By PharmaCompass

2022-12-15

Impressions: 3,380 Article

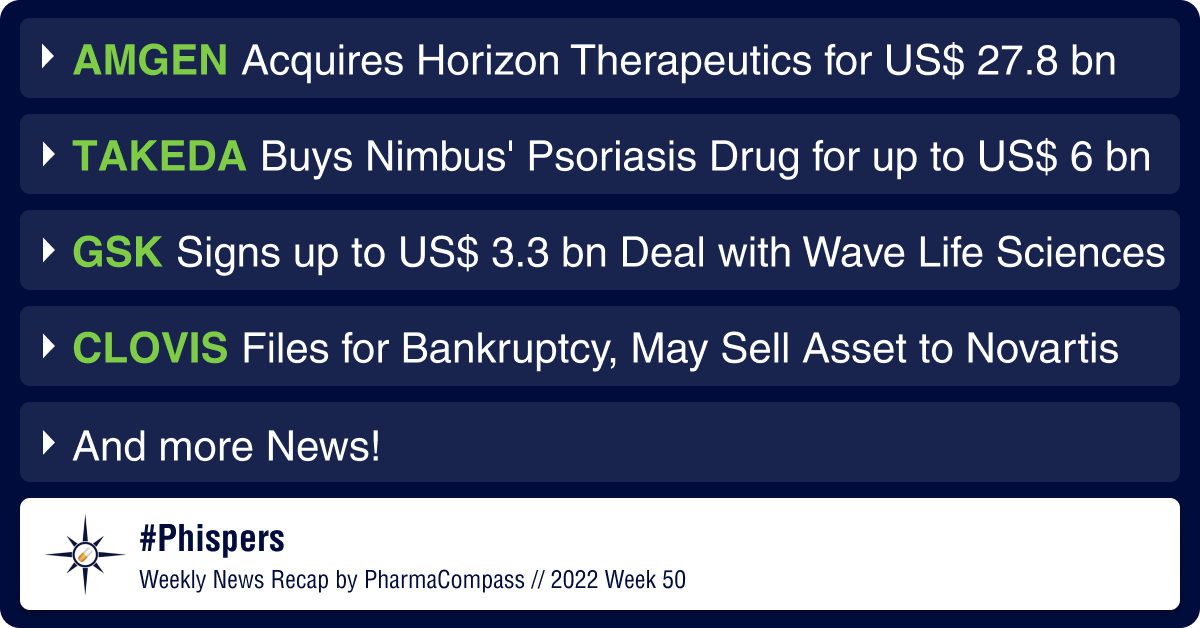

It’s nearly Christmas time and drugmakers are on a shopping spree. Amgen announced the biggest deal of the year – it is acquiring Irish rare disease drugmaker Horizon Therapeutics for US$ 27.8 billion. Japanese drugmaker Takeda said it is buying Nimbus Therapeutics’ experimental psoriasis drug for up to US$ 6 billion, its biggest buy since it purchased Shire for US$ 62 billion in 2019.

In other deals, GSK signed a potential US$ 3.3 billion collaboration with Wave Life Sciences to advance several oligonucleotide therapeutics. Gilead’s Kite and Arcellx have inked a US$ 225 million deal to co-develop and co-commercialize the latter’s multiple myeloma candidate. And Vertex has signed a US$ 224 million deal with Entrada Therapeutics to develop new treatments for a rare muscle disease.

In approvals, Mirati Therapeutics’ Krazati (adagrasib) has received an accelerated approval from the US Food and Drug Administration (FDA) as a second-line treatment for adults with KRAS G12C-mutated locally advanced or metastatic non-small cell lung cancer (NSCLC). The agency has also approved Roche’s blockbuster drug Tecentriq (atezolizumab) as a treatment for patients two years of age and older suffering from unresectable or metastatic alveolar soft part sarcoma (ASPS), a rare soft tissue cancer. And, the FDA has granted fast track designation to Pfizer and BioNTech’s mRNA-based vaccine candidate for influenza and Covid-19.

