non-Compliances

in 2018 (Excel version) for FREE!

While Mylan is putting pressure on Pfizer

to do more to tackle shortages of this life-saving medicine, Pfizer has

struggled to meet demand for the EpiPen and the FDA had put the medicine on its

official shortages list.

In September last year, the FDA had

issued a warning letter to Meridian

Medical Technologies over serious component and product failures that had

been associated with patient deaths.

Pfizer’s

troubles are far from over as an FDA inspection of an ex-Hospira sterile

manufacturing facility in India resulted in the issuance of a 32 page Form 483. The

same facility was issued a warning letter by the FDA in 2013.

Germany: FDA highlights contamination, data-integrity concerns at Bayer facility

In a shocking warning letter issued

by the FDA to Bayer Pharma’s finished pharmaceuticals manufacturing facility

located in Leverkusen, Germany, investigators found compliance shortcomings

ranging from concerns over data-integrity to serious product contamination

problems.

While reviewing a drug product manufacturing

operation, FDA investigators found residue on equipment which seemed most

likely from a drug product that had been previously processed in the same room.

When Bayer tested the samples of the tablets being produced to “assess the potential of cross-contamination”, the testing confirmed contamination of the previously processed product inside the tablets which resulted in a recall of several lots of drug products.

Click here to access all Mid-Year Non-Compliances

in 2018 (Excel version) for FREE!

Before the FDA inspection, Bayer had started its own data-remediation program to discontinue the practice of using “test” injections during testing. However, when the FDA investigators performed their own inspection, they found unreported data from in-process tablet weight checks. Bayer’s staff had programmed their in-process weight checker not to report values that varied more than a specified amount from the tablet target weight.

The inspection was held between January 12 and

20, 2017, and responses submitted to the FDA in May and August 2017

failed to address the concerns of the agency.

Fresenius aborted US$ 4.3

billion takeover of Akorn: ‘Blatant fraud’ or buyer’s remorse?

This year also saw German healthcare group

Fresenius abandon its US$ 4.3 billion takeover of US generic drugmaker Akorn over

data-integrity concerns.

Illinois-based Akorn filed a lawsuit in the

Delaware Chancery Court asking that Fresenius be required to “fulfill its obligations” under the buyout agreement.

In a court filing made public, Fresenius alleged that its investigation uncovered “blatant fraud at the very top level of Akorn’s executive team, stunning evidence of blatant and pervasive data integrity violations.”

Click here to access all Mid-Year Non-Compliances

in 2018 (Excel version) for FREE!

Akorn’s lawsuit acknowledged it investigated the possible submission of falsified data and

fired an executive who was involved.

Fresenius claims the executive involved in the fraud wasn’t fired. Instead, he was suspended and given a consulting position with a US$ 250,000 salary. The executive, whose name is redacted from the court filings, stands to receive a payout if the merger is consummated.

The most significant instance

of a data integrity issue involves an ANDA for the drug product azithromycin that was pending with the FDA, which Akorn had submitted

on December 21, 2012.

The court will decide if the data-integrity concerns are truly legitimate or being blown out of proportion by Fresenius, who may be suffering from buyer’s remorse and wants to exit the deal.

The court agreed to put Akorn’s case on fast track and the trial is currently underway.

South Korea: Teva’s potential blockbuster gets delayed due to problems at Celltrion

As Korea emerges as a force

to reckon with in the emerging world of biosimilars, the USFDA's issuance of a warning letter to Celltrion (a major manufacturer of biosimilars that has also partnered

with Pfizer for commercialization in the United States) came as a major

setback.

In an inspection conducted by

the FDA from May 22 to June 2, 2017, the investigators raised concerns over

multiple poor aseptic practices during the set-up and filling operations.

The warning letter highlights

an example where during the aseptic filling of vials, an operator used

restricted access barrier system (RABS) to remove a jammed stopper by reaching

over exposed sterile stoppers

in the stopper bowl. The RABS disrupted the unidirectional airflow over the

stopper bowl, creating a risk for microbial contamination.

After the operator removed

the jammed stopper, the filling line was restarted, but the affected stoppers

were not cleared.

Click here to access all Mid-Year Non-Compliances

in 2018 (Excel version) for FREE!

At Celltrion, the FDA

raised concern over 140 complaints received between October 2015 to May 2017,

which were identified to have occurred because of vial stoppers.

The deficiencies at Celltrion impacted Teva as the Korean company is the main API supplier for Teva’s migraine drug fremanezumab.

Teva confirmed that the USFDA had extended the goal date of the

Biologics License Application (BLA) for fremanezumab. The Prescription Drug

User Fee Act (PDUFA) action date for fremanezumab is currently set

for September 16, 2018.

The Celltrion warning letter

was followed by an announcement by the US-based Evolus that a USFDA pre-approval inspection of Daewoong Pharmaceutical’s plant in South Korea, where a botox biosimilar is being produced, resulted in 10 observations.

Back in 2013, Daewoong had inked a

contract with Evolus to export DWP-450 (a botulinum neurotoxin candidate),

which was expected to be released in the US market around 2017-18.

While Daewoong said it expects “no significant further actions”, Evolus’ SEC filing highlights that “any failure to adequately resolve the FDA’s observations at the Daewoong facility would likely cause FDA approval of DWP-450 to be delayed or denied”.

In May, the FDA declined to approve Evolus’ Botox rival citing deficiencies related to the chemistry and manufacturing of its potential treatment for frown lines.

Click here to access all Mid-Year Non-Compliances

in 2018 (Excel version) for FREE!

India: Data-integrity

violations, invalidation of OOS results continue

Alkem has ‘no quality control unit’: After eight days of inspecting Alkem Laboratories’ finished formulation facility in India in March 2018, the FDA investigators concluded — “there is no quality control unit”.

