Acquisitions and spin-offs dominated headlines in 2019 and the tone was set very early with Bristol-Myers Squibb acquiring

New Jersey-based cancer drug company Celgene in a US$ 74 billion deal announced on

January 3, 2019. After factoring

in debt, the deal value ballooned to about US$ 95 billion, which according

to data compiled by Refinitiv, made it the largest healthcare deal on

record.

In the summer, AbbVie Inc,

which sells the world’s best-selling drug Humira, announced its acquisition of Allergan Plc, known for Botox and other cosmetic

treatments, for US$ 63 billion. While the companies are still awaiting

regulatory approval for their deal, with US$ 49 billion in combined 2019

revenues, the merged entity would rank amongst the biggest in the industry.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

The big five by pharmaceutical sales — Pfizer,

Roche, J&J, Novartis and Merck

Pfizer

continued

to lead companies by pharmaceutical sales by reporting annual 2019 revenues of

US$ 51.8 billion, a decrease of US$ 1.9 billion, or 4 percent, compared to

2018. The decline was primarily attributed to the loss of exclusivity of Lyrica in 2019,

which witnessed its sales drop from US$ 5 billion in 2018 to US$ 3.3 billion in

2019.

In 2018, Pfizer’s then incoming CEO Albert Bourla had mentioned that the company did not see the need for any large-scale M&A activity as Pfizer had “the best pipeline” in its history, which needed the company to focus on deploying its capital to keep its pipeline flowing and execute on its drug launches.

Bourla stayed true to his word and barring the acquisition of Array Biopharma for US$ 11.4 billion and a spin-off to merge Upjohn, Pfizer’s off-patent branded and generic established medicines business with

Mylan, there weren’t any other big ticket deals which were announced.

The

Upjohn-Mylan merged entity will be called Viatris and is expected to have 2020

revenues between US$ 19 and US$ 20 billion

and could outpace Teva to

become the largest generic company in the world, in term of revenues.

Novartis, which had

followed Pfizer with the second largest revenues in the pharmaceutical industry

in 2018, reported its first full year earnings after spinning off its Alcon eye

care devices business division that

had US$ 7.15 billion in 2018 sales.

In 2019,

Novartis slipped two spots in the ranking after reporting total sales of US$

47.4 billion and its CEO Vas Narasimhan continued his deal-making spree by buying New

Jersey-headquartered The Medicines Company (MedCo) for US$ 9.7

billion to acquire a late-stage cholesterol-lowering

therapy named inclisiran.

As Takeda Pharmaceutical Co was

busy in 2019 on working to reduce its debt burden incurred due to its US$ 62

billion purchase of Shire Plc, which was announced in 2018, Novartis also purchased

the eye-disease medicine, Xiidra, from the Japanese drugmaker for US$ 5.3 billion.

Novartis’ management also spent a considerable part of 2019 dealing with data-integrity concerns which emerged from its 2018 buyout of AveXis, the

gene-therapy maker Novartis had acquired for US$ 8.7 billion.

The deal gave Novartis rights to Zolgensma,

a novel treatment intended for children less than two years of age with the

most severe form of spinal muscular atrophy (SMA). Priced at US$ 2.1 million,

Zolgensma is currently the world’s most expensive drug.

However,

in a shocking announcement, a month after approving the drug, the US Food and

Drug Administration (FDA) issued a press release on

data accuracy issues as the agency was informed by AveXis that

its personnel had manipulated data which

the FDA used to evaluate product comparability and nonclinical (animal)

pharmacology as part of the biologics license application (BLA), which was

submitted and reviewed by the FDA.

With US$

50.0 billion (CHF 48.5 billion) in annual pharmaceutical sales, Swiss drugmaker

Roche came in at number two position in 2019

as its sales grew 11 percent driven by

its multiple sclerosis medicine Ocrevus, haemophilia drug Hemlibra and cancer medicines Tecentriq and Perjeta.

Roche’s newly introduced medicines generated US$ 5.53 billion (CHF 5.4 billion) in growth, helping offset the impact of the competition from biosimilars for its three best-selling drugs MabThera/Rituxan, Herceptin and Avastin.

In late 2019, after months of increased

antitrust scrutiny, Roche completed

its US$ 5.1 billion acquisition of Spark Therapeutics to strengthen its presence in

gene therapy.

Last year, J&J reported almost flat worldwide sales of US$ 82.1 billion. J&J’s pharmaceutical division generated US$ 42.20 billion and its medical devices and consumer health divisions brought in US$ 25.96 billion and US$ 13.89 billion respectively.

