As we come to an end of the shortest month of the year, we are back this week with another edition of PharmaFlow, a monthly roundup of deals and investments from across the globe.

If you have been following pharma news, you would already know that January was a big month for M&As. Here we look at some deals announced last month, and hope our roundup gives you an insight into the breakthrough technologies and business trends of tomorrow.

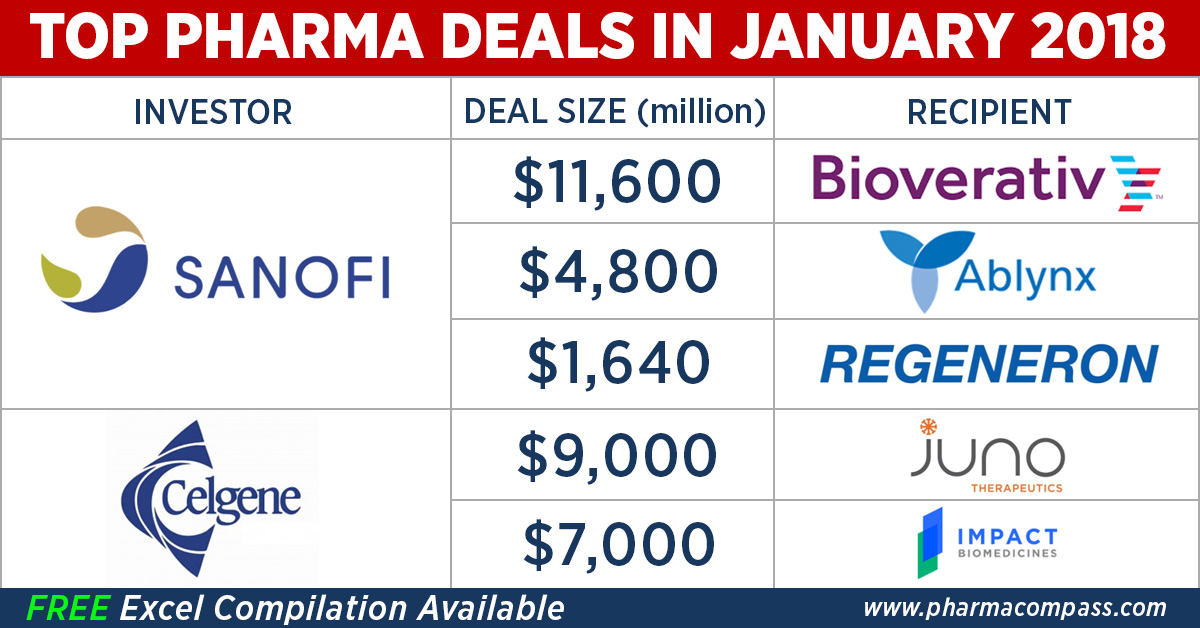

Big bang M&As: Sanofi acquires Bioverativ, Ablynx;

Celgene acquires Juno Therapeutics

The year started with big bang M&A deals and was the most active January for deal making in over a decade with Sanofi and Celgene dominating the headlines.

French drugmaker Sanofi started off by announcing it had closed a deal to acquire Biogen spinout Bioverativ, a maker of drugs for hemophilia, for almost US$ 11.6 billion.

The second biggest deal in January, announced in the same week, was the acquisition announcement of Juno Therapeutics by Celgene Corporation for approximately US$ 9 billion.

Click here to view the major deals in January 2018 (FREE Excel version available)

Juno is a pioneer in the development of CAR (chimeric antigen receptor) T and TCR (T cell receptor) therapeutics with a broad, novel portfolio evaluating multiple targets and cancer indications. This acquisition will add to Celgene’s lymphoma program, JCAR017. Regulatory approval for JCAR017 in the US is expected in 2019. With this acquisition, Celgene hopes to deliver a new CAR-T with peak sales of US$ 3 billion a year.

Sanofi, on the other hand, bet big on the fast-changing hemophilia market, where Bioverativ’s business is threatened by Roche and developers like BioMarin and Spark/Pfizer, who are looking to disrupt the business with new gene therapies now in late-stage development.

