By PharmaCompass

2022-05-26

Impressions: 3162

Over the last few decades, there has been a rise in kidney-related diseases. Conventionally, diabetes, hypertension, obesity are seen to be the main reasons behind chronic kidney disease (CKD). A report published by Research Dive attributes the worldwide rise in kidney diseases, such as kidney fibrosis and kidney failure, among millennials to lifestyle changes. The increasing geriatric population across the world is further adding to the numbers, since CKD is known to be common amongst the elderly.

Kidney disease can also be termed as a “hidden epidemic”. According to various estimates, over 850 million people worldwide suffer from kidney disease. That’s twice the number of diabetics (422 million) across the world. According to the Centers for Disease Control and Prevention 2021, CKD affects more than one in seven adults in the US.

Covid-19 has also resulted in a growth in kidney-related diseases. The incidence of acute kidney injury was observed in 50 percent of hospitalized Covid-19 patients.

Nephrology, or the study of kidneys, has witnessed tremendous growth and innovation in recent years. Today, there are several new therapies in the pipeline. Advancement in fields like bioartificial kidney, organs-on-chips technology, cell and gene therapy are poised to bring effective treatments to the market soon.

The global nephrology drugs market generated US$ 14.5 billion in 2020, and is projected to generate US$ 23.4 billion by 2030, witnessing a CAGR of 5 percent over a 10-year period. Companies like AstraZeneca, AbbVie, Akebia Therapeutics, GSK, FibroGen and Aurinia Pharmaceuticals are the major players in this segment.