Alkem’s head of quality control (QC) and quality assurance (QA) confirmed out-of-specification (OOS) results for the assay for a batch of tablets. However, the company did not recall the product, which was distributed in the US market.

Less than three weeks before the inspection, the “firm’s QC department deleted two-thousand one hundred one (2,101) files” on its computer network.

Alembic invalidated OOS results: In the seven days that the FDA investigator — Jessica L Pressley — spent at

Alembic Pharmaceuticals’ oral solid dosage manufacturing facility in Tajpura, Gujarat, she uncovered that the firm invalidated 131 of the 140 OOS results (an invalidation rate of 94 percent) for products marketed in the US.

The firm attributed the invalidation to

analyst errors. In 2017, the invalidation rate was 91 percent.

The Form 483 shares a concern that the “OOS results that were invalidated by the firm’s QC unit were without rationale and supporting documentation.”

Alchymars falsified lab data: A September 2017 inspection by the USFDA at Alchymars ICM SM Private Limited in India uncovered that the firm “was falsifying laboratory data”. During the inspection, the FDA investigator found that an analyst reported far fewer colony-forming units (CFU) in a water sample than those observed on the plate by the investigator.

The FDA raised serious concerns as Alchymars uses the water to manufacture

APIs intended for use in sterile injectable dosage form drug products.

Alchymars is part of a group of companies and the factory is controlled by Trifarma in Italy, a

company which was cited

by the FDA for data-integrity violations in 2014.

Click here to access all Mid-Year Non-Compliances

in 2018 (Excel version) for FREE!

Our view

This year, concerns over pharmaceutical

manufacturing spread beyond China, India and the United States as data

integrity issues also emerged in Japan and Australia.

In Taiwan, the failure to establish an

adequate system for monitoring environmental conditions in aseptic processing

areas was a problem uncovered by both the FDA and EU inspectors.

A firm in France released an over-the-counter

(OTC) drug product without testing if the active ingredients conformed to

specifications.

PharmaCompass’ review of the observations indicates that as inspectors start adopting a more standardized approach towards inspections, the problems they uncover across countries are along similar lines.

At PharmaCompass, we believe that a

review of our Mid-Year Non-Compliances in

2018 will provide you with the

insights necessary to prepare and insulate your business from the concerns

raised during regulatory inspections.

Click here to access all Mid-Year Non-Compliances

in 2018 (Excel version) for FREE!

Impressions: 9174

In April last year, German drugmaker Fresenius Kabi had agreed to acquire Akorn, a manufacturer and

marketer of prescription and over-the-counter pharmaceutical products based in

the US, for approximately US$ 4.3 billion. The transaction was expected to

close in early 2018.

Fresenius’ CEO Stephan Sturm now says the German drug major may back out of its planned

acquisition of Akorn if an independent probe into data integrity at Akorn yields evidence of wrongdoing.

On Monday, Fresenius said it was conducting an independent investigation “using external experts, into alleged breaches” at Akorn of the US Food and Drug Administration’s (USFDA) data integrity requirements relating to product development.

Strum also mentioned that if the allegations (of breaches into

data integrity) prove to be untrue, the company will go ahead with the

acquisition as planned.

“To date, the company’s investigation has not found any facts that would result in a material impact on Akorn’s operations and the company does not believe this investigation should affect the closing of the transaction with Fresenius,” Akorn said in a statement.

Akorn shares plummeted by over 30

percent in after-market trading. Akorn has also been burdened by supply disruptions and competition for a range of products such as ephedrine injection for low blood pressure under anesthesia and lidocaine anesthetic ointment.

With the acquisition of Akorn, Fresenius hopes to get a stronger foothold into the US, with access to a network of retail pharmacies and outpatient clinics as well as hospitals where it has traditionally marketed its products. The acquisition will also complement Fresenius’ Kabi medicines unit, which specializes in intravenous drugs.

Akorn’s questionable compliance record

While the exact nature of observations into Akorn’s product development processes have not been published, an FDA inspection conducted in April 2017 at Akorn’s Decatur (Illinois) facility found particle contamination in washed vials. Although the FDA investigator shared his concern with an Akorn vice president, the company went ahead and released the vials for manufacture of the drug product.

Earlier, Akorn’s plan to expand its operations to India had backfired when one of the plants it had acquired was placed on FDA’s import alert list in 2015. Three years later, the plant is still on FDA’s import alert list.

It has also not paid its GDUFA fee for FY 2018, indicating that

the plant is unlikely to produce generic drugs for the US market.

Fresenius’ long drawn battle with data-integrity

In 2008, Fresenius had acquired a 73 percent stake in India’s largest anti-cancer drug maker, Dabur Pharma. In 2013, its API manufacturing site received a warning letter from the USFDA over

data-integrity concerns. And once again, in December 2017, Fresenius’ API plant received a warning letter for data-integrity concerns.

Investigators

found employees had halted and invalidated HPLC (high-performance liquid

chromatography) analyses nearly 250 times when they believed the tests were going to end with out-of-specification

(OOS) results.

FDA issues warning letter to Alchymars ICM in India

A September 2017 inspection by the USFDA at Alchymars ICM SM Private Limited in India uncovered that the firm “was falsifying laboratory data”. During the inspection, the FDA investigator found that an analyst reported far fewer colony-forming units (CFU) in a water sample than those observed on the plate by the investigator.

The FDA raised

serious concerns as Alchymars uses the water to manufacture APIs intended for

use in sterile injectable dosage form drug products.

The FDA investigator also found damaged product contact surfaces and observed that the firm’s quality unit did not thoroughly investigate customer complaints. The company received complaints about black spots in finished API and OOS results for moisture content. In each case, the company classified the complaint as “minor and unjustified” without a thorough review.

The FDA also raised objection with regard to the equipment washroom which “was found in a filthy condition” and that the firm failed to “provide personnel with adequate clean washing and toilet facilities”.

