Acquisitions and spin-offs dominated headlines in 2019 and the tone was set very early with Bristol-Myers Squibb acquiring

New Jersey-based cancer drug company Celgene in a US$ 74 billion deal announced on

January 3, 2019. After factoring

in debt, the deal value ballooned to about US$ 95 billion, which according

to data compiled by Refinitiv, made it the largest healthcare deal on

record.

In the summer, AbbVie Inc,

which sells the world’s best-selling drug Humira, announced its acquisition of Allergan Plc, known for Botox and other cosmetic

treatments, for US$ 63 billion. While the companies are still awaiting

regulatory approval for their deal, with US$ 49 billion in combined 2019

revenues, the merged entity would rank amongst the biggest in the industry.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

The big five by pharmaceutical sales — Pfizer,

Roche, J&J, Novartis and Merck

Pfizer

continued

to lead companies by pharmaceutical sales by reporting annual 2019 revenues of

US$ 51.8 billion, a decrease of US$ 1.9 billion, or 4 percent, compared to

2018. The decline was primarily attributed to the loss of exclusivity of Lyrica in 2019,

which witnessed its sales drop from US$ 5 billion in 2018 to US$ 3.3 billion in

2019.

In 2018, Pfizer’s then incoming CEO Albert Bourla had mentioned that the company did not see the need for any large-scale M&A activity as Pfizer had “the best pipeline” in its history, which needed the company to focus on deploying its capital to keep its pipeline flowing and execute on its drug launches.

Bourla stayed true to his word and barring the acquisition of Array Biopharma for US$ 11.4 billion and a spin-off to merge Upjohn, Pfizer’s off-patent branded and generic established medicines business with

Mylan, there weren’t any other big ticket deals which were announced.

The

Upjohn-Mylan merged entity will be called Viatris and is expected to have 2020

revenues between US$ 19 and US$ 20 billion

and could outpace Teva to

become the largest generic company in the world, in term of revenues.

Novartis, which had

followed Pfizer with the second largest revenues in the pharmaceutical industry

in 2018, reported its first full year earnings after spinning off its Alcon eye

care devices business division that

had US$ 7.15 billion in 2018 sales.

In 2019,

Novartis slipped two spots in the ranking after reporting total sales of US$

47.4 billion and its CEO Vas Narasimhan continued his deal-making spree by buying New

Jersey-headquartered The Medicines Company (MedCo) for US$ 9.7

billion to acquire a late-stage cholesterol-lowering

therapy named inclisiran.

As Takeda Pharmaceutical Co was

busy in 2019 on working to reduce its debt burden incurred due to its US$ 62

billion purchase of Shire Plc, which was announced in 2018, Novartis also purchased

the eye-disease medicine, Xiidra, from the Japanese drugmaker for US$ 5.3 billion.

Novartis’ management also spent a considerable part of 2019 dealing with data-integrity concerns which emerged from its 2018 buyout of AveXis, the

gene-therapy maker Novartis had acquired for US$ 8.7 billion.

The deal gave Novartis rights to Zolgensma,

a novel treatment intended for children less than two years of age with the

most severe form of spinal muscular atrophy (SMA). Priced at US$ 2.1 million,

Zolgensma is currently the world’s most expensive drug.

However,

in a shocking announcement, a month after approving the drug, the US Food and

Drug Administration (FDA) issued a press release on

data accuracy issues as the agency was informed by AveXis that

its personnel had manipulated data which

the FDA used to evaluate product comparability and nonclinical (animal)

pharmacology as part of the biologics license application (BLA), which was

submitted and reviewed by the FDA.

With US$

50.0 billion (CHF 48.5 billion) in annual pharmaceutical sales, Swiss drugmaker

Roche came in at number two position in 2019

as its sales grew 11 percent driven by

its multiple sclerosis medicine Ocrevus, haemophilia drug Hemlibra and cancer medicines Tecentriq and Perjeta.

