The coronavirus pandemic changed the way we lived our lives, and

regulatory agencies were no exception to that rule. In early March 2020, the US

Food and Drug Administration (FDA) announced that it was postponing most inspections outside the United States. And the agency said only foreign inspections “deemed mission-critical” will be considered on a case-by-case basis.

As an interim measure, the FDA ensured the safety of products imported into the US through physical examinations and/or product sampling at borders, by reviewing a firm’s compliance history and by requesting records “in advance of or in lieu of” on-site drug inspections.

By the end

of 2020, FDA and the European Directorate for the Quality of Medicines &

HealthCare (EDQM) had managed to complete over 2,200 inspections across the

world. According

to a report published on the Regulatory Affairs Professionals Society (RAPS)

website, across all approval types, the number of cases where pre-approval

inspections by the FDA were skipped in favor of alternative approaches rose

from 48 percent in July-September 2020 to 60 percent by October-December 2020.

Although inspections were down in 2020, the FDA’s Center for Drug Evaluation and Research (CDER) met its user fee commitments.

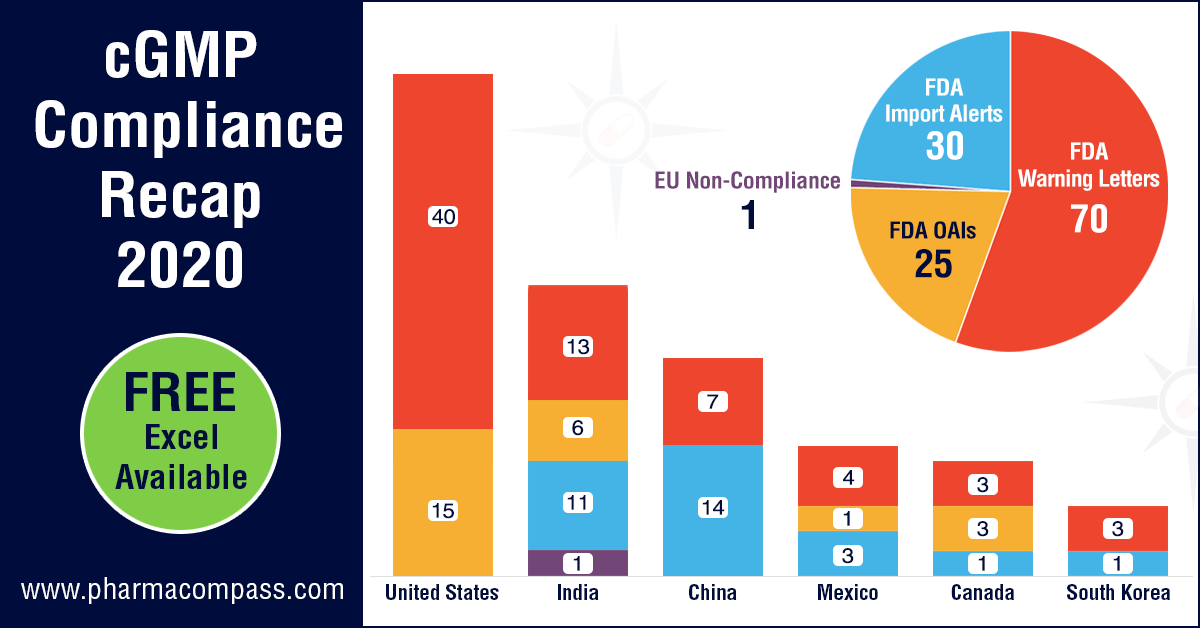

The FDA was the most active locally and issued almost 40 warning letters to drug manufacturers based in the US. Consistent with the previous years’ trend, warning letters in the US were followed by those issued to manufacturers in India (13) and China (7).

View cGMP Non-Compliance Recap 2020 Dashboard (Free Excel Available)

Celgene

investors lose out on deal sweetener due to FDA inspection delays

The

suspension of inspections impacted Bristol Myers Squibb

the most. It was hopeful of getting an FDA approval for its CAR-T therapy — lisocabtagene maraleucel (liso-cel) — for the treatment of adults with relapsed or refractory large B-cell lymphoma after at least two prior therapies. However, the FDA extended the action data by three months due to the pandemic, with no decision taken even after its November 2020 deadline.

The FDA

approval of liso-cel by December 31, 2020 was one of the milestones of the

contingent value rights (CVRs) issued upon the close of the Celgene acquisition by Bristol Myers

to its investors. Since the approval never came through by December-end, Celgene investors lost out on

the deal sweetener.

One of the

reasons for the delayed approval was the inspection of a Lonza

facility (which is under contract to make viral vectors for liso-cel) which was

finally inspected in December 2020. The Form 483 issued

last month revealed problems such as lack of storage

area controls and inadequate measures to prevent microbial contamination.

Liso-cel finally bagged the FDA nod this month.

View cGMP Non-Compliance Recap 2020 Dashboard (Free Excel Available)

Manufacturing problems, data-integrity issues drive Akorn to bankruptcy

Akorn, which has seen a series of

problems over the last few years, filed its Chapter 11 petition

in the Delaware bankruptcy court last year. The Illinois-based company listed

as much as US$ 10 billion in debt and US$ 10 billion in assets in its Chapter

11 petition.

The

drugmaker said it had given up on finding itself a

buyer amidst the uncertainties brought about by the pandemic.

In April 2018, Fresenius had walked away from a

US$ 4 billion takeover of Akorn, citing a breach of FDA’s data integrity requirements by Akorn. Its shareholders then sued Akorn for concealing data integrity problems. In August 2019, Akorn settled the matter with its shareholders.

Akorn has

received several FDA warning letters over the last few years, including

those issued to its Somerset (New Jersey) facility in June 2019, to its Decatur

(Illinois) facility in January 2019 and to its Amityville (New York) facility

in February 2019.

