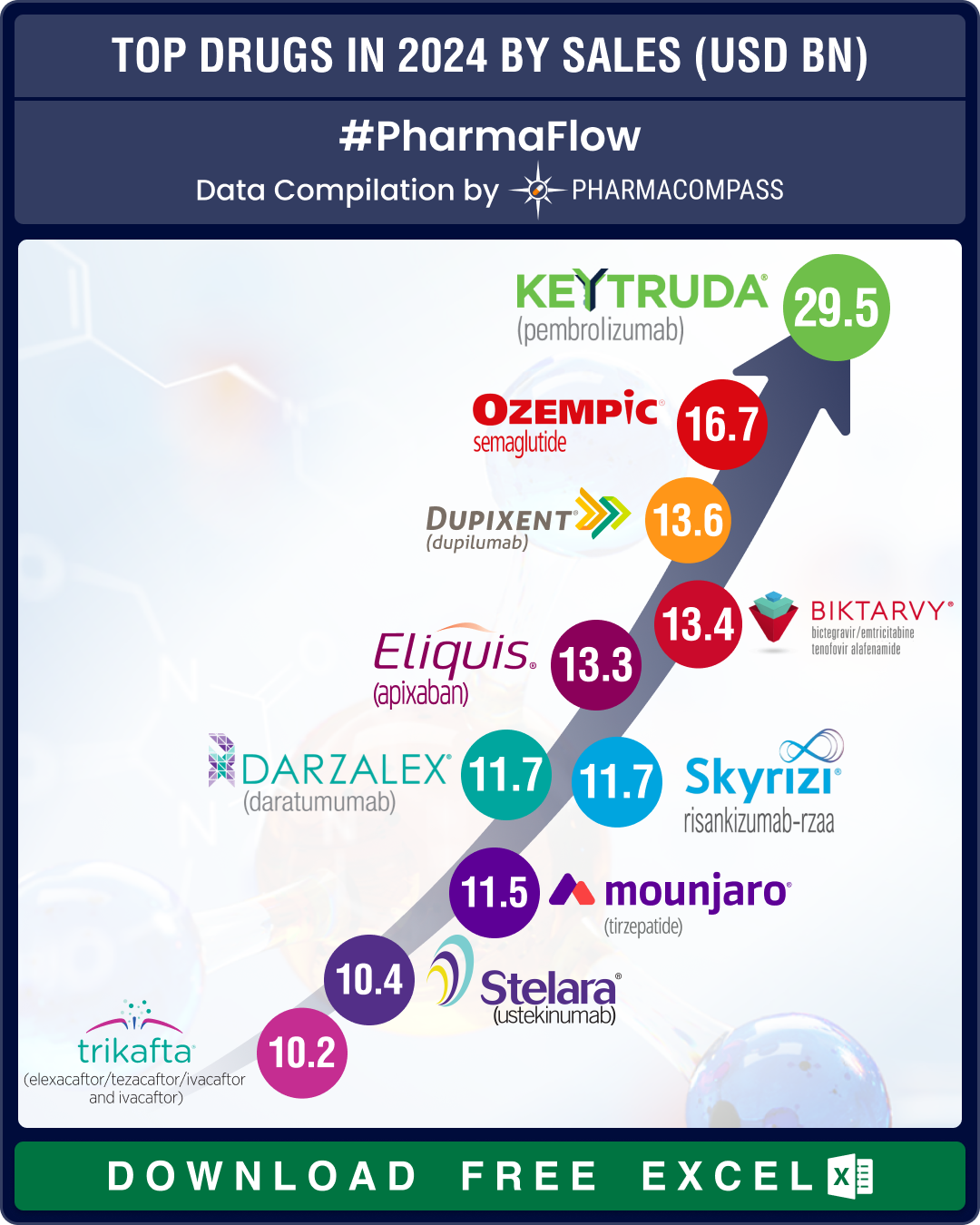

Top Pharma Companies & Drugs in 2024: Merck’s Keytruda maintains top spot as Novo’s semaglutide nips at its heels

