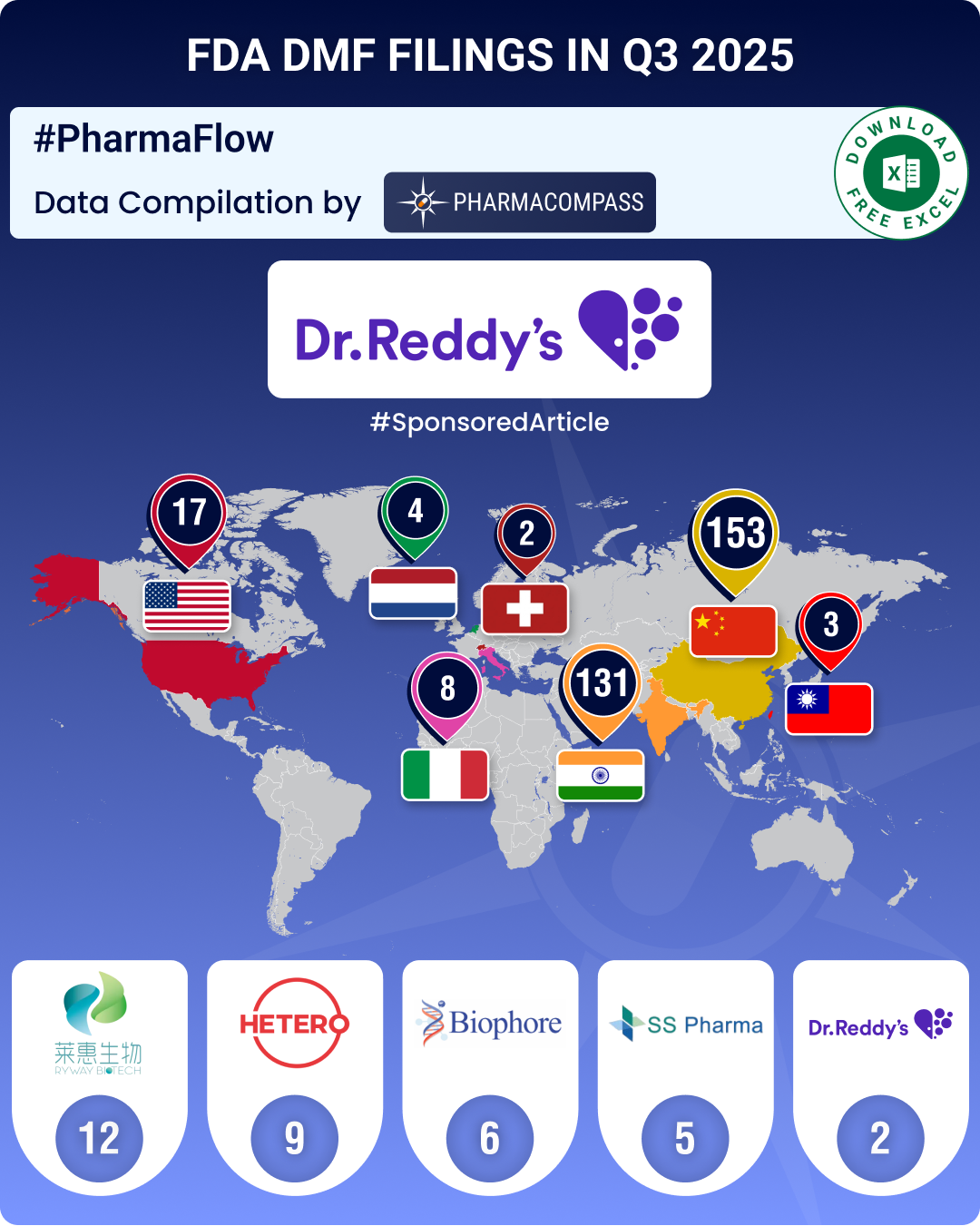

DMF filings rise 4.5% in Q3 2025; China holds lead, India records 20% growth in submissions

The

third quarter (Q3) of 2025 witnessed a steady rise in Drug Master File (DMF) submissions to the