Recently, Roche won a nod for its hemophilia drug Hemlibra.

Sanofi didn’t stop at the Bioverativ buy — it agreed to buy Belgian biotech company Ablynx for US$ 4.8 billion (Euro 3.9 billion), beating Denmark’s Novo Nordisk. Ablynx had earlier rejected a US$ 3.2 billion (Euro 2.6 billion) offer from Novo Nordisk.

Ablynx specializes in the research of novel drugs based on nanobodies (which are found in the immune systems of llamas and alpacas). Ablynx partners with several of the world’s largest pharmaceutical companies.

Click here to view the major deals in January 2018 (FREE Excel version available)

Sanofi and its partners at Regeneron also announced they were boosting their development budget for cemiplimab to a minimum of US$ 1.65 billion — one billion dollars more than what had been agreed upon in the development agreement signed three years ago.

Celgene buys Impact Biomedicines, a startup that bought Sanofi’s cast off drug

In January, Celgene also agreed to acquire Impact Biomedicines for US$ 7 billion, subject to certain milestones associated with regulatory hurdles and sales performance.

Celgene’s buy was driven by its interest in Impact Biomedicines’ fedratinib, a kinase inhibitor that has shown promise as a potential treatment for myelofibrosis. Myelofibrosis is a group of rare cancers of the bone marrow in which the marrow is replaced by scar tissue and is not able to make healthy blood cells.

San Diego-based Impact Biomedicines had bought fedratinib — Sanofi’s cast off drug — in 2013. Fedratinib was a flop for Sanofi as patients began to develop a dangerous neurological condition tied to vitamin B deficiency called Wernicke’s encephalopathy. As a result, the US Food and Drug Administration (USFDA) put a clinical hold on it in 2013 and Sanofi ultimately shelved the effort. However, last fall, Impact Biomedicines began convincing regulators that patients can be protected from the lethal side effects of fedratinib.

Click here to view the major deals in January 2018 (FREE Excel version available)

The US$ 7 billion deal is structured in three parts, with Celgene paying US$ 1.1 billion in cash upfront to Impact Biomedicines. Celgene will pay an additional US$ 1.4 billion on receiving USFDA milestone approvals.

Finally, Celgene will make payments depending on sales, with a maximum of US$ 4.5 billion due if annual net sales of Impact’s treatments exceed US$ 5 billion.

While the deal is considered a great buy for drug inventors, and that includes John Hood, one of the co-inventors of fedratinib, analysts say the acquisition may not be great for Celgene.

According to a Bloomberg report, Celgene’s shares are “suffering because the company promised investors the world, then significantly revised the planet’s size”.

In October 2017, Celgene had reported weak third-quarter earnings and significantly cut its ambitious 2020 revenue guidance that it had set in 2015.

Click here to view the major deals in January 2018 (FREE Excel version available)

Cast off natural products meet artificial intelligence in Pfizer’s deal with Adapsyn

In a deal valued up to US$ 162 million, Adapsyn Bioscience Inc announced it had completed a round of financing that was co-funded by Pfizer R&D Innovate and Genesys Capital. In addition, the company also announced a research collaboration with Pfizer Inc.

Adapsyn technology platform combines genomic and metabolomic data with artificial intelligence and machine-learning to identify novel, mechanistically diverse evolved small molecules.

Adapsyn’s technology could potentially help take much of the guess work out of the process of discovering truly novel compounds that exhibit new pharmacological signatures from natural products. The process to reveal novel chemistry and biology from natural product samples has historically been a very time- and labor-intensive process.

Under the terms of the research agreement, Adapsyn and Pfizer are working together to employ Adapsyn’s proprietary platform technologies with the goal to identify and test previously undiscovered natural products from Pfizer’s collection of microbial strains.

Click here to view the major deals in January 2018 (FREE Excel version available)

Indian firms on buying spree:

Ipca buys Pisgah Labs; Torrent expands in US

Two Indian pharmaceutical companies Ipca Laboratories and Torrent Pharmaceuticals also made news in the M&A space in January .

