Acquisitions and spin-offs dominated headlines in 2019 and the tone was set very early with Bristol-Myers Squibb acquiring

New Jersey-based cancer drug company Celgene in a US$ 74 billion deal announced on

January 3, 2019. After factoring

in debt, the deal value ballooned to about US$ 95 billion, which according

to data compiled by Refinitiv, made it the largest healthcare deal on

record.

In the summer, AbbVie Inc,

which sells the world’s best-selling drug Humira, announced its acquisition of Allergan Plc, known for Botox and other cosmetic

treatments, for US$ 63 billion. While the companies are still awaiting

regulatory approval for their deal, with US$ 49 billion in combined 2019

revenues, the merged entity would rank amongst the biggest in the industry.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

The big five by pharmaceutical sales — Pfizer,

Roche, J&J, Novartis and Merck

Pfizer

continued

to lead companies by pharmaceutical sales by reporting annual 2019 revenues of

US$ 51.8 billion, a decrease of US$ 1.9 billion, or 4 percent, compared to

2018. The decline was primarily attributed to the loss of exclusivity of Lyrica in 2019,

which witnessed its sales drop from US$ 5 billion in 2018 to US$ 3.3 billion in

2019.

In 2018, Pfizer’s then incoming CEO Albert Bourla had mentioned that the company did not see the need for any large-scale M&A activity as Pfizer had “the best pipeline” in its history, which needed the company to focus on deploying its capital to keep its pipeline flowing and execute on its drug launches.

Bourla stayed true to his word and barring the acquisition of Array Biopharma for US$ 11.4 billion and a spin-off to merge Upjohn, Pfizer’s off-patent branded and generic established medicines business with

Mylan, there weren’t any other big ticket deals which were announced.

The

Upjohn-Mylan merged entity will be called Viatris and is expected to have 2020

revenues between US$ 19 and US$ 20 billion

and could outpace Teva to

become the largest generic company in the world, in term of revenues.

Novartis, which had

followed Pfizer with the second largest revenues in the pharmaceutical industry

in 2018, reported its first full year earnings after spinning off its Alcon eye

care devices business division that

had US$ 7.15 billion in 2018 sales.

In 2019,

Novartis slipped two spots in the ranking after reporting total sales of US$

47.4 billion and its CEO Vas Narasimhan continued his deal-making spree by buying New

Jersey-headquartered The Medicines Company (MedCo) for US$ 9.7

billion to acquire a late-stage cholesterol-lowering

therapy named inclisiran.

As Takeda Pharmaceutical Co was

busy in 2019 on working to reduce its debt burden incurred due to its US$ 62

billion purchase of Shire Plc, which was announced in 2018, Novartis also purchased

the eye-disease medicine, Xiidra, from the Japanese drugmaker for US$ 5.3 billion.

Novartis’ management also spent a considerable part of 2019 dealing with data-integrity concerns which emerged from its 2018 buyout of AveXis, the

gene-therapy maker Novartis had acquired for US$ 8.7 billion.

The deal gave Novartis rights to Zolgensma,

a novel treatment intended for children less than two years of age with the

most severe form of spinal muscular atrophy (SMA). Priced at US$ 2.1 million,

Zolgensma is currently the world’s most expensive drug.

However,

in a shocking announcement, a month after approving the drug, the US Food and

Drug Administration (FDA) issued a press release on

data accuracy issues as the agency was informed by AveXis that

its personnel had manipulated data which

the FDA used to evaluate product comparability and nonclinical (animal)

pharmacology as part of the biologics license application (BLA), which was

submitted and reviewed by the FDA.

With US$

50.0 billion (CHF 48.5 billion) in annual pharmaceutical sales, Swiss drugmaker

Roche came in at number two position in 2019

as its sales grew 11 percent driven by

its multiple sclerosis medicine Ocrevus, haemophilia drug Hemlibra and cancer medicines Tecentriq and Perjeta.

Roche’s newly introduced medicines generated US$ 5.53 billion (CHF 5.4 billion) in growth, helping offset the impact of the competition from biosimilars for its three best-selling drugs MabThera/Rituxan, Herceptin and Avastin.

In late 2019, after months of increased

antitrust scrutiny, Roche completed

its US$ 5.1 billion acquisition of Spark Therapeutics to strengthen its presence in

gene therapy.

Last year, J&J reported almost flat worldwide sales of US$ 82.1 billion. J&J’s pharmaceutical division generated US$ 42.20 billion and its medical devices and consumer health divisions brought in US$ 25.96 billion and US$ 13.89 billion respectively.

