Acquisitions and spin-offs dominated headlines in 2019 and the tone was set very early with Bristol-Myers Squibb acquiring

New Jersey-based cancer drug company Celgene in a US$ 74 billion deal announced on

January 3, 2019. After factoring

in debt, the deal value ballooned to about US$ 95 billion, which according

to data compiled by Refinitiv, made it the largest healthcare deal on

record.

In the summer, AbbVie Inc,

which sells the world’s best-selling drug Humira, announced its acquisition of Allergan Plc, known for Botox and other cosmetic

treatments, for US$ 63 billion. While the companies are still awaiting

regulatory approval for their deal, with US$ 49 billion in combined 2019

revenues, the merged entity would rank amongst the biggest in the industry.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

The big five by pharmaceutical sales — Pfizer,

Roche, J&J, Novartis and Merck

Pfizer

continued

to lead companies by pharmaceutical sales by reporting annual 2019 revenues of

US$ 51.8 billion, a decrease of US$ 1.9 billion, or 4 percent, compared to

2018. The decline was primarily attributed to the loss of exclusivity of Lyrica in 2019,

which witnessed its sales drop from US$ 5 billion in 2018 to US$ 3.3 billion in

2019.

In 2018, Pfizer’s then incoming CEO Albert Bourla had mentioned that the company did not see the need for any large-scale M&A activity as Pfizer had “the best pipeline” in its history, which needed the company to focus on deploying its capital to keep its pipeline flowing and execute on its drug launches.

Bourla stayed true to his word and barring the acquisition of Array Biopharma for US$ 11.4 billion and a spin-off to merge Upjohn, Pfizer’s off-patent branded and generic established medicines business with

Mylan, there weren’t any other big ticket deals which were announced.

The

Upjohn-Mylan merged entity will be called Viatris and is expected to have 2020

revenues between US$ 19 and US$ 20 billion

and could outpace Teva to

become the largest generic company in the world, in term of revenues.

Novartis, which had

followed Pfizer with the second largest revenues in the pharmaceutical industry

in 2018, reported its first full year earnings after spinning off its Alcon eye

care devices business division that

had US$ 7.15 billion in 2018 sales.

In 2019,

Novartis slipped two spots in the ranking after reporting total sales of US$

47.4 billion and its CEO Vas Narasimhan continued his deal-making spree by buying New

Jersey-headquartered The Medicines Company (MedCo) for US$ 9.7

billion to acquire a late-stage cholesterol-lowering

therapy named inclisiran.

As Takeda Pharmaceutical Co was

busy in 2019 on working to reduce its debt burden incurred due to its US$ 62

billion purchase of Shire Plc, which was announced in 2018, Novartis also purchased

the eye-disease medicine, Xiidra, from the Japanese drugmaker for US$ 5.3 billion.

Novartis’ management also spent a considerable part of 2019 dealing with data-integrity concerns which emerged from its 2018 buyout of AveXis, the

gene-therapy maker Novartis had acquired for US$ 8.7 billion.

The deal gave Novartis rights to Zolgensma,

a novel treatment intended for children less than two years of age with the

most severe form of spinal muscular atrophy (SMA). Priced at US$ 2.1 million,

Zolgensma is currently the world’s most expensive drug.

However,

in a shocking announcement, a month after approving the drug, the US Food and

Drug Administration (FDA) issued a press release on

data accuracy issues as the agency was informed by AveXis that

its personnel had manipulated data which

the FDA used to evaluate product comparability and nonclinical (animal)

pharmacology as part of the biologics license application (BLA), which was

submitted and reviewed by the FDA.

With US$

50.0 billion (CHF 48.5 billion) in annual pharmaceutical sales, Swiss drugmaker

Roche came in at number two position in 2019

as its sales grew 11 percent driven by

its multiple sclerosis medicine Ocrevus, haemophilia drug Hemlibra and cancer medicines Tecentriq and Perjeta.

Roche’s newly introduced medicines generated US$ 5.53 billion (CHF 5.4 billion) in growth, helping offset the impact of the competition from biosimilars for its three best-selling drugs MabThera/Rituxan, Herceptin and Avastin.

In late 2019, after months of increased

antitrust scrutiny, Roche completed

its US$ 5.1 billion acquisition of Spark Therapeutics to strengthen its presence in

gene therapy.

Last year, J&J reported almost flat worldwide sales of US$ 82.1 billion. J&J’s pharmaceutical division generated US$ 42.20 billion and its medical devices and consumer health divisions brought in US$ 25.96 billion and US$ 13.89 billion respectively.

Since J&J’s consumer health division sells analgesics, digestive health along with beauty and oral care products, the US$ 5.43 billion in consumer health sales from over-the-counter drugs and women’s health products was only used in our assessment of J&J’s total pharmaceutical revenues. With combined pharmaceutical sales of US$ 47.63 billion, J&J made it to number three on our list.

While the sales of products like Stelara, Darzalex, Imbruvica, Invega Sustenna drove J&J’s pharmaceutical business to grow by 4 percent over 2018, the firm had to contend with generic competition against key revenue contributors Remicade and Zytiga.

US-headquartered Merck, which is known as

MSD (short for Merck Sharp & Dohme) outside the United States and

Canada, is set to significantly move up the rankings next year fueled by its

cancer drug Keytruda, which witnessed a 55

percent increase in sales to US$ 11.1 billion.

Merck reported total revenues of US$ 41.75 billion and also

announced it will spin off its women’s health drugs,

biosimilar drugs and older products to create a new pharmaceutical

company with US$ 6.5 billion in annual revenues.

The firm had anticipated 2020 sales between US$ 48.8 billion and US$ 50.3 billion however this week it announced that the coronavirus pandemic will reduce 2020 sales by more than $2 billion.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

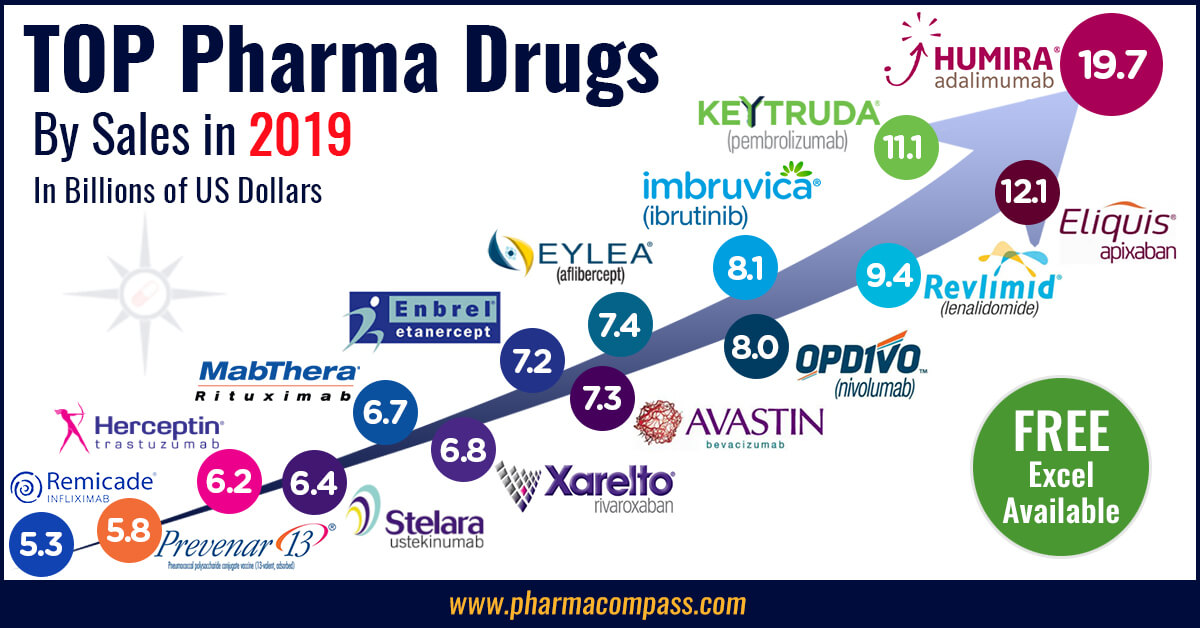

Humira holds on to remain world’s best-selling drug

AbbVie’s acquisition of Allergan comes as the firm faces the expiration of patent protection for Humira, which brought in a staggering US$ 19.2 billion in sales last year for

the company. AbbVie has failed to successfully acquire or develop a major new

product to replace the sales generated by its flagship drug.