In trial news, a combination of Moderna’s experimental messenger RNA cancer vaccine and Merck’s blockbuster immunotherapy Keytruda has shown benefit in patients suffering from stage III/IV melanoma in a mid-stage trial. Novartis’ experimental oral drug — iptacopan — has been successful in treating paroxysmal nocturnal hemoglobinuria (PNH), a rare blood disorder, in a late-stage trial. And Belgian drugmaker UCB’s bimekizumab has been successful in treating patients suffering from moderate-to-severe hidradenitis suppurativa, a skin disease.

In negative news, a panel of external experts to the FDA has voted 8-3 against recommending Cytokinetics’ heart drug, omecamtiv mecarbil, as a treatment for a type of heart failure. And a combination of Exelixis-Ipsen’s Cabometyx (cabozantinib) and Roche’s Tecentriq (atezolizumab) has failed to meet the primary endpoint in a phase 3 lung cancer trial.

Meanwhile, Colorado-based cancer drugmaker Clovis Oncology has filed for bankruptcy in a US court. And, the FDA has issued a warning letter to Centrient’s API facility in India for cGMP violations.Amgen to buy rare disease drugmaker Horizon Therapeutics for US$ 27.8 billion

Amgen announced the biggest pharmaceutical deal of the year — it is acquiring rare disease drugmaker Horizon Therapeutics for US$ 27.8 billion. The Irish firm develops medicines for rare autoimmune and severe inflammatory diseases mostly sold in the US.

This is the second major buyout by Amgen in recent months. In August, it had picked up Californian biotech ChemoCentryx for US$ 3.7 billion to help broaden its portfolio of inflammation and kidney drugs. The deal will give Amgen access to Horizon’s two best-selling drugs – thyroid eye disease drug Tepezza and gout treatment Krystexxa. Amgen expects the deal to close in the first half of 2023.

Takeda to buy Nimbus’ experimental psoriasis drug for potential US$ 6 billion

Takeda Pharmaceutical is buying US-based Nimbus Therapeutics’ experimental psoriasis drug for up to US$ 6 billion. The deal is among the pharma industry’s largest single-asset purchases since Amgen bought Otezla from Celgene in 2019 for US$ 13.4 billion. It is also the biggest deal for the Japanese drugmaker since it purchased Shire in 2019 for US$ 62 billion. The ambitious buyout had stretched Takeda’s finances thin, prompting it to sell some of its assets to reduce the debt burden.

Takeda will pay US$ 4 billion upfront to Nimbus for the drug, NDI-034858. The drugmaker has pledged Nimbus another potential US$ 1 billion if the drug’s annual sales exceed US$ 4 billion, and another US$ 1 billion when sales cross US$ 5 billion. Last week Nimbus said the TYK2 inhibitor drug had shown statistically significant reduction in moderate-to-severe psoriasis in a mid-stage study. It is expected to enter late-stage trials next year.

EU authorizes Takeda’s dengue vaccine: Takeda’s dengue vaccine – Qdenga – has been authorized by the European Union for use in those four years and older to prevent any of the four so-called serotypes of the mosquito-borne disease. Last month, the FDA had granted priority review to Qdenga. Sanofi’s Dengvaxia was the first dengue vaccine to be approved in the US in 2019, but its usage is severely restricted.

GSK signs up to US$ 3.3 billion deal with Wave Life Sciences

GSK has signed a potential US$ 3.3 billion collaboration with Massachusetts-based Wave Life Sciences to advance oligonucleotide medicines. The deal will give GSK the global license to Wave’s preclinical RNA editing therapy, WVE-006, which is being developed as a treatment for alpha-1 antitrypsin deficiency (AATD), an inherited disorder that can cause lung and liver disease.

The UK-based drugmaker will make an upfront cash payment of US$ 120 million to Wave and invest another US$ 50 million in equity. For WVE-006, the Massachusetts-based biotech can earn up to US$ 525 million in milestones.

