This week, PharmaCompass

reviews the recently released data on prescription drugs paid for under the

Medicare Part D Prescription Drug Program in the United States in calendar year

2016.

But first, let’s understand what is Medicare.

Medicare is the federal health insurance program in the US. In 2017, it covered 58.4 million people — 49.5 million aged 65 and older, and 8.9 million disabled.

Prescription drug coverage under this

program was started in 2006, and is known as Medicare Part D.

As part of this

coverage, the Centers for Medicare & Medicaid Services (CMS) contracts insurance

companies and other private companies, known as plan sponsors, that offer

prescription drug plans to their beneficiaries with varying drug coverage and

cost-sharing requirements.

In

2017, the Congressional Budget Office (CBO) had estimated that spending on

Medicare Part D would reach US$ 94 billion, or about 16 percent of all Medicare

expenditures for the year.

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

According

to the CBO, Medicare Part D is the most significant expansion of the Medicare

program since it was created by Congress in 1965.

With

more than 1.48 billion claims from beneficiaries enrolled under the Part D

prescription drug benefit program under its umbrella, our analysis of Medicare

Part D provides valuable insights into how elderly Americans use prescription

drugs.

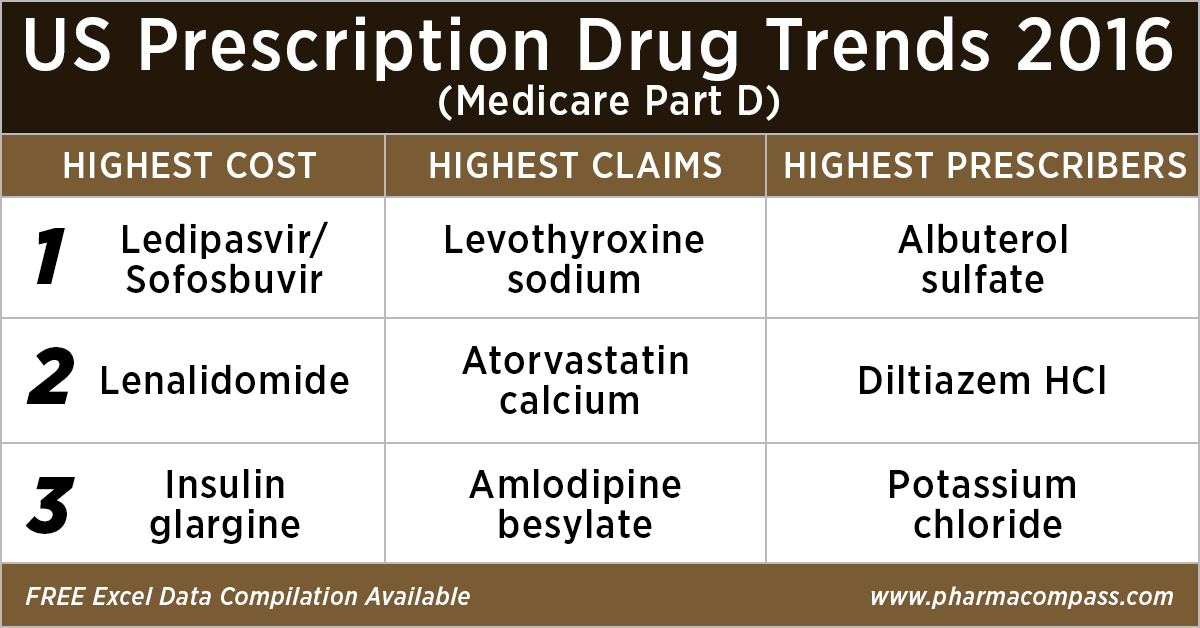

Top 10 drugs by

cost: The ones that bore the highest cost burden for Medicare

As in 2015, in 2016

too Gilead’s Hepatitis C treatment — Ledipasvir/Sofosbuvir (Harvoni) — remained the single drug highest payout under the Medicare Part D Prescription Drug Program with a total cost of US$ 4.4 billion.

As Gilead continued

to face competition from AbbVie and Merck in the Hepatitis C space, the spending on Harvoni was down

37 percent from US$ 7.03 billion in 2015.

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Celgene’s cancer treatment, Lenalidomide (Revlimid), Sanofi and Merck’s diabetes treatments and AstraZeneca’s Crestor (Rosuvastatin Calcium) for

cholesterol followed Harvoni. All together, they cost the Medicare program over US$ 10 billion.

Generic Name

Number of Medicare Part D Claims

Number of Medicare Beneficiaries

Number of Prescribers

Aggregate Cost Paid for Part D

Claims (In USD)

LEDIPASVIR/ SOFOSBUVIR (HARVONI)

141,665

52,782

12,097

4,398,534,465

LENALIDOMIDE

239,049

35,368

10,382

2,661,106,127

LANTUS SOLOSTAR (INSULIN

GLARGINE, HUM.REC.ANLOG )

5,028,485

1,075,248

245,447

2,526,048,766

SITAGLIPTIN PHOSPHATE

4,742,505

864,442

206,223

2,440,013,513

ROSUVASTATIN CALCIUM

6,012,444

1,560,050

249,981

2,322,724,007

FLUTICASONE/SALMETEROL

5,194,391

1,196,007

275,442

2,319,808,482

PREGABALIN

4,940,115

852,497

267,532

2,098,953,250

RIVAROXABAN

4,403,332

807,820

252,141

1,954,748,890

APIXABAN

4,455,782

826,969

231,631

1,926,107,484

TIOTROPIUM BROMIDE

4,153,162

903,494

235,564

1,818,857,361

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Top 10 drugs by claims: The most commonly

used drugs of 2016

With 46.6 million claims, the thyroid hormone deficiency treatment — Levothyroxine Sodium — retained its position of being the most claimed product under Medicare’s Part D Prescription Drug Program in 2016.

The number of

Medicare Part D claims includes original prescriptions and refills.

Following Levothyroxine Sodium was the lipid-lowering agent — Atorvastatin Calcium — which had 44.5 million Medicare Part D claims that

were filed by almost 9.4 million beneficiaries.

