CDMO Activity Tracker: Veranova, Carbogen lead ADC investments; Axplora, Polfa Tarchomin, Famar expand European footprint

During the second quarter (Q2) of 2025, contract development and manufacturing organizations (CDMOs)

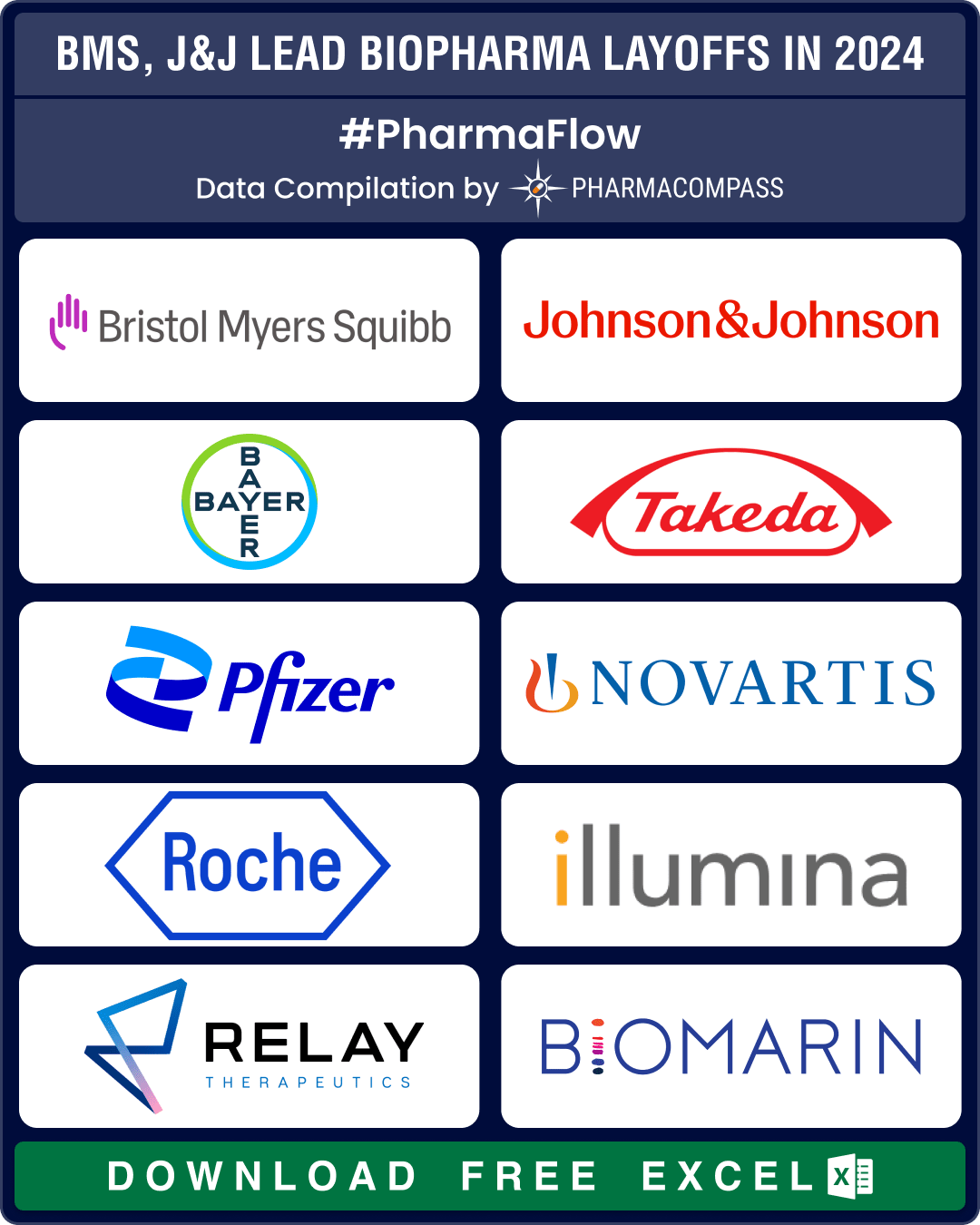

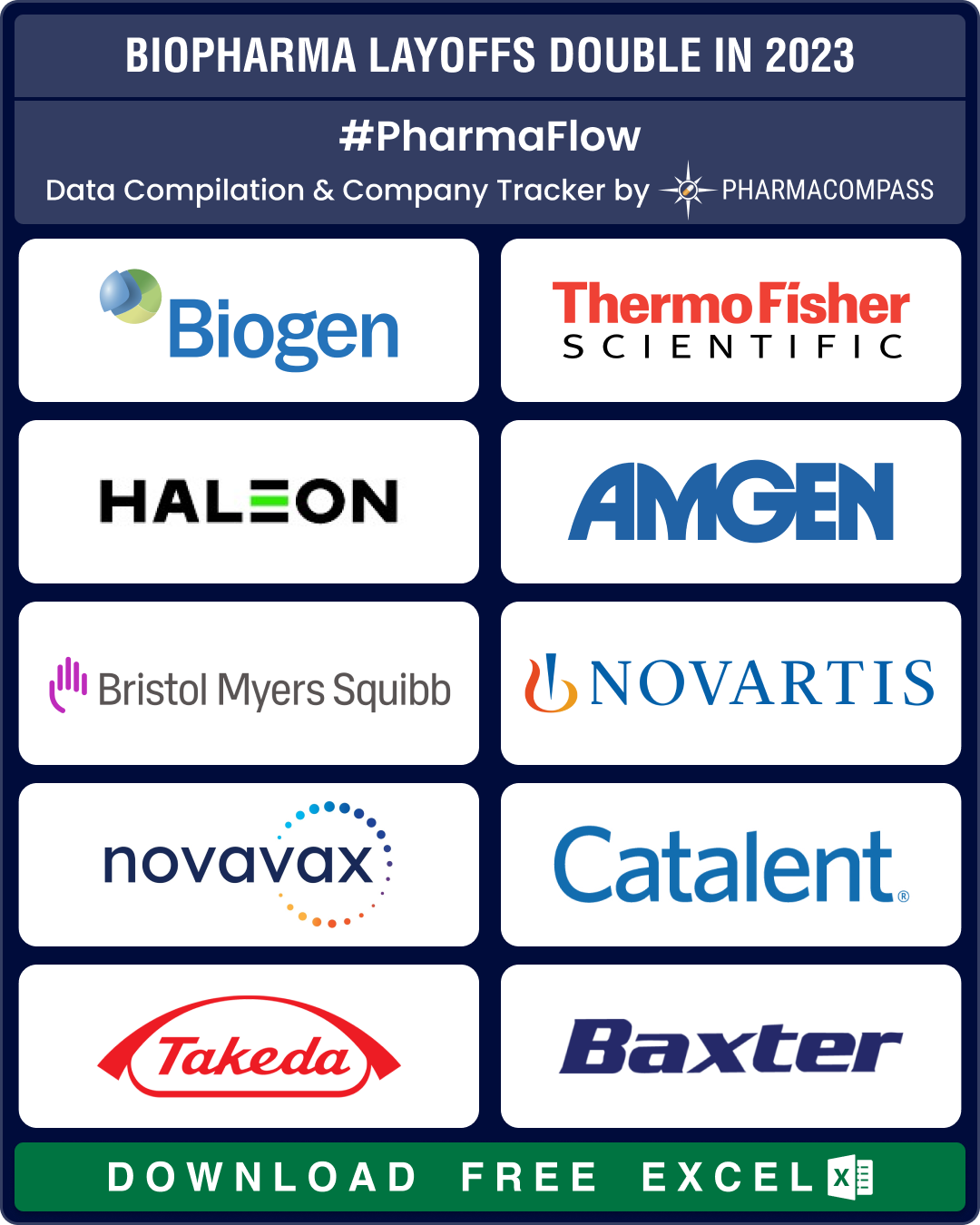

BMS, J&J, Bayer lead 25,000+ pharma layoffs in 2024; Amylyx, FibroGen, Kronos Bio hit by trial failures, cash crunch

Since 2022, there has been a significant surge in layoffs by pharmaceutical and biotech companies. W

CDMO Activity Tracker: Bora, PolPharma make acquisitions; Evonik, EUROAPI, Porton announce technological expansions