View cGMP Non-Compliance Recap 2020 Dashboard (Free Excel Available)

Ipca placed back on FDA import alert after US overcomes chloroquine shortage

In March 2020, when chloroquine (CQ) and hydroxychloroquine (HCQ) were considered

possible treatments for Covid-19, the FDA had partially lifted an import alert on Ipca’s two plants to ensure the supply of chloroquine tablets. The exemption had

allowed Ipca to export APls chloroquine phosphate and hydroxychloroquine sulfate from the company’s API manufacturing facility situated in Ratlam (Madhya Pradesh, India).

In June, once questions were raised around the efficacy of chloroquine in treating Covid, FDA said no shipment of API

chloroquine phosphate will be excluded from the import alert.

View cGMP Non-Compliance Recap 2020 Dashboard (Free Excel Available)

Data-integrity concerns at Pfizer’s India unit; warning letters to Mylan

In 2019,

when the mega-merger of Mylan with Upjohn (Pfizer’s off-patent branded and generic established medicines business) was announced, PharmaCompass had highlighted how compliance would play a key role in determining the merger’s success.

Early last

year, Pfizer’s sterile

manufacturing operations in India received a warning letter from

the FDA. The site, located in Visakhapatnam (Andhra Pradesh, India), was

inspected from August 29 to September 6, 2019.

The warning letter highlighted that Pfizer’s operations failed to conduct adequate investigations, including the timely implementation of effective corrective action and preventive action (CAPA) plans.

The Visakhapatnam operation was acquired by Pfizer in February 2015 as

part of its US$ 17 billion acquisition of Hospira. When the deal was struck, Pfizer was aware of Hospira’s manufacturing record as the company was issued FDA warning letters in four out of seven continents.

Last year, the FDA also issued a warning letter to Mylan's API

manufacturing facility in India

which had issues related to enhanced cross-contamination risk and inadequate

cleaning procedures.

View cGMP Non-Compliance Recap 2020 Dashboard (Free Excel Available)

Serious

cross-contamination problems at Cipla; data-integrity issues at Windlas

Indian drugmaker Cipla’s finished pharmaceuticals manufacturing facility in Goa received a 38-page Form 483 following a September 2019 inspection, and the warning letter issued to the facility

highlighted severe cross contamination concerns.

During the inspection, FDA investigators observed residue on manufacturing equipment which when tested by Cipla confirmed the presence of multiple APIs. In its warning letter, the agency states that there is no assurance that the scope of Cipla’s evaluation into this cross-contamination problem was comprehensive.

Following

the inspection, Cipla informed

the FDA of its decision to suspend production in its sterile units where the

FDA had raised concerns over atypical High Efficiency Particulate Air (HEPA)

filter failures.

The FDA

also issued a warning letter to Indian finished

formulation manufacturer Windlas Healthcare, which was placed on an import alert by

the FDA on January 21, 2020. Indian generic drugmakers Panacea Biotech and Shilpa Medicare

were also issued FDA warning letters in 2020.

View cGMP Non-Compliance Recap 2020 Dashboard (Free Excel Available)

Apotex’s API unit in Mexico receives FDA warning letter

The

manufacturing operations of Canadian generic drug maker, Apotex, continued to run into problems with the FDA as its API manufacturing facility in Mexico — Signa SA de CV — received a warning letter following

an inspection from December 16 to 20, 2019. As in previous cases, this

warning letter too highlighted cGMP deviations.

The key

concern highlighted by the FDA was that the facility undertook inadequate

investigations into out-of-specification (OOS) test results. The agency said

Signa failed to appropriately justify potential root causes, expand

investigations to all potentially affected batches, and implement adequate

CAPA.

View cGMP Non-Compliance Recap 2020 Dashboard (Free Excel Available)

Our view

Although

the FDA had halted all physical inspections last year due to the pandemic, last

month the agency announced the resumption of inspections

in China and India in a bid to keep drug approvals on schedule.

On

January 27, 2021, Patrizia Cavazzoni, the acting director of CDER, said in a tweet: “FDA has begun conducting prioritized inspections by investigator staff in China and is planning to initiate prioritized inspections in India shortly.”

Earlier

this month, Alembic Pharmaceuticals said the FDA has made five

observations post an inspection of its new injectable facility at Karkhadi

(Gujarat, India) from January 29 to February 5.

With the restart of inspections in Asia, it’s only a matter of time before we see a significant increase in regulatory actions by the regulators.

View cGMP Non-Compliance Recap 2020 Dashboard (Free Excel Available)

Impressions: 3551

The year

2020 was an eventful year for the pharmaceutical industry, with several

companies across the world working at a feverish pace to find a treatment or a

vaccine for the raging Covid-19, which has so far taken over 1.79 million lives

worldwide.

With

countries imposing lockdowns and regulators putting on-site inspections on

hold, we were expecting far lower new drug approvals in mid-2020. But our mid-2020 recap published in July, which

looked at new drug approvals by the US Food and Drug Administration (FDA) and European Medical Agency (EMA),

found that the FDA had approved 33 new drugs by the end of June. This put the

approvals within the ballpark of the past two years.

This week, we bring you a roundup of 2020, a tumultuous year when 58 drugs (53 approvals by the Center for Drug Evaluation and Research and 5 by the Center for Biologics Evaluation and Research) bagged FDA’s new drug approvals. While this number is lower than the number of drugs approved in 2018 (62), it is higher than the number for 2019 (54). Out of this, while 23 approvals were in the field of oncology, 9 were for infectious diseases and infections, 8 for genetic diseases, 7 for neurology, 3 for immunology and 2 for gastroenterology.

View New Drug Approvals in 2020 with Estimated Sales (Free Excel Available)

A year marked by EUA

With the pandemic raging across the world, emergency use authorizations (EUAs) dominated news headlines in 2020 — the FDA issued 10 EUAs, with the most

prominent being those issued to Pfizer-BioNTech and Moderna for their Covid-19 vaccines.

EMA was busy as well since they issued 75 positive opinions

with Novartis leading

the pack with 8, followed by Pfizer and Sanofi which received 4 each.

