Acquisitions and spin-offs dominated headlines in 2019 and the tone was set very early with Bristol-Myers Squibb acquiring

New Jersey-based cancer drug company Celgene in a US$ 74 billion deal announced on

January 3, 2019. After factoring

in debt, the deal value ballooned to about US$ 95 billion, which according

to data compiled by Refinitiv, made it the largest healthcare deal on

record.

In the summer, AbbVie Inc,

which sells the world’s best-selling drug Humira, announced its acquisition of Allergan Plc, known for Botox and other cosmetic

treatments, for US$ 63 billion. While the companies are still awaiting

regulatory approval for their deal, with US$ 49 billion in combined 2019

revenues, the merged entity would rank amongst the biggest in the industry.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

The big five by pharmaceutical sales — Pfizer,

Roche, J&J, Novartis and Merck

Pfizer

continued

to lead companies by pharmaceutical sales by reporting annual 2019 revenues of

US$ 51.8 billion, a decrease of US$ 1.9 billion, or 4 percent, compared to

2018. The decline was primarily attributed to the loss of exclusivity of Lyrica in 2019,

which witnessed its sales drop from US$ 5 billion in 2018 to US$ 3.3 billion in

2019.

In 2018, Pfizer’s then incoming CEO Albert Bourla had mentioned that the company did not see the need for any large-scale M&A activity as Pfizer had “the best pipeline” in its history, which needed the company to focus on deploying its capital to keep its pipeline flowing and execute on its drug launches.

Bourla stayed true to his word and barring the acquisition of Array Biopharma for US$ 11.4 billion and a spin-off to merge Upjohn, Pfizer’s off-patent branded and generic established medicines business with

Mylan, there weren’t any other big ticket deals which were announced.

The

Upjohn-Mylan merged entity will be called Viatris and is expected to have 2020

revenues between US$ 19 and US$ 20 billion

and could outpace Teva to

become the largest generic company in the world, in term of revenues.

Novartis, which had

followed Pfizer with the second largest revenues in the pharmaceutical industry

in 2018, reported its first full year earnings after spinning off its Alcon eye

care devices business division that

had US$ 7.15 billion in 2018 sales.

In 2019,

Novartis slipped two spots in the ranking after reporting total sales of US$

47.4 billion and its CEO Vas Narasimhan continued his deal-making spree by buying New

Jersey-headquartered The Medicines Company (MedCo) for US$ 9.7

billion to acquire a late-stage cholesterol-lowering

therapy named inclisiran.

As Takeda Pharmaceutical Co was

busy in 2019 on working to reduce its debt burden incurred due to its US$ 62

billion purchase of Shire Plc, which was announced in 2018, Novartis also purchased

the eye-disease medicine, Xiidra, from the Japanese drugmaker for US$ 5.3 billion.

Novartis’ management also spent a considerable part of 2019 dealing with data-integrity concerns which emerged from its 2018 buyout of AveXis, the

gene-therapy maker Novartis had acquired for US$ 8.7 billion.

The deal gave Novartis rights to Zolgensma,

a novel treatment intended for children less than two years of age with the

most severe form of spinal muscular atrophy (SMA). Priced at US$ 2.1 million,

Zolgensma is currently the world’s most expensive drug.

However,

in a shocking announcement, a month after approving the drug, the US Food and

Drug Administration (FDA) issued a press release on

data accuracy issues as the agency was informed by AveXis that

its personnel had manipulated data which

the FDA used to evaluate product comparability and nonclinical (animal)

pharmacology as part of the biologics license application (BLA), which was

submitted and reviewed by the FDA.

With US$

50.0 billion (CHF 48.5 billion) in annual pharmaceutical sales, Swiss drugmaker

Roche came in at number two position in 2019

as its sales grew 11 percent driven by

its multiple sclerosis medicine Ocrevus, haemophilia drug Hemlibra and cancer medicines Tecentriq and Perjeta.