In the warning letter, the FDA highlighted that some of the

observations were repeat deviations from a previous inspection which was

conducted in February 2015.

Alchymars is part of a group of companies and the factory is controlled by Trifarma in Italy, a company which was cited by the FDA for data-integrity violations in

2014.

Our view

Recent cases, such as Daiichi’s catastrophic acquisition of Ranbaxy, Teva’s problems with Rimsa in Mexico, Baxter’s challenges with Claris and Mylan’s struggles with Agila tell us that for the pharma company that is making the

acquisition, data integrity challenges lead to a sticky situation.

We view Fresenius’ independent investigation into data-integrity issues at Akorn in the backdrop of some of the M&A fiascos mentioned above.

Fresenius’ reliance on such an investigation goes on to prove how learnings on quality violations in manufacturing operations have taken centerstage in pharmaceutical corporate decision making.

Impressions: 4157

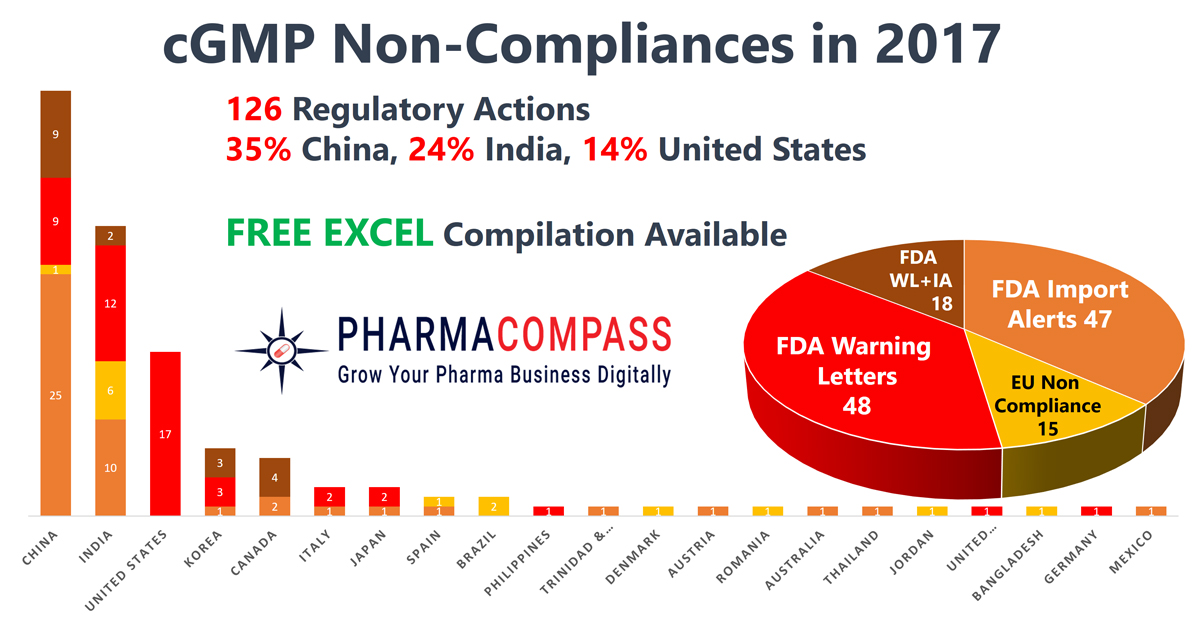

Data

integrity continued to be a hot topic in the pharmaceutical industry through

2017. According to a recent analysis by GMP (good

manufacturing practices) intelligence expert, Barbara Unger, approximately 65

percent of all US Food and

Drug Administration (USFDA) warning letters

issued in FY2017 (October 1, 2016 until September 30, 2017) included a data integrity component.

However, in the previous year, this number was even higher — at 79 percent — implying there has been a decline in non-compliance incidents pertaining to data integrity in 2017.

Click here for our compilation of all non-compliances in 2017 (Excel version available) for FREE!

2017’s recurring concern – a failure

to thoroughly investigate problems

In PharmaCompass’ 2016 compilation, serious charges of blatant data manipulation surfaced at organizations around the world.

In 2017, we witnessed a reduction in data-integrity violations

uncovered at pharmaceutical manufacturers due to the absence of audit trail

software in quality control testing equipment.

However, the implementation of audit trails has resulted in the emergence of a new failing – the improper handling of out-of-specification (OOS) results.

Failure “to thoroughly investigate any unexplained discrepancy or failure of a batch” became a recurring theme in concerns highlighted at major generic players like Mylan, Fresenius, Teva, Dr Reddy’s, Hetero Labs and Lupin.

In the case of Fresenius’ oncology API plant in India, USFDA investigators found employees had halted and invalidated

HPLC (high-performance liquid chromatography) analyses nearly 250 times when they

believed the tests were going to end with OOS results.

The

USFDA warned Fresenius SE after the company’s Indian plant that makes cancer-drug ingredients for the US market aborted hundreds of drug-quality tests.

Click here for our compilation of all non-compliances in 2017 (Excel version available) for FREE!

The situation at Lupin wasn’t much better as the warning letter issued to its formulation manufacturing facilities in Goa and Indore (Pithampur Unit II) said the company failed to “thoroughly review any unexplained discrepancy” as Lupin invalidated approximately 96 percent of all OOS results obtained at Pithampur and over 75 percent of them in Goa.

Failure to resolve

recurring problems also led the USFDA to tell Meridian Medical

Technologies, a division of Pfizer that

makes the EpiPen injector

device (sold by Mylan NV), that serious component and product failures had

been associated with patient deaths.

In its warning

letter, the USFDA said the Pfizer unit failed to adequately investigate

problems at its manufacturing facility in Brentwood, Missouri. It also did not

take appropriate corrective actions before a USFDA inspection earlier this

year.

Meridian had received hundreds of complaints that

the EpiPen device, which is used to combat serious allergic reactions,

failed to operate during life-threatening emergencies.

