By PharmaCompass

2025-06-19

Impressions: 8608

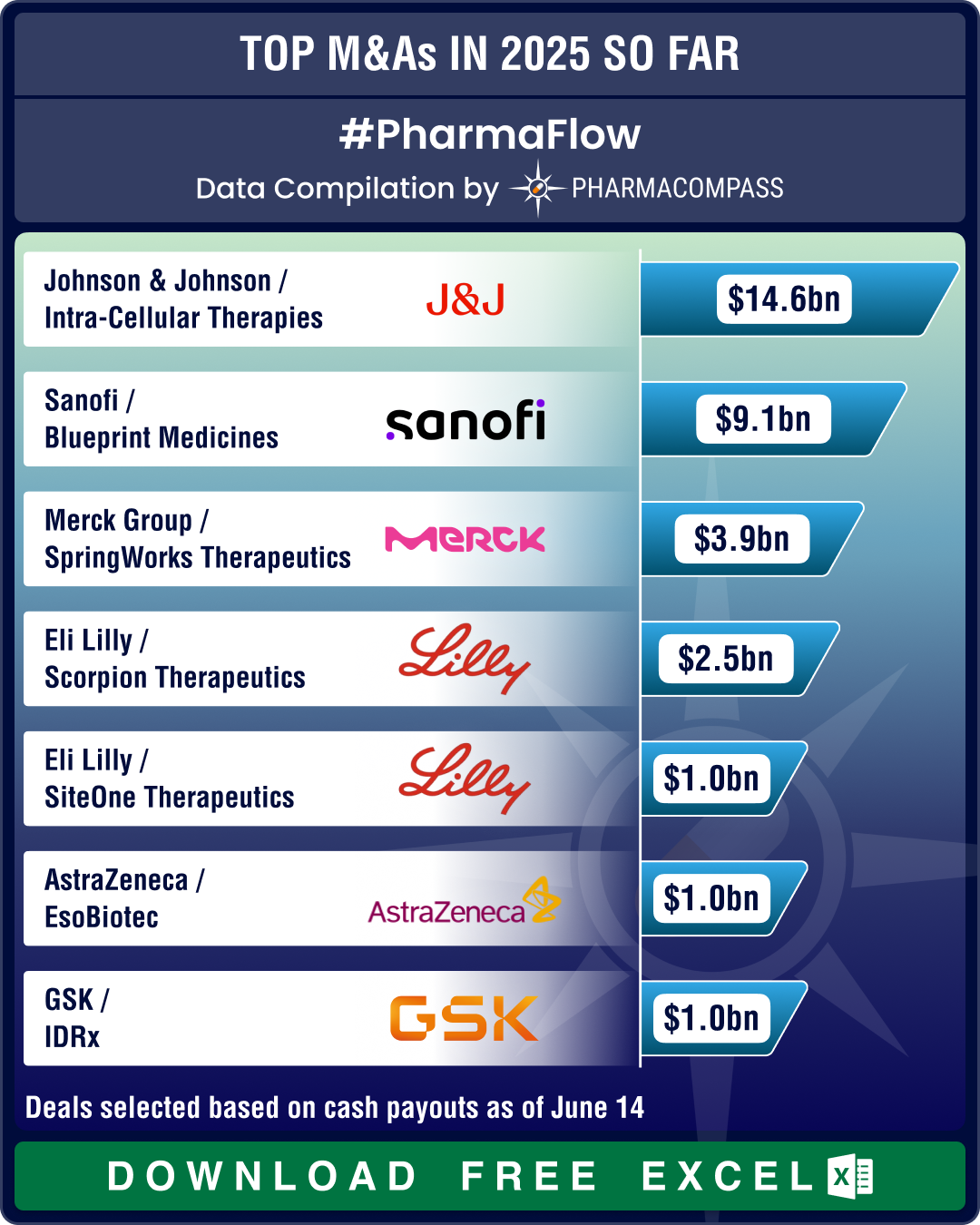

The pharmaceutical industry has witnessed a wave of mergers, acquisitions, and strategic partnerships so far in the first half (H1) of 2025, with deal values exceeding US$ 170 billion.