Roche’s newly introduced medicines generated US$ 5.53 billion (CHF 5.4 billion) in growth, helping offset the impact of the competition from biosimilars for its three best-selling drugs MabThera/Rituxan, Herceptin and Avastin.

In late 2019, after months of increased

antitrust scrutiny, Roche completed

its US$ 5.1 billion acquisition of Spark Therapeutics to strengthen its presence in

gene therapy.

Last year, J&J reported almost flat worldwide sales of US$ 82.1 billion. J&J’s pharmaceutical division generated US$ 42.20 billion and its medical devices and consumer health divisions brought in US$ 25.96 billion and US$ 13.89 billion respectively.

Since J&J’s consumer health division sells analgesics, digestive health along with beauty and oral care products, the US$ 5.43 billion in consumer health sales from over-the-counter drugs and women’s health products was only used in our assessment of J&J’s total pharmaceutical revenues. With combined pharmaceutical sales of US$ 47.63 billion, J&J made it to number three on our list.

While the sales of products like Stelara, Darzalex, Imbruvica, Invega Sustenna drove J&J’s pharmaceutical business to grow by 4 percent over 2018, the firm had to contend with generic competition against key revenue contributors Remicade and Zytiga.

US-headquartered Merck, which is known as

MSD (short for Merck Sharp & Dohme) outside the United States and

Canada, is set to significantly move up the rankings next year fueled by its

cancer drug Keytruda, which witnessed a 55

percent increase in sales to US$ 11.1 billion.

Merck reported total revenues of US$ 41.75 billion and also

announced it will spin off its women’s health drugs,

biosimilar drugs and older products to create a new pharmaceutical

company with US$ 6.5 billion in annual revenues.

The firm had anticipated 2020 sales between US$ 48.8 billion and US$ 50.3 billion however this week it announced that the coronavirus pandemic will reduce 2020 sales by more than $2 billion.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