Since J&J’s consumer health division sells analgesics, digestive health along with beauty and oral care products, the US$ 5.43 billion in consumer health sales from over-the-counter drugs and women’s health products was only used in our assessment of J&J’s total pharmaceutical revenues. With combined pharmaceutical sales of US$ 47.63 billion, J&J made it to number three on our list.

While the sales of products like Stelara, Darzalex, Imbruvica, Invega Sustenna drove J&J’s pharmaceutical business to grow by 4 percent over 2018, the firm had to contend with generic competition against key revenue contributors Remicade and Zytiga.

US-headquartered Merck, which is known as

MSD (short for Merck Sharp & Dohme) outside the United States and

Canada, is set to significantly move up the rankings next year fueled by its

cancer drug Keytruda, which witnessed a 55

percent increase in sales to US$ 11.1 billion.

Merck reported total revenues of US$ 41.75 billion and also

announced it will spin off its women’s health drugs,

biosimilar drugs and older products to create a new pharmaceutical

company with US$ 6.5 billion in annual revenues.

The firm had anticipated 2020 sales between US$ 48.8 billion and US$ 50.3 billion however this week it announced that the coronavirus pandemic will reduce 2020 sales by more than $2 billion.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

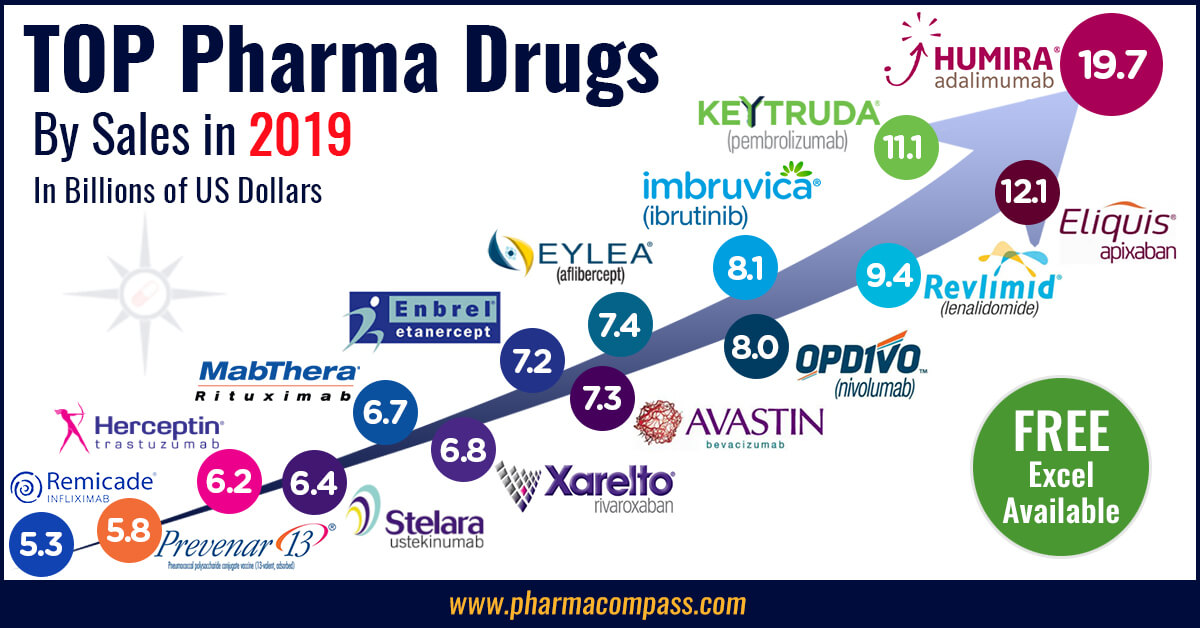

Humira holds on to remain world’s best-selling drug

AbbVie’s acquisition of Allergan comes as the firm faces the expiration of patent protection for Humira, which brought in a staggering US$ 19.2 billion in sales last year for

the company. AbbVie has failed to successfully acquire or develop a major new

product to replace the sales generated by its flagship drug.

In 2019, Humira’s US revenues increased 8.6 percent to US$ 14.86 billion while internationally, due

to biosimilar competition, the sales dropped 31.1 percent to US$ 4.30 billion.

Bristol Myers Squibb’s Eliquis, which is also marketed by Pfizer, maintained its number two position

and posted total sales of US$ 12.1 billion, a 23 percent increase over 2018.

While Bristol Myers Squibb’s immunotherapy treatment Opdivo, sold in partnership with Ono in Japan, saw sales increase from US$ 7.57 billion to US$ 8.0 billion, the growth paled in comparison to the US$ 3.9

billion revenue increase of Opdivo’s key immunotherapy competitor Merck’s Keytruda.

Keytruda took the number three spot in drug sales that

previously belonged to Celgene’s Revlimid, which witnessed a sales decline from US$ 9.69 billion to US$ 9.4 billion.