Generic

Name

Number

of Prescribers

Number

of Medicare Part D Claims

Number

of Medicare Beneficiaries

LEVOTHYROXINE SODIUM

669,999

46,617,109

8,091,785

ATORVASTATIN CALCIUM

494,973

44,595,686

9,435,633

AMLODIPINE BESYLATE

497,017

39,913,468

7,802,905

LISINOPRIL

490,452

39,469,840

8,009,954

OMEPRAZOLE

492,951

32,909,236

7,001,160

METFORMIN HCL

611,700

31,007,932

6,394,014

SIMVASTATIN

380,560

29,687,947

6,201,911

HYDROCODONE/ACETAMINOPHEN

660,617

28,595,150

7,265,882

FUROSEMIDE

488,352

27,878,243

5,421,598

GABAPENTIN

555,997

27,627,466

5,363,382

Click here

to access the compilation of Medicare Part D Prescriber Summary Report

Top 10 drugs by prescribers: Medicines that were most popular with

doctors

Among the prescribers, albuterol sulfate (salbutamol) and Diltiazem had

over 900,000 unique providers (or

doctors) prescribing the drug.

Albuterol (salbutamol) is

used to provide quick relief from wheezing and shortness

of breath while Diltiazem is used to prevent chest

pain (angina).

Also

on the list of popular drugs with prescribers is Hydrocodone-Acetaminophen.

With more doctors prescribing Hydrocodone-Acetaminophen (an

opioid) than commonly used antibiotics, such as Cephalexin, Ciprofloxacin and Amoxicillin, the

series of new FDA initiatives to combat the epidemic of opioid misuse and abuse

should change the position of opioids in the top 10 drugs by prescribers in the

coming years.

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Generic

Name

Number of

Prescribers

Number of

Medicare Part D Claims

Number of

Medicare Beneficiaries

ALBUTEROL SULFATE

985,427

13,100,354

5,417,718

DILTIAZEM HCL

931,159

8,142,004

1,982,550

POTASSIUM CHLORIDE

879,491

18,945,969

4,278,000

PEN NEEDLE, DIABETIC

677,210

5,281,778

1,795,046

LEVOTHYROXINE SODIUM

669,999

46,617,109

8,091,785

HYDROCODONE/ACETAMINOPHEN

660,617

28,595,150

7,265,882

METFORMIN HCL

611,700

31,007,932

6,394,014

CEPHALEXIN

597,647

5,603,879

3,933,373

CIPROFLOXACIN HCL

594,129

7,000,081

4,851,657

AZITHROMYCIN

591,028

7,958,625

5,734,122

What does the

future hold?

Although the Part D Prescriber PUF (public use file) has a wealth of information on payment and utilization for Medicare Part D prescriptions, the dataset has a number of limitations. Of particular importance is the fact that the data may not be representative of a physician’s entire practice or all of Medicare as it only includes information on beneficiaries enrolled in the Medicare Part D prescription drug program (i.e., approximately two-thirds of all Medicare beneficiaries).

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Last

month, the Office of the Inspector General (OIG)

reviewed

the Part D claims data for the years 2011 to 2015 for brand-name drugs.

The OIG’s report found that the total reimbursement for all brand-name drugs in Part D increased 77 percent from 2011 to 2015, despite a 17-percent decrease in the number of prescriptions for these drugs.

With soaring drug prices being an issue for

regular debate in the Unites States and President Trump announcing that his

team will use strategies to strengthen the negotiating powers under

Medicare Part D and Part B, it remains to be seen how the data on prescription drugs paid for under

the Medicare Part D Prescription Drug Program will change in the coming years.

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Impressions: 2500

The year 2017 was a landmark year for pharmaceutical

industries in the US and Europe, with a sharp increase in the number of new molecular entities (NMEs) being approved in both geographies.

The US Food

and Drug Administration (USFDA) approved 46 NMEs in 2017, the second highest

since 1996 when 53 NMEs were approved. In Europe, the European Medicines Agency

(EMA) approved 35 drugs with a new active substance, up from 27 in 2016.

Sales for most major pharmaceutical

companies continued to grow in 2017. Earnings forecasts for 2018 have been raised due to the recent US tax reform that has

generated investor hopes for accelerated dividend growth and share buyback

plans.

This week, PharmaCompass brings

you a compilation of the top drugs of 2017 by sales revenue.

Click here to Access All the 2017 Data (Excel

version available) for FREE!

Top-sellers: Humira races ahead, despite launch of biosimilars; Enbrel a distant second

There wasn’t any upheaval

at the top of the pharma drug sales charts. AbbVie’s anti-TNF (tumor necrosis factor) giant

Humira (adalimumab), which is approved to treat

psoriasis and rheumatoid arthritis, added

almost another US $3 billion to its 2016 sales and posted nearly US $19 billion in revenues.

Last year, AbbVie’s raised expectations for Humira’s earnings to reach US $21 billion in global sales by 2020. The

company believes this drug will continue to be a significant cash contributor

until 2025 and the US $21 billion sales forecast

by 2020 is about US $3 billion higher than its expectation two years ago.

In 2016, the US Food and Drug Administration

(FDA) approved Amgen’s Amjevita (adalimumab-atto) — a biosimilar of Humira. And in 2017, another Humira biosimilar — Boehringer Ingelheim’s Cyltezo

(adalimumab-adbm) — received approval from the FDA and European authorities.

Click here to Access All the 2017 Data (Excel

version available) for FREE!

Enbrel (etanercept),

the longest-used biologic medicine for the treatment of rheumatism around the

world, was the second best-selling drug with US $8.262 billion in 2017 sales.

The sales of the drug were down from US $9.366 billion in

2016 owing to lower selling prices and increased

competition, which in turn hurt demand.

Since it was first approved in the United States in 1998,

Enbrel has been approved in over 100 countries and the drug is promoted by Amgen,

Pfizer

and Takeda

in different geographies.

Novartis’ biosimilar copy of Enbrel, which got approved by the FDA in August

2016 for the treatment of patients with

rheumatoid arthritis (RA), plaque psoriasis, ankylosing spondylitis (AS) and

other diseases is still not on the market because of a patent-protection

challenge from Amgen.

Amgen is arguing in the US federal court

that its drug has patent protection until 2029.

Click here to Access All the 2017 Data (Excel

version available) for FREE!

Fast-growing drugs: Eylea and Revlimid bring

fortunes for Regeneron and Celgene

Regeneron’s

flagship eye treatment, Eylea (aflibercept) which is marketed by Bayer outside the United States, added another US $1 billion in

annual sales last year to record US $8.260 billion in total sales. Eylea net

sales grew 11 percent year-on-year in the US and 19 percent year-over-year

outside the US.