Since J&J’s consumer health division sells analgesics, digestive health along with beauty and oral care products, the US$ 5.43 billion in consumer health sales from over-the-counter drugs and women’s health products was only used in our assessment of J&J’s total pharmaceutical revenues. With combined pharmaceutical sales of US$ 47.63 billion, J&J made it to number three on our list.

While the sales of products like Stelara, Darzalex, Imbruvica, Invega Sustenna drove J&J’s pharmaceutical business to grow by 4 percent over 2018, the firm had to contend with generic competition against key revenue contributors Remicade and Zytiga.

US-headquartered Merck, which is known as

MSD (short for Merck Sharp & Dohme) outside the United States and

Canada, is set to significantly move up the rankings next year fueled by its

cancer drug Keytruda, which witnessed a 55

percent increase in sales to US$ 11.1 billion.

Merck reported total revenues of US$ 41.75 billion and also

announced it will spin off its women’s health drugs,

biosimilar drugs and older products to create a new pharmaceutical

company with US$ 6.5 billion in annual revenues.

The firm had anticipated 2020 sales between US$ 48.8 billion and US$ 50.3 billion however this week it announced that the coronavirus pandemic will reduce 2020 sales by more than $2 billion.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

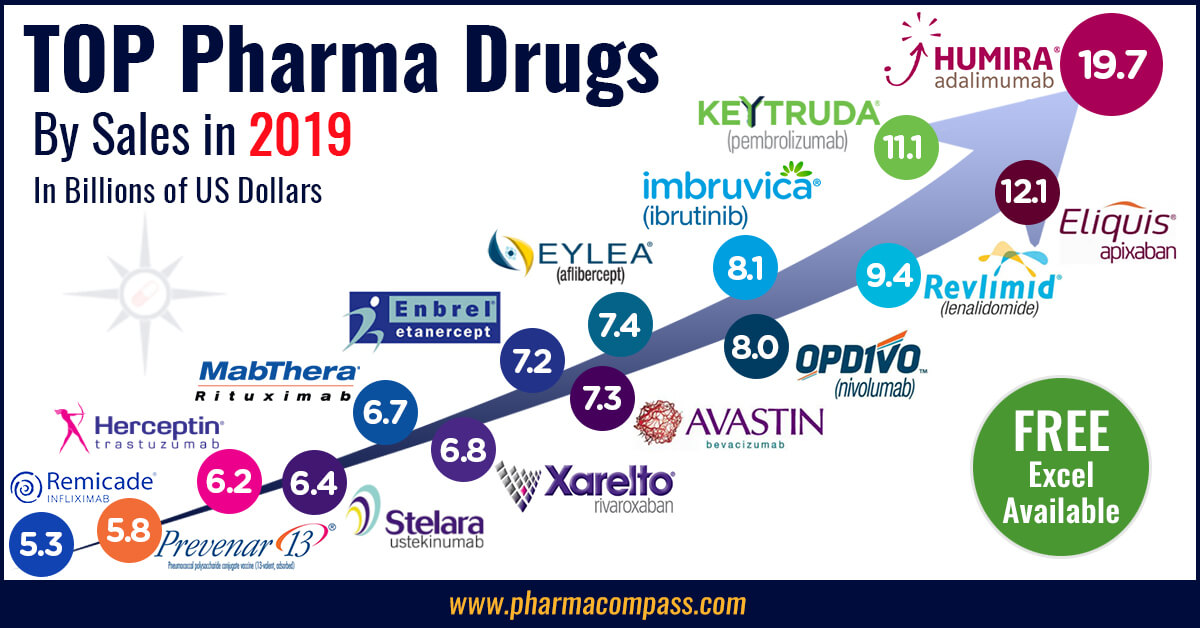

Humira holds on to remain world’s best-selling drug

AbbVie’s acquisition of Allergan comes as the firm faces the expiration of patent protection for Humira, which brought in a staggering US$ 19.2 billion in sales last year for

the company. AbbVie has failed to successfully acquire or develop a major new

product to replace the sales generated by its flagship drug.

In 2019, Humira’s US revenues increased 8.6 percent to US$ 14.86 billion while internationally, due

to biosimilar competition, the sales dropped 31.1 percent to US$ 4.30 billion.

Bristol Myers Squibb’s Eliquis, which is also marketed by Pfizer, maintained its number two position

and posted total sales of US$ 12.1 billion, a 23 percent increase over 2018.