Click here for our compilation of all non-compliances in 2017 (Excel version available) for FREE!

Non-compliances at

finished drug producers

outnumbered those at API facilities

During 2017, the

number of finished pharmaceutical companies cited for compliance concerns

significantly outnumbered the number of active pharmaceutical ingredient (API)

producers.

While the FDA issued 48 warning letters to drug product manufacturers, API producers received only 18 warning letters. The actions by the European regulators was similar — 15 non-compliance certificates were issued to finished drug producers, as compared to only two API manufactures who were found lagging behind in compliance standards.

China, India and the

United States continued to lead the countries where regulators found most

shortcomings.

As compared to the

previous year, in 2017 regulators issued fewer non-compliance certifications as

the FDA had

been hampered by staffing shortages. As a result, the FDA’s inspections in India “dropped 27 percent in fiscal 2017 from a year earlier, to 185 from 252.”

Click here for our compilation of all non-compliances in 2017 (Excel version available) for FREE!

In 2017, EU and

FDA started their mutual recognition program. But will it work?

2017 was also a

landmark year for the US and European regulators as the USFDA and the European Medicines Agency (EMA) announced their program

for mutual recognition of inspections of drug manufacturers, which

became operational on November 1, 2017.

The FDA will now recognize eight EU drug regulators – from Austria, Croatia, France, Italy, Malta, Spain, Sweden and the UK – as capable of conducting inspections of manufacturing facilities that meet the USFDA requirements.

This is an unprecedented move — prior to this, the USFDA had never recognized another country’s inspectorate.

As

part of the agreement, the European Commission (EC), the US FDA and the EMA signed a confidentiality commitment that allows the USFDA to share non-public

and commercially confidential information, including trade secret

information relating to inspections with European regulators.

As the mutual

recognition of inspections program goes live, there were examples of many

companies that were found to be consistently out of compliance by both the FDA

and regulators from the EU. Yet, there were cases where the regulators came to

different conclusions about the state of a particular facility they had

inspected.

While

European regulators had raised compliance concerns at Biocon, the company went ahead and got an FDA nod

for its biosimilar of Roche’s blockbuster cancer drug — Herceptin.

Click here for our compilation of all non-compliances in 2017 (Excel version available) for FREE!

The case of Qinhuangdao Zizhu — when WHO and FDA differed

In

another case, an inspection conducted by the USFDA at Qinhuangdao Zizhu Pharmaceutical from November 28 to December 1, 2016 uncovered

significant data integrity concerns and failures in the level of adherence to

current good manufacturing practices (cGMPs) for APIs.

In

the warning letter issued to the firm, the laboratory analysts admitted to the FDA inspectors that they had been “setting the clock back and repeating analyses for undocumented reasons.”

At

Qinhuangdao Zizhu, “initial sample results were overwritten or deleted” and the company “reported only the passing results from repeat analyses”.

In addition to not having effective measures to control data within their computerized systems, the FDA investigators found that the firm “relied on incomplete information” to determine whether Qinhuangdao Zizhu’s drugs met established specifications.

The investigators found “a recurring practice of re-testing samples until acceptable results were obtained” and that batch production records “contained blank or partially completed manufacturing data”.

On

March 8, 2017, Qinhuangdao Zizhu Pharmaceutical was placed on import alert

by the USFDA.

Click here for our compilation of all non-compliances in 2017 (Excel version available) for FREE!

Almost

a year prior to the USFDA inspection, in October 2015, the company had been

inspected by a WHO Prequalification Team (PQT) for levonorgestrel, mifepristone and ethinylestradiol APIs. The inspection found “five major deficiencies including data integrity issues and several minor deficiencies”.

The

WHO, however, went ahead and closed its inspection as compliant, based on

corrective and preventive actions (CAPAs) provided by the manufacturer.

In

view of the USFDA actions, and the fact that Qinhuangdao Zizhu Pharmaceutical

is the only WHO-PQT prequalified source of levonorgestrel API (as was seen in a similar case at Mylan), the WHO approach towards the compliance position was to

focus extensively on product quality.

READ: FDA and EU differ on cGMP standards at the same facilities: How will they mutually recognize inspections?

Our view

As the US regulators push hundreds of new generic drugs to market

in an effort to drive down prices of generic drugs in the United States, the

industry should get ready for an increasing number of inspections in the coming

years.

Our compilation indicates that in 2017, while most companies had installed the infrastructure necessary to combat issues related to data-integrity, there were problems that were systemic in nature. These ‘systemic problems’ remain, and the industry must get ready as the FDA and European inspectors join hands to crack down on them.

PharmaCompass’ 2017 Recap of FDA Warning Letters, Import Alerts & EU Non-Compliances is an easy way to evaluate companies that have run into compliance challenges so that appropriate risk mitigation strategies can be adopted.

Impressions: 9112

This week in Phispers, we look at the contrasting 2017 forecasts of Mylan and Teva, resulting from the FDA approval of Mylan’s generic Copaxone. Valeant decides to return the female libido pill business to Sprout Pharma. In India, two Lupin facilities receive FDA warning letters. And Torrent Pharma’s imminent acquisition of Unichem is set to make it the country’s fifth largest drug company. Meanwhile, Pfizer admits to have faltered on integrating Hospira and QuintilesIMS rebrands itself as IQVIA.

Teva’s credit rating nosedives, as Mylan raises 2017 forecast with approval of Copaxone

Here’s the tale of two drug makers — Teva Pharmaceutical Industries

and Mylan NV. Both have been facing tough times — Teva due to the declining prices of drugs and the high debt it incurred due to its US$ 40 billion acquisition of Allergan Plc’s generics business last

year; and Mylan due to its struggles with its blockbuster emergency allergy

shot EpiPen.