The EUAs came with their own set of controversies. In March,

the FDA had issued an EUA “for oral formulations of chloroquine phosphate and hydroxychloroquine sulfate

for the treatment of” Covid-19. However, by June, FDA had revoked the EUA,

as the agency determined that chloroquine and

hydroxychloroquine were not likely to be effective in treating Covid-19 for the

authorized uses in the EUA.

Amongst treatments for Covid-19, in May the FDA

authorized the emergency use of Gilead’s antiviral

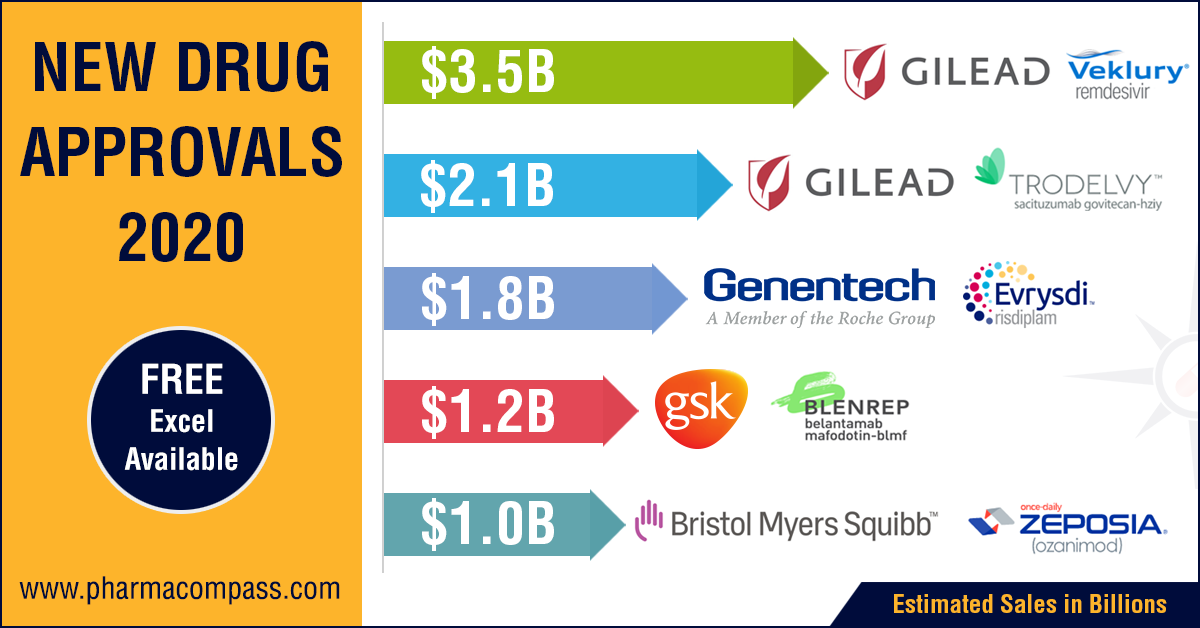

drug remdesivir. In our mid-2020 recap, Gilead’s remdesivir was on top of

our list of top-selling drugs after it received an EUA from the FDA.

In October, remdesivir became the first drug to

be approved by the FDA for treatment of Covid-19 patients requiring

hospitalization. While analysts predicted US$ 3.5 billion in revenue in early

October, the future of this drug as a treatment for Covid-19 in hospitalized

patients remains uncertain, especially in wake of results from the World Health

Organization (WHO)-led Solidarity Trial that said Gilead’s remdesivir

had little or no effect on the 28-day mortality or length of hospital

stays for Covid-19 patients. The FDA approved remdesivir for

hospitalized patients a week after the WHO results.

View New Drug Approvals in 2020 with Estimated Sales (Free Excel Available)

Gilead US$ 21 billion Immunomedics acquisition

Immunomedics' antibody-drug conjugate (ADC) — Trodelvy (sacituzumab govitecan-hziy) — was approved by the FDA in April this year for the treatment of adult patients with metastatic triple-negative breast cancer who have received at least two prior therapies for the disease. Such tumor types account for 15 to 20 percent of breast cancers. Trodelvy follows remdesivir in our list of FDA approved drugs in 2020 with the highest sales potential. The current forecast for Trodelvy sales is US$ 2.151 billion by 2026.

In

September, Gilead made a big move and acquired biotech company

Immunomedics Inc for US$ 21 billion. The

transaction, which was completed in October, will strengthen Gilead’s cancer portfolio and add another potential blockbuster to it.

Immunomedics

plans to submit a supplemental Biologics License Application (BLA) to support

full approval of Trodelvy in the US over the next quarter. According to a statement, Immunomedics

is also on track to file for regulatory approval of the drug in Europe in the

first half of 2021. Moreover, ongoing studies are also evaluating the potential

of Trodelvy as a treatment for non-small cell lung cancer and other types of

solid tumors.

View New Drug Approvals in 2020 with Estimated Sales (Free Excel Available)

Roche-PTC Therapeutics’ risdiplam bags approval

Following

Troveldy in sales potential for drugs approved by the FDA is Roche and PTC Therapeutics’ drug Evrysdi (risdiplam), the first oral medicine approved for the

rare genetic disease, spinal muscular atrophy, which until four years ago had

no available treatments.

The approval of Evrysdi presents patients and their families with a unique choice between a one-time gene therapy, an RNA-based drug infused three times a year at the doctor’s office and a daily medicine taken at home.

Roche priced the drug by patient weight, with a maximum cost of US$ 340,000 per year — substantially lesser than the competing (and approved) therapies from Biogen and Novartis.

View New Drug Approvals in 2020 with Estimated Sales (Free Excel Available)

Vertex’s Kaftrio bags EMA approval

Earlier

this year, PharmaCompass had published its compilation of sales

forecasts for the new drugs approved by the FDA in 2019. The list was led by Vertex’s cystic

fibrosis treatment — Trikafta — which was expected to have sales of US$ 3.935 billion by 2024.

Trikafta

is a combination of ivacaftor, tezacaftor and elexacaftor and its

stellar clinical data made the FDA approve the drug within three months of

Vertex’s application

filing and five months before FDA’s action date.