While Bristol Myers Squibb’s immunotherapy treatment Opdivo, sold in partnership with Ono in Japan, saw sales increase from US$ 7.57 billion to US$ 8.0 billion, the growth paled in comparison to the US$ 3.9

billion revenue increase of Opdivo’s key immunotherapy competitor Merck’s Keytruda.

Keytruda took the number three spot in drug sales that

previously belonged to Celgene’s Revlimid, which witnessed a sales decline from US$ 9.69 billion to US$ 9.4 billion.

Cancer treatment Imbruvica, which is marketed

by J&J and AbbVie, witnessed a 30 percent increase in sales. With US$ 8.1

billion in 2019 revenues, it took the number five position.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Vaccines – Covid-19 turns competitors into partners

This year has been dominated by the single biggest health emergency in years — the novel coronavirus (Covid-19) pandemic. As drugs continue to fail to meet expectations, vaccine development has received a lot of attention.

GSK reported the highest vaccine sales of all drugmakers with

total sales of US$ 8.4 billion (GBP 7.16 billion), a significant portion of its

total sales of US$ 41.8 billion (GBP 33.754 billion).

US-based Merck’s vaccine division also reported a significant increase in sales to US$ 8.0 billion and in 2019 received FDA and EU approval to market its Ebola vaccine Ervebo.

This is the first FDA-authorized vaccine against the deadly virus which causes

hemorrhagic fever and spreads from person to person through direct contact with

body fluids.

Pfizer and Sanofi also reported an increase in their vaccine sales to US$ 6.4

billion and US$ 6.2 billion respectively and the Covid-19 pandemic has recently

pushed drugmakers to move faster than ever before and has also converted

competitors into partners.

In a rare move, drug behemoths — Sanofi and GlaxoSmithKline (GSK) —joined hands to develop a vaccine for the novel coronavirus.

The two companies plan to start human trials

in the second half of this year, and if things go right, they will file

for potential approvals by the second half of 2021.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Our view

Covid-19 has brought the world economy to a grinding halt and shifted the global attention to the pharmaceutical industry’s capability to deliver solutions to address this pandemic.

Our compilation shows that vaccines and drugs

for infectious diseases currently form a tiny fraction of the total sales of

pharmaceutical companies and few drugs against infectious diseases rank high on

the sales list.

This could well explain the limited range of

options currently available to fight Covid-19. With the pandemic currently infecting

over 3 million people spread across more than 200 countries, we can safely

conclude that the scenario in 2020 will change substantially. And so should our

compilation of top drugs for the year.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Impressions: 54752