Roche’s newly introduced medicines generated US$ 5.53 billion (CHF 5.4 billion) in growth, helping offset the impact of the competition from biosimilars for its three best-selling drugs MabThera/Rituxan, Herceptin and Avastin.

In late 2019, after months of increased

antitrust scrutiny, Roche completed

its US$ 5.1 billion acquisition of Spark Therapeutics to strengthen its presence in

gene therapy.

Last year, J&J reported almost flat worldwide sales of US$ 82.1 billion. J&J’s pharmaceutical division generated US$ 42.20 billion and its medical devices and consumer health divisions brought in US$ 25.96 billion and US$ 13.89 billion respectively.

Since J&J’s consumer health division sells analgesics, digestive health along with beauty and oral care products, the US$ 5.43 billion in consumer health sales from over-the-counter drugs and women’s health products was only used in our assessment of J&J’s total pharmaceutical revenues. With combined pharmaceutical sales of US$ 47.63 billion, J&J made it to number three on our list.

While the sales of products like Stelara, Darzalex, Imbruvica, Invega Sustenna drove J&J’s pharmaceutical business to grow by 4 percent over 2018, the firm had to contend with generic competition against key revenue contributors Remicade and Zytiga.

US-headquartered Merck, which is known as

MSD (short for Merck Sharp & Dohme) outside the United States and

Canada, is set to significantly move up the rankings next year fueled by its

cancer drug Keytruda, which witnessed a 55

percent increase in sales to US$ 11.1 billion.

Merck reported total revenues of US$ 41.75 billion and also

announced it will spin off its women’s health drugs,

biosimilar drugs and older products to create a new pharmaceutical

company with US$ 6.5 billion in annual revenues.

The firm had anticipated 2020 sales between US$ 48.8 billion and US$ 50.3 billion however this week it announced that the coronavirus pandemic will reduce 2020 sales by more than $2 billion.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