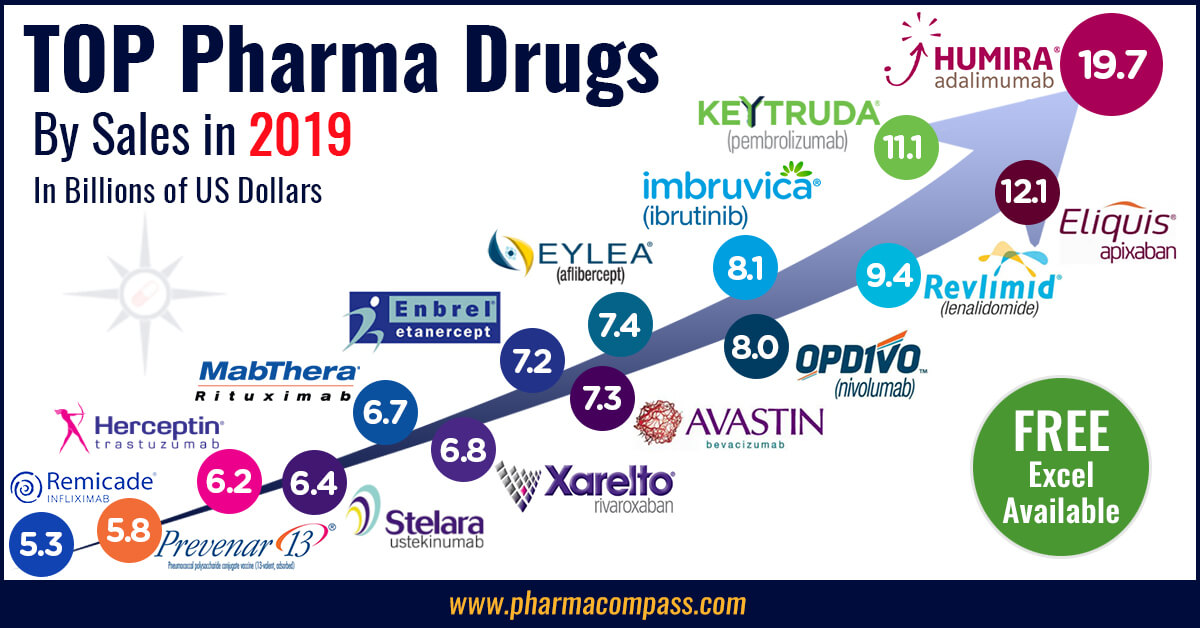

Humira holds on to remain world’s best-selling drug

AbbVie’s acquisition of Allergan comes as the firm faces the expiration of patent protection for Humira, which brought in a staggering US$ 19.2 billion in sales last year for

the company. AbbVie has failed to successfully acquire or develop a major new

product to replace the sales generated by its flagship drug.

In 2019, Humira’s US revenues increased 8.6 percent to US$ 14.86 billion while internationally, due

to biosimilar competition, the sales dropped 31.1 percent to US$ 4.30 billion.

Bristol Myers Squibb’s Eliquis, which is also marketed by Pfizer, maintained its number two position

and posted total sales of US$ 12.1 billion, a 23 percent increase over 2018.

While Bristol Myers Squibb’s immunotherapy treatment Opdivo, sold in partnership with Ono in Japan, saw sales increase from US$ 7.57 billion to US$ 8.0 billion, the growth paled in comparison to the US$ 3.9

billion revenue increase of Opdivo’s key immunotherapy competitor Merck’s Keytruda.

Keytruda took the number three spot in drug sales that

previously belonged to Celgene’s Revlimid, which witnessed a sales decline from US$ 9.69 billion to US$ 9.4 billion.

Cancer treatment Imbruvica, which is marketed

by J&J and AbbVie, witnessed a 30 percent increase in sales. With US$ 8.1

billion in 2019 revenues, it took the number five position.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Vaccines – Covid-19 turns competitors into partners

This year has been dominated by the single biggest health emergency in years — the novel coronavirus (Covid-19) pandemic. As drugs continue to fail to meet expectations, vaccine development has received a lot of attention.

GSK reported the highest vaccine sales of all drugmakers with

total sales of US$ 8.4 billion (GBP 7.16 billion), a significant portion of its

total sales of US$ 41.8 billion (GBP 33.754 billion).

US-based Merck’s vaccine division also reported a significant increase in sales to US$ 8.0 billion and in 2019 received FDA and EU approval to market its Ebola vaccine Ervebo.

This is the first FDA-authorized vaccine against the deadly virus which causes

hemorrhagic fever and spreads from person to person through direct contact with

body fluids.

Pfizer and Sanofi also reported an increase in their vaccine sales to US$ 6.4

billion and US$ 6.2 billion respectively and the Covid-19 pandemic has recently

pushed drugmakers to move faster than ever before and has also converted

competitors into partners.

In a rare move, drug behemoths — Sanofi and GlaxoSmithKline (GSK) —joined hands to develop a vaccine for the novel coronavirus.

The two companies plan to start human trials

in the second half of this year, and if things go right, they will file

for potential approvals by the second half of 2021.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Our view

Covid-19 has brought the world economy to a grinding halt and shifted the global attention to the pharmaceutical industry’s capability to deliver solutions to address this pandemic.

Our compilation shows that vaccines and drugs

for infectious diseases currently form a tiny fraction of the total sales of

pharmaceutical companies and few drugs against infectious diseases rank high on

the sales list.