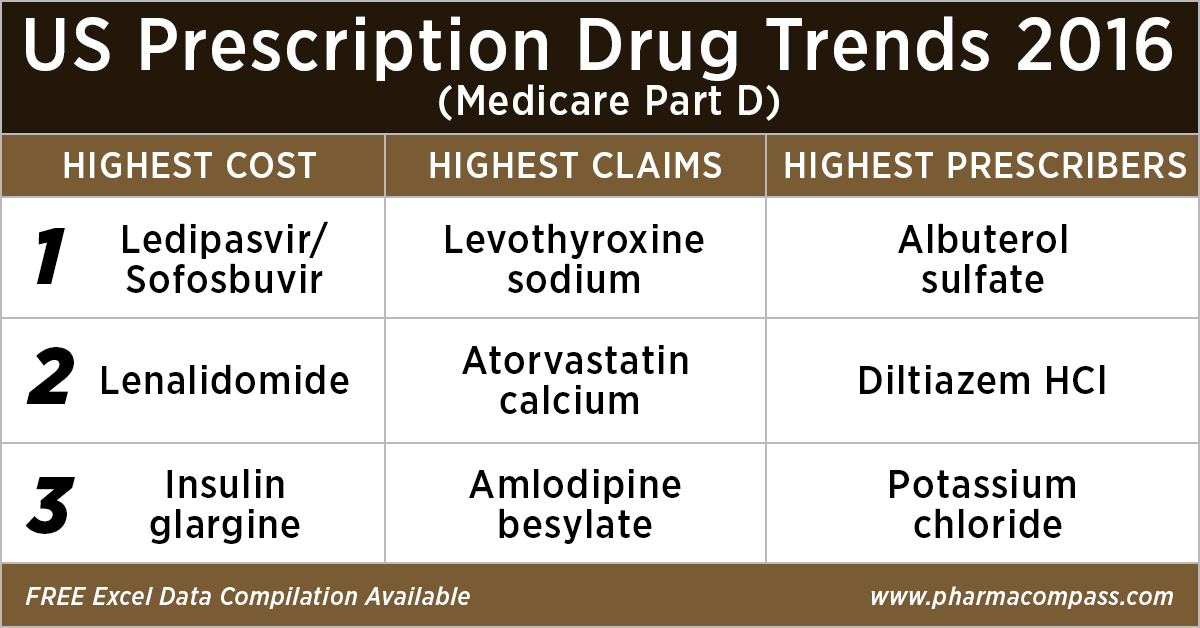

This week, PharmaCompass

reviews the recently released data on prescription drugs paid for under the

Medicare Part D Prescription Drug Program in the United States in calendar year

2016.

But first, let’s understand what is Medicare.

Medicare is the federal health insurance program in the US. In 2017, it covered 58.4 million people — 49.5 million aged 65 and older, and 8.9 million disabled.

Prescription drug coverage under this

program was started in 2006, and is known as Medicare Part D.

As part of this

coverage, the Centers for Medicare & Medicaid Services (CMS) contracts insurance

companies and other private companies, known as plan sponsors, that offer

prescription drug plans to their beneficiaries with varying drug coverage and

cost-sharing requirements.

In

2017, the Congressional Budget Office (CBO) had estimated that spending on

Medicare Part D would reach US$ 94 billion, or about 16 percent of all Medicare

expenditures for the year.

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

According

to the CBO, Medicare Part D is the most significant expansion of the Medicare

program since it was created by Congress in 1965.

With

more than 1.48 billion claims from beneficiaries enrolled under the Part D

prescription drug benefit program under its umbrella, our analysis of Medicare

Part D provides valuable insights into how elderly Americans use prescription

drugs.

Top 10 drugs by

cost: The ones that bore the highest cost burden for Medicare

As in 2015, in 2016

too Gilead’s Hepatitis C treatment — Ledipasvir/Sofosbuvir (Harvoni) — remained the single drug highest payout under the Medicare Part D Prescription Drug Program with a total cost of US$ 4.4 billion.

As Gilead continued

to face competition from AbbVie and Merck in the Hepatitis C space, the spending on Harvoni was down

37 percent from US$ 7.03 billion in 2015.

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Celgene’s cancer treatment, Lenalidomide (Revlimid), Sanofi and Merck’s diabetes treatments and AstraZeneca’s Crestor (Rosuvastatin Calcium) for

cholesterol followed Harvoni. All together, they cost the Medicare program over US$ 10 billion.

Generic Name

Number of Medicare Part D Claims

Number of Medicare Beneficiaries

Number of Prescribers

Aggregate Cost Paid for Part D

Claims (In USD)

LEDIPASVIR/ SOFOSBUVIR (HARVONI)

141,665

52,782

12,097

4,398,534,465

LENALIDOMIDE

239,049

35,368

10,382

2,661,106,127

LANTUS SOLOSTAR (INSULIN

GLARGINE, HUM.REC.ANLOG )

5,028,485

1,075,248

245,447

2,526,048,766

SITAGLIPTIN PHOSPHATE

4,742,505

864,442

206,223

2,440,013,513

ROSUVASTATIN CALCIUM

6,012,444

1,560,050

249,981

2,322,724,007

FLUTICASONE/SALMETEROL

5,194,391

1,196,007

275,442

2,319,808,482

PREGABALIN

4,940,115

852,497

267,532

2,098,953,250

RIVAROXABAN

4,403,332

807,820

252,141

1,954,748,890

APIXABAN

4,455,782

826,969

231,631

1,926,107,484

TIOTROPIUM BROMIDE

4,153,162

903,494

235,564

1,818,857,361

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Top 10 drugs by claims: The most commonly

used drugs of 2016

With 46.6 million claims, the thyroid hormone deficiency treatment — Levothyroxine Sodium — retained its position of being the most claimed product under Medicare’s Part D Prescription Drug Program in 2016.

The number of

Medicare Part D claims includes original prescriptions and refills.

Following Levothyroxine Sodium was the lipid-lowering agent — Atorvastatin Calcium — which had 44.5 million Medicare Part D claims that

were filed by almost 9.4 million beneficiaries.