But

last week clearly favored Mylan. Teva saw its credit rating cut to junk by Fitch Ratings after the US Food and Drug Administration (FDA) approved two doses of Mylan’s generic version of Teva’s Copaxone. This multiple sclerosis drug happens to be Teva’s biggest product. As a result, Teva slashed its 2017 profit forecast for a third time.

Fitch

predicted that Teva will have to either sell assets or find external sources of

financing to meet its obligations. Mylan, on the other hand, raised its 2017 forecast as it expects to benefit from the ‘earlier-than-expected approval’ of its generic Copaxone.

Even

as Mylan hopes to benefit from its generic Copaxone, its challenges

continue unabated. Its third-quarter results highlighted the company's struggles with

declining sales of EpiPen. Sales of EpiPen fell by US$ 245.1 million on increased

competition and higher governmental rebates following a settlement with the US

Department of Justice.

EpiPens,

which contain the hormone epinephrine, are used to stave off allergic

reactions that can be fatal. However, since mid-September this year, seven

people have died as a result of failure of EpiPens to deploy correctly. In all, the FDA has

received 228 reports of EpiPen or EpiPen Jr failures since mid-September.

Teva’s JV with Guangzhou:

Meanwhile, Teva is exploring growth through the world’s second-largest market for drugs — China. It is setting

up a joint venture with Guangzhou Pharmaceutical Holdings

to manufacture and sell its drugs in the Chinese market. It is awaiting

approval from the local government.

Two years after buying ‘female-Viagra’, Valeant plans to sell it back to Sprout

After

buying the female libido pill business from Sprout Pharmaceuticals two years

back for US$ 1 billion, this week Valeant Pharmaceuticals International

said it plans to sell the business back to its original

owner.

The controversial pink pill — Addyi — made by Sprout was said to be a blockbuster drug, expected to command a US$ 2 billion market. However, Addyi proved to be a commercial disaster, with its sales being sluggish last year. What was worse, Valeant was sued on behalf of the former Sprout investors for

its alleged failure to market Addyi successfully. The complaint had said that

sales of the pill may have totaled less than US$ 10 million in 2016, far short

of the US$ 1 billion targeted by July, 2017.

Addyi, approved by the US FDA in August 2015 under intense pressure from patient advocacy groups, is meant to be taken daily. It is prescribed to activate sexual impulses, but carries a strong warning about its potential side effects — such as low blood pressure and fainting, especially when taken with alcohol. Many in the industry believe that the drug should never have been approved.

Valeant has agreed to sell its subsidiary and Addyi to a new company “associated” with Sprout’s founders, for a royalty stream of only 6 percent on global sales of Addyi. In addition, Valeant said it will provide a US$ 25 million loan to fund initial operating expenses to the new company to get things started. And in exchange, Sprout is dropping its lawsuit claiming Valeant mismanaged the launch by pricing the drug too high.

Valeant’s glaucoma drug:

Last week, the US FDA approved Valeant’s long-delayed glaucoma drug — latanoprostene bunod ophthalmic solution.

Christened Vyzulta, the solution was approved for the reduction of

intraocular pressure (IOP) in patients with open-angle glaucoma. Valeant hopes

to have the drug in the market before 2017-end, Joseph Papa, CEO of Valeant,

said in a statement.

Valeant

acquired the drug through its US$ 8.7 billion buyout of Bausch + Lomb in 2013. The drug was

licensed to Bausch + Lomb by France-based Nicox.

Torrent to emerge fifth-largest Indian drug player after

Unichem buyout

In

India, Ahmedabad-headquartered Torrent Pharmaceuticals plans to acquire Unichem Laboratories’ domestic business for US$ 558 million (Rs 36 billion) by the end of this week.

The

deal would make Torrent the fifth largest player in the Indian market with

a market share of 3.4 percent. According to a Reuters report, Torrent

would buy more than 120 brands from Unichem in India and Nepal,

along with its manufacturing plant in Sikkim.

The

board of Torrent is meeting on November 10 to approve the second quarter

results. A formal announcement on the acquisition of Unichem is likely to come on

that day.

Unichem has not been able to leverage its slow-growing, mature brands. The deal includes the purchase of the brands like Unienzyme, Losar, Ampoxin and Telsar.

The

acquisition is likely to deliver synergies in both cost and revenues for Torrent’s branded drugs business in India. Torrent is expected to turnaround Unichem’s mature brand, just the way it had turned around Elder Pharma’s branded formulations,

which it had acquired in 2014 for US$ 308 million (Rs 20 billion).

Analysts expect Unichem to use the proceeds from the deal to ramp up its unprofitable international business. The transaction will strengthen Torrent’s position in cardiology, diabetology, gastro-intestinals and central nervous systems therapies, Torrent chairman Samir Mehta said.

Despite record profits, Pfizer’s CEO says troubles with Hospira persist

American pharmaceutical giant Pfizer reported third-quarter profits

last week, which more than doubled as its new drugs to treat cancer and other

illnesses made up for the hit the company took due to patent expirations.

Pfizer’s net income from the

quarter stood at US$ 2.8 billion, compared with just under US$ 1.4 billion in

the year-ago period.

However, Pfizer’s Essential Health unit remained an area of concern, into which Hospira was folded. The third quarter

revenue of this unit was down 11 percent, at US$ 5.06 billion. Pfizer had

acquired Hospira in 2015 for US$ 15

billion.

While praising other parts of the Essential Health unit (such as biosimilars and emerging markets), Pfizer CEO Ian Read pointed his finger at Hospira. “Within our Essential Health portfolio, we have been experiencing supply shortages with some products. The shortages are primarily for products from the legacy Hospira portfolio and are largely driven by capacity constraints and technical issues,” Read said.

Pfizer

has attributed a 12 percent operational decline from its sterile injectable products on “capacity constraints and technical issues” stemming from the former Hospira facilities.