Cancer treatment Imbruvica, which is marketed

by J&J and AbbVie, witnessed a 30 percent increase in sales. With US$ 8.1

billion in 2019 revenues, it took the number five position.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Vaccines – Covid-19 turns competitors into partners

This year has been dominated by the single biggest health emergency in years — the novel coronavirus (Covid-19) pandemic. As drugs continue to fail to meet expectations, vaccine development has received a lot of attention.

GSK reported the highest vaccine sales of all drugmakers with

total sales of US$ 8.4 billion (GBP 7.16 billion), a significant portion of its

total sales of US$ 41.8 billion (GBP 33.754 billion).

US-based Merck’s vaccine division also reported a significant increase in sales to US$ 8.0 billion and in 2019 received FDA and EU approval to market its Ebola vaccine Ervebo.

This is the first FDA-authorized vaccine against the deadly virus which causes

hemorrhagic fever and spreads from person to person through direct contact with

body fluids.

Pfizer and Sanofi also reported an increase in their vaccine sales to US$ 6.4

billion and US$ 6.2 billion respectively and the Covid-19 pandemic has recently

pushed drugmakers to move faster than ever before and has also converted

competitors into partners.

In a rare move, drug behemoths — Sanofi and GlaxoSmithKline (GSK) —joined hands to develop a vaccine for the novel coronavirus.

The two companies plan to start human trials

in the second half of this year, and if things go right, they will file

for potential approvals by the second half of 2021.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Our view

Covid-19 has brought the world economy to a grinding halt and shifted the global attention to the pharmaceutical industry’s capability to deliver solutions to address this pandemic.

Our compilation shows that vaccines and drugs

for infectious diseases currently form a tiny fraction of the total sales of

pharmaceutical companies and few drugs against infectious diseases rank high on

the sales list.

This could well explain the limited range of

options currently available to fight Covid-19. With the pandemic currently infecting

over 3 million people spread across more than 200 countries, we can safely

conclude that the scenario in 2020 will change substantially. And so should our

compilation of top drugs for the year.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Impressions: 54752

This week, Phispers brings you the latest on controversies, such as the one surrounding Hillary Clinton’s running mate Tim Kaine and Roche’s Avastin that caused vision damage in patients at an Indian hospital. There is also regulatory news from across the world, and the latest M&A deal. Did Abbott’s sales rep in India kill himself due to pressure to meet targets? An Abbott medical representative in India killed himself last week, allegedly due to the pressure put by the pharma company to achieve

periodic sales targets. As per a news report, Ashish Awasthi, 35, was found

dead on a railway track, with a note that blamed the company for his

death. Abbott, however, has denied any role in his death. In fact,

the company has said Awasthi was rated among the top performers and had

recently qualified for a training certification meant for high performers. Roche’s Avastin sent for testing, as stakeholders play blame-game in vision damage caseIndia’s Health Ministry has sent samples of Roche’s Avastin for

testing following reports that 27 out of 30 patients at the Post-Graduate

Institute of Medical Education and Research (PGIMER), Chandigarh, complained of

infection

and vision damage after being administered the drug.Samples of the drug used were sent to Central Drugs

Laboratory in Kolkata for testing. The cause of the problem remains unclear,

though the patients have been discharged

from the hospital. PGIMER suspects the problem was an outcome of the local

chemist supplying spurious drugs. This is the first

time in nine years that the hospital has purchased the medicine from a

chemist, as this time there was a delay in supply from Roche. The chemist, in

turn, passed the buck onto Roche.In a statement, Roche blamed the doctors, and said they should

not have administered the drug. “The safety of patients is always our priority and we are treating the event in Chandigarh relating to the off-label use of Avastin (bevacizumab) in the eye very seriously. Avastin is an important cancer therapy... We would like to reiterate that [it] has not been approved for use in the eye by the US FDA (Federal Drug Administration), EMA (European Medicines Agency) or the Government of India,” Roche said. Clinton’s VP nominee under scrutiny for receiving favours from Teva’s BarrWhen it comes to accepting gifts from pharmaceutical companies, doctors have invariably been the target of scrutiny. However, last week America’s presidential candidate Hillary Clinton’s running mate – Senator

Tim Kaine – received much bad press for accepting a pharma company’s offer to fly him on a private jet to a meeting in Aspen.

