25 Aug 2025

// PRESS RELEASE

04 Aug 2025

// PRESS RELEASE

17 Mar 2025

// PRESS RELEASE

KEY PRODUCTS

KEY PRODUCTS

AMI Lifesciences is Driven by Chemistry. Powered by People.

About

Industry Trade Show

Lotte New York Palace

23-26 March, 2026

BioProcess Internation...BioProcess International US West

Industry Trade Show

Not Confirmed

09-11 March, 2026

BioProcess Internation...BioProcess International

Industry Trade Show

Not Confirmed

09-11 March, 2026

CONTACT DETAILS

Events

Webinars & Exhibitions

Industry Trade Show

Lotte New York Palace

23-26 March, 2026

BioProcess Internation...BioProcess International US West

Industry Trade Show

Not Confirmed

09-11 March, 2026

BioProcess Internation...BioProcess International

Industry Trade Show

Not Confirmed

09-11 March, 2026

https://www.pharmacompass.com/speak-pharma/we-are-building-capabilities-to-stay-ahead-of-the-curve-and-align-with-future-needs-of-global-healthcare

CORPORATE CONTENT #SupplierSpotlight

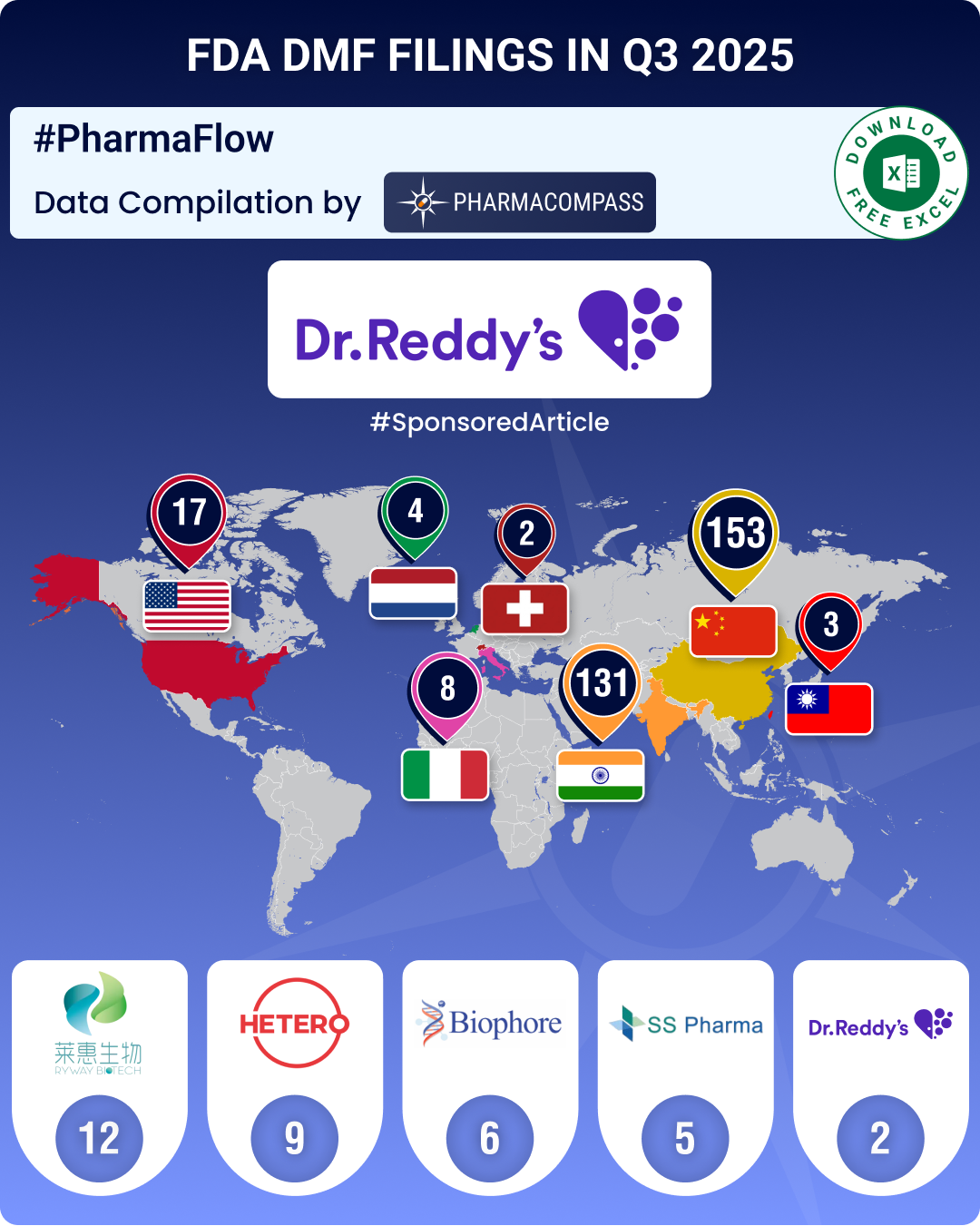

https://www.pharmacompass.com/radio-compass-blog/dmf-filings-rise-4-5-in-q3-2025-china-holds-lead-india-records-20-growth-in-submissions

