Acquisitions and spin-offs dominated headlines in 2019 and the tone was set very early with Bristol-Myers Squibb acquiring

New Jersey-based cancer drug company Celgene in a US$ 74 billion deal announced on

January 3, 2019. After factoring

in debt, the deal value ballooned to about US$ 95 billion, which according

to data compiled by Refinitiv, made it the largest healthcare deal on

record.

In the summer, AbbVie Inc,

which sells the world’s best-selling drug Humira, announced its acquisition of Allergan Plc, known for Botox and other cosmetic

treatments, for US$ 63 billion. While the companies are still awaiting

regulatory approval for their deal, with US$ 49 billion in combined 2019

revenues, the merged entity would rank amongst the biggest in the industry.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

The big five by pharmaceutical sales — Pfizer,

Roche, J&J, Novartis and Merck

Pfizer

continued

to lead companies by pharmaceutical sales by reporting annual 2019 revenues of

US$ 51.8 billion, a decrease of US$ 1.9 billion, or 4 percent, compared to

2018. The decline was primarily attributed to the loss of exclusivity of Lyrica in 2019,

which witnessed its sales drop from US$ 5 billion in 2018 to US$ 3.3 billion in

2019.

In 2018, Pfizer’s then incoming CEO Albert Bourla had mentioned that the company did not see the need for any large-scale M&A activity as Pfizer had “the best pipeline” in its history, which needed the company to focus on deploying its capital to keep its pipeline flowing and execute on its drug launches.

Bourla stayed true to his word and barring the acquisition of Array Biopharma for US$ 11.4 billion and a spin-off to merge Upjohn, Pfizer’s off-patent branded and generic established medicines business with

Mylan, there weren’t any other big ticket deals which were announced.

The

Upjohn-Mylan merged entity will be called Viatris and is expected to have 2020

revenues between US$ 19 and US$ 20 billion

and could outpace Teva to

become the largest generic company in the world, in term of revenues.

Novartis, which had

followed Pfizer with the second largest revenues in the pharmaceutical industry

in 2018, reported its first full year earnings after spinning off its Alcon eye

care devices business division that

had US$ 7.15 billion in 2018 sales.

In 2019,

Novartis slipped two spots in the ranking after reporting total sales of US$

47.4 billion and its CEO Vas Narasimhan continued his deal-making spree by buying New

Jersey-headquartered The Medicines Company (MedCo) for US$ 9.7

billion to acquire a late-stage cholesterol-lowering

therapy named inclisiran.

As Takeda Pharmaceutical Co was

busy in 2019 on working to reduce its debt burden incurred due to its US$ 62

billion purchase of Shire Plc, which was announced in 2018, Novartis also purchased

the eye-disease medicine, Xiidra, from the Japanese drugmaker for US$ 5.3 billion.

Novartis’ management also spent a considerable part of 2019 dealing with data-integrity concerns which emerged from its 2018 buyout of AveXis, the

gene-therapy maker Novartis had acquired for US$ 8.7 billion.

The deal gave Novartis rights to Zolgensma,

a novel treatment intended for children less than two years of age with the

most severe form of spinal muscular atrophy (SMA). Priced at US$ 2.1 million,

Zolgensma is currently the world’s most expensive drug.

However,

in a shocking announcement, a month after approving the drug, the US Food and

Drug Administration (FDA) issued a press release on

data accuracy issues as the agency was informed by AveXis that

its personnel had manipulated data which

the FDA used to evaluate product comparability and nonclinical (animal)

pharmacology as part of the biologics license application (BLA), which was

submitted and reviewed by the FDA.

With US$

50.0 billion (CHF 48.5 billion) in annual pharmaceutical sales, Swiss drugmaker

Roche came in at number two position in 2019

as its sales grew 11 percent driven by

its multiple sclerosis medicine Ocrevus, haemophilia drug Hemlibra and cancer medicines Tecentriq and Perjeta.

Roche’s newly introduced medicines generated US$ 5.53 billion (CHF 5.4 billion) in growth, helping offset the impact of the competition from biosimilars for its three best-selling drugs MabThera/Rituxan, Herceptin and Avastin.

In late 2019, after months of increased

antitrust scrutiny, Roche completed

its US$ 5.1 billion acquisition of Spark Therapeutics to strengthen its presence in

gene therapy.

Last year, J&J reported almost flat worldwide sales of US$ 82.1 billion. J&J’s pharmaceutical division generated US$ 42.20 billion and its medical devices and consumer health divisions brought in US$ 25.96 billion and US$ 13.89 billion respectively.

Since J&J’s consumer health division sells analgesics, digestive health along with beauty and oral care products, the US$ 5.43 billion in consumer health sales from over-the-counter drugs and women’s health products was only used in our assessment of J&J’s total pharmaceutical revenues. With combined pharmaceutical sales of US$ 47.63 billion, J&J made it to number three on our list.

While the sales of products like Stelara, Darzalex, Imbruvica, Invega Sustenna drove J&J’s pharmaceutical business to grow by 4 percent over 2018, the firm had to contend with generic competition against key revenue contributors Remicade and Zytiga.

US-headquartered Merck, which is known as

MSD (short for Merck Sharp & Dohme) outside the United States and

Canada, is set to significantly move up the rankings next year fueled by its

cancer drug Keytruda, which witnessed a 55

percent increase in sales to US$ 11.1 billion.

Merck reported total revenues of US$ 41.75 billion and also

announced it will spin off its women’s health drugs,

biosimilar drugs and older products to create a new pharmaceutical

company with US$ 6.5 billion in annual revenues.

The firm had anticipated 2020 sales between US$ 48.8 billion and US$ 50.3 billion however this week it announced that the coronavirus pandemic will reduce 2020 sales by more than $2 billion.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

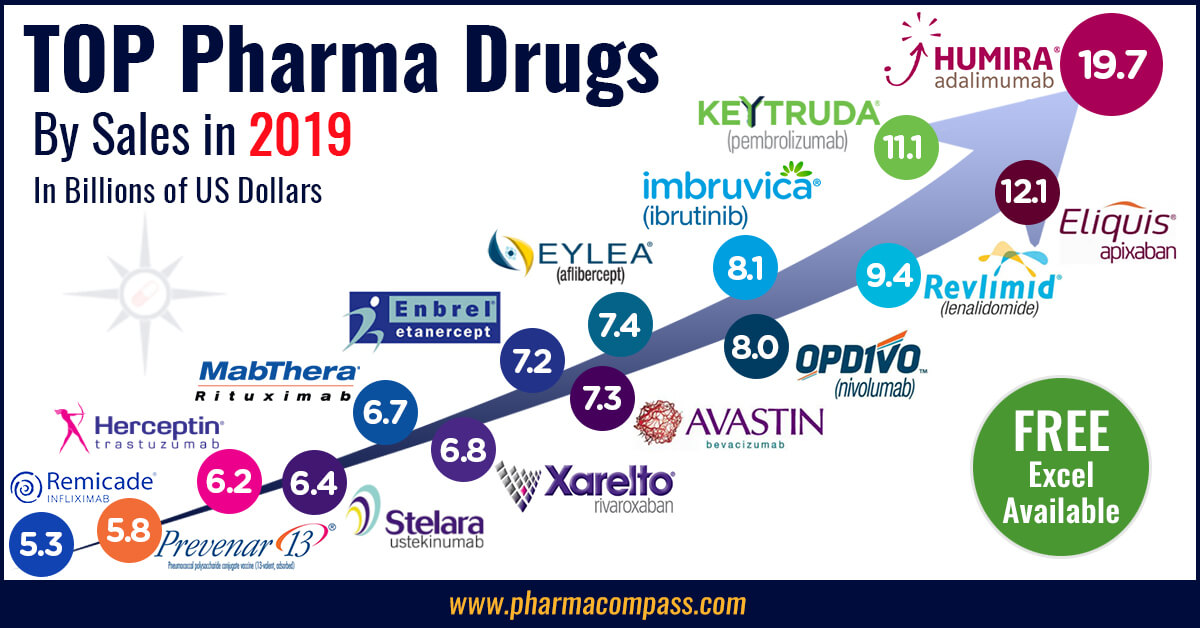

Humira holds on to remain world’s best-selling drug

AbbVie’s acquisition of Allergan comes as the firm faces the expiration of patent protection for Humira, which brought in a staggering US$ 19.2 billion in sales last year for

the company. AbbVie has failed to successfully acquire or develop a major new

product to replace the sales generated by its flagship drug.

