In

its continuous endeavor to bolster the competitiveness of the generics

market, the US Food and Drug Administration (FDA) updated its list of ‘off-patent, off-exclusivity drugs without an approved generic’.

The

agency updates this list every six months to improve transparency and to

encourage the development and submission of abbreviated new drug applications

(ANDAs) in markets that have little competition.

The

latest compilation by the FDA, which was published in June, contains 452

entries with 307 classified as Part I (drug products for which FDA could

immediately accept an ANDA without prior discussion), 136 as Part II (drug

products for which ANDA development or approval may raise potential legal,

regulatory, or scientific issues that should be addressed with the Agency prior

to considering submission of an ANDA) and 9 products being added to the Appendix

which indicates one or more ANDAs referencing NDA drug products that have been

approved since the publication of the previous list.

View FDA's List of Off-Patent, Off-Exclusivity Drugs with No Approved Generics

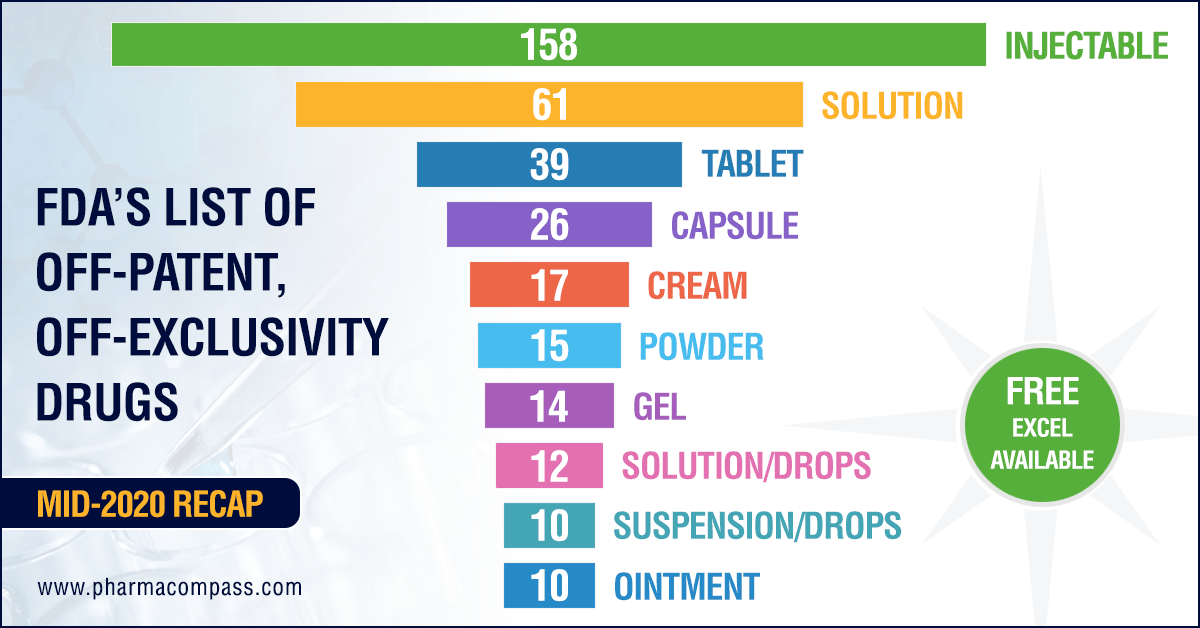

Injectables make up one-third of the products in June list

A

total of 69 entries, which were present in the December 2019 compilation, are

missing from the recent compilation posted in June 2020, whereas 25 entries

have been added to the December list. The new additions are an outcome of drugs

for which patents and/or exclusivities expired after December 2019. Products

that have been added include the commonly used anti-cancer drug Docetaxel

as well as the peptic ulcer treatment Esomeprazole Magnesium suspension.

Almost one-third of the products in the latest list —158 out of 452 — are drug products delivered as injectables, while there are 83 entries for oral solid dosage forms (such as tablets, capsules and modified release forms).

In

2017, FDA had announced the Drug Competition Action Plan (DCAP)

to encourage robust

and timely market competition for generic drugs and help bring greater

efficiency and transparency to the generic drug review process, without

sacrificing the scientific rigor underlying their generic drug program.

In

February this year, as part of this initiative, the FDA had

approved the first generic of toxoplasmosis drug, Daraprim

(pyrimethamine),

the drug which made ‘pharma bro’ Martin Shkreli infamous in 2015 after he raised the price of the drug, first approved by FDA in 1953, from US$ 17.50 to US$ 750 per tablet.

To date, the FDA has focused its efforts under

the Drug Competition Action Plan on three key areas:

1. Improving the efficiency of the generic drug development, review, and approval process.

2. Maximizing scientific and regulatory clarity with respect to complex generic drugs.

3. Closing loopholes that allow brand-name drug companies to “game” FDA rules in ways that delay the generic competition.

View FDA's List of Off-Patent, Off-Exclusivity Drugs with No Approved Generics

New guidance on CGTs to improve generic competitiveness

In March 2020, FDA had issued the guidance on Competitive Generic Therapies (CGTs). This guidance describes the process

that potential ANDA applicants should follow to request designation of a drug

as a CGT. It also outlines the criteria for designating a drug as a CGT,

provides information on the actions FDA may take to expedite the development

and review of ANDAs for drugs designated as CGTs, and explains how FDA

implements the statutory provisions providing for a 180-day exclusivity period

for certain first approved applicants that submit ANDAs for CGTs.