The company believes much of the recent

growth in the US was driven by demographic trends with an aging population as

well as an overall increase in the prevalence of diabetes.

These demographic trends are expected to

continue in the coming years, providing an opportunity for continued growth.

Eylea sales alone contribute 63 percent to Regeneron’s total sales.

Click here to Access All the 2017 Data (Excel

version available) for FREE!

Celgene’s

Revlimid

(lenalidomide)

— a thalidomide derivative introduced in 2004 as an immunomodulatory agent for the treatment of various cancers such as multiple myeloma — brought in an additional US $1.2 billion in 2017 sales and had total revenues of US $8.187 billion.

Revlimid continues to contribute more than 60 percent to the company’s total sales of US $13 billion.

Celgene received a setback this month as the

USFDA refused to consider Celgene’s

application for ozanimod, an experimental

treatment for relapsing multiple sclerosis. The treatment was being seen as a

key to the company’s fortunes as Celgene had

said ozanimod is worth US $4 billion to

US $6

billion a year in peak sales.

Click here to Access All the 2017 Data (Excel

version available) for FREE!

Gilead’s Hepatitis C franchise enters free fall

Gilead Sciences’ blockbuster hepatitis C drugs franchise that includes Sovaldi and Harvoni continue to feel the

competitive heat as they registered US $9.137

billion in 2017 sales, down from US $14.834

billion the previous year.

While reporting 2017 results, Gilead provided guidance for

2018 and said its sales of Hepatitis C drugs could fall

further to US $3.5 billion - US $4 billion. At their peak in 2015, Gilead’s Sovaldi and Harvoni had together generated

US $19.1 billion in sales.

One of the major reasons for this drop is AbbVie’s launch of its new treatment Mavyret

at a deep price discount to the competition. AbbVie

also claims to have the shortest treatment course at eight weeks, compared with

12 weeks or longer for other treatments.

AbbVie reported US $1.274 billion in Hepatitis C drug sales

in 2017, down from US $1.522 billion in 2016.

Click here to Access All the 2017 Data (Excel

version available) for FREE!

Novartis’ Gleevec, Merck’s cardiovascular drugs, GSK’s Advair face generic heat

Novartis’ Gleevec (imatinib), which had at one point become the best-selling drug for Novartis and had brought in US $3.323 billion for the company in 2016, started facing generic competition last year and the anti-cancer drug lost US $1.380 billion in sales to bring in ‘only’ US $1.943 billion last year.

The US patents of Merck’s cardiovascular drugs — Zetia (Ezetimibe)

and Vytorin (Ezetimibe

and Simvastatin) — expired in April 2017. In May 2010, Merck and Glenmark

Pharmaceuticals entered into an agreement that allowed Glenmark to launch

a generic version of Zetia in late 2016. The drugs

that had combined sales of US $3.701

billion in 2016 felt the generic heat in 2017 and the sales were US

$1.606 billion lower at US $2.095

billion.

Click here to Access All the 2017 Data (Excel

version available) for FREE!

GSK’s Advair, which was expected

to encounter generic competition in 2017, continued to breathe easy as the FDA

found deficiencies in the applications of Hikma, Mylan and Sandoz.

All three failed to get the FDA nod for their generic versions of Advair, a drug used in the management of asthma and chronic obstructive pulmonary disease that generated sales worth US $4.431 billion (£3.130 billion) in 2017.

Top 15 drugs by sales

Here is PharmaCompass’ compilation

of the best-selling drugs of 2017. This is based on information extracted from

annual reports and US Securities and Exchange Commission (SEC) filings of major

pharmaceutical companies.

If you would like your own copy of all the information we’ve collected, email us at support@pharmacompass.com and we’ll send you an Excel version.

Click here to access all the 2017 data (Excel

version available) for FREE!

S. No.

Company / Companies

Product Name

Active Ingredient

Main Therapeutic Indication

2017 Revenue in Millions (USD)

1

AbbVie Inc., Eisai

Humira®

Adalimumab

Immunology (Organ Transplant, Arthritis etc.)

18,946

2

Amgen, Pfizer Inc., Takeda

Enbrel®

Etanercept

Immunology (Organ Transplant, Arthritis etc.)

8,262

3

Regeneron, Bayer

Eylea

Aflibercept

Ophthalmology

8,260

4

Celgene

Revlimid

Lenalidomide

Oncology

8,187

5

Roche

MabThera®/Rituxan®

Rituximab

Oncology

7,831

6

Johnson & Johnson, Merck, Mitsubishi Tanabe

Remicade®

Infliximab

Autoimmune Disorders

7,784

7

Roche

Herceptin®

Trastuzumab

Oncology

7,435

8

Bristol-Myers Squibb, Pfizer Inc.

Eliquis®

Apixaban

Cardiovascular Diseases

7,395

9

Roche

Avastin®

Bevacizumab

Oncology

7,089

10

Bayer, Johnson & Johnson

XareltoTM

Rivaroxaban

Cardiovascular Diseases

6,590

11

Bristol Myers Squibb, Ono Pharmaceutical

Opdivo

Nivolumab

Oncology

5,815

12

Sanofi

Lantus

Insulin Glargine

Diabetes

5,731

13

Pfizer Inc.

Prevnar 13/Prevenar 13

Pneumococcal 7-Valent Conjugate

Anti-bacterial

5,601

14

Pfizer Inc., Eisai

Lyrica

Pregabalin

Neurological/Mental Disorders

5,318

15

Amgen, Kyowa Hakko Kirin

Neulasta®

Pegfilgrastim

Blood Disorders

4,553

Sign up, stay ahead

In order to stay informed, and receive

industry updates along with our data compilations, do sign up for the PharmaCompass Newsletter and

you will receive updated information as it becomes available along with a lot

more industry analysis.

Click here to Access All

the 2017 Data (Excel version available) for FREE!

Impressions: 58406

In less than three weeks, Donald Trump will assume office as the

President of the United States. He has mentioned that he wants Medicare (a

national social insurance program) to directly negotiate the price it pays for prescription drugs.

Medicare provides health insurance to Americans aged 65 or more, who

have worked and paid into the system through the payroll tax. It also provides

health insurance to younger people with some disabilities or end-stage renal

disease and amyotrophic lateral sclerosis.

In 2015, Medicare provided health insurance to over 55 million Americans — including 46 million people aged 65 or more, and nine million younger people.