In 2019, Humira’s US revenues increased 8.6 percent to US$ 14.86 billion while internationally, due

to biosimilar competition, the sales dropped 31.1 percent to US$ 4.30 billion.

Bristol Myers Squibb’s Eliquis, which is also marketed by Pfizer, maintained its number two position

and posted total sales of US$ 12.1 billion, a 23 percent increase over 2018.

While Bristol Myers Squibb’s immunotherapy treatment Opdivo, sold in partnership with Ono in Japan, saw sales increase from US$ 7.57 billion to US$ 8.0 billion, the growth paled in comparison to the US$ 3.9

billion revenue increase of Opdivo’s key immunotherapy competitor Merck’s Keytruda.

Keytruda took the number three spot in drug sales that

previously belonged to Celgene’s Revlimid, which witnessed a sales decline from US$ 9.69 billion to US$ 9.4 billion.

Cancer treatment Imbruvica, which is marketed

by J&J and AbbVie, witnessed a 30 percent increase in sales. With US$ 8.1

billion in 2019 revenues, it took the number five position.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Vaccines – Covid-19 turns competitors into partners

This year has been dominated by the single biggest health emergency in years — the novel coronavirus (Covid-19) pandemic. As drugs continue to fail to meet expectations, vaccine development has received a lot of attention.

GSK reported the highest vaccine sales of all drugmakers with

total sales of US$ 8.4 billion (GBP 7.16 billion), a significant portion of its

total sales of US$ 41.8 billion (GBP 33.754 billion).

US-based Merck’s vaccine division also reported a significant increase in sales to US$ 8.0 billion and in 2019 received FDA and EU approval to market its Ebola vaccine Ervebo.

This is the first FDA-authorized vaccine against the deadly virus which causes

hemorrhagic fever and spreads from person to person through direct contact with

body fluids.

Pfizer and Sanofi also reported an increase in their vaccine sales to US$ 6.4

billion and US$ 6.2 billion respectively and the Covid-19 pandemic has recently

pushed drugmakers to move faster than ever before and has also converted

competitors into partners.

In a rare move, drug behemoths — Sanofi and GlaxoSmithKline (GSK) —joined hands to develop a vaccine for the novel coronavirus.

The two companies plan to start human trials

in the second half of this year, and if things go right, they will file

for potential approvals by the second half of 2021.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Our view

Covid-19 has brought the world economy to a grinding halt and shifted the global attention to the pharmaceutical industry’s capability to deliver solutions to address this pandemic.

Our compilation shows that vaccines and drugs

for infectious diseases currently form a tiny fraction of the total sales of

pharmaceutical companies and few drugs against infectious diseases rank high on

the sales list.

This could well explain the limited range of

options currently available to fight Covid-19. With the pandemic currently infecting

over 3 million people spread across more than 200 countries, we can safely

conclude that the scenario in 2020 will change substantially. And so should our

compilation of top drugs for the year.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Impressions: 54752

The year 2017 was a landmark year for pharmaceutical

industries in the US and Europe, with a sharp increase in the number of new molecular entities (NMEs) being approved in both geographies.

The US Food

and Drug Administration (USFDA) approved 46 NMEs in 2017, the second highest

since 1996 when 53 NMEs were approved. In Europe, the European Medicines Agency

(EMA) approved 35 drugs with a new active substance, up from 27 in 2016.

Sales for most major pharmaceutical

companies continued to grow in 2017. Earnings forecasts for 2018 have been raised due to the recent US tax reform that has

generated investor hopes for accelerated dividend growth and share buyback

plans.

This week, PharmaCompass brings

you a compilation of the top drugs of 2017 by sales revenue.

Click here to Access All the 2017 Data (Excel

version available) for FREE!

Top-sellers: Humira races ahead, despite launch of biosimilars; Enbrel a distant second

There wasn’t any upheaval

at the top of the pharma drug sales charts. AbbVie’s anti-TNF (tumor necrosis factor) giant

Humira (adalimumab), which is approved to treat

psoriasis and rheumatoid arthritis, added

almost another US $3 billion to its 2016 sales and posted nearly US $19 billion in revenues.

Last year, AbbVie’s raised expectations for Humira’s earnings to reach US $21 billion in global sales by 2020. The

company believes this drug will continue to be a significant cash contributor

until 2025 and the US $21 billion sales forecast

by 2020 is about US $3 billion higher than its expectation two years ago.

In 2016, the US Food and Drug Administration

(FDA) approved Amgen’s Amjevita (adalimumab-atto) — a biosimilar of Humira. And in 2017, another Humira biosimilar — Boehringer Ingelheim’s Cyltezo

(adalimumab-adbm) — received approval from the FDA and European authorities.

Click here to Access All the 2017 Data (Excel

version available) for FREE!

Enbrel (etanercept),

the longest-used biologic medicine for the treatment of rheumatism around the

world, was the second best-selling drug with US $8.262 billion in 2017 sales.

The sales of the drug were down from US $9.366 billion in

2016 owing to lower selling prices and increased

competition, which in turn hurt demand.

Since it was first approved in the United States in 1998,

Enbrel has been approved in over 100 countries and the drug is promoted by Amgen,

Pfizer

and Takeda

in different geographies.

Novartis’ biosimilar copy of Enbrel, which got approved by the FDA in August

2016 for the treatment of patients with

rheumatoid arthritis (RA), plaque psoriasis, ankylosing spondylitis (AS) and

other diseases is still not on the market because of a patent-protection

challenge from Amgen.

Amgen is arguing in the US federal court

that its drug has patent protection until 2029.

Click here to Access All the 2017 Data (Excel

version available) for FREE!

Fast-growing drugs: Eylea and Revlimid bring

fortunes for Regeneron and Celgene

Regeneron’s

flagship eye treatment, Eylea (aflibercept) which is marketed by Bayer outside the United States, added another US $1 billion in

annual sales last year to record US $8.260 billion in total sales. Eylea net

sales grew 11 percent year-on-year in the US and 19 percent year-over-year

outside the US.

The company believes much of the recent

growth in the US was driven by demographic trends with an aging population as

well as an overall increase in the prevalence of diabetes.

These demographic trends are expected to

continue in the coming years, providing an opportunity for continued growth.

Eylea sales alone contribute 63 percent to Regeneron’s total sales.

Click here to Access All the 2017 Data (Excel

version available) for FREE!

Celgene’s

Revlimid

(lenalidomide)

— a thalidomide derivative introduced in 2004 as an immunomodulatory agent for the treatment of various cancers such as multiple myeloma — brought in an additional US $1.2 billion in 2017 sales and had total revenues of US $8.187 billion.

Revlimid continues to contribute more than 60 percent to the company’s total sales of US $13 billion.

Celgene received a setback this month as the

USFDA refused to consider Celgene’s

application for ozanimod, an experimental

treatment for relapsing multiple sclerosis. The treatment was being seen as a

key to the company’s fortunes as Celgene had

said ozanimod is worth US $4 billion to

US $6

billion a year in peak sales.

Click here to Access All the 2017 Data (Excel

version available) for FREE!

Gilead’s Hepatitis C franchise enters free fall

Gilead Sciences’ blockbuster hepatitis C drugs franchise that includes Sovaldi and Harvoni continue to feel the

competitive heat as they registered US $9.137

billion in 2017 sales, down from US $14.834

billion the previous year.

While reporting 2017 results, Gilead provided guidance for

2018 and said its sales of Hepatitis C drugs could fall

further to US $3.5 billion - US $4 billion. At their peak in 2015, Gilead’s Sovaldi and Harvoni had together generated

US $19.1 billion in sales.

One of the major reasons for this drop is AbbVie’s launch of its new treatment Mavyret

at a deep price discount to the competition. AbbVie

also claims to have the shortest treatment course at eight weeks, compared with

12 weeks or longer for other treatments.

AbbVie reported US $1.274 billion in Hepatitis C drug sales

in 2017, down from US $1.522 billion in 2016.

Click here to Access All the 2017 Data (Excel

version available) for FREE!

