Acquisitions and spin-offs dominated headlines in 2019 and the tone was set very early with Bristol-Myers Squibb acquiring

New Jersey-based cancer drug company Celgene in a US$ 74 billion deal announced on

January 3, 2019. After factoring

in debt, the deal value ballooned to about US$ 95 billion, which according

to data compiled by Refinitiv, made it the largest healthcare deal on

record.

In the summer, AbbVie Inc,

which sells the world’s best-selling drug Humira, announced its acquisition of Allergan Plc, known for Botox and other cosmetic

treatments, for US$ 63 billion. While the companies are still awaiting

regulatory approval for their deal, with US$ 49 billion in combined 2019

revenues, the merged entity would rank amongst the biggest in the industry.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

The big five by pharmaceutical sales — Pfizer,

Roche, J&J, Novartis and Merck

Pfizer

continued

to lead companies by pharmaceutical sales by reporting annual 2019 revenues of

US$ 51.8 billion, a decrease of US$ 1.9 billion, or 4 percent, compared to

2018. The decline was primarily attributed to the loss of exclusivity of Lyrica in 2019,

which witnessed its sales drop from US$ 5 billion in 2018 to US$ 3.3 billion in

2019.

In 2018, Pfizer’s then incoming CEO Albert Bourla had mentioned that the company did not see the need for any large-scale M&A activity as Pfizer had “the best pipeline” in its history, which needed the company to focus on deploying its capital to keep its pipeline flowing and execute on its drug launches.

Bourla stayed true to his word and barring the acquisition of Array Biopharma for US$ 11.4 billion and a spin-off to merge Upjohn, Pfizer’s off-patent branded and generic established medicines business with

Mylan, there weren’t any other big ticket deals which were announced.

The

Upjohn-Mylan merged entity will be called Viatris and is expected to have 2020

revenues between US$ 19 and US$ 20 billion

and could outpace Teva to

become the largest generic company in the world, in term of revenues.

Novartis, which had

followed Pfizer with the second largest revenues in the pharmaceutical industry

in 2018, reported its first full year earnings after spinning off its Alcon eye

care devices business division that

had US$ 7.15 billion in 2018 sales.

In 2019,

Novartis slipped two spots in the ranking after reporting total sales of US$

47.4 billion and its CEO Vas Narasimhan continued his deal-making spree by buying New

Jersey-headquartered The Medicines Company (MedCo) for US$ 9.7

billion to acquire a late-stage cholesterol-lowering

therapy named inclisiran.

As Takeda Pharmaceutical Co was

busy in 2019 on working to reduce its debt burden incurred due to its US$ 62

billion purchase of Shire Plc, which was announced in 2018, Novartis also purchased

the eye-disease medicine, Xiidra, from the Japanese drugmaker for US$ 5.3 billion.

Novartis’ management also spent a considerable part of 2019 dealing with data-integrity concerns which emerged from its 2018 buyout of AveXis, the

gene-therapy maker Novartis had acquired for US$ 8.7 billion.

The deal gave Novartis rights to Zolgensma,

a novel treatment intended for children less than two years of age with the

most severe form of spinal muscular atrophy (SMA). Priced at US$ 2.1 million,

Zolgensma is currently the world’s most expensive drug.

However,

in a shocking announcement, a month after approving the drug, the US Food and

Drug Administration (FDA) issued a press release on

data accuracy issues as the agency was informed by AveXis that

its personnel had manipulated data which

the FDA used to evaluate product comparability and nonclinical (animal)

pharmacology as part of the biologics license application (BLA), which was

submitted and reviewed by the FDA.

With US$

50.0 billion (CHF 48.5 billion) in annual pharmaceutical sales, Swiss drugmaker

Roche came in at number two position in 2019

as its sales grew 11 percent driven by

its multiple sclerosis medicine Ocrevus, haemophilia drug Hemlibra and cancer medicines Tecentriq and Perjeta.