In

June 2020, EMA’s CHMP adopted a positive opinion, recommending the granting of a marketing authorization for

Vertex’s

combination, which will be marketed as Kaftrio.

View New Drug Approvals in 2020 with Estimated Sales (Free Excel Available)

A year

of multiple setbacks

Not everything went smoothly in 2020. In fact, the year saw several setbacks — almost 44 drugs were not granted approval by the FDA. Bristol Myers Squibb was one such company that

received setbacks. As part of Bristol’s US$ 74 billion acquisition of Celgene, the New

York-headquartered drug company offered Celgene shareholders Contingent Value Rights or

CVRs. But to realize the US$ 9-a piece payment, approvals for three

ex-Celgene drugs must meet their pre-specified deadlines.

While in March, the FDA approved Bristol’s ozanimod, a sphingosine-1-phosphate receptor agonist for the treatment of relapsing multiple sclerosis, well ahead of the December 31, 2020 deadline, in May, Bristol Myers Squibb and bluebird bio, Inc announced

that they have received a Refusal to File letter from FDA regarding the Biologics License Application (BLA) for their CAR-T therapy — idecabtagene vicleucel

(ide-cel) — for patients with heavily pre-treated relapsed and refractory multiple myeloma, which was submitted in March 2020. Upon preliminary review, the FDA

determined that the Chemistry, Manufacturing and Control (CMC) module of the

BLA requires further details to complete the review.

This was

followed by Bristol Myers announcing that the FDA has extended the action date

by three months for the BLA for lisocabtagene maraleucel (liso-cel), a

CD19-directed CAR-T therapy for the treatment of adults with relapsed or

refractory (R/R) large B-cell lymphoma after at least two prior therapies. The

FDA had then set the new Prescription Drug User Fee Act (PDUFA) action date as

November 16, 2020. However, on that day, FDA informed the company that its

review of the BLA for liso-cel will not be completed by November 16.

The FDA

approval of liso-cel by December 31, 2020 is one of the required remaining

milestones of the CVRs issued upon the close of the Celgene acquisition in the

fourth quarter of 2019. The other is FDA approval of ide-cel by March 31, 2021.

FDA declines approval to Novartis’ inclisiran: Recently, there was news that

the FDA declined to approve Swiss drugmaker Novartis AG’s lipid-lowering therapy, inclisiran (branded as Leqvio). The drug came to Novartis' fold through the

US$ 9.7 billion acquisition of The Medicines Company last year. The drug has been cleared by the European Commission.

In a statement, Novartis said the

FDA has not raised any concerns

related to the efficacy or safety of inclisiran. The complete

response letter (CRL) is due to unresolved facility inspection-related

conditions. No onsite inspection was conducted by the FDA, the company said.

View New Drug Approvals in 2020 with Estimated Sales (Free Excel Available)

Our

view

Like the

drug companies, regulators across the world also worked at a frenetic pace in

order to accelerate EUAs and drug approvals, especially for treatments and

vaccines for Covid-19.

Apart from

Covid-19, the year saw wider adoption and

approvals for cell and gene therapies along with approvals of several innovative medicines like relugolix (the first

oral gonadotropin-releasing hormone receptor antagonist for the treatment of

adult patients with advanced prostate cancer), berotralstat

the first oral once daily plasma kallikrein inhibitor to prevent attacks of

hereditary angioedema in adults and pediatric patients 12 years and older,

lumasiran (an HAO1-directed small interfering

ribonucleic acid indicated for the treatment of primary hyperoxaluria type 1 to lower urinary oxalate levels in pediatric and adult

patients) and osilodrostat for the treatment of adults with Cushing’s disease).

Moreover, there were several interesting ‘non-Covid’ medical breakthroughs that took place during 2020. One such breakthrough is a single pill that combines four medications meant to

lower blood pressure and cholesterol and aspirin that was found to cut the risk

of heart disease.

While the agility shown by pharma companies and regulators was

undoubtedly quite impressive, with many countries granting EUA to vaccines for

Covid-19, the ongoing pandemic did put mankind in a bind for several months.

And if the words of the WHO director general Tedros

Adhanom Ghebreyesus are to be believed, the

coronavirus crisis will not be the last pandemic and attempts to improve human health are “doomed” without tackling climate change and animal welfare.

If that really proves to be the case, the pharma industry has a lot to learn from this pandemic, and science has a lot to demonstrate if mankind is to emerge unscathed from such adversities.

View New Drug Approvals in 2020 with Estimated Sales (Free Excel Available)

Impressions: 6869

Last month, we had carried an article ‘Hydroxychloroquine: Hype versus reality’ that

highlighted some of the limitations of the study undertaken in France at

the infection hospital l'Institut Hospitalo-Universitaire (IHU) Méditerranée Infection in Marseille. On March

16, Professor Didier Raoult

had published a video explaining

the trials following which the US

President Donald Trump had tweeted last month that hydroxychloroquine (HCQ) taken together with azithromycin had a real chance to be one of the biggest game changers in

the history of medicine.

The excitement over HCQ being a potentially effective treatment for Covid-19 led to a tremendous demand surge globally for the drug and countries like India, Hungary and Finland, which are major manufacturers of the active pharmaceutical ingredient (API) restricted exports. Following direct discussions between President Trump and India’s Prime Minister Narendra Modi last week, India relaxed its restrictions and cleared the export of 3.58

million tablets of HCQ to the US along with nine metric tons of API required in

the manufacturing of the drug.

While

the consignment of HCQ from India arrived in the US last week, Raoult has

since been criticized by the scientific community for his methods, especially

the lack of a control group to establish a benchmark for the success of his

experimental treatments.

The pushback

started last month, when clinical studies published in Chinese patients showed

limited clinical improvement over standard care. In a controlled clinical study on 30 patients, a report published by the Journal

of Zhejiang University in China revealed that patients who got treated by HCQ didn’t fare any better than those who did not get the medicine.

This

week, we examine some of the findings of fresh studies undertaken in France,

Brazil and China on HCQ to examine its efficacy in the treatment of Covid-19.