This could well explain the limited range of

options currently available to fight Covid-19. With the pandemic currently infecting

over 3 million people spread across more than 200 countries, we can safely

conclude that the scenario in 2020 will change substantially. And so should our

compilation of top drugs for the year.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Impressions: 54768

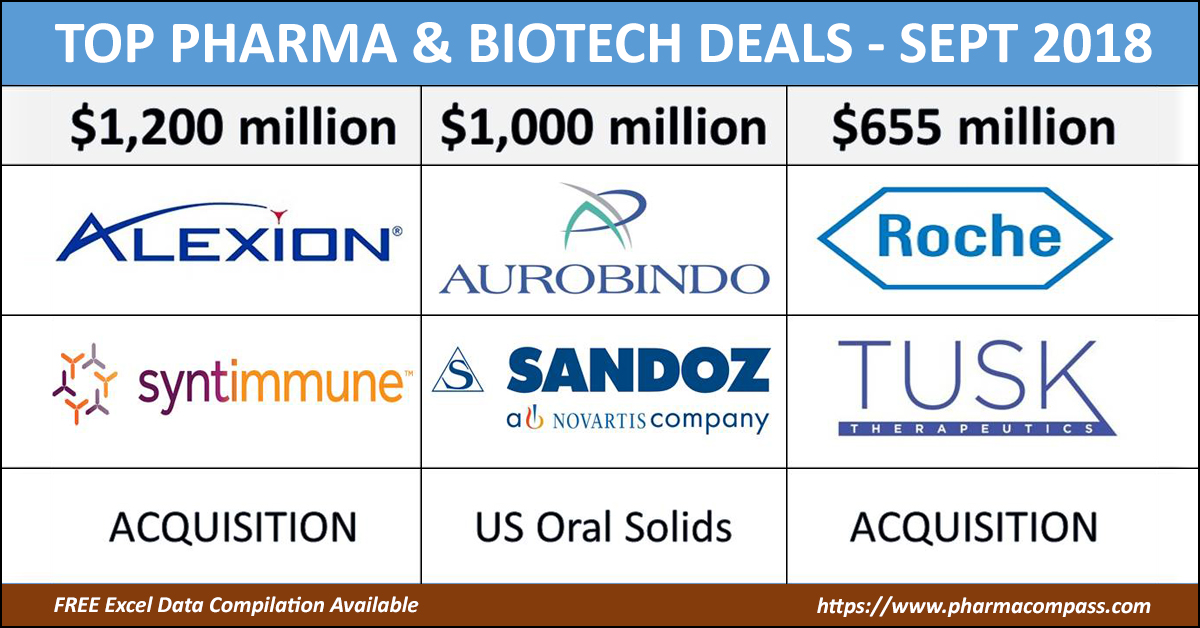

As

compared to the previous months, September was a slower month for dealmaking.

The Wall Street Journal recently attributed the drought in big biotech deals to the riskiness of the business. In a note to clients, a Jefferies health care trader wrote: “What appears to be a best-in-class drug on a Monday can often be deemed obsolete headed into the weekend, given the pace of development”.

Last

month, Novartis continued its strategic revamp by selling selected portions of its Sandoz US generics portfolio and Alexion diversified its rare disease pipeline. In addition, a lot of companies announced large investments into manufacturing.

Novartis unloads troubled US generics to India’s Aurobindo Pharma

Novartis finally got rid of some troubled US generic assets when it sold 300 products and several development projects in

its Sandoz US generic oral solids and dermatology business to

Indian drug maker Aurobindo Pharma for US$ 1

billion. Aurobindo agreed to pay US$ 900 million upfront and up to

US$ 100 million in performance payments.

Click here to view the major deals in September 2018 (FREE Excel version available)

The deal

relieves Novartis of a troubled franchise, while catapulting Aurobindo to the position of the

second-largest generics player by prescriptions in the US.

The deal with Aurobindo is part of Novartis’ effort to focus Sandoz’s US operations on higher-margin assets like biosimilars and complex generics, which would include injectables, respiratory drugs and eye therapies.

As part of the deal, Aurobindo also gets Sandoz’s dermatology development center, as well as manufacturing facilities in Wilson, North Carolina, and Hicksville and Melville, New York, which Aurobindo said are “highly complementary” to its existing production footprint.

When the deal was announced, investors in two other drug companies — Mylan and Teva — weren’t so happy. The reason? The US$ 900 million upfront payment reached by Novartis and Aurobindo was less than the 2017 annual revenue the portfolio sold, Wells Fargo analyst David Maris said.