Generic

Name

Number

of Prescribers

Number

of Medicare Part D Claims

Number

of Medicare Beneficiaries

LEVOTHYROXINE SODIUM

669,999

46,617,109

8,091,785

ATORVASTATIN CALCIUM

494,973

44,595,686

9,435,633

AMLODIPINE BESYLATE

497,017

39,913,468

7,802,905

LISINOPRIL

490,452

39,469,840

8,009,954

OMEPRAZOLE

492,951

32,909,236

7,001,160

METFORMIN HCL

611,700

31,007,932

6,394,014

SIMVASTATIN

380,560

29,687,947

6,201,911

HYDROCODONE/ACETAMINOPHEN

660,617

28,595,150

7,265,882

FUROSEMIDE

488,352

27,878,243

5,421,598

GABAPENTIN

555,997

27,627,466

5,363,382

Click here

to access the compilation of Medicare Part D Prescriber Summary Report

Top 10 drugs by prescribers: Medicines that were most popular with

doctors

Among the prescribers, albuterol sulfate (salbutamol) and Diltiazem had

over 900,000 unique providers (or

doctors) prescribing the drug.

Albuterol (salbutamol) is

used to provide quick relief from wheezing and shortness

of breath while Diltiazem is used to prevent chest

pain (angina).

Also

on the list of popular drugs with prescribers is Hydrocodone-Acetaminophen.

With more doctors prescribing Hydrocodone-Acetaminophen (an

opioid) than commonly used antibiotics, such as Cephalexin, Ciprofloxacin and Amoxicillin, the

series of new FDA initiatives to combat the epidemic of opioid misuse and abuse

should change the position of opioids in the top 10 drugs by prescribers in the

coming years.

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Generic

Name

Number of

Prescribers

Number of

Medicare Part D Claims

Number of

Medicare Beneficiaries

ALBUTEROL SULFATE

985,427

13,100,354

5,417,718

DILTIAZEM HCL

931,159

8,142,004

1,982,550

POTASSIUM CHLORIDE

879,491

18,945,969

4,278,000

PEN NEEDLE, DIABETIC

677,210

5,281,778

1,795,046

LEVOTHYROXINE SODIUM

669,999

46,617,109

8,091,785

HYDROCODONE/ACETAMINOPHEN

660,617

28,595,150

7,265,882

METFORMIN HCL

611,700

31,007,932

6,394,014

CEPHALEXIN

597,647

5,603,879

3,933,373

CIPROFLOXACIN HCL

594,129

7,000,081

4,851,657

AZITHROMYCIN

591,028

7,958,625

5,734,122

What does the

future hold?

Although the Part D Prescriber PUF (public use file) has a wealth of information on payment and utilization for Medicare Part D prescriptions, the dataset has a number of limitations. Of particular importance is the fact that the data may not be representative of a physician’s entire practice or all of Medicare as it only includes information on beneficiaries enrolled in the Medicare Part D prescription drug program (i.e., approximately two-thirds of all Medicare beneficiaries).

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Last

month, the Office of the Inspector General (OIG)

reviewed

the Part D claims data for the years 2011 to 2015 for brand-name drugs.

The OIG’s report found that the total reimbursement for all brand-name drugs in Part D increased 77 percent from 2011 to 2015, despite a 17-percent decrease in the number of prescriptions for these drugs.

With soaring drug prices being an issue for

regular debate in the Unites States and President Trump announcing that his

team will use strategies to strengthen the negotiating powers under

Medicare Part D and Part B, it remains to be seen how the data on prescription drugs paid for under

the Medicare Part D Prescription Drug Program will change in the coming years.

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Impressions: 2500

In less than three weeks, Donald Trump will assume office as the

President of the United States. He has mentioned that he wants Medicare (a

national social insurance program) to directly negotiate the price it pays for prescription drugs.

Medicare provides health insurance to Americans aged 65 or more, who

have worked and paid into the system through the payroll tax. It also provides

health insurance to younger people with some disabilities or end-stage renal

disease and amyotrophic lateral sclerosis.

In 2015, Medicare provided health insurance to over 55 million Americans — including 46 million people aged 65 or more, and nine million younger people.

As we flag off the New Year, PharmaCompass

provides insights into drug prices and prescription patterns in the US in order

to help professionals make informed decisions. We believe that the cost of

medicines in the US, which have been a subject of much public outcry and

discussions in the recent years, will continue to be scrutinized during 2017.

