Synopsis

Synopsis

0

CEP/COS

0

JDMF

0

EU WC

0

KDMF

0

NDC API

0

VMF

0

Listed Suppliers

0

EDQM

0

USP

0

JP

0

Others

0

FDF Dossiers

0

FDA Orange Book

0

Europe

0

Canada

0

Australia

0

South Africa

0

Listed Dossiers

DRUG PRODUCT COMPOSITIONS

0

US Patents

0

US Exclusivities

0

Health Canada Patents

US Medicaid

NA

Annual Reports

NA

Regulatory FDF Prices

NA

0

API

0

FDF

0

Stock Recap #PipelineProspector

0

Weekly News Recap #Phispers

0

News #PharmaBuzz

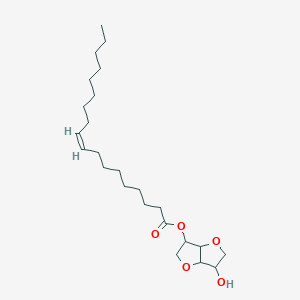

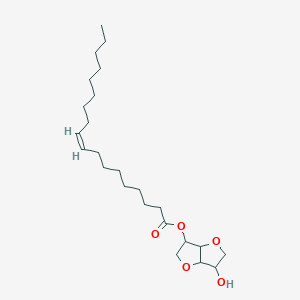

1. Arlacel A

2. Mannide Mono-oleate

3. Mannide Monooleate

4. Montanide Isa 720

1. Dianhydro-d-mannitol Monooleate

2. Arlacel A

3. Einecs 246-872-8

4. D-mannitol, Dianhydro-, Mono-9-octadecenoate, (z)-

5. Schembl3666282

6. Dtxsid0025525

| Molecular Weight | 410.6 g/mol |

|---|---|

| Molecular Formula | C24H42O5 |

| XLogP3 | 6.4 |

| Hydrogen Bond Donor Count | 1 |

| Hydrogen Bond Acceptor Count | 5 |

| Rotatable Bond Count | 17 |

| Exact Mass | 410.30322444 g/mol |

| Monoisotopic Mass | 410.30322444 g/mol |

| Topological Polar Surface Area | 65 Ų |

| Heavy Atom Count | 29 |

| Formal Charge | 0 |

| Complexity | 464 |

| Isotope Atom Count | 0 |

| Defined Atom Stereocenter Count | 0 |

| Undefined Atom Stereocenter Count | 4 |

| Defined Bond Stereocenter Count | 1 |

| Undefined Bond Stereocenter Count | 0 |

| Covalently Bonded Unit Count | 1 |

ABOUT THIS PAGE

35

PharmaCompass offers a list of Mannide Monooleate API manufacturers, exporters & distributors, which can be sorted by GMP, USDMF, JDMF, KDMF, CEP (COS), WC, Price,and more, enabling you to easily find the right Mannide Monooleate manufacturer or Mannide Monooleate supplier for your needs.

Send us enquiries for free, and we will assist you in establishing a direct connection with your preferred Mannide Monooleate manufacturer or Mannide Monooleate supplier.

PharmaCompass also assists you with knowing the Mannide Monooleate API Price utilized in the formulation of products. Mannide Monooleate API Price is not always fixed or binding as the Mannide Monooleate Price is obtained through a variety of data sources. The Mannide Monooleate Price can also vary due to multiple factors, including market conditions, regulatory modifications, or negotiated pricing deals.

A MONTANIDE ISA 206 manufacturer is defined as any person or entity involved in the manufacture, preparation, processing, compounding or propagation of MONTANIDE ISA 206, including repackagers and relabelers. The FDA regulates MONTANIDE ISA 206 manufacturers to ensure that their products comply with relevant laws and regulations and are safe and effective to use. MONTANIDE ISA 206 API Manufacturers are required to adhere to Good Manufacturing Practices (GMP) to ensure that their products are consistently manufactured to meet established quality criteria.

A MONTANIDE ISA 206 supplier is an individual or a company that provides MONTANIDE ISA 206 active pharmaceutical ingredient (API) or MONTANIDE ISA 206 finished formulations upon request. The MONTANIDE ISA 206 suppliers may include MONTANIDE ISA 206 API manufacturers, exporters, distributors and traders.

click here to find a list of MONTANIDE ISA 206 suppliers with USDMF, JDMF, KDMF, CEP, GMP, COA and API Price related information on PharmaCompass.

A MONTANIDE ISA 206 DMF (Drug Master File) is a document detailing the whole manufacturing process of MONTANIDE ISA 206 active pharmaceutical ingredient (API) in detail. Different forms of MONTANIDE ISA 206 DMFs exist exist since differing nations have different regulations, such as MONTANIDE ISA 206 USDMF, ASMF (EDMF), JDMF, CDMF, etc.

A MONTANIDE ISA 206 DMF submitted to regulatory agencies in the US is known as a USDMF. MONTANIDE ISA 206 USDMF includes data on MONTANIDE ISA 206's chemical properties, information on the facilities and procedures used, and details about packaging and storage. The MONTANIDE ISA 206 USDMF is kept confidential to protect the manufacturer’s intellectual property.

click here to find a list of MONTANIDE ISA 206 suppliers with USDMF on PharmaCompass.

MONTANIDE ISA 206 Active pharmaceutical ingredient (API) is produced in GMP-certified manufacturing facility.

GMP stands for Good Manufacturing Practices, which is a system used in the pharmaceutical industry to make sure that goods are regularly produced and monitored in accordance with quality standards. The FDA’s current Good Manufacturing Practices requirements are referred to as cGMP or current GMP which indicates that the company follows the most recent GMP specifications. The World Health Organization (WHO) has its own set of GMP guidelines, called the WHO GMP. Different countries can also set their own guidelines for GMP like China (Chinese GMP) or the EU (EU GMP).

PharmaCompass offers a list of MONTANIDE ISA 206 GMP manufacturers, exporters & distributors, which can be sorted by USDMF, JDMF, KDMF, CEP (COS), WC, API price, and more, enabling you to easily find the right MONTANIDE ISA 206 GMP manufacturer or MONTANIDE ISA 206 GMP API supplier for your needs.

A MONTANIDE ISA 206 CoA (Certificate of Analysis) is a formal document that attests to MONTANIDE ISA 206's compliance with MONTANIDE ISA 206 specifications and serves as a tool for batch-level quality control.

MONTANIDE ISA 206 CoA mostly includes findings from lab analyses of a specific batch. For each MONTANIDE ISA 206 CoA document that a company creates, the USFDA specifies specific requirements, such as supplier information, material identification, transportation data, evidence of conformity and signature data.

MONTANIDE ISA 206 may be tested according to a variety of international standards, such as European Pharmacopoeia (MONTANIDE ISA 206 EP), MONTANIDE ISA 206 JP (Japanese Pharmacopeia) and the US Pharmacopoeia (MONTANIDE ISA 206 USP).