At

the time of acquisition, the sterile injectables player Hospira was facing

regulatory challenges. The executives of Pfizer had assured

investors and regulators that they would quickly resolve issues at

the plants. However, two years on, the problems still persist.

Pfizer has sold or closed some of the troubled operations of Hospira. But one that has continued to bother the company is a facility in McPherson, Kansas. Earlier this year, Pfizer’s fill/finish manufacturing facility in McPherson received a warning letter from the US FDA. The manufacturing problems at the McPherson plant also derailed the launch of a generic version of Teva’s Copaxone, that was being developed by Sandoz and Momenta. The drug

was being finished at the McPherson plant, which was slapped the FDA warning

letter.

Goodbye

QuintilesIMS, Hello IQVIA

QuintilesIMS has rebranded itself and changed its name to IQVIA. Last year, Quintiles and IMS Health had merged. The merged entity — QuintilesIMS — had emerged as the world's largest pharma services provider, with a market value of almost US$ 18 billion and around 50,000 employees.

The name change (to IQVIA) is effective from November 6, 2017; and beginning November 15, 2017, equity shares of the company will trade on the New York Stock Exchange (NYSE) under the new name and new ticker symbol ‘IQV’.

“IQVIA may be grounded in the intelligence and capabilities of I and Q, but it is ‘via’ the path forward that we hope to inspire and ignite real change for healthcare stakeholders,” a spokesperson told Endpoints News.

Two Lupin facilities receive FDA warning letters

In another setback to Indian generic manufacturers trying to

overcome concerns of non-compliance with good manufacturing practices (GMPs),

Lupin informed the bourses that it had received a warning

letter for its formulation manufacturing facilities in Goa

and Indore (Pithampur Unit II).

In April 2017, Lupin had received three Form 483 observations for its Goa facility, and a month later six Form 483 observations for Pithampur.

In June last year, a PharmaCompass article had asked the question — “Lupin’s FDA inspections, how serious are the concerns?”. In our review of FDA observations of previous inspections at Lupin, we had highlighted concerns over “instances where batches that generated ‘out of specification (OOS)’ results and failed in-process specifications, had the finished product released by the quality control unit (QCU) and distributed” without invalidating the OOS results.

The recent warning letters indicate continued

concerns at Lupin.

The observations of the recent inspections specifically highlight Lupin’s continued “failure to thoroughly review any unexplained discrepancy” as Lupin invalidated approximately 96 percent of all OOS results obtained at Pithampur and over 75 percent of them in Goa.

While Lupin does not expect any disruption

in supplies, the company does anticipate a delay of new product approvals.

Impressions: 3808

This

week, Phispers brings you news about Teva, which finally found a CEO in Kare

Schultz. Allergan transferred the patent of its best-selling eye drug Restasis

to the Mohawk tribe in order to protect it from patent dispute. There was more

news on EpiPen, as Pfizer received an FDA warning

letter for Mylan’s flagship product. And, a leaked audio revealed how Insys lied to a patient who didn’t have cancer to sell a prescription opioid.

Teva nabs Lundbeck’s CEO to revive its fortunes; to pay over US$ 44 million

After

months of bad news, this week there was finally some good news from the

much-troubled Teva. The Israeli generic

drug giant finally managed to get a new chief executive officer for itself, after Erez Vigodman’s resignation in February this year.

Teva

poached Lundbeck’s Kare Schultz as its new CEO. Schultz, 56, will move to Israel and be based at Teva’s headquarters in Petach Tikva. In an SEC filing, Teva said Schultz is starting with a base pay of US$ 2 million. Along

with several bonuses (including a signing bonus of US$ 20 million), his initial

package adds up to over US $44 million. Schultz has 30 years of

experience in global pharma business.

After

the acquisition of Allergan’s generic business — Actavis — last year, Teva has been saddled with huge debts. And the key question before the new CEO is whether he will maintain Teva as both a generics and specialty drugmaker, or split it in two or get out of the highly competitive generics business.

During

the last quarter (April to June), Teva posted revenues of US$ 5.7 billion, out

of which US$ 3.1 billion came from generics and US$ 2.1 billion from its own

branded drugs. About half the sales of its own medicines come from a

blockbuster multiple sclerosis drug which is now facing competition from generics.

Pfizer

gets FDA warning letter for supplying faulty EpiPens to Mylan

The

US Food and Drug Administration (FDA) has told Meridian

Medical Technologies,

a division of Pfizer

that makes the EpiPen injector device (sold

by Mylan NV), that serious component and product failures have been associated with patient deaths.

In

a warning letter issued on September 5, the FDA said the Pfizer unit failed to

adequately investigate problems at its manufacturing facility in Brentwood,

Missouri. It also did not take appropriate corrective actions before an FDA

inspection earlier this year.

Throughout last year,

Meridian received hundreds of complaints that the EpiPen device, which is used

to combat serious allergic reactions, failed to operate during life-threatening

emergencies.

In

March this year, tens of thousands of EpiPens were recalled worldwide after two

reports of the shot failing to work in emergencies.

In

a note to Stat News, Pfizer said: “Between 2015 and now, we have shipped more than 30 million EpiPen Auto-Injectors globally. It’s not unusual to receive product complaints, especially when the product is frequently administered by non-medically trained individuals.”

“We currently have no information to indicate that there was any causal connection between these product complaints and any patient deaths,” it added.

In

a statement, Mylan said it is confident of the safety

and efficacy of EpiPen products being produced at the Brentwood site.

According to the FDA warning letter, in April 2016, a customer complained that an EpiPen failed to activate. Though Meridian confirmed the problem, in June 2016 it decided the defect was infrequent. Moreover, between 2014 and 2017, Meridian received 171 devices from patients who complained their devices failed to activate even when they followed the instructions. But Meridian only examined some of the devices and told the FDA inspectors they could not examine the rest without “approval by management”.

