Acquisitions and spin-offs dominated headlines in 2019 and the tone was set very early with Bristol-Myers Squibb acquiring

New Jersey-based cancer drug company Celgene in a US$ 74 billion deal announced on

January 3, 2019. After factoring

in debt, the deal value ballooned to about US$ 95 billion, which according

to data compiled by Refinitiv, made it the largest healthcare deal on

record.

In the summer, AbbVie Inc,

which sells the world’s best-selling drug Humira, announced its acquisition of Allergan Plc, known for Botox and other cosmetic

treatments, for US$ 63 billion. While the companies are still awaiting

regulatory approval for their deal, with US$ 49 billion in combined 2019

revenues, the merged entity would rank amongst the biggest in the industry.

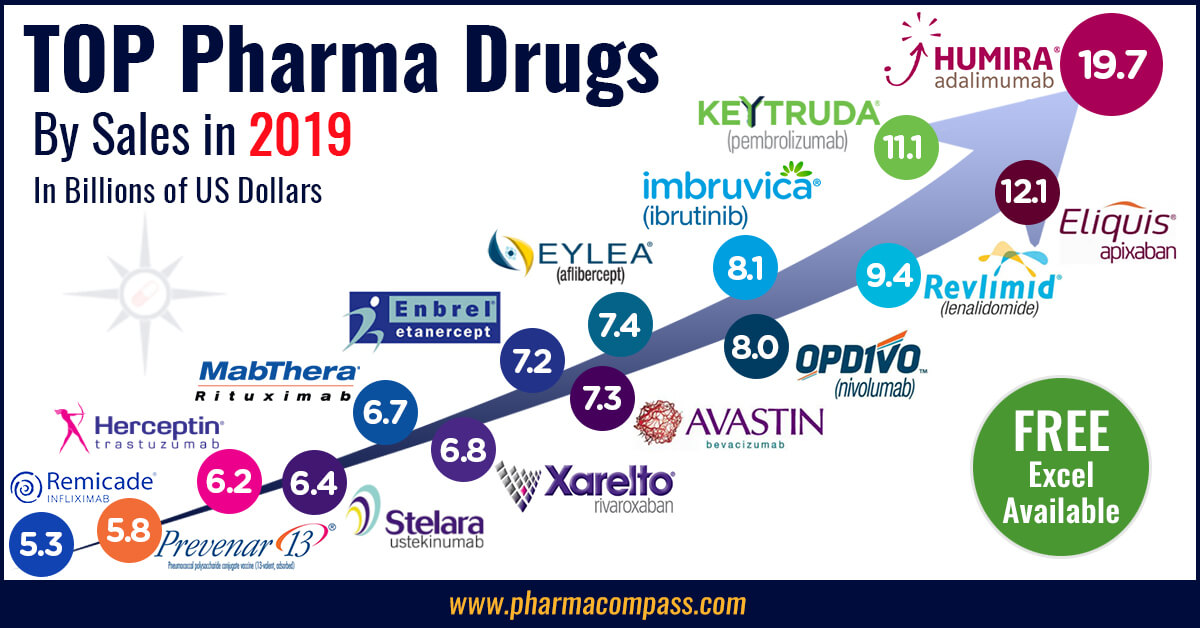

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

The big five by pharmaceutical sales — Pfizer,

Roche, J&J, Novartis and Merck

Pfizer

continued

to lead companies by pharmaceutical sales by reporting annual 2019 revenues of

US$ 51.8 billion, a decrease of US$ 1.9 billion, or 4 percent, compared to

2018. The decline was primarily attributed to the loss of exclusivity of Lyrica in 2019,

which witnessed its sales drop from US$ 5 billion in 2018 to US$ 3.3 billion in

2019.

In 2018, Pfizer’s then incoming CEO Albert Bourla had mentioned that the company did not see the need for any large-scale M&A activity as Pfizer had “the best pipeline” in its history, which needed the company to focus on deploying its capital to keep its pipeline flowing and execute on its drug launches.

Bourla stayed true to his word and barring the acquisition of Array Biopharma for US$ 11.4 billion and a spin-off to merge Upjohn, Pfizer’s off-patent branded and generic established medicines business with

Mylan, there weren’t any other big ticket deals which were announced.

The

Upjohn-Mylan merged entity will be called Viatris and is expected to have 2020

revenues between US$ 19 and US$ 20 billion

and could outpace Teva to

become the largest generic company in the world, in term of revenues.

Novartis, which had

followed Pfizer with the second largest revenues in the pharmaceutical industry

in 2018, reported its first full year earnings after spinning off its Alcon eye

care devices business division that

had US$ 7.15 billion in 2018 sales.

In 2019,

Novartis slipped two spots in the ranking after reporting total sales of US$

47.4 billion and its CEO Vas Narasimhan continued his deal-making spree by buying New

Jersey-headquartered The Medicines Company (MedCo) for US$ 9.7

billion to acquire a late-stage cholesterol-lowering

therapy named inclisiran.

As Takeda Pharmaceutical Co was

busy in 2019 on working to reduce its debt burden incurred due to its US$ 62

billion purchase of Shire Plc, which was announced in 2018, Novartis also purchased

the eye-disease medicine, Xiidra, from the Japanese drugmaker for US$ 5.3 billion.

Novartis’ management also spent a considerable part of 2019 dealing with data-integrity concerns which emerged from its 2018 buyout of AveXis, the

gene-therapy maker Novartis had acquired for US$ 8.7 billion.

