By PharmaCompass

2025-11-20

Impressions: 5613

The global pharmaceutical excipients market continued to evolve in the third quarter (Q3) of 2025, supported by rising demand for functional excipients, growth in production of generics, and advances in drug delivery technologies.

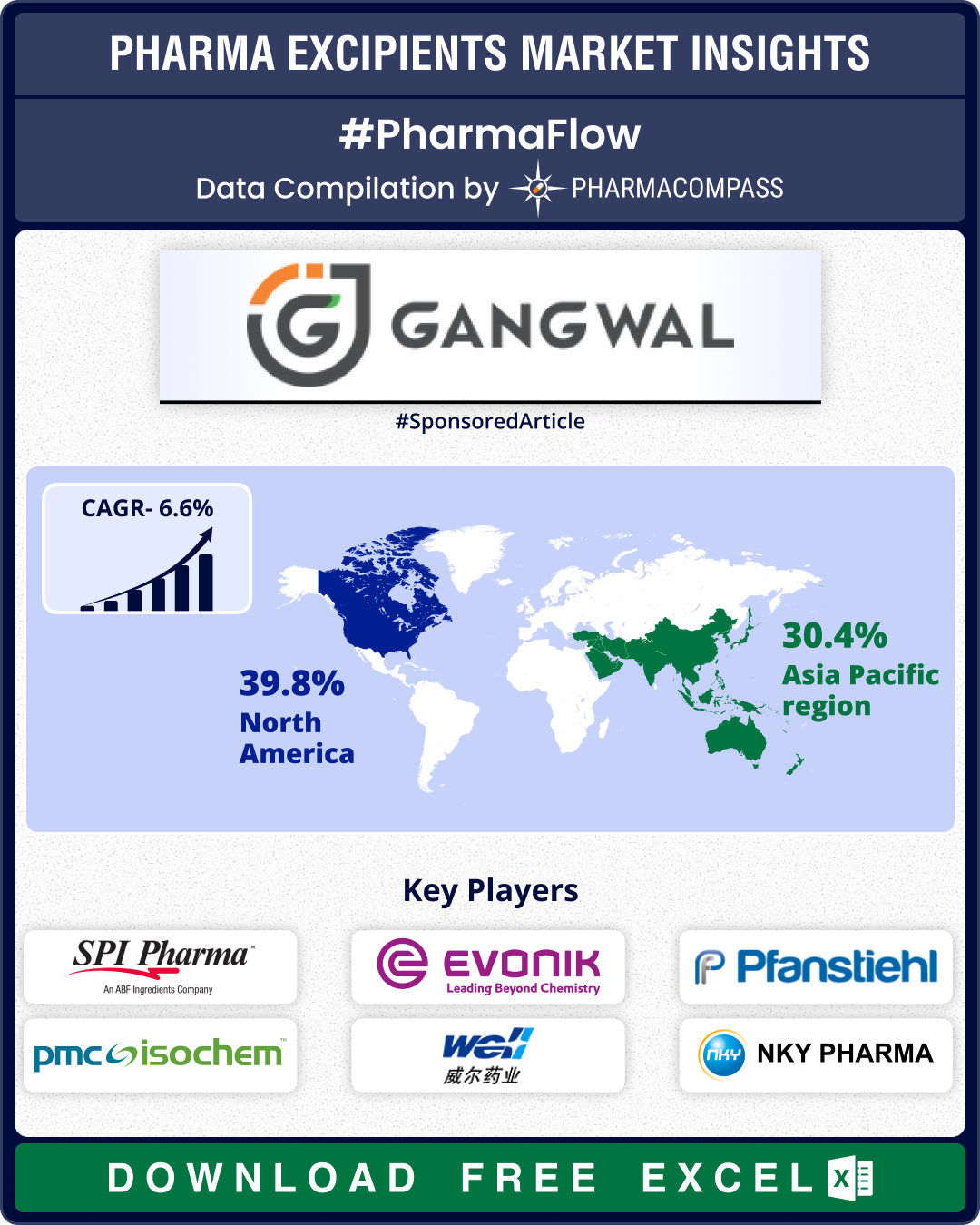

The global market for pharmaceutical excipients was estimated at US$ 9.8 billion to US$ 10.7 billion in 2024, and is projected to grow at a compound annual growth rate (CAGR) of 4.1 to 6.6 percent through 2030. At this pace, the market is expected to reach US$ 13.05 billion to US$ 14.86 billion by 2030.

Europe retained the largest market share in 2024, followed by Asia-Pacific. Key drivers shaping the excipients market include the rising prevalence of chronic diseases, expansion of biologics and biosimilars, and increasing quality and regulatory expectations. Increased investments in facility expansions and ongoing reforms in clinical trial regulations are also facilitating market growth.

The

sector remains highly competitive and fragmented. Major excipient providers include BASF, Roquette, Gangwal Healthcare, DuPont, Evonik, Seqens, SPI Pharma, PMC Isochem, Croda International, Pfanstiehl, Colorcon, Kewpie Corporation, ICE Pharma, Nanjing Well Pharmaceutical, Merck KGaA owned MilliporeSigma, Minakem, Ashland Global, Actylis and Nippon Fine Chemical.