Access the Nephrology Newsmakers Dashboard

Lilly’s Jardiance may soon compete with Farxiga, Kerendia as treatment for CKD

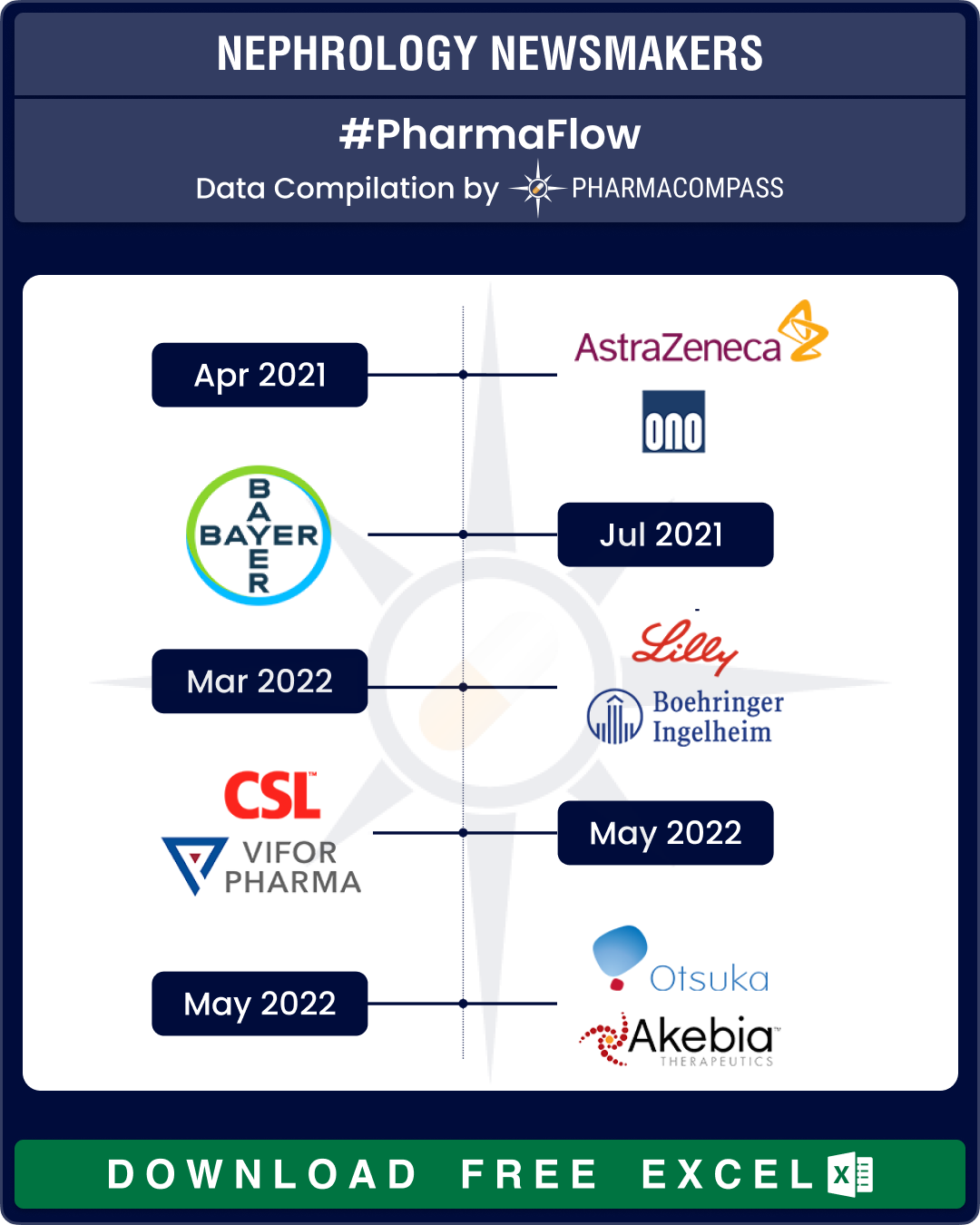

Nephrology saw two key approvals last year — Farxiga and Kerendia. In April 2021, the US Food and Drug Administration (FDA) approved Farxiga (dapagliflozin) oral tablets to reduce the risk of kidney function decline, kidney failure, cardiovascular death and hospitalization for heart failure in adults with CKD who are at risk of disease progression. AstraZeneca and Ono Pharma’s Farxiga was originally approved in 2014 to improve glycemic control in adults with type 2 diabetes. Farxiga reached US$1 billion in quarterly sales for the first time during the first three months of 2022.

In July 2021, FDA approved Kerendia (finerenone) tablets to reduce the risk of kidney function decline, kidney failure, cardiovascular death, non-fatal heart attacks and hospitalization for heart failure in adults with CKD associated with type 2 diabetes. Kerendia bagged approval in EU in February this year. Bayer estimates the drug to bring in US$ 1.06 billion (€1 billion) in peak sales.

Besides these two treatments, two more drugs maybe approved soon as treatments for CKD — Eli Lilly and Boehringer Ingelheim’s Jardiance and GSK and its Japanese partner Kyowa Kirin’s candidate daprodustat.

In March this year, a phase 3 trial of Jardiance (empagliflozin) tablet in adults with CKD was stopped early on the recommendation of the trial’s independent data monitoring committee. If approved for CKD, Jardiance will be up against Bayer’s Kerendia and AstraZeneca’s Farxiga. Jardiance was originally approved for type 2 diabetes in 2014.

GSK-Kyowa Kirin’s candidate daprodustat is in phase 3 trials as a treatment for anemia in CKD. A decision on the approval of this drug is expected by February 1, 2023.

Access the Nephrology Newsmakers Dashboard

CSL-Vifor deal faces regulatory snag; Otsuka ends agreement with Akebia

The field of nephrology has suffered some setbacks of late. In December, the world of pharmaceuticals saw its biggest deal of 2021 when Australian biopharma CSL agreed to acquire Vifor Pharma for US$ 11.7 billion. CSL is heavily dependent on vaccines and blood plasma products, and the acquisition was to give the drugmaker access to Vifor’s portfolio of products across nephrology, dialysis and iron deficiency therapies. CSL was expecting to close the acquisition in June this year. However, earlier this month, the company said the regulatory approval process has hit a snag and it will take a few more months to get the deal approved.

The other jolt came earlier this month when Otsuka Pharmaceutical said it is terminating its global license agreements with Akebia Therapeutics for vadadustat, an HIF-PH (hypoxia-inducible factor prolyl hydroxylase) inhibitor in phase 3 trials. HIF-PH is a new class of agents for the treatment of anemia in CKD. These licenses were signed in December 2016 for the US and in April 2017 for Europe and other regions. In March this year, Akebia received a complete response letter (CRL) from the FDA. As a result, Otsuka decided to terminate its agreement.

Akebia had applied for approval of vadadustat to treat anemia due to CKD in both dialysis-dependent (DD) and non-dialysis dependent (NDD) patients. FDA had noted safety concerns for the drug, including higher risks of thromboembolic events and liver injury.

The third setback came in the form of FDA’s CRL to FibroGen’s roxadustat. The agency’s cardiovascular and renal drugs advisory committee voted 13 to one on the benefit-risk profile of roxadustat, not supporting its approval in this indication in adult NDD-CKD patients. The CRL also sought a further clinical trial to analyze the safety of the drug before resubmission.

Roxadustat was developed in collaboration with Astellas Pharma and AstraZeneca. It has received approvals in Japan, China, Europe and several other countries. It is marketed as Evrenzo in Europe and sells the most in China.