In 2019, Humira’s US revenues increased 8.6 percent to US$ 14.86 billion while internationally, due

to biosimilar competition, the sales dropped 31.1 percent to US$ 4.30 billion.

Bristol Myers Squibb’s Eliquis, which is also marketed by Pfizer, maintained its number two position

and posted total sales of US$ 12.1 billion, a 23 percent increase over 2018.

While Bristol Myers Squibb’s immunotherapy treatment Opdivo, sold in partnership with Ono in Japan, saw sales increase from US$ 7.57 billion to US$ 8.0 billion, the growth paled in comparison to the US$ 3.9

billion revenue increase of Opdivo’s key immunotherapy competitor Merck’s Keytruda.

Keytruda took the number three spot in drug sales that

previously belonged to Celgene’s Revlimid, which witnessed a sales decline from US$ 9.69 billion to US$ 9.4 billion.

Cancer treatment Imbruvica, which is marketed

by J&J and AbbVie, witnessed a 30 percent increase in sales. With US$ 8.1

billion in 2019 revenues, it took the number five position.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Vaccines – Covid-19 turns competitors into partners

This year has been dominated by the single biggest health emergency in years — the novel coronavirus (Covid-19) pandemic. As drugs continue to fail to meet expectations, vaccine development has received a lot of attention.

GSK reported the highest vaccine sales of all drugmakers with

total sales of US$ 8.4 billion (GBP 7.16 billion), a significant portion of its

total sales of US$ 41.8 billion (GBP 33.754 billion).

US-based Merck’s vaccine division also reported a significant increase in sales to US$ 8.0 billion and in 2019 received FDA and EU approval to market its Ebola vaccine Ervebo.

This is the first FDA-authorized vaccine against the deadly virus which causes

hemorrhagic fever and spreads from person to person through direct contact with

body fluids.

Pfizer and Sanofi also reported an increase in their vaccine sales to US$ 6.4

billion and US$ 6.2 billion respectively and the Covid-19 pandemic has recently

pushed drugmakers to move faster than ever before and has also converted

competitors into partners.

In a rare move, drug behemoths — Sanofi and GlaxoSmithKline (GSK) —joined hands to develop a vaccine for the novel coronavirus.

The two companies plan to start human trials

in the second half of this year, and if things go right, they will file

for potential approvals by the second half of 2021.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Our view

Covid-19 has brought the world economy to a grinding halt and shifted the global attention to the pharmaceutical industry’s capability to deliver solutions to address this pandemic.

Our compilation shows that vaccines and drugs

for infectious diseases currently form a tiny fraction of the total sales of

pharmaceutical companies and few drugs against infectious diseases rank high on

the sales list.

This could well explain the limited range of

options currently available to fight Covid-19. With the pandemic currently infecting

over 3 million people spread across more than 200 countries, we can safely

conclude that the scenario in 2020 will change substantially. And so should our

compilation of top drugs for the year.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Impressions: 54752

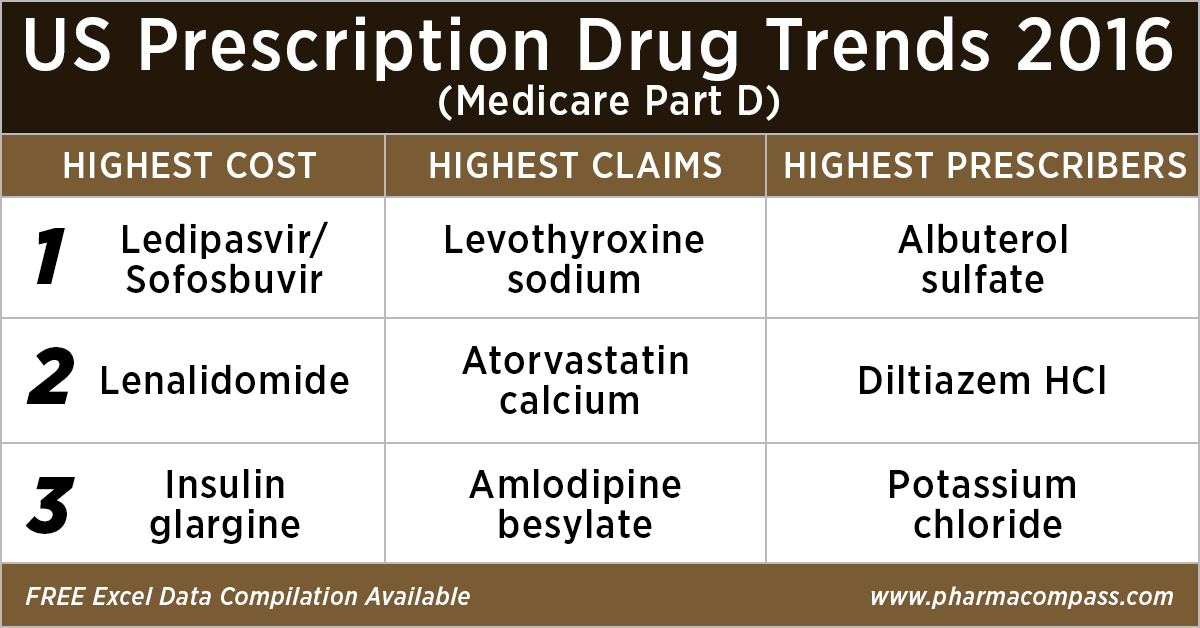

This week, PharmaCompass

reviews the recently released data on prescription drugs paid for under the

Medicare Part D Prescription Drug Program in the United States in calendar year

2016.

But first, let’s understand what is Medicare.

Medicare is the federal health insurance program in the US. In 2017, it covered 58.4 million people — 49.5 million aged 65 and older, and 8.9 million disabled.

Prescription drug coverage under this

program was started in 2006, and is known as Medicare Part D.

As part of this

coverage, the Centers for Medicare & Medicaid Services (CMS) contracts insurance

companies and other private companies, known as plan sponsors, that offer

prescription drug plans to their beneficiaries with varying drug coverage and

cost-sharing requirements.

In

2017, the Congressional Budget Office (CBO) had estimated that spending on

Medicare Part D would reach US$ 94 billion, or about 16 percent of all Medicare

expenditures for the year.

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

According

to the CBO, Medicare Part D is the most significant expansion of the Medicare

program since it was created by Congress in 1965.

With

more than 1.48 billion claims from beneficiaries enrolled under the Part D

prescription drug benefit program under its umbrella, our analysis of Medicare

Part D provides valuable insights into how elderly Americans use prescription

drugs.

Top 10 drugs by

cost: The ones that bore the highest cost burden for Medicare

As in 2015, in 2016

too Gilead’s Hepatitis C treatment — Ledipasvir/Sofosbuvir (Harvoni) — remained the single drug highest payout under the Medicare Part D Prescription Drug Program with a total cost of US$ 4.4 billion.

As Gilead continued

to face competition from AbbVie and Merck in the Hepatitis C space, the spending on Harvoni was down

37 percent from US$ 7.03 billion in 2015.

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Celgene’s cancer treatment, Lenalidomide (Revlimid), Sanofi and Merck’s diabetes treatments and AstraZeneca’s Crestor (Rosuvastatin Calcium) for

cholesterol followed Harvoni. All together, they cost the Medicare program over US$ 10 billion.

