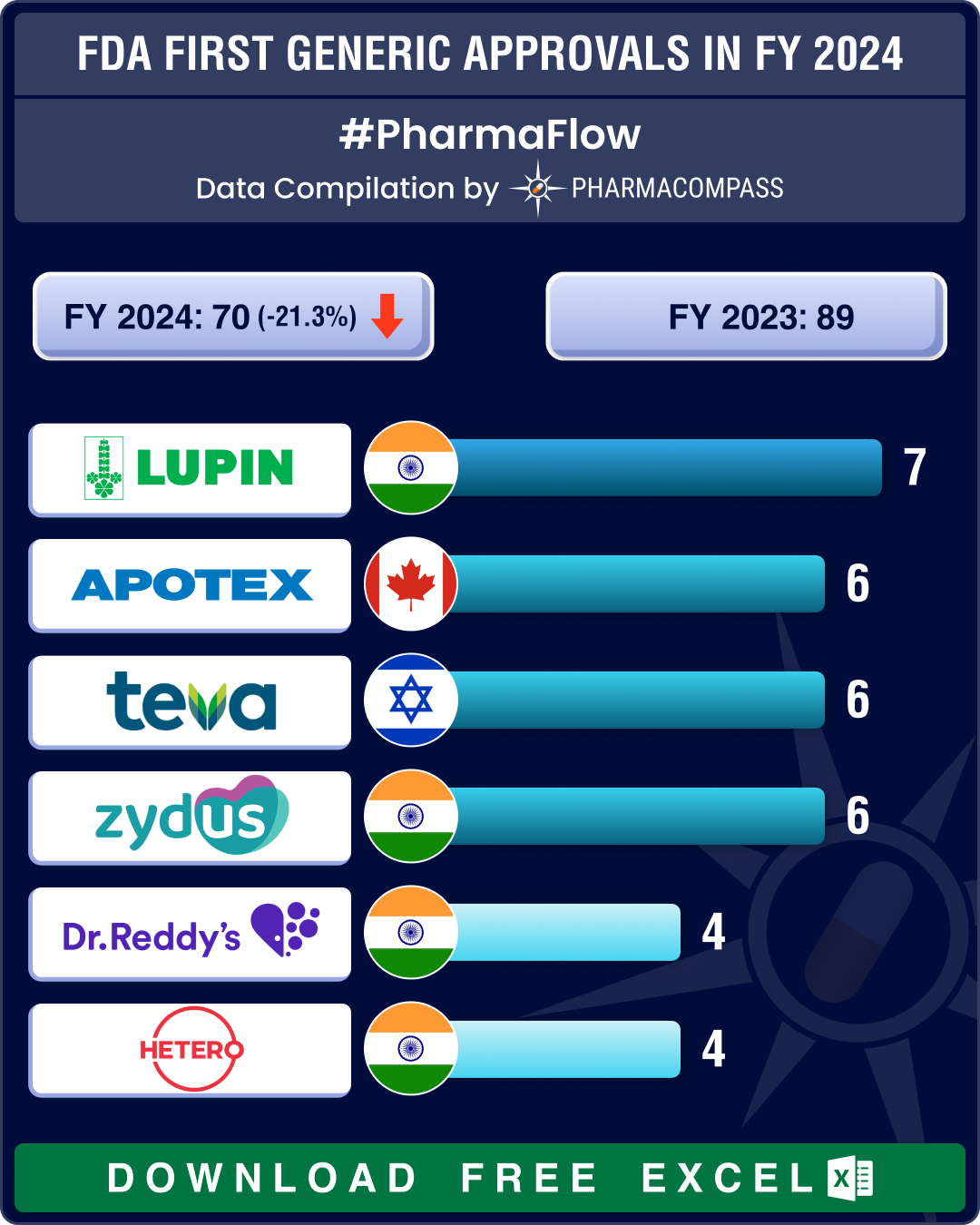

FDA’s first generic approvals slump 21% in 2024; Novartis’ top seller Entresto, cancer blockbuster Tasigna lead 2024 patent cliff

A watershed moment in the journey of a drug is when it transitions from being a patented, high‐

Market Place

Market Place Sourcing Support

Sourcing Support