French

study results do not support HCQ use in hospitalized patients

A study

undertaken in France, spearheaded by doctors in Paris, collected data from routine care of adults in four French hospitals with documented

SARS-CoV-2 pneumonia and who required oxygen to emulate a target trial aimed at assessing the effectiveness of HCQ

at 600 mg/day.

This

study included 181 patients with SARS-CoV-2 pneumonia; and out of this 84

received HCQ within 48 hours of admission (HCQ group) and 97 did not (no-HCQ

group).

An

analysis of this study reveals that 20.2 percent patients in the HCQ group were

transferred to the ICU or died within seven days as opposed to 22.1 percent in

the no-HCQ group. In the HCQ group, 2.8 percent of the patients died within

seven days as against 4.6 percent in the no-HCQ group. And 27.4

percent and 24.1 percent, respectively, in both the groups developed acute respiratory

distress syndrome within seven days. Eight patients receiving HCQ (9.5 percent) experienced electrocardiogram (ECG) modifications requiring HCQ discontinuation.

The

authors concluded that the results do not support the use of HCQ in patients

hospitalized for documented SARS CoV-2-positive hypoxic pneumonia.

Chinese study shows benefits in alleviation of symptoms but not in clearing virus

In

another randomized controlled trial in China, which tracked 150 patients hospitalized with Covid-19, 75 patients were

assigned to HCQ plus standard of care (SOC) and 75 were assigned to SOC alone. The results

concluded that administration of HCQ did not result in a higher negative

conversion rate but more alleviation of clinical symptoms than SOC alone in

patients hospitalized with Covid-19. Adverse events were significantly

increased in HCQ recipients.

While

the primary endpoint for this trial was the negative conversion of SARS-CoV-2

within 28-days, the study does mention that more rapid alleviation of clinical

symptoms with SOC plus HCQ than with SOC alone was observed during the second

week.

Minimum

requirements for the SOC included the provision of intravenous fluids,

supplemental oxygen, regular laboratory testing, and SARS-CoV-2 test,

hemodynamic monitoring and intensive care and the ability to deliver

concomitant medications.

HCQ was administrated with a loading dose of 1,200 mg daily for three

days followed by a maintained dose of 800 mg daily for the remaining days

(total treatment duration: two weeks for mild/moderate patients, three weeks

for severe patients).

Brazilian study reports hazards on its analog chloroquine

A small

study undertaken in Brazil on the effects of the anti-malaria drug chloroquine (CQ), which is structurally similar to HCQ, was abruptly halted because some patients taking high doses developed irregular heart rates generating “safety hazards.” The findings were revealed in a study funded by the Brazilian state of Amazonas.

The

Brazilian study included 81 hospitalized patients, with about half being

given a 450 milligram dose of chloroquine twice on the first day of the study followed by one daily

450 milligram dose for four more days. The other participants

were prescribed a dose of 600 milligrams twice daily for 10 days.

Patients

taking higher doses experienced heart arrhythmias within three days.

Eleven patients died by the sixth day of treatment and the research on the

high-dosages, therefore, had to be ended.

“Preliminary findings suggest that the higher CQ dosage (10-day regimen) should not be recommended for Covid-19 treatment because of its potential safety hazards,” the study's abstract said. “Such results forced us to prematurely halt patient recruitment to this arm.”

The lower-dosage portion of the study did not include enough patients to gauge whether it is effective in treating severely ill patients. The researchers said that more studies assessing the efficacy of chloroquine are “urgently needed.”

Heart incidents linked to HCQ in France

France

has reported 43 cases of heart incidents linked to treating Covid-19 patients with HCQ. According to a

statement issued by the French drug safety agency ANSM, the country has recorded about 100 health incidents and four deaths linked to experimental drugs for Covid-19 patients since March 27. Three other patients had to be revived.

Some 82

incidents were deemed “serious.” Most of those were split between HCQ and HIV antivirals lopinavir-ritonavir.

Last

month, Nigeria reported cases of chloroquine poisoning. “These drugs should only be used in hospitals, under close medical supervision,” ANSM said.

Our view

A large multinational collaboration presenting data obtained from

health care systems (claims data or electronic medical records) in Germany,

Japan, Netherlands, Spain, UK and the USA concludes that short-term HCQ

monotherapy does appear to be safe. However, it notes that long-term HCQ dosing

is indeed tied to increased cardiovascular mortality.

Moreover, significant risks are identified for combination users of HCQ

and azithromycin, even in the short-term. There is a 15-20 percent increased

risk of angina/chest pain and heart failure, and a two-fold risk of

cardiovascular mortality in the first month of treatment.

At the same time,

French Professor

Didier Raoult published expanded study results highlighting that 1,061 patients treated for at least three days with the HCQ and azithromycin combination had a cure rate of 98 percent and “no cardiac toxicity was observed”.

As of

today, controlled studies undertaken on HCQ

indicate that the drug does little to eliminate the presence of the virus but

it does help in the short-term to make patients feel better, especially those

who have a milder Covid-19 infection.

For now, there is likelihood that HCQ may turnout of be another TamiFlu.

The drug was widely prescribed during the swine flu outbreak in 2009. A recent

study concluded that the drug reduced the persistence of flu symptoms from seven days to 6.3 days in adults and to 5.8 days in children. But the report’s authors said drugs such as paracetamol could have had a similar impact. If that indeed is the case with HCQ, millions of dollars may get wasted on the drug, just as they were wasted in 2009 during the swine flu outbreak.

Impressions: 3585

While the world feels the heat of the Covid-19 pandemic with the global pharmaceutical supply chain getting impacted, normalcy is returning

to China. According to new reports, the production of drugs and APIs in China is also returning to normal.

In a press conference held by top Chinese officials this week, the country’s ministers highlighted that as of March 28, the average operating rate of industrial enterprises across China had reached 98.6 percent and the production of some key vitamin, antibiotic and analgesic raw material drug companies had returned to normal with yields of major products reaching above 80 percent.