PharmaCompass’ data shows oncology alone accounted for nearly US$ 47 billion in deal value, followed by US$ 18 billion each in immunology and psychiatry, US$ 17 billion in nutrition/weight loss and US$ 7 billion in neurology.

Pharma majors such as Johnson & Johnson and Bristol Myers Squibb led with two deals worth over US$ 10 billion each. Sanofi executed a series of deals in the immunology and neuro-inflammation space. And Eli Lilly stood out for its aggressive dealmaking, which spanned oncology, pain, RNA therapies, and AI-driven oligonucleotides. In all, it signed seven deals worth over US$ 1 billion each.

View Pharma & Biotech Acquisitions, Deals & Agreements in 2025 as of June 14 (Free Excel Available)

H1 records several mega deals as J&J buys Intra-Cellular, BMS ties up with BioNTech, Sanofi acquires Blueprint

Johnson & Johnson dominated headlines with its US$ 14.6 billion acquisition of Intra-Cellular Therapies in January 2025. This marks the largest biopharma deal since Novo Nordisk’s US$ 16.5 billion acquisition of Catalent in February 2024. This acquisition positions J&J as a formidable player in the neuroscience space.

Bristol Myers Squibb entered into a US$ 11.1 billion partnership with BioNTech. The deal structure — US$ 3.5 billion in unconditional payments and up to US$ 7.6 billion in milestone payments — demonstrates BMS’ confidence in BNT327, a next-generation bispecific antibody in phase 3 trials for treating extensive stage small cell lung cancer and non-small cell lung cancer.

Sanofi acquired Blueprint Medicines for US$ 9.5 billion in order to enhance its rare disease portfolio. The French drugmaker is also creating a comprehensive immunology portfolio. The company signed a US$ 1.9 billion deal for Dren Bio’s DR-0201 bispecific antibody for autoimmune diseases. Sanofi also acquired Vigil Neuroscience for US$ 470 million for its phase 2-ready Alzheimer’s disease candidate. Additionally, the drugmaker secured a US$ 1.84 billion global license agreement with Earendil Labs for two next-generation bispecific antibodies.

Pfizer’s US$ 6.05 billion partnership with 3SBio provides it global licensing rights (excluding China) for SSGJ-707, a bispecific antibody currently undergoing multiple clinical trials in China for non-small cell lung cancer, metastatic colorectal cancer, and gynecological tumors.

View Pharma & Biotech Acquisitions, Deals & Agreements in 2025 as of June 14 (Free Excel Available)

Obesity gold rush sees Roche, AbbVie, Sciwind ink deals; Novo pledges over US$ 5 bn across three deals

The obesity therapeutics market has triggered intense competition among pharmaceutical giants. Roche’s US$ 5.3 billion partnership with Zealand Pharma is focused on petrelintide, an amylin analog designed to preserve lean mass better than existing GLP-1-based treatments. The collaboration combines petrelintide with Roche’s dual GLP-1/GIP receptor agonist CT-388, creating a differentiated obesity treatment.

Market leader Novo Nordisk has promised over US$ 5 billion across three major obesity deals in 2025. The US$ 2.2 billion Septerna collaboration targets oral small molecule medicines for obesity and cardiometabolic diseases.

Novo signed a separate US$ 2 billion agreement with China’s United Biotechnology for UBT251, a triple agonist for GLP-1, GIP, and glucagon receptors in phase 2 clinical development for obesity, type 2 diabetes, and other diseases. The company’s third major deal, a US$ 1 billion partnership with Lexicon Pharmaceuticals, provides it access to LX9851, a molecule in preclinical development for obesity and associated metabolic disorders.

Sciwind Biosciences secured a US$ 2.5 billion global licensing and collaboration agreement with Verdiva Bio Limited for the global development and commercialization of a portfolio of metabolic diseases therapies. AbbVie entered the amylin arena through its US$ 2.2 billion Gubra partnership for GUB014295, a candidate in phase 1 trials for treating obesity.

