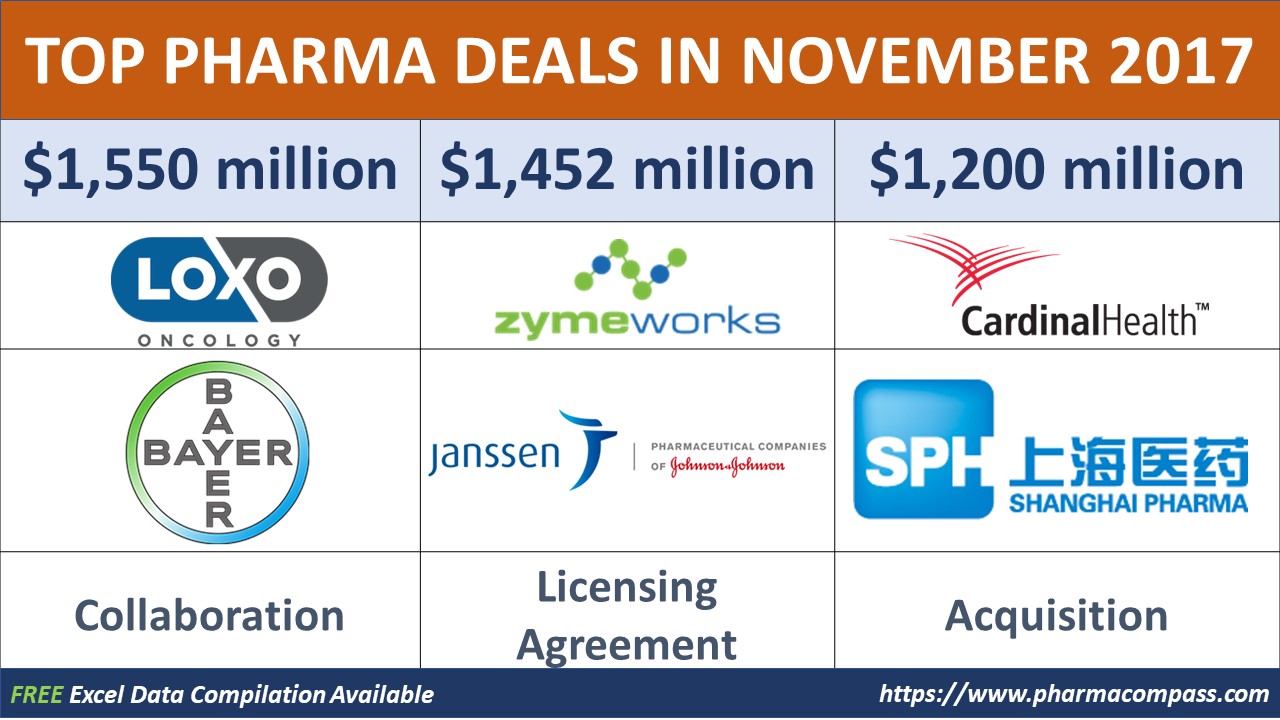

We are back this week with another edition of PharmaFlow, a monthly roundup of deals and investments from across the globe. Here, we look at the deals announced in November 2017.

The deals last month revolved around breakthrough cancer research and drug discovery, and new biopharmaceutical therapies for the disease. There were some exits too, as the female viagra (the controversial pink pill — Addyi— known for its harmful side-effects) got sold back to its original owners — Sprout Pharmaceuticals — and Cardinal Health exited China by selling its business to Shanghai Pharmaceuticals.

We hope our roundup of deals announced in November 2017 provides you with an insight into the breakthrough technologies and business trends of tomorrow.

Click here to view the major deals in November 2017 (FREE Excel version available)

Bayer bets big on oncology; in deals with Loxo Oncology and Japan’s PeptiDream

In November, Bayer announced a global collaboration with Loxo Oncology, Inc., a company focused on the development of highly selective medicines for patients with genetically defined cancers.