In 2024, Big Pharma players consolidated

and maintained their dominance, even as innovation continu

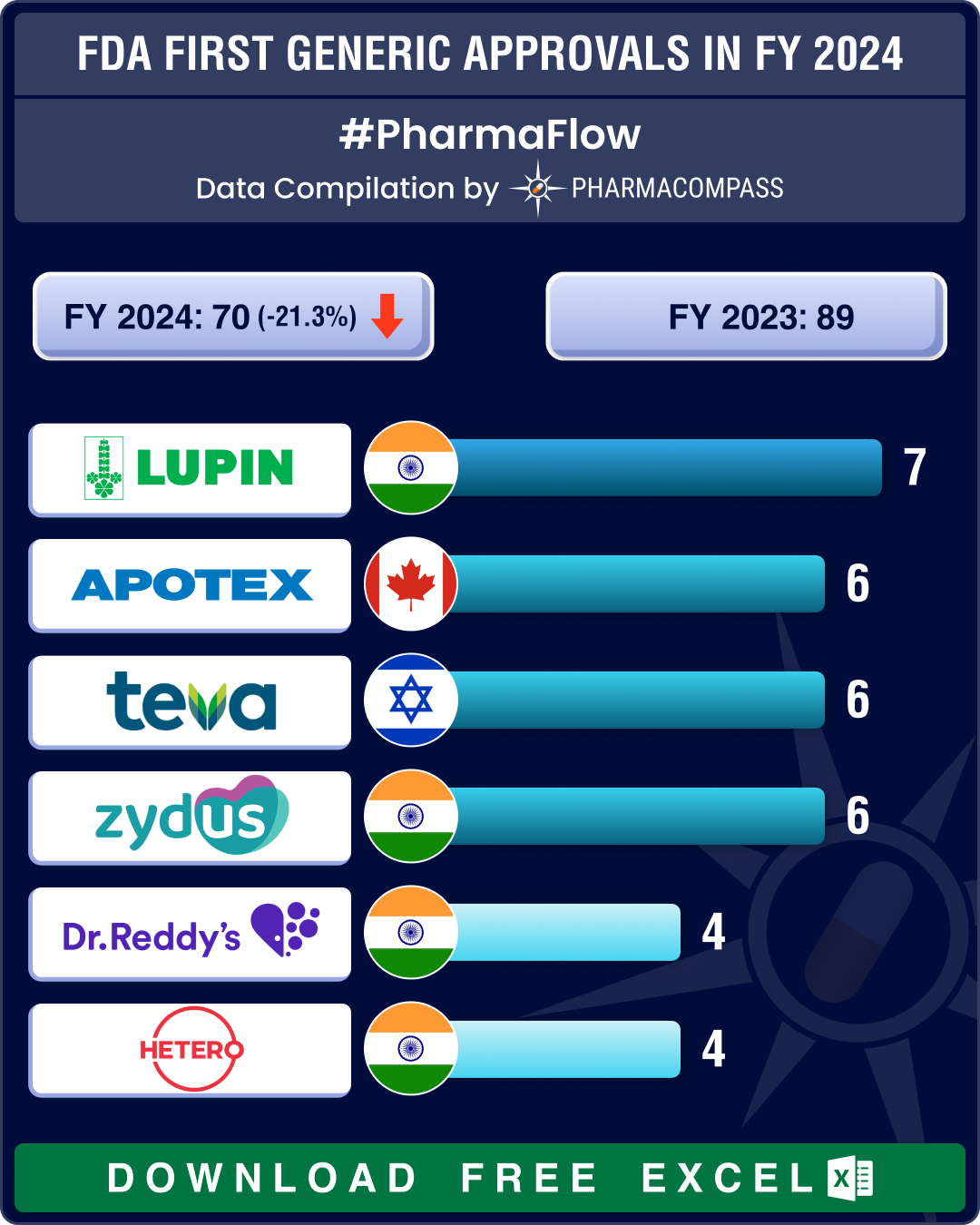

FDA’s first generic approvals slump 21% in 2024; Novartis’ top seller Entresto, cancer blockbuster Tasigna lead 2024 patent cliff

A watershed moment in the journey of a drug is when it transitions from being a patented, high‐