As we flag off the New Year, PharmaCompass

provides insights into drug prices and prescription patterns in the US in order

to help professionals make informed decisions. We believe that the cost of

medicines in the US, which have been a subject of much public outcry and

discussions in the recent years, will continue to be scrutinized during 2017.

Medicare data for 2014

Medicare Part D, also known as the Medicare prescription drug benefit — the program which subsidizes the costs of prescription drugs and prescription drug insurance premiums for Medicare beneficiaries — published a data set (for calendar year 2014) which contains information from over one million healthcare providers

who collectively prescribed approximately US $121 billion worth of prescription

drugs paid for under this program.

For each prescriber and drug, the dataset

includes the total number of prescriptions that were dispensed (including

original prescriptions and any refills), and the total drug cost.

The total drug cost includes the ingredient cost of the medication, dispensing fees, sales tax, and any applicable administration fees. It’s based on the amounts paid by the Part D plan, the Medicare beneficiary, other government subsidies, and any other third-party payers (such as employers and liability insurers).

The total drug cost does not reflect any manufacturer rebates paid to Part D plan sponsors through direct and indirect remuneration or point-of sale rebates. In order to protect the beneficiary’s privacy, the Centers for Medicare & Medicaid Services (CMS) did not

include information in cases where 10 or fewer prescriptions were dispensed.

Top

Ten Drugs by Cost, 2014 [Most expensive for Medicare]

Drug Name

Total Claim Count

Beneficiary Count

Prescriber Count

Total Drug Cost

Sofosbuvir

109,543

33,028

7,323

$3,106,589,192

Esomeprazole Magnesium

7,537,736

1,405,570

286,927

$2,660,052,054

Rosuvastatin Calcium

9,072,799

1,752,423

266,499

$2,543,475,142

Aripiprazole

2,963,457

405,048

130,933

$2,526,731,476

Fluticasone/Salmeterol

6,093,354

1,420,515

281,775

$2,276,060,161

Tiotropium Bromide

5,852,258

1,211,919

253,277

$2,158,219,163

Lantus

Solostar

(Insulin Glargine)

4,441,782

972,882

224,710

$2,016,728,436

Sitagliptin Phosphate

4,495,964

789,828

190,741

$1,775,094,282

Lantus

(Insulin Glargine)

4,284,173

787,077

223,502

$1,725,391,907

Lenalidomide

178,373

27,142

9,337

$1,671,610,362

View the Medicare Part D National Prescriber Summary Report, Calendar Year 2014 (Excel version available) for FREE!

Top

Ten Drugs by Average Cost per Claim, 2014 [Most expensive drugs]

Drug Name

Total Claim Count

Beneficiary Count

Prescriber Count

Total Drug Cost

Average Cost Per Claim

Adagen

13

$1,224,835

$94,218

Elaprase

100

$6,560,225

$65,602

Cinryze

1,820

194

196

$96,155,785

$52,833

Carbaglu

60

$2,901,115

$48,352

Naglazyme

129

$6,189,045

$47,977

Berinert

538

73

68

$25,685,311

$47,742

Firazyr

1,568

269

232

$70,948,143

$45,248

H.P. Acthar

9,611

2,932

1,621

$391,189,653

$40,702

Procysbi

314

41

47

$12,542,911

$39,946

Folotyn

15

$598,210

$39,881

Top

Ten Drugs by Claims, 2014 [Most Commonly Used by Patients]

Generic Name

Total Claim Count

Beneficiary Count

Prescriber Count

Total Drug Cost

Lisinopril

38,278,860

7,454,940

464,747

$281,614,340

Levothyroxine Sodium

37,711,869

6,245,507

416,518

$631,855,415

Amlodipine Besylate

36,344,166

6,750,062

451,350

$303,779,661

Simvastatin

34,092,548

6,768,159

387,651

$346,677,118

Hydrocodone-Acetaminophen

33,446,696

8,005,790

677,865

$676,296,988

Omeprazole

33,032,770

6,707,964

475,122

$529,050,385

Atorvastatin Calcium

32,603,055

6,740,061

419,327

$747,635,818

Furosemide

27,133,430

5,176,582

456,047

$135,710,772

Metformin HCl

23,475,787

4,509,978

364,273

$203,948,989

Gabapentin

22,143,641

4,298,609

486,754

$492,557,255

View the Medicare Part D National Prescriber Summary Report, Calendar Year 2014 (Excel version available) for FREE!

Top

Ten Drugs by Prescribers, 2014 [Most Popular with Doctors]

Generic Name

Total Claim Count

Beneficiary Count

Prescriber Count

Total Drug Cost

Hydrocodone/Acetaminophen

33,446,696

8,005,790

677,865

$676,296,988

Ciprofloxacin HCl

7,253,018

4,926,835

568,201

$46,728,353

Amoxicillin

6,298,980

4,384,899

557,614

$31,193,739

Cephalexin

5,040,219

3,529,303

557,048

$36,987,401

Azithromycin

7,339,954

5,274,010

544,625

$70,699,119

Prednisone

11,032,986

4,505,821

536,108

$86,537,932

Tramadol HCl

14,250,227

4,272,724

515,816

$125,343,514

Sulfamethoxazole /Trimethoprim

4,833,758

3,090,944

500,790

$29,231,511

Gabapentin

22,143,641

4,298,609

486,754

$492,557,255

Amoxicillin/Potassium Clav

3,551,452

2,710,244

478,361

$61,713,432

The findings from CMS

data

The CY 2014 data represented a 17 percent

increase compared to the 2013 data set and a substantial part of the total estimated prescription drug spending (as estimated by the Department of Health and Human Services Office of the Assistant Secretary for Planning and Evaluation, or ASPE) in the United States — at about US $ 457 billion in 2015, which was 16.7 percent of the overall personal healthcare services.

Of that US $ 457 billion, US $ 328 billion (71.9 percent) was for retail

drugs and US $ 128 billion (28.1 percent) was for non-retail drugs.

The drug pricing process in the US is complex and

reflects the influence of numerous factors, including manufacturer list prices,

confidential negotiated discounts and rebates, insurance plan benefit designs,

and patient choices.

An IMS study found that across 12 therapy classes widely used in Medicare Part D,

medicine costs to plans and patients in Medicare Part D are 35 percent below

list prices.

View the Medicare Part D National Prescriber Summary Report, Calendar Year 2014 (Excel version available) for FREE!