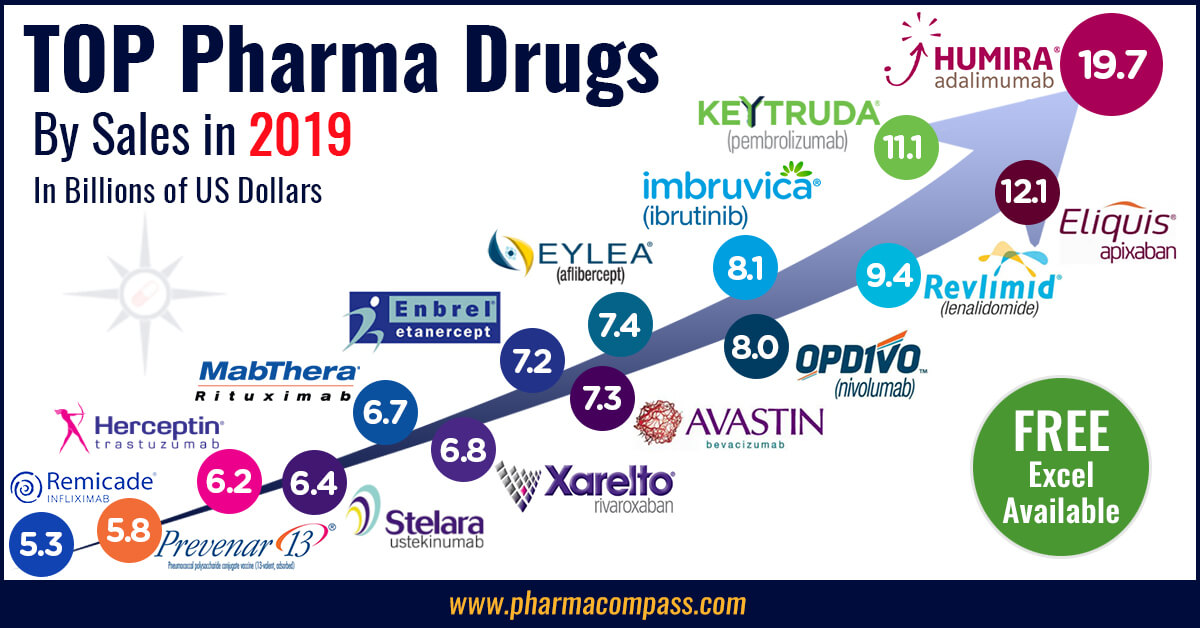

Humira holds on to remain world’s best-selling drug

AbbVie’s acquisition of Allergan comes as the firm faces the expiration of patent protection for Humira, which brought in a staggering US$ 19.2 billion in sales last year for

the company. AbbVie has failed to successfully acquire or develop a major new

product to replace the sales generated by its flagship drug.

In 2019, Humira’s US revenues increased 8.6 percent to US$ 14.86 billion while internationally, due

to biosimilar competition, the sales dropped 31.1 percent to US$ 4.30 billion.

Bristol Myers Squibb’s Eliquis, which is also marketed by Pfizer, maintained its number two position

and posted total sales of US$ 12.1 billion, a 23 percent increase over 2018.

While Bristol Myers Squibb’s immunotherapy treatment Opdivo, sold in partnership with Ono in Japan, saw sales increase from US$ 7.57 billion to US$ 8.0 billion, the growth paled in comparison to the US$ 3.9

billion revenue increase of Opdivo’s key immunotherapy competitor Merck’s Keytruda.

Keytruda took the number three spot in drug sales that

previously belonged to Celgene’s Revlimid, which witnessed a sales decline from US$ 9.69 billion to US$ 9.4 billion.

Cancer treatment Imbruvica, which is marketed

by J&J and AbbVie, witnessed a 30 percent increase in sales. With US$ 8.1

billion in 2019 revenues, it took the number five position.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Vaccines – Covid-19 turns competitors into partners

This year has been dominated by the single biggest health emergency in years — the novel coronavirus (Covid-19) pandemic. As drugs continue to fail to meet expectations, vaccine development has received a lot of attention.

GSK reported the highest vaccine sales of all drugmakers with

total sales of US$ 8.4 billion (GBP 7.16 billion), a significant portion of its

total sales of US$ 41.8 billion (GBP 33.754 billion).

US-based Merck’s vaccine division also reported a significant increase in sales to US$ 8.0 billion and in 2019 received FDA and EU approval to market its Ebola vaccine Ervebo.

This is the first FDA-authorized vaccine against the deadly virus which causes

hemorrhagic fever and spreads from person to person through direct contact with

body fluids.

Pfizer and Sanofi also reported an increase in their vaccine sales to US$ 6.4

billion and US$ 6.2 billion respectively and the Covid-19 pandemic has recently

pushed drugmakers to move faster than ever before and has also converted

competitors into partners.

In a rare move, drug behemoths — Sanofi and GlaxoSmithKline (GSK) —joined hands to develop a vaccine for the novel coronavirus.

The two companies plan to start human trials

in the second half of this year, and if things go right, they will file

for potential approvals by the second half of 2021.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Our view

Covid-19 has brought the world economy to a grinding halt and shifted the global attention to the pharmaceutical industry’s capability to deliver solutions to address this pandemic.

Our compilation shows that vaccines and drugs

for infectious diseases currently form a tiny fraction of the total sales of

pharmaceutical companies and few drugs against infectious diseases rank high on

the sales list.