Click here to view the major deals in September 2018 (FREE Excel version available)

“Although clearly Teva and Mylan have very different businesses than the largely commodity and dermatology portfolio Sandoz is selling, we believe some investors are looking at this as a proxy for what the commodity portions of Teva’s US and Mylan’s US businesses might be worth,” said Maris.

According

to Aurobindo, the acquired portfolio brought in sales of about US$ 1.2 billion

in 2017, higher than the US$ 1 billion the deal could eventually be worth if

performance-related payments are added.

Novartis’ US Sandoz business has been suffering due to the

increased pricing pressure that has wreaked havoc across the entire US generics

industry. Mylan and Teva face the same pricing pressures in the US as

Novartis.

Click here to view the major deals in September 2018 (FREE Excel version available)

Meanwhile,

Mylan finally revealed what it had bought during the last quarter for US$ 463 million. The company had purchased Novartis’ Tobi Podhaler and Tobi liquid, two cystic

fibrosis products. The company expects to pay US$ 240 million of that sum this

year.

Click here to view the major deals in September 2018 (FREE Excel version available)

Last month, Olon S.p.A., a leading

active pharmaceutical ingredients (API) contract development and manufacturing

organization (CDMO) and generics supplier, announced the acquisition of a local

generics chemical operations API manufacturing facility in Mahad, India,

as part of a continuing expansion of its global footprint.

Olon is a division of Italy’s P&R Group, which had acquired the Infa Group in 2016. P&R rolled Infa’s manufacturing sites in Labochim and Sifavitor in Italy and Derivados Químicos in Spain into the Olon operations. Last year, Olon bought the chemical division of Ricerca Biosciences, a CRO and CDMO based in Concord, Ohio.

Click here to view the major deals in September 2018 (FREE Excel version available)

Alexion, Roche, Amicus lead deal making for new developments

Massachusetts-based Alexion announced

its plans to acquire Syntimmune, a

clinical-stage biotechnology company developing antibody therapeutics targeting

the neonatal Fc receptor (FcRn), a protein that is encoded by the FCGRT gene in

the human body.

Alexion would pay US$ 400 million upfront for Syntimmune, and follow it up with US$ 800 million in

milestone payments.

Click here to view the major deals in September 2018 (FREE Excel version available)

Syntimmune’s lead candidate, SYNT001 – a humanized monoclonal antibody — is currently being evaluated in Phase 1b/2a studies in patients with warm autoimmune hemolytic anemia (WAIHA) and in patients with pemphigus vulgaris (PV) or pemphigus foliaceus (PF) and has demonstrated proof of mechanism showing rapid IgG reduction.

Alexion sees “potential for broad application across a number of indications” for SYNT001. A related company presentation listed potential indications in neurology, hematology,

nephrology, rheumatology and dermatology.

Click here to view the major deals in September 2018 (FREE Excel version available)

Roche acquires Tusk Therapeutics: Tusk Therapeutics Ltd announced it

would be acquired by Roche. Under the

terms of the agreement, Tusk’s shareholders will receive an upfront cash payment of Euro 70 million (US$ 79.79 million), plus additional contingent payments of up to Euro 585 million (US$ 666.8 million) based on achievements of certain predetermined milestones.

Tusk has developed an antibody with a novel mode of action aimed at

depleting regulatory T-cells (Tregs). Tregs suppress immune responses,

including those against cancer cells.

Preclinical data has shown that depleting Tregs from the tumor microenvironment can enhance and/or restore anti-tumor immunity. Tusk’s antibody has been designed to deplete these harmful Tregs, while not interfering with other immune cells acting against the tumor.

In other deals, Amicus Therapeutics paid

US$ 100 million upfront to obtain worldwide development and commercial rights

for 10 gene therapy programs developed at The Center for Gene Therapy at The Research Institute at Nationwide Children’s Hospital and The Ohio State

University.