Novartis’ Gleevec, Merck’s cardiovascular drugs, GSK’s Advair face generic heat

Novartis’ Gleevec (imatinib), which had at one point become the best-selling drug for Novartis and had brought in US $3.323 billion for the company in 2016, started facing generic competition last year and the anti-cancer drug lost US $1.380 billion in sales to bring in ‘only’ US $1.943 billion last year.

The US patents of Merck’s cardiovascular drugs — Zetia (Ezetimibe)

and Vytorin (Ezetimibe

and Simvastatin) — expired in April 2017. In May 2010, Merck and Glenmark

Pharmaceuticals entered into an agreement that allowed Glenmark to launch

a generic version of Zetia in late 2016. The drugs

that had combined sales of US $3.701

billion in 2016 felt the generic heat in 2017 and the sales were US

$1.606 billion lower at US $2.095

billion.

Click here to Access All the 2017 Data (Excel

version available) for FREE!

GSK’s Advair, which was expected

to encounter generic competition in 2017, continued to breathe easy as the FDA

found deficiencies in the applications of Hikma, Mylan and Sandoz.

All three failed to get the FDA nod for their generic versions of Advair, a drug used in the management of asthma and chronic obstructive pulmonary disease that generated sales worth US $4.431 billion (£3.130 billion) in 2017.

Top 15 drugs by sales

Here is PharmaCompass’ compilation

of the best-selling drugs of 2017. This is based on information extracted from

annual reports and US Securities and Exchange Commission (SEC) filings of major

pharmaceutical companies.

If you would like your own copy of all the information we’ve collected, email us at support@pharmacompass.com and we’ll send you an Excel version.

Click here to access all the 2017 data (Excel

version available) for FREE!

S. No.

Company / Companies

Product Name

Active Ingredient

Main Therapeutic Indication

2017 Revenue in Millions (USD)

1

AbbVie Inc., Eisai

Humira®

Adalimumab

Immunology (Organ Transplant, Arthritis etc.)

18,946

2

Amgen, Pfizer Inc., Takeda

Enbrel®

Etanercept

Immunology (Organ Transplant, Arthritis etc.)

8,262

3

Regeneron, Bayer

Eylea

Aflibercept

Ophthalmology

8,260

4

Celgene

Revlimid

Lenalidomide

Oncology

8,187

5

Roche

MabThera®/Rituxan®

Rituximab

Oncology

7,831

6

Johnson & Johnson, Merck, Mitsubishi Tanabe

Remicade®

Infliximab

Autoimmune Disorders

7,784

7

Roche

Herceptin®

Trastuzumab

Oncology

7,435

8

Bristol-Myers Squibb, Pfizer Inc.

Eliquis®

Apixaban

Cardiovascular Diseases

7,395

9

Roche

Avastin®

Bevacizumab

Oncology

7,089

10

Bayer, Johnson & Johnson

XareltoTM

Rivaroxaban

Cardiovascular Diseases

6,590

11

Bristol Myers Squibb, Ono Pharmaceutical

Opdivo

Nivolumab

Oncology

5,815

12

Sanofi

Lantus

Insulin Glargine

Diabetes

5,731

13

Pfizer Inc.

Prevnar 13/Prevenar 13

Pneumococcal 7-Valent Conjugate

Anti-bacterial

5,601

14

Pfizer Inc., Eisai

Lyrica

Pregabalin

Neurological/Mental Disorders

5,318

15

Amgen, Kyowa Hakko Kirin

Neulasta®

Pegfilgrastim

Blood Disorders

4,553

Sign up, stay ahead

In order to stay informed, and receive

industry updates along with our data compilations, do sign up for the PharmaCompass Newsletter and

you will receive updated information as it becomes available along with a lot

more industry analysis.

Click here to Access All

the 2017 Data (Excel version available) for FREE!

Impressions: 58408

This

week, Phispers brings you lots of regulatory news from the US, where the Trump

administration has instructed FDA to fund itself entirely through industry fees; and the agency’s chief has pledged to accelerate generic reviews through two new policies. This was yet another bad week for Teva, as it faced charges in Europe, lost a patent battle in the US to Takeda, and AstraZeneca’s CEO reportedly tossed away an offer to head it. Plus, there is news on AstraZeneca’s investment in China and Novartis’ CAR-T cell therapy for cancer.

Teva’s woes continue: Faces EC charges; loses patent battle; and Soriot drops offer

Teva’s troubles continued unabated. First, Pascal Soriot, the

chief executive of AstraZeneca, who was rumored to be the next head of

the Israeli drugmaker, decided not to leave AstraZeneca. He is reportedly forgoing an offer of a US$ 20 million bonus, and a chance to reorganize Teva, the world’s largest generic drug company.

Last week, the UK-based drug firm confirmed that Soriot would be presenting AstraZeneca’s second-quarter earnings, on July 27. Rumors of Soriot’s likely appointment were floated by an Israeli financial website. Teva is likely to announce the name of its new CEO within a month, Chaim Hurvitz, a member of Teva’s founding family, said.

Second, the European

Commission (EC) charged Teva of doing an illegal deal with Cephalon to delay selling a cheaper generic version of Cephalon’s sleep disorder drug. In the past, the EU regulator has charged scores of other companies as well, including Denmark’s Lundbeck, USA’s Johnson & Johnson and France’s Servier. According to the regulator, the pay-for-delay deals cost European consumers billions of euros.

Third, the Israeli

pharma biggie lost a patent battle in the US

appeals court to Takeda Pharmaceutical. The court said a patent on Takeda's cancer treatment — Velcade — is valid, pushing back the date when generic drug makers, including Teva and Mylan, will be allowed to launch lower-cost versions of the drug

in the US.

AZ invests US$ 79 million in Australia to cater to China’s demand for asthma drug

Air pollution is choking people in the big cities of China, raising demand for AstraZeneca’s asthma medicine — Pulmicort respules.

As a result, the British pharmaceutical giant

announced an investment of US$ 79.27 million (AUD $100 million) last week at its Sydney site which

manufactures the treatment.

The announcement was made in London on July 13, at a meeting between AstraZeneca CEO Pascal Soriot and Australia’s Prime Minister Malcolm Turnbull.

AstraZeneca will add three production lines

to the existing eight at its Sydney site, each with a capacity to produce over

70 million units of Pulmicort respules in a year. The company will bolster

exports from the site to over US$ 1.9 billion (AUD 2.4 billion) in the next

four years, with a further goal of doubling respules production to 1

billion by 2025.

“The demand for this asthma product, particularly for children in China, is immense and we see that trend continuing,” Mark Morgan, manufacturing director of AstraZeneca Australia, said.

Although labor costs are lower in China, the manufacturing technology “is difficult to replicate,” Morgan added. Over 50 percent of Pulmicort’s worldwide sales come from China. And its demand increased by 18 percent — from US$ 485 million in 2015 to US$ 570 million in 2016.

White

House tells FDA to fund itself via industry fees; FDA scouts for top talent

In the US last week, the House of Representatives passed the bill

that reauthorizes US Food and Drug Administration (FDA) to levy user fees. Soon

after that, the White House reiterated its earlier call to amend

the agreements so that the FDA is entirely funded by the medical products

industries.

In a statement, the White House said: “The Administration urges the Congress to provide for 100 percent user fee funding within the reauthorized programs… In an era of renewed fiscal restraint, industries that benefit directly from FDA’s work should pay for it.”

Last week’s statement said President Trump is “concerned with certain other provisions in the bill, such as those providing additional market exclusivity to manufacturers, which could make exclusivity unpredictable and decrease competition.”

Meanwhile,

the FDA

Commissioner Scott Gottlieb is

embarking on a talent hunt

to recruit new staffers for the

Prescription Drug User Fee Act (PDUFA)-related positions in the drugs and

biologics programs.

“To take on this new effort, we’re establishing a dedicated group of full-time staff with the responsibility to ensure that we reliably and predictably identify, recruit, and efficiently hire the scientific personnel the Agency needs,” Gottlieb said in his blog.

Novartis’ CAR-T cell therapy unanimously recommended for approval by FDA

The US FDA’s advisory committee has unanimously (10:0) recommended

Novartis’ CAR-T cell therapy — CTL019

(tisagenlecleucel) — for approval to treat pediatric and young adult patients with B-cell acute

lymphoblastic leukemia (ALL).

CAR-T is short for

chimeric antigen receptor T cell (CAR-T) therapy. In the US, ALL is the most

common childhood cancer.