The deal gave Novartis rights to Zolgensma,

a novel treatment intended for children less than two years of age with the

most severe form of spinal muscular atrophy (SMA). Priced at US$ 2.1 million,

Zolgensma is currently the world’s most expensive drug.

However,

in a shocking announcement, a month after approving the drug, the US Food and

Drug Administration (FDA) issued a press release on

data accuracy issues as the agency was informed by AveXis that

its personnel had manipulated data which

the FDA used to evaluate product comparability and nonclinical (animal)

pharmacology as part of the biologics license application (BLA), which was

submitted and reviewed by the FDA.

With US$

50.0 billion (CHF 48.5 billion) in annual pharmaceutical sales, Swiss drugmaker

Roche came in at number two position in 2019

as its sales grew 11 percent driven by

its multiple sclerosis medicine Ocrevus, haemophilia drug Hemlibra and cancer medicines Tecentriq and Perjeta.

Roche’s newly introduced medicines generated US$ 5.53 billion (CHF 5.4 billion) in growth, helping offset the impact of the competition from biosimilars for its three best-selling drugs MabThera/Rituxan, Herceptin and Avastin.

In late 2019, after months of increased

antitrust scrutiny, Roche completed

its US$ 5.1 billion acquisition of Spark Therapeutics to strengthen its presence in

gene therapy.

Last year, J&J reported almost flat worldwide sales of US$ 82.1 billion. J&J’s pharmaceutical division generated US$ 42.20 billion and its medical devices and consumer health divisions brought in US$ 25.96 billion and US$ 13.89 billion respectively.

Since J&J’s consumer health division sells analgesics, digestive health along with beauty and oral care products, the US$ 5.43 billion in consumer health sales from over-the-counter drugs and women’s health products was only used in our assessment of J&J’s total pharmaceutical revenues. With combined pharmaceutical sales of US$ 47.63 billion, J&J made it to number three on our list.

While the sales of products like Stelara, Darzalex, Imbruvica, Invega Sustenna drove J&J’s pharmaceutical business to grow by 4 percent over 2018, the firm had to contend with generic competition against key revenue contributors Remicade and Zytiga.

US-headquartered Merck, which is known as

MSD (short for Merck Sharp & Dohme) outside the United States and

Canada, is set to significantly move up the rankings next year fueled by its

cancer drug Keytruda, which witnessed a 55

percent increase in sales to US$ 11.1 billion.

Merck reported total revenues of US$ 41.75 billion and also

announced it will spin off its women’s health drugs,

biosimilar drugs and older products to create a new pharmaceutical

company with US$ 6.5 billion in annual revenues.

The firm had anticipated 2020 sales between US$ 48.8 billion and US$ 50.3 billion however this week it announced that the coronavirus pandemic will reduce 2020 sales by more than $2 billion.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Humira holds on to remain world’s best-selling drug

AbbVie’s acquisition of Allergan comes as the firm faces the expiration of patent protection for Humira, which brought in a staggering US$ 19.2 billion in sales last year for

the company. AbbVie has failed to successfully acquire or develop a major new

product to replace the sales generated by its flagship drug.

In 2019, Humira’s US revenues increased 8.6 percent to US$ 14.86 billion while internationally, due

to biosimilar competition, the sales dropped 31.1 percent to US$ 4.30 billion.

Bristol Myers Squibb’s Eliquis, which is also marketed by Pfizer, maintained its number two position

and posted total sales of US$ 12.1 billion, a 23 percent increase over 2018.

While Bristol Myers Squibb’s immunotherapy treatment Opdivo, sold in partnership with Ono in Japan, saw sales increase from US$ 7.57 billion to US$ 8.0 billion, the growth paled in comparison to the US$ 3.9

billion revenue increase of Opdivo’s key immunotherapy competitor Merck’s Keytruda.

Keytruda took the number three spot in drug sales that

previously belonged to Celgene’s Revlimid, which witnessed a sales decline from US$ 9.69 billion to US$ 9.4 billion.

Cancer treatment Imbruvica, which is marketed

by J&J and AbbVie, witnessed a 30 percent increase in sales. With US$ 8.1

billion in 2019 revenues, it took the number five position.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Vaccines – Covid-19 turns competitors into partners

This year has been dominated by the single biggest health emergency in years — the novel coronavirus (Covid-19) pandemic. As drugs continue to fail to meet expectations, vaccine development has received a lot of attention.

GSK reported the highest vaccine sales of all drugmakers with

total sales of US$ 8.4 billion (GBP 7.16 billion), a significant portion of its

total sales of US$ 41.8 billion (GBP 33.754 billion).

US-based Merck’s vaccine division also reported a significant increase in sales to US$ 8.0 billion and in 2019 received FDA and EU approval to market its Ebola vaccine Ervebo.

This is the first FDA-authorized vaccine against the deadly virus which causes

hemorrhagic fever and spreads from person to person through direct contact with

body fluids.

Pfizer and Sanofi also reported an increase in their vaccine sales to US$ 6.4

billion and US$ 6.2 billion respectively and the Covid-19 pandemic has recently

pushed drugmakers to move faster than ever before and has also converted

competitors into partners.

In a rare move, drug behemoths — Sanofi and GlaxoSmithKline (GSK) —joined hands to develop a vaccine for the novel coronavirus.

The two companies plan to start human trials

in the second half of this year, and if things go right, they will file

for potential approvals by the second half of 2021.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Our view

Covid-19 has brought the world economy to a grinding halt and shifted the global attention to the pharmaceutical industry’s capability to deliver solutions to address this pandemic.