The warning letter highlights that Meridian “failed to thoroughly investigate multiple serious component and product failures for your EpiPen products, including failures associated with patient deaths and severe illness. You also failed to expand the scope of your investigations into these serious and life-threatening failures or take appropriate corrective actions, until FDA's inspection.”

Allergan tries to protect eye drug by selling its patent

rights to Mohawk tribe

Allergan

played an unusual gambit last week to protect its best-selling eye drug — Restasis — from a patent dispute. It did that by transferring the patent of the drug to the Saint Regis Mohawk Tribe, a Mohawk Indian reservation in Franklin County, New York, United States.

Under

the deal, Allergan will pay the tribe US$ 13.75 million. In exchange, the tribe

will claim sovereign immunity as grounds to dismiss a patent challenge through

a unit of the United States Patent and Trademark Office. The tribe will lease

the patents back to Allergan, and will receive US$ 15 million in annual royalties

as long as the patents remain valid.

For

the Mohawk tribe, the deal could generate a new revenue stream. Bob Bailey, Allergan’s chief legal officer told FiercePharma: “I have spent time with the chiefs and their primary motivation for doing this… is to diversify the stream of incomes that this tribe enjoys away from casinos and cigarettes, into longer term, more viable streams…”

If

successful, the move will represent a new way for drug companies to circumvent

the inter partes review, a procedure for challenging the validity of a

United States patent before the United States Patent and Trademark Office.

The

move sent ripples across the pharmaceutical industry. Surely, if this strategy

pays off, there will be other drug companies following suit. Many observers

ridiculed the company on social media by calling the deal unscrupulous and sure

to bring more criticism to the industry. The tribe has reportedly also

taken ownership of patents owned by a technology company.

Interestingly,

last year, Allergan CEO Brent Saunders had won accolades for

condemning predatory drug pricing by the likes of Martin Shkreli and emphasized the company’s commitment to research and development.

This week, in a Federal District Court in

Marshall, Texas, Mylan challenged Allergan’s move. Netherland headquartered Mylan, in its court filing stated that Ireland headquartered Allergan is “attempting to misuse Native American sovereignty to shield invalid patents from cancellation.”

Biocon’s Malaysia facility gets EU nod; Dr Reddy’s gets six major observations

Biocon, India’s leading biopharmaceutical company, had some good news to share, after its recent setbacks related to its biosimilar program. Its insulin facility in Malaysia — Biocon Sdn Bhd — received an EU GMP compliance certificate

from the

HPRA (Ireland), the representative European inspection authority.

Biocon Malaysia is “one of Asia’s largest state-of-the-art integrated insulins manufacturing facilities, set up with an investment of about US$ 275 million, at the BioXcell Biotech Park in Johor, Malaysia,” Biocon said in a statement.

Dr Reddy’s Vizag plant:

Indian pharma major Dr Reddy’s said its plant in

Vishakapatnam (India) has been issued

six major observations related to good manufacturing practices (GMP) by the regulatory authority of Germany — Regierung von Oberbayern.

In a statement issued to the Bombay Stock Exchange last week, the company said: “This is to inform you that on 7th September, 2017, the Regulatory Authority of Germany, concluded an audit for our formulations manufacturing facility in Duvvada, Vishakapatnam, with zero critical and six major observations.” Products manufactured at this facility are not currently exported to the EU.

The

company will be submitting a Corrective and Preventive Action plan (CAPA) to

the authorities, the company added. The Duvvada facility’s compliance with the CAPA and other applicable regulations will be reviewed again by the regulator by November 2018 for continuation of its

EU-GMP certification, the

statement added.

Meanwhile,

Cadila Healthcare received zero observations from the USFDA for its Moraiya plant, situated in Gujarat

(India). The FDA has issued zero observations for the unit after its

re-inspection this year.

Opioid crisis: Leaked audio reveals how Insys lied to a patient who didn’t have cancer

In

the United States, an explosive audio revealed how opioids were being given by a drug company to a patient who didn’t have cancer. The audio was released by Senator Claire McCaskill’s office last week. It explains how many in America had been victims of the opioid crisis.

According

to Business Insider, the audio is a phone call between an employee from Insys, the Arizona-based maker of Subsys (an opioid pain medication given to cancer patients), and a pharmacy benefit manager (PBM).

In

the US, PBMs are supposed to ensure that everyone who gets Subsys has cancer.

But the patient in question, Sarah Fuller, didn't have cancer.

An

Insys employee tried to convince Fuller she had cancer, and succeeded. Fuller

eventually died of a Subsys overdose on March 25, 2016.

The audio accompanies a report from McCaskill’s office on the marketing and business practices of Insys. Since December 2016, several Insys executives, including a former CEO, have been arrested over the opioid issue.

German Merck hires JP Morgan to divest its consumer health

business

Germany’s Merck KGaA has hired JP Morgan to sell its consumer health business, which includes brands such as Seven Seas vitamins, the company said last week. The annual sales of Merck’s over-the-counter medicines and vitamin supplements are around US$ 1 billion.

The

divestment would help fund research into higher-margin prescription drugs,

Merck said. The business could be worth around US$ 4.5 billion.

According to news reports, Merck has already sounded out prospective buyers including Swiss food giant Nestle. Merck had held preliminary talks with Nestle in summer this year. Nestle reportedly favored a joint venture deal and no agreement could be reached.

According

to Euromonitor International, the global market for consumer health products is

worth around US$ 233 billion. Merck ranks 32nd in this sector, with a 0.4

percent share.

J&J

dumps hepatitis C drug development; Roche suffers R&D setback

Janssen Sciences Ireland UC, a unit of Johnson & Johnson, said it would discontinue further development of its hepatitis C

research, citing increased availability of a number of effective hepatitis C

therapies.

Its investigational hepatitis C treatment regimen — JNJ-4178 — is a combination of three direct acting antivirals. “The ongoing phase II studies with JNJ-4178 will be completed as planned, with no additional development thereafter,” Janssen said in a statement.