Officials had paid heed to resumption of production

The officials

highlighted that during the critical period of epidemic prevention and control,

the Chinese government had paid close attention to the resumption of production

of API companies. After receiving reports that some companies in Hubei had not

resumed work, which would impact the supply chains of products like metronidazole, ibuprofen, and taurine, the

authorities urgently coordinated with the relevant departments of Hubei, other

provinces, cities and counties to carry out key scheduling for some API

manufacturers and actively organized employees to return to work.

However, despite

these initiatives, due to the impact of the epidemic, wherein some enterprises

had stopped production and subsequently faced challenges with logistics and

transportation difficulties, there was a shortfall in supply.

The export

volume of APIs did decrease this year compared with the same period last year

and the officials estimated that most products witnessed a drop of about 10 to

20 percent, and in some cases the decline of individual varieties had reached

30 percent. Repeated communications between the officials and these

companies revealed that the main contributor to the decline in exports was sea

freight, as international shipping had greatly reduced, and transportation

costs have also increased.

Although

international transportation has become a bottleneck for the supply of some

APIs, the press conference highlighted that the output of other APIs had

exceeded the level of the same period last year.

China to meet global demand for chloroquine

The officials

made a special mention of medications like chloroquine phosphate which have

received significant attention as a potential treatment of the novel

coronavirus. After chloroquine phosphate was identified as a potentially

effective treatment, the government worked with the two major API manufacturers

in China to organize the companies to meet international demand. For example, Chongqing Kangle Pharmaceuticals exported 4.9

tons of chloroquine APIs within five days.

This news from

China is encouraging to the global supply chain as following the rising interest in a chloroquine analog — Hydroxychloroquine (HCQ) — the

Indian government issued a directive which

prohibits the export of HCQ API and formulations made from HCQ. The directive

did, however, offer exemptions to exports from special economic

zones/export-oriented units and in cases where export is made to fulfill an

export obligation under any advance license issued on or before the date of the

notification.

Last week, Hungary, which is also one of the world’s largest exporters of HCQ, also banned the commercial export of the ingredient and the

United Kingdom (UK) banned the export of finished formulations of HCQ as part

of a list of 135 medicines posted that cannot be exported from the UK

because they were needed for the UK patients.

In early

March, the Indian government had also restricted the exports of

13 APIs along with some of their finished formulations. The list included paracetamol tinidazole metronidazole acyclovir vitamin B1 vitamin B6 vitamin B12 progesterone chloramphenicol and neomycin.

However, a recent report published in The Economic Times highlighted that out of 13 drugs whose exports were restricted, the government is likely to lift the ban on the following five APIs — paracetamol, tinidazole, metronidazole, ornidazole and azithromycin. There were

also reports of significant pressure from the US on the Indian government for products

like paracetamol and the officials expect the ban to be lifted in the coming

days.

The Chinese

officials further went on to provide assurances that the supply of chloroquine phosphate can be increased in accordance with international market demand and that China’s Ministry of Industry and Information Technology will also organize the implementation of monitoring and production scheduling of key products, coordinate and solve the export transportation difficulties encountered by enterprises and strengthen communication.

Our view

The press

conference highlighted that China attaches great importance to the safety of

the global pharmaceutical industry supply chain and President Xi Jinping had

promised at the G20 summit of member states on March 26 that China will

increase its efforts to supply APIs to the international community.

The Chinese

government is working earnestly to implement the commitment to maintain the

production of API manufacturers and ensure the safety and stability of global

industrial chain supply, the statement emerging out of the press conference

said.

Given the global pharmaceutical supply chain’s overwhelming dependence on China, the nation’s return to normalcy is a positive sign for countries across the world. For the time being, the pandemic has only increased the world’s dependence on China. All countries that want to reduce their reliance on China will take time not just to build capacities, but also to emerge out of the Covid-19 crisis.

Impressions: 1618

The

President of United States Donald Trump’s

tweet

late last week has swung the pharmaceutical industry’s

focus on hydroxychloroquine, an anti-malarial drug which has been in use since

the 1950s and is now used to treat a variety of autoimmune disorders.

Trump had

tweeted: “HYDROXYCHLOROQUINE & AZITHROMYCIN, taken together, have a real chance to be one of the biggest game changers in the history of medicine. The FDA has moved mountains — Thank You! Hopefully they will BOTH (H works better with A, International Journal of Antimicrobial Agents) be put in use IMMEDIATELY. PEOPLE ARE DYING, MOVE FAST, and GOD BLESS EVERYONE!”

We look at the study quoted by Trump to know the efficacy of these drugs, and whether the world is any closer to finding a cure for the novel coronavirus which has impacted people across the world over the last two months. Our findings suggest it maybe too early to term the combo as a game-changer. Here’s our detailed analysis:

The

study in France that wasn’t

done by Sanofi

The US

President’s tweet referenced the results

of a study conducted in France, which was published in the International

Journal of Antimicrobial Agents last week title “Hydroxychloroquine and azithromycin as a treatment of COVID‐19: results of an open‐label non‐randomized clinical trial”.

The study

was performed at the infection hospital l'Institut Hospitalo-Universitaire

(IHU) Méditerranée Infection in Marseille and Professor Didier Raoult published a video explaining the trials on

Monday, March 16. All patients at the Marseille center were given oral

hydroxychloroquine sulfate 200 mg, three times per day during 10 days.

Social

media posts incorrectly promoted the French study as a trial conducted by the

country’s largest drugmaker Sanofi and went on to recommend Sanofi’s hydroxychloroquine

brand Plaquenil as ‘anti-corona’.

There is

no mention of Sanofi or Plaquenil in the research publication which attributes

its funding support to the French government.