Our compilation shows that vaccines and drugs

for infectious diseases currently form a tiny fraction of the total sales of

pharmaceutical companies and few drugs against infectious diseases rank high on

the sales list.

This could well explain the limited range of

options currently available to fight Covid-19. With the pandemic currently infecting

over 3 million people spread across more than 200 countries, we can safely

conclude that the scenario in 2020 will change substantially. And so should our

compilation of top drugs for the year.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Impressions: 54752

Insofar as pharma M&As are concerned, 2018 is turning out to be a milestone year with more than US$ 170 billion invested in the first quarter alone. While March saw a steep climb in deal values with the Cigna-Express Scripts US$ 67 billion acquisition, April remained significant for Novartis’ renewed interests in gene therapy — the Swiss pharma giant acquired AveXis, a clinical-stage gene therapy company, for US$ 8.7 billion.

Novartis retains focus on gene

therapy with US$ 8.7 billion AveXis buyout

In a bid to secure its leadership position in gene therapy,

Novartis struck a deal to acquire

Illinois-based AveXis, a

clinical-stage gene therapy company working to develop treatments of rare and

life-threatening neurological genetic diseases.

AveXis’ lead pipeline candidate is a neurology-targeted treatment based on virus-mediated gene therapy — AVXS-101. It has the potential to be the first one-time gene replacement therapy for spinal muscular atrophy (SMA), a disease which results in early death or lifelong disability with considerable healthcare costs.

“What was remarkable and what we consider transformative – and frankly all the experts in the SMA field also feel the same – is that we had 100 percent survival of the children at 13.6 months of age, and 100 percent survival of the children at 20 months of age,” Sukumar Nagendran, the chief medical officer of AveXis said in an interview with SMA News Today.

Click

here to view the major deals in April 2018 (FREE Excel version available)

In addition, AVXS-101 has attained the Breakthrough Therapy

Designation in the US and the Sakigake

Designation in Japan.

Moreover, this therapy, which is currently in Clinical Phase 3 development,

also has access into the PRIority MEdicines (PRIME) scheme in the EU.Novartis

CEO Vas Narasimhan said recently the patient population for SMA was

23,500 people in established markets. A filing with the US Food and Drug

Administration (FDA) for AVXS-101 is expected in the second half of 2018 and

approval and launch in the US is expected in 2019.

Click

here to view the major deals in April 2018 (FREE Excel version available)

P&G acquires Merck KGaA’s consumer healthcare business

Proctor & Gamble, one of the world’s largest personal care goods manufacturer, announced in mid-April that it has agreed to buy Merck KGaA’s consumer health unit for US$ 4 billion (€3.4 billion). This was just weeks after GlaxoSmithKline

announced its buyout of Novartis’ consumer healthcare joint venture

for US$ 13 billion.

Priced at US$ 4.2 billion, the deal enables P&G to expand its

successful consumer healthcare business by adding a fast-growing portfolio of

differentiated, physician-supported brands across a broad geographic footprint.

P&G now has better access to the Asian and

Latin American markets, and an enhanced product portfolio that includes vitamin

brands like Femibion, Neurobion and Seven Seas. It also provides P&G with

leadership in consumer healthcare, complementing its existing portfolio that

includes brands like Vicks, Metamucil, Pepto-Bismol,

Crest and Oral-B.

According to Reuters, the purchase price for Merck’s business suggests the German consumer healthcare conglomerate climbed down from price demands of as much as US$ 4.71 billion (€4 billion), which may have deterred initial suitors such as Nestle.

Click

here to view the major deals in April 2018 (FREE Excel version available)

Ionis is flush with cash as it bags deals with Biogen and AstraZeneca

Carlsbad, California-based drug maker, Ionis Pharmaceuticals, which successfully brought Spinraza (nusinersen)

to clinic, earned US$ 1 billion in cash from Biogen as the

two companies expanded their research collaboration on neurological diseases.

Biogen announced

in April this year that the transaction builds

upon the collaboration that produced Spinraza as well as two antisense

drug candidates currently in the clinic, with the potential to

advance up to seven more drug candidates to the

clinic within the next two years.

Biogen’s announcement came less than two weeks after AstraZeneca

paid Ionis a US$ 30 million license fee for its potential treatment for nonalcoholic steatohepatitis (NASH) where the inhibition target

is undisclosed.

Click

here to view the major deals in April 2018 (FREE Excel version available)

Ionis stands to receive up to US$ 300 million in

additional development and regulatory milestone payments, as well as tiered

royalties from sales of the drug.Speaking about the development, Brett P. Monia, CEO and senior vice president of Antisense Drug Discovery at Ionis Pharmaceuticals said: “AstraZeneca has played a strategic role in advancing this program forward by providing both preclinical and development expertise in NASH that has contributed to the rapid advance of this drug into development. We look forward to AstraZeneca moving this program swiftly into clinical testing and ultimately to the market.”

Click

here to view the major deals in April 2018 (FREE Excel version available)

Rise in immuno-oncology deals

Shire announced it was selling its oncology business to

French company Servier for US$ 2.4 billion, whilst Takeda said it was

considering an acquisition bid for Shire.

Servier has obtained the rights to Shire’s

presently marketed chemotherapy agent, Oncaspar, and pancreatic cancer treatment, Onivyde. Additionally, Shire’s pipeline of immuno-oncology assets (including Calaspargase Pegol under priority review) are all part of the offerings that were made during the divestment to Servier.