Access the Nephrology Newsmakers Dashboard

FDA grants RMAT status to ProKidney’s cell therapy

In January this year, blank-check firm Social Capital Suvretta Holdings Corp III said it will merge with biotech firm ProKidney to form an entity valued at US$ 2.64 billion. The merger with Suvretta will give ProKidney up to US$ 825 million to advance research and development of its treatment for CKD. It includes US$ 250 million that Suvretta raised through an IPO in July last year and a US$ 575 million private investment in equity.

The deal includes ProKidney’s lead product REACT (renal autologous cell therapy), a first-of-its-kind cellular therapy, which has the potential to slow and stabilize the progression of CKD. REACT has received FDA’s Regenerative Medicine Advanced Therapy Designation (RMAT) for its phase 3 clinical program, which was launched in the US in January 2022. RMAT is a designation given by the FDA to drug candidates intended to treat serious or life-threatening conditions.

Access the Nephrology Newsmakers Dashboard

New drug candidates for IgA nephropathy; new treatment for lupus nephritis

There are several other kidney diseases, besides CKD, for which drugmakers are working on new treatments. IgA nephropathy (IgAN) is one such kidney disease. It occurs when an antibody called immunoglobulin A (IgA) builds up in the kidneys, resulting in local inflammation that, over time, can hamper the kidneys’ ability to filter waste from the blood.

In 2021, Vifor Pharma and Travere Therapeutics had announced a licensing agreement for the commercialization of Travere’s IgAN drug candidate — sparsentan — in Europe, Australia and New Zealand. The candidate is in phase 3 trials.

As part of the deal, Travere received US$ 55 million as upfront payment. It is also eligible for milestone payments and royalties on net sales. This month, Travere announced FDA’s acceptance and priority review of its new drug application (NDA) for sparsentan as a treatment for IgAN.

Another drug candidate — atrasentan — to treat IgAN is being developed by Chinook, a company created in June 2020 through the merger of Aduro Biotech and Chinook Therapeutics. Atrasentan is in phase 3 trial for the treatment of IgAN and other kidney diseases.

In July 2021, Calliditas Therapeutics and STADA partnered to commercialize Nefecon (budesonide), now Kinpeygo, in Europe. Last week, Calliditas announced that the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA) has recommended a conditional marketing authorization for Kinpeygo to treat patients with primary IgAN. In December, the FDA had granted accelerated approval to Calliditas’ Tarpeyo (budesonide) delayed release capsules.

Another serious kidney ailment is lupus nephritis, which leads to inflammation of the kidneys. It is caused by an autoimmune disease called systemic lupus erythematosus (SLE), the most common type of lupus, causing widespread inflammation and tissue damage in the affected organs.

In December 2020, GSK’s Benlysta (belimumab) became the first drug approved by the FDA for adult patients with active lupus nephritis. The approval extends the current indication in the US to include both SLE and lupus nephritis for both the intravenous and subcutaneous formulations. Benlysta was approved by China for active lupus nephritis in February 2022. GSK is up against Aurinia’s Lupkynis (voclosporin) capsule, which was approved by FDA in January 2021.

Benlysta is also up against AstraZeneca’s Saphnelo (anifrolumab), which in February 2022 became the first new drug to be approved to treat SLE in the EU. It was approved by the FDA in August last year. Saphnelo recorded worldwide sales of around US$ 1.2 billion in SLE last year. Saphnelo is currently in a phase 3 trial for lupus nephritis.

Access the Nephrology Newsmakers Dashboard

Our view

The number of people with end-stage renal disease (ESRD), a condition in which a person’s kidneys cease to function on a permanent basis, has grown considerably. The world has also seen rapid changes in the way dialysis (a procedure to remove waste and excess fluid from the blood in patients with ESRD) is performed, and to whom it is provided. Today, patients can perform hemodialysis at home. Despite the breakthroughs, the costs are prohibitive and many ESRD patients forego treatment due to lack of access, resulting in millions of deaths worldwide.

The Covid-19 pandemic not just caused delays in clinical trials of nephrology drugs, but also resulted in lower usage of these drugs. Lockdowns affected drug production and caused supply chain disruptions.

Nephrology requires patient-centric innovation. The approvals of Farxiga and Kerendia to address CKD, numerous licensing deals, breakthroughs in cell therapy and other new means to treat kidney diseases have created a glimmer of hope for kidney patients across the world. However, a reduction in costs of nephrology drugs and dialysis is the only way to improve access of these treatments.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Nephrology Newsmakers by PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”