Effectiveness of hydroxychloroquine, azithromycin against Covid-19

An analysis of the results of the study shows that on

day 6 the effectiveness of the treatments on 36 patients was:

— 100 percent (6/6 patients tested negative) for hydroxychloroquine + azithromycin

— 57 percent (8/14 patients tested

negative) for hydroxychloroquine as a stand-alone therapy

— 13 percent (2/16 patients tested negative) for the control therapy (which is not described in the paper)

The lesser known details — 1 patient died, 3 patients transferred to ICU

However,

the original study had enrolled 42, and not 36 patients. The publication shares the details of the six

hydroxychloroquine-treated patients who failed to complete the trial and could

not be tested on day 6 for the presence of Covid-19. The reasons to not be

tested were:

- Three

patients, who were still testing positive, were transferred to the intensive

care unit (ICU)

- One

patient, who tested negative on day 2, died on day 3

- One

patient, although testing positive on days 1 to 3, stopped treatment because of

nausea

- One

patient left the hospital after testing negative on days 1, 2

The

results also highlight that one patient who was still testing positive on day 6

under hydroxychloroquine only treatment, received azithromycin in addition to

hydroxychloroquine and was cured off her infection on day 9.

However,

one of the patients under hydroxychloroquine and azithromycin combination who

tested negative at Day 6, tested positive on Day 8.

Negative results were reported at a lower limit

The trial

in France used the RT-PCR testing methodology to determine if a person had

Covid-19 and reported the Cycle Threshold (CT) reading.

The RT-PCR

technology builds on a Nobel Prize winning technique of PCR, or polymerase

chain reaction, which is a DNA amplification technique that is routinely used

in laboratories to turn tiny amounts of DNA into large enough quantities that

can be analyzed. For scientists to

detect a virus like Covid-19, they also need to turn its genome, which is made

of a single-strand RNA, into DNA. In order to do this, an enzyme called

reverse-transcriptase is utilized.

Combining

the two techniques created RT-PCR and when the DNA is combined with a

fluorescent dye, that glows in the presence of DNA, PCR can actually tell

scientists how much DNA there is.

The cycle

threshold (CT) is the number of cycles which are required for the fluorescent

signal to cross an established threshold. CT levels are also inversely

proportional to the amount of target nucleic acid in the sample (i.e. the lower

the CT level the greater is the amount of the viral load).

As per the

method guidelines published on the United States Food and

Drug Administration (FDA) website “when all controls exhibit the expected performance, a specimen is considered negative if all 2019- nCoV marker (N1, N2) cycle threshold growth curves DO NOT cross the threshold line within 40.00 cycles (< 40.00 Ct)”.

The French

study reported negative results at a CT value of 35 as against the FDA guidance

of 40 cycles, which indicates reporting negative results earlier than what

would have been acceptable to the FDA.

In

addition, as a lower CT number indicates a higher amount of the nucleic acid

load, in all cases where the patients had a CT of less than 22 at the start of

the study, they failed to test negative on the hydroxychloroquine-only

treatment.

The

hydroxychloroquine-azithromycin combination was only administered and effective

on patients with a CT of more than 23.

The

expected surge in demand for hydroxychloroquine

Following

Trump’s tweet, Novartis pledged to donate up to 130

million hydroxychloroquine tablets, pending regulatory approvals for

Covid-19, Mylan announced it was ramping up production to

make 50 million tablets and Teva said it was donating 16 million

tablets to hospitals around the US.

PharmaCompass’ MarketPlace has been flooded with

requests for hydroxychloroquine sulphate, chloroquine phosphate (although hydroxychloroquine

clinical safety profile is better than that of chloroquine, in long-term use,

and allows higher daily dose) and azithromycin and API suppliers have informed

us that their capacities are sold out.

With pharmacies running out of the drugs, in a surprise move the FDA made an exception to the four-year old ban

placed on India’s

Ipca Labs, one of the major

manufacturers of chloroquine and hydroxychloroquine, to sell their drugs in the United

States.

The

company informed the bourses that due to the shortage implications and/or

medical necessity of certain drugs and finished products, the import alert for

the company's hydroxychloroquine sulphate and chloroquine phosphate APIs and

hydroxychloroquine sulphate tablets had been partially lifted.

In a

recent August 2019 inspection, the FDA had observed “a cascade of failure” in Ipca’s quality unit.

Our

view

We support

the authors of the study who themselves acknowledge that “our study has some limitations including a small sample size, limited long-term outcome follow-up, and dropout of six patients from the study, however in the current context, we believe that our results should be shared with the scientific community.”

While the world is desperately looking for solutions, a balanced view of the results is necessary. And it’s important to reiterate that we are far away from finding a quick fix to the single biggest health emergency in years.

Impressions: 7628

This week, Phispers looks at fresh troubles brewing at Mylan, as rebel investors intensify their demand for remaking the board, and a low-cost rival for EpiPen gets FDA nod. Meanwhile, BMS sold off its API plant in Ireland to South Korea’s SK Biotek and Baxter tied up with CRO Dorizoe for speedier development of generic injectables. There is more news on Dr. Reddy’s, Ipca and CROs this week. Read on.

Tough time for

Mylan as camp to oust directors grows; Adamis to launch EpiPen rival

The war at Mylan — with rebel investors on one side, and the management on the other side — intensified last week as another proxy firm joined

hands with the rebel investors looking to remake the board.

Egan-Jones Proxy

Services joined ISS, Glass Lewis and a group of rebel shareholders in pushing

for the ouster of the board members. Together, they feel Mylan shareholders

should vote against the re-election of six directors.

Mylan shareholders

will meet

in Amsterdam on Thursday, June 22, 2017.

The investors are not just disturbed over Chairman Robert Coury’s US$ 97 million pay package for 2016, but are also upset that Mylan turned away potential acquirer Teva. And that government investigations over

pricing went beyond the EpiPen, and involved its generic drugs as well.

However, Mylan’s CEO Heather Bresch shot back by blaming the company’s problems on external pressures, as opposed to internal missteps.

Meanwhile, Mylan received

another setback last week when Adamis Pharmaceuticals received approval for selling its emergency epinephrine syringes in the US. Adamis’ epinephrine syringes will prove to be a lower cost alternative to Mylan’s widely used EpiPen. Epinephrine

treats severe allergic reactions.

Adamis is reportedly looking

for a marketing partner and would set a price for the product before its launch

sometime in the second half of 2017. Its pre-filled epinephrine syringes would

be sold under the brand name Symjepi.