For Servier,

the acquisition of Shire’s oncology franchise enables it to establish a stronger “commercial presence in the US as well as the ex-US territories where Servier is already present,” Olivier Laureau, President of the Servier Group, said.

Two dedicated cancer immunotherapy companies — Allogene Therapeutics and Cellectis — together announced a joint asset contribution agreement

involving select allogeneic CAR-T

programs from Pfizer’s

oncology portfolio for a massive US$ 2.8 billion. This deal also landed Allogene US$ 300 million in funding and Pfizer a 25 percent stake

in the company.

Click

here to view the major deals in April 2018 (FREE Excel version available)

The immune-oncology collaboration provides Allogene exclusive rights to develop 16 preclinical assets including UCART19 — a CAR T-cell product jointly developed by Servier and Pfizer that Pfizer had earlier licensed from Cellectis and Servier.

Cellectis’ CAR-T platform provides an allogeneic approach of using engineered T-cells from healthy donors, which makes T-cell therapy more accessible to cancer patients. This is distinct from autologous approaches that require the patient’s own T-cells for targeting tumor cells.

Early last month, Boehringer Ingelheim and OSE Immunotherapeutics entered into an immuno-oncology collaboration to develop OSE-172 — a novel antibody targeting myeloid lineage cells.

Click

here to view the major deals in April 2018 (FREE Excel version available)

While this highlights Boehringer Ingelheim’s strategy to strengthen its core pillar of cancer immunology, Paris-based OSE stands to receive approximately US$ 1.2 billion (€1.1 billion) upon reaching pre-specified development, commercialization and sales milestones, plus royalties on worldwide net sales.

Our view

Deals by major pharmaceutical companies during the month of April

continued to be driven by their focus on gene therapy and immuno-oncology.

While companies like Novartis, Biogen, AstraZeneca and Boehringer-Ingelheim are betting

big on drugs that are still

in development, others like Proctor & Gamble, Servier and Takeda

have chosen to acquire proven assets that will immediately contribute to their

sales.

All eyes are set on Pfizer,

which is exploring a sale of its consumer healthcare business. However, the

pharma major has seen potential suitors drop out and during an earnings call a few weeks ago, its

chairman Ian Read ruled out a transformative deal.

“I don’t see that we need a transformative deal or see one at an appropriate value,” Read had said. Even if the Pfizer deal does not prove to be transformative, the M&A deals in the first few months of 2018 surely indicate that the world of pharmaceuticals is transforming at a fast pace.

Click

here to view the major deals in April 2018 (FREE Excel version available)

Impressions: 3242

The New

Year began with the JP Morgan Healthcare Conference— the drug industry’s annual investor meet — where industry leaders were busy announcing deals, until Donald Trump accused the industry of “getting away with murder”. His comments sent shockwaves within the industry as pharma and biotech stocks tanked. In the first Phispers of 2017, we also bring you a compilation of the likely patent conflicts this year. And, there is news on Aurobindo Pharma’s acquisition, Teva's revised guidance for 2017, lowering of growth prospects for Mylan, fresh bribery charges against Novartis and more.

Trump promises aggressive

federal bidding process to slash drug prices

Donald Trump, America’s president-elect dropped a bombshell in his first news conference held Wednesday, accusing the pharmaceutical industry of “getting away with murder”. He said he would bring

down drug prices, as well as government spending on drugs by changing the way

the country bids for drugs.

During the event held at Trump Tower in New York, Trump said: “Pharma has a lot of lobbies, a lot of lobbyists and a lot of power. And there’s very little bidding on drugs. We’re the largest buyer of drugs in the world, and yet we don’t bid properly.”

The country’s federal law forbids the government from negotiating drug prices with drug companies in order to lower the price of drugs for seniors using Medicare. Trump, however, did not announce how he will address the

issue of high drug prices. In the past though, he has called for ending the

policy.

His comment came in the midst of the JP Morgan Healthcare Conference, a

major annual investor meeting taking place in San Francisco, and knocked down

the stocks of biotech and pharmaceutical companies by around 2 percent.

“If anybody is walking away from this conference thinking ‘business as usual,’ I think that’s a mistake,” Heather Bresch, chief executive of Mylan Pharmaceuticals said at the JP Morgan meet.

“The pricing model has got to change. It’s not incremental change; I don’t think that’s what this country needs. I think it’s truly rethinking the business model,” she added. Mylan was under scrutiny recently for repeated list price increases on its lifesaving allergy drug EpiPen.

RECOMMENDED READ:

Drug costs and prescription trends in the United States: Analyzing Medicare’s $121 billion spend

Teva lowers guidance, Mylan expected to lose

US $ 800 million in 2018

Israeli drugmaker Teva revised the predictions it made in July 2016, about its financial expectations for 2017.

And these are considerably below its previous expectations. For instance, it

laid out a revenue forecast of US $ 23.8 billion to US $ 24.5 billion for 2017,

well below the US $ 25.2 billion to US $ 26.2 billion guidance it had

previously estimated. Teva now expects its earnings per share (EPS) to be between US $ 4.90 and US $ 5.30 — another big drop from its July guidance of US $ 6.00 to US $ 6.50.

Several industry observers had expected this downward revision. “I think it’s pretty clear that management’s prior expectations for 2017 were very inflated,” Umer Raffat, an Evercore ISI analyst, said.

Meanwhile, Teva began the new year by forking out over US $ 520 million in order to resolve a bribery

lawsuit in the US filed by its shareholders. It pertained to its operations in

Russia, Ukraine and Mexico.