This therapy is an immunotherapy approach to treat cancer, also considered the “fifth pillar” (after surgery, chemotherapy, radiation and targeted therapies like imatinib and trastuzumab) of cancer treatment. This approach,

called adoptive cell transfer (ACT), uses engineered immune cells to generate

remarkable responses in patients with advanced cancer.

In several early stage trials, when ACT was tested in patients with advanced ALL (with few treatment options left before these patients), many reported a complete disappearance of the cancer. And these patients remained cancer free for extended periods. Therefore, Novartis’ CTL019 assumes tremendous importance.

Meanwhile, the FDA

advisory committee also unanimously recommended Biocon/Mylan’s and Amgen’s biosimilars for approval. The two recommendations imply a

double whammy for Roche, with its drugs Avastin and Herceptin poised to get impacted by these

biosimilars.

The FDA’s Oncologic Drugs Advisory Committee (ODOC) voted 16-0 in favor of Milan’s proposed Herceptin biosimilar to treat HER2-positive breast

cancer, both for patients after surgery and for metastatic disease. The ODOC

also voted 17-0 to recommend FDA approval for Amgen’s ABP 215, an Avastin biosimilar, in each of the approved indications for the reference medication. The uses include metastatic colorectal cancer, non-squamous non-small cell lung cancer and glioblastoma.

Concord

Biotech faces GMP concerns; FDA warning letters to firms in

India, Italy

Ahmedabad-based Concord Biotech, a research and development-driven biotech firm that makes

fermentation-based APIs, was placed on Health Canada’s

Inspection Tracker due to “general GMP

observations” shared by a

regulatory partner. While no details of the observations were divulged, Health

Canada did not mention any data integrity concerns and is “continuing to review evidence submitted (i.e.

corrective actions, information from regulatory partner).”

The FDA also issued a warning letter to Tubilux Pharma SpA in Italy over concerns arising from an inspection

conducted in December 2016. The investigators raised concerns over turbulent

airflow on an aseptic processing line which “poses a significant contamination hazard” to the product. Limitations in Tubilux’s “current

equipment and process design” also

posed “a significant hazard” in the aseptic processing operation.

The warning letter also highlights that some of the products

manufactured at Tubilux were not tested for particulates prior to release.

During the inspection, FDA “observed repeated

instances of high particle count alarms during production”.

Tubilux specializes in manufacturing various types of products used in

ophthalmic applications.

A

September 2016, FDA inspection at Vista Pharmaceuticals in India highlighted concerns over the sale of

isoxsuprine hydrochloride USP, 20 mg tablets, by the firm. Although isoxsuprine

hydrochloride is sold in the US, the drug is not approved in the Orange Book.

The firm had also not validated the manufacturing process for isoxsuprine

hydrochloride USP, 20 mg tablets.

The warning letter also mentions that during the walk through of the

firm’s manufacturing

areas, FDA investigators observed that the equipment was in a state of

disrepair. “Specifically, our

investigators saw holes and corrosion in three pieces of equipment,” the letter noted.

FDA chief pledges to accelerate generic reviews through

two new policies

This week, the US FDA

Commissioner, Scott Gottlieb, made an announcement that by the end of 2017, the American

drug regulator will issue two new documents to improve the review process for

generic drugs.

These documents are

meant to streamline the submission and review of abbreviated new drug applications (ANDAs) under the FDA’s drug competition action plan.

The first document is a planned internal manual of policies and procedures (MAPP) — titled “Good ANDA Assessment Practices”. It will look to reduce “unnecessary” and “duplicative” procedures from FDA’s reviews to make them more efficient.

However, the document

will not alter any of the review goals the FDA agreed to as part of the

negotiations to reauthorize the GDUFA.

For applications that aren’t approved, MAPP will instruct reviewers to detail what needs to be fixed in the complete response letter (CRL), and provide follow up with sponsors over phone if the reasons in the letter are unclear, Gottlieb said.

The second document will be a guidance on “Good ANDA Submission Practices”. It will be added to the Center for Drug Evaluation and Research’s ‘to-do list’ for the year, which already includes 13 other new and revised draft guidances for generic drugs.

According to Gottlieb, this guidance will detail common issues found in ANDA submissions and give sponsors advice on how to avoid those issues before submitting an application.

Impressions: 3438

The year 2016 finished with a whimper insofar as mergers and acquisitions (M&As) were concerned. The preceding year — 2015 — had gone down in history as a record year for M&As in the pharmaceutical and biotech space, when deals worth US $300 billion were announced.

While drug companies were not as active on

the M&A front, the product sales growth in 2016 continued to stay extremely

robust and the order of the top ranked drugs changed little from the previous

year.

This week, PharmaCompass brings you

a compilation of the top drugs of 2016 by sales revenue.

Click here to Access All the

2016 Data (Excel version available) for FREE!

The top-sellers

Abbvie’s Humira (adalimumab) continued to remain the best-selling drug in the

world and added another US $2 billion to its 2015 sales by generating record

sales of US $16.078 billion in 2016.

Last year also saw the US Food and Drug Administration (FDA) approve Amgen’s Amjevita™ (adalimumab – atto) — a biosimilar of Humira®. Amjevita was approved for treating adults with a variety of medical conditions ranging from rheumatoid arthritis, plaque psoriasis, to ulcerative colitis.

Click here to Access All the

2016 Data (Excel version available) for FREE!

Gilead’s Harvoni (ledipasvir and sofosbuvir), with record sales of US $13.864 billion in 2015, had a slightly muted performance in 2016 as sales fell to US $9.081 billion (a drop of US $4.783 billion). Gilead failed to maintain its initial rate of new prescriptions, and competition from Merck and AbbVie forced it to offer major discounts to health insurers.

While Gilead executives still believe there is lots of growth left in the hepatitis C market, this year Gilead will continue to face headwinds as Merck's new combination pill — Zepatier — entered the market with a list price at US $54,600 for a 12-week regimen, well below the US $94,500 for Harvoni.

Biological drugs, Enbrel (etanercept),

Remicade (infliximab) and MabThera (rituximab), held onto their positions of 2015, although their combined sales increased a little over US $300

million.

This means that for yet another year, the

four best-selling drugs in the world are from biological origin.

Celgene’s Revlimid (lenalidomide) — a thalidomide derivative introduced in 2004 as an immunomodulatory agent for the treatment of various cancers such as multiple myeloma — brought in US $5.8 billion in 2015, and grew another 20 percent this year, to US $6.974 billion. Revlimid now contributes more than 60 percent to the company's total sales of US $11.229 billion.

With almost identical sales of US $6.7

billion, Roche’s cancer treatments Herceptin and Avastin were also into

the top 10 best selling drugs in 2016, making Roche have the most number of

products, three of which made it to the list.

Click here to Access All the

2016 Data (Excel version available) for FREE!

Facing onslaught of generics, biosimilars

Against the backdrop of questions being raised about

insulin pricing and possible collusion in the United States, Sanofi saw its insulin treatment Lantus (insulin glargine) drop from number six on the 2015 list to number 9 in 2016 as sales fell by US $717 million to a little over US $6 billion. Sanofi’s competitors in the diabetes space — Novo Nordisk and Eli Lilly — also registered a drop in their insulin sales.

In addition to the pricing pressure, Sanofi will continue to contend with Lilly and Boehringer Ingelheim’s FDA approved biosimilar of insulin glargine — Basaglar — which was approved in December 2015.

Click here to Access All the

2016 Data (Excel version available) for FREE!

Basaglar is biologically similar to Sanofi’s Lantus and was announced at a price 15 percent lower than that of Lantus.

GSK’s Advair, which is preparing for generic competition in 2017, saw its sales drop 5 percent in British Pounds to £3,485. However, the dollar value was significantly lower in view of the fall in the Pound’s value after Brexit.

AstraZeneca’s Crestor (rosuvastatin calcium), Otsuka’s Abilify (aripiprazole) and Novartis’ Gleevec (imatinib) all saw their sales crash in 2016 as a result of generic onslaught. The three drugs together witnessed a combined sales drop of US $5.7 billion.

Top 20 drugs by sales

Here is PharmaCompass’ compilation

of the best-selling drugs of 2016. This is based on information extracted from

annual reports and US Securities and Exchange Commission (SEC) filings of major

pharmaceutical companies.

If you would like your own copy of all the information we’ve collected, email us at support@pharmacompass.com and we’ll send you an Excel version.

