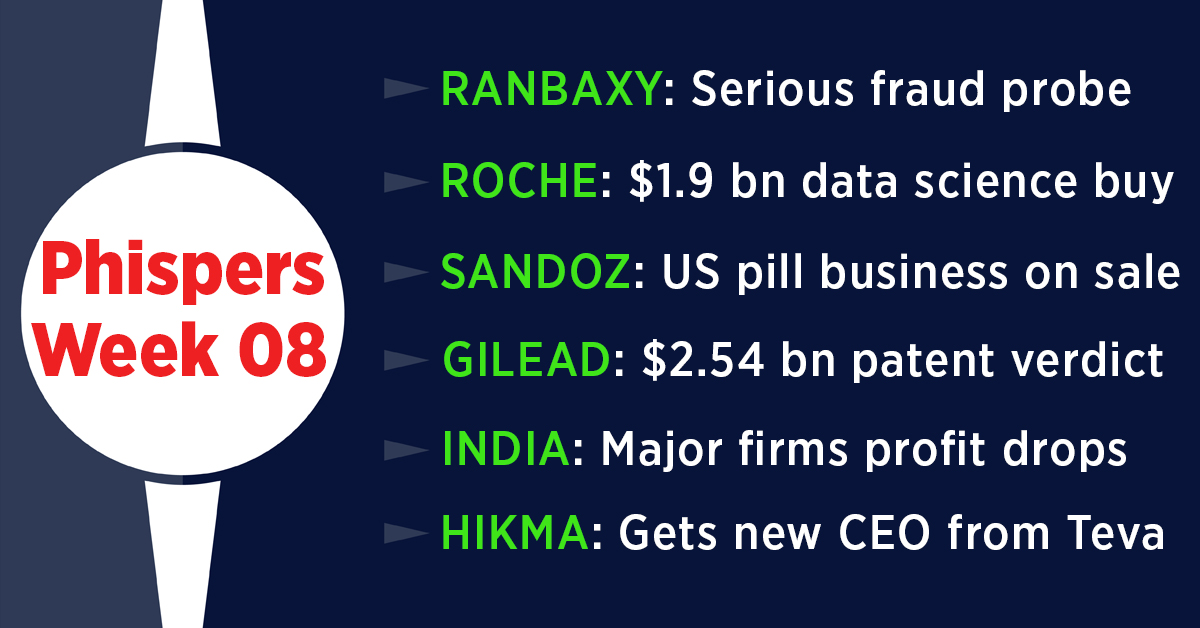

This week in Phispers, we bring you news about Swiss drugmaker Novartis as it plans to sell off its generic pill business in the US. In India, the (collective) net profit of 30 major drug companies dropped by 38 percent in April to December 2017. Meanwhile, the Indian government ordered a serious fraud investigation against the former Ranbaxy promoters. Roche picked up Alphabet-backed Flatiron Health for US$ 1.9 billion. And Merck and Gilead’s patent battle over hepatitis C drugs took a fresh turn as a US federal jury reversed an earlier verdict.

After Sanofi,

Novartis decides to put its US generic pill unit on sale

Last month, there was news that French drugmaker Sanofi was planning to sell off its European generic business. And Indian pharmaceutical companies like Aurobindo, Zydus Cadila, Torrent Pharma and Intas had expressed preliminary interest in buying Sanofi’s generic business, valued at around US$ 1.25 to 2 billion.

This month, there is news that Swiss drug major Novartis is following Sanofi’s footsteps and is getting ready to auction its US generic pill business. The unit has been struggling due to fierce price competition. This particular unit’s fortunes, in fact, are quite diverged from the rest of Novartis’ US$ 10 billion Sandoz generics and biosimilars division.

According to the new CEO Vasant Narasimhan, the US generics business had fared better in manufacturing ‘hard-to-make’ generic drugs, such as injectables and inhalables than in making pills. Novartis’ generic pills business is likely to fetch around US$ 1.6 billion. A sale process for the unit will be launched in the next few weeks.

Net profit of

30 major Indian drug companies drops by 38 percent in 2017

The year gone by was a difficult year for Indian pharma companies. And this had a direct impact on the profitability of India’s 30 major pharma companies. According to Pharmabiz, the (combined) net profit of 30 major Indian drug companies dropped by as much as 38 percent during April to December 2017 to US$ 1.9 billion (INR 123.13 billion), from US$ 3.06 billion (INR 198.33 billion) in the corresponding nine months of 2016.

The key reasons behind this drastic drop in profitability were US Food and Drug Administration’s (USFDA) actions against leading companies, a challenging US generic pricing environment, price cuts and stiff competition, the Pharmabiz report said.

However, the net sales of these 30 companies remained almost stagnant at US$ 19.7 billion (INR 1,274.8 billion), as against US$ 19.8 billion (INR 1,284.7 billion).

Net profits of companies like Sun Pharmaceuticals, Lupin, Dr Reddy's Laboratories, Glenmark Pharmaceuticals, Alkem Laboratories, Torrent Pharma, Biocon, Strides Shasun and Vivimed Laboratories dropped by over 25 per cent during April to December 2017.

Among the 30 companies, Cipla, Jubilant Life Sciences, Ipca Laboratories, GlaxoSmithKline Pharma (GSK) and Hikal posted double digit growth in net profits during this period.