Generic Name

Number of Medicare Part D Claims

Number of Medicare Beneficiaries

Number of Prescribers

Aggregate Cost Paid for Part D

Claims (In USD)

LEDIPASVIR/ SOFOSBUVIR (HARVONI)

141,665

52,782

12,097

4,398,534,465

LENALIDOMIDE

239,049

35,368

10,382

2,661,106,127

LANTUS SOLOSTAR (INSULIN

GLARGINE, HUM.REC.ANLOG )

5,028,485

1,075,248

245,447

2,526,048,766

SITAGLIPTIN PHOSPHATE

4,742,505

864,442

206,223

2,440,013,513

ROSUVASTATIN CALCIUM

6,012,444

1,560,050

249,981

2,322,724,007

FLUTICASONE/SALMETEROL

5,194,391

1,196,007

275,442

2,319,808,482

PREGABALIN

4,940,115

852,497

267,532

2,098,953,250

RIVAROXABAN

4,403,332

807,820

252,141

1,954,748,890

APIXABAN

4,455,782

826,969

231,631

1,926,107,484

TIOTROPIUM BROMIDE

4,153,162

903,494

235,564

1,818,857,361

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Top 10 drugs by claims: The most commonly

used drugs of 2016

With 46.6 million claims, the thyroid hormone deficiency treatment — Levothyroxine Sodium — retained its position of being the most claimed product under Medicare’s Part D Prescription Drug Program in 2016.

The number of

Medicare Part D claims includes original prescriptions and refills.

Following Levothyroxine Sodium was the lipid-lowering agent — Atorvastatin Calcium — which had 44.5 million Medicare Part D claims that

were filed by almost 9.4 million beneficiaries.

Generic

Name

Number

of Prescribers

Number

of Medicare Part D Claims

Number

of Medicare Beneficiaries

LEVOTHYROXINE SODIUM

669,999

46,617,109

8,091,785

ATORVASTATIN CALCIUM

494,973

44,595,686

9,435,633

AMLODIPINE BESYLATE

497,017

39,913,468

7,802,905

LISINOPRIL

490,452

39,469,840

8,009,954

OMEPRAZOLE

492,951

32,909,236

7,001,160

METFORMIN HCL

611,700

31,007,932

6,394,014

SIMVASTATIN

380,560

29,687,947

6,201,911

HYDROCODONE/ACETAMINOPHEN

660,617

28,595,150

7,265,882

FUROSEMIDE

488,352

27,878,243

5,421,598

GABAPENTIN

555,997

27,627,466

5,363,382

Click here

to access the compilation of Medicare Part D Prescriber Summary Report

Top 10 drugs by prescribers: Medicines that were most popular with

doctors

Among the prescribers, albuterol sulfate (salbutamol) and Diltiazem had

over 900,000 unique providers (or

doctors) prescribing the drug.

Albuterol (salbutamol) is

used to provide quick relief from wheezing and shortness

of breath while Diltiazem is used to prevent chest

pain (angina).

Also

on the list of popular drugs with prescribers is Hydrocodone-Acetaminophen.

With more doctors prescribing Hydrocodone-Acetaminophen (an

opioid) than commonly used antibiotics, such as Cephalexin, Ciprofloxacin and Amoxicillin, the

series of new FDA initiatives to combat the epidemic of opioid misuse and abuse

should change the position of opioids in the top 10 drugs by prescribers in the

coming years.

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Generic

Name

Number of

Prescribers

Number of

Medicare Part D Claims

Number of

Medicare Beneficiaries

ALBUTEROL SULFATE

985,427

13,100,354

5,417,718

DILTIAZEM HCL

931,159

8,142,004

1,982,550

POTASSIUM CHLORIDE

879,491

18,945,969

4,278,000

PEN NEEDLE, DIABETIC

677,210

5,281,778

1,795,046

LEVOTHYROXINE SODIUM

669,999

46,617,109

8,091,785

HYDROCODONE/ACETAMINOPHEN

660,617

28,595,150

7,265,882

METFORMIN HCL

611,700

31,007,932

6,394,014

CEPHALEXIN

597,647

5,603,879

3,933,373

CIPROFLOXACIN HCL

594,129

7,000,081

4,851,657

AZITHROMYCIN

591,028

7,958,625

5,734,122

What does the

future hold?

Although the Part D Prescriber PUF (public use file) has a wealth of information on payment and utilization for Medicare Part D prescriptions, the dataset has a number of limitations. Of particular importance is the fact that the data may not be representative of a physician’s entire practice or all of Medicare as it only includes information on beneficiaries enrolled in the Medicare Part D prescription drug program (i.e., approximately two-thirds of all Medicare beneficiaries).

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Last

month, the Office of the Inspector General (OIG)

reviewed

the Part D claims data for the years 2011 to 2015 for brand-name drugs.

The OIG’s report found that the total reimbursement for all brand-name drugs in Part D increased 77 percent from 2011 to 2015, despite a 17-percent decrease in the number of prescriptions for these drugs.

With soaring drug prices being an issue for

regular debate in the Unites States and President Trump announcing that his

team will use strategies to strengthen the negotiating powers under

Medicare Part D and Part B, it remains to be seen how the data on prescription drugs paid for under

the Medicare Part D Prescription Drug Program will change in the coming years.

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Impressions: 2500

The year 2017 was a landmark year for pharmaceutical

industries in the US and Europe, with a sharp increase in the number of new molecular entities (NMEs) being approved in both geographies.

The US Food

and Drug Administration (USFDA) approved 46 NMEs in 2017, the second highest

since 1996 when 53 NMEs were approved. In Europe, the European Medicines Agency

(EMA) approved 35 drugs with a new active substance, up from 27 in 2016.

Sales for most major pharmaceutical

companies continued to grow in 2017. Earnings forecasts for 2018 have been raised due to the recent US tax reform that has

generated investor hopes for accelerated dividend growth and share buyback

plans.

This week, PharmaCompass brings

you a compilation of the top drugs of 2017 by sales revenue.

Click here to Access All the 2017 Data (Excel

version available) for FREE!

Top-sellers: Humira races ahead, despite launch of biosimilars; Enbrel a distant second

There wasn’t any upheaval

at the top of the pharma drug sales charts. AbbVie’s anti-TNF (tumor necrosis factor) giant

Humira (adalimumab), which is approved to treat

psoriasis and rheumatoid arthritis, added

almost another US $3 billion to its 2016 sales and posted nearly US $19 billion in revenues.

Last year, AbbVie’s raised expectations for Humira’s earnings to reach US $21 billion in global sales by 2020. The

company believes this drug will continue to be a significant cash contributor

until 2025 and the US $21 billion sales forecast

by 2020 is about US $3 billion higher than its expectation two years ago.

In 2016, the US Food and Drug Administration

(FDA) approved Amgen’s Amjevita (adalimumab-atto) — a biosimilar of Humira. And in 2017, another Humira biosimilar — Boehringer Ingelheim’s Cyltezo

(adalimumab-adbm) — received approval from the FDA and European authorities.

Click here to Access All the 2017 Data (Excel

version available) for FREE!

Enbrel (etanercept),

the longest-used biologic medicine for the treatment of rheumatism around the

world, was the second best-selling drug with US $8.262 billion in 2017 sales.

The sales of the drug were down from US $9.366 billion in

2016 owing to lower selling prices and increased

competition, which in turn hurt demand.

Since it was first approved in the United States in 1998,

Enbrel has been approved in over 100 countries and the drug is promoted by Amgen,

Pfizer

and Takeda

in different geographies.

Novartis’ biosimilar copy of Enbrel, which got approved by the FDA in August

2016 for the treatment of patients with

rheumatoid arthritis (RA), plaque psoriasis, ankylosing spondylitis (AS) and

other diseases is still not on the market because of a patent-protection

challenge from Amgen.

Amgen is arguing in the US federal court

that its drug has patent protection until 2029.

Click here to Access All the 2017 Data (Excel

version available) for FREE!

Fast-growing drugs: Eylea and Revlimid bring

fortunes for Regeneron and Celgene

Regeneron’s

flagship eye treatment, Eylea (aflibercept) which is marketed by Bayer outside the United States, added another US $1 billion in

annual sales last year to record US $8.260 billion in total sales. Eylea net

sales grew 11 percent year-on-year in the US and 19 percent year-over-year

outside the US.

The company believes much of the recent

growth in the US was driven by demographic trends with an aging population as

well as an overall increase in the prevalence of diabetes.

These demographic trends are expected to

continue in the coming years, providing an opportunity for continued growth.

Eylea sales alone contribute 63 percent to Regeneron’s total sales.

Click here to Access All the 2017 Data (Excel

version available) for FREE!

Celgene’s

Revlimid

(lenalidomide)

— a thalidomide derivative introduced in 2004 as an immunomodulatory agent for the treatment of various cancers such as multiple myeloma — brought in an additional US $1.2 billion in 2017 sales and had total revenues of US $8.187 billion.