The contract development and

manufacturing organization (CDMO) space continued to grow at an impres

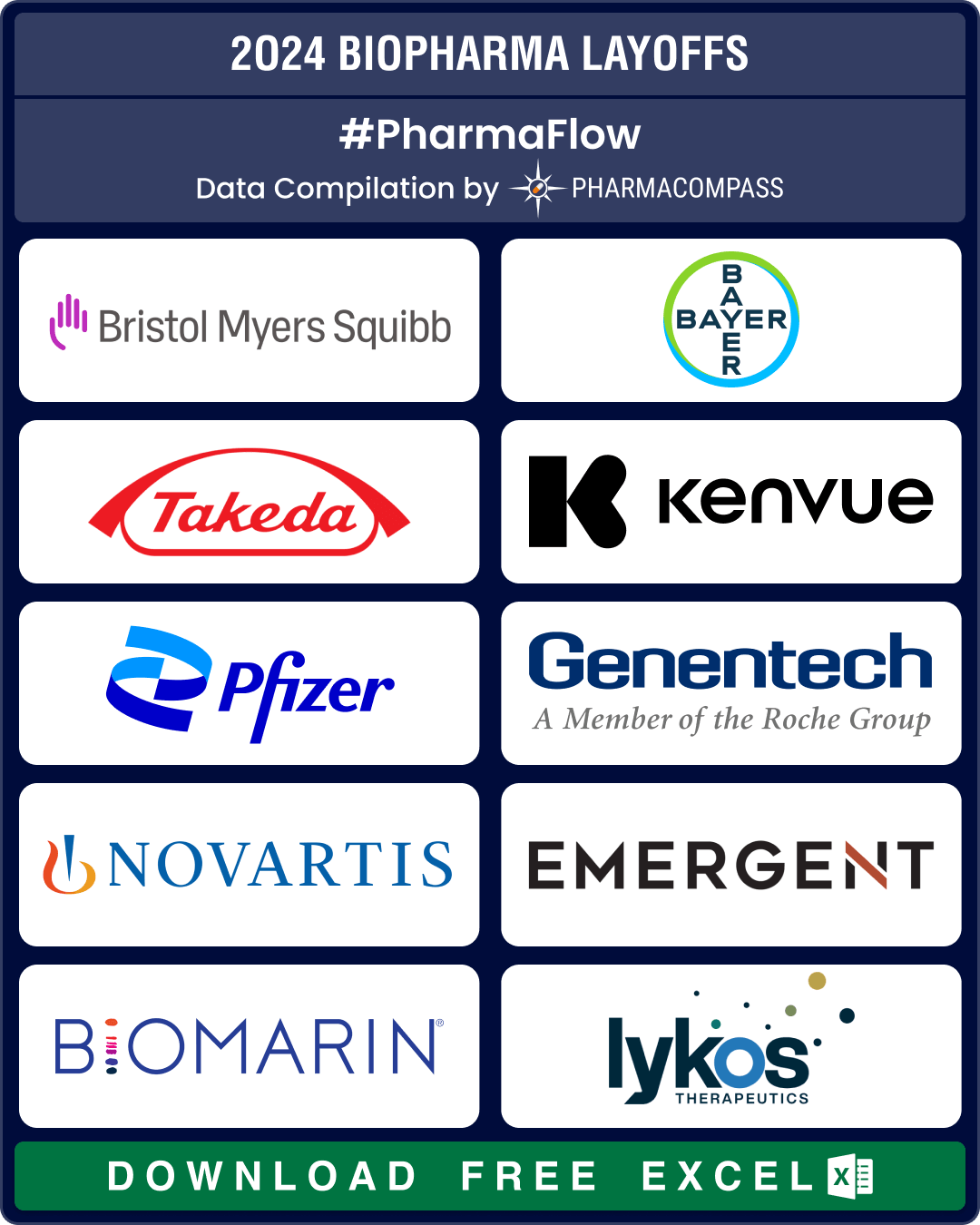

BMS, Bayer, Takeda, Pfizer downsize to combat cost pressures, meet restructuring plans

Over

the last two years, there has been a significant surge in layoffs by

pharmaceutical and biote

CDMO Activity Tracker: Novo’s parent buys Catalent for US$ 16.5 bn; Fujifilm, Merck KGaA, Axplora expand capabilities