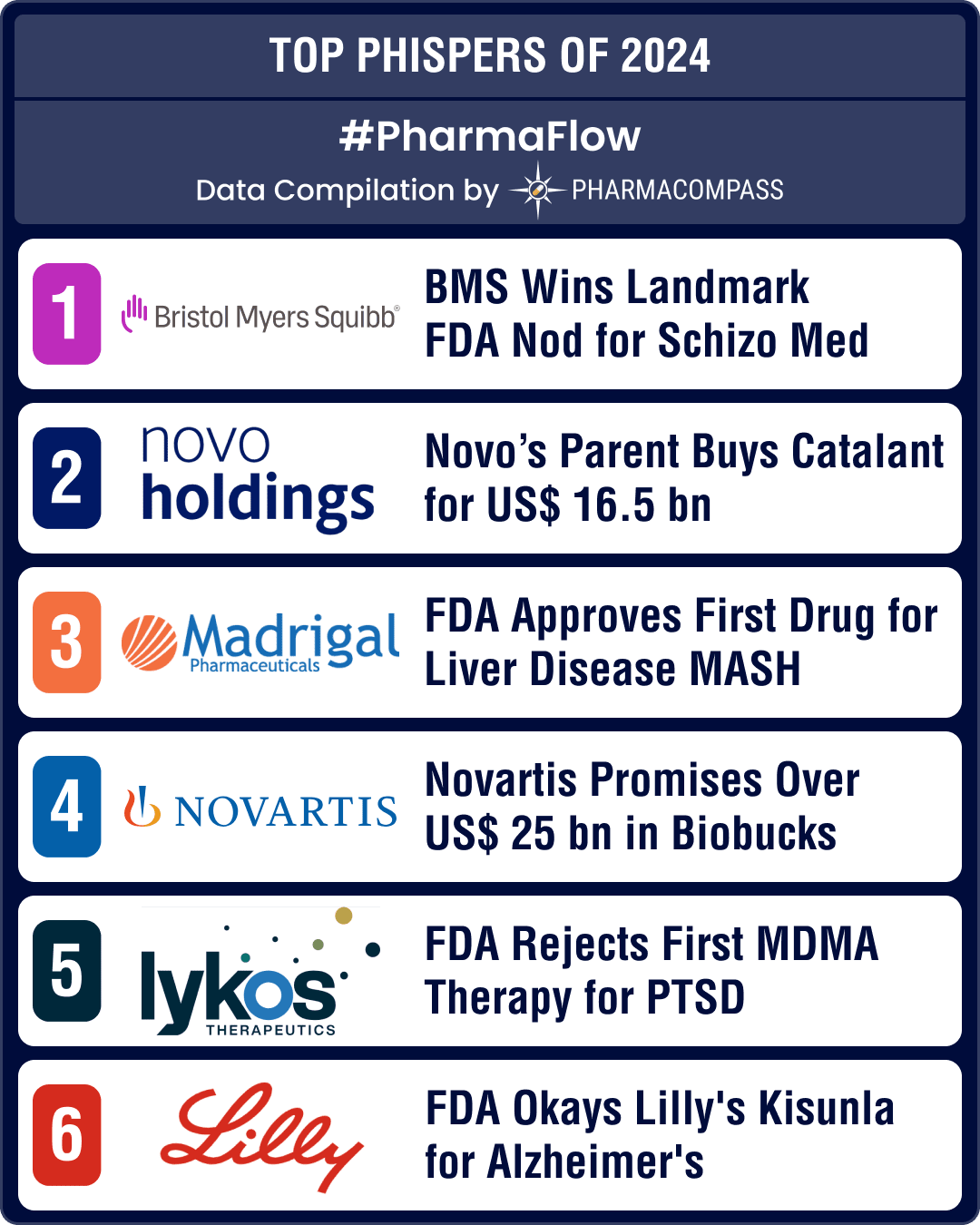

FDA’s landmark approvals of BMS’ schizo med, Madrigal’s MASH drug, US$ 16.5 bn Catalent buyout make it to top 10 news of 2024

The year 2024 was marked by some landmark drug approvals in the areas of schizophrenia, metabolic dy