As part of the four-year collaboration, GSK can advance up to eight preclinical programs, while Wave can advance up to three preclinical programs using Wave’s PRISM drug development platform and GSK’s in-house expertise in genetics and genomics. Wave will be eligible to receive milestones of up to US$ 375 million for each of the eight additional programs.

Gilead’s Kite, Arcellx in deal for blood cancer: Gilead Sciences’ cell therapy unit Kite Pharma and Arcellx have entered into a collaboration to co-develop and co-commercialize Arcellx’s lead product candidate for the treatment of patients with relapsed or refractory multiple myeloma. Kite will pay Arcellx US$ 225 million in cash and another US$ 100 million in equity for the phase 2 cell therapy, CART-ddBCMA.

Vertex to collaborate with Entrada for rare muscle disease drugs: Vertex Pharmaceuticals and fellow Boston-based biotech Entrada Therapeutics have inked a US$ 224 million deal to develop new treatments for a rare muscle disease – myotonic dystrophy type 1 (DM1). Vertex will gain rights to develop DM1 drugs created through Entrada’s Endosomal Escape Vehicle (EEV) technology platform. Entrada’s most advanced drug for DM1, ENTR-701, is in preclinical development. Vertex will invest another US$ 26 million in equity and has agreed to pay up to US$ 485 million to Entrada if certain milestones are hit.

FDA grants accelerated approval to Mirati’s lung cancer drug Krazati

Mirati Therapeutics’ Krazati (adagrasib) has received an accelerated approval from the FDA as a second-line treatment for adults with KRAS G12C-mutated locally advanced or metastatic non-small cell lung cancer (NSCLC). The drug’s approval is based on a phase 2 study where it shrank tumors in 43 percent of trial patients who have received at least one prior systemic therapy.

Krazati is the second KRAS drug approved in the US. It will compete with Amgen’s Lumakras, which received an FDA nod for the same condition in 2021. The drug will cost US$ 19,750 for a month’s supply. This is higher than Lumakras, which costs US$ 17,900 per month.

Moderna’s mRNA jab-Merck’s Keytruda combo shows promise in skin cancer study

A combination of Moderna’s experimental messenger RNA cancer vaccine and Merck’s blockbuster immunotherapy Keytruda successfully reduced the risk of recurrence or death by 44 percent in patients suffering from stage III/IV melanoma compared with Keytruda alone in a mid-stage trial.

The phase 2 study involved 157 melanoma patients whose tumors were surgically removed before being treated. Moderna’s personalized vaccine – mRNA-4157/V940 – has been created using mRNA genetic material from each patient’s respective tumors. The companies are now planning to discuss the results with the FDA and initiate a phase 3 study next year.

Pfizer-BioNTech’s mRNA jab for influenza, Covid: The FDA has granted fast track designation to Pfizer and BioNTech’s mRNA-based combination vaccine candidate for influenza and Covid-19. The vaccine aims to help prevent both the respiratory diseases with a single shot.

Novartis’ rare blood disease drug wins late-stage trial: Novartis said its experimental oral drug iptacopan has been successful in treating paroxysmal nocturnal hemoglobinuria (PNH) in a late-stage trial. PNH is a rare blood disorder in which the body destroys red blood cells, leading to anemia and blood clots. In a separate late-stage trial, iptacopan had proved to be better than AstraZeneca subsidiary Alexion’s rare disease drugs Soliris (eculizumab) and Ultomiris (ravulizumab) at treating patients suffering from PNH.

UCB’s skin disease drug hits mark in two late-stage trials: Belgian drugmaker UCB’s experimental drug bimekizumab has been successful in treating patients suffering from moderate-to-severe hidradenitis suppurativa (a chronic and debilitating inflammatory skin disease) in two late-stage trials. In the two trials, bimekizumab reduced the number of inflammatory nodule count and total pus in hidradenitis suppurativa patients by 50 to 75 percent from the baseline, with no increase in the abscess or draining tunnel count after 16 weeks of treatment.