While the CMS does not

currently have an established formulary, Part D drug coverage excludes drugs

not approved by the US Food and Drug Administration, those prescribed for off-label

use, drugs not available by prescription for

purchase in the US, and drugs for which payments would be available under Parts

A or B of Medicare.

Part D coverage

excludes drugs or classes of drugs excluded from Medicaid coverage,

such as:

Drugs used for anorexia, weight loss, or weight gain

Drugs used to promote fertility

Drugs used for erectile dysfunction

Drugs used for cosmetic purposes (hair growth, etc.)

Drugs used for the symptomatic relief of cough and colds

Prescription vitamins and mineral products, except prenatal vitamins and fluoride preparations

Drugs where the manufacturer requires (as a condition of sale) any associated tests or monitoring services to be purchased exclusively from that manufacturer or its designee

Our view

The Medicare program is designed such that the

federal government is not permitted to negotiate prices of drugs with the drug

companies, as federal agencies do under other programs.

For instance, the Department of Veterans Affairs — which is allowed to negotiate drug prices and establish a formulary — has been estimated to pay (on an average) between 40 to 58 percent less for drugs, as opposed to Medicare Part D.

If Trump administration kick starts direct

negotiations on Medicare drug prices with drug companies, 2017 will surely turn

out to be a year for the pharmaceutical industry to remember.

View the Medicare Part D National Prescriber Summary Report, Calendar Year 2014 (Excel version available) for FREE!

Impressions: 7923

This week, Phispers brings you the

latest on the Ranbaxy-Daiichi and Merck-Gilead cases. There is also news on

Medtronics, which faces a whistleblower lawsuit. And Valeant, which has come

under the scanner for allegedly defrauding insurers. Our compliance roundup

updates you on companies across the world that faced regulatory action

recently. Singapore court’s 373-page order reveals how Ranbaxy withheld information from DaiichiLast week, a report in The Indian Express brought to light how Ranbaxy deliberately withheld information from Japan’s Daiichi Sankyo in the Ranbaxy-Daiichi case. The information was based on a copy of the Singapore International Arbitration Centre’s (SIAC) order, passed in April 2016. The former owners of Ranbaxy – Malvinder Singh and Shivinder Singh – face a penalty of Rs 35 billion (US $ 523 million) and have until August 22 to challenge the SIAC order. The information implicates the Ranbaxy top brass in a “in a slew of irregularities, from fraud to falsehood.” In over 373 pages, the SIAC order lays out what it calls “the path of deception that Ranbaxy took and how it kept Japan’s Daiichi Sankyo — which bought Ranbaxy in 2008 for Rs 198 billion (US $ 2.96 billion) — in the dark even a year after its purchase”. The SAIC order was based on a 2004 Self-Assessment Report (SAR) prepared by the then head of research and development of Ranbaxy, Rajinder Kumar, for the company’s internal use. The contents of an internal report were not shared with Daiichi. The SAR listed

over 200 drugs, including antiretroviral drugs for treating AIDS patients, for

which Ranbaxy allegedly used fabricated data to bag approvals from regulators

and authorities of more than 40 countries. Compliance roundup: Chinese, Indian, American and Spanish firms in compliance troubles Notice of non-compliance to Artemis Biotech: Artemis

Biotech, a division of Themis

Medicare in India, received a notice

of non-compliance from European regulators. According to the regulators,

the company had violated basic principles of data integrity within its instrument

laboratory. And the relevant GMP data was outside the control of the quality

management system. As an outcome of the inspection, the Certificates of Suitability (CEPs) granted for popular cholesterol lowering ingredient – simvastatin – have been suspended. Just three months ago another Indian manufacturer – Krebs

Biochemicals & Industries – had its CEPs suspended for the same product.Alcor found to have unsuitable facilities: A Spanish manufacturer – Alcor SL – that manufactures liquid syrups for use in Spain was found not to have suitable facilities, personnel and materials to ensure proper compliance with GMP during an inspection in June this year. Although the company responded with a corrective action plan, it was found “insufficient”.Claris recalls injections in the UK: Indian manufacturer Claris

Lifesciences recalled

Furosemide

injections in the United Kingdom as they had been inadvertently distributed in

the country. The product was intended for sale in Australia. FDA’s warning letters to Zhejiang Medicine, Concept Products: While

there was activity in Europe, the FDA issued a warning

letter to Zhejiang

Medicine (Xinchang Pharmaceutical Factory), a manufacturer of antibiotics

like levofloxacin,

daptomycin

and vancomycin,

for data integrity violations. Laboratory personnel were found “disguising testing”. The personnel were conducting unofficial testing that was being recorded in separate ‘R&D’ folders before conducting the officially reported sample analyses. Analysts were also found signing

and dating microbiological testing laboratory worksheets five days before the

test results were available and backdating laboratory worksheets for impurities

and content testing by four days.The FDA also issued a warning

letter to a Chinese manufacturer, Concept Products Limited, for “significant violations of cGMP regulations for finished pharmaceuticals”. It placed yet another Indian company Laxachem Organics and Chinese firm Yangzhou

Hengyuan on import alert. Warning letter to Noven: A US-based patch manufacturer – Noven

Pharmaceuticals – received a warning

letter over quality concerns uncovered in its transdermal drug delivery

systems (TDDS) such as Minivelle

and Daytrana.

The FDA expressed concerns over the scientific soundness of the company’s measurement method since the FDA stated that “your unsound methods could be masking product failures” and leading “to product detachment, expose the drug to other people, and other safety issues.” Now, Merck has to pay Gilead’s US $ 200 million legal feeIn March this year, Merck

had won a legal dispute over sofosbuvir,

the API in Gilead's

multibillion-dollar drugs Sovaldi and Harvoni.