The year gone by was a turbulent one for Teva.

For instance, its US $ 2.3 billion acquisition of Rimsa (short for Representaciones e Investigaciones Médicas, SA de CV), a leading pharmaceutical manufacturing and distribution company in Mexico, went the Ranbaxy way, with the former owners filing a legal complaint against Teva. The complaint mentioned that Teva is suffering from “buyer’s remorse” and is trying to undo the transaction “by any desperate measure” after destroying the Rimsa companies with firings and manufacturing shutdowns.

It’s not just Teva which is set to see a downtrend. Mylan's EpiPen — which hogged the headlines last year for its price hikes — is projected to face substantial decline, until 2018, say analysts.

EpiPen is all set to face competition from Kaleo’s Auvi-Q (another

epinephrine injection), which is due for launch in the first half of 2017,

Ronny Gal of Bernstein Research said. EpiPen (excluding the generic version) will

bring in only US $ 300 million in 2018 for Mylan, down from its US $ 1.1

billion estimate for 2016, Bernstein Research said.

Aurobindo to acquire Portugal’s Generis Farmaceutica

The New Year began with a bang for India’s Aurobindo Pharma. The company said it has inked a pact to acquire Portugal’s Generis Farmaceutica SA from Magnum Capital Partners for a consideration of US $ 143 million (or €135 million).

In a statement, Aurobindo Pharma said the binding agreement has been inked through Aurobindo’s wholly-owned subsidiary — Agile Pharma BV Netherlands. Generis produces and sells pharmaceutical products in Portugal.

The combined entity will benefit from a robust pipeline covering all major molecules coming off patent in the next five years, V Muralidharan, Senior Vice President of European Operations at Aurobindo Pharma, said. “The acquisition of Generis, by leveraging its strong portfolio and unrivalled brand recognition will allow us to establish ourselves as the top generics player in the Portuguese market,” he added.

The deal, however, is conditional, and depends on obtaining necessary approvals from Portuguese authorities. The acquisition deal includes Generis’ manufacturing facility in Amadora (Portugal) with a capacity to produce 1.2 billion tablets/capsules/sachets annually.

Patent battles between the Big Pharma could dominate 2017

This year may well be the year of big patent

battles between pharmaceutical giants. It began with a ruling on a patent

infringement case involving partners Sanofi-Regeneron and Amgen. A US federal judge ordered French pharmaceutical giant Sanofi and partner Regeneron to stop selling their latest cholesterol treatment — Praluent — due to patent infringement. After the court order, the stocks of Regeneron and Sanofi got hammered.

Sanofi and Regeneron plan to immediately appeal

that decision. According to the ruling, Sanofi and Regeneron had infringed

biotech giant Amgen’s patents for a rival cholesterol fighting drug — Repatha. Both Praluent and Repatha are the only approved ‘PCSK9 inhibiting’ therapies known to considerably reduce bad cholesterol levels in patients during clinical trials. Both won FDA approval in 2015 and both are expensive — priced at US $ 14,000 per year.

Sanofi is also in a battle with Novo Nordisk. In the last week of December, there was news that Sanofi filed a lawsuit in the US accusing Novo Nordisk of making the false claim that Sanofi’s insulin drugs would no longer be available for many US patients. According to Sanofi, Novo made that claim in order to promote its own competing drug. The complaint seeks an order forcing Novo to pay damages and withdraw marketing materials for its drug Tresiba.

Both Sanofi and Novo have been tied in a regulatory

race for their basal insulin/GLP-1 combo diabetes products. But Sanofi is already ahead in the race, as last week it rolled out Soliqua, a combination of

(insulin) Lantus and GLP-1 drug Adlyxin, at a list price of US $ 127 for a 300-unit pen. Novo’s Xultophy—which received regulatory approval on November 21—won’t be in the market until early May.

And then there is the battle between Merck

and Gilead. The latter ended the year on a sour note after a federal jury in the US ordered Gilead to pay US $ 2.5 billion in royalties to Merck in an ongoing

dispute. The legal battle between Merck and Gilead centres around Gilead's flagship hepatitis C cures — Sovaldi and Harvoni. Both these drugs gained disrepute for their lofty prices. Yet they

dominated the hepatitis C drug market (before they ran into trouble with

insurers and benefits managers who demanded better deals).

Lastly, there is a significant patent battle brewing in experimental biopharma technology in the form of a spat between the University of California and the University of Vienna on one side and the Broad Institute of MIT and Harvard University on the other. The battle centers around CRISPR-Cas9 — an early-stage gene-editing platform that significantly simplifies the process of slicing and dicing problematic genetic material. It is being tested as a treatment option for cancer, sickle cell, and a host of other diseases.

The dispute is around who owns the patent

right to CRISPR. While University of California at Berkeley professor Jennifer Doudna and the University of Vienna’s Emannuelle Charpentier were first to announce their discoveries, MIT's Feng Zhang actually won the patent after going through an expedited process.

After Korea, US and China, Novartis faces

bribery charges in Greece

In the last one year, Swiss drugmaker Novartis has faced three sets

of bribery charges. The fourth one came in the New Year, with Greek officials

announcing they are investigating Novartis for bribery in the wake of local media reports raising questions about the

company.

Greek corruption prosecutors raided the Athens offices of Novartis last week, as part of the probe over bribery

allegations. Greek authorities have reportedly interviewed scores of sources.

