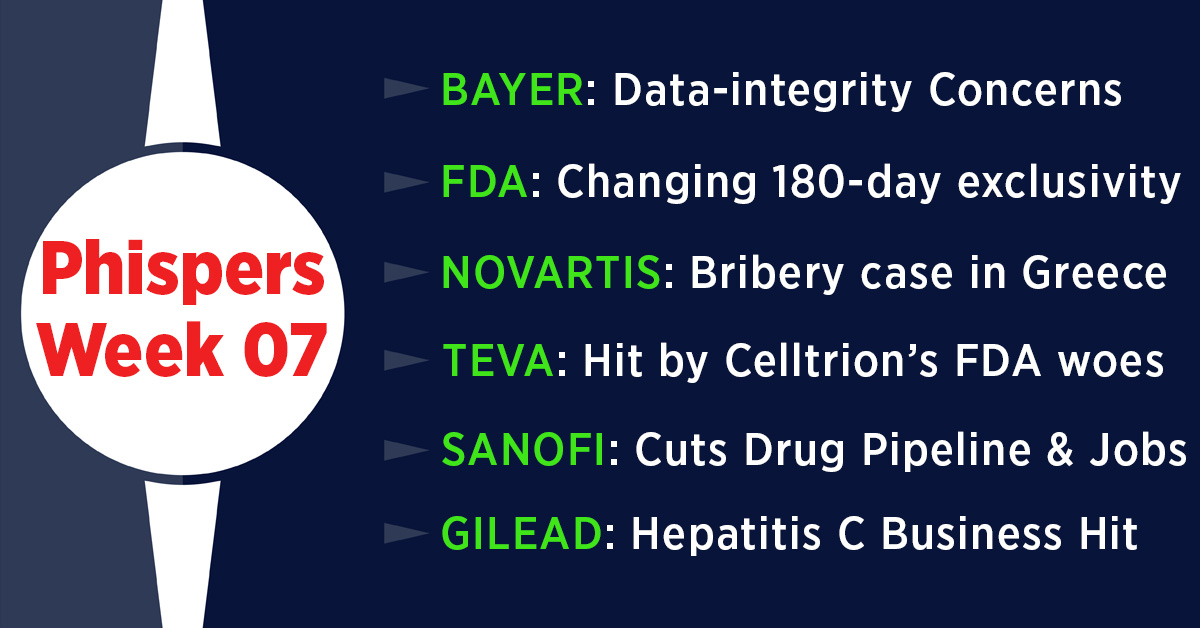

This week, Phispers brings you news on the FY 2019 budget proposals in the US that seek to change the way generic drugs come to market. Gilead’s big triplet for HIV — Biktarvy — won the FDA nod, even as GSK swiftly filed a lawsuit accusing it of infringing its HIV patents. It was a mixed week for Novartis as its Copaxone generic (40 mg/ml injection) won the FDA nod, while its Advair generic got delayed. Meanwhile, Teva’s migraine drug suffered due to problems at its partner Celltrion. And an FDA warning letter highlighted contamination, data-integrity concerns at a Bayer facility in Germany.

FDA highlights

contamination, data-integrity concerns at Bayer facility in Germany

In a shocking warning letter issued by the FDA to Bayer Pharma’s finished pharmaceuticals manufacturing facility located in Leverkusen, Germany, investigators found compliance shortcomings ranging from concerns over data-integrity to serious product contamination problems.

While reviewing a drug product manufacturing operation, FDA investigators found residue on equipment which seemed most likely from a drug product that had been previously processed in the same room. When Bayer tested the samples of the tablets being produced to “assess the potential of cross-contamination”, the testing confirmed contamination of the previously processed product inside the tablets which resulted in a recall of several lots of drug products.

Before the FDA inspection, Bayer had started its own data-remediation program to discontinue the practice of using “test” injections during testing. However, when the FDA investigators performed their own inspection, they found unreported data from in-process tablet weight checks. Bayer’s staff had programmed their in-process weight checker not to report values that varied more than a specified amount from the tablet target weight.

In addition, investigators observed discarded original personnel training records and forms used to document and set inspection parameters for the automated tablet visual inspection machinery.

The inspection was held between January 12–20, 2017, and responses submitted to the FDA in May and August 2017 failed to address the concerns of the agency.

FDA seeks landmark change in 180-day exclusivity for

generics in FY 2019 budget

Donald Trump, the US President, has put drug pricing at the front of his FY 2019 budget proposals released earlier this week. Importantly, the proposals seek to change the way generic drugs come to market. The proposals address generic players who block competition by (a) filing ANDAs (abbreviated new drug application) and blocking subsequent generics from receiving approval; and (b) by being the first filers that receive tentative approval but then intentionally delay seeking final approval, thereby also blocking competition.

Last month, the US Food and Drug Administration (FDA) had issued draft guidance on 180-day exclusivity. The proposal is a result of that draft, which seeks to give the FDA more power to bring generics to market faster by ensuring that first-to-file generic applicants “awarded a 180-day exclusivity period do not unreasonably and indefinitely block subsequent generics from entering the market beyond the exclusivity period.”

The 180-day provision, was introduced to provide an incentive for generic-drug manufacturers to challenge the patents that are covered in an originator’s application as invalid, unenforceable, or not being infringed.

The 180-day head start allows a generics firm to build market share at a price lower than the branded product but higher than what would have been possible if they were up against competing generics.

Under the new budget plan, when a first-to-file generic application is not yet approved due to deficiencies, the “FDA would be able to tentatively approve a subsequent generic application, which would start the 180-day exclusivity clock, rather than waiting an indefinite period for the first-to-file applicant to fix the deficiencies in its application.”