During the first half (H1) of 2024, the global contract development and manufacturing organization (

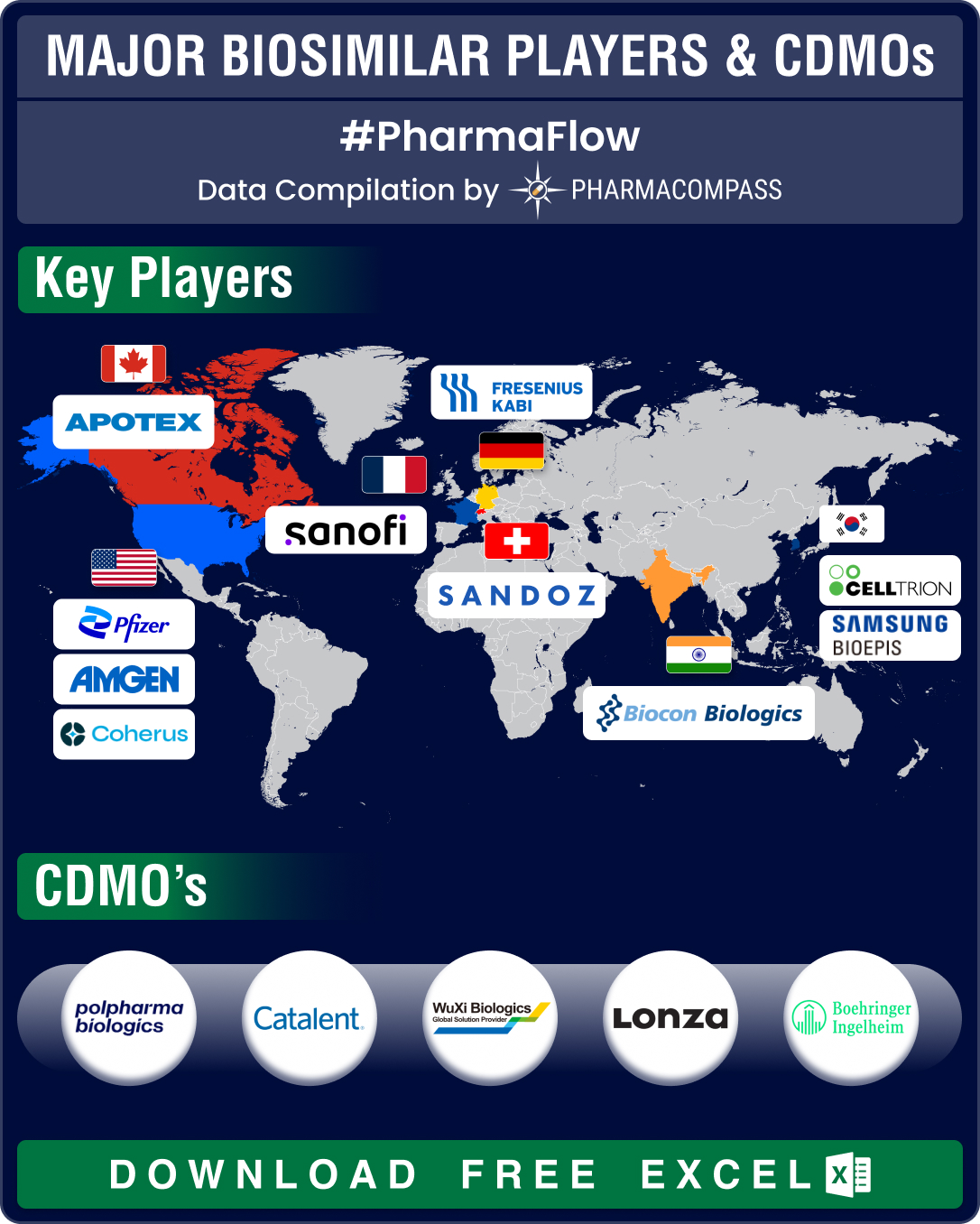

FDA approves record eight biosimilars in H1 2024; okays first interchangeable biosimilars for Eylea