Bayer will assist in the development and commercialization of Loxo’s lead drug candidates — larotrectinib and LOXO-195.

Under the terms of the agreement, Loxo will receive a US$ 400 million upfront payment and is eligible for US$ 450 million in milestone payments upon larotrectinib achieving regulatory approvals and initial commercial sales in certain major markets.

An additional US$ 200 million in milestone payments will be paid by Bayer if larotrectinib’s follow-up drug, LOXO-195, obtains regulatory approvals and gets commercialized. The deal also has clauses where Bayer will pay Loxo Oncology milestone payments which can total another US$ 500 million.

Click here to view the major deals in November 2017 (FREE Excel version available)

Larotrectinib is a potent, oral and selective investigational new drug in clinical development for the treatment of patients with cancers that harbor abnormalities involving the tropomyosin receptor kinases (TRKs), also known as TRK fusion cancers.

Protein coding genes — or neurotrophic tyrosine receptor kinase (NTRK) 1 to 3 — contained within the DNA of a cell provide instructions for synthesizing proteins, the blueprint for cellular communication. The NTRK1-3 genes encode for the TRK family of receptor proteins that sit on the surface of cells. The TRK receptors provide instructions to cells. They are found primarily in neurons and help regulate how neurons function in the setting of pain, cognition, movement, memory, and mood.

Growing research suggests that the NTRK genes, which encode for TRKs, can become abnormally fused to other genes, resulting in growth signals that can lead to cancer in many sites of the body. As a result, research during the last several years has generated interest in TRKs as a potential target for cancer therapeutics.

Click here to view the major deals in November 2017 (FREE Excel version available)

Bayer signs research agreement with PeptiDream: At almost the same time as Bayer announced the Loxo deal, the company also signed a major research agreement with Japan’s PeptiDream. While the details of the payments involved were not announced, the overall deal could be worth as much as US$ 1.11 billion (¥124.5 billion) in milestone bonuses, as well as royalties on sales.

The deal requires the Japanese biotech to use its Peptide Discovery Platform System (PDPS) to find macrocyclic/constrained peptides against multiple targets “of interest selected by Bayer,” as well as to “optimize hit peptides into therapeutic peptides or small molecule products.”

Peptides are natural biological or artificially manufactured short chains of amino acid monomers linked by peptide bonds. Therapeutic drugs for cancer and immune diseases are generally very expensive and often cause side effects. Use of non-standard peptides have been attracting considerable attention as a new approach to develop drugs with less side effects.

Click here to view the major deals in November 2017 (FREE Excel version available)

PeptiDream’s PDPS enables humans to artificially create millions of different kinds of non-standard peptides and then narrow these peptides down to candidates for new drugs in short time.

Over the past seven years, PeptiDream has established discovery collaborations with 17 of the leading pharmaceutical companies in the world.

Canada’s ZymeWorks in licensing agreement with Janssen Biotech

Another company that has established multiple strategic partnerships with global biopharmaceutical companies is Canada’s ZymeWorks.

In November, it announced a licensing agreement with Janssen Biotech, one of the Janssen Pharmaceutical Companies of Johnson & Johnson.

Under the terms of the licensing agreement, Zymeworks will provide Janssen with a worldwide, royalty-bearing license to research, develop, and commercialize up to six bispecific antibodies directed to Janssen therapeutic targets using Zymeworks’ Azymetric™ and EFECT™ platforms.

Under this agreement, ZymeWorks will receive an upfront payment of US$ 50 million and become eligible to potentially receive up to US$ 282 million in development payments and up to US$ 1.12 billion in commercial milestone payments.

Click here to view the major deals in November 2017 (FREE Excel version available)

Merck

announces US$ 1.3 billion post-Brexit investment in London

MSD, known as Merck and Co., Inc., in the US and Canada, announced its commitment to establish a state-of-the-art life sciences discovery research facility in London, focused on early bioscience discovery and entrepreneurial innovation. The new UK Discovery Centre will involve an investment of around US$ 1.2 billion (£1 billion).