View Our Dashboard on Major Excipient Companies in 2025 (Free Excel Available)

Evonik in partnership with Ethris; Colorcon Ventures invests in Phytolon

The market saw strategic collaborations across the excipients and drug formulation ecosystem in Q3 2025. Evonik entered into a partnership with Ethris to strengthen its nucleic acid delivery platform. The collaboration integrates Ethris’ proprietary technology — its lipidoid nanoparticle platform, known as SNaP LNP — into Evonik’s CDMO offerings, enhancing the latter’s ability to support RNA-based therapeutics from concept to clinic.

Colorcon Ventures, the investment arm of Colorcon, announced a strategic investment in Israel-based Phytolon. The biotechnology start-up uses precision fermentation to develop natural colorants. The investment underscores Colorcon’s commitment to next-generation coloring technologies that support cleaner-label formulations and innovation in oral solid dosage coatings.

View Our Dashboard on Major Excipient Companies in 2025 (Free Excel Available)

Evonik launches MaxiPure Polysorbate 80; Asahi Kasei expands its portfolio

The quarter saw continued innovation in high-purity and injectable-grade excipients. Evonik introduced MaxiPure Polysorbate 80, a high-purity injectable-grade surfactant designed for biologics and parenteral formulations. This excipient addresses key challenges such as protein stability, viral inactivation, and the solubilization of hydrophobic APIs, while meeting regulatory expectations across global markets.

Asahi Kasei expanded its Sonanos portfolio of excipients with two new products — Sonanos PG (optimized for sustained release of biologics and peptides while supporting patient-friendly dosing) and Sonanos DS (developed to enhance solubility of poorly water-soluble APIs). These additions reflect growing industry demand for dosage optimization, stability, and specialized delivery of complex molecules.

Gangwal Healthcare operates EXCiPACT-certified GMP facilities and offers a broad range of functional excipients, including co-processed blends like ProBlend, Starlose, and Microlose. Its excipients, including Solvostar (sodium starch glycolate) and Sallyso (croscarmellose sodium), support enhanced tablet disintegration and drug release. The company also provides taste-masking agents such as SucreX (sucralose) and CutCal (neotame), supporting the development of patient-friendly oral dosage forms.

View Our Dashboard on Major Excipient Companies in 2025 (Free Excel Available)

Colorcon, Gattefossé, Croda, Roquette, Clariant expand manufacturing capacities

Manufacturing investments and facility expansions remained a key trend during Q3 2025. Colorcon inaugurated a new state-of-the-art, film coating manufacturing facility in Johor, Malaysia. The site incorporates energy-efficient systems and advanced production technologies to strengthen Colorcon’s functional-excipient supply network across Asia.

Gattefossé opened a new lipid-based excipient facility in Texas (US), marking a strategic expansion of its North American manufacturing footprint. Croda International expanded its Leek, UK facility with a lipid system synthesis unit and enhanced R&D capabilities. The site will support the launch of Super Refined Poloxamer 188, a highly purified fast-dissolving granular excipient.

Roquette announced the opening of a dedicated innovation center in São Paulo, Brazil, strengthening its engagement with regional drug developers.

Clariant expanded its Daya Bay, China facility, adding a second spray tower dedicated to pharmaceutical excipient production. The upgraded site increases capacity for excipients used in laxatives and other formulations.

BASF also strengthened its commitment to biopharma and pharmaceutical ingredients with a new GMP Solution Center in Michigan (US). The facility expands BASF’s network of poloxamer (a synthetic polymer) manufacturing sites. With state-of-the-art clean room packaging and high-sensitivity analytical testing, this new facility will enable close collaboration with BASF’s customers on customized chemistries for product development.

View Our Dashboard on Major Excipient Companies in 2025 (Free Excel Available)

India mandates excipient disclosure; new rules to apply from March 2026

India has made it mandatory to disclose excipient details from March 2026 under the country’s new Drugs (2nd Amendment) Rules, 2025. This applies to Schedule H2 medicines. The final notification expands earlier draft requirements by mandating qualitative excipient details in QR codes on product packaging. This should enhance transparency and support patient safety.Meanwhile, US pharmaceutical groups have responded to the US Food and Drug Administration’s draft guidance proposing simplified pathways for replacing color additives in drug products. Industry associations have supported draft guidance, noting that it reduces regulatory burden while maintaining product quality and consistency.

View Our Dashboard on Major Excipient Companies in 2025 (Free Excel Available)

Our view

While the fast-growing generics market is creating demand for cost-effective and versatile excipients, the market is also witnessing innovations tailored to the specialized needs of biologics and biosimilars.

India is poised to become a key player in the global excipient market, supported by the rapid growth in its generic drug industry, expansion of its health infrastructure and increasing investments in R&D. The new excipient-disclosure rules, therefore, are likely to benefit the global excipient industry by improving transparency and strengthening quality ecosystems.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : EXPANSIONS DRIVE EXCIPIENT MARKET by PharmaCompass license under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”