In March 2016, Novartis paid US $ 25 million to settle a US Securities and Exchange

Commission (SEC) case that claimed the Swiss drug maker paid bribes to health

professionals in China to increase sales during 2009 and 2013.

While the US case got settled, Novartis has

been accused by a whistleblower in Turkey of paying bribes through a consulting

firm to secure business advantages.

In August 2016, PharmaCompass had

reported that six former and current Novartis executives at its unit in South Korea allegedly paid more than US $ 2 million to doctors in return for prescribing its medicines. Among those indicted was the former CEO of Novartis’ Korea unit.

Twitter

bans Martin Shkreli for making unwanted advances at journalist

In September 2015, Martin Shkreli, the former

CEO of Turing Pharmaceuticals, had received widespread flak for raising the

price of anti-parasitic drug Daraprim by a factor of

56. Since the Daraprim episode, Shkreli has also been indicted on unrelated

fraud charges.

Well, Shkreli is back in news. And once again for

all the wrong reasons. A few days back, he was temporarily kicked off Twitter and its live-streaming platform — Periscope — for making unwanted advances toward Lauren Duca, the weekend editor of Teen Vogue.

In a tweet to Twitter’s CEO Jack Dorsey, Duca said: “How is this allowed?” She included two screenshots of Shkreli's Twitter profile page.

Apparently, Shkreli manipulated a photograph of Duca with her husband, wherein he had put his face in place of Duca’s husband. Duca also posted another screenshot wherein Shkreli had put up a montage of Duca’s photos as his Twitter background image, with the text: “For better or worse, till death do us part, I love you with every single beat of my heart.” Moreover, Shkreli’s Twitter bio said that he had a “small crush” on Duca. “Hope she doesn't find out,” it said.

According to the Twitter spokesperson, Twitter’s rules prohibit “targeted harassment”.

Oncology deals: Takeda acquires Ariad; Daiichi ties up

with Kite; Ipsen with Merrimack

The JP Morgan conference saw some major deals being announced in the field of oncology. Japan’s Takeda Pharmaceutical Company and Massachusetts-headquartered Ariad Pharmaceuticals recently entered into a definitive agreement under which Takeda will acquire all outstanding shares in Ariad for

US $24 per share in cash, in a deal valued at US $ 5.2 billion.

Ariad

Pharmaceuticals is a cancer-focused drugmaker. The agreement has been

unanimously approved by the boards of directors of both companies. It is likely

to close by the end of February this year, subject to required regulatory

approvals and other conditions.

Kite Pharma — a California-based, clinical-stage biopharmaceutical company engaged in the development of novel cancer immunotherapy products — has entered into a deal with Daiichi Sankyo of

Japan. Kite Pharma will enter the Japanese

market, along with Daiichi, which has lined up US $ 250 million deal.

Kite Pharma’s new drug application for the pioneering CAR-T drug —KTE-C19 — is in the final weeks of being completed and shipped to regulators in search of an accelerated approval. CAR-T (short for chimeric antigen receptors-T cell) is a therapy for cancer, using a technique called adoptive cell transfer. The T cells, which can recognize and kill cancer cells, are reintroduced into the patient.

Under the deal, Kite will be taking US $ 50 million

upfront and US $ 200 million in milestones for the deal, while Daiichi Sankyo

is reserving another US $ 200 million in additional milestones for each new

drug candidate that Kite takes to the FDA over the next three years.

Meanwhile, French pharmaceutical company Ipsen

has entered into a US $ 1 billion deal to acquire oncology assets from Massachusetts-headquartered Merrimack

Pharmaceuticals, including the pancreatic cancer drug Onivyde.

The deal is broken down into two steps, involving

an upfront fee of US $ 575 million, to be followed by a potential US $450 million that

would depend on approvals for Onivyde in the US.

With this deal, Merrimack is likely to pay off

US $ 195 million in debts, return US $ 200 million to stockholders and make a

further payment of US $ 450 million to shareholders. Merrimack would also

plough US $ 125 million into the development of three experimental cancer

drugs.

Impressions: 5614

Each year,

the US Food and Drug Administration (FDA) approve hundreds

of new medications. A small subset of approvals, classified as novel drugs, are considered to

be truly innovative products that often help advance clinical care.

In 2015, the

FDA approved 45 novel drugs, an all-time record high. PharmaCompass has compiled a list of novel drugs approved by the FDA in 2015.The FDA also approved new dosage forms of existing products in the market (email us if you would like a copy), like the 3D printed version of anti-epilepsy drug, Spritam (Levetiracetam).

This week, PharmaCompass focuses on the new dosage

forms of existing drugs that got approved last year.

Modified blockbusters

Improving the delivery form of a blockbuster drug is something that not only helps patients but often successfully extends the patent life of the cash-generating drugs for Big Pharma. Here are some blockbuster drugs that saw their modified versions being launched in 2015:

Jadenu (deferasirox): With

almost a billion dollars in revenues in 2015, Exjade (deferasirox) was approved in 2005 as a

tablet for use in a suspension. Novartis, the innovator,

got approval in March 2015

for Jadenu, a once-daily oral tablet. Jadenu (deferasirox), a new formulation

of Exjade, is the only once-daily oral tablet for iron chelation. Jadenu has

simplified daily treatment administration for patients with chronic iron

overload.

Nexium

24HR (esomeprazole magnesium): Also

known as the Purple Pill, Nexium – Astra

Zeneca’s blockbuster drug for acid reflux that generated annual sales in America of more than US $ 3 billion – went generic in 2015. In order to extend Nexium’s market, Pfizer and AstraZeneca came together to promote an over-the-counter (OTC) version of Nexium. A capsule version of OTC Nexium was approved in 2014 and is known as

Nexium 24HR. Last year, the FDA granted approval to the tablet form of the

drug.