The federal jury had ordered Gilead to pay Merck US $ 200 million in damages

for infringing on patents for the hepatitis C drugs. But

in June, the US Dristrict Judge Beth Labson Freeman threw out Merck’s victory and snatched back the US $ 200 million Merck had been awarded. Last week, the same judge added insult to Merck’s US $ 200 million-injury. Freeman said Gilead was entitled to relief from legal fees it had incurred while defending its case.Merck has been handed a US $200

million bill for Gilead's

legal fees. Merck now intends to appeal in the case, saying the judge’s ruling “does not reflect the facts of the case.” FDA launches improved web-based version of its Orange BookThis week, the US Food and Drug

Administration (FDA) launched an improved

web-based version of its Orange Book – a publication on drugs approved on the basis of safety and effectiveness. The Orange Book is widely used by doctors and by the regulatory community for identifying which drug products are substitutable for one another. The improved Orange Book has an updated design and has more user-friendly search optionsFormerly known as the Approved

Drug Products with Therapeutic Equivalence Evaluations, the Orange Book had

first appeared as a published list in 1980. It came online in 1997. Valeant allegedly defrauded insurers, may be under criminal

investigation In one of the most serious probes

faced by Valeant

Pharmaceuticals, the Canada-headquartered company may be under criminal investigation over allegations that it defrauded insurers by hiding its ties with a mail-order pharmacy – Philidor – that boosted its sales. Prosecutors are probing whether

Philidor made false statements to insurers about its ties with Valeant, while

helping patients get coverage for the higher-priced Valeant drugs. According to

a report published in The Wall Street

Journal, criminal charges are likely to be levied against former Philidor

executives and against Valeant as a company. The relationship between Philidor

and Valeant has been under the scanner since October 2015, when questions were

raised about Valeant's accounting. Novartis to expand capacity of monoclonal antibody plant in EuropeNovartis

is investing

US $ 100 million to expand its monoclonal antibody (mAb) capacity at a

plant in Europe. The Swiss drugmaker has committed about US $ 1 billion to

boost its biosimilar production in order to emerge a leading player in

biosimilars. Novartis is beginning work on the mAb project that will boost

capacity by 70 percent at the Novartis biotechnology center in Huningue,

France. Meanwhile, the company has

acknowledged that employees in South Korea may have been involved in rebate

trickeries. But it says an investigation of similar accusations

in Turkey uncovered no problems. In Turkey, Novartis considers the matter

closed.In April, a prosecutor in Turkey

had reportedly opened an investigation after receiving a copy of an email sent

by an anonymous whistleblower to Novartis CEO saying the unit there paid

consultants US $ 290,000 in 2013 and 2014 to win about US $ 85 million in

business from government hospitals.Matters in South Korea are a lot serious. In South Korea, prosecutors want the government to suspend the company’s operations there after they indicted half-dozen executives for issuing improper rebates. German watchdog criticizes efforts to accelerate new drug approvalsGermany’s cost-effectiveness watchdog – the German Institute for Quality and Efficiency in Health Care – has criticized

an effort by European regulators to accelerate approval for new medicines

based on limited evidence. These concerns come at a time when regulators on both

sides of the Atlantic are looking for new approaches to fulfill unmet

medical needs through faster approval of drugs.Adaptive pathways approach is a term

used to describe a method for jumpstarting drug approvals for select patient

populations. Two years ago, the European Medicines Agency (EMA) had launched a

specific pilot program in this direction. However, the German watchdog

maintained that the EMA failed to make its case that this approach for

approving drugs can make a demonstrable difference. Medtronic faces

whistleblower lawsuit for using devices under false pretensesMedtronic, a major medical device manufacturer, is facing a whistleblower lawsuit that claims it sought FDA approval for its devices under false pretenses. The devices were being regularly used for a purpose they weren’t intended to be used by the regulators.According to Dr. Vikas Saini, president of the Lown Institute, a Boston healthcare think tank, who has been following the case, the devices had been labelled ‘not for cervical spine use’. “Yet, in everything about them, including emails from their marketing folks, it makes clear that they were meant to be and were used in the cervical spine,” Saini said.Medical devices are lightly regulated by the FDA. Once

cleared by the FDA, physicians used medical devices however they deem fit. Questions being

raised on health of Clinton, Trump Donald Trump and Hillary Clinton are two of the oldest presidential candidates in the US history. While Clinton’s doctor certified that she “is in excellent physical condition” and Trump’s physician declared he would be “the healthiest president – ever”, these testaments are not being taken seriously in the absence of detailed medical records. Both Trump’s and Clinton’s doctors released brief

assessments of their health recently. Television host Sean Hannity has aired a series of segments on Fox that cast doubts on Clinton’s health. Democrats, on the other hand, have been questioning Trump’s mental health. One congresswoman recently suggested he should undergo a “mental fitness test.”

Impressions: 5118

GSK, Google form first bioelectronics firm; 11 generic companies benefit from the Teva Allergan deal

This week,

Phispers brings to you the details of the bioelectronics firm formed by GSK and

Google. There is also news on companies like Teva, Takeda, Jinan Jinda and Eli

Lilly, besides two other news snippets pertaining to the FDA -- while the first

one pertains to generic approvals, the other one relates to an additional black

box warning on a few antibiotics. GSK and Google

join hands to form first bioelectronics startupGlaxoSmithKline and Google’s parent company – Alphabet – have joined hands to create a new company that is focused on fighting diseases by targeting electrical signals in the human body. This way, GSK and Alphabet’s life sciences unit – known as Verily Life Sciences – will be jump-starting a new field of medicine known as bioelectronics.Verily Life

Sciences and GSK will together contribute US $ 715.12

million

over seven years to the startup Galvani Bioelectronics. The startup will develop

miniature electronic implants for the treatment of asthma, diabetes and other

chronic conditions. The

implantable devices developed by Galvani, which is owned 55 percent by GSK and

45 percent by Verily, can modify electrical nerve signals. The aim is to

modulate irregular or altered impulses that occur in many illnesses.The

new company

will be based at GSK’s Stevenage research center north of London, with a second research hub in South San Francisco.The announcement comes just weeks after GSK had said it was going to use Apple’s HealthKit to conduct clinical trials.Three years ago, GSK had first unveiled its ambitions in bioelectronics in the journal – Nature. Bioelectronic remedies attach battery-powered implants the size of a grain of rice (or even smaller) to individual nerves to correct faulty electrical signals between the nervous system and the body’s organs.GSK believes altering these nerve signals could open up the airways of asthma patients, reduce inflammation in the gut from Crohn’s disease and treat patients with a range of other chronic ailments such as arthritis. So far, the implants have only been tested on animals but the aim is to produce treatments that will supplement or replace drugs that often come with side-effects.GSK

has been working on bioelectronic medicines since 2012 in a push to develop new

patentable treatments, since its Advair respiratory treatment faces competition

from generic versions. It has invested US $50 million in a venture capital fund

for bioelectronics and provided funding to scientists working in the field. Teva divests 79

products to 11 generic players to close Allergan dealTeva

Pharmaceutical Industries – the world’s largest generics drug company – won a US

anti-trust approval to purchase Allergan's generics

business, after agreeing to divest 79 generic drugs to rival firms. This was arrived