Revlimid continues to contribute more than 60 percent to the company’s total sales of US $13 billion.

Celgene received a setback this month as the

USFDA refused to consider Celgene’s

application for ozanimod, an experimental

treatment for relapsing multiple sclerosis. The treatment was being seen as a

key to the company’s fortunes as Celgene had

said ozanimod is worth US $4 billion to

US $6

billion a year in peak sales.

Click here to Access All the 2017 Data (Excel

version available) for FREE!

Gilead’s Hepatitis C franchise enters free fall

Gilead Sciences’ blockbuster hepatitis C drugs franchise that includes Sovaldi and Harvoni continue to feel the

competitive heat as they registered US $9.137

billion in 2017 sales, down from US $14.834

billion the previous year.

While reporting 2017 results, Gilead provided guidance for

2018 and said its sales of Hepatitis C drugs could fall

further to US $3.5 billion - US $4 billion. At their peak in 2015, Gilead’s Sovaldi and Harvoni had together generated

US $19.1 billion in sales.

One of the major reasons for this drop is AbbVie’s launch of its new treatment Mavyret

at a deep price discount to the competition. AbbVie

also claims to have the shortest treatment course at eight weeks, compared with

12 weeks or longer for other treatments.

AbbVie reported US $1.274 billion in Hepatitis C drug sales

in 2017, down from US $1.522 billion in 2016.

Click here to Access All the 2017 Data (Excel

version available) for FREE!

Novartis’ Gleevec, Merck’s cardiovascular drugs, GSK’s Advair face generic heat

Novartis’ Gleevec (imatinib), which had at one point become the best-selling drug for Novartis and had brought in US $3.323 billion for the company in 2016, started facing generic competition last year and the anti-cancer drug lost US $1.380 billion in sales to bring in ‘only’ US $1.943 billion last year.

The US patents of Merck’s cardiovascular drugs — Zetia (Ezetimibe)

and Vytorin (Ezetimibe

and Simvastatin) — expired in April 2017. In May 2010, Merck and Glenmark

Pharmaceuticals entered into an agreement that allowed Glenmark to launch

a generic version of Zetia in late 2016. The drugs

that had combined sales of US $3.701

billion in 2016 felt the generic heat in 2017 and the sales were US

$1.606 billion lower at US $2.095

billion.

Click here to Access All the 2017 Data (Excel

version available) for FREE!

GSK’s Advair, which was expected

to encounter generic competition in 2017, continued to breathe easy as the FDA

found deficiencies in the applications of Hikma, Mylan and Sandoz.

All three failed to get the FDA nod for their generic versions of Advair, a drug used in the management of asthma and chronic obstructive pulmonary disease that generated sales worth US $4.431 billion (£3.130 billion) in 2017.

Top 15 drugs by sales

Here is PharmaCompass’ compilation

of the best-selling drugs of 2017. This is based on information extracted from

annual reports and US Securities and Exchange Commission (SEC) filings of major

pharmaceutical companies.

If you would like your own copy of all the information we’ve collected, email us at support@pharmacompass.com and we’ll send you an Excel version.

Click here to access all the 2017 data (Excel

version available) for FREE!

S. No.

Company / Companies

Product Name

Active Ingredient

Main Therapeutic Indication

2017 Revenue in Millions (USD)

1

AbbVie Inc., Eisai

Humira®

Adalimumab

Immunology (Organ Transplant, Arthritis etc.)

18,946

2

Amgen, Pfizer Inc., Takeda

Enbrel®

Etanercept

Immunology (Organ Transplant, Arthritis etc.)

8,262

3

Regeneron, Bayer

Eylea

Aflibercept

Ophthalmology

8,260

4

Celgene

Revlimid

Lenalidomide

Oncology

8,187

5

Roche

MabThera®/Rituxan®

Rituximab

Oncology

7,831

6

Johnson & Johnson, Merck, Mitsubishi Tanabe

Remicade®

Infliximab

Autoimmune Disorders

7,784

7

Roche

Herceptin®

Trastuzumab

Oncology

7,435

8

Bristol-Myers Squibb, Pfizer Inc.

Eliquis®

Apixaban

Cardiovascular Diseases

7,395

9

Roche

Avastin®

Bevacizumab

Oncology

7,089

10

Bayer, Johnson & Johnson

XareltoTM

Rivaroxaban

Cardiovascular Diseases

6,590

11

Bristol Myers Squibb, Ono Pharmaceutical

Opdivo

Nivolumab

Oncology

5,815

12

Sanofi

Lantus

Insulin Glargine

Diabetes

5,731

13

Pfizer Inc.

Prevnar 13/Prevenar 13

Pneumococcal 7-Valent Conjugate

Anti-bacterial

5,601

14

Pfizer Inc., Eisai

Lyrica

Pregabalin

Neurological/Mental Disorders

5,318

15

Amgen, Kyowa Hakko Kirin

Neulasta®

Pegfilgrastim

Blood Disorders

4,553

Sign up, stay ahead

In order to stay informed, and receive

industry updates along with our data compilations, do sign up for the PharmaCompass Newsletter and

you will receive updated information as it becomes available along with a lot

more industry analysis.

Click here to Access All

the 2017 Data (Excel version available) for FREE!

Impressions: 58408

This week in Phispers, we look at the growing troubles at Teva. The company plans to divest non-core assets to reduce debt and lay-off 7,000 workers. The FDA approved AbbVie’s Mavyret, a drug that poses considerable challenge to Gilead’s Harvoni and Sovaldi. Meanwhile, Martin Shkreli was found guilty in three out of eight charges; diabetes drug exenatide showed benefit to Parkinson’s disease patients in a study; and in the US, the Senate passed key FDA funding bill.

Teva in dire straits: To lay off 7,000 workers, to sell non-core assets to repay

debt

Teva has been in trouble for quite sometime now. It’s a classic case of a company taking on more debt to spur growth. But it’s fallen into hard times, as three CEOs changed guard this decade.

Last week, the world’s largest manufacturer of generic medicines said it would divest non-core assets to shed a part of its US$ 35 billion debt load. While debt may be historically cheap, it still has to be repaid. And if revenues don’t keep up with payments, the downfall can be rapid for Teva.

Teva had taken on

the debt in order to

dominate all facets of generic drugs, including a US$ 40.5 billion

acquisition of Allergan’s generics business last year. The

Allergan deal added more pressure on drug prices and margins.

Teva also slashed

its earnings goals

for the second time this year. It warned investors it may have to renegotiate

some debt agreements if cash flow worsens. Teva reduced its dividend by 75

percent.

The company also

mentioned that it is in the process of laying off 7,000 workers. Greater competition in the

generic drug business due to increased approvals (of generic drugs) by the US

Food and Drug Administration (USFDA) has led to poor results, the company said.

The continued deterioration of its business environment in Venezuela has made

matters worse.

The plight of Teva

has been worsened due to the leadership crisis — the company has been without a CEO and a CFO for months.

Activist

shareholder Benny

Landa blamed acting CEO Yitzhak Peterburg and the board of directors for leading Teva to disaster. Landa said what is happening in the company is no less than a catastrophe. “I've been saying this for three or four years: the company board of directors is incapable of making big decisions and getting the company back on track,” he said.

Price-gouging Shkreli awaits sentence; found guilty on three out of eight charges

Martin Shkreli — the co-founder of Elea Capital, MSMB Capital, Retrophin and the former CEO of Turing Pharmaceuticals who is more famous for price gouging and for defrauding investors — could spend years in prison due to last week’s investor fraud conviction if the judge focuses on the intended impact of his

crime and on his antics on the social media, say legal experts.

Back

in 2015, Shkreli had raised the price of an infection treatment by 5,000 percent to avoid prison due to an unusual twist to his case — defrauded investors suffered no loss from his crime.

That

could work in Shkreli’s favor, because investor harm is the main factor in determining a sentence for securities fraud in the US. However, a report quotes a law enforcement source as saying that prosecutors will challenge Shkreli's underlying assumption of how to calculate the losses of investors.