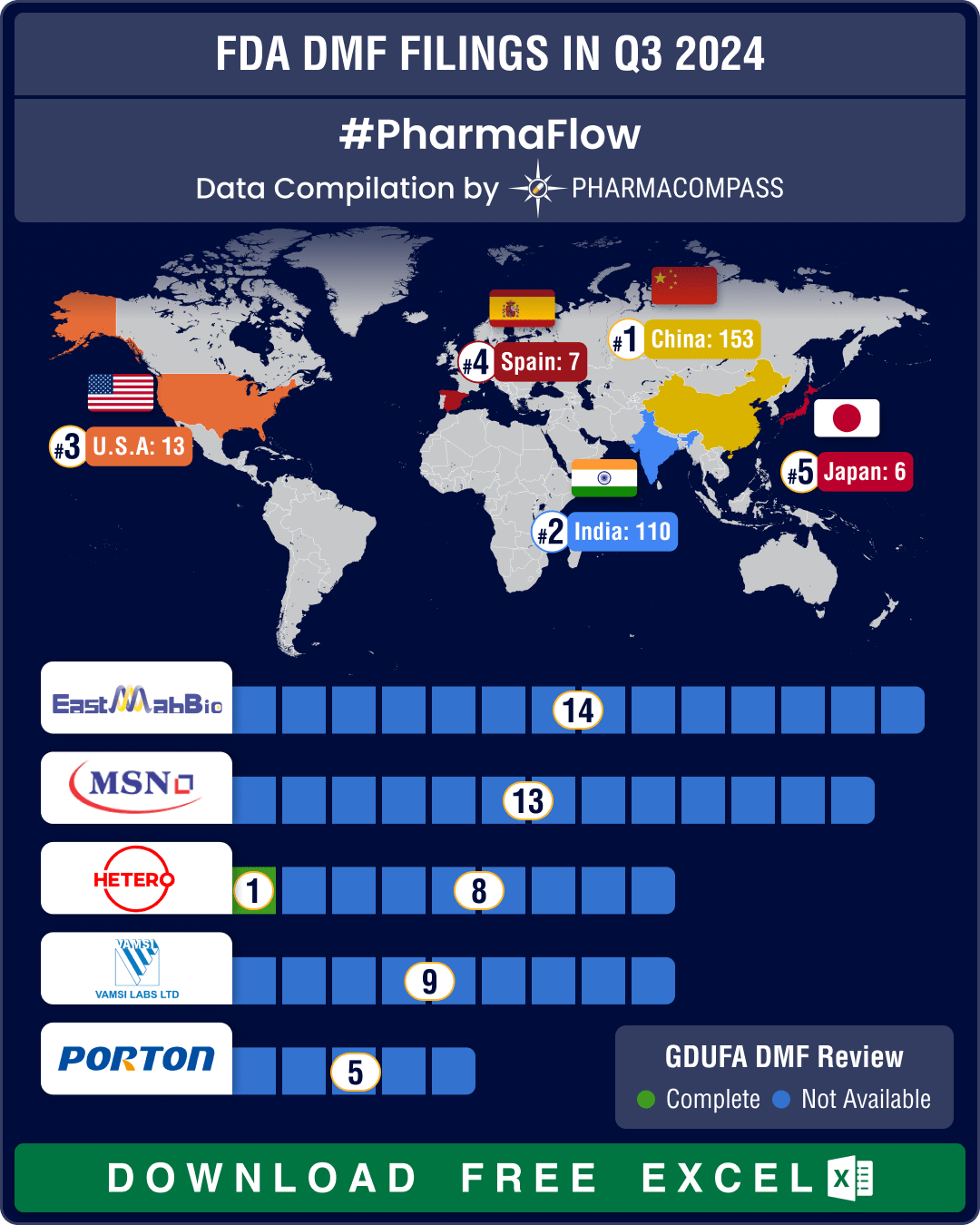

DMF filings hit all-time high in Q3 2024; China tops list with 58% increase in Type II submissions

Drug Master Files, or DMFs, are confidential documents that play a crucial role in the pharmaceutica