This could well explain the limited range of

options currently available to fight Covid-19. With the pandemic currently infecting

over 3 million people spread across more than 200 countries, we can safely

conclude that the scenario in 2020 will change substantially. And so should our

compilation of top drugs for the year.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Impressions: 54764

This week in Phispers, we introduce you to Vas Narasimhan, the new CEO set to head Novartis in February next year. The appointment comes days after the Swiss drugmaker’s CAR-T cell therapy — Kymriah — won the FDA nod. Meanwhile, the US agency wants to improve its inspection efficiency; and Doctors Without Borders has opposed the priority review voucher given by the FDA to an old drug it approved for Chagas disease. Daiichi Sankyo denies receiving a takeover bid from AstraZeneca in 2016; and US

dumps its tie-up with Sanofi to develop

a vaccine for Zika virus.

Post FDA nod for its CAR-T therapy, Novartis names drug development chief as CEO

Swiss drugmaker Novartis’ CEO Joe Jimenez will step down on February 1, 2018. He will hand over the baton to Vasant (Vas) Narasimhan (41), who is currently heading the company’s drug development and is also its chief medical officer.

This will make Narasimhan the first person of Indian origin to head a large pharma multinational.

Narasimhan is the youngest amongst the new CEOs at large drug

companies. For instance, Emma

Walmsley, the new global CEO of GlaxoSmithKline, is

48. And David Ricks, who became the CEO of Eli Lilly in

January this year, is 50.

Narasimhan is a doctor from the Harvard Medical School and a

second-generation immigrant in the US. He joined Novartis in 2005.

Jimenez will retire next year, after being at the helm for eight years.

Though Jimenez undertook several steps to focus on more profitable prescription

medicines, particularly in cancer, Novartis saw its sales being hit as its

top-selling drugs (such as blood cancer treatment Gleevec) lost patent

protection. Its eye business Alcon has

lagged expectations and generics arm Sandoz has

faced intense price pressures in the US.

However, Novartis got a boost last week, when the US Food and

Drug Administration (USFDA) approved its US$ 475,000-per-patient Kymriah

treatment for young people with B-cell acute lymphoblastic leukemia. Known as

CAR-T (short for chimeric antigen receptor T-cell) therapy for cancer,

Kymriah is seen as one of a series of new drugs that can revive sales beginning

next year.

“We’re entering a new frontier in medical innovation with the ability to reprogram a patient’s own cells to attack a deadly cancer,” FDA commissioner

Scott Gottlieb said in a statement announcing the approval of Kymriah.

CAR-T therapy also got a shot in the arm when Gilead announced a US$ 11.9 billion acquisition

of Kite Pharma, which

is said to be just months away from the first approval of its own CAR-T

therapy.

Ironically, the same week as Kymriah got approved, Johnson & Johnson (through its subsidiary Janssen Biotech Inc) ended its deal with MacroGenics, a

Rockville-based biotech company that was working on another CAR-T therapy (duvortuxizumab), after patients in the study

experienced neurotoxicity. MacroGenics said enrollment in a Phase I trial of duvortuxizumab to treat B cell malignancies will be

discontinued.

FDA to strengthen inspections and oversight of drug manufacturing

Through an official blog, the FDA commissioner Scott Gottlieb made known the US agency’s intentions to improve its inspection efficiency and reach. As a step toward towards this, the FDA had earlier announced it is restructuring its field activities, to direct its focus and

organization around the programs it regulates, instead of its previous

structure wherein its activities and resources were organized based on

geographic regions.

In the blog dated August 31, Gottlieb

said the FDA’s Center for Drug Evaluation and Research (CDER) and the Office of Regulatory Affairs (ORA) are implementing a new, historic concept of operations agreement to fully integrate the drug review programs with the

facility evaluations and inspections for human drugs.

As part of the commitments made by the FDA in

the context of the Generic Drug User Fee Amendments II (GDUFA II), the agency

agreed to communicate final surveillance inspection classifications to facility

owners within 90 days of an inspection. The new operating model will be a key

element of meeting these promises. The FDA will start operationalizing this

agreement in fall of this year, in order to more quickly meet this commitment.