While

Shkreli was convicted on three securities fraud and conspiracy counts, he was

acquitted of other charges, including the charge that he conspired to steal US$

11 million in assets from Retrophin.

What’s caught the public eye though is Shkreli’s social media antics. Hours after his conviction, Shkreli declared the mixed verdict by the federal jury on YouTube as an “astounding victory.”

Without showing any sign of remorse, 34-year old Shkreli said: “I’m one of the richest New Yorkers there is, and after today's outcome it's going to stay that way.”

According

to lawyers, such a conduct on social media could backfire at the time of sentencing. “He lacked any remorse, and the judge may avoid appearing lenient when she sentences him,” James Cox, a law professor at Duke University, said.

Diabetes drug exenatide could stop the progress of Parkinson’s disease

In future,

clinicians may be able to stop the progress of Parkinson’s disease with a drug normally used in type 2 diabetes. At present, the drugs used to treat Parkinson’s disease only help in managing the symptoms. They do not prevent brain cells from dying.

In Parkinson’s, the brain is progressively damaged and the cells that produce the hormone dopamine are lost. Legendary boxer Muhammad Ali had died last year at the age of 74 after battling for years with Parkinson’s disease.

In the trial, half

the patients were given

the diabetes drug exenatide and the rest were given a placebo (dummy treatment). All the patients stayed on their usual medication. Those on just their usual medication declined over 48 weeks of treatment. But those given exenatide were stable. And three months after the experimental treatment stopped, those who had been taking exenatide were still better off.

Exenatide,

derived from the saliva of Gila monster, is a glucagon-like peptide-1 (GLP-1)

agonist. It treats type 2 diabetes by mimicking the hormone GLP-1, which

triggers insulin secretion.

According to University College London (UCL) researchers, Parkinson’s patients treated with exenatide did

better on movement tests than patients who received a placebo. If they can prove the drug changes the disease itself, it could transform the way we treat Parkinson’s.

Though the UCL team is “excited”, it has urged caution as any

long-term benefit is uncertain and the drug needs more testing.

FDA approves AbbVie’s Mavyret — a drug that cures Hepatitis C in eight weeks

Last

week, the USFDA approved the first-ever drug that can treat all six major strains of hepatitis C (or HCV) in just eight weeks — AbbVie’s Mavyret. For competitors like Gilead, Mavyret spells bad news. Mavyret is

also being considered a ‘steal’ in the world of HCV drugs, with a price tag of US$ 26,400 for an eight-week treatment course. In comparison, Gilead’s Harvoni costs about US$ 63,000 for eight weeks, though the

discounts bring the net price down to US$ 30,000.

Gilead also has its own ‘pan-genotype’ hepatitis C medicine, Epclusa, in addition to its blockbuster HCV drugs

Sovaldi and Harvoni, that have been at the centre of a

controversy around their steep prices.

With

a combination of two new direct-acting antivirals — glecaprevir and pibrentasvir — Mavyret treats adult Hepatitis C patients with genotype 1 through 6 who don’t have cirrhosis or with mild cirrhosis, or those who are on dialysis. According to the FDA, it’s the first pan-genotypic HCV drug with an eight-week treatment duration. Other options cure the disease in 12 weeks or longer.

J&J’s Invokana is CVS Caremark’s preferred diabetes drug

Close on the heels of Express Scripts’ 2018 formulary release, rival pharmacy benefit management (PBM) giant CVS Caremark has published its own list of drugs that are in,

and those that are out. Express

Scripts Holding is the largest PBM organization in the US.

In

the SGLT2 class of drugs to treat diabetes, CVS

removed Eli Lilly and Boehringer Ingelheim’s Jardiance and added Johnson & Johnson’s

Invokana as a preferred option. This, despite the fact that Invokana came with an

increased risk for amputations in a cardiovascular outcomes study finished

earlier this year.

A Boehringer Ingelheim spokesperson said the company is “very disappointed” with the formulary move “and the potential treatment disruption” and the impact this could have on patients. This decision restricts treatment options for patients who could benefit from Jardiance’s life-saving cardiovascular benefit, the spokesperson added.

CVS removed 17

drugs in 10 classes, with Merck’s Zetia, Daiichi

Sankyo’s Benicar and Teva’s Nuvigil among them. Despite the removals, the company expects 99.76

percent of members will be able to keep using their current treatments.

US Senate overwhelmingly passes reauthorization of FDA’s user fees

In the US last week, Senators voted overwhelmingly to pass a key Food and Drug Administration (FDA) funding bill. The bill is now with President Trump, for his approval.

The Senate passed a five-year reauthorization of the FDA’s user fees in a 94-1 vote, with only Senator Bernie Sanders voting against the measure. The move is in major contrast to the recent rancor surrounding the Senate’s efforts to repeal ObamaCare.

The

funding reauthorizations are based on recommendations from industry groups.

This bill renews FDA’s authority to collect fees from the prescription drug and medical device industries. Together, they account for 25 percent of all FDA funding; and should amount to around US$ 8-9 billion over the next five years.

The

fee helps speed

up the approval of new drugs and devices. This funding reauthorization of FDA’s user fee comes about a month before the current user fee agreement expires.

The White House hasn’t said if it will sign the user fee bill. In a statement of administrative policy issued in July after the bill passed the House, the White House expressed concern with some minor provisions, though it did not threaten a veto.

Impressions: 2374

The year 2016 finished with a whimper insofar as mergers and acquisitions (M&As) were concerned. The preceding year — 2015 — had gone down in history as a record year for M&As in the pharmaceutical and biotech space, when deals worth US $300 billion were announced.

While drug companies were not as active on

the M&A front, the product sales growth in 2016 continued to stay extremely

robust and the order of the top ranked drugs changed little from the previous

year.

This week, PharmaCompass brings you

a compilation of the top drugs of 2016 by sales revenue.

Click here to Access All the

2016 Data (Excel version available) for FREE!

The top-sellers

Abbvie’s Humira (adalimumab) continued to remain the best-selling drug in the

world and added another US $2 billion to its 2015 sales by generating record

sales of US $16.078 billion in 2016.

Last year also saw the US Food and Drug Administration (FDA) approve Amgen’s Amjevita™ (adalimumab – atto) — a biosimilar of Humira®. Amjevita was approved for treating adults with a variety of medical conditions ranging from rheumatoid arthritis, plaque psoriasis, to ulcerative colitis.

Click here to Access All the

2016 Data (Excel version available) for FREE!

Gilead’s Harvoni (ledipasvir and sofosbuvir), with record sales of US $13.864 billion in 2015, had a slightly muted performance in 2016 as sales fell to US $9.081 billion (a drop of US $4.783 billion). Gilead failed to maintain its initial rate of new prescriptions, and competition from Merck and AbbVie forced it to offer major discounts to health insurers.

While Gilead executives still believe there is lots of growth left in the hepatitis C market, this year Gilead will continue to face headwinds as Merck's new combination pill — Zepatier — entered the market with a list price at US $54,600 for a 12-week regimen, well below the US $94,500 for Harvoni.

Biological drugs, Enbrel (etanercept),

Remicade (infliximab) and MabThera (rituximab), held onto their positions of 2015, although their combined sales increased a little over US $300

million.

This means that for yet another year, the

four best-selling drugs in the world are from biological origin.

Celgene’s Revlimid (lenalidomide) — a thalidomide derivative introduced in 2004 as an immunomodulatory agent for the treatment of various cancers such as multiple myeloma — brought in US $5.8 billion in 2015, and grew another 20 percent this year, to US $6.974 billion. Revlimid now contributes more than 60 percent to the company's total sales of US $11.229 billion.

With almost identical sales of US $6.7

billion, Roche’s cancer treatments Herceptin and Avastin were also into

the top 10 best selling drugs in 2016, making Roche have the most number of

products, three of which made it to the list.

Click here to Access All the

2016 Data (Excel version available) for FREE!

Facing onslaught of generics, biosimilars

Against the backdrop of questions being raised about

insulin pricing and possible collusion in the United States, Sanofi saw its insulin treatment Lantus (insulin glargine) drop from number six on the 2015 list to number 9 in 2016 as sales fell by US $717 million to a little over US $6 billion. Sanofi’s competitors in the diabetes space — Novo Nordisk and Eli Lilly — also registered a drop in their insulin sales.