Roche’s newly introduced medicines generated US$ 5.53 billion (CHF 5.4 billion) in growth, helping offset the impact of the competition from biosimilars for its three best-selling drugs MabThera/Rituxan, Herceptin and Avastin.

In late 2019, after months of increased

antitrust scrutiny, Roche completed

its US$ 5.1 billion acquisition of Spark Therapeutics to strengthen its presence in

gene therapy.

Last year, J&J reported almost flat worldwide sales of US$ 82.1 billion. J&J’s pharmaceutical division generated US$ 42.20 billion and its medical devices and consumer health divisions brought in US$ 25.96 billion and US$ 13.89 billion respectively.

Since J&J’s consumer health division sells analgesics, digestive health along with beauty and oral care products, the US$ 5.43 billion in consumer health sales from over-the-counter drugs and women’s health products was only used in our assessment of J&J’s total pharmaceutical revenues. With combined pharmaceutical sales of US$ 47.63 billion, J&J made it to number three on our list.

While the sales of products like Stelara, Darzalex, Imbruvica, Invega Sustenna drove J&J’s pharmaceutical business to grow by 4 percent over 2018, the firm had to contend with generic competition against key revenue contributors Remicade and Zytiga.

US-headquartered Merck, which is known as

MSD (short for Merck Sharp & Dohme) outside the United States and

Canada, is set to significantly move up the rankings next year fueled by its

cancer drug Keytruda, which witnessed a 55

percent increase in sales to US$ 11.1 billion.

Merck reported total revenues of US$ 41.75 billion and also

announced it will spin off its women’s health drugs,

biosimilar drugs and older products to create a new pharmaceutical

company with US$ 6.5 billion in annual revenues.

The firm had anticipated 2020 sales between US$ 48.8 billion and US$ 50.3 billion however this week it announced that the coronavirus pandemic will reduce 2020 sales by more than $2 billion.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