The company – Barr

Pharmaceutical (now a part of Teva) – flew Clinton’s pick for the US vice president in a private jet, and the flight was worth US $ 12,000, says Kaine’s disclosure report. Kaine was then the governor of Virginia. And Barr executives were lobbying Kaine to write a letter to the FDA on its behalf. Kaine signed a letter to US regulators – as requested by Barr – before taking the flight, say reports.However,

other news reports point that the flight and other gifts (worth US $ 160,000) Kaine

accepted during his stint as governor were legal under Virginia’s laws at the time, since they were disclosed. FDA rejects Valeant’s potential blockbuster drug for treating glaucomaLast week, Valeant’s

experimental glaucoma drug was rejected by the FDA, due to manufacturing

practices at its Florida facility. In a statement, Valeant said it had received a Complete Response Letter from the FDA regarding its New Drug Application for Vesneo (latanoprostene bunod) – an intraocular pressure lowering single-agent eye drop for patients with open angle glaucoma or ocular hypertension. In its rejection letter, the FDA did not cite concerns over efficacy or safety of the drug, but raised unspecified deficiencies at the Florida plant operated by Valeant’s Bausch

& Lomb division. If approved, Vesneo will be the first nitric

oxide donating prostaglandin

receptor agonist available for the two disorders. Some analysts have suggested

the drug (when approved) could become a global blockbuster with more than US $ 1

billion in annual sales. FDA approves record

number of generic drug applications from IndiaAll news pertaining to Indian pharma may sound negative. But that’s not true – several new players are winning approvals to sell generics in the US market. Thought the FDA has stepped up both scrutiny and regulatory action against drug companies in India, it’s also been approving generic drug applications from India at a frenetic pace.For instance, Sun

Pharma, Glenmark

and Aurobindo

said they had received approval

to sell generics of the AstraZeneca’s blockbuster cholesterol pill Crestor in

the US.During July to December 2015, the FDA approved a record 83

new generic drug applications out of India’s publicly listed firms. And during January to June 2016, though the pace of approvals slowed down to 73, it is still amongst the best six-months in statistics for approvals going back to 2005. An off-patent malaria drug may help treat cancerAn off-patent malaria drug – Atovaquone – has been found to boost oxygen levels in the tumour cells in mice. This makes radiotherapy

more effective in treating a range of cancer, including cancer of the

lung, bowel, brain and head and neck. The drug is known to be

safe.Cancer

cells with low oxygen levels are more difficult to treat with radiotherapy, and

are more likely to spread to other parts of the body. Early

work undertaken by British scientists points that Atovaquone could help destroy

cancer cells by making them more susceptible to radiotherapy. This has prompted

the scientists to start clinical trial on the off-patent drug. China likely to be

first off-the-block to use CRISPR-Cas9 genome editing tool A long-standing goal of biomedical research is the development of an efficient and reliable way to make precise and targeted changes to the genome of living cells. Clustered regularly interspaced short palindromic repeats (CRISPR) are segments of prokaryotic DNA containing short repetitions of base sequences. And CRISPR-Cas9 – a new tool in genome editing – has created considerable excitement in biomedical research.However, it’s not the Americans who will be the first to use this tool. Scientists

in China plan to use CRISPR-Cas9 in patients as early as next month. If

they go ahead, it would be the first time people would be injected with cells

whose DNA has been altered.A US proposal to run a similar study received

approval by a federal ethics and safety panel last month, but it faces

months of additional regulatory hurdles. And the earliest it can go ahead is

2016-end.Scientists intend to use CRISPR to edit

immune-system T cells in patients with cancer in an effort to make those

cells destroy malignant cells. Novartis AG stops

making TB drugs in Pakistan due to dispute over pricingPakistan has the world’s fifth-largest incidence of tuberculosis. And fears of a health crisis – triggered by the shortage of TB drugs – looms over the country, as Novartis

AG said it has stopped making TB

drugs in Pakistan due to a dispute over pricing. The

Drug Regulatory Authority of Pakistan (DRAP) sets prices for about 320 critical

medicines. But pricing caps have not been significantly raised since 2001, and

drug companies find it unviable to make several drugs in the country. This

news comes at a time when Novartis is bracing up for a

tougher price environment in the US, post the presidential

elections. This imminent pricing environment is likely to compel the global

pharmaceutical industry to restructure. China’s Fosun to buy Gland Pharma for US $ 1.4 billionThis week, Shanghai

Fosun Pharmaceutical (Group) signed a definitive

agreement to acquire controlling stake in Hyderabad-based Gland

Pharma in a US $ 1.4 billion deal. This is the first instance of a large FDI coming into India’s manufacturing sector from China. It also paves the way for Fosun to expand its research and manufacturing capacity in India.By way

of this agreement, Fosun will acquire 86 percent stake in the company, by

buying shares held by founders Ravi Penmetsa and family and private equity

giant KKR & Company LP. KKR had bought 38 percent in Gland in November

2013, for about US $ 191 million, valuing the company at US $ 600-650 million

at the time.

Impressions: 1906