Medicare data for 2014

Medicare Part D, also known as the Medicare prescription drug benefit — the program which subsidizes the costs of prescription drugs and prescription drug insurance premiums for Medicare beneficiaries — published a data set (for calendar year 2014) which contains information from over one million healthcare providers

who collectively prescribed approximately US $121 billion worth of prescription

drugs paid for under this program.

For each prescriber and drug, the dataset

includes the total number of prescriptions that were dispensed (including

original prescriptions and any refills), and the total drug cost.

The total drug cost includes the ingredient cost of the medication, dispensing fees, sales tax, and any applicable administration fees. It’s based on the amounts paid by the Part D plan, the Medicare beneficiary, other government subsidies, and any other third-party payers (such as employers and liability insurers).

The total drug cost does not reflect any manufacturer rebates paid to Part D plan sponsors through direct and indirect remuneration or point-of sale rebates. In order to protect the beneficiary’s privacy, the Centers for Medicare & Medicaid Services (CMS) did not

include information in cases where 10 or fewer prescriptions were dispensed.

Top

Ten Drugs by Cost, 2014 [Most expensive for Medicare]

Drug Name

Total Claim Count

Beneficiary Count

Prescriber Count

Total Drug Cost

Sofosbuvir

109,543

33,028

7,323

$3,106,589,192

Esomeprazole Magnesium

7,537,736

1,405,570

286,927

$2,660,052,054

Rosuvastatin Calcium

9,072,799

1,752,423

266,499

$2,543,475,142

Aripiprazole

2,963,457

405,048

130,933

$2,526,731,476

Fluticasone/Salmeterol

6,093,354

1,420,515

281,775

$2,276,060,161

Tiotropium Bromide

5,852,258

1,211,919

253,277

$2,158,219,163

Lantus

Solostar

(Insulin Glargine)

4,441,782

972,882

224,710

$2,016,728,436

Sitagliptin Phosphate

4,495,964

789,828

190,741

$1,775,094,282

Lantus

(Insulin Glargine)

4,284,173

787,077

223,502

$1,725,391,907

Lenalidomide

178,373

27,142

9,337

$1,671,610,362

View the Medicare Part D National Prescriber Summary Report, Calendar Year 2014 (Excel version available) for FREE!

Top

Ten Drugs by Average Cost per Claim, 2014 [Most expensive drugs]

Drug Name

Total Claim Count

Beneficiary Count

Prescriber Count

Total Drug Cost

Average Cost Per Claim

Adagen

13

$1,224,835

$94,218

Elaprase

100

$6,560,225

$65,602

Cinryze

1,820

194

196

$96,155,785

$52,833

Carbaglu

60

$2,901,115

$48,352

Naglazyme

129

$6,189,045

$47,977

Berinert

538

73

68

$25,685,311

$47,742

Firazyr

1,568

269

232

$70,948,143

$45,248

H.P. Acthar

9,611

2,932

1,621

$391,189,653

$40,702

Procysbi

314

41

47

$12,542,911

$39,946

Folotyn

15

$598,210

$39,881

Top

Ten Drugs by Claims, 2014 [Most Commonly Used by Patients]

Generic Name

Total Claim Count

Beneficiary Count

Prescriber Count

Total Drug Cost

Lisinopril

38,278,860

7,454,940

464,747

$281,614,340

Levothyroxine Sodium

37,711,869

6,245,507

416,518

$631,855,415

Amlodipine Besylate

36,344,166

6,750,062

451,350

$303,779,661

Simvastatin

34,092,548

6,768,159

387,651

$346,677,118

Hydrocodone-Acetaminophen

33,446,696

8,005,790

677,865

$676,296,988

Omeprazole

33,032,770

6,707,964

475,122

$529,050,385

Atorvastatin Calcium

32,603,055

6,740,061

419,327

$747,635,818

Furosemide

27,133,430

5,176,582

456,047

$135,710,772

Metformin HCl

23,475,787

4,509,978

364,273

$203,948,989

Gabapentin

22,143,641

4,298,609

486,754

$492,557,255

View the Medicare Part D National Prescriber Summary Report, Calendar Year 2014 (Excel version available) for FREE!