Click

here to access all the 2016 data (Excel version available) for FREE!

S. No

Product

Active Ingredient

Main Therapeutic Indication

Company

2016 Revenue in Millions (USD)

2015 Revenue in Millions (USD)

Sales Difference in Millions (USD)

1

Humira

Adalimumab

Immunology (Organ Transplant, Arthritis etc.)

Abbvie

16,078

14,012

2,066

2

Harvoni

Ledipasvir and Sofosbuvir

Infectious Diseases (HIV, Hepatitis etc.)

Gilead

9,081

13,864

(4,783)

3

Enbrel

Etanercept

Immunology (Organ Transplant, Arthritis etc.)

Amgen/Pfizer Inc.

8875

8697

178

4

Remicade

Infliximab

Immunology (Organ Transplant, Arthritis etc.)

Johnson & Johnson/Merck & Co

8,234

8,355

(121)

5

MabThera/Rituxan

Rituximab

Oncology

Roche

7227

6974.55

252

6

Revlimid

Lenalidomide

Oncology

Celgene

6,974

5,801

1,173

7

Avastin

Bevacizumab

Oncology

Roche

6,715

6,617

98

8

Herceptin

Trastuzumab

Oncology

Roche

6,714

6,473

242

9

Lantus

Insulin Glargine

Diabetes

Sanofi

6,057

6,773

(717)

10

Prevnar/Prevenar

13

Pneumococcal 13-Valent Conjugate

Anti-bacterial

Pfizer Inc.

5,718

6,246

(528)

11

Xarelto

Rivaroxaban

Cardiovascular Diseases

Bayer/Johnson & Johnson

5,392

4,255

1,137

12

Eylea

Aflibercept

Ophthalmology

Regeneron Pharmaceuticals, Inc./Bayer

5,046

3,978

1,068

13

Lyrica

Pregabalin

Neurological/Mental Disorders

Pfizer Inc.

4,966

4,839

127

14

Neulasta

Pegfilgrastim

Blood Disorders

Amgen

4,648

4,715

(67)

15

Seretide/Advair

Salmeterol

Respiratory Disorders

GlaxoSmithKline

4,252

4,491

(239)

16

Copaxone

Glatiramer

Neurological/Mental Disorders

Teva

4,223

4,023

200

17

Sovaldi

Sofosbuvir

Infectious Diseases (HIV, Hepatitis etc.)

Gilead

4,001

5,276

(1,275)

18

Tecfidera

Dimethyl Fumarate

Neurological/Mental Disorders

Biogen

3,968

3,638

330

19

Januvia

Sitagliptin

Diabetes

Merck & Co

3,908

3,864

44

20

Opdivo

Nivolumab

Oncology

Bristol-Myers Squibb

3,774

942

2,832

Blockbusters in the making

With almost US $5 billion in sales, a 14 percent growth over the previous year, Pfizer’s Lyrica enjoyed its last year before generic competition enters the market as Generics (UK) Limited (Mylan) and Actavis Group PTC ehf won a patent challenge in the United Kingdom.

Lyrica generics are expected in the United

States in late 2018.

Click here to Access All the

2016 Data (Excel version available) for FREE!

As Abbvie’s Humira begins to face competition from Amgen, Abbvie’s US $21 billion buy of Pharmacyclics seems to be paying off. The Pharmacyclics buy was a way to get access to Imbruvica (ibrutinib), which generated total 2016 sales of US $3.083 billion — an increase of US $1.64 billion over the previous year.

Anticoagulants, Xarelto (rivaroxaban), Eliquis (apixaban), Pradaxa (dabigatran) all registered significant positive growth with a combined increase of almost US $ 2.75 billion.

Gilead and GSK’s combination HIV treatments — Genvoya and Triumeq — also reported sales increase of over a billion dollars each.

Sign up,

stay ahead

In order to stay informed, and receive

industry updates along with our data compilations, do sign up for the PharmaCompass

Newsletter and you will receive updated information as it becomes available

along with a lot more industry analysis.

Click here to Access All the

2016 Data (Excel version available) for FREE!

Impressions: 58546

This week’s Phispers has regulatory and M&A news from across the world as Pfizer ends its support to drugs used in lethal injections, Endo’s problems get compounded and Thalidomide’s Nazi war criminal links are uncovered. European regulators to ‘rely more’ on FDA inspectionsSince the US Department of Justice imposed a US $ 500

million fine on Indian drug manufacturer Ranbaxy in 2013, we have seen regulatory concerns over globalization of drug manufacturing. The Ranbaxy controversy also demonstrated differences in the approaches of regulators in the EU and the US. While the US FDA banned the import of products from two of Ranbaxy’s factories into the US, no such move was taken by the European regulator, the European Medicines Agency (EMA). “A legal framework will allow us to be able to rely

more on US inspections,” Emer Cooke, head of international affairs at the EMA, said in a news report. “That will allow us to release resources to adopt a more risk-based approach.” This statement manifests that European regulators rely more

on FDA inspections, than on their own. Cooke was referring to the need for

Transatlantic Trade and Investment Partnership, a partnership between the EU

and the US to better channel scarce resources between the two regions. Data-integrity issues uncovered at Capsugel’s U.S. plant Problems of data-integrity don’t seem limited only to Asia as Sweden’s regulator, Medical Products Agency (MPA), uncovered “two critical and one major concerns” related to data-integrity at Capsugel’s Bend Research Inc. facility in Oregon. The inspectors also found that several findings, from two previous MPA inspections, had not been corrected and concluded that the facility had an “unacceptable level of GMP compliance”.Bend

Research makes oral solid dose products, primarily for clinical trials and was acquired

by Capsugel

in 2013. Capsugel subsequently invested $20m in to add commercial

spray drying capacity at the Oregon site. Mylan and Pfizer put skin in the game by

investing billionsThis week, both Mylan NV and Pfizer made

acquisitions in the dermatology/topicals space.

Mylan NV announced its decision to

buy skin drug assets from Renaissance Acquisition Holdings LLC for around

US $ 1 billion to complement its existing products. Pfizer, on the other hand, will buy Anacor Pharmaceuticals – a biopharmaceutical company – for US $ 4.5 billion. This is said to be Pfizer’s Plan B, post the collapse of the Allergan mega deal. Pfizer CEO Ian Read had earlier said Pfizer will shop for deals to beef up the “innovative” side of its business. Anacor is “a strong fit” with Pfizer’s inflammation and immunology group, said Albert Bourla, group president of the Pfizer division that includes innovative pharma. The acquisition is “expected to enhance near-term revenue growth for the innovative business.” For instance, Anacor’s eczema therapy, crisaborole, should bring in US $ 2 billion in annual sales. “The dermatology/topicals space has long been an area of focus for Mylan and one that we have targeted for expansion,” Heather Bresch, Mylan’s chief executive officer, said. Pfizer ends support to drugs used in lethal

injectionsLast week, Pfizer took a milestone

step and announced it had imposed sweeping controls on the distribution of

its products to ensure that none are used in lethal injections. This is a step that closes the last remaining open-market

source of drugs used in executions. Such restrictions have already been adopted

by over 20 American and European drug companies. They have cited moral or

business reasons to take such steps. “With Pfizer’s announcement, all FDA-approved manufacturers of any potential execution drug have now blocked their sale for this purpose,” said Maya Foa, who tracks drug companies for Reprieve, a London-based human rights advocacy group. Thalidomide’s inventor knew about its risks before marketing it, says filmVancouver

documentary director John Zaritsky who has made his third film this year on Thalidomide – the

devastating drug that caused thousands of birth defects before being pulled out of the market in the early 1960s – has revealed an interesting finding in his latest film ‘No Limits’. The world premiere of the film took place on May 7, as part of Vancouver’s DOXA festival. According to the film, developers of the drug were war criminals in Nazi Germany. It also shows how today’s developing world is still marketing thalidomide as treatment for leprosy — leading to the birth of deformed babies. The drug maker – Grunenthal – continues to operate. According to the film, Grunenthal researcher and Thalidomide’s inventor, Heinrich Mueckter, had been a doctor at the Buchenwald concentration camp, performing experiments on prisoners. Mueckter

became a multi-millionaire through Thalidomide sales. The documents revealed

that Grunenthal knew months before putting Thalidomide on the market that their

drug would produce malformed babies. They still went ahead and made fortunes

off the drug. China’s Fosun group makes billion dollar bid for India’s Gland PharmaThis