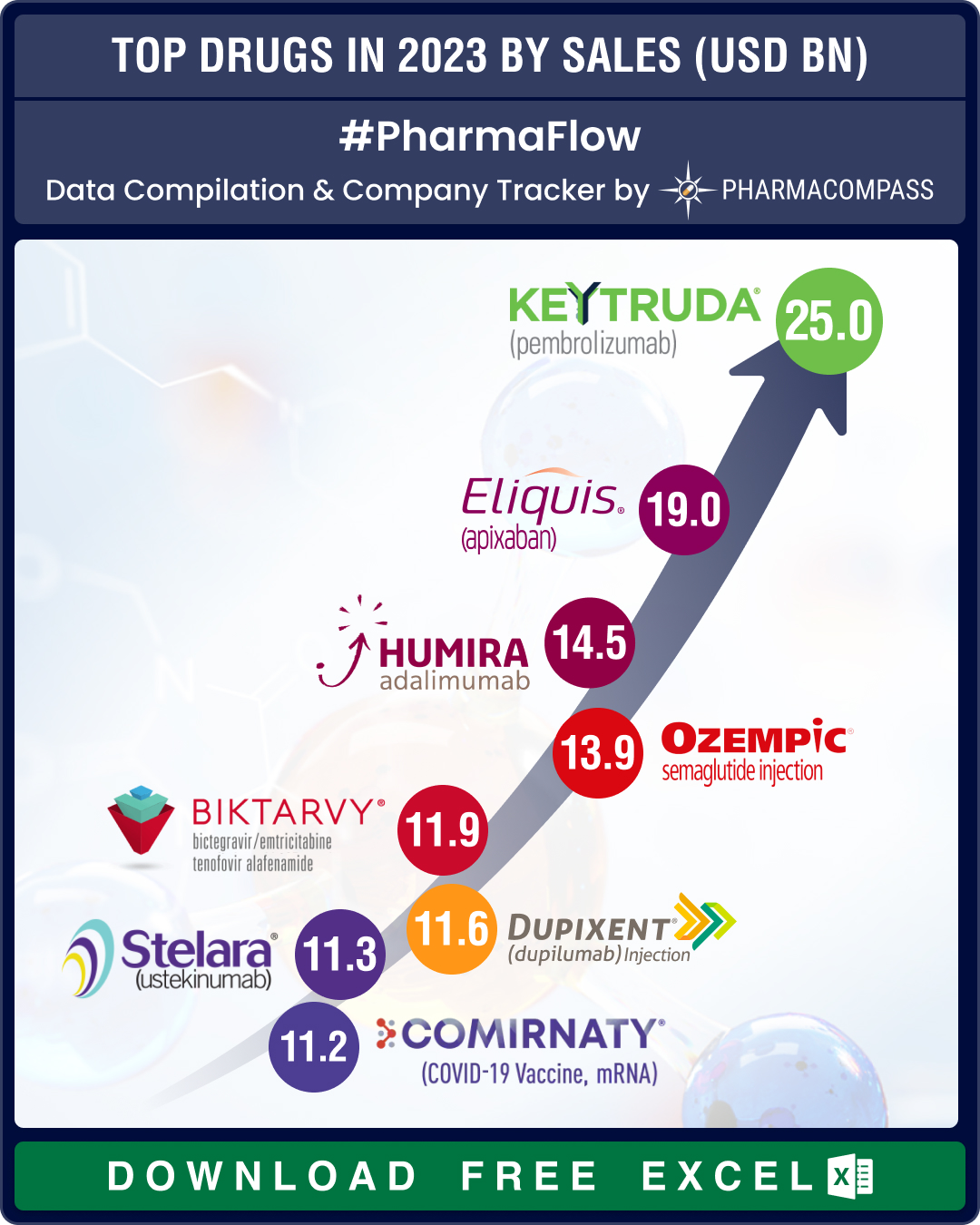

Top Pharma Companies & Drugs in 2023: Merck’s Keytruda emerges as top-selling drug; Novo, Lilly sales skyrocket

The pharma industry clearly recalibrated itself in 2023, turning its focus away from Covid and onto

Market Place

Market Place Sourcing Support

Sourcing Support