at to settle Federal

Trade Commission (FTC) charges that its proposed US $ 40.5 billion acquisition of Allergan’s generic pharmaceutical business would be anti-competitive. The remedy requires Teva to divest the drug portfolio to 11 firms, and marks the largest drug divestiture order in a FTC pharmaceutical merger case.The Teva-Allergan deal, which was announced in July 2015, solidifies Teva’s position as the world's largest maker of generics while freeing Allergan to focus on branded drugs.The

companies that

have acquired

the divested products are Mayne Pharma

Group, Impax

Laboratories, Dr Reddy’s Laboratories, Sagent

Pharmaceuticals, Cipla Limited, Zydus Worldwide

DMCC, Mikah Pharma, Perrigo Pharma

International, Aurobindo

Pharma USA,

Prasco and 3M Company. Eli Lilly CEO

steps down; company under probe by US Justice Department Eli Lilly CEO John

Lechleiter has stepped down after steering the pharma company through long R&D droughts. The company’s president David Ricks will move up to the top spot. And after a brief spell as executive chairman, Lechleiter will leave the company next spring.Lechleiter

has been the company's CEO since April 1, 2008, and the chairman of its board

of directors since January 1, 2009.The

announcement has come at a time when Eli Lilly has been asked by the

Justice Department to disclose information on relationships with pharmacy benefits

managers (PBMs), the companies that negotiate prices and set reimbursement

conditions.It

has not been clear what exactly the department of justice is looking for. In

the past, drug makers such as Novartis and AstraZeneca have agreed to

pay fines and penalties to settle allegations pertaining to PBMs. FDA continues

to race ahead with generic approvals The

American regulator has reduced its pile of ANDA (abbreviated new drug

applications) by about 500

applications in the first six months of 2016. The FDA has also approved 315 more ANDAs over the same time period and has sent 66 more complete response letters — or rejections — to drug makers.This

news comes after Bloomberg reported

last month that the FDA has become ‘something of a bogeyman’ for India’s stock markets by approving generic drug applications from India at a record place. Similarly, PharmaCompass

had reported last week that Indian

companies have been fixing compliance issues. China’s Jinan Jinda fails another EDQM inspection; compliance troubles in Denmark In

regulatory news from across the world, Jinan Jinda, a Chinese API

manufacturer that had failed an inspection by Italian regulators in June 2015,

had more bad news awaiting it a year on. In

a June 2016

re-inspection, this time by the Spanish Health Authority, the regulator maintained the ‘facilities non-compliance standing’ since two critical observations were made and the corrections from the previous inspection “were found as not having been implemented in a satisfactory way”. And critical deficiencies were found on raw data.In

the June 2015 inspection, the critical observation was related to an unofficial

and non-controlled storage area containing mainly raw materials and finished

products which had been made

inaccessible to inspectors as the door had been removed and replaced with a panel fixed with

screws to the wall.Meanwhile,

the FDA issued an untitled letter (dated July 15, 2016) to Danish allergy

immunotherapy company ALK-Abelló (ALK) over manufacturing and quality control issues at its Horsholm, Denmark facility. The letter comes after a 12-day inspection of the facility in March 2016. During the inspection, the FDA had cited ALK for four “significant deviations” from cGMP requirements. Another black

box warning added to antibiotics like Cipro and LevaquinThe

FDA has upgraded

warnings on

certain antibiotics, such as Johnson & Johnson’s Levaquin, Bayer’s Cipro

extended-release tablets and Merck’s Avelox. The FDA had

added a black box warning in 2008 about the increased risk of tendinitis in

which the tissue connecting muscle to bone becomes inflamed. In

May this year, the FDA had advised restricting the use of fluoroquinolone antibiotic for certain uncomplicated

infections and had warned about the disabling side-effects of the drug.The new warning talks about long-term risks to the drugs’ current black box warning. The agency also advised using the drugs only for serious infections. Manufacturers of fluoroquinolone have faced thousands of lawsuits from patients who claim that their injuries were caused by the drugs. J&J alone faced 3,400 lawsuits over Levaquin’s links to tendon problems and has also settled many of those cases. Takeda to

overhaul R&D, downsize operations in the UKTakeda Pharmaceutical of Japan has

said it plans to build a new pipeline of drugs. It plans to revamp its

research operations at the cost of around US $ 727 million.. The

company also plans to close some of its R&D operations in the UK. Takeda is

beginning the first ‘consultation stage’ of the layoff process in the UK, which hosts a pre-clinical R&D operation in Cambridge as well as a development center headquarter with facilities in the UK, Switzerland and Denmark.Under the revamp, Takeda’s R&D activities will be concentrated in Japan and the US, the 235-year old drug company said in a statement. Takeda plans to now focus on the three therapeutic areas of oncology, gastroenterology and the central nervous system.“We need to first build new capabilities and embrace new ways of working,” Andy Plump, Takeda’s chief medical and scientific officer, said in the statement.

Impressions: 2757

The proposed overhaul of the U.S. drug

approval system through the 21st

Century Cures Act won’t take us back in time. With the right safeguards in

place, this legislation can help win the fight against Alzheimer’s, Ebola and many

other diseases. It seems like the much awaited prescription for patients as

well as the industry.Development of pharmaceutical drugs can be

time-consuming and extremely expensive. The last industry-funded research estimated

the cost of developing

each new drug at US $ 2.6 billion. The losing fight against Alzheimer’sOn top of the high cost of development, the failure rate can be quite high. Take the case of Alzheimer’s disease. Since 1998, over 120 programs attempting to develop Alzheimer’s drugs have failed. Between 2002 and 2012, there was just a 0.04 percent success rate of Alzheimer’s drugs meeting the standard.Last week, the fight against Alzheimer’s received yet another setback. US-based Biogen’s biotech drug, Aducanumab, was hailed as a potential breakthrough in March when it became the first Alzheimer's treatment to significantly slow cognitive decline. However, new

data published by Biogen last week revealed that Aducanumab failed to

significantly slow mental decline, thereby tempering the great expectations the

world had from this potential drug. Enter

the 21st Century Cures ActClearly, the new drug development process

needs to change. On July 10, the U.S. House of Representatives approved

the 21st Century Cures Act. The Act seeks to modernize clinical trials and

deliver better, faster cures to more patients. The Act is awaiting approval in

the Senate. However, several provisions of the proposed

act have come under severe criticism. For instance, in The New England Journal of