The new measures are bound to effect

generic firms based in India and China. This could also mean stricter inspections, D G

Shah, secretary general of industry lobby group Indian Pharmaceutical Alliance,

told Mint. “USFDA’s inspections are likely to get more coordinated and broader,” Rahul Guha, partner and director at the Boston Consulting Group, told the publication.

Daiichi

Sankyo denies it received takeover bid

from AstraZeneca in 2016

Last week, Daiichi Sankyo denied it received a takeover bid in 2016 from British drugmaker AstraZeneca.

The online version of the magazine Nikkei

Business had reported that AstraZeneca had offered to buy the Japanese drug major Daiichi Sankyo in

2016, which has a market value of about US$ 16 billion.

“It was today reported by Nikkei

Business that Daiichi Sankyo Co Ltd received the acquisition offer from AstraZeneca. However, this is not the fact,” the company said in a statement. AstraZeneca has declined to comment on Daiichi’s statement.

Both Daiichi and Astra go back a long way — they have an agreement to jointly commercialize constipation drug Movantik in the US, and have also entered into a deal to supply and

promote blockbuster heartburn treatment Nexium in Japan.

There are some commonalities too — both have interests in cancer drugs. However, last month, Astra’s prospects in cancer suffered a setback when a closely watched immunotherapy combination treatment failed to help patients. That led to speculation that Astra has

itself become a target for takeover.

US backs away from tie-up with Sanofi to

develop Zika

vaccine

French drug major Sanofi received a setback recently when the US government said it is backing away from a

collaboration with it to develop a vaccine for the Zika virus.

Sanofi said in a statement: “On August 17, 2017, Sanofi Pasteur was informed by The Biomedical Advanced Research and Development Authority (BARDA) within the Office of the Assistant Secretary for Preparedness and Response in the US Department of Health and Human Services that they completed an assessment of all Zika-related projects they were funding and have decided to focus on a more limited set of goals and deliverables.”

This decision means Sanofi won’t further develop or license the US Army’s promising Zika candidate. BARDA had committed US$ 43 million in research funding, with another US$ 130 million available if the vaccine advanced into later-stage testing.

After a rather explosive early outbreak, the spread of Zika virus has slowed down. And both BARDA and Sanofi blamed Zika’s “evolving epidemiology” for their change in focus for developing a vaccine. The development of the vaccine has been paused indefinitely, but could be “restarted if the epidemic re-emerges,” Sanofi said.

The collaboration had come under intense

scrutiny this year as critics demanded pricing guarantees if a commercial

vaccine grew out of the taxpayer-funded research.

Zika virus may kill brain cancer cells: A study supported by the

National Institute of Allergy and Infectious Diseases (NIAID), a part of the

National Institutes of Health, says that the Zika virus (ZIKV) may infect and

kill a specific type of brain cancer cells while leaving normal adult brain

tissue minimally affected.

In the paper, published online on September

5 in The Journal of Experimental Medicine, researchers say ZIKV may

behave differently when introduced to an active glioblastoma (an aggressive

cancer that begins in the brain) in a living person. A word of caution though:

Even if further studies continue to yield promising results, any potential

treatment derived from ZIKV would need several years of thorough testing for

safety and efficacy.

MSF opposes priority review voucher given

to old drug approved for Chagas disease

Earlier this year, Marathon Pharmaceuticals was in the spotlight after

it received an FDA approval for Emflaza (deflazacort) tablets and oral suspension to treat patients aged five years and older with Duchenne muscular dystrophy (DMD) — a rare genetic disorder that causes progressive muscle deterioration and weakness. Marathon had planned a list price of US$ 89,000 for a year’s supply of Emflaza.

Since the drug has been available outside the US for decades, patients in the US imported the drug from Canada and the UK, where it’s available at a price between US$ 1,000 or US$ 2,000 a year.

Last week, the FDA approved another old drug — benznidazole — as treatment for Chagas disease. The

drug has been used outside the United States for years. In the US, benznidazole

is the first treatment approved for Chagas disease. This time the point of

contention is not the price of the drug but the issuance of a priority review voucher (PRV) which can get sold for hundreds of

millions of dollars.