Top

Ten Drugs by Prescribers, 2014 [Most Popular with Doctors]

Generic Name

Total Claim Count

Beneficiary Count

Prescriber Count

Total Drug Cost

Hydrocodone/Acetaminophen

33,446,696

8,005,790

677,865

$676,296,988

Ciprofloxacin HCl

7,253,018

4,926,835

568,201

$46,728,353

Amoxicillin

6,298,980

4,384,899

557,614

$31,193,739

Cephalexin

5,040,219

3,529,303

557,048

$36,987,401

Azithromycin

7,339,954

5,274,010

544,625

$70,699,119

Prednisone

11,032,986

4,505,821

536,108

$86,537,932

Tramadol HCl

14,250,227

4,272,724

515,816

$125,343,514

Sulfamethoxazole /Trimethoprim

4,833,758

3,090,944

500,790

$29,231,511

Gabapentin

22,143,641

4,298,609

486,754

$492,557,255

Amoxicillin/Potassium Clav

3,551,452

2,710,244

478,361

$61,713,432

The findings from CMS

data

The CY 2014 data represented a 17 percent

increase compared to the 2013 data set and a substantial part of the total estimated prescription drug spending (as estimated by the Department of Health and Human Services Office of the Assistant Secretary for Planning and Evaluation, or ASPE) in the United States — at about US $ 457 billion in 2015, which was 16.7 percent of the overall personal healthcare services.

Of that US $ 457 billion, US $ 328 billion (71.9 percent) was for retail

drugs and US $ 128 billion (28.1 percent) was for non-retail drugs.

The drug pricing process in the US is complex and

reflects the influence of numerous factors, including manufacturer list prices,

confidential negotiated discounts and rebates, insurance plan benefit designs,

and patient choices.

An IMS study found that across 12 therapy classes widely used in Medicare Part D,

medicine costs to plans and patients in Medicare Part D are 35 percent below

list prices.

View the Medicare Part D National Prescriber Summary Report, Calendar Year 2014 (Excel version available) for FREE!

While the CMS does not

currently have an established formulary, Part D drug coverage excludes drugs

not approved by the US Food and Drug Administration, those prescribed for off-label

use, drugs not available by prescription for

purchase in the US, and drugs for which payments would be available under Parts

A or B of Medicare.

Part D coverage

excludes drugs or classes of drugs excluded from Medicaid coverage,

such as:

Drugs used for anorexia, weight loss, or weight gain

Drugs used to promote fertility

Drugs used for erectile dysfunction

Drugs used for cosmetic purposes (hair growth, etc.)

Drugs used for the symptomatic relief of cough and colds

Prescription vitamins and mineral products, except prenatal vitamins and fluoride preparations

Drugs where the manufacturer requires (as a condition of sale) any associated tests or monitoring services to be purchased exclusively from that manufacturer or its designee

Our view

The Medicare program is designed such that the

federal government is not permitted to negotiate prices of drugs with the drug

companies, as federal agencies do under other programs.

For instance, the Department of Veterans Affairs — which is allowed to negotiate drug prices and establish a formulary — has been estimated to pay (on an average) between 40 to 58 percent less for drugs, as opposed to Medicare Part D.

If Trump administration kick starts direct

negotiations on Medicare drug prices with drug companies, 2017 will surely turn

out to be a year for the pharmaceutical industry to remember.

View the Medicare Part D National Prescriber Summary Report, Calendar Year 2014 (Excel version available) for FREE!

Impressions: 7923

Unrelated to the inspection of

the USFDA at the Dr. Reddys Srikakulam facility, Dr. Reddys sought permission from the Ministry of Environment,

Forests & Climate Change to expand

their drug and intermediate manufacturing at three locations.

All three chemical technical operation (CTO) units, CTO-I, CTO-II & CTO-III are located in Medak district and the announced planned capacity increases along with the anticipated capital investment were

Existing Capacity

Planned Capacity

Anticipated Investment

CTO I

14.7 TPM

45.5 TPM

Rs 30 crores

CTO II

21.9 TPM

68.9 TPM

Rs 45 crores

CTO - III

4.45 TPM

28.1 TPM

Rs 12 crores

*$1 million is approximately about Rs 6.2

crores & TPM is tons per month

In addition, the declaration given by Dr. Reddys also mentions the various products which will be produced at each facility (table below).

Needless to say, the plans are ambitious however with the growth witnessed by the Indian pharmaceutical industry over the past decade, one can understand Dr. Reddys commitment to investing further in their business.