An

example of the FDA improving generic competitiveness through their various

initiatives is the case of the suspension form of Pfizer’s

Revatio,

which contains the same active ingredient as Viagra (sildenafil)

and is indicated for the treatment of pulmonary arterial hypertension (PAH).

The

drug was first approved in 2012 and generated sales of US$ 227 million in 2018. Since the approval of the first generic in May 2019, there are now seven approved generics of the drug on the US market. As a result, Pfizer reported a 37 percent drop in sales to US$ 144 million in 2019.

View FDA's List of Off-Patent, Off-Exclusivity Drugs with No Approved Generics

Impressions: 57849

This week, Phispers brings you news on the oversubscription of EU’s online pharmacy Zur Rose, and Amazon’s plans of entering the online pharma business. While shareholders voted against Mylan’s executive pay policy, former

Turing CEO Martin Shkreli faced trial. In Canada, supply shortages are likely to play spoiler in the country’s plans to rollout legal recreational marijuana. And Evaluate’s latest World Preview report scaled down its forecasts for worldwide drug sales growth.

Zur Rose IPO

gets over-subscribed; Amazon may launch its online pharmacy soon

Swiss online

pharmacy Zur Rose Group's initial public offering (IPO) is already well oversubscribed. Zur Rose aims to raise up to 230 million Swiss francs

(around US$ 240 million) through the share sale to aid its expansion plans in

Germany, open new shops and possibly make acquisitions, the company said last

week.

The company, which

was founded by Swiss doctors back in 1993, has been valued at between 780 to

870 million Swiss francs (US$ 813.5 million to US$ 907.4 million). The IPO is

expected to be priced in range of 120 francs to 140 francs (US$ 125 to US$ 146)

per share.

Demand from long-term investors in Germany, Switzerland, Britain and the United States is being cited as the key reason behind the oversubscription of Zur Rose’s IPO. The stock is due to start trading on the SIX Swiss Exchange on July 6.

This news should come as music to Amazon’s ears. Amazon is hiring a business lead to figure

how the company can break into the multibillion-dollar online pharmacy market.

Amazon is learnt to have begun recruitments from the pharmacy space.

According to news

reports, over the last few years, the Amazon headquarters in Seattle has been

discussing whether it should enter the pharmacy business or not. But this year

it is ready to get more serious with its plans.

Mylan board

survives shareholder meet but receives vote against executive pay policy

Last week, we

carried news on how rebel investors had upped the ante against Mylan

and wanted the drugmaker to remake its board, in wake of the scandal over the

high prices of EpiPen. Well, last week, the Mylan shareholders voted against the generic drugmaker's

executive pay policy, but re-elected the board at its

annual meeting held on June 22.

The company did not disclose the vote totals for the directors. In order to vote out the directors, rebel investors needed more than two-thirds of the shares voted, as well as more than half of Mylan’s outstanding shares.

New York City

Comptroller Scott Stringer, who is one of the chief leaders of this campaign,

said failure to disclose the vote totals suggests that the directors of Mylan faced strong opposition.

“This company massively hiked prices on life-saving drugs, allegedly overcharged the government for its products, allowed excessive executive pay to go unchecked — all ultimately fundamental failures of board oversight,” Stringer said.

BlackRock, Mylan's third-largest shareholder with more than 5 percent of the company's shares, said it had voted against four of the drugmaker’s directors as well as its executive pay.

Meanwhile, a Reuters report points that a non-pharmaceutical offering – refined coal – has quietly generated hundreds of millions of dollars in tax credits

for Mylan over the last six years, thereby boosting its bottomline.

Since 2011, Mylan has bought 99 percent stakes in five companies across the US that own plants which process coal to reduce smog-causing emissions. It then sells the coal at a loss to power plants. This way, it generates credits for itself, that lower Mylan’s tax bill.

Supply shortages may delay Canada’s rollout of legal recreational marijuana market

Canada plans to legalize the recreational marijuana market over the next one year. This will make it the first economy to do so. However, the biggest challenge for Canada’s prime minister Justin Trudeau’s legalized pot market is, well, shortage of marijuana.

This was revealed by Canada’s minister of finance Charles Sousa. The supply crunch was discussed during a meeting with provincial and federal counterparts last week, Sousa said.

According to an

analyst, the Canadian government may use the supply shortage as an excuse to

delay rolling out the program.

“Ultimately the biggest problem that appears after today’s discussion is one of supply,” Sousa said. According to his ministry officials, the demand is “quite high” for marijuana. “So we want to make certain that, when we do proceed, there is sufficient supply to accommodate the activity because what we’re trying to do is curb the illicit use and organized crime that now exists around it,” Sousa added. Trudeau had unveiled the framework for legalization of marijuana in April this year.

Pricing

pressure causes worldwide drug sales forecast to fall for first time in 10

years

Across the world,

increased scrutiny on the pricing of medicines is beginning to have an impact

on drug sales growth.

According to Evaluate’s latest World Preview report,

consensus forecasts for worldwide drug sales are estimated to hit US$ 1.06

trillion in 2022. However, this is down from the US$ 1.12 trillion that

analysts had forecast for the same period last year.