Iressa

(gefitinib): AstraZeneca re-introduced Iressa in

the US market in 2015. The

FDA had approved Gefitinib in May 2003 for non-small cell lung cancer. Approved

as a third-line therapy, in 2010 the FDA requested AstraZeneca to voluntarily withdraw Iressa tablets

from the market, as post-marketing studies had failed

to verify and confirm clinical benefit. Iressa (gefitinib) is now back in the US as a first-line therapy for a type of lung cancer. However, the patent protection is limited – only one listed patent in the Orange Book which expires next year, and five US Drug Master Files already submitted.

Onivyde (irinotecan): Liposomal formulation of anti-cancer

drugs have been in vogue for some time. Merrimack Pharmaceuticals got its novel encapsulation of Irinotecan in a liposomal formulation approved for the

treatment of patients with metastatic pancreatic cancer, sold under the brand

name Onivyde.

Vivlodex (meloxicam): In October 2015, the FDA approved 5 mg and 10 mg (administered once daily) doses of Vivlodex™ (meloxicam) capsules, a nonsteroidal anti-inflammatory drug (NSAID) used for the management of osteoarthritis pain. The previously approved doses for meloxicam capsules were 7.5mg and 15mg. Vivlodex uses a proprietary SoluMatrix Fine Particle Technology™, which contains meloxicam as submicron particles that are approximately 10 times smaller than their original size. The reduction in particle size provides an increased surface area, leading to faster dissolution.

Kalydeco (ivacaftor): A cystic fibrosis drug from Vertex Pharmaceuticals – Kalydeco – has been making headlines

because of its high price (more than US $ 300,000 a year). Price concerns

aside, 2015 saw the launch of a pediatric version of the drug as a ‘weight-based oral granule formulation of Kalydeco that can be mixed in soft foods or liquids’.

Extended release versions

Many of

the approvals granted by the FDA last year were to extended release

formulations (a pill formulated so that the drug is released slowly) of

existing drugs.

Kremers Urban’s

extended release version of Methylphenidate

capsules made headlines last year because of a reclassification of the drug by

the FDA. Under the new classification rating, methylphenidate hydrochloride extended-release tablets can be prescribed but may

not be automatically substituted for J&J’s reference drug Concerta (methylphenidate hydrochloride). Kremers Urban was almost sold last year. But due to this reclassification, investors aborted their US $ 1.53 billion buyout. Kremers Urban was later acquired by Lannett Company Inc.

In

addition, extended-release versions of Aspirin, Carbidopa/Levodopa, Paliperidone Palmitate, Tacrolimus

and Morphine Sulphate also received green signals for a market launch.

First generic opportunities

Last year, PharmaCompass

shared the names of some drugs which had no generic competition and were also

not protected by patents. (Read: “Litigation Free, first generic opportunities list”).

Deferiprone (a drug that chelates iron and is

used to treat iron overload in thalassemia major) met the criteria. But it still

has no generic competitor and is now available as a new dosage form.

Amedra Pharmaceuticals, now owned by Impax Laboratories, has enjoyed the rights to sell Albendazole tablets for almost two decades

without generic competition in the US. Albendazole is a medication used for the

treatment of a variety of parasitic worm infestations. In 2015, patients were

provided access to chewable tablets of Albendazole.

New combinations at work

The FDA also approved

multiple combination drugs where the individual active ingredients had been brought

to market previously.

Most of the combination drugs

approved belong to major pharma players like Novartis, Novo Nordisk, Bristol Myers etc.

Boehringer’s diabetes treatments – Jardiance (empagliflozin) – approved in 2014 and

Tradjenta (linagliptin) approved in 2011, were

combined and the combination drug product Glyxambi was approved in 2015. Another

combination of empagliflozin, with metformin – Synjardy – was also approved in August last

year.

Lesser known companies also

got combination drugs approved. UK-based

development company Vernalis got approval for its cold-cough treatment, Tuzistra XR – an extended release suspension of codeine polistirex and chlorpheniramine

polistirex.

Similarly, US-based biopharmaceutical startup, Spriaso LLC, also

working in the cold and cough therapeutic area, got an extended release tablet

containing codeine phosphate and chlorpheniramine maleate approved.

Symplmed, a company which is

developing various forms of Perindopril, got approval for Prestalia (a

combination of perindopril arginine and amlodipine besylate) for the

treatment of hypertension.

Our view

Each year, the FDA approves several

pharmaceutical drugs in order to improve patient care; and often versions of

these drugs are marketed and distributed across the globe.

PharmaCompass’ list of drugs approved in 2015 is now available – just email us for your copy.

Accelerate your drug development

PharmaCompass has also launched

the Drug Development Assistance tool on its platform.

Simply search for the drug or the active ingredient of your interest, click on the Drug Development icon on the left menu bar and you can see the inactive ingredients used to formulate

the various drug products approved in the United States.

Impressions: 5419

Unrelated to the inspection of

the USFDA at the Dr. Reddys Srikakulam facility, Dr. Reddys sought permission from the Ministry of Environment,

Forests & Climate Change to expand

their drug and intermediate manufacturing at three locations.

