FDA’s December 2025 OPOE list features 784 prescription drugs, 73 OTC drugs

This

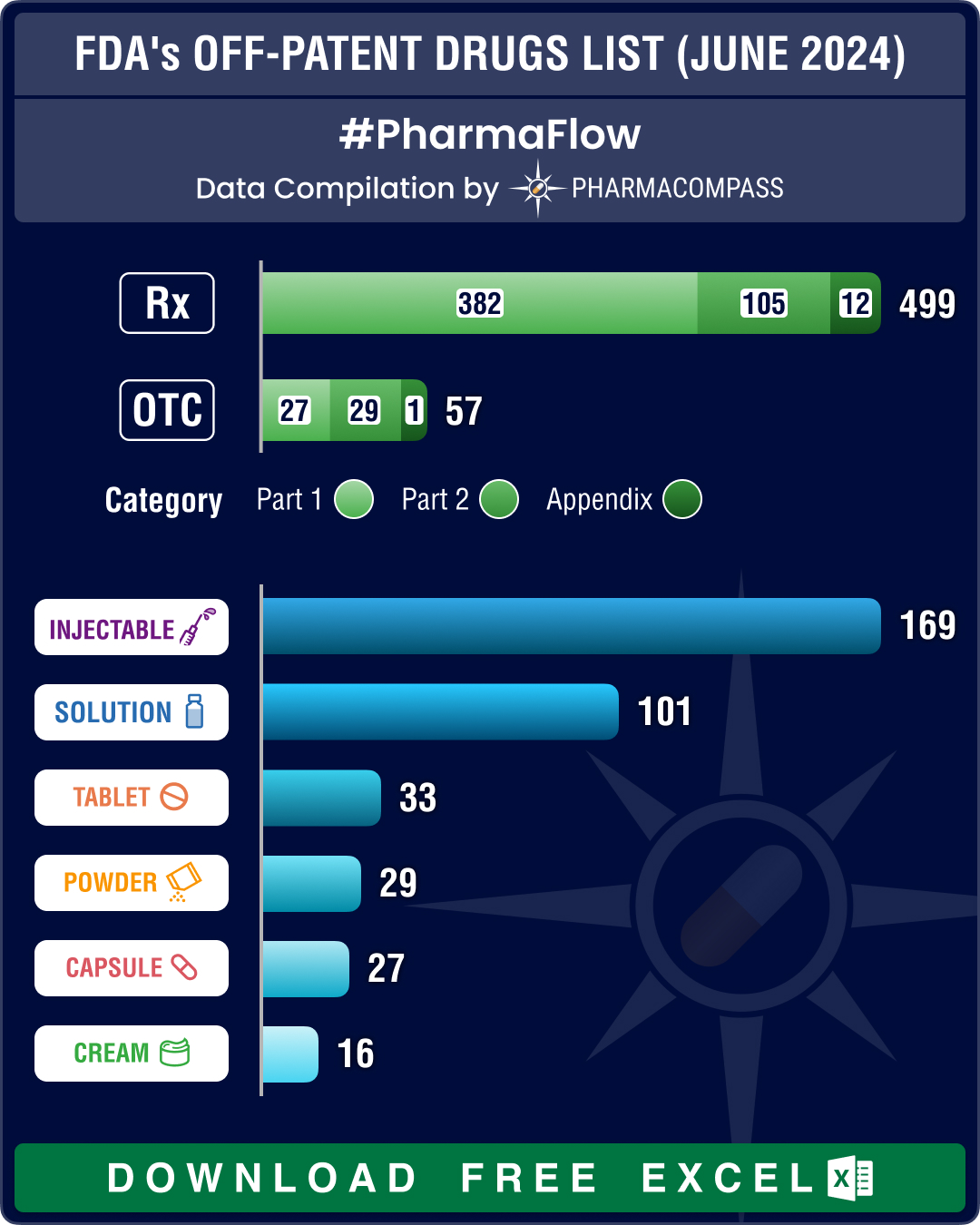

week, PharmaCompass brings you key highlights of the US Food and Drug Administration’s D

US drug shortages hit record high in Q1 2024, impacts cancer, ADHD drugs; Lilly, Novo ramp up production

Drug shortages are threatening healthcare systems the world over.

Be it the US, Canada, Europe or A