Medicine, Jerry Avorn, M.D., and Aaron S. Kesselheim, M.D., J.D., M.P.H., say “if enacted into law, some of its provisions could have a profound effect on what is known about the safety and efficacy of medical products, as well as which ones become available for use.” Biomarker

based drug approvalThe proposed Act encourages biomarker-based drug approval. Unlike conventional drug approvals, which involve extensive clinical trials, where outcomes are studied in patients, the biomarker-based approach works on studying a “surrogate marker”, which is strongly linked with the final outcome in the patient. “A commonly used example

is cholesterol. While elevated cholesterol levels increase the likelihood for heart disease, the relationship is not linear – many people with normal cholesterol develop heart disease, and many with high cholesterol do not. ‘Death from heart disease’ is the endpoint of interest, but ‘cholesterol’ is the surrogate marker. A clinical trial may show that a particular drug (for example, simvastatin) is effective in reducing cholesterol, without showing directly that the drug prevents death.” The bill would encourage the FDA to rely

more on biomarkers and other surrogate measures rather than actual clinical

endpoints in assessing the efficacy of both drugs and devices. The biomarker-based drug approval has also

generated its fair share of concerns since “a drug's effect on a biomarker can make approval quicker and less costly, especially if the comparator is placebo, it may not always predict the drug's capacity to improve patient outcomes” But the key point to note is that the FDA

already uses surrogate endpoints in about half of the new drug approvals. The

legislation would not immediately change FDA approval standards, but they would

give the agency greater discretion to approve drugs on the basis of less comprehensive

data. Accelerated

approvals have been in place since 1992The FDA has had an Accelerated

Approval (AA) program in place since 1992. This has already been used

extensively in oncology

and HIV drugs.And the AA programme has benefited

patients. As per an FDA presentation, almost 90 percent of the drugs approved

for oncology through the AA process demonstrated a benefit in the post-market

study. Since 1995, 49 new drug indications have been launched. In the case of HIV

drugs, all indications that were given accelerated approval also received regular

approval.For something as dangerous as Ebola, where there still isn’t an approved treatment to contain the spread of the Ebola virus, computational models have been used to evaluate existing drugs. Over 50 FDA approved

drugs have now been identified with activity against the Ebola virus. Will it not be wise to use them in the fight

against Ebola? Need

for vigorous safety monitoringThe essence of the proposed 21st Century Cures Act is positive. Increased and faster drug approvals is great news for patients and the industry. What is needed are the right measures and safeguards to ensure the drug approvals (based on biomarkers) are not ‘free for all’ and there isn’t an unfettered access of such drugs to a large population.More importantly, the proposed act will increase

safety monitoring. This means drug developers will have to monitor patients

more vigorously using devices, such as smartphones. If drugs get approved based

on biomarkers, the smartphone should be leveraged as an integrated health tool

that sends feedback on how patients are performing after a drug is

administered. Our

View There are several smartphone applications available today. For instance, Apple’s ResearchKit

allows developers to monitor multiple healthcare outcomes like asthma occurrence, determine the progress of Parkinson’s, share information about the effects of chemotherapy used in breast cancer and also measure gait and balance.Supportive legislation coupled with Apple

and Google aggressively getting into the healthcare space, it is just a matter

of time before the digital health revolution joins our fight against diseases

to benefit patients as well as the industry.

Impressions: 2430

It doesn’t help that the company, which calls

itself Merck in the United States isn’t allowed to do so in other parts of the

world, because the other Merck is called Merck. Confused? Well you

wouldn’t be the only one!

Merck is the world’s oldest pharmaceutical and chemical company, which has done business for almost 350 years. Since almost everybody in a chemistry lab has used a Merck product at some point of time, and now that Sigma Aldrich also belongs to Merck, we thought it would be worthwhile to create a simple comparison chart to better understand the two companies:

Merck & Co., Inc.

Merck KGaA

Website

www.merck.com

www.merckgroup.com

Logo

Headquarter

Kenilworth, New Jersey, United States

Darmstadt, Germany

Founded

1891, by George Merck, as an American

subsidiary of German Merck

1668, by Friedrich Jacob Merck

The Split

Owing to World War I, Merck &

Co. was expropriated by the U.S. government in 1917

Name in the US and Canada

Merck

EMD Millipore

(Emanuel Merck Darmstadt)

Name in the rest of the World

MSD,

Merck Sharp & Dohme or

MSD

Sharp & Dohme

Merck

Total Sales (2014)

$42 Billion

€11.5 Billion

Employees

70,000

39,000

Merger & Acquisitions

Sharp & Dohme, Inc.

Schering-Plough

Idenix Pharmaceuticals

Cubist Pharmaceuticals

OncoEthix

Medco Containment Services Inc.

Millipore Corporation

Serono SA

Sigma-Aldrich

AZ Electronic Materials SA

Major Products

Januvia®, Janumet®, Zetia®, Vytorin®, Gardasil®, Remicade®

Rebif®, Erbitux®, Gonal-f®, Concor®, Glucophage®, Euthyrox®

Recent facts of Confusion:

2011 German Merck KGaA used to have Facebook page:http://www.facebook.com/merck, but one day found U.S. Merck & Co. there instead. As Merck KGaA had an agreement with Facebook, the matter reached the courts

. Eventually Facebook admitted their mistake and let the German

Merck resume its place at www.facebook.com/merck.

U.S. Merck & Co. now sits at http://www.facebook.com/MerckBeWell.

2014 Protestors from the

group STOPAIDS (a network working

on how to secure an effective global response to HIV and AIDS) reached the offices of Merck KGaA in London, when protesting Merck’s “campaign to delay South Africa’s proposal to allow low-cost copies of patented drugs.”

The only problem: the protestors were targeting U.S. based Merck & Co instead of German Merck…

2014 Bloomberg headline “Bayer to Buy Merck Consumer-Health Unit for $14.2 Billion” resulted in Merck KGaA issuing a same day clarification “Merck to Keep Consumer Health Business” since the Bloomberg article was referring to the U.S. Merck & Co!

2015 Even Merck KGaA CEO Karl-Ludwig Kley admits that his company bears some fault in allowing the situation to get to this point: “over many decades we underinvested in our brand,” he told the Financial

Times: “we need to make people more aware of the fact there are two Mercks.”

RadioCompass just thought it was

worth helping Mr Kley out with this complilation!

Impressions: 9771