week, Shanghai

Fosun Pharmaceutical (Group) announced it has made a

non-binding bid for India’s Gland

Pharma Ltd,

the Hyderabad-based injectable drugs manufacturer. According

to a Reuters news report, Gland Pharma founders and KKR, which jointly own

about 96 percent of the company, are selling their combined stake, which is

valued at US $ 1 billion and US $ 1.5 billion respectively. Global

buyout firm Advent International and US-based Baxter

International are also said to be among the companies interested in buying out

Gland Pharma. Shanghai Fosun said the proposal was made through its unit Fosun

Industrial Co Ltd. More trouble for Endo as Mylan, Novartis eye Teva’s generic portfolioAfter the disappointing guidance which caused Endo’s stock price to crash last week, the Federal Trade Commission (FTC) attacked Endo for delaying the launch of an authorized generic. The FTC filed a complaint

in a district court in Pennsylvania against Endo, Impax, Watson

Laboratories and others, alleging the companies violated the FTC Act by entering into no-AG commitments, among other things on two of its “most important branded prescription drug products,’’ Opana ER, an opioid drug, and Lidoderm, a lidocaine patch.Meanwhile Endo’s arch rival Teva’s drug portfolio in the UK, Ireland and Iceland is attracting bidders such as Mylan NV

and Novartis AG. According

to reports, private equity firms such as Apollo Global Management and Cinven

are weighing bids for Teva, which could fetch US $ 1.5 to US $ 2 billion. Teva is selling assets as it works to get regulatory approval for its US $ 40.5 billion acquisition of Allergan Plc’s generics business. Envoy warns Colombia government about its

efforts to override Novartis patentLast month, a Colombian embassy official sent a memo to the foreign

minister of his country warning the government about its efforts to override a

patent on a cancer drug made by Novartis. According to the official, such efforts

could harm US support for peace initiative in Colombia. According to

reports, the Colombian health ministry has been planning to issue a compulsory

license for Gleevec (also marketed as Glivec) – a leukemia treatment – which would allow generic drug makers to manufacture a cheaper version of the drug. Novartis has strongly opposed the move. The leaked memo was posted by Knowledge Ecology International and

states that the US Trade Representative and staffers from the Senate Finance

Committee requested to meet embassy officials to discuss US concerns with

Colombia's plans. Gilead gets Sovaldi patent in India amid protests

by patient groupsIn a politically sensitive move, the Indian Patent Office (IPO) reversed

course and granted a patent to Gilead

Sciences for its Sovaldi

hepatitis C treatment. This way, the IPO earned the wrath of many patient groups, while

handing Gilead an unexpected victory. The decision came in response to a

challenge to the Gilead patent filed by several patient advocacy groups and

companies that make pharmaceutical ingredients. Last year, the IPO had rejected

the company’s patent application on grounds that it was not a significant

improvement over an earlier compound developed by Gilead.

Impressions: 3021

The year 2015 has gone down

in history as a record year for mergers and acquisitions in the pharmaceutical

and biotech space with deals worth US $ 300 billion being announced. The highlight

of the year was the Pfizer-Allergan mega-merger – the biggest-ever pharma transaction worth more than US $ 160 billion.

Pharma Letter tracked transactions

through the year and found the number of deals exceeding US $1 billion at 30 in

2015, as compared to 26 in 2014 and 20 in 2013. In all, a total of 166 M&A

deals were announced in 2015 (out of which some are yet to be completed),

compared to 137 in 2014.

This week, PharmaCompass

brings you a compilation of the top drugs of 2015 by sales revenue and growth.

Sofosbuvir – the outright winner of 2015

2015 was the year of Sofosbuvir – the revolutionary active ingredient used for the treatment of hepatitis. Together, through the sale of drugs Harvoni and

Sovaldi, Sofosbuvir brought in sales of almost US $ 19 billion.

The PharmaCompass prediction

that Harvoni (a combination of Ledipasvir and Sofosbuvir; and used for the treatment

of infectious diseases like hepatitis and HIV) would become the best-selling

drug ever in 2015 fell slightly short of expectations as its sales of US $ 13.864

billion were marginally less than AbbVie’s rheumatoid arthritis treatment – Humira.

Humira retained its place as the best-selling drug with US $

14.012 billion in sales in 2015. However, with sales growth of US $ 11.737

billion in a single year, Harvoni is poised to become the best-selling drug by

the end of 2016.

Top 20 Drugs by Sales

Here is PharmaCompass’ compilation of the best-selling drugs of 2015. This is based on information

extracted from annual reports and US Securities and Exchange Commission (SEC) filings

of major pharmaceutical companies.

If you would like your own copy of all the information we’ve collected, email us at support@pharmacompass.com and we’ll send you an Excel version.

Click here to access all

the 2015 data (Excel version available) for FREE!

Product

Active Ingredient

Main Therapeutic Indication

Company

2014 Revenue in Millions

(USD)

2015 Revenue in Millions

(USD)

2015 Sales Difference

Millions (USD)

1

Humira

Adalimumab

Immunology (Organ Transplant, Arthritis etc.)

AbbVie

12,543

14,012

1,469

2

Harvoni

Ledipasvir

and Sofosbuvir

Infectious Diseases (HIV, Hepatitis etc.)

Gilead

Sciences

2,127

13,864

11,737

3

Enbrel

Etanercept

Immunology (Organ Transplant, Arthritis etc.)

Amgen / Pfizer

4,688

8,697

4009

4

Remicade

Infliximab

Immunology (Organ Transplant, Arthritis etc.)

Johnson

& Johnson / Merck

6,868

8,355

1487

5

MabThera/Rituxan

Rituximab

Oncology

Roche

5,659

7,115

1,456

6

Lantus

Insulin Glargine

Diabetes

Sanofi

6,978

7,029

51

7

Avastin

Bevacizumab

Oncology

Roche

6,481

6,751

270

8

Herceptin

Trastuzumab

Oncology

Roche

6,338

6,603

265

9

Revlimid

Lenalidomide

Blood Related Disorders

Celgene

Corpoartion

4,980

5,801

821

10

Sovaldi

Sofosbuvir

Infectious Diseases (HIV, Hepatitis etc.)

Gilead

Sciences

10,283

5,276

(5,007)

11

Seretide / Advair

Salmeterol

Respiratory Disorders

GlaxoSmithKline

6,005

5,227

(778)

12

Crestor

Rosuvastatin

Calcium

Cardiovascular

AstraZeneca

5,512

5,017

(495)

13

Lyrica

Pregabalin

Neuroscience and Mental Health

Pfizer

Inc.

5,168

4,839

(329)

14

Neulasta

Pegfilgrastim

Blood Related Disorders

Amgen

4,596

4,715

119

15

Gleevec / Glivec

Imatinib

Oncology

Novartis

4,746

4,658

(88)

16

Xarelto

Rivaroxaban

Anticoagulants

Bayer / Johnson

& Johnson

3,369

4,345

976

17

Copaxone

Glatiramer

Neuroscience and Mental Health

Teva

4,237

4,023

(214)

18

Januvia

Sitagliptin

Diabetes

Merck

& Co

3,931

3,863

(68)

19

Abilify

Aripiprazole

Neuroscience and Mental Health

Bristol-Myers

Squibb/ Otsuka

Holdings

6,485

3,804

(2681)

20

Tecfidera

Dimethyl

Fumarate

Neuroscience and Mental Health

Biogen

2,909

3,638

729

Click here to access all

the 2015 data (Excel version available) for FREE!

A year of record FDA approvals

2015 was also the

year when the US Food and Drug Administration (FDA) approved 45 novel drugs, another

all-time record high. In January this year, PharmaCompass had compiled a list of novel drugs approved by the FDA in 2015. We also extensively covered the new dosage forms of existing drugs approved in 2015. Do go through the article published on January 14, 2016, for more information.

PharmaCompass’ compilation of sales forecasts of novel drugs indicated a significant

variation in estimates. However, in our view, drugs that

saw highest sales growth in 2015 are likely to do well this year as well.

Top 20 drugs by sales growth (in USD, millions)

Product

Active Ingredient

Main Therapeutic Indication

2014 Revenue in Millions

(USD)

2015 Revenue in Millions

(USD)

2015 Sales Difference

Millions (USD)

1

Harvoni

Ledipasvir

and Sofosbuvir

Infectious Diseases (HIV, Hepatitis etc.)

