10 Dec 2025

// PRESS RELEASE

01 Oct 2025

// PRESS RELEASE

29 Sep 2025

// PRESS RELEASE

KEY SERVICES

KEY SERVICES

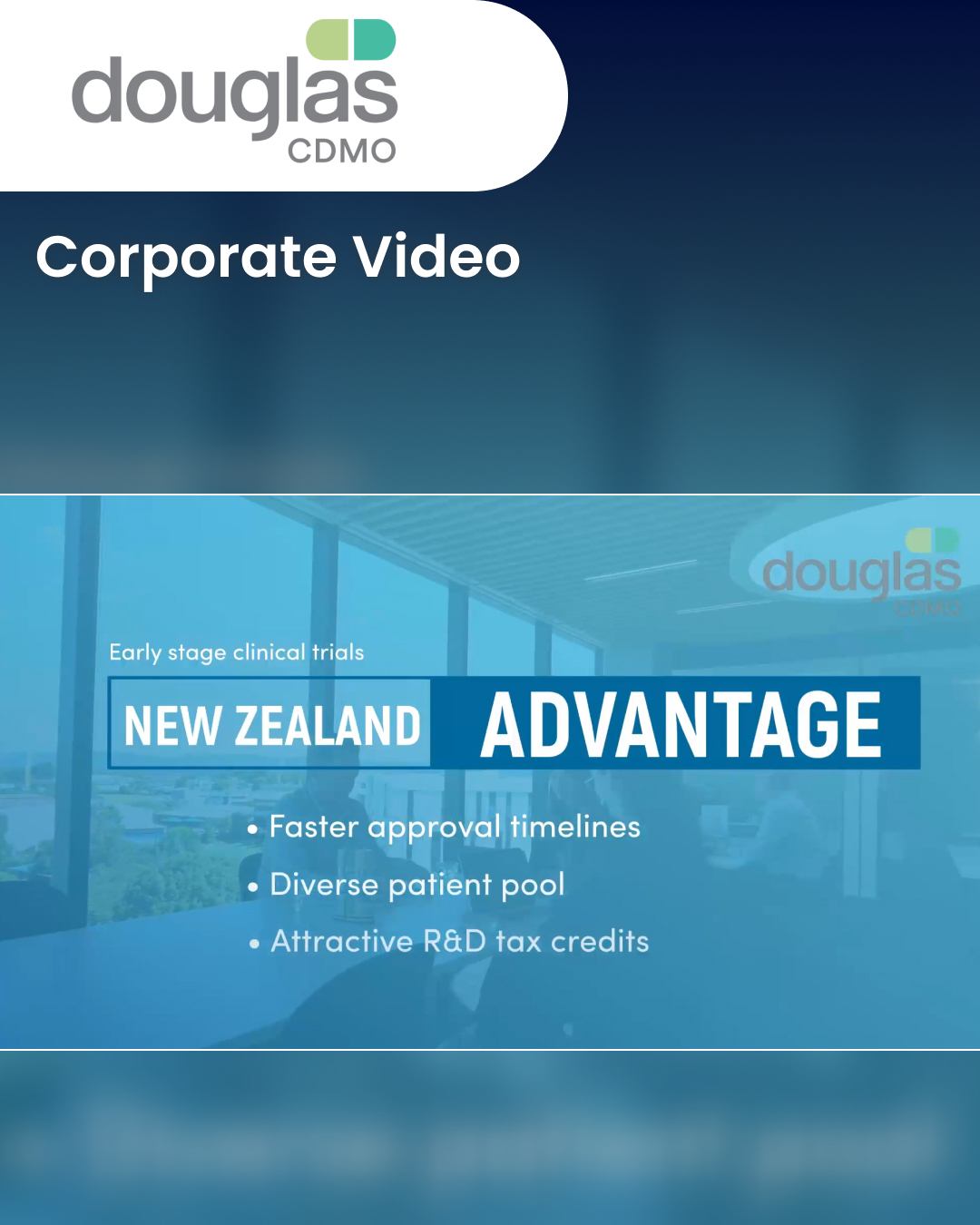

End-to-end drug development, specializing in high-potency softgels and liquids, providing global partners with a competitive advantage.

About

Industry Trade Show

Attending

16-18 March, 2026

Industry Trade Show

Attending

16-18 May, 2026

CPhI North AmericaCPhI North America

Industry Trade Show

Attending

02-04 June, 2026

CONTACT DETAILS

Events

Webinars & Exhibitions

Industry Trade Show

Attending

16-18 March, 2026

Industry Trade Show

Attending

16-18 May, 2026

CPhI North AmericaCPhI North America

Industry Trade Show

Attending

02-04 June, 2026

CORPORATE CONTENT #SupplierSpotlight

https://www.pharmacompass.com/radio-compass-blog/cdmo-activity-tracker-veranova-carbogen-lead-adc-investments-axplora-polfa-tarchomin-famar-expand-european-footprint

https://www.pharmacompass.com/radio-compass-blog/cdmo-activity-tracker-bora-polpharma-make-acquisitions-evonik-euroapi-porton-announce-technological-expansions

https://www.pharmacompass.com/radio-compass-blog/cdmo-activity-tracker-novo-s-parent-buys-catalent-for-us-16-5-bn-fujifilm-merck-kgaa-axplora-lonza-expand-capabilities

10 Dec 2025

// PRESS RELEASE

https://www.douglascdmo.com/insights/articles/douglas-cdmos-commitment-to-a-sustainable-future-in-global-healthcare

01 Oct 2025

// PRESS RELEASE

https://www.douglascdmo.com/insights/articles/softgels-proven-formula-for-pharma-commercial-success

29 Sep 2025

// PRESS RELEASE

https://www.douglascdmo.com/insights/articles/your-guide-to-minimizing-scope-creep

01 Jul 2025

// PRESS RELEASE

https://www.douglascdmo.com/insights/articles/the-role-of-cdmos-in-supporting-generic-drug-development-for-the-usa

20 May 2025

// PRESS RELEASE

12 May 2025

// PRESS RELEASE

Services

Packaging

Drug Product Manufacturing

API & Drug Product Development

ABOUT THIS PAGE

Douglas CDMO

Douglas CDMO