It’s the first time in a decade that Evaluate’s forecasts for total drug sales have failed to beat previous year forecasts.

However, sales of some of the industry’s top-selling products, such as cancer immunotherapies Keytruda and Opdivo, are expected to help push the sector to its expected trillion dollar sales target. According to this report, despite increasing questions around their pricing, orphan drugs are poised to make up a third of pharma sales by 2022.

“The continued political and public scrutiny over pricing of both the industry’s new and old drugs is not going to go away and we are starting to feel the impact now. Market access is becoming harder, as seen by the disappointing sales of the drugs like Repatha, Praluent, and Nucala. And the increasing cost of taking a novel therapy to market, now at US$ 4 billion over the last 10 years puts additional pressure on the productivity of the industry and its longer term sustainability,” Antonio Iervolino, head of forecasting, Evaluate, said.

Meanwhile, a Reuters

report said the first ever EU antitrust probe

into excessive drug pricing is unnerving the European drug industry, with

lawyers worried about the reach of market intervention.

Last month, the European Commission probed whether Aspen Pharmacare made “unjustified” hikes of up to several hundred percent in the cost of five old cancer drugs.

Poster boy of

price gouging and America's most hated man Martin Shkreli faces trial

Martin Shkreli, who is often referred to as the “most hated man in America” for raising the price of a life-saving drug by 5,000 percent, is undergoing trial this week

for a Ponzi-like scheme at his former hedge fund (MSMB Capital Management) and

drug company (Retrophin).

Shkreli

will face charges of securities fraud in federal court in Brooklyn, New York, more than 18 months after he

was arrested in December 2015.

Back

in 2015, as the CEO of Turing Pharmaceuticals, Shkreli had angered patients

and US lawmakers by raising the price of anti-parasitic drug Daraprim from US$ 13.50 a pill

to US$ 750.

Shkreli

has been accused of lying to investors in the hedge fund and siphoning off millions of dollars in assets

from biopharmaceutical company Retrophin Inc to repay them. He has pleaded not

guilty.

The trial will be

heard by US District Judge Kiyo Matsumoto in Brooklyn, and is expected to last

four to six weeks.

Nestle may sell L’Oreal stake, which could lead to share sale of Sanofi

Dan Loeb, activist

investor, recently encouraged Nestle SA to sell its stake in L’Oreal.

Loeb has amassed a US$ 3.5 billion stake in Nestle SA.

This demand by Loeb could lead to the divestment of yet another long-standing investment: L’Oreal’s US$ 11.6 billion (or Euro 10.4 billion) holding in French drugmaker Sanofi.

Paris-based cosmetic maker L’Oreal owns about 9.4 percent of Sanofi. For several years now, speculation has been rife that L’Oreal would sell the stock to finance a repurchase of Nestle’s L’Oreal shares.

Nestle had taken the stake in L’Oreal 43 years ago, as the latter had feared nationalization. Back in 1973, L’Oreal had taken control of a French drugmaker named Synthelabo. And in 1999, Synthelabo merged with Sanofi, leaving L’Oreal as a key shareholder.

If

both these divestments — by Nestle of L’Oreal and by L’Oreal of Sanofi — see the light of the day, they would manifest the growing power of activist investors in Europe.

Spokespersons for both L’Oreal and Sanofi declined to comment on a stake sale.

Impressions: 1823

In April last year, PharmaCompass

had shared a list of over 300

different dosage forms of drugs which had no patents and no competition.

These drugs were ripe for ‘price-gouging’ — a hot industry topic that became synonymous with activities of many major pharmaceutical companies, after Martin Shkreli (former CEO of Turing Pharmaceuticals) increased the price of Daraprim (Pyrimethamine) from US$ 13.50 per tablet to US$ 750 overnight in the US. Similarly, Valeant Pharmaceuticals

adopted a strategy of buying up companies and dramatically increasing the price

of the acquired drugs.

Although it has been a while

since Hillary Clinton tweeted angrily: “Price gouging like this in the specialty drug market is outrageous”; last week newly appointed US Food Drug Administration (FDA) Commissioner Scott Gottlieb, indicated that the topic is still very much on top of his agenda.

Access the 2017 Compilation of Drugs with No Patents & No Competition (Excel version available) for FREE!

FDA to play a more active

role in drug pricing

On May 25, Gottlieb told a congressional panel that the FDA is developing a “drug competition action plan” aimed at expediting approval of generic versions of brand-name medications that lack competition.

“While FDA does not play a direct role in drug pricing, we can take steps to facilitate entry of lower-cost alternatives to the market and increase competition,” Gottlieb said in his testimony before a House Appropriations subcommittee. “This is especially true when it comes to safe and effective generic medicines.”

In his testimony,

Gottlieb highlighted that he would like the FDA to take a more active role

in pricing and would publish a list of drugs that are off-patent and lack

generic competition.

Access the 2017 Compilation of Drugs with No Patents & No Competition (Excel version available) for FREE!

Our compilation — Drugs with No Patents and No Competition

500 dosage forms this year, where oral drugs (tablets, capsules etc.) had the least competition followed by drugs administered as injections.

The list has over 400

different active pharmaceutical ingredients (APIs) that are used in

manufacturing these dosage forms.