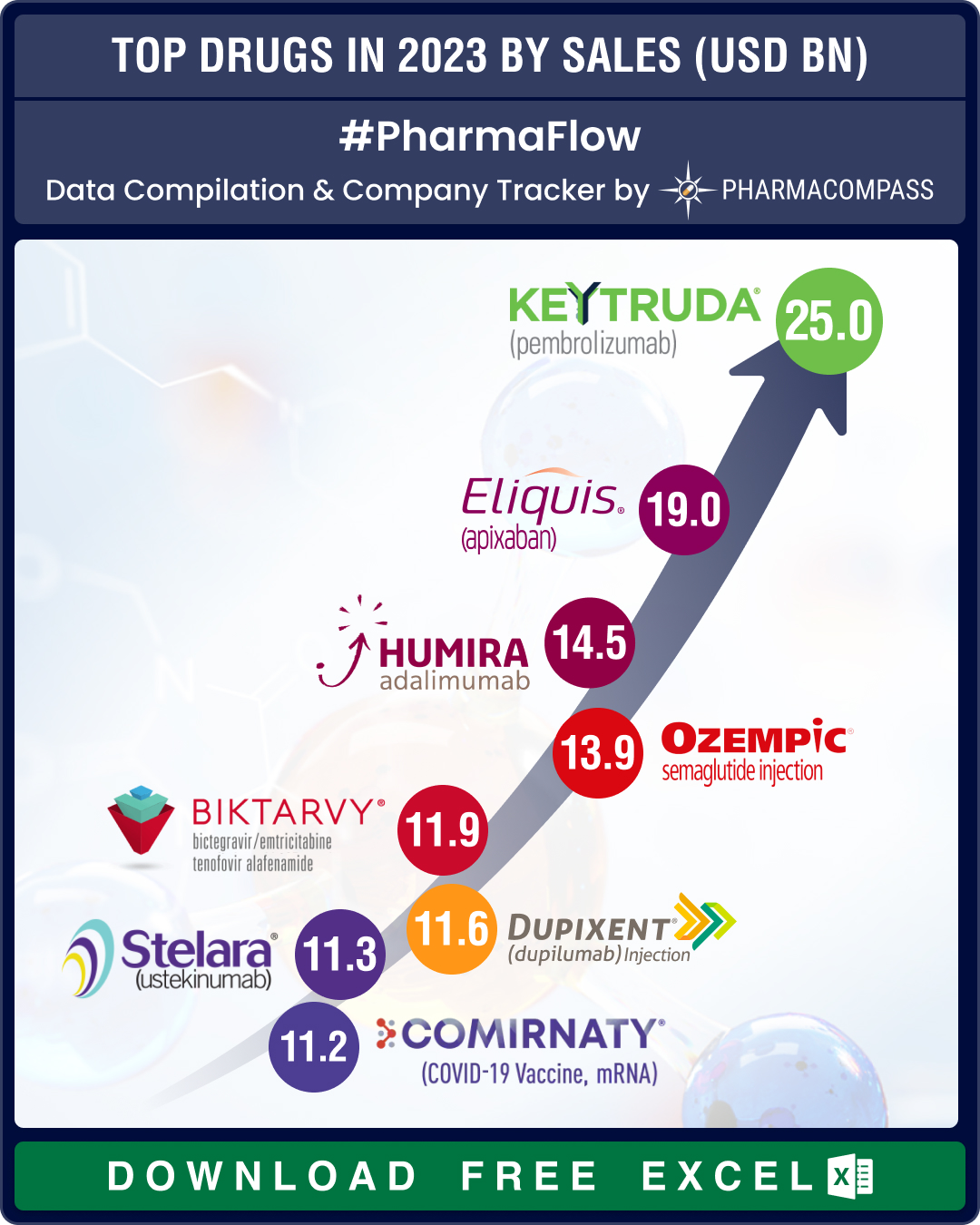

Top Pharma Companies & Drugs in 2024: Merck’s Keytruda maintains top spot as Novo’s semaglutide nips at its heels

