By PharmaCompass

2020-01-23

Impressions: 8738

At PharmaCompass, we highlighted the significance of India in the global active pharmaceutical ingredient (API) supply chain last week with our list of generic drug facilities registered with the US Food and Drug Administration (FDA).

Our compilation revealed that India had 182 generic drug facilities registered with the FDA and this number was nearly as much as the corresponding numbers for China (100) and United States (84) put together. These 182 facilities paid a fee of US$ 59,400 each to the FDA.

View FDA DMF Filings in 2019 (Power BI Dashboard, Free Excel Available)

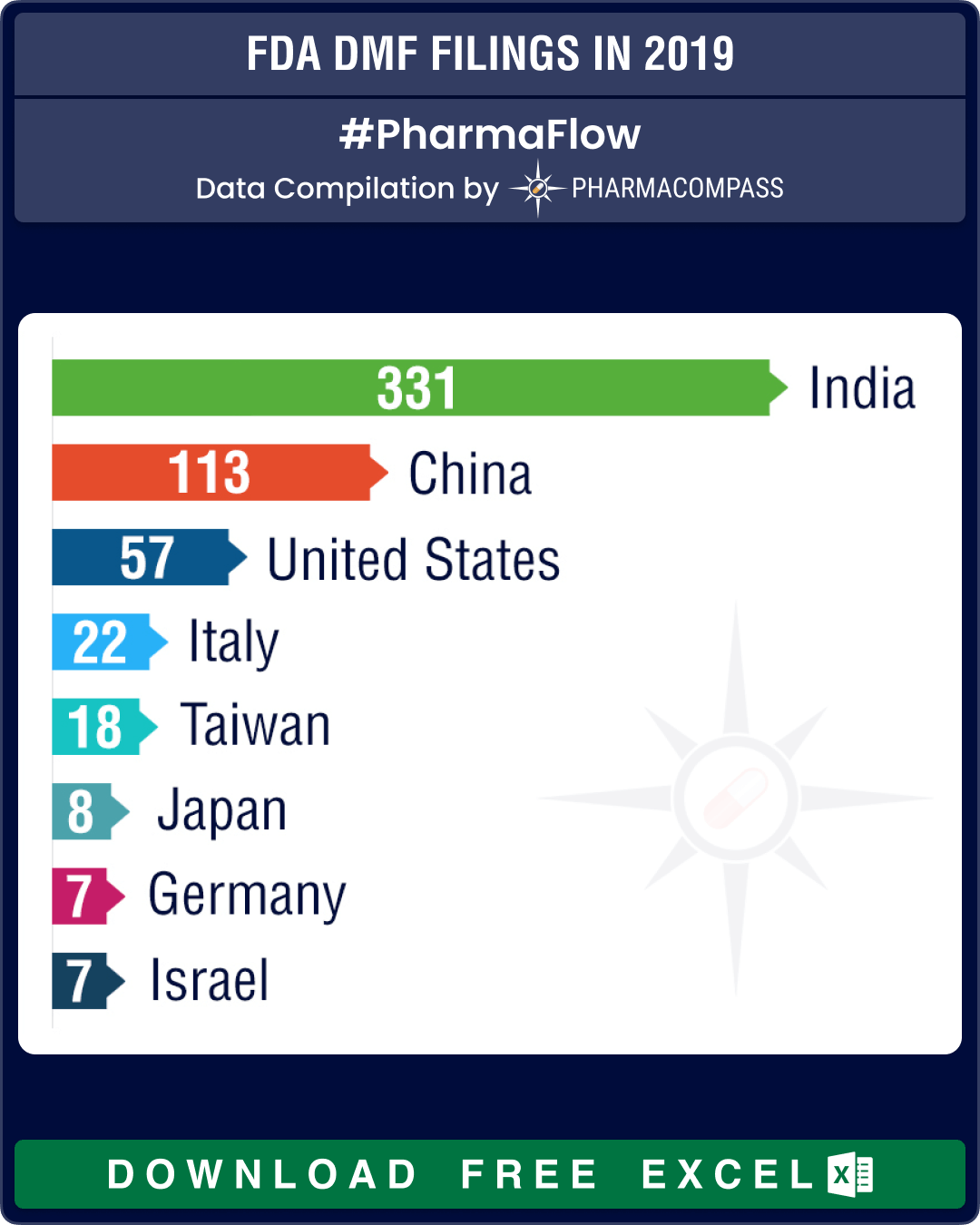

This week, we review the API Drug Master Files (DMFs) submitted to the FDA in 2019. Expectedly, India also led the DMF submission list.

In 2019, there were 616 active DMF submissions to the FDA with Indian companies submitting more than half (331) of them. Submissions from India were a little less than double the number of DMF submissions made by Chinese (113) and the US (57) firms put together.