While there are

almost 70 drugs which were approved recently (since 2015), the majority of

products on the list are those that have been on the market for years.

Some of the products that made

it to our list last year continue to enjoy monopolies, such as Pfizer's Premarin, isolated from pregnant mares’ urine,

which brings in over US$ 1 billion in sales to Emcure’s BICNU (carmustine or BICNU is an anti-cancer, chemotherapy

drug).

While Emcure is still banned from exporting products

to the United States, due to compliance problems found in its manufacturing

operations, BICNU remains exempted since there is no other alternative

available in the market.

While an estimated 13 million

people in the United States have latent tuberculosis infection (LTBI), Sanofi’s Priftin (rifapentine) still has no generic competition.

Access the 2017 Compilation of Drugs with No Patents & No Competition (Excel version available) for FREE!

Our view

Our list provides

tremendous opportunities for generic companies in the short-term. In many

cases, to capitalize on the opportunities, generic drug companies will need to

partner with API manufacturers as the lack of sustained, quality API supply is

a major reason that there are no competitors on the market.

However, it is important for generic companies to remember that the FDA’s continued focus on accelerating review of these drugs will require companies to rely on strategies less opportunistic than price-gouging, to drive their future business growth.

Access the 2017 Compilation of Drugs with No Patents & No Competition (Excel version available) for FREE!

Impressions: 6730

The New

Year began with the JP Morgan Healthcare Conference— the drug industry’s annual investor meet — where industry leaders were busy announcing deals, until Donald Trump accused the industry of “getting away with murder”. His comments sent shockwaves within the industry as pharma and biotech stocks tanked. In the first Phispers of 2017, we also bring you a compilation of the likely patent conflicts this year. And, there is news on Aurobindo Pharma’s acquisition, Teva's revised guidance for 2017, lowering of growth prospects for Mylan, fresh bribery charges against Novartis and more.

Trump promises aggressive

federal bidding process to slash drug prices

Donald Trump, America’s president-elect dropped a bombshell in his first news conference held Wednesday, accusing the pharmaceutical industry of “getting away with murder”. He said he would bring

down drug prices, as well as government spending on drugs by changing the way

the country bids for drugs.

During the event held at Trump Tower in New York, Trump said: “Pharma has a lot of lobbies, a lot of lobbyists and a lot of power. And there’s very little bidding on drugs. We’re the largest buyer of drugs in the world, and yet we don’t bid properly.”

The country’s federal law forbids the government from negotiating drug prices with drug companies in order to lower the price of drugs for seniors using Medicare. Trump, however, did not announce how he will address the

issue of high drug prices. In the past though, he has called for ending the

policy.

His comment came in the midst of the JP Morgan Healthcare Conference, a

major annual investor meeting taking place in San Francisco, and knocked down

the stocks of biotech and pharmaceutical companies by around 2 percent.

“If anybody is walking away from this conference thinking ‘business as usual,’ I think that’s a mistake,” Heather Bresch, chief executive of Mylan Pharmaceuticals said at the JP Morgan meet.

“The pricing model has got to change. It’s not incremental change; I don’t think that’s what this country needs. I think it’s truly rethinking the business model,” she added. Mylan was under scrutiny recently for repeated list price increases on its lifesaving allergy drug EpiPen.

RECOMMENDED READ:

Drug costs and prescription trends in the United States: Analyzing Medicare’s $121 billion spend

Teva lowers guidance, Mylan expected to lose

US $ 800 million in 2018

Israeli drugmaker Teva revised the predictions it made in July 2016, about its financial expectations for 2017.

And these are considerably below its previous expectations. For instance, it

laid out a revenue forecast of US $ 23.8 billion to US $ 24.5 billion for 2017,

well below the US $ 25.2 billion to US $ 26.2 billion guidance it had

previously estimated. Teva now expects its earnings per share (EPS) to be between US $ 4.90 and US $ 5.30 — another big drop from its July guidance of US $ 6.00 to US $ 6.50.

Several industry observers had expected this downward revision. “I think it’s pretty clear that management’s prior expectations for 2017 were very inflated,” Umer Raffat, an Evercore ISI analyst, said.

Meanwhile, Teva began the new year by forking out over US $ 520 million in order to resolve a bribery

lawsuit in the US filed by its shareholders. It pertained to its operations in

Russia, Ukraine and Mexico.

The year gone by was a turbulent one for Teva.

For instance, its US $ 2.3 billion acquisition of Rimsa (short for Representaciones e Investigaciones Médicas, SA de CV), a leading pharmaceutical manufacturing and distribution company in Mexico, went the Ranbaxy way, with the former owners filing a legal complaint against Teva. The complaint mentioned that Teva is suffering from “buyer’s remorse” and is trying to undo the transaction “by any desperate measure” after destroying the Rimsa companies with firings and manufacturing shutdowns.

It’s not just Teva which is set to see a downtrend. Mylan's EpiPen — which hogged the headlines last year for its price hikes — is projected to face substantial decline, until 2018, say analysts.

EpiPen is all set to face competition from Kaleo’s Auvi-Q (another

epinephrine injection), which is due for launch in the first half of 2017,

Ronny Gal of Bernstein Research said. EpiPen (excluding the generic version) will

bring in only US $ 300 million in 2018 for Mylan, down from its US $ 1.1

billion estimate for 2016, Bernstein Research said.