In 2024, Big Pharma players consolidated

and maintained their dominance, even as innovation continu

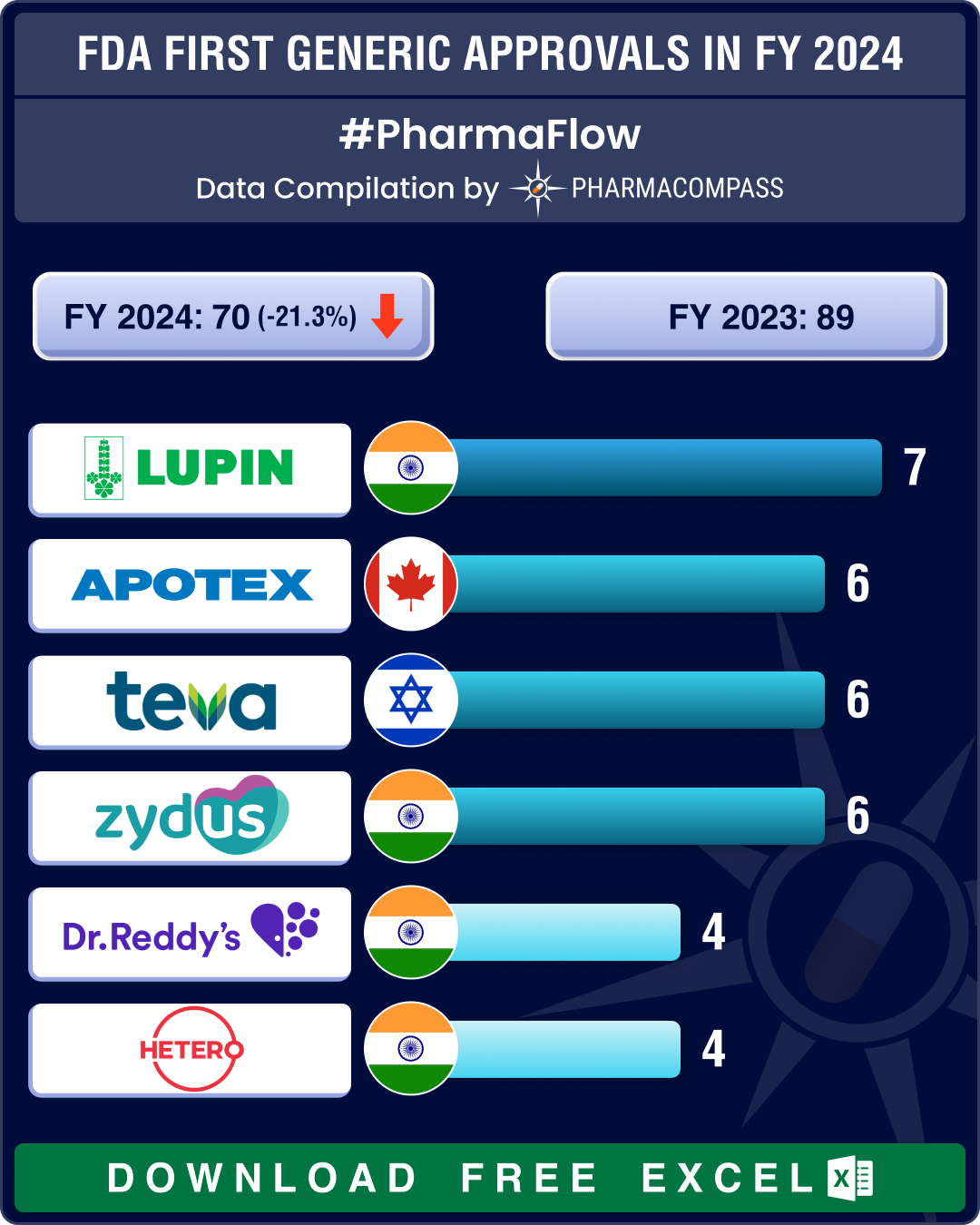

FDA’s first generic approvals slump 21% in 2024; Novartis’ top seller Entresto, cancer blockbuster Tasigna lead 2024 patent cliff

A watershed moment in the journey of a drug is when it transitions from being a patented, high‐