Click here to view the major deals in September 2018 (FREE Excel version available)

The 10 programs are licensed to Amicus from Nationwide Children’s Hospital through the acquisition of Celenex, a private, clinical stage gene therapy company. The lead programs in CLN6, CLN3, and CLN8 Batten disease are potential first-to-market curative therapies for these rare diseases.

Celenex shareholders are also eligible for up to US$ 15 million in

development milestones and US$ 262 million in BLA/MAA submission and approval

milestones across multiple programs.

Click here to view the major deals in September 2018 (FREE Excel version available)

As demand for drugs surge, so do manufacturing investments

Regeneron plans

to invest approximately US$ 800 million over seven years to expand its

laboratory space, manufacturing capacity and warehouse facilities at its

Rensselaer, New York campus. The expansion will create 1,500 new full-time jobs

in the area.

Alvotech of Iceland, an independent sister company of US pharmaceutical firm Alvogen Group Inc, joined hands with China’s Changchun High & New Technology Industries group to develop, manufacture and commercialize its biosimilar portfolio in China. The

collaboration will see a new joint venture with manufacturing capabilities in

China's Jilin province, which will be equally funded by both the companies.

Click here to view the major deals in September 2018 (FREE Excel version available)

This collaboration aligns the interests and strengths of Alvotech and

Changchun, A new state-of-the-art biologics drugs manufacturing facility will

be built in Changchun, China. Under the terms of the agreement, Changchun will

fund the joint venture with US$ 100 million while Alvotech will contribute

additional capital and six drug market authorizations for its monoclonal

antibodies, used in advanced therapy of cancer and autoimmune diseases, valued

at US$ 100 million. The construction of a jointly owned facility is expected to

start as early as in the first half of 2019.

BioMarin, a

pharmaceutical company focused on developing drugs for rare diseases, said

it will invest US$ 43 million to further

expand its manufacturing plant in Cork, Ireland, adding drug product filling

capabilities to help meet the growing demand for its rare disease medicines.

BioMarin produces the APIs for Vimizim (a drug for the treatment of Morquio syndrome) and its second-newest drug Brineura (enzyme replacement treatment for Batten disease) at the Cork facility.

Click here to view the major deals in September 2018 (FREE Excel version available)

As the

need for contract development and manufacturing grows, Lonza announced a CHF 400 million (US$ 400.87

million) investment at its biopark in Visp, Switzerland, to expand its drug

substance development and drug substance and drug product manufacturing

offerings.

With the

objective to allow customers to manage the complete product lifecycle in one

site and shorten time to clinic and to market by 2020, Lonza will offer a

fixed-price gene-to-vial package with terms under which Lonza will deliver drug

product based on at least 1 kg drug substance within 12 months.

Lonza will also be offering services that

enable biologics license applications (BLAs) to be submitted within 22 months

from the start of process characterization.

Click here to view the major deals in September 2018 (FREE Excel version available)

Our view

Given the pace of deal making we have seen during much of 2018, September was a bit of an outlier as there weren’t too many multi-billion dollar deals.

However, the month saw a stock market launch. Since

Pfizer listed Zoetis Inc, the largest animal health company, five years ago, the firm’s value has nearly tripled. In September, Eli Lilly followed Pfizer’s footsteps. Elanco Animal Health

Incorporated, a subsidiary of Eli Lilly held its initial public offering (IPO) of

62.9 million shares of its common stock at a price to the public of US$ 24.00

per share.

Following the IPO, Lilly holds over 80 percent of

Elanco and a month after the IPO, the share is up over 30 percent and trading

at US$ 32, indicating the opportunities which reside within pharmaceutical

companies to generate value for their shareholders.

Keep track of dealmaking in the world of pharmaceuticals with PharmaCompass’ compilation of Top Pharma & Biotech Deals — PharmaFlow.

Click here to view the major deals in September 2018 (FREE Excel version available)

Impressions: 2696