Aurobindo to acquire Portugal’s Generis Farmaceutica

The New Year began with a bang for India’s Aurobindo Pharma. The company said it has inked a pact to acquire Portugal’s Generis Farmaceutica SA from Magnum Capital Partners for a consideration of US $ 143 million (or €135 million).

In a statement, Aurobindo Pharma said the binding agreement has been inked through Aurobindo’s wholly-owned subsidiary — Agile Pharma BV Netherlands. Generis produces and sells pharmaceutical products in Portugal.

The combined entity will benefit from a robust pipeline covering all major molecules coming off patent in the next five years, V Muralidharan, Senior Vice President of European Operations at Aurobindo Pharma, said. “The acquisition of Generis, by leveraging its strong portfolio and unrivalled brand recognition will allow us to establish ourselves as the top generics player in the Portuguese market,” he added.

The deal, however, is conditional, and depends on obtaining necessary approvals from Portuguese authorities. The acquisition deal includes Generis’ manufacturing facility in Amadora (Portugal) with a capacity to produce 1.2 billion tablets/capsules/sachets annually.

Patent battles between the Big Pharma could dominate 2017

This year may well be the year of big patent

battles between pharmaceutical giants. It began with a ruling on a patent

infringement case involving partners Sanofi-Regeneron and Amgen. A US federal judge ordered French pharmaceutical giant Sanofi and partner Regeneron to stop selling their latest cholesterol treatment — Praluent — due to patent infringement. After the court order, the stocks of Regeneron and Sanofi got hammered.

Sanofi and Regeneron plan to immediately appeal

that decision. According to the ruling, Sanofi and Regeneron had infringed

biotech giant Amgen’s patents for a rival cholesterol fighting drug — Repatha. Both Praluent and Repatha are the only approved ‘PCSK9 inhibiting’ therapies known to considerably reduce bad cholesterol levels in patients during clinical trials. Both won FDA approval in 2015 and both are expensive — priced at US $ 14,000 per year.

Sanofi is also in a battle with Novo Nordisk. In the last week of December, there was news that Sanofi filed a lawsuit in the US accusing Novo Nordisk of making the false claim that Sanofi’s insulin drugs would no longer be available for many US patients. According to Sanofi, Novo made that claim in order to promote its own competing drug. The complaint seeks an order forcing Novo to pay damages and withdraw marketing materials for its drug Tresiba.

Both Sanofi and Novo have been tied in a regulatory

race for their basal insulin/GLP-1 combo diabetes products. But Sanofi is already ahead in the race, as last week it rolled out Soliqua, a combination of

(insulin) Lantus and GLP-1 drug Adlyxin, at a list price of US $ 127 for a 300-unit pen. Novo’s Xultophy—which received regulatory approval on November 21—won’t be in the market until early May.

And then there is the battle between Merck

and Gilead. The latter ended the year on a sour note after a federal jury in the US ordered Gilead to pay US $ 2.5 billion in royalties to Merck in an ongoing

dispute. The legal battle between Merck and Gilead centres around Gilead's flagship hepatitis C cures — Sovaldi and Harvoni. Both these drugs gained disrepute for their lofty prices. Yet they

dominated the hepatitis C drug market (before they ran into trouble with

insurers and benefits managers who demanded better deals).

Lastly, there is a significant patent battle brewing in experimental biopharma technology in the form of a spat between the University of California and the University of Vienna on one side and the Broad Institute of MIT and Harvard University on the other. The battle centers around CRISPR-Cas9 — an early-stage gene-editing platform that significantly simplifies the process of slicing and dicing problematic genetic material. It is being tested as a treatment option for cancer, sickle cell, and a host of other diseases.

The dispute is around who owns the patent

right to CRISPR. While University of California at Berkeley professor Jennifer Doudna and the University of Vienna’s Emannuelle Charpentier were first to announce their discoveries, MIT's Feng Zhang actually won the patent after going through an expedited process.

After Korea, US and China, Novartis faces

bribery charges in Greece

In the last one year, Swiss drugmaker Novartis has faced three sets

of bribery charges. The fourth one came in the New Year, with Greek officials

announcing they are investigating Novartis for bribery in the wake of local media reports raising questions about the

company.

Greek corruption prosecutors raided the Athens offices of Novartis last week, as part of the probe over bribery

allegations. Greek authorities have reportedly interviewed scores of sources.

In March 2016, Novartis paid US $ 25 million to settle a US Securities and Exchange

Commission (SEC) case that claimed the Swiss drug maker paid bribes to health

professionals in China to increase sales during 2009 and 2013.

While the US case got settled, Novartis has

been accused by a whistleblower in Turkey of paying bribes through a consulting

firm to secure business advantages.

In August 2016, PharmaCompass had

reported that six former and current Novartis executives at its unit in South Korea allegedly paid more than US $ 2 million to doctors in return for prescribing its medicines. Among those indicted was the former CEO of Novartis’ Korea unit.

Twitter

bans Martin Shkreli for making unwanted advances at journalist

In September 2015, Martin Shkreli, the former

CEO of Turing Pharmaceuticals, had received widespread flak for raising the

price of anti-parasitic drug Daraprim by a factor of

56. Since the Daraprim episode, Shkreli has also been indicted on unrelated

fraud charges.