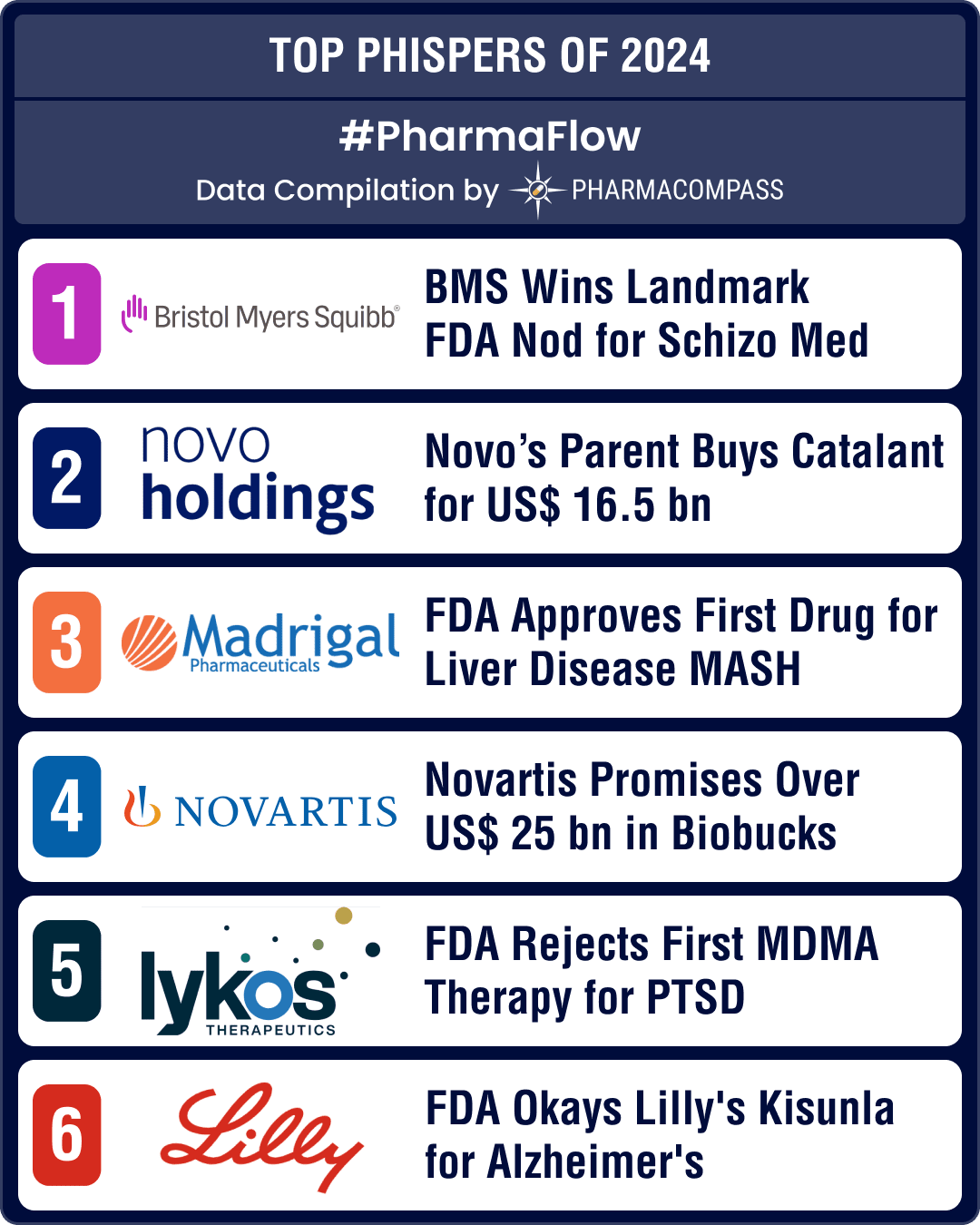

FDA’s landmark approvals of BMS’ schizo med, Madrigal’s MASH drug, US$ 16.5 bn Catalent buyout make it to top 10 news of 2024

The year 2024 was marked by some landmark drug approvals in the areas of schizophrenia, metabolic dy