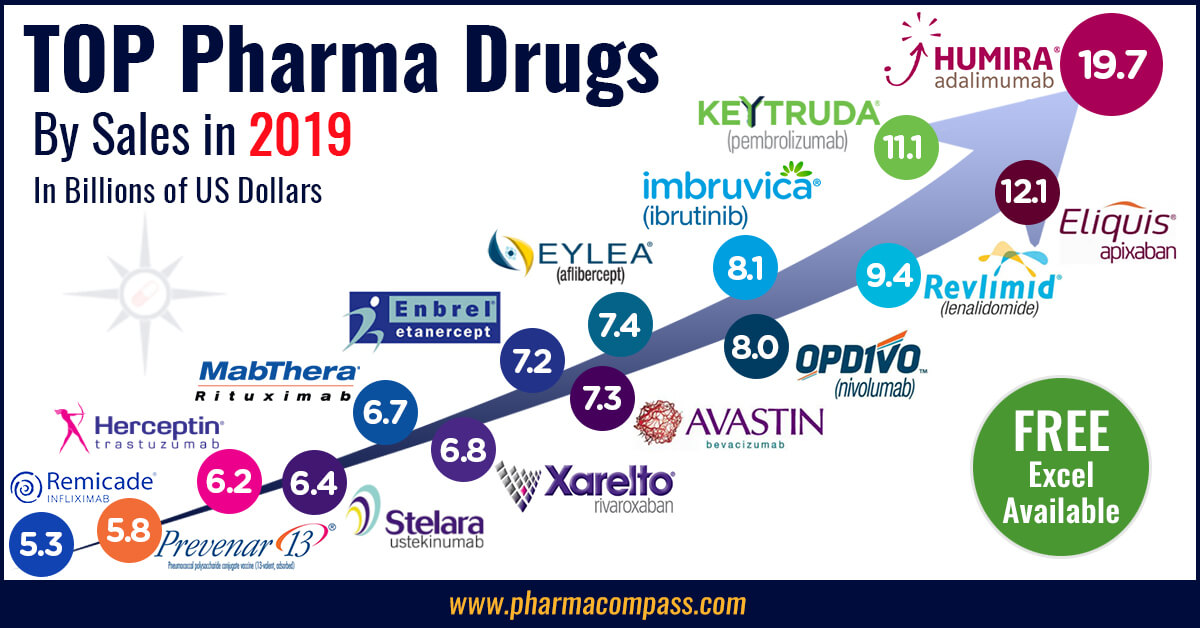

Humira holds on to remain world’s best-selling drug

AbbVie’s acquisition of Allergan comes as the firm faces the expiration of patent protection for Humira, which brought in a staggering US$ 19.2 billion in sales last year for

the company. AbbVie has failed to successfully acquire or develop a major new

product to replace the sales generated by its flagship drug.

In 2019, Humira’s US revenues increased 8.6 percent to US$ 14.86 billion while internationally, due

to biosimilar competition, the sales dropped 31.1 percent to US$ 4.30 billion.

Bristol Myers Squibb’s Eliquis, which is also marketed by Pfizer, maintained its number two position

and posted total sales of US$ 12.1 billion, a 23 percent increase over 2018.

While Bristol Myers Squibb’s immunotherapy treatment Opdivo, sold in partnership with Ono in Japan, saw sales increase from US$ 7.57 billion to US$ 8.0 billion, the growth paled in comparison to the US$ 3.9

billion revenue increase of Opdivo’s key immunotherapy competitor Merck’s Keytruda.

Keytruda took the number three spot in drug sales that

previously belonged to Celgene’s Revlimid, which witnessed a sales decline from US$ 9.69 billion to US$ 9.4 billion.

Cancer treatment Imbruvica, which is marketed

by J&J and AbbVie, witnessed a 30 percent increase in sales. With US$ 8.1

billion in 2019 revenues, it took the number five position.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Vaccines – Covid-19 turns competitors into partners

This year has been dominated by the single biggest health emergency in years — the novel coronavirus (Covid-19) pandemic. As drugs continue to fail to meet expectations, vaccine development has received a lot of attention.

GSK reported the highest vaccine sales of all drugmakers with

total sales of US$ 8.4 billion (GBP 7.16 billion), a significant portion of its

total sales of US$ 41.8 billion (GBP 33.754 billion).

US-based Merck’s vaccine division also reported a significant increase in sales to US$ 8.0 billion and in 2019 received FDA and EU approval to market its Ebola vaccine Ervebo.

This is the first FDA-authorized vaccine against the deadly virus which causes

hemorrhagic fever and spreads from person to person through direct contact with

body fluids.

Pfizer and Sanofi also reported an increase in their vaccine sales to US$ 6.4

billion and US$ 6.2 billion respectively and the Covid-19 pandemic has recently

pushed drugmakers to move faster than ever before and has also converted

competitors into partners.

In a rare move, drug behemoths — Sanofi and GlaxoSmithKline (GSK) —joined hands to develop a vaccine for the novel coronavirus.

The two companies plan to start human trials

in the second half of this year, and if things go right, they will file

for potential approvals by the second half of 2021.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Our view

Covid-19 has brought the world economy to a grinding halt and shifted the global attention to the pharmaceutical industry’s capability to deliver solutions to address this pandemic.

Our compilation shows that vaccines and drugs

for infectious diseases currently form a tiny fraction of the total sales of

pharmaceutical companies and few drugs against infectious diseases rank high on

the sales list.

This could well explain the limited range of

options currently available to fight Covid-19. With the pandemic currently infecting

over 3 million people spread across more than 200 countries, we can safely

conclude that the scenario in 2020 will change substantially. And so should our

compilation of top drugs for the year.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Impressions: 54754

This week’s pharma news capsule – Phispers (Pharmaceutical Whispers) – updates us on smoking cessation pills, WHO alert on Bangalore’s Semler Research, Valeant’s new CEO and more.Novartis plans to

sell Roche stake and fuel its M&A machine Novartis

is in

talks with banks to sell its US $ 14 billion stake in rival Roche.