https://www.pharmacompass.com/radio-compass-blog/dmf-filings-hit-all-time-high-in-q3-2024-china-tops-list-with-58-increase-in-type-ii-submissions

25 Aug 2025

// PRESS RELEASE

04 Aug 2025

// PRESS RELEASE

17 Mar 2025

// PRESS RELEASE

17 Mar 2025

// PRESS RELEASE

17 Mar 2025

// PRESS RELEASE

08 Oct 2024

// PRESS RELEASE

Services

API Manufacturing

API & Drug Product Development

Excipients

Inspections and registrations

ABOUT THIS PAGE

Ami Lifesciences Private Limited is a supplier offers 82 products (APIs, Excipients or Intermediates).

Find a price of Ambroxol Hydrochloride bulk with CEP, JDMF, WC offered by Ami Lifesciences Private Limited

Find a price of Tadalafil bulk with DMF, CEP, WC offered by Ami Lifesciences Private Limited

Find a price of Tranexamic Acid bulk with DMF, JDMF, WC offered by Ami Lifesciences Private Limited

Find a price of Benzonatate bulk with DMF, WC offered by Ami Lifesciences Private Limited

Find a price of Betahistine Dihydrochloride bulk with CEP, WC offered by Ami Lifesciences Private Limited

Find a price of Brivaracetam bulk with DMF, WC offered by Ami Lifesciences Private Limited

Find a price of Desvenlafaxine Succinate bulk with DMF, WC offered by Ami Lifesciences Private Limited

Find a price of Diacerein bulk with DMF, WC offered by Ami Lifesciences Private Limited

Find a price of Empagliflozin bulk with DMF, WC offered by Ami Lifesciences Private Limited

Find a price of Eslicarbazepine Acetate bulk with DMF, WC offered by Ami Lifesciences Private Limited

Find a price of Febuxostat bulk with DMF, WC offered by Ami Lifesciences Private Limited

Find a price of Oxcarbazepine bulk with DMF, CEP offered by Ami Lifesciences Private Limited

Find a price of Sacubitril-Valsartan bulk with DMF, WC offered by Ami Lifesciences Private Limited

Find a price of Sevelamer Carbonate bulk with DMF, WC offered by Ami Lifesciences Private Limited

Find a price of Sevelamer Hydrochloride bulk with DMF, WC offered by Ami Lifesciences Private Limited

Find a price of Sitagliptin Phosphate bulk with DMF, CEP offered by Ami Lifesciences Private Limited

Find a price of Tapentadol bulk with CEP, WC offered by Ami Lifesciences Private Limited

Find a price of Vildagliptin bulk with JDMF, WC offered by Ami Lifesciences Private Limited

Find a price of Vonoprazan Fumarate bulk with DMF, WC offered by Ami Lifesciences Private Limited

Find a price of Acebrophylline bulk with WC offered by Ami Lifesciences Private Limited

Find a price of Alpha Lipoic Acid bulk with WC offered by Ami Lifesciences Private Limited

Find a price of Ambroxol Hydrochloride bulk with CEP offered by Ami Lifesciences Private Limited

Find a price of Bempedoic Acid bulk with DMF offered by Ami Lifesciences Private Limited

Find a price of Benfotiamine bulk with WC offered by Ami Lifesciences Private Limited

Find a price of Benzonatate bulk with WC offered by Ami Lifesciences Private Limited

Find a price of Brivaracetam bulk with DMF offered by Ami Lifesciences Private Limited

Find a price of Choline Fenofibrate bulk with WC offered by Ami Lifesciences Private Limited

Find a price of Dapagliflozin bulk with DMF offered by Ami Lifesciences Private Limited

Find a price of Dapagliflozin Propanediol Monohydrate bulk with DMF offered by Ami Lifesciences Private Limited

Find a price of Dapoxetine Hydrochloride bulk with WC offered by Ami Lifesciences Private Limited

Find a price of Daprodustat bulk with DMF offered by Ami Lifesciences Private Limited

Find a price of Dicyclomine Hydrochloride bulk with DMF offered by Ami Lifesciences Private Limited