Roche

drug fails endpoints:

Roche said its drug for geographic atrophy — lampalizumab — failed in first of two late-stage studies.

Lampalizumab was once considered a potential mega-blockbuster that could bring

in US$ 6 billion a year.

Lampalizumab did not reduce mean change in geographic atrophy lesion area compared to a placebo at one year (48 weeks). Given the lack of efficacy, “further dosing in patients will be interrupted until the results from the second Phase III study are evaluated,” Roche said.

Impressions: 3144

This week, Phispers brings you the latest from the world of biosimilars, with Samsung Bioepis tying up with Japan’s Takeda, Biocon transferring its biosimilar business to a subsidiary, and South Korea’s Celltrion denying reports that its proposed biosimilar of Herceptin could face delays in Europe. Teva faced yet another bad week, with two Congressmen in the US attacking it over price increases of its multiple sclerosis drug. Meanwhile, Mylan and J&J will have to pay millions of dollars for cases against them. In vaccines, GSK faces flak for shortage of its Hepatitis B vaccine in the UK. And Pfizer won a pneumonia vaccine patent battle in India.

Biocon transfers biosimilar business to subsidiary; Samsung

Bioepis ties up with Takeda

A lot has been going on in the world of biosimilars. Last week, in

a stock exchange filing, Biocon said it has withdrawn the dossier for the biosimilar products — Fulphila® (pegfilgrastim) and Ogivri® (trastuzumab). Since the

approval of its trastuzumab and pegfilgrastim applications would require re-inspection of its drug product facility (for these products), the “request of withdrawal of the dossiers and re-submission is part of the EMA procedural requirements linked to this reinspection…,” Biocon said in the statement.

The announcement came a fortnight before

the FDA was supposed to take a decision on the trastuzumab application.

This week, the board of Biocon approved

the transfer of the biosimilar business of the company to Biocon Biologics India, a step-down subsidiary of the company, subject to the consent of its shareholders. The transfer of the biosimilar business has been done by way of a ‘slump sale’ as a going concern — wherein a sale is done for a lump sum consideration without values being assigned to the individual assets and liabilities.

Concerns also emerged over Biocon’s Herceptin

biosimilar competitor — Celltrion — as it denied a news report that its proposed biosimilar of Herceptin (a breast cancer drug) could face delayed European approval due to late submission of data. With global sales of around US$ 7 billion a year, Herceptin is one of Roche’s best-selling drugs.

According to the Celltrion, the European Medicines Agency

(EMA) found no lapses during a pre-approval inspection of its product site and drug substance Herzuma — its copy version of Roche’s Herceptin. The South Korea-headquartered biopharmaceutical firm also managed to hand in the documents that it was required to provide after inspection.

“We don’t expect any major changes in approval procedures although the inspection date had been pushed back a little because of differing schedules,” a Celltrion official said. There was news that the EMA could postpone approval of Herzuma to 2018 as the company failed to submit documents on time. However, it seems like Celltrion’s Herzuma may get EMA’s nod this autumn.

Any delays in approval procedures for Herceptin biosimilar candidates could have an impact on other drug makers eyeing the US$ 2 billion EU market for the original drug including another South Korean biosimilar firm — Samsung Bioepis — which filed for EU approval in September 2016.

The biosimilar industry is keeping a close

watch on which of the two South Korean firms is the first to get the nod for

its Herceptin biosimilar, after Biocon withdrew its application last week.

Meanwhile, Samsung Bioepis unveiled a new alliance this week — with Japan’s Takeda. Together with Takeda, Samsung Bioepis hopes to accelerate the development of effective therapies. The Japanese firm

has been open to devising new alliances that will share the risk in order to

broaden its overall drug development work.

More bad news for Teva as US

Congressmen attack pricing of its flagship therapy

Two US Congressmen accused Teva of hiking the price of its flagship multiple sclerosis (MS) drug — Copaxone (glatiramer acetate) — by more than 1,000 percent since 1996. Copaxone generated US$ 4.22 billion in sales last year.

The Congressmen — Elijah Cummings and Peter Welch — want to fully investigate Teva’s pricing practices, while also calling out firms such as Novartis, Bayer and Biogen.

According to the Congressmen, a year’s worth of 20 mg Copaxone was priced at US$ 8,292 in 1996. This increased to US$ 51,315 in 2012 and US$ 91,401 in 2017. Lack of generic competition permitted Teva to increase the price of the drug to such high levels.

Cummings and Welch said they were launching an investigation into

why prices for MS treatments have nearly quintupled since 2004. According to

the National Multiple Sclerosis Society, the average annual cost of MS therapy

rose to US$ 78,000 in 2016 from US$ 16,000 in 2004.

Meanwhile, Teva is planning to tie up with other drugmakers to fund some

of its development pipeline as it struggles with debts and expiring patents.

Teva needs funds to develop new drugs, and striking alliances with big pharma

players is one way of doing that.

Earlier this month, Teva reported a steep

drop in second-quarter earnings. Teva is saddled with debts of around US$ 35

billion, which it took on when it acquired Actavis (Allergan’s generic business) for US$ 40.5 billion last year.

Sanofi

gains millions via Mylan’s EpiPen settlement; J&J to pay US$ 417 million in baby powder case

Last week, Mylan NV and the US Justice Department finalized a US$ 465 million

settlement to resolve claims that Mylan had defrauded taxpayers and overcharged

the government by misclassifying its EpiPen emergency allergy treatment as a generic drug.

EpiPen had become the center of a drug

price-hikes controversy last year.

The probe into the price of EpiPen followed

a whistleblower lawsuit filed under the False Claims Act that rival drugmaker Sanofi SA filed in 2016. As a result of the settlement, Sanofi will

receive US$ 38.7 million as a reward, authorities said.