Once struck, the sale will provide the Basel-headquartered Novartis cash for

new deals. Between 2001 and 2003, Novartis had built up its one-third stake in

Roche's voting stock under former chairman and CEO Daniel Vasella, as a basis

for a possible merger that never happened. Since Vasella's departure in 2013, there

has been speculation that Novartis would sell its holding. The divestment makes sense for current Novartis CEO Joe Jimenez, who is under pressure to improve growth after disappointments with the company’s eye care unit Alcon

and new heart drug Entresto. After FDA action, WHO

issues notice of concern to Bangalore-based CRO Semler Just days after the FDA alerted an

untold number of drug makers that marketing applications containing clinical

trial data prepared by Semler Research Center would have to be repeated, due to

data integrity concerns, the World Health Organization (WHO) issued the company

a notice

of concern. Investigators concluded that, “Manipulation of at least five studies over an extended period of time indicates this is a common practice; WHO is of the impression that to execute this type of manipulation several staff members on various levels within the organization have to be collaborating and coordinating.”The findings have questioned studies performed on WHO

pre-qualified products for Mylan

Laboratories, Micro Labs

Ltd, Lupin

Ltd, Strides Shasun Ltd as well as others which are currently under evaluation. Valent ropes in Perrigo’s Joseph Papa to be its next CEOValeant

Pharmaceuticals International has taken on Joseph

Papa (aged 60) from its rival Dublin-based Perrigo to be its chairman and chief executive and work on rebuilding investor confidence in Valeant, after last year’s price-gouging episodes and the more recent accounting troubles. The announcement came after weeks of talks with Papa. The

news led to tumbling of Perrigo shares

by 18 percent on Monday. Some months back,

Papa had helped Perrigo beat

back a hostile bid from Mylan. Nonetheless,

Papa leaves behind a business which is struggling business to meet the

commitments made while fending off the Mylan bid. Setback for DMD patients as FDA panel votes against Sarepta’s drugOn Monday, the FDA advisory panel in the US voted that a

drug from Sarepta Therapeutics was not effective in treating Duchenne muscular dystrophy (DMD) – a rare and fatal muscle-wasting disease. While the FDA staff took dim view of the Sarepta trial data,

the day-long session saw emotional pleas from dozens of parents and their

children, some of whom appeared in wheelchairs, to describe how the Sarepta

drug, called eteplirsen, could impact their lives. While the FDA usually follows the advisory panel’s recommendation, the final decision on whether or not to approve eteplirsen will be taken on May 26. Smoking-cessation

pills have no suicide risk, says studySeven years after American regulators slapped the strictest ‘black box’ warnings on two popular smoking-cessation medicines – Pfizer’s Chantix and GlaxoSmithKline’s Zyban – a large international study found these pills did

not appear to increase the risk of suicidal behavior. The study had been order by the US Food and Drug Administration (FDA), and both Pfizer and GSK are hopeful that the regulator will remove warnings put on these prescription drugs. The warnings about serious psychiatric side effects, such as “changes in behavior, hostility, agitation, depressed mood, and suicidal thoughts or actions” in some patients scared off both doctors and smokers wanting to quit. Meanwhile, experts say both Chantix and Zyban are safe — far safer than smoking, which kills about 440,000 Americans each year. Drug makers may lose

case in the US over patent reviewsA case in the US could end up with serious implications for drug pricing. In the Supreme Court this week, there were signs that the pharmaceutical industry could end up on the losing side of the case – which focuses on Obama administration’s rules for a new

process to review patents.Drug makers, supporting the plaintiffs, are urging the court

to change that process, which at present makes it easier to invalidate the

patents that are crucial to their business. But the plaintiffs seemed to be at

a disadvantage before the court.