Merck’s announcement was considered a vote of confidence in the United Kingdom at a time when it is struggling to convince companies they will thrive in the UK after Brexit.

The UK Discovery Centre is anticipated to create 150 new research roles with the aim of attracting the brightest and best research scientists to work in London. The company is currently evaluating several potential locations in the London region with a target date of 2020 for operational readiness.

Click here to view the major deals in November 2017 (FREE Excel version available)

Cardinal Health exits China, sells business to Shanghai

Pharmaceuticals

Cardinal Health announced it had reached an agreement to sell its Cardinal Health China business to Shanghai Pharmaceuticals Holding for US$ 1.2 billion. The sale was a highly competitive auction which drew keen interest from state-backed Chinese pharmaceutical companies and private equity firms.

The buyout will help Shanghai Pharma, the country’s third largest drug distributor, become a leading importer of foreign medicine into China, which is today the world’s second-largest drug market.

With ongoing supply-side reforms in China, the domestic pharmaceutical distribution sector is poised to embrace a new wave of industry consolidation. The Chinese government has issued several new industry policies, in particular, the adoption of the "two invoice system" that aims to reduce intermediary links, and the "zero price markup" policy that limits public hospitals from profiting from drug sales.

These industry policies are driving distributors to upgrade a number of capabilities, including distribution network coverage, operational efficiency, capital sufficiency and logistic capabilities, resulting in accelerated sector consolidation and change of business model.

Click here to view the major deals in November 2017 (FREE Excel version available)

Cardinal Health had put its China business up for sale in July amid worries that the country’s upcoming drug distribution reform could slow its growth.

‘Female Viagra’ sold back to its owners

Two years after buying the female libido pill business from Sprout Pharmaceuticals for US$ 1 billion, Valeant Pharmaceuticals International said it plans to sell the business back to its original owner.

The controversial pink pill — Addyi — made by Sprout was said to be a blockbuster drug, expected to command a US$ 2 billion market. However, Addyi proved to be a commercial disaster, with its sales being sluggish last year. What was worse, Valeant was sued on behalf of the former Sprout investors for its alleged failure to market Addyi successfully. The complaint had said that sales of the pill may have totaled less than US$ 10 million in 2016, far short of the US$ 1 billion targeted by July, 2017.

Addyi, approved by the US FDA in August 2015 under intense pressure from patient advocacy groups, is meant to be taken daily. It is prescribed to activate sexual impulses, but carries a strong warning about its potential side effects — such as low blood pressure and fainting, especially when taken with alcohol. Many in the industry believe that the drug should never have been approved.

Click here to view the major deals in November 2017 (FREE Excel version available)

Valeant has agreed to sell its subsidiary and Addyi to a new company “associated” with Sprout’s founders, for a royalty stream of only 6 percent on global sales of Addyi. In addition, Valeant said it will provide a US$ 25 million loan to fund initial operating expenses to the new company to get things started. And in exchange, Sprout is dropping its lawsuit claiming Valeant mismanaged the launch by pricing the drug too high.

Our view

For two successive months, thanks to a rapidly deteriorating business environment for generic companies, we saw generic drug makers get ahead of others in deal making. But in November, new breakthrough technologies driving future drug development were back in prominence.

Earlier this month, the Cancer Research Institute (CRI), a leading non-profit organization, released an analysis on the exciting space of cancer immuno-oncology (IO).

In its report, titled, “Comprehensive Analysis of the Immuno-Oncology Landscape,” CRI tracked the clinical landscape (from pre-clinical development to regulatory approval) and uncovered 2,004 IO agents, of which 940 are already in clinical development.

Novel cancer therapies have almost always been among the major deals struck. However, the CRI report and these major deals in oncology makes one wonder if drug discovery efforts need to be balanced and re-directed to other therapy areas as well.

Click here to view the major deals in November 2017 (FREE Excel version available)

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : TOP PHARMA DEALS IN NOVEMBER 2017 by PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”