View Pharma & Biotech Acquisitions, Deals & Agreements in 2025 as of June 14 (Free Excel Available)

Molecular glue degraders draw investments; Lilly signs seven deals over US$ 1 billion each

Molecular glue degraders have emerged as a transformative therapeutic modality, attracting significant investment across multiple partnerships. AbbVie’s US$ 1.64 billion collaboration with Neomorph leverages the biotech’s leading molecular glue discovery platform for oncology and immunology applications.

Genentech’s potential US$ 2.1 billion partnership with Orionis Biosciences focuses on small-molecule monovalent glue medicines for novel and challenging oncology targets. This is the second partnership between the two companies, following their initial 2023 collaboration.

Eli Lilly has collaborated with Magnet Biomedicine, utilizing Magnet’s TrueGlue discovery platform for oncology applications. The deal could be worth up to US$ 1.3 billion.

Eli Lilly has emerged as one of 2025’s most active dealmakers, with approximately seven deals exceeding US$ 1 billion each. The company’s US$ 2.5 billion Scorpion Therapeutics acquisition provides access to STX-478, an experimental oral therapy in early-stage trials for breast cancer and advanced solid tumors, potentially addressing 30 to 40 percent of hormone-positive breast cancer patients.

On June 17, Lilly announced the acquisition of gene-editing startup Verve Therapeutics for US$ 1.3 billion. Lilly’s US$ 1 billion SiteOne acquisition announced in May brings STC-004, a phase 2-ready non-opioid chronic pain treatment to its pipeline. Other partnerships announced by Lilly include a US$ 1.4 billion capsid licensing deal with Sangamo for central nervous system disease genomic medicines and a US$ 1.3 billion collaboration with South Korean company Rznomics for RNA-based hearing loss treatments. Lilly has also strengthened its oligonucleotide pipeline through a potential US$ 1 billion collaboration with Creyon Bio for AI-designed oligonucleotide therapies targeting RNA.

View Pharma & Biotech Acquisitions, Deals & Agreements in 2025 as of June 14 (Free Excel Available)

Merck KGaA acquires SpringWorks for US$ 3.9 bn; Novartis buys out Anthos for US$ 3.1 bn

AstraZeneca signed a US$ 5.3 billion AI-led research agreement with China’s CSPC Pharmaceuticals Group to advance the discovery of novel oral candidates for immunological diseases.

Merck KGaA acquired SpringWorks for US$ 3.9 billion in April, which gave it access to two FDA-approved therapies — Ogsiveo (nirogacestat), the first and only approved therapy for adult patients with progressing desmoid tumors requiring systemic treatment, and Gomekli (mirdametinib), the first and only FDA-approved therapy for adults and children with neurofibromatosis type 1-associated plexiform neurofibromas.

Novartis’ US$ 3.1 billion Anthos Therapeutics acquisition centered around abelacimab, a potential first-in-class monoclonal antibody currently in three phase 3 studies for stroke and systemic embolism prevention in atrial fibrillation patients.

GSK’s US$ 2 billion acquisition of Boston Pharmaceuticals’ efimosfermin targets steatotic liver disease (fatty liver disease). The medicine is also in clinical development for MASH treatment. GSK’s second major deal involved the US$ 1.15 billion acquisition of US biotech IDRx, strengthening its gastrointestinal cancer portfolio.

The pharma industry also drew some private equity interest as Bain Capital acquired Japan’s Mitsubishi Tanabe Pharma from Mitsubishi Chemical Group for US$ 3.3 billion.

View Pharma & Biotech Acquisitions, Deals & Agreements in 2025 as of June 14 (Free Excel Available)

Our view

Despite an uncertain geopolitical environment, the year has seen a surge in M&As and dealmaking in the first half of 2025. However, a sizable chunk of the acquisitions were bolt-on transactions, indicating that companies are not ready to take on risks, and are buying out smaller players who strategically fit into their operations. Going forward, there are indications that M&A activity will stay strong throughout 2025.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : TOP M&As IN 2025 SO FAR by PharmaCompass license under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”