FDA advisory panel votes against Cytokinetics’ heart drug

A panel of external experts to the FDA has voted 8-3 against recommending Cytokinetics’ heart drug, omecamtiv mecarbil, as a treatment for a type of heart failure. The panel said the drug’s potential benefits did not outweigh its risks, and suggested that Cytokinetics gather more data on the drug’s ability to reduce the risk of heart-failure related death. In a late-stage trial on 8,000 patients, the drug met the trial goals of reducing the risk of heart-failure related death or the need for hospitalization but failed to reduce cardiovascular deaths. The FDA had raised concerns about the drug’s safety at higher doses last week. Meanwhile, Cytokinetics said it will continue engaging with the FDA until the review is complete.

Roche, Exelixis-Ipsen’ drug combo fails phase 3 lung cancer trial

A combination of Exelixis-Ipsen’s Cabometyx (cabozantinib) and Roche’s Tecentriq (atezolizumab) has failed to meet the primary endpoint in a phase 3 lung cancer trial. In the 366-patient trial, the drug combo was compared to docetaxel (a chemotherapy medication) in patients with unmutated NSCLC whose disease advanced during or after treatment with an immune checkpoint inhibitor and platinum-containing chemotherapy. The combo failed to show that it could help patients live longer than chemotherapy alone.

Tecentriq approved to treat rare soft tissue cancer: The FDA has approved Roche’s blockbuster drug Tecentriq (atezolizumab) as a treatment for patients two years of age and older suffering from unresectable or metastatic alveolar soft part sarcoma (ASPS), a rare soft tissue cancer. The approval is based on results of a mid-stage study conducted by the National Cancer Institute in 49 patients suffering from the condition. Meanwhile, Roche’s head of pharmaceuticals division, Bill Anderson, will step down at the end of this month. He will be replaced by the director of diagnostics, Thomas Schinecker, in an interim capacity before he takes over as the CEO of the Swiss pharma in March next year.

CSL appoints Paul McKenzie as CEO: Australian healthcare giant CSL has appointed Paul McKenzie as its CEO and managing director. McKenzie, who is currently CSL’s chief operating officer, will take on the new role on March 6, 2023. He will succeed Paul Perreault, who has decided to retire after heading the company for 10 years.

Clovis Oncology files for bankruptcy, plans to sell pipeline asset to Novartis

More than a month after it laid off 115 employees citing dire financial situation, Colorado-based cancer drugmaker Clovis Oncology has filed for bankruptcy. If approved by the court, the drugmaker plans to sell off its fibroblast activation protein (FAP)-targeting therapeutic candidate, FAP-2286, to Novartis for US$ 50 million upfront. The Swiss drugmaker has also promised up to US$ 333.75 million in development milestones and up to US$ 297 million in future sales milestones to Clovis. The beleaguered company is also trying to sell off its other assets.

Novartis sells eye therapies to Harrow: As part of its restructuring, Swiss drugmaker Novartis AG has sold five of its ophthalmic drugs to eye therapy company Harrow for a one-time payment of US$ 130 million, plus additional milestone payments of US$ 45 million. The sale includes cataract surgery recovery eye drops Ilevro and Nevanac, bacterial conjunctivitis eye drop Vigamox, inflammation eye drops Maxidex and the injectable Triesence. The deal is likely to close during the first quarter of 2023.

FDA issues warning letter to Centrient’s API facility in India for cGMP violations

The FDA has issued a warning letter to Centrient Pharmaceuticals’ active pharmaceutical ingredient (API) facility in Punjab, India. The letter mentions three current good manufacturing practice (cGMP) violations at the site.

The agency had inspected the facility between June 23 and July 1 of this year. Following the inspection, the FDA had issued a Form 483 and later placed the facility on import alert.

The letter highlighted Centrient’s failure to ensure that all test procedures are scientifically sound, all APIs are manufactured in accordance with established standards of quality and purity and in compliance with cGMP. The FDA has recommended that the company hire a cGMP consultant.The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Phisper Infographic by SCORR MARKETING & PharmaCompass license under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”