In addition to the pricing pressure, Sanofi will continue to contend with Lilly and Boehringer Ingelheim’s FDA approved biosimilar of insulin glargine — Basaglar — which was approved in December 2015.

Click here to Access All the

2016 Data (Excel version available) for FREE!

Basaglar is biologically similar to Sanofi’s Lantus and was announced at a price 15 percent lower than that of Lantus.

GSK’s Advair, which is preparing for generic competition in 2017, saw its sales drop 5 percent in British Pounds to £3,485. However, the dollar value was significantly lower in view of the fall in the Pound’s value after Brexit.

AstraZeneca’s Crestor (rosuvastatin calcium), Otsuka’s Abilify (aripiprazole) and Novartis’ Gleevec (imatinib) all saw their sales crash in 2016 as a result of generic onslaught. The three drugs together witnessed a combined sales drop of US $5.7 billion.

Top 20 drugs by sales

Here is PharmaCompass’ compilation

of the best-selling drugs of 2016. This is based on information extracted from

annual reports and US Securities and Exchange Commission (SEC) filings of major

pharmaceutical companies.

If you would like your own copy of all the information we’ve collected, email us at support@pharmacompass.com and we’ll send you an Excel version.

Click

here to access all the 2016 data (Excel version available) for FREE!

S. No

Product

Active Ingredient

Main Therapeutic Indication

Company

2016 Revenue in Millions (USD)

2015 Revenue in Millions (USD)

Sales Difference in Millions (USD)

1

Humira

Adalimumab

Immunology (Organ Transplant, Arthritis etc.)

Abbvie

16,078

14,012

2,066

2

Harvoni

Ledipasvir and Sofosbuvir

Infectious Diseases (HIV, Hepatitis etc.)

Gilead

9,081

13,864

(4,783)

3

Enbrel

Etanercept

Immunology (Organ Transplant, Arthritis etc.)

Amgen/Pfizer Inc.

8875

8697

178

4

Remicade

Infliximab

Immunology (Organ Transplant, Arthritis etc.)

Johnson & Johnson/Merck & Co

8,234

8,355

(121)

5

MabThera/Rituxan

Rituximab

Oncology

Roche

7227

6974.55

252

6

Revlimid

Lenalidomide

Oncology

Celgene

6,974

5,801

1,173

7

Avastin

Bevacizumab

Oncology

Roche

6,715

6,617

98

8

Herceptin

Trastuzumab

Oncology

Roche

6,714

6,473

242

9

Lantus

Insulin Glargine

Diabetes

Sanofi

6,057

6,773

(717)

10

Prevnar/Prevenar

13

Pneumococcal 13-Valent Conjugate

Anti-bacterial

Pfizer Inc.

5,718

6,246

(528)

11

Xarelto

Rivaroxaban

Cardiovascular Diseases

Bayer/Johnson & Johnson

5,392

4,255

1,137

12

Eylea

Aflibercept

Ophthalmology

Regeneron Pharmaceuticals, Inc./Bayer

5,046

3,978

1,068

13

Lyrica

Pregabalin

Neurological/Mental Disorders

Pfizer Inc.

4,966

4,839

127

14

Neulasta

Pegfilgrastim

Blood Disorders

Amgen

4,648

4,715

(67)

15

Seretide/Advair

Salmeterol

Respiratory Disorders

GlaxoSmithKline

4,252

4,491

(239)

16

Copaxone

Glatiramer

Neurological/Mental Disorders

Teva

4,223

4,023

200

17

Sovaldi

Sofosbuvir

Infectious Diseases (HIV, Hepatitis etc.)

Gilead

4,001

5,276

(1,275)

18

Tecfidera

Dimethyl Fumarate

Neurological/Mental Disorders

Biogen

3,968

3,638

330

19

Januvia

Sitagliptin

Diabetes

Merck & Co

3,908

3,864

44

20

Opdivo

Nivolumab

Oncology

Bristol-Myers Squibb

3,774

942

2,832

Blockbusters in the making

With almost US $5 billion in sales, a 14 percent growth over the previous year, Pfizer’s Lyrica enjoyed its last year before generic competition enters the market as Generics (UK) Limited (Mylan) and Actavis Group PTC ehf won a patent challenge in the United Kingdom.

Lyrica generics are expected in the United

States in late 2018.

Click here to Access All the

2016 Data (Excel version available) for FREE!

As Abbvie’s Humira begins to face competition from Amgen, Abbvie’s US $21 billion buy of Pharmacyclics seems to be paying off. The Pharmacyclics buy was a way to get access to Imbruvica (ibrutinib), which generated total 2016 sales of US $3.083 billion — an increase of US $1.64 billion over the previous year.

Anticoagulants, Xarelto (rivaroxaban), Eliquis (apixaban), Pradaxa (dabigatran) all registered significant positive growth with a combined increase of almost US $ 2.75 billion.

Gilead and GSK’s combination HIV treatments — Genvoya and Triumeq — also reported sales increase of over a billion dollars each.

Sign up,

stay ahead

In order to stay informed, and receive

industry updates along with our data compilations, do sign up for the PharmaCompass

Newsletter and you will receive updated information as it becomes available

along with a lot more industry analysis.

Click here to Access All the

2016 Data (Excel version available) for FREE!

Impressions: 58546

The New

Year began with the JP Morgan Healthcare Conference— the drug industry’s annual investor meet — where industry leaders were busy announcing deals, until Donald Trump accused the industry of “getting away with murder”. His comments sent shockwaves within the industry as pharma and biotech stocks tanked. In the first Phispers of 2017, we also bring you a compilation of the likely patent conflicts this year. And, there is news on Aurobindo Pharma’s acquisition, Teva's revised guidance for 2017, lowering of growth prospects for Mylan, fresh bribery charges against Novartis and more.

Trump promises aggressive

federal bidding process to slash drug prices

Donald Trump, America’s president-elect dropped a bombshell in his first news conference held Wednesday, accusing the pharmaceutical industry of “getting away with murder”. He said he would bring

down drug prices, as well as government spending on drugs by changing the way

the country bids for drugs.

During the event held at Trump Tower in New York, Trump said: “Pharma has a lot of lobbies, a lot of lobbyists and a lot of power. And there’s very little bidding on drugs. We’re the largest buyer of drugs in the world, and yet we don’t bid properly.”

The country’s federal law forbids the government from negotiating drug prices with drug companies in order to lower the price of drugs for seniors using Medicare. Trump, however, did not announce how he will address the

issue of high drug prices. In the past though, he has called for ending the

policy.

His comment came in the midst of the JP Morgan Healthcare Conference, a

major annual investor meeting taking place in San Francisco, and knocked down

the stocks of biotech and pharmaceutical companies by around 2 percent.

“If anybody is walking away from this conference thinking ‘business as usual,’ I think that’s a mistake,” Heather Bresch, chief executive of Mylan Pharmaceuticals said at the JP Morgan meet.

“The pricing model has got to change. It’s not incremental change; I don’t think that’s what this country needs. I think it’s truly rethinking the business model,” she added. Mylan was under scrutiny recently for repeated list price increases on its lifesaving allergy drug EpiPen.

RECOMMENDED READ:

Drug costs and prescription trends in the United States: Analyzing Medicare’s $121 billion spend

Teva lowers guidance, Mylan expected to lose

US $ 800 million in 2018

Israeli drugmaker Teva revised the predictions it made in July 2016, about its financial expectations for 2017.

And these are considerably below its previous expectations. For instance, it

laid out a revenue forecast of US $ 23.8 billion to US $ 24.5 billion for 2017,

well below the US $ 25.2 billion to US $ 26.2 billion guidance it had

previously estimated. Teva now expects its earnings per share (EPS) to be between US $ 4.90 and US $ 5.30 — another big drop from its July guidance of US $ 6.00 to US $ 6.50.

Several industry observers had expected this downward revision. “I think it’s pretty clear that management’s prior expectations for 2017 were very inflated,” Umer Raffat, an Evercore ISI analyst, said.

Meanwhile, Teva began the new year by forking out over US $ 520 million in order to resolve a bribery

lawsuit in the US filed by its shareholders. It pertained to its operations in

Russia, Ukraine and Mexico.