Well, Shkreli is back in news. And once again for

all the wrong reasons. A few days back, he was temporarily kicked off Twitter and its live-streaming platform — Periscope — for making unwanted advances toward Lauren Duca, the weekend editor of Teen Vogue.

In a tweet to Twitter’s CEO Jack Dorsey, Duca said: “How is this allowed?” She included two screenshots of Shkreli's Twitter profile page.

Apparently, Shkreli manipulated a photograph of Duca with her husband, wherein he had put his face in place of Duca’s husband. Duca also posted another screenshot wherein Shkreli had put up a montage of Duca’s photos as his Twitter background image, with the text: “For better or worse, till death do us part, I love you with every single beat of my heart.” Moreover, Shkreli’s Twitter bio said that he had a “small crush” on Duca. “Hope she doesn't find out,” it said.

According to the Twitter spokesperson, Twitter’s rules prohibit “targeted harassment”.

Oncology deals: Takeda acquires Ariad; Daiichi ties up

with Kite; Ipsen with Merrimack

The JP Morgan conference saw some major deals being announced in the field of oncology. Japan’s Takeda Pharmaceutical Company and Massachusetts-headquartered Ariad Pharmaceuticals recently entered into a definitive agreement under which Takeda will acquire all outstanding shares in Ariad for

US $24 per share in cash, in a deal valued at US $ 5.2 billion.

Ariad

Pharmaceuticals is a cancer-focused drugmaker. The agreement has been

unanimously approved by the boards of directors of both companies. It is likely

to close by the end of February this year, subject to required regulatory

approvals and other conditions.

Kite Pharma — a California-based, clinical-stage biopharmaceutical company engaged in the development of novel cancer immunotherapy products — has entered into a deal with Daiichi Sankyo of

Japan. Kite Pharma will enter the Japanese

market, along with Daiichi, which has lined up US $ 250 million deal.

Kite Pharma’s new drug application for the pioneering CAR-T drug —KTE-C19 — is in the final weeks of being completed and shipped to regulators in search of an accelerated approval. CAR-T (short for chimeric antigen receptors-T cell) is a therapy for cancer, using a technique called adoptive cell transfer. The T cells, which can recognize and kill cancer cells, are reintroduced into the patient.

Under the deal, Kite will be taking US $ 50 million

upfront and US $ 200 million in milestones for the deal, while Daiichi Sankyo

is reserving another US $ 200 million in additional milestones for each new

drug candidate that Kite takes to the FDA over the next three years.

Meanwhile, French pharmaceutical company Ipsen

has entered into a US $ 1 billion deal to acquire oncology assets from Massachusetts-headquartered Merrimack

Pharmaceuticals, including the pancreatic cancer drug Onivyde.

The deal is broken down into two steps, involving

an upfront fee of US $ 575 million, to be followed by a potential US $450 million that

would depend on approvals for Onivyde in the US.

With this deal, Merrimack is likely to pay off

US $ 195 million in debts, return US $ 200 million to stockholders and make a

further payment of US $ 450 million to shareholders. Merrimack would also

plough US $ 125 million into the development of three experimental cancer

drugs.

Impressions: 5614

This week, Phispers gets you news on illegal exports of Metformin in India, Hillary Clinton’s stance on price gouging, a report’s recommendations on reducing India’s dependence on Chinese APIs, Pfizer’s patent dispute case in the UK and more.

Aspen Pharma fined for price

gouging in Italy

Last week,

Italian antitrust authorities fined South Africa-based drug maker Aspen Pharmacare nearly US $ 5.5 million for

halting supplies of several cancer drugs. This is being seen as a negotiating

tactic designed to hike prices by as much as 1,500 percent.

The

products whose supplies were halted are: Leukeran 2 mg (chlorambucil);

Alkeran 50 mg / 10 mg powder and solvent (melphalan);

Alkeran 2 mg (melphalan); Purinethol 50 mg (mercaptopurine);

and Thioguanine 40 mg (thioguanine).

The

price-gouging episode began after Aspen purchased the drugs from GlaxoSmithKline. It then began negotiations with

the Italian Medicines Agency over pricing for the cancer medicines. According

to the Italian Competition Authority, Aspen also used the threat of a shortage

to achieve the prices it had sought, because the drugs temporarily disappeared

from the market.

It would

be interesting to see the price rise in the US market for these products since Chlorambucil

and Thioguanine have no generics in the United States. Clinton’s team had debated attacking FDA commissioner Califf, reveals WikiLeaks