Data science

leads the way, Roche picks up Google-backed Flatiron for US$ 1.9 billion

Pharmaceutical giant Roche is buying Flatiron Health — a firm developing technology for life science, academics and hospitals — for US$ 1.9 billion. The firm was founded by two ex-Google employees — Nat Turner and Zach Weinberg — and is a cancer-focused start-up.

Roche was already an investor in this New York-based firm and had a 12 percent stake in the company before the buyout. Besides Roche, Flatiron’s biggest investors include Alphabet’s GV (formerly Google Ventures).

If we include Roche’s existing 12 percent stake, the total value of Flatiron Health comes to around US$ 2.1 billion. Flatiron employs 25 people with medical degrees and 104 engineers and technology specialists.

Flatiron has an electronic health record system that collects data from doctors who are treating patients with cancer. This data later becomes useful to researchers and life sciences companies in developing better treatments for cancer. Flatiron has raised more than US$ 300 million from investors such as Roche and Alphabet.

“As a leading technology company in oncology, Flatiron Health is best positioned to provide the technology and data analytics infrastructure needed not only for Roche, but for oncology research and development efforts across the entire industry,” Roche CEO Daniel O’Day said in a statement.

The transaction is expected to close in the first half of this year and will bolster Roche's oncology portfolio.

Indian

government orders serious fraud probe against former Ranbaxy promoters

Earlier this month, the Delhi High Court had allowed Daiichi Sankyo to recover US$ 551 million (INR 35 billion) from Ranbaxy’s Singh brothers. The verdict meant Daiichi can now enforce the award granted by a Singapore arbitration tribunal in April 2016.

Back in 2008, the promoters of Ranbaxy — Malvinder and Shivinder Singh — had sold their stake in Ranbaxy to Daiichi Sankyo, which subsequently exited from the venture.

The Delhi HC ruling is being seen as a significant milestone in India’s corporate governance and functioning of its regulatory institutions.

This verdict was followed by more bad news for the Singh brothers. The government of India has ordered a Serious Fraud Investigation Office (SFIO) probe against the two firms promoted by the Singhs — Fortis Healthcare and Religare Enterprises. The Singh brothers had recently quit the boards of these two companies.

Last week, the Securities and Exchange Board of India (SEBI) ordered an inquiry into Fortis, amid reports that the Singh duo had diverted funds from Fortis. The Singh brothers have denied this charge.

Fortis, which runs a chain of hospitals, has not declared results as auditor Deloitte has refused to sign them due to differences over accounting issues.

Meanwhile, the Delhi Debts Recovery Tribunal (DRT) has restrained Malvinder Singh from selling a posh property in Lutyen’s Delhi and some other assets in a bank loan default case.

The tribunal passed the interim order on an application by Yes Bank seeking recovery of a US$ 88 million (INR 5.7 billion) loan given to Oscar Investment for which Singh was a guarantor. The tribunal also directed Singh to file an affidavit disclosing his movable and immovable assets.

Gilead wins

reversal of US$ 2.54 billion patent verdict for its hepatitis C drugs

Back in December 2016, Gilead Sciences was told by a federal jury in the US to pay US$ 2.54 billion to Merck for using a patented invention as the basis for its blockbuster hepatitis C drugs — Sovaldi and Harvoni. This was the biggest patent-infringement verdict in US history.

Last week, a federal judge in Delaware overturned this verdict. The US District Judge Leonard Stark in Wilmington, Delaware, ruled that Merck’s patent was invalid.

Gilead in a statement issued on Saturday said it always believed the patent was invalid and was pleased the judge confirmed that opinion. Merck, however, said it planned to appeal and believed the judge’s ruling did not reflect the facts of the case.

The Merck and Gilead battle over the patents of Sovaldi and Harvoni has been going on for a while now. Back in March 2016, a federal jury had ordered Gilead to pay Merck US$ 200 million in damages for infringing two Merck patents related to these drugs. But in June 2016, a federal judge in San Jose, California, had overturned that verdict.

Former Teva

generics CEO Olafsson to head Hikma Pharmaceuticals

In December 2016, Siggi Olafsson, the then generics CEO of Israeli drug giant Teva Pharmaceuticals, had announced his resignation. The move had surprised investors as he had resigned just a few months after Teva had picked up Allergan’s generics unit — Actavis — for US$ 40.5 billion.

Olafsson had previously served the Actavis group and was seen as the champion of the buyout. Later, the deal led to the downfall of Teva.

After leaving Teva, Olafsson joined US listed biosimilars player Pfenex. Now, Olafsson is back in the game of generics. This week, he got appointed as the new CEO of Jordan’s Hikma Pharmaceuticals.

Hikma has separated the roles of the chairman and the CEO. The current CEO of Hikma, Said Darwazah, will now be the executive chairman of the company, while Olafsson will take over as its CEO. In a statement, Darwazah praised Olafsson’s “deep sector knowledge” and “proven ability to drive growth.”

Hikma is amongst the few players in the US that have developed a generic version of GSK’s blockbuster Advair. However, it has been embroiled in a dispute with the USFDA over its generic Advair.

For Teva though, Olafsson’s exit was the first in a string of executive departures that continued throughout 2017. Olafsson had been replaced by Dipankar Bhattacharjee. However, the new CEO of Teva Kåre Schultz began his stint by eliminating Bhattacharjee. And what followed was Teva’s famous restructuring plan, which sought to reduce its workforce by 25 percent, and reduce total cost base by US$ 3 billion by the end of 2019.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Phisper Infographic by PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”