Impressions: 2562

The pharmaceutical industry, which spends more

on marketing than research, has a dismal track record when it comes down to

developing mobile applications. However,

the Johnson & Johnson

Official 7 Minute Workout app may finally have turned the

tables and given Big Pharma a fighting chance before Apple, Google and Samsung

takeover digital health. Johnson & Johnson Official 7 Minute Workout and the app

marketJ&J Official 7 Minute Workout application recently announced a partnership with U.S. pharmacy chain Walgreens’ Balance Rewards for healthy choices program. Since Walgreens’ previous collaborations has been primarily with technology companies, like Jawbone, Fitbit, iHealth etc. how is Big Pharma going to finally get back in the mobile app development game?Johnson

& Johnson’s app, with more than 1.3 million downloads, has a significantly higher popularity when compared with the 6.6

million downloads in the past 7 years, for apps from all leading

pharma companies combined. Based

on a research report published last year, pharmaceutical companies developed more

than 40,000 apps, however downloads

and usage weren’t at par with apps from other industries. Two primary reasons cited for the limited success of pharma apps have been that the “app portfolio is not globally available” and apps are “built around core products of the pharma companies and not around actual market demand”.J&J’s focus on fitness and that too in 7 minutes, has clearly found a global market demand, which is different to those buying their baby shampoo. Actually, the app not only made Men’s Fitness list of top

10 fitness apps for 2014, it also topped

the internal J&J blog for the most read stories last

year. We tried it too and while we may not participate in any upcoming triathlon, we definitely are addicted! It’s convenient to do and provides the high impact energy exercise needed without consuming a lot of time. Which other

Pharma apps have become popular?Other apps, which topped the popularity charts

are Sanofi’s GoMeals (a

nutrition

database can tell you what's in your meal before you pick up your fork) and Janssen’s Care4Today (providing the tools to take your medication on time). They also meet the same criteria as J&J’s workout app of being global in design and not focusing on any specific product.The focus on mobile health is becoming the “next

big thing” for Apple, Google and Samsung. Apple has introduced, through its Apple HealthKit feature, capabilities to not only monitor health metrics but

also change the way clinical trials will be performed in the future. Announcements made at the recent Apple WorldWide Developers Conference (WWDC) in June, also introduced capabilities where HealthKit can now measure women’s menstruation cycles, the skin’s UV exposure as well the body’s water hydration levels. What will the Pharma app market look like soon?Ernst

& Young assessed that “social media channels will generate significant health care data — from 50 petabytes today to 25,000 petabytes by 2020”; a petabyte is a million gigabytes (GB)! However, before app developers let their

creativity run wild, there are regulations, which need to be complied with

since apps can get classified as medical devices. The FDA has published guidelines, on when an app crosses the threshold and

becomes a medical device. With Walgreens now incentivizing “doing everyday healthy

activities” to earn Balance® Rewards customer loyalty points, and Apple’s sensors monitoring body functions and activity levels, a new wave of technology integration is getting ready to surround us. The success of Johnson and Johnson’s app clearly shows that the pharmaceutical companies who will win, are going to be the ones focused on improving the health of patients and not those just trying to find a new way to distribute their medicines. After Pfizer’s failed efforts to promote their stop-smoking drug Chantix their new app, Quitter’s Circle is clearly a step in the right direction. The app is designed to

help those who want to quit smoking through educational, social and

financial support and does not promote Chantix at all. Our viewWhile Big Pharma is working on developing apps,

there are new age competitors who are waiting to attack in case the

pharmaceutical industry fails. Google’s establishment of Calico, their bio-tech initiative, headed by ex-Genentech CEO and former chairman of the board at Apple, Arthur Levinson is just one such

example. The big question going forward, as both big

pharm and the technology giants, focus on digital health is who does a better

job taking care of the wellness of people?

Impressions: 3784