Around

this time last year, the pharmaceutical industry had come under severe

criticism for price gouging. And, if emails released by WikiLeaks are to be believed, Hillary Clinton’s campaign team had debated attacking Dr. Robert Califf, over his ties with various drug makers. Back then, Califf had been nominated to head the US Food and Drug Administration. Earlier this year, Califf got named as FDA commissioner.The email thread, pertaining to September 21-26, 2015, suggests how the issue had become a factor in her campaign. Through these emails, few members of Clinton’s team had weighed the pros and cons of picking a fight that would “fit into the larger themes we are trying to promote,” an email written by Clinton’s campaign press secretary had said.Similarly, a senior policy advisor had written: “We could certainly signal that we want someone willing to stand up to pharma.”Califf was

the founding director of the Duke Clinical Research Institute, which conducts

studies for companies. He has authored numerous papers with industry

researchers. Two years ago, several large drug makers had partly supported his

salary, while many others paid him for consulting work. These

email exchanges took place amid rising outrage over price gouging, triggered by

Martin Shkreli (founder and former CEO of Turing Pharmaceuticals). In September

last year, Clinton had taken a jab at Shkreli through a tweet, for hiking the

price of the antimalarial drug Daraprim by more than 5,000 percent. Clinton’s campaign staff had tweeted: “FYI – We have started the war with Pharma!!” Last

month, Clinton issued a plan to contain prescription drug pricing. She proposed

a federal panel of officials to determine if price increases for certain drugs

are justified, authorize the federal government to directly purchase drugs

through imports of competing drugs from other countries, and fine offending

companies. India initiates action against two Metformin

makers for illegal exports

The Food

and Drug Administration of Maharashtra, India has initiated action against two pharmaceutical companies – Pharmaceutical Products of India Ltd and Wanbury – for illegally rebranding and exporting a diabetic drug to Mexico, Brazil, Bangladesh and Pakistan.A part of the bulk drug – metformin hydrochloride – was being manufactured by Pharmaceutical Products of India, based in Tarapur. It was manufacturing 300,000 kilos of metformin hydrochloride for export every month. The company, however, did not have an export licence. On further investigation, the department found that the drug was sold to another firm – Wanbury in Patalganga – that had an export licence. The modus operandi was clear – Wanbury had an export licence and orders worth 650,000 kg per month of metformin HCL, but had a shortfall of 350,000 kg in manufacturing capacity, which was being fulfilled by Pharmaceutical Products of lndia. “Wanbury would just stick their labels on the drugs supplied by the latter without any quality checks,” said a Maharashtra FDA official. “Such unholy alliances can have disastrous effects on the country's drug export sector,” the official added. The companies have been charged under the Drugs and Cosmetics Act. Industry watchers share how

deregulation brings further risks

Last week,

in Speak Pharma, Bernard Plau, CEO of

Akovia Consulting, talked about how fraud broke the trust of regulators. And this week, industry watchers – Dinesh Thakur and Prashant Reddy Thikkavarapu – share how deregulation by the Drug Controller General of India (DCGI) brings further risk, in an article published on The News Minute, titled “Deregulation of the pharma industry in the time of scandals’.

Since the Ranbaxy scandal, there have been several

other scandals in the Indian pharmaceutical industry, and these have involved

big names such as Sun, Dr. Reddy’s, Wockhardt, GVK Bio and Alkem. These companies have come under

scrutiny from foreign drug regulators.

Thakur and

Thikkavarapu say two kind of scandals have plagued the Indian pharma industry. The

first is related to data fabrication by contract research organisations (CROs)

that conduct bioequivalence (BE) testing. The second type involves drug

companies indulging in fabrication of data during quality testing.

“Instead of increasing regulatory scrutiny, the DGCI has been on a drive to reduce the regulation governing the Indian pharmaceutical industry in the name of ‘Make in India’,” they added.

Indian trade body study suggests

ways of reducing dependence on Chinese APIs

A study

undertaken by trade body Assocham and market research firm RNCOS has

highlighted how India’s overwhelming dependence on China for APIs has emerged as a worrisome area. The study has recommended steps that can help reduce imports of APIs from China – which stand at Rs 138.53 billion (US $ 2.08 billion), or 65.29 percent of the total API imports of Rs 212.16 billion (US $ 3.18 billion).

“This is all the more disconcerting in the face of louder narrative against reducing trade gap with China, which is well over US $ 51 billion,” the study says.

One of the main reasons for huge API imports from China is the low cost of manufacturing and subsidy there. Moreover, India levies negligible import fee. “The import fees should be increased in line with other counterparts”, the paper said.

The

existence of multiple regulatory authorities for renewal of licences by India’s bulk drug manufacturers is also affecting production. “Therefore a single committee of various government departments should be formed to regulate the industry through a single window and audit of plants,” the study said. It also recommended developing mega parks for APIs across the country.

More bad news for Teva as it mulls acquisition of Korea’s CelltrionLast week,

PharmaCompass covered Teva’s misadventure in Mexico. Little did we know that more bad

news awaited Teva. Just one month after Teva paid Regeneron US $ 250 million to get access to a new pain drug – fasinumab, the FDA has put its clinical trial on hold. The news

comes at a time when Teva is said to be considering the acquisition of South Korea’s Celltrion in order to strengthen its biosimilar portfolio. Going forward, biosimilars are said to be a key element of Teva’s overall strategy.

Teva and Regeneron’s fasinumab was being studied in a Phase IIb trial in chronic low back pain, among others tests including osteoarthrosis pain. The FDA is now asking the two partners for “an amendment of the study protocol” after seeing a case of adjudicated arthropathy (a disease of the joint) in a patient receiving high-dose fasinumab, who had advanced osteoarthritis.The two

companies said they would now set about designing a pivotal Phase III study in

chronic low back pain that specifically excludes patients with advanced

osteoarthritis in the hope this was a one-off related to this disease. Pfizer loses appeal in a UK patent

dispute case over Lyrica

Pfizer lost an appeal in a UK patent dispute over Lyrica, one of the company’s top-selling drugs. The Court of Appeal upheld a 2015 verdict that had struck down key patent claims on Lyrica by Pfizer and cleared Allergan Plc’s Actavis generic unit of infringing it.