2,127

13,864

11,737

2

Viekira Pak

Ombitasvir/Paritaprevir/Ritonavir

Infectious Diseases (HIV, Hepatitis etc.)

48

1,639

1,591

3

Humira

Adalimumab

Immunology (Organ Transplant, Arthritis etc.)

12,543

14,012

1,469

4

Hepatits C Franchise

Daclatasvir and Asunaprevir

Infectious Diseases (HIV, Hepatitis etc.)

256

1,603

1,347

5

Imbruvica

Ibrutinib

Chronic lymphocytic leukemia

200

1,443

1,243

6

Cubicin

Daptomycin

Anti-bacterial

25

1,127

1,102

7

Eliquis

Apixaban

Anticoagulants

774

1,860

1,086

8

Triumeq

Abacavir, Dolutegravir and Lamivudine

Infectious Diseases (HIV, Hepatitis etc.)

-

1,037

1,037

9

Xarelto

Rivaroxaban

Anticoagulants

3,369

4,345

976

10

Opdivo

Nivolumab

Oncology

6

942

936

11

Revlimid

Lenalidomide

Blood Related Disorders

4,980

5,801

821

12

Tecfidera

Dimethyl

Fumarate

Neuroscience and Mental Health

2,909

3,638

729

13

Xtandi

Enzalutamide

Oncology

480

1,207

727

14

Ibrance

Palbociclib

Oncology

-

723

723

15

Invokana / Invokamet

Canagliflozin

Type 2 diabetes

586

1,308

722

16

Victoza

Liraglutide

Diabetes

2,014

2,704

690

17

Stribild

Cobicistat, Elvitegravir, Emtricitabine and Tenofovir

Disoproxil Fumarate

Infectious Diseases (HIV, Hepatitis etc.)

1,197

1,825

628

18

Levemir

Insulin

Diabetes

2,133

2,745

612

19

Votrient

Pazopanib

Oncology

565

565

20

Perjeta

Pertuzumab

Oncology

927

1459

532

Hepatitis C products, which had three

of the four highest sales growths in 2015, clearly show the impact these

revolutionary treatments will have on the global healthcare landscape in time

to come. Cancer immunotherapy treatments, a new generation of blood thinners

and novel diabetes treatments were some of the others which demonstrated stellar

growth in 2015.

Vaccines from Pfizer and Sanofi also displayed tremendous sales growth although they

have not been included in the compilation of drugs.

Click here to access all

the 2015 data (Excel version available) for FREE!

Sign Up, Stay Ahead

While some companies like Boehringer and Valeant are yet to release their annual reports. In order to

stay informed, do sign up for the PharmaCompass

Newsletter and you will receive updated information as it becomes available

along with a lot more industry analysis.

Click here to access all

the 2015 data (Excel version available) for FREE!

CORRECTION, April 12, 2016: An earlier version of this compilation

did not account for cases where the same drug is sold by multiple companies

(e.g. Enbrel, Remicade, Xarelto etc.). As an outcome, a re-ranking of the Top

20 Drugs by Sales and Sales Growth has been done.

Impressions: 56504

This week, Pharmaceutical

Whispers (Phispers) looks at Ranbaxy whistleblower’s public interest litigation (PIL) against the Indian government, Bristol-Myers’ clampdown on doctor payments in China and how Jimmy Carter won the battle against cancer. Ranbaxy whistleblower

takes government to court over harmful drugs being sold in India Dinesh Thakur got almost US

$ 48 million as a whistleblower award, when American regulators fined

Ranbaxy US $ 500 million for violating federal drug safety laws and making

false statements to the Food and Drug Administration (FDA). Thakur has now filed a fresh case – a public interest litigation (PIL) alleging responses provided to him by the Indian government show how lax regulation can lead to potentially harmful medicines being sold in India without proper approvals. Thakur's

suit refers to the case of Buclizine, a drug made

by Belgian firm UCB, but since sold to Mankind Pharma for marketing in India. The Central Drugs Standard Control Organization (CDSCO) allowed UCB to sell Buclizine as an appetite stimulant in 2006, though it wasn’t approved for the purpose in Belgium and is banned in many other countries. The case is scheduled for a Supreme Court hearing on March 11. Evergreen pharma

sector is facing some serious headwindsLast week, we heard some not-so good news about the

pharmaceutical sector. First, Moody's Investors Service reduced its outlook from ‘positive’ to ‘stable’ for both the pharmaceutical and medical device industries. The reasons cited are: One, a strong dollar is reducing company sales outside of the US. Two, there is pressure on drug-makers to reduce price in the US. And three, drug-makers have also been hurt by slower uptake of many drugs. Back in India, there was news that pharma

companies in the state of Gujarat have witnessed a dip in exports to the African countries. Most of the countries in Africa have seen their currencies depreciate against the dollar, making imports costlier. As a result, Gujarat’s pharma exports dipped 40 percent in the last six months. And then there was news that Venezuela

settled debts with at least three global drug companies by giving them

bonds that trade at a heavy discount. Merck claims US $ 3

billion from Gilead as patent royalties from Hepatitis C franchise Gilead

Sciences is trying to fend off an

over US $ 3 billion demand by Merck in a patent dispute over the treatment

of hepatitis C, a disease for which the former had pioneered a cure. Last month, a judge found a compound in Gilead's blockbuster

drugs Sovaldi

and Harvoni

may have infringed Merck's patents. A jury will now decide whether those patents are valid or not. In case they are valid, how much does Gilead owe Merck in royalties? Gilead, on the other hand, plans to show jurors that scientists were working on the medicine as early as 2001, a year before Merck got the patent rights it’s seeking to enforce in this case. According to Gilead’s lawyer, the company owes the success of its drug not to Merck but to laboratory research done 15 years ago by Pharmasset, a company Gilead acquired in 2011 for US $ 11 billion. Bristol-Myers curbs

doctor payments in China Novartis got raided in

Korea over bribery concerns two weeks ago, and now Bristol-Myers Squibb has clamped down on the use of

expenses and speaker fees for doctors, after the issue got reported in Chinese social

media. Although

the news could not be confirmed, an emailed statement to Reuters said “Bristol-Myers Squibb has voluntarily stopped certain initiatives in China as the company continues to review its activities and build upon its business model in China.” In October 2015, Bristol-Myers had agreed to pay US $ 14 million to resolve allegations

that it violated the Foreign Corrupt Practices Act. Government’s authority to override patents makes headlines in India, US and ColombiaOf

late, the authority to override patents in order to make medicines accessible to

more people has been making headlines across the world. In

a stunning revelation, the US-India

Business Council (USIBC), in a report, said the Indian government had “privately reassured” them it would not use compulsory licences (CLs) for commercial purposes. This indicates that India’s patent office will take a more restrained approach in handing out licences to domestic players to produce cheaper versions of patented drugs. A CL allows a company to make a patent-protected product without the consent of the patent holder. This news comes at a time when the

same issue is being debated in the United States and even in Colombia. Last week, Obama administration rejected a request from dozens of Congressional Democrats to develop guidelines that would require drug makers to license their patents and put a lid on “price gouging.” Similarly, in Colombia, a government committee in February-end recommended that a CL should be issued for a cancer treatment drug – Gleevec – sold by Novartis. Across the world, several patients turn to countries like India for cheaper, generic versions of life-saving

patented drugs. Billions worth of cancer

drugs wasted due to their packagingPackaging plays a large role in determining how drugs get

used. A new study (undertaken by researchers at Memorial Sloan Kettering Cancer

Center and the University of Chicago) projects US

$ 3 billion worth of the most common cancer medicines will go to waste this

year in the US. According to the study, the drugs are wasted because

manufacturers sell

them in vials that are not practical to reuse. Experts have asked for

policies that require pharmaceutical companies to package drugs differently or

buy back unused drugs. Jimmy Carter says his

cancer has gone into remission, thanks to immunotherapyIf you are one of those who is skeptical of immunotherapy,

think again. Recently, former US President Jimmy

Carter said he will no longer need treatment for melanoma, a type of skin

cancer that had spread to his liver and brain. The 91-year-old Nobel Peace

Prize winner will continue to be observed by doctors, but will not need

treatment. The reason – a promising immunotherapy drug has helped his body’s immune system target cancer cells. Ten years back, Japan’s Ono