A

nonprofit group including Chemo Group won this FDA approval and pledged to make it available at low cost to patients. “The fact that a company can receive an innovation award for registering a medicine that has been used to treat Chagas for years shows how far removed we are from the original intent of this program,” said Jennifer Reid, advocacy and research officer at Doctors Without Borders (MSF).

Chagas disease, or American trypanosomiasis,

is a parasitic infection that

can be transmitted through contact with the feces of a certain insect, through

blood transfusions, or in the womb from the mother to the child. After years of

infection, the disease can cause serious heart ailment, and can also affect

swallowing and digestion. Chagas disease primarily affects people living in

rural parts of Latin America. According to estimates, around 300,000 persons in

the US suffer from Chagas disease.

“People suffering from Chagas and other neglected diseases still desperately need innovation and new research to save their lives and improve treatment and prevention options. They should be able to use and afford these medicines no matter where they live. Before a company can receive this prize, US Congress should mandate that only new medicines receive a PRV and that companies ensure access and affordability for all patients,” she added.

Impressions: 1834

Unless you are like Voltaire and think that “The art of medicine consists of amusing patients while nature cures the disease”, you will be thrilled with the new drugs approval (NDAs) list of the FDA: about 40 new drugs in 10 therapeutic areas! It has been 18 years since the FDA approved so many new drugs, so let’s quickly take a tour at the Olympic podium:

OLYMPIC PODIUM

The golden medal comes to AstraZeneca with 4 NDAs: Farxiga (diabetes), Movantik (constipation), Lynparza (ovarian cancer) and Myalept (lipodystrophy, also called fat reduction, which is common in patients with HIV and AIDS).

Then come the silver medals with 3 NDAs each:

Biogen Idec with Alprolix (hemophilia B), Eloctate (hemophilia A), Plegridy (multiple sclerosis).

Lilly with Cyramza (gastric cancer), Jardiance (diabetes), Trulicity (diabetes).

Merck&Co with Zontivity (coronary artery disease), Belsomra (insomnia), Keytruda (melanoma).

And the bronze medals with 2 NDAs each:

Boehringer-Ingelheim with Striverdi Respimat (chronic obstructive pulmonary disease), Ofev (idiopathic pulmonary fibrosis).

Cubist with Sivextro (skin infection), Zerbaxa (urinary and abdominal infections).

Gilead with Zydelig (leukemia), Harvoni (hepatitis C –“first combination pill approved to treat chronic hepatitis C virus genotype 1 infection and the first approved regimen that does not require administration with interferon or ribavirin”).

Novartis with Xtoro (acute otitis externa), Zykadia (lung cancer).

THERAPEUTIC AREAS

In terms of therapeutic areas, infectious diseases come first with 27% of the NDAs, followed by cancer with 18% and then rare diseases with 11% according to Forbes. Knowing that a disease is classified as ‘rare’ when it affects 200,000 people maximum in the US, the pharmaceutical industry and the FDA have done a fantastic job because overall it is 25 millions American whom are concerned by orphan diseases. And how many more around the world?

According to EvaluatePharma, in 2020 orphan drugs are expected to account for 19% of the total share of prescription drug sales excluding generics, reaching $176 billion in annual sales in America alone.

Here are the main NDAs 2014 for rare diseases:

Amgen with Blincyto (Philadelphia chromosome-negative precursor B-cell acute lymphoblastic leukemia- leads to cancer).

Anacor with Kerydin (fungal infection).

BioCryst with Rapivab (influenza- infectious disease caused by the influenza virus).

Biomarin with Vimizim (Morquio A syndrome- the body is missing or doesn't have enough of a substance needed to break down long chains of sugar molecules).

Boehringer-Ingelheim with Ofev (idiopathic pulmonary fibrosis).