The year gone by was a turbulent one for Teva.

For instance, its US $ 2.3 billion acquisition of Rimsa (short for Representaciones e Investigaciones Médicas, SA de CV), a leading pharmaceutical manufacturing and distribution company in Mexico, went the Ranbaxy way, with the former owners filing a legal complaint against Teva. The complaint mentioned that Teva is suffering from “buyer’s remorse” and is trying to undo the transaction “by any desperate measure” after destroying the Rimsa companies with firings and manufacturing shutdowns.

It’s not just Teva which is set to see a downtrend. Mylan's EpiPen — which hogged the headlines last year for its price hikes — is projected to face substantial decline, until 2018, say analysts.

EpiPen is all set to face competition from Kaleo’s Auvi-Q (another

epinephrine injection), which is due for launch in the first half of 2017,

Ronny Gal of Bernstein Research said. EpiPen (excluding the generic version) will

bring in only US $ 300 million in 2018 for Mylan, down from its US $ 1.1

billion estimate for 2016, Bernstein Research said.

Aurobindo to acquire Portugal’s Generis Farmaceutica

The New Year began with a bang for India’s Aurobindo Pharma. The company said it has inked a pact to acquire Portugal’s Generis Farmaceutica SA from Magnum Capital Partners for a consideration of US $ 143 million (or €135 million).

In a statement, Aurobindo Pharma said the binding agreement has been inked through Aurobindo’s wholly-owned subsidiary — Agile Pharma BV Netherlands. Generis produces and sells pharmaceutical products in Portugal.

The combined entity will benefit from a robust pipeline covering all major molecules coming off patent in the next five years, V Muralidharan, Senior Vice President of European Operations at Aurobindo Pharma, said. “The acquisition of Generis, by leveraging its strong portfolio and unrivalled brand recognition will allow us to establish ourselves as the top generics player in the Portuguese market,” he added.

The deal, however, is conditional, and depends on obtaining necessary approvals from Portuguese authorities. The acquisition deal includes Generis’ manufacturing facility in Amadora (Portugal) with a capacity to produce 1.2 billion tablets/capsules/sachets annually.

Patent battles between the Big Pharma could dominate 2017

This year may well be the year of big patent

battles between pharmaceutical giants. It began with a ruling on a patent

infringement case involving partners Sanofi-Regeneron and Amgen. A US federal judge ordered French pharmaceutical giant Sanofi and partner Regeneron to stop selling their latest cholesterol treatment — Praluent — due to patent infringement. After the court order, the stocks of Regeneron and Sanofi got hammered.

Sanofi and Regeneron plan to immediately appeal

that decision. According to the ruling, Sanofi and Regeneron had infringed

biotech giant Amgen’s patents for a rival cholesterol fighting drug — Repatha. Both Praluent and Repatha are the only approved ‘PCSK9 inhibiting’ therapies known to considerably reduce bad cholesterol levels in patients during clinical trials. Both won FDA approval in 2015 and both are expensive — priced at US $ 14,000 per year.

Sanofi is also in a battle with Novo Nordisk. In the last week of December, there was news that Sanofi filed a lawsuit in the US accusing Novo Nordisk of making the false claim that Sanofi’s insulin drugs would no longer be available for many US patients. According to Sanofi, Novo made that claim in order to promote its own competing drug. The complaint seeks an order forcing Novo to pay damages and withdraw marketing materials for its drug Tresiba.

Both Sanofi and Novo have been tied in a regulatory

race for their basal insulin/GLP-1 combo diabetes products. But Sanofi is already ahead in the race, as last week it rolled out Soliqua, a combination of

(insulin) Lantus and GLP-1 drug Adlyxin, at a list price of US $ 127 for a 300-unit pen. Novo’s Xultophy—which received regulatory approval on November 21—won’t be in the market until early May.

And then there is the battle between Merck

and Gilead. The latter ended the year on a sour note after a federal jury in the US ordered Gilead to pay US $ 2.5 billion in royalties to Merck in an ongoing

dispute. The legal battle between Merck and Gilead centres around Gilead's flagship hepatitis C cures — Sovaldi and Harvoni. Both these drugs gained disrepute for their lofty prices. Yet they

dominated the hepatitis C drug market (before they ran into trouble with

insurers and benefits managers who demanded better deals).

Lastly, there is a significant patent battle brewing in experimental biopharma technology in the form of a spat between the University of California and the University of Vienna on one side and the Broad Institute of MIT and Harvard University on the other. The battle centers around CRISPR-Cas9 — an early-stage gene-editing platform that significantly simplifies the process of slicing and dicing problematic genetic material. It is being tested as a treatment option for cancer, sickle cell, and a host of other diseases.

The dispute is around who owns the patent

right to CRISPR. While University of California at Berkeley professor Jennifer Doudna and the University of Vienna’s Emannuelle Charpentier were first to announce their discoveries, MIT's Feng Zhang actually won the patent after going through an expedited process.

After Korea, US and China, Novartis faces

bribery charges in Greece

In the last one year, Swiss drugmaker Novartis has faced three sets

of bribery charges. The fourth one came in the New Year, with Greek officials

announcing they are investigating Novartis for bribery in the wake of local media reports raising questions about the

company.

Greek corruption prosecutors raided the Athens offices of Novartis last week, as part of the probe over bribery

allegations. Greek authorities have reportedly interviewed scores of sources.

In March 2016, Novartis paid US $ 25 million to settle a US Securities and Exchange

Commission (SEC) case that claimed the Swiss drug maker paid bribes to health

professionals in China to increase sales during 2009 and 2013.

While the US case got settled, Novartis has

been accused by a whistleblower in Turkey of paying bribes through a consulting

firm to secure business advantages.

In August 2016, PharmaCompass had

reported that six former and current Novartis executives at its unit in South Korea allegedly paid more than US $ 2 million to doctors in return for prescribing its medicines. Among those indicted was the former CEO of Novartis’ Korea unit.

Twitter

bans Martin Shkreli for making unwanted advances at journalist

In September 2015, Martin Shkreli, the former

CEO of Turing Pharmaceuticals, had received widespread flak for raising the

price of anti-parasitic drug Daraprim by a factor of

56. Since the Daraprim episode, Shkreli has also been indicted on unrelated

fraud charges.

Well, Shkreli is back in news. And once again for

all the wrong reasons. A few days back, he was temporarily kicked off Twitter and its live-streaming platform — Periscope — for making unwanted advances toward Lauren Duca, the weekend editor of Teen Vogue.

In a tweet to Twitter’s CEO Jack Dorsey, Duca said: “How is this allowed?” She included two screenshots of Shkreli's Twitter profile page.

Apparently, Shkreli manipulated a photograph of Duca with her husband, wherein he had put his face in place of Duca’s husband. Duca also posted another screenshot wherein Shkreli had put up a montage of Duca’s photos as his Twitter background image, with the text: “For better or worse, till death do us part, I love you with every single beat of my heart.” Moreover, Shkreli’s Twitter bio said that he had a “small crush” on Duca. “Hope she doesn't find out,” it said.

According to the Twitter spokesperson, Twitter’s rules prohibit “targeted harassment”.

Oncology deals: Takeda acquires Ariad; Daiichi ties up

with Kite; Ipsen with Merrimack

The JP Morgan conference saw some major deals being announced in the field of oncology. Japan’s Takeda Pharmaceutical Company and Massachusetts-headquartered Ariad Pharmaceuticals recently entered into a definitive agreement under which Takeda will acquire all outstanding shares in Ariad for

US $24 per share in cash, in a deal valued at US $ 5.2 billion.

Ariad

Pharmaceuticals is a cancer-focused drugmaker. The agreement has been

unanimously approved by the boards of directors of both companies. It is likely

to close by the end of February this year, subject to required regulatory

approvals and other conditions.

Kite Pharma — a California-based, clinical-stage biopharmaceutical company engaged in the development of novel cancer immunotherapy products — has entered into a deal with Daiichi Sankyo of

Japan. Kite Pharma will enter the Japanese

market, along with Daiichi, which has lined up US $ 250 million deal.