Table Dr. Reddys production plans at various facilities

Product

Name

Planned

Capacity (TPM)

Facility

Location

Alendronate

Sodium Trihydrate

6.67

CTO

- III

Alfuzosin

2.33

CTO

- I

Altretamine

0.03

CTO

- I

Amlodipine

Besylate

33.33

CTO

- II

Amlodipine

Besylate

133.33

CTO

- III

Amlodipine

Besylate ( Ethyl 4 [2- (pthalamide)ethoxy] aceto acetate (TDM-2)

100

CTO

- II

Amlodipine

Maleate

30

CTO

- III

Amsacrine

0.07

CTO

- I

Anastrazole

0.83

CTO

- II

Aprepitant

3.33

CTO

- III

Aripiprazole

0.33

CTO

- II

Atomoxetine

1.67

CTO

- III

Atorvastatin

375.83

CTO

- II

Azacitidine

0.67

CTO

- I

Bicalutamide

0.03

CTO

- II

Bivalirudin

0.03

CTO

- II

Bivalirudin

Trifluoro Acetate

0.03

CTO

- I

Bortezomib

0.03

CTO

- I

Cabazitaxel

0.02

CTO

- I

Candesartan

cilexetil

6.67

CTO

- II

Cetirizine

Hydrochloride

66.67

CTO

- I

Cetirizine

16.67

CTO

- II

Ciprofloxacin

176.67

CTO

- II

Ciprofloxacin

HCl

533.33

CTO

- II

Ciprofloxacin Lactate

33.33

CTO

- II

Clopidogrel

Bisulfate

500

CTO

- I

Clopidogrel Premix

166.67

CTO

- II

Diluted

Everolimus 5% (Everolimus)

0.33

CTO

- II

Disodium

Pamidronate

0.33

CTO

- III

Docetaxel

1.9

CTO

- I

Dutasteride

3.33

CTO

- II

Esomeprazole

magnesium

66.67

CTO

- III

Ezetimibe

3.33

CTO

- II

Fexofenadine

Hydrochloride

500

CTO

- I

Finasteride

10

CTO

- II

Fluoxetine

110

CTO

- I

Fondaparinux

Sodium

0.33

CTO

- II

Galantamine

0.03

CTO

- II

Gemcitabine

13.33

CTO

- I

Glimepiride

13.33

CTO

- II

Imatinib

0.17

CTO

- I

Irinotecan

0.33

CTO

- I

Ketorolac

66.67

CTO

- II

Lacidipine

5

CTO

- III

Lamotrigine

33.33

CTO

- I

Lansoprozole

8.33

CTO

- III

Letrozole

0.03

CTO

- II

Levocetrizine

Di HCl

10

CTO

- III

Levofloxacin

200

CTO

- II

Lomustine

1.33

CTO

- I

Losartan

Postassium

150

CTO

- I

Meloxicam

0.03

CTO

- I

Memantine

HCl

3.33

CTO

- II

Mesalamine

0.03

CTO

- II

Metoprolol

Succinate

266.67

CTO

- II

Moxifloxacin

116.67

CTO

- II

Norfloxacin

0.03

CTO

- I

Omeprazole

133.33

CTO

- III

Omeprazole

Magnesium

50

CTO

- III

Omeprazole

Sodium

10

CTO

- III

Omerprazole Form B

33.33

CTO

- III

Paclitaxel

0.33

CTO

- I

Pantoprazole

Sodium

100

CTO

- III

paroxetine

HCl

0.03

CTO

- II

Pemetrexed

0.67

CTO

- I

Rabeprazole

Sodium

83.33

CTO

- III

Raloxifene

33.33

CTO

- II

Ramipril

100

CTO

- III

Repaglinide

6.67

CTO

- II

Rivastigmine

6.67

CTO

- II

Risperidone

13.33

CTO

- I

Rivastigmine

6.667

CTO

- I

Rizatriptan

Benzoate

1.33

CTO

- II

Rocuronium

Bromide

0.03

CTO

- II

Ropinrole

HCl

1.83

CTO

- III

Rosiglitazone

3.33

CTO

- II

Sparfloxacin

3.33

CTO

- I

Tacrolimus

5

CTO

- II

Tadalafil

3.33

CTO

- II

Telmisartan

100

CTO

- II

Temozolamide

0.03

CTO

- I

Terbinafine

HCl

133.33

CTO

- III

Tizanidine

HCl

16.67

CTO

- III

Topotecan

0.07

CTO

- I

valganciclovir

0.03

CTO

- I

Vardenafil

3.33

CTO

- II

Voriconazole

8.33

CTO

- III

Ziprasidone

Hydrochloride

100

CTO

- I

Zoledronic

acid

0.33

CTO

- III

Zolmitriptan

0.83

CTO

- I

Zonisamide

0.03

CTO

- II

Impressions: 3086