Drug master files (DMFs) are submissions made to the FDA by manufacturers by providing the agency with confidential, detailed information about facilities, processes, or articles used in manufacturing, processing, packaging, and storing of human drug products.

View FDA DMF Filings in 2019 (Power BI Dashboard, Free Excel Available)

MSN Labs leads total count of DMF filings

The 616 active DMF filings to the FDA were quite diverse — they covered over 400 products, and over half (322) the filings were for unique products.

Among the products with multiple DMF filings, Sugammadex Sodium topped the list as it had 18 DMF filings. Sugammadex is the API used in Merck’s Bridion for the reversal of neuromuscular blockade induced by rocuronium and vecuronium in general anesthesia.

The other products with over five DMF filings were for the APIs of Lundbeck and Otsuka’s antipsychotic drug Brexpiprazole, Novartis, Gilead and Intercept’s blockbuster products Sacubitril-Valsartan, Tenofovir Alafenamide Fumarate and Obeticholic Acid.

View FDA DMF Filings in 2019 (Power BI Dashboard, Free Excel Available)

The year 2019 also witnessed continued DMF filings for Rivaroxaban, Sitagliptin Phosphate, Ticagrelor and Tipiracil Hydrochloride. These filings indicate that the companies currently developing these products should brace themselves for intense competition in the near future.

India’s MSN Labs continued to lead the count of total DMF filings with 42, of which it had 17 filings where it was the only one submitting a DMF for a specific product in 2019. The leading Chinese company filing DMFs was Fuxin Long Rui Pharmaceutical with nine DMFs, followed by Brightgene Bio-Medical Technology Co with five.

The API DMF is part of the final generic drug product submission to the FDA. Therefore, the owner of a DMF incurs a one-time fee (US$ 55,013 for FY2019, US$ 57, 795 for FY2020) the first time the generic drug submission references that DMF.

View FDA DMF Filings in 2019 (Power BI Dashboard, Free Excel Available)

DMF holders may also pay the fee in advance in order to have their DMF subjected to an initial completeness assessment by the FDA. This would allow their DMF to be included on a publicly-available list of DMFs that have paid their fee and not failed the initial completeness assessment.

Aurobindo, Sun, Lupin lead DMF assessments

While reviewing the DMF submissions made in 2019, we found that a third (209 out of 621) of the DMFs were listed on FDA’s publicly-available list of DMFs that have paid their fee and whose initial assessment had been completed. This indicates that either companies may have been unwilling to pay the fee or the FDA’s review process found shortcomings in their applications.

Major Indian generic drug companies like Aurobindo (16), Sun Pharmaceuticals (13), MSN Labs (12), Lupin (7) and Macleods (7) led the list of companies that had the maximum DMF assessments completed for their 2019 submissions.

There are also DMF submissions for products which can sometimes indicate future drug approvals.

View FDA DMF Filings in 2019 (Power BI Dashboard, Free Excel Available)

Sanyo Chemicals submitted a DMF for Ibudilast, an anti-inflammatory drug whose oral capsules are used in Japan for the treatment of asthma and its ophthalmic solution is used to treat allergic conjunctivitis. The product is currently not approved in the United States.

New drug approvals in the future can also be expected for Tertomotide, Omarigliptin, Estetrol Monohydrate, Abametapir, Pirenzepine, Cortexolone Proprionate, Lurbinectedin, Terlipressin, Ethyl Olivetolate, Remimazolam and Triapine. These products are currently under clinical trials for a variety of indications.

Our view

After compiling the list of companies that have submitted DMFs to the FDA as well as the generic facilities that paid their user fees, it’s clear that the API industry is beginning to find a new equilibrium.

View FDA DMF Filings in 2019 (Power BI Dashboard, Free Excel Available)

Our compilations of the previous years have shown that there is a steady decline in facility registrations and DMF filings. Given the increasing costs involved, as well as scaled up regulatory requirements, it seems that companies are becoming more selective in their product development decisions and also their willingness to do business in the United States.

While the number of Indian API facilities registered with the FDA has remained relatively unchanged, the number of Chinese sites that registered with the US has reduced by 35 percent over the past five years.

Several factors are changing the landscape of the generic drug industry. For instance, environmental regulations in China are driving up the cost of raw materials. Quality issues — such as the valsartan impurities case — have increased regulatory scrutiny. Moreover, passing inspections continues to remain a challenge for many manufacturers. And generic drug product manufacturers are also facing margin pressures, which in turn is driving a lot of M&A activity. Given this scenario, the generic industry should brace itself for more challenges in 2020.

View FDA DMF Filings in 2019 (Power BI Dashboard, Free Excel Available)

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : FDA DMF filings in 2019 by PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”