Kite Pharma’s new drug application for the pioneering CAR-T drug —KTE-C19 — is in the final weeks of being completed and shipped to regulators in search of an accelerated approval. CAR-T (short for chimeric antigen receptors-T cell) is a therapy for cancer, using a technique called adoptive cell transfer. The T cells, which can recognize and kill cancer cells, are reintroduced into the patient.

Under the deal, Kite will be taking US $ 50 million

upfront and US $ 200 million in milestones for the deal, while Daiichi Sankyo

is reserving another US $ 200 million in additional milestones for each new

drug candidate that Kite takes to the FDA over the next three years.

Meanwhile, French pharmaceutical company Ipsen

has entered into a US $ 1 billion deal to acquire oncology assets from Massachusetts-headquartered Merrimack

Pharmaceuticals, including the pancreatic cancer drug Onivyde.

The deal is broken down into two steps, involving

an upfront fee of US $ 575 million, to be followed by a potential US $450 million that

would depend on approvals for Onivyde in the US.

With this deal, Merrimack is likely to pay off

US $ 195 million in debts, return US $ 200 million to stockholders and make a

further payment of US $ 450 million to shareholders. Merrimack would also

plough US $ 125 million into the development of three experimental cancer

drugs.

Impressions: 5614

This week, Phispers brings you news on FDA meeting its generic drug approval goal, M&A deals in the world of pharma, Obama’s article in JAMA, Abbott’s new bio-degradable stent for heart patients, Amgen’s predicament in the field of biosimilars and more.

FDA meets generic

drug approval goal a year ahead of schedule

The Center for Drug Evaluation and Research (CDER) at the US

Food and Drug Administration (FDA) has acted on more than 90 percent of the

Generic Drug User Fee Amendments (GDUFA)

backlog.

The GDUFA required the FDA to meet this goal by September 30,

2017, which is the end of the five-year funding period authorized under the GDUFA.

This way, the FDA has achieved its backlog commitment more than one year ahead

of schedule. This information was provided by Janet Woodcock, director of the

CDER.

Amgen’s double-standards on biosimilars; China to lead the biotech boom

Amgen

is playing

on the offense as well as on defense insofar as biosimilars are concerned. Last week, the FDA approved Amgen’s biosimilar of AbbVie’s Humira. And, if FDA insiders are to be believed, Novartis’

generics division Sandoz

may soon get the nod for its biosimilar of the US $ 9 billion drug Enbrel.

Amgen sells Enbrel in the US.

Amgen’s Humira biosimilar threatens AbbVie’s US $ 14 billion franchise. While Amgen is fighting to get its biosimilar on the market, it’s also fighting Novartis tooth and nail to guard its drug Enbrel. It has waged a legal war against Novartis’ development strategy, which studied the drug only for psoriasis but is now looking for an approval on a full slate of indications.

Meanwhile, a survey of international companies found that 85

percent of the respondents believe that China is set to have the fastest

growing biologics sector over the next decade, while 65 percent predict

patented new chemical entities (NCEs) will be discovered and developed within

China in as little as five years. The driving force behind these findings is

the growing biotechnology and R&D industry, which is heavily supported by

the Chinese government.

2016 shows lively

M&A activity, but deal sizes are smaller

Merger and acquisitions in the world of pharma picked up in

the April-June quarter of 2016.

According to market intelligence firm EvaluatePharma, pharma and biotech

companies announced transactions worth US $ 22.1 billion. However, the size of the

M&A

deals were a lot smaller, with AbbVie’s US $ 9.8 billion acquisition of Stemcentrx being the largest deal in the April-June quarter.

The pickup in M&A activity is an encouraging sign for

the industry that has been concerned about fears of a slowdown. This week also

saw Japanese drug maker Nichi-iko

acquire Sagent Pharmaceuticals in an all-cash deal of US $ 736 million. Yet,

2016 might not match the last two years in terms of deal value.

Theresa May says Britain will defend its pharma sector

from takeovers

While Britain mulls a second Brexit

referendum, Theresa May, the new prime minister of the UK, indicated in a press

conference that she

would help shield the nation’s pharmaceutical industry from takeovers, considering it an important sector for Britain.

This announcement comes after US giant Pfizer failed

in its bid to acquire AstraZeneca

and GlaxoSmithKline

has been rumored to be a takeover target.

British drug companies Shire,

AstraZeneca and GSK have been picked as potential takeover targets by

Pfizer, which had earlier tied up with Ireland's Allergan

before the deal got cancelled. Analysts say Pfizer needs to find a partner in

its quest to relocate its headquarters and lower its tax burden. And the three

British drug companies fit the bill.

A new industrial strategy is needed to enable the government to “defend a sector that is as important as pharmaceuticals is to Britain,” May said in a press conference in London this week.

Abbott’s dissolving stent offers long-term benefits to heart patients

Cardiologists and heart patients in the US now have a new

option for treating blockages in coronary arteries. Last week, cardiologists

began implanting

Absorb – Abbott Laboratories’ new biodegradable stent – in patients after it got FDA’s approval on July 5.

Unlike the permanent metal devices that have been used to

prop open clogged vessels for more than 20 years, Absorb is designed to fully

dissolve within two to three years of its deployment.

Proponents of the new device say it holds the potential for

long-term benefits over metal stents, including widely used drug-coated stents

that have dominated the market since 2003.

Drug makers

financially supported lawmakers who opposed Medicare Part B overhaul

Four months ago, the Obama administration had unveiled a

proposal to overhaul Medicare Part B, a medical insurance that covers necessary

services and supplies for American citizens. A large number of lawmakers had opposed

the effort.

This week, a new analysis has revealed that drug makers, who were worried that the Obama administration’s proposal to overhaul Medicare Part B will cut into their revenues, gave

lawmakers who opposed the overhaul considerably more

financial support than lawmakers who have not raised objections.

According to an analysis by a consumer advocacy group, 310

lawmakers who opposed the overhaul or were critical of it received a total of

more than US $7.2 million from drug and health product firms for their 2016

campaigns. The amount given to each representative averaged more than US $ 23,300.

Obama tells drug

makers to renew their commitment to improving public health

US President Barack Obama has written a game plan on

healthcare for the next president, including a crackdown on prices of

prescription drugs. In a first for a sitting president, Obama wrote

a scholarly article in the Journal of the American Medical Association (JAMA) that examines the passage of the Affordable Care Act – his landmark health law.

He also proposes future improvements to the US healthcare

system. Obama reprimanded drug makers for their stance

on pharmaceutical pricing and challenged companies to renew their

commitment to improving public health. He also castigated the Congress for

refusing to work with him to provide health coverage more quickly.

Cadila, Lupin,

Alembic close issues with the FDA

After weeks of news pertaining to non-compliance by India’s drug companies, the country’s pharmaceutical industry heaved a sigh of relief as Cadila,

Lupin and Alembic

reported

closure of some issues with the FDA.

“This receipt of EIR (Establishment Inspection Report) only indicates closure

of the inspection points (483s) raised, based on the inspection carried out between August 28, 2014 and September 05, 2014. What is ‘closed’ is the initial review that resulted in the warning letter issuance,” Cadila Healthcare said in a regulatory filing.

Gilead wins lawsuit

against AIDS activist group; gets approval for hepatitis C drug

It’s been a good fortnight for Gilead

Sciences. Last week, a

lawsuit against the drug maker by an AIDS activist group was dismissed by a

US federal court judge. The lawsuit accused Gilead Sciences of manipulating the

patent system in order to thwart competition for its HIV medicines.

In its lawsuit, the AIDS Healthcare Foundation had charged

that Gilead not only violated antitrust laws, but also prevented countless HIV

patients from access to a newer and safer treatment.

Gilead Sciences also recently won FDA approval for another groundbreaking hepatitis C drug. This first of its kind oral, once-a-day drug – known as Epclusa – can treat all six major subtypes of hepatitis without patients taking any other drug, including the debilitating ribavirin.

But the cost

of Epclusa is prohibitive. The company said Epclusa would be priced at US $

74,760 for a 12-week course of treatment, which works out to US $ 900 per

tablet.

In 2013, Gilead was criticized for initially pricing its first hepatitis C drug – Sovaldi – at US $ 1,000 a pill. Its second-generation drug Harvoni was

also launched at around the same price.

Impressions: 2235