Biologics, or complex drugs that are derived from living organisms, have revolutionized treatment of

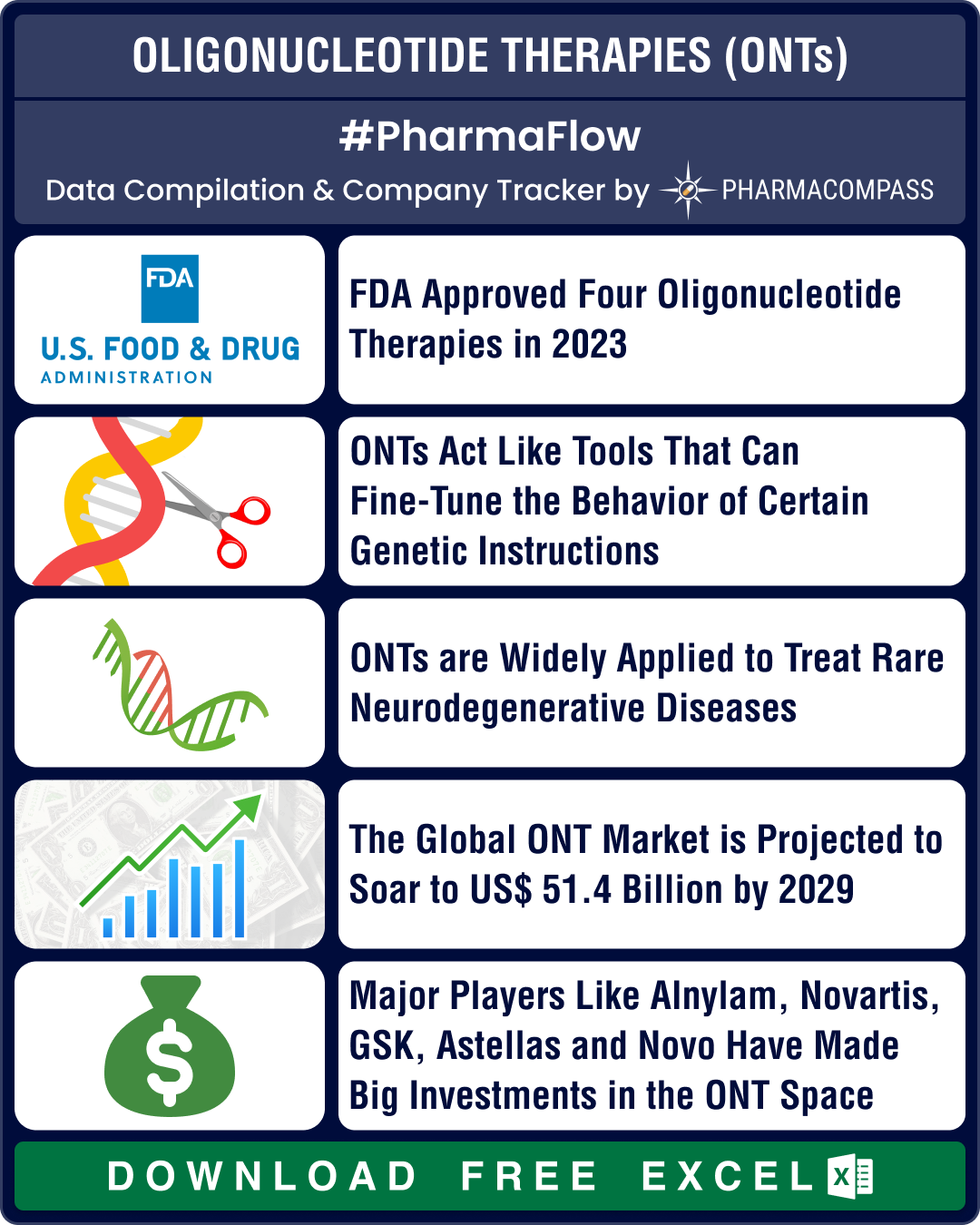

FDA approves four oligonucleotide therapies in 2023; Novartis, GSK, Novo bet big

In the intricate world of molecular biology, oligonucleotides stand out as versatile, powerful molec

Market Place

Market Place Sourcing Support

Sourcing Support