Find a price of Doxofylline bulk with WC offered by Ami Lifesciences Private Limited

Find a price of Edoxaban Tosylate bulk with DMF offered by Ami Lifesciences Private Limited

Find a price of Finerenone bulk with DMF offered by Ami Lifesciences Private Limited

Find a price of Flavoxate bulk with WC offered by Ami Lifesciences Private Limited

Find a price of Gliclazide bulk with CEP offered by Ami Lifesciences Private Limited

Find a price of Itopride Hydrochloride bulk with WC offered by Ami Lifesciences Private Limited

Find a price of Levocloperastine Fendizoate bulk with WC offered by Ami Lifesciences Private Limited

Find a price of Mirabegron bulk with DMF offered by Ami Lifesciences Private Limited

Find a price of Mirogabalin Besylate bulk with DMF offered by Ami Lifesciences Private Limited

Find a price of Pamabrom bulk with WC offered by Ami Lifesciences Private Limited

Find a price of Rivaroxaban bulk with DMF offered by Ami Lifesciences Private Limited

Find a price of Sacubitril Sodium bulk with DMF offered by Ami Lifesciences Private Limited

Find a price of Tapentadol Phosphate bulk with WC offered by Ami Lifesciences Private Limited

Find a price of Tegoprazan bulk with DMF offered by Ami Lifesciences Private Limited

Find a price of Teneligliptin Hydrobromide bulk with WC offered by Ami Lifesciences Private Limited

Find a price of Tolvaptan bulk with DMF offered by Ami Lifesciences Private Limited

Find a price of Vadadustat bulk with DMF offered by Ami Lifesciences Private Limited

Find a price of Vibegron bulk with DMF offered by Ami Lifesciences Private Limited

Find a price of Acebrophylline bulk offered by Ami Lifesciences Private Limited

Find a price of Azilsartan Medoxomil Potassium bulk offered by Ami Lifesciences Private Limited

Find a price of Benfotiamine bulk offered by Ami Lifesciences Private Limited

Find a price of Benserazide Hydrochloride bulk offered by Ami Lifesciences Private Limited

Find a price of Betahistine Dihydrochloride bulk offered by Ami Lifesciences Private Limited

Find a price of Bilastine bulk offered by Ami Lifesciences Private Limited

Find a price of Bisbentiamine bulk offered by Ami Lifesciences Private Limited

Find a price of Colesevelam Hydrochloride bulk offered by Ami Lifesciences Private Limited

Find a price of Desvenlafaxine Benzoate bulk offered by Ami Lifesciences Private Limited

Find a price of Desvenlafaxine Fumarate bulk offered by Ami Lifesciences Private Limited

Find a price of Deucravacitinib bulk offered by Ami Lifesciences Private Limited

Find a price of Diacerein bulk offered by Ami Lifesciences Private Limited

Find a price of Doxofylline bulk offered by Ami Lifesciences Private Limited

Find a price of Edoxaban Tosylate bulk offered by Ami Lifesciences Private Limited

Find a price of Fenofibrate bulk offered by Ami Lifesciences Private Limited

Find a price of Fexofenadine Hydrochloride bulk offered by Ami Lifesciences Private Limited

Find a price of Fezolinetant bulk offered by Ami Lifesciences Private Limited

Find a price of Fimasartan bulk offered by Ami Lifesciences Private Limited

Find a price of Fursultiamine bulk offered by Ami Lifesciences Private Limited

Find a price of Itopride Hydrochloride bulk offered by Ami Lifesciences Private Limited

Find a price of Mirabegron bulk offered by Ami Lifesciences Private Limited

Find a price of Pemafibrate bulk offered by Ami Lifesciences Private Limited

Find a price of Resmetirom bulk offered by Ami Lifesciences Private Limited

Find a price of Roxadustat bulk offered by Ami Lifesciences Private Limited

Find a price of Sacubitril-Valsartan bulk offered by Ami Lifesciences Private Limited

Find a price of Salcaprozate Sodium bulk offered by Ami Lifesciences Private Limited

Find a price of Sitagliptin Hydrochloride bulk offered by Ami Lifesciences Private Limited

Find a price of Tadalafil bulk offered by Ami Lifesciences Private Limited

Find a price of Tegoprazan bulk offered by Ami Lifesciences Private Limited

Find a price of Trelagliptin Succinate bulk offered by Ami Lifesciences Private Limited

Find a price of Vonoprazan Fumarate bulk offered by Ami Lifesciences Private Limited

Find a price of Baddustart bulk offered by Ami Lifesciences Private Limited

Ami Lifesciences Private Limited

Ami Lifesciences Private Limited