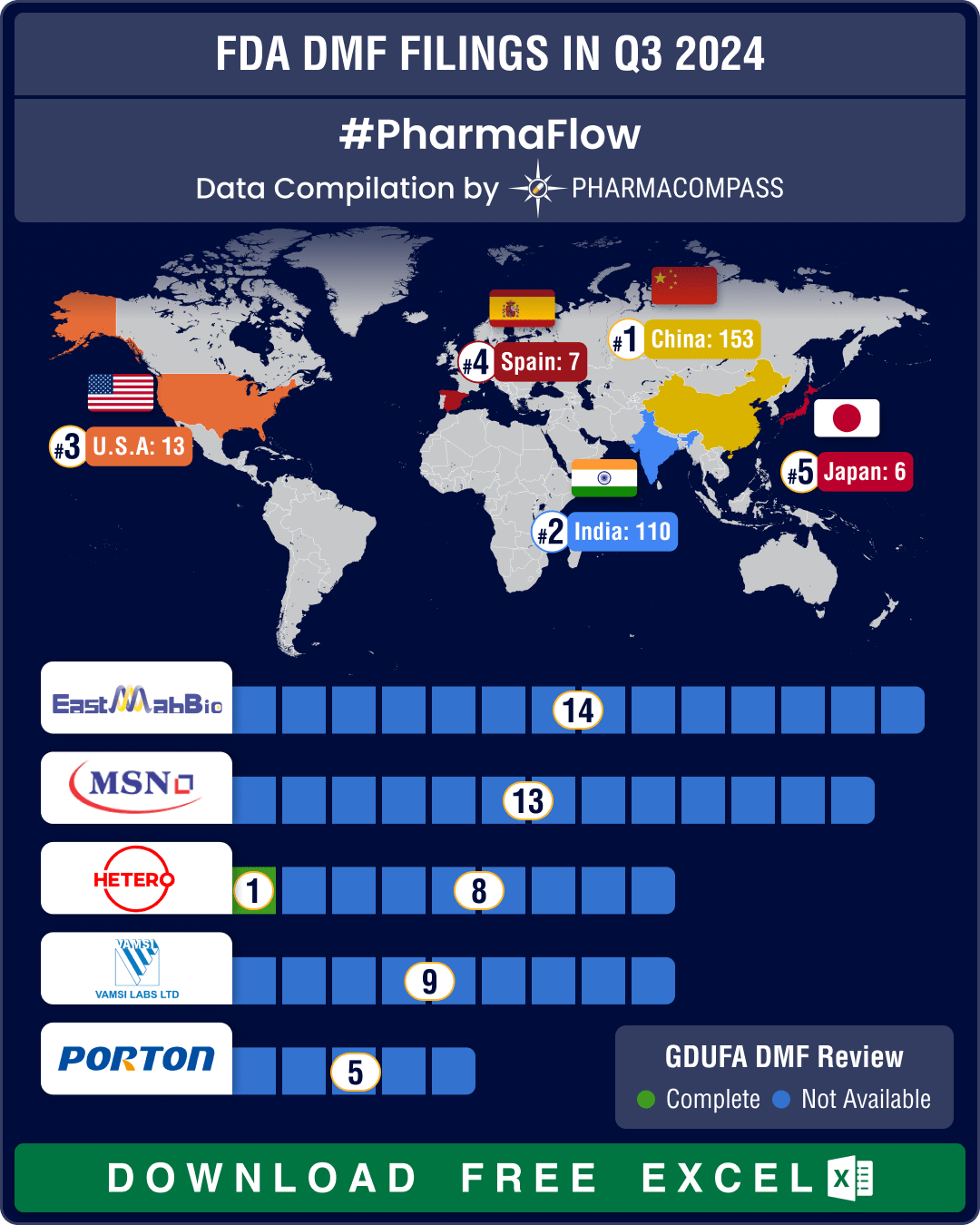

DMF filings hit all-time high in Q3 2024; China tops list with 58% increase in Type II submissions

Drug Master Files, or DMFs, are confidential documents that play a crucial role in the pharmaceutica

Market Place

Market Place Sourcing Support

Sourcing Support