Chelsea with Northera (neurogenetic orthostatic hypotension- often associated with Parkinson’s disease).

Hoffman la Roche with Esbriet (idiopathic pulmonary fibrosis).

Johnson & Johnson with Sylvant (multicentric Castleman’s disease- involves hyper activation of the immune system).

Paladin with Impavido (leishmaniasis- disease caused by protozoan parasites).

Sanofi with Cerdelga (Gaucher’s disease- genetic disease in which fatty substance accumulate in cells and certain organs).

Spectrum with Beleodaq (non-Hodgkin lymphoma- group of blood cancers that includes any kind of lymphoma except Hodgkin's lymphomas).

Takeda with Entyvio (ulcerative colitis ; Crohn’s disease- inflammatory disease that affects any part of the gastrointestinal tract from mouth to anus)

Valeant with Jublia (fungal infection).

Vanda with Hetlioz (non stop 24 hour sleep wake disorder).

The huge impact after the release of the 2014 NDAs list was the pharma exchange-traded funds flared up (Nasdaq Biotechnology Index and S&P 500 Health Care Index 34 percent and 23 percent respectively.

However, finance is not everything, as we have all learned during the 2008 financial crisis, and NDAs are not the only conditions for a new strategy to success anymore, as proven by a lot of pharmaceutical companies in the past years who haven’t achieved enough revenues despite NDAs.

It seems that pricing is going to be key as competition is becoming fiercer. Look at the 2014 NDAs batch for anti bacterial drugs to treat skin infections; 3 brand new drugs for this year only.

Cubist with Sivextro

Durata with Dalvance

The Medecine Companies with Orbactiv

Same for the idiopathic pulmonary fibrosis as we just saw in the rare diseases approval list above: 2 NDAs for 2014. According to Fierce Pharma, there are 8 therapeutic areas where competition is going to be even fiercer in the future: hepatitis C, diabetes, cholesterol, hemophilia, hemo-oncology, psoriasis, melanoma and obesity.

And it is not like patents are not going to continue dropping; generics represent now more than 40% of the products sales. Moreover, premium prices following NDAs have been implicating confrontations with insurers and governments in regards to diabetes and respiratory drugs in the past.

Therefore, new tactics have to be found!

AbbVie offered their new anti hepatitis C drug, Viekira Pak, at a discount price to Express Script (the largest pharmacy benefit management organization in the United States) for an exclusive distribution. Even if Viekira Pak is said to be a less convenient dosing regiment when compared to Gilead’s anti hepatitis C drug (Sovaldi), the deal was closed as Sovaldi’s premium price actually chocked the payers. It is a perfect move for AbbVie, who just lost their patent on one of their main drug: Humira (rheumatoid arthritis).

Biotech are said to be an excellent area for successful strategy as well.

If there is more success at R&D projects (as it looks to be the case in the biotech field) then R&D department cost less and the overall financial risk should be lowered.

Here are the main NDAs 2014 for biotech/ cancer:

Baxter with Obizur (hemophilia).

Biogen Idec with Plegridy (multiple sclerosis), and Alprolix and Eloctate (hemophilia).

Celgene with Otezla (psoriasis)

Gilead with Zydelig (anti-cancer treatment).

Helsinn with Akynzeo (emesis- prevent nausea and vomiting caused by cancer drug treatment).

Salix with Ruconest and Pfizer with Trumenba (meningitides type B).

Bristol-Myers Squibb with Opdivo (melanoma) and Merck & Co with Keytruda (melanoma as well), which work by blocking a protein called Programmed Death receptor (PD-1), are the first in a coming wave of immunotherapies and are said to have the potential of generating more than 30 million USD/ year.

So in case all these new strategies don’t work and definitely become a financial matter only instead of a medical focus to help the world to live a little better, don’t forget to “always laugh when you can, it is cheap medicine” as George Gordon Byron liked to advise.

Impressions: 2361