Pharmaceutical had tried convincing doctors to test a drug that helped the body’s immune system fight cancer. No one got convinced back then. They had dismissed immunotherapy as a fad. But now, Ono’s CEO Gyo Sagara says he received plenty of apologies when Opdivo – the drug the Japanese company worked on with Bristol-Myers Squibb – got the green light from regulators. Prostate cancer drug

to fund UCLA scholarships, stipendsThe University of California, Los Angeles (UCLA) took US $

520 million pay-out as part of a deal announced last week that transferred

royalty rights for a prostate cancer drug originally discovered in one of its

science laboratories. The UCLA innovation is transforming cancer treatments. UCLA

says it will spend the money until 2027 supporting research, scholarships for

undergraduates, and stipends for graduate students. Khloé Kardashian to promote Allergan’s double-chin treatment KybellaReality TV star Khloé Kardashian hosted the kick-off event for Allergan’s Live Chin Up campaign. Khloé moderated a panel of experts who talked about how Allergan's injection -- Kybella – can treat chin fat. We hope her involvement with the pharma company doesn’t trigger a warning letter from the FDA, akin to how her sister Kim received one when her media posts promoted Diclegis, a prescription-only drug used to treat nausea and vomiting during pregnancy. Kim

Kardashian had shared a selfie on Instagram and Twitter, holding a bottle

of Diclegis, which invited a warning letter issued to Duchesnay USA, the

company which produces the drug. The FDA’s warning letter said the media posts did not communicate the medical risks of the drug. Deal round-up: Sanofi-Merck,

Alvogen-County Line, AbbVie-Boehringer & Amgen Alvogen

has signed an agreement to acquire

County Line Pharmaceuticals, a specialty generic pharma company based in

Wisconsin. The transaction is likely to provide annual revenues of more than US

$ 100 million per year for Alvogen.AbbVie

will pay Boehringer Ingelheim nearly US $ 595 million to collaborate in developing drugs aimed at treating psoriasis, Crohn’s disease, asthma and other diseases affecting the immune system.After sitting out for most of the biotech acquisition frenzy

of 2015, Amgen

is ready to do a deal. According to Amgen’s Chief

Financial Officer David Meline, the time is ripe for bigger targets. Sanofi and Merck ended a 22-year-old joint venture to sell vaccines in Europe, arguing they would do better by managing their product portfolios independently. Sanofi and Merck

said they expected the unwinding of the vaccines joint venture to be completed by

2016-end.

Impressions: 2211

Unrelated to the inspection of

the USFDA at the Dr. Reddys Srikakulam facility, Dr. Reddys sought permission from the Ministry of Environment,

Forests & Climate Change to expand

their drug and intermediate manufacturing at three locations.

All three chemical technical operation (CTO) units, CTO-I, CTO-II & CTO-III are located in Medak district and the announced planned capacity increases along with the anticipated capital investment were

Existing Capacity

Planned Capacity

Anticipated Investment

CTO I

14.7 TPM

45.5 TPM

Rs 30 crores

CTO II

21.9 TPM

68.9 TPM

Rs 45 crores

CTO - III

4.45 TPM

28.1 TPM

Rs 12 crores

*$1 million is approximately about Rs 6.2

crores & TPM is tons per month

In addition, the declaration given by Dr. Reddys also mentions the various products which will be produced at each facility (table below).

Needless to say, the plans are ambitious however with the growth witnessed by the Indian pharmaceutical industry over the past decade, one can understand Dr. Reddys commitment to investing further in their business.

Table Dr. Reddys production plans at various facilities

Product

Name

Planned

Capacity (TPM)

Facility

Location

Alendronate

Sodium Trihydrate

6.67

CTO

- III

Alfuzosin

2.33

CTO

- I

Altretamine

0.03

CTO

- I

Amlodipine

Besylate

33.33

CTO

- II

Amlodipine

Besylate

133.33

CTO

- III

Amlodipine

Besylate ( Ethyl 4 [2- (pthalamide)ethoxy] aceto acetate (TDM-2)

100

CTO

- II

Amlodipine

Maleate

30

CTO

- III

Amsacrine

0.07

CTO

- I

Anastrazole

0.83

CTO

- II

Aprepitant

3.33

CTO

- III

Aripiprazole

0.33

CTO

- II

Atomoxetine

1.67

CTO

- III

Atorvastatin

375.83

CTO

- II

Azacitidine

0.67

CTO

- I

Bicalutamide

0.03

CTO

- II

Bivalirudin

0.03

CTO

- II

Bivalirudin

Trifluoro Acetate

0.03

CTO

- I

Bortezomib

0.03

CTO

- I

Cabazitaxel

0.02

CTO

- I

Candesartan

cilexetil

6.67

CTO

- II

Cetirizine

Hydrochloride

66.67

CTO

- I

Cetirizine

16.67

CTO

- II

Ciprofloxacin

176.67

CTO

- II

Ciprofloxacin

HCl

533.33

CTO

- II

Ciprofloxacin Lactate

33.33

CTO

- II

Clopidogrel

Bisulfate

500

CTO

- I

Clopidogrel Premix

166.67

CTO

- II

Diluted

Everolimus 5% (Everolimus)

0.33

CTO

- II

Disodium

Pamidronate

0.33

CTO

- III

Docetaxel

1.9

CTO

- I

Dutasteride

3.33

CTO

- II

Esomeprazole

magnesium

66.67

CTO

- III

Ezetimibe

3.33

CTO

- II

Fexofenadine

Hydrochloride

500

CTO

- I

Finasteride

10

CTO

- II

Fluoxetine

110

CTO

- I

Fondaparinux

Sodium

0.33

CTO

- II

Galantamine

0.03

CTO

- II

Gemcitabine

13.33

CTO

- I

Glimepiride

13.33

CTO

- II

Imatinib

0.17

CTO

- I

Irinotecan

0.33

CTO

- I

Ketorolac

66.67

CTO

- II

Lacidipine

5

CTO

- III

Lamotrigine

33.33

CTO

- I

Lansoprozole

8.33

CTO

- III

Letrozole

0.03

CTO

- II

Levocetrizine

Di HCl

10

CTO

- III

Levofloxacin

200

CTO

- II

Lomustine

1.33

CTO

- I

Losartan

Postassium

150

CTO

- I

Meloxicam

0.03

CTO

- I

Memantine

HCl

3.33

CTO

- II

Mesalamine

0.03

CTO

- II

Metoprolol

Succinate

266.67

CTO

- II

Moxifloxacin

116.67

CTO

- II

Norfloxacin

0.03

CTO

- I

Omeprazole

133.33

CTO

- III

Omeprazole

Magnesium

50

CTO

- III

Omeprazole

Sodium

10

CTO

- III

Omerprazole Form B

33.33

CTO

- III

Paclitaxel

0.33

CTO

- I

Pantoprazole

Sodium

100

CTO

- III

paroxetine

HCl

0.03

CTO

- II

Pemetrexed

0.67

CTO

- I

Rabeprazole

Sodium

83.33

CTO

- III

Raloxifene

33.33

CTO

- II

Ramipril

100

CTO

- III

Repaglinide

6.67

CTO

- II

Rivastigmine

6.67

CTO

- II

Risperidone

13.33

CTO

- I

Rivastigmine

6.667

CTO

- I

Rizatriptan

Benzoate

1.33

CTO

- II

Rocuronium

Bromide

0.03

CTO

- II

Ropinrole

HCl

1.83

CTO

- III

Rosiglitazone

3.33

CTO

- II

Sparfloxacin

3.33

CTO

- I

Tacrolimus

5

CTO

- II

Tadalafil

3.33

CTO

- II

Telmisartan

100

CTO

- II

Temozolamide

0.03

CTO

- I

Terbinafine

HCl

133.33

CTO

- III

Tizanidine

HCl

16.67

CTO

- III

Topotecan

0.07

CTO

- I

valganciclovir

0.03

CTO

- I

Vardenafil

3.33

CTO

- II

Voriconazole

8.33

CTO

- III

Ziprasidone

Hydrochloride

100

CTO

- I

Zoledronic

acid

0.33

CTO

- III

Zolmitriptan

0.83

CTO

- I

Zonisamide

0.03

CTO

- II

Impressions: 3086