All three chemical technical operation (CTO) units, CTO-I, CTO-II & CTO-III are located in Medak district and the announced planned capacity increases along with the anticipated capital investment were

Existing Capacity

Planned Capacity

Anticipated Investment

CTO I

14.7 TPM

45.5 TPM

Rs 30 crores

CTO II

21.9 TPM

68.9 TPM

Rs 45 crores

CTO - III

4.45 TPM

28.1 TPM

Rs 12 crores

*$1 million is approximately about Rs 6.2

crores & TPM is tons per month

In addition, the declaration given by Dr. Reddys also mentions the various products which will be produced at each facility (table below).

Needless to say, the plans are ambitious however with the growth witnessed by the Indian pharmaceutical industry over the past decade, one can understand Dr. Reddys commitment to investing further in their business.

Table Dr. Reddys production plans at various facilities

Product

Name

Planned

Capacity (TPM)

Facility

Location

Alendronate

Sodium Trihydrate

6.67

CTO

- III

Alfuzosin

2.33

CTO

- I

Altretamine

0.03

CTO

- I

Amlodipine

Besylate

33.33

CTO

- II

Amlodipine

Besylate

133.33

CTO

- III

Amlodipine

Besylate ( Ethyl 4 [2- (pthalamide)ethoxy] aceto acetate (TDM-2)

100

CTO

- II

Amlodipine

Maleate

30

CTO

- III

Amsacrine

0.07

CTO

- I

Anastrazole

0.83

CTO

- II

Aprepitant

3.33

CTO

- III

Aripiprazole

0.33

CTO

- II

Atomoxetine

1.67

CTO

- III

Atorvastatin

375.83

CTO

- II

Azacitidine

0.67

CTO

- I

Bicalutamide

0.03

CTO

- II

Bivalirudin

0.03

CTO

- II

Bivalirudin

Trifluoro Acetate

0.03

CTO

- I

Bortezomib

0.03

CTO

- I

Cabazitaxel

0.02

CTO

- I

Candesartan

cilexetil

6.67

CTO

- II

Cetirizine

Hydrochloride

66.67

CTO

- I

Cetirizine

16.67

CTO

- II

Ciprofloxacin

176.67

CTO

- II

Ciprofloxacin

HCl

533.33

CTO

- II

Ciprofloxacin Lactate

33.33

CTO

- II

Clopidogrel

Bisulfate

500

CTO

- I

Clopidogrel Premix

166.67

CTO

- II

Diluted

Everolimus 5% (Everolimus)

0.33

CTO

- II

Disodium

Pamidronate

0.33

CTO

- III

Docetaxel

1.9

CTO

- I

Dutasteride

3.33

CTO

- II

Esomeprazole

magnesium

66.67

CTO

- III

Ezetimibe

3.33

CTO

- II

Fexofenadine

Hydrochloride

500

CTO

- I

Finasteride

10

CTO

- II

Fluoxetine

110

CTO

- I

Fondaparinux

Sodium

0.33

CTO

- II

Galantamine

0.03

CTO

- II

Gemcitabine

13.33

CTO

- I

Glimepiride

13.33

CTO

- II

Imatinib

0.17

CTO

- I

Irinotecan

0.33

CTO

- I

Ketorolac

66.67

CTO

- II

Lacidipine

5

CTO

- III

Lamotrigine

33.33

CTO

- I

Lansoprozole

8.33

CTO

- III

Letrozole

0.03

CTO

- II

Levocetrizine

Di HCl

10

CTO

- III

Levofloxacin

200

CTO

- II

Lomustine

1.33

CTO

- I

Losartan

Postassium

150

CTO

- I

Meloxicam

0.03

CTO

- I

Memantine

HCl

3.33

CTO

- II

Mesalamine

0.03

CTO

- II

Metoprolol

Succinate

266.67

CTO

- II

Moxifloxacin

116.67

CTO

- II

Norfloxacin

0.03

CTO

- I

Omeprazole

133.33

CTO

- III

Omeprazole

Magnesium

50

CTO

- III

Omeprazole

Sodium

10

CTO

- III

Omerprazole Form B

33.33

CTO

- III

Paclitaxel

0.33

CTO

- I

Pantoprazole

Sodium

100

CTO

- III

paroxetine

HCl

0.03

CTO

- II

Pemetrexed

0.67

CTO

- I

Rabeprazole

Sodium

83.33

CTO

- III

Raloxifene

33.33

CTO

- II

Ramipril

100

CTO

- III

Repaglinide

6.67

CTO

- II

Rivastigmine

6.67

CTO

- II

Risperidone

13.33

CTO

- I

Rivastigmine

6.667

CTO

- I

Rizatriptan

Benzoate

1.33

CTO

- II

Rocuronium

Bromide

0.03

CTO

- II

Ropinrole

HCl

1.83

CTO

- III

Rosiglitazone

3.33

CTO

- II

Sparfloxacin

3.33

CTO

- I

Tacrolimus

5

CTO

- II

Tadalafil

3.33

CTO

- II

Telmisartan

100

CTO

- II

Temozolamide

0.03

CTO

- I

Terbinafine

HCl

133.33

CTO

- III

Tizanidine

HCl

16.67

CTO

- III

Topotecan

0.07

CTO

- I

valganciclovir

0.03

CTO

- I

Vardenafil

3.33

CTO

- II

Voriconazole

8.33

CTO

- III

Ziprasidone

Hydrochloride

100

CTO

- I

Zoledronic

acid

0.33

CTO

- III

Zolmitriptan

0.83

CTO

- I

Zonisamide

0.03

CTO

- II

Impressions: 3086