In June 2017, the USFDA had banned almost all drugs manufactured by India’s Ipca Laboratories at its facilities at Pithampur, Silvassa and Ratlam for violation of current good manufacturing norms (cGMPs).

While continuing to be on the import alert list of the USFDA, Ipca Laboratories said its two subsidiaries have fully acquired US-based Pisgah Labs Inc for US$ 9.65 million.

Pisgah, a contract manufacturer and developer of APIs and intermediates, will continue to operate out of its North Carolina manufacturing facility under the Pisgah trade name.

Meanwhile, Ahmedabad-based Torrent Pharmaceuticals announced the acquisition of Bio-Pharm Inc, a drugmaker based in Pennsylvania, US. The company did not disclose the deal size or other financial details.

Bio-Pharm, a generic pharmaceuticals and over-the-counter (OTC) drugs company, has a proven track record in the research and development and manufacturing of oral solutions, suspensions and suppositories, it said.

Click here to view the major deals in January 2018 (FREE Excel version available)

With an annual revenue of more than US$ 911.8 million (INR 58 billion), Torrent Pharma is the flagship company of the US$ 2.9 billion (Rs 183 billion) Torrent Group.

Indian companies to bid for Sanofi’s European generics business: Indian drug companies — Aurobindo Pharma, Zydus Cadila, Torrent Pharma and Intas — also expressed preliminary interest in buying the European generics business of Sanofi.

The Indian drug majors are positioned against top drugmakers in China, as well as several global private equity players. Therefore, the Indian drug majors may tie-up with strategic players to pitch for the Paris-headquartered drug major’s generic business.

Europe’s leading private equity player Apax Partners is joining forces with Zydus Cadila while Intas is backed by Temasek and Chrys Capital.

In January 2017, Sanofi had said it plans to finalize the sale of its generic drugs business by the end of 2018. The unit employs 3,000 people and reported about US$ 977.25 (Euros 800 million) in sales in 2016.

Click here to view the major deals in January 2018 (FREE Excel version available)

J&J

opts out of the race for Pfizer’s US$ 20 billion consumer unit

The mother of all M&A deals would be the sale of Pfizer’s consumer health unit. It could be as big as all the M&A deals announced in January put together.

Johnson & Johnson was once considered the strongest contender for Pfizer’s consumer health unit. However, it announced last month that it is pulling out of the race to buy Pfizer’s consumer health business.

Back in 2006, J&J had snapped up Pfizer’s previous consumer health business for US$ 16.6 billion. And the same was expected of J&J in 2018, with plans of Pfizer to put its consumer unit on the block. The unit makes Advil painkiller, Centrum multivitamins and Chapstick lip balm.

Click here to view the major deals in January 2018 (FREE Excel version available)

J&J is cash rich — it is about to bring home US$ 12 million in overseas cash, thanks to new tax laws in the US. It also wants to continue expanding its portfolio.

However, CEO Alex Gorsky told investors the company would put a good chunk of that money back into R&D.

With J&J out, drugmaker GlaxoSmithKline and consumer goods group Reckitt Benckiser are left in the game. And the two players are learnt to be preparing bids.

The deal could be a game-changer for GSK or Reckitt by making them one of the biggest global players in consumer health, which has emerged as a booming sector worldwide.

Though the company is yet to make public any details about the sale process, a Reuters report says Pfizer wants to sell this unit for no less than US$ 20 billion.

Click here to view the major deals in January 2018 (FREE Excel version available)

Our view

Experts predict that 2018 will be a bumper year for M&As. The year began with more than enough signs that validate this prediction.

During January, we saw biotech M&As worth US$ 26.3 billion. According to Thomson Reuters data, this is more than 80 percent of the value of all deals in 2016 and far ahead of any comparable January tally in over a decade.

There is much consolidation happening in generics. And biotech is also witnessing hectic M&A activity. Deals in the biotech space are driven by the need for large drug makers to tap the promising new medicines being developed by smaller rivals in order to rev up their sluggish growth engines.

With new tax policies in the US, stay connected with PharmaFlow to follow all the action.

Click here to view the major deals in January 2018 (FREE Excel version available)

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : TOP PHARMA DEALS IN JANUARY 2018 by PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”