Trump’s volte-face: Pharma executive order to have positive impact on industry

President Donald Trump has

repeatedly spoken about being tough on the drug industry. Yet, his

administration is yet to take any measure that lives up to his promise of

lowering drug prices.

On the contrary, news reports suggest that Trump administration’s plan to lower prescription drug

prices may end up being friendly to drug companies.

The 'Drug Pricing and Innovation Working Group’, a group of officials from the Trump administration, have been meeting every two weeks to discuss drug pricing. The group is led by Joe Grogan, an associate director at the Office of Management and Budget who worked for Gilead Sciences until March this year. Gilead has been

repeatedly criticized for pricing its hepatitis C drugs at US$ 1,000 per pill.

To solve the

crisis of high drug prices, the group discussed strengthening the monopoly

rights of pharmaceuticals overseas, ending discounts for low-income hospitals

and accelerating drug approvals by the US Food and Drug Administration (FDA).

According to Kaiser Health News, the policies wouldn't ease the cost of prescription

drugs, and might even increase them.

The Trump

administration is preparing the executive order, which could be signed within

weeks.

According to

another news report, the executive order was originally expected to have a

negative impact on the drug industry, but the policies now under consideration

would not do so. For instance, the Trump administration is said to be considering

direct federal agencies to pursue value-based purchasing contracts for drugs.

Another policy under discussion would instruct agencies to pursue trade

policies that would strengthen the intellectual property rights of drug

companies.

The industry too

expects a positive impact. Allergan CEO Brent

Saunders recently said the

executive order on drug pricing could have a positive impact and

he believes his company is well-positioned to handle any changes.

BMS sells its API plant in Ireland to Korea’s SK Biotek

Bristol-Myers Squibb (BMS) is selling off its API plant in Ireland to South Korea’s SK Biotek. The divestment is in line with BMS’ shift in focus towards biologics manufacturing.

SK Biotek is a unit of South Korea’s third largest conglomerate, SK Holdings. The company has been a BMS ingredient supplier for a decade.

Though the terms

of the deal are not known, it is likely to close in the last quarter of 2017.

SK Biotek will continue to manufacture products BMS currently makes at the

plant, which includes the API for BMS and Pfizer’s anticoagulant Eliquis.

SK Biotek will use

this plant for its contract development and manufacturing business, which is

growing at a healthy pace. It plans to add marketing and R&D operations at

the site, as well as invest in boosting capacity.

“This transaction is an important step to achieve our goal of becoming a leading global CDMO (contract development and marketing organization),” Junku Park, CEO, SK Biotek, said in a statement.

Ipca’s products banned from US; Dr. Reddy’s provides positive inspections updates

Of late, Dr. Reddy’s has been providing positive inspection updates. On

June 16, the company said it received one US FDA observation for its Srikakulam formulation plant, which the company is addressing. However, the company didn’t disclose the nature of the observation.

Three days prior, on June 13, Dr.Reddy’s had received an Establishment Inspection Report (EIR) for its Miryalaguda plant, indicating closure of the

FDA audit. The API plant was inspected by the US regulator in February this

year, and had received three Form 483 observations.

The Miryalaguda plant was one among the three plants for which the company received FDA’s warning letter in November 2015. The warning letter mentioned deviations in good manufacturing practices (GMPs).

Meanwhile, the FDA banned entry of products

of Ipca Lab in the US due to non-compliance with manufacturing norms at three of its facilities. All drugs manufactured at facilities in Ratlam, Indore SEZ and Silvassa will be refused admission in the US until the company can demonstrate that products from these sites are in compliance with prescribed norms.

The company’s API plant at Ratlam and formulations units at Indore SEZ and Silvassa have been under FDA import alert since 2015 for violation of GMPs.

However, few products were exempted from the ban to avoid shortages in the US

market.

Now, only one API

product, chloroquine phosphate manufactured at Ratlam facility, is

exempted from the import ban.

Baxter in

agreement with Dorizoe to speed up development of generic injectables

Global medical products

company Baxter International Inc announced it had entered into an agreement

with Dorizoe Lifesciences Limited (Dorizoe), a full-service global contract research and development organization headquartered in Ahmedabad (India). The agreement will speed up the development of more than 20 generic injectable products—including anti-infectives, oncolytics and cardiovascular medicines.

“This partnership extends Baxter’s growing pipeline of generic injectables, further strengthening our portfolio with a broad range of high-quality essential medicines,” Robert

Felicelli, president, Pharmaceuticals, Baxter, said.

Baxter has been in

an expansion mode. In December last year, Baxter had announced the acquisition of Claris Injectables Limited (Claris) for US$ 625 million. The

acquisition of Claris, which is expected to close in the second half of 2017,

will provide Baxter with a portfolio of molecules in anesthesia and analgesics,

renal, anti-infectives and critical care.

Recently, Baxter

also announced a strategic partnership with ScinoPharm Taiwan, a leading process R&D and API

manufacturing service provider to the global pharmaceutical industry. The

partnership is for developing, manufacturing and commercializing five generic

injectables used in cancer treatment, with an option to add up to 15 additional

injectable molecules.

After AMRI, Parexel International — gets acquired by a PE firm for US$

4.5 billion

This appears to be

a month when private equity firms are continuing to pick up stake in pharma

contract research organizations or CROs. On June 6, global asset manager, the

Carlyle Group (CG) and GTCR LLC (a private equity firm), acquired Albany Molecular Research (AMRI), a global contract research and

manufacturing organization, for about US$ 922 million in cash.

And this week, Parexel International Corp, a US drug research services provider,

got acquired by Pamplona Capital Management LLP in a US$ 4.5 billion deal. There was pressure from investors, including Starboard Value LP, on Parexel to explore a sale. They argued the company’s profit margins have consistently fallen behind those of its peers.

Headquartered near

Boston, Massachusetts, Parexel provides a range of services to the pharma

industry, such as drug development, regulatory consulting, clinical

pharmacology, clinical trials management and reimbursement.

Impressions: 2695