The

disputed patent covers the use of pregabalin for the treatment of pain. The business was bought by Teva this year. In 2015, Lyrica – which is also used to treat epilepsy – generated sales of US $ 4.8 billion for Pfizer.

Pfizer has

also sued Dr. Reddy’s Laboratories and Teva Pharmaceutical Industries

over their generic pregabalin products. These days, Lyrica is used more for

pain than for its original indication as a seizure drug.

Pfizer now

hopes to take its fight to the UK Supreme Court. “We maintain our belief in the validity and importance” of the patent, said Pfizer spokeswoman.

Explosion at BASF’s biggest plant in Germany kills twoOn October

17, an explosion and fire at chemicals maker BASF's production site in Germany is said

to have killed at least two people and severely injured six.

The explosion occurred at around 11.20 am local time, on a supply line connecting a harbor and a tank depot on the Ludwigshafen site. BASF is the world’s biggest chemicals company and the Ludwigshafen site, which is situated around 80 km south of Frankfurt, is the world's largest chemical complex, covering an area of 10 square km. The site employs 39,000 workers. Located on the Rhine river, the Ludwigshafen site receives many of its raw materials by ship.

The

company said it was unclear so far what caused the explosion. BASF is also

unclear about the financial impact of the explosion.

Impressions: 4737

Drug price increases have emerged as a core strategy for generic pharmaceutical companies in the recent past. In September last year, Martin Shkreli’s decision to increase the price of Daraprim (Pyrimethamine)

from US $ 13.50 per tablet to US $ 750 overnight, received an angry tweet from Hillary Clinton. “Price gouging like this in the specialty drug market is outrageous,” she had tweeted. Shkreli of Turing Pharmaceuticals wasn’t the only one hiking prices of drugs. ‘Price gouging’ has become a hot topic, and synonymous with the activities of many major pharmaceutical companies. Price increase due

to ownership, not improved scienceValeant

Pharmaceuticals, a stock market darling until

recently, developed a strategy of buying up companies and dramatically

increasing the price of the acquired drugs. In February 2015, Valeant purchased two life-saving heart drugs – Isuprel

and Nitropress.

And the same day, Valeant increased the prices of these drugs by 525 percent and 212 percent

respectively. The increase was not an outcome of improved science but simply a

change of ownership. Similarly, on January 1, 2016, Pfizer raised

prices of more than 100 of its drugs. According to global information

services company Wolters Kluwer the price increase was as much as 20 percent in

the case of some medicines.

Another recent study on US drug prices uncovered that “prices for four of the nation's top 10 drugs increased more than 100 percent since 2011, Reuters found. Six others went up more than 50 percent.” “It’s not funny, Mr. Shkreli. People are dying”Scrutiny on drug price increases and its accounting

practices has made Valeant Pharmaceuticals, which not so long ago was

the biggest company on the Toronto Stock Exchange (TSX), lose 90 per cent

of its market value in less than a year.

“Pharma Bro” Shkreli was arrested

in December for allegedly bilking tens of millions of dollars from his former biotech venture, Retrophin. And

while he smirked

his way through the Senate hearing on drug price increases, he was rebuked by Representative Elijah Cummings. “It’s not funny, Mr. Shkreli. People are dying, and they are getting sicker and sicker,” he told Shkreli, as the latter grinned during the Congressman’s opening statement. The appearance by Shkreli was the highlight of this

congressional hearing, which explored the complicated reality of drug pricing

in the US. Bernie Sanders, a US presidential candidate, has long been protesting “skyrocketing

drug prices” and has also proposed a new bill last year – The Prescription Drug Affordability Act of 2015. FDA’s accelerated review planIn this backdrop, the US Food and Drug Administration (FDA) announced a small regulatory change – it will prioritize review of new applications for generic drugs “that would compete with treatments made by only one company.”The policy mentions that “potential first generic products for which there are no blocking patents or exclusivities on the reference listed drug may receive expedited review”. In an email to Bloomberg, the FDA estimates the change in prioritization could expedite review of as many as 125 generic drug applications. The next ‘price-gouging’ targetsPharmaCompass has

found over 300 different dosage forms of drugs which currently have no patents

and no competition. Click

here to access the compilation (Excel version available) for FREE!Our compilation covers a broad range of products from Pfizer's Premarin, isolated from pregnant mares’ urine, which brings in over

US $ 1 billion in sales to Emcure’s

BICNU (carmustine

or BICNU is an anti-cancer, chemotherapy drug).While Emcure was banned from exporting products to the United

States, due to compliance problems found in their manufacturing operations,

BICNU was exempted since there was no other alternative available in the

market. While an estimated 13 million people in the United States

have latent tuberculosis infection (LTBI), Sanofi’s Priftin

(rifapentine),

launched last year in

a new packaging, still has no generic competition. Click

here to access the compilation (Excel version available) for FREE! Our viewWhile our list provides tremendous opportunities for generic

companies in the short-term, the FDA’s accelerated review program will require

companies to rely on strategies less opportunistic than price-gouging to drive

their future business growth.

Impressions: 7836