The plan estimates that such a change to exclusivity would save US$ 118 million in 2019 and US$ 1.79 billion over 10 years.

Overall, the FDA received a proposed funding boost of US$ 473 million in Trump's FY 2019 budget. However, the plan looks to cut the Department of Health and Human Services’ (HHS) budget by 21 percent from the 2017 enacted level.

The budget also calls to increase funding to fight the opioid crisis, and includes US$ 10 million for FDA regulatory science activities to develop tools to stem the misuse and abuse of opioids.

GSK breathes easy as Novartis’ Advair generic gets delayed

British drug major GlaxoSmithKline won another reprieve for its blockbuster lung drug — Advair — after the US FDA delayed approval of a generic of the drug from Novartis’ Sandoz division.

Novartis said it had received a complete response letter from the FDA and a generic Advair launch this year was now “highly unlikely”. Novartis was counting on an approval for its Advair copy to help boost its ailing Sandoz generics unit.

This setback for the Swiss drug maker follows similar delays last year for other generic versions of Advair developed by Mylan and Hikma. Hikma and its partner Vectura are fighting with the FDA over the rejection of their Advair copy.

Dealing with the threat to Advair, which has generated more than US$ 1 billion in annual sales since 2001, is a key challenge facing GSK’s core pharmaceuticals division.

Last week, GSK had said its earnings, at constant exchange rates, would be flat to down 3 percent in 2018 if generic Advair launches in the US market by mid-year. Without generics, earnings would be up 4 to 7 percent.

Another challenge to GSK comes from competition to its HIV medicines division, where Gilead Sciences last week won an FDA nod for a once-daily, triple-combination tablet — Biktarvy.

Advair is a complex generic as generic drugmakers must develop an inhaler device that delivers the medicine correctly into patients’ lungs. ‘Complex generics’ is a territory that generic manufacturers want to get into in order to overcome the pricing pressures of the broader generic market.

For instance, Glenmark leadership recently said the business environment is particularly challenging for generic drug makers, and the “challenging business outlook in the US is expected to continue for at least five quarters.”

Generic drugmakers have been posting disappointing results due to poor US sales. India’s leading drug company Sun Pharma posted a 75.2 percent drop in its third quarter earnings. Sun Pharma’s US subsidiary Taro reported a substantial 40 percent drop in sales for the third quarter of FY 2018. Glenmark last week reported a 78 percent drop in its net profit for the same quarter at US$ 15.63 million (as against US$ 71.7 million for the previous corresponding quarter).

Novartis wins FDA nod for Teva’s Copaxone generic; gets mired in bribery case in Greece

While its Advair generic failed to get the FDA nod, Novartis had something to cheer about — its Sandoz division won the FDA nod for its 40 mg/ml injection of generic Copaxone (Glatopa).

Copaxone is Teva’s blockbuster drug. This double-dosage version of Glatopa had been pushed back by the FDA last year after contamination problems emerged at Pfizer’s fill-and-finish plant that was being used by Sandoz. The company has been selling a 20 mg/ml Glatopa dosage to US patients with relapsing multiple sclerosis (MS) since 2015.

Meanwhile, the Swiss drugmaker got embroiled in a controversy regarding industrial scale bribery of senior politicians in Greece. The Greek prime minister, Alexis Tsipras, asked the parliament to probe whether two of his predecessors and eight former ministers accepted bribes from Novartis.

The former PMs Antonis Samaras and Panagiotis Pikrammenos, the governor of the Bank of Greece and the EU’s migration commissioner were identified as alleged beneficiaries of bribes.

Novartis allegedly bribed politicians to approve overpriced contracts as part of concerted efforts to boost sales between 2006 to 2015. It also allegedly bribed thousands of doctors.

Gilead gets Biktarvy approval; rival GSK files suit; AbbVie’s Mavyret hits Gilead hard

The US FDA approved Gilead Sciences’ big triplet for HIV, known as Biktarvy. This once-daily, triple-combination tablet includes novel drug bictegravir in combination with emtricitabine and tenofovir alafenamide.

Biktarvy is estimated to have peak sales of US$ 6 billion a year, making it one of the biggest drugs in the industry’s pipeline.

Gilead faces major competition from GlaxoSmithKline’s HIV unit ViiV Healthcare, which won an approval for its single pill regimen Juluca in November 2017. It sells for US$ 2,579 a month.

However, GSK was swift in retaliating — it filed a federal lawsuit in the US accusing Gilead of infringing on its HIV patents.

In the lawsuit, ViiV Healthcare — a joint venture majority-owned by GSK with Pfizer and Shionogi as partners — alleged that Gilead was infringing patents on ViiV’s dolutegravir, a component of the venture’s triple-drug HIV treatment Triumeq.

Gilead, in a statement, said it remained steadfast in its opinion that “Biktarvy does not infringe ViiV’s US patent, and that the court challenge did not affect the US availability of the drug”.

Meanwhile, Gilead Sciences’ hepatitis C drugs now have new competition from AbbVie. While reporting its 2017 results, the company said it expects its hep C sales for 2018 to be around US$ 3.5 billion to US$ 4 billion, far below analyst expectations of US$ 5 billion. A major reason behind this is AbbVie's Mavyret, which got approved and launched last year at a deep discount.

As rivals race to finish line, Teva’s migraine drug suffers due to problems at Celltrion

Last week, PharmaCompass had reported that the USFDA had issued a warning letter to Celltrion, a major manufacturer of biosimilars. In an inspection conducted by the FDA from May 22 to June 2, 2017, the investigators had raised concerns over multiple poor aseptic practices during the set-up and filling operations.

Post that news, beleaguered generic drug maker Teva Pharmaceutical said its bid to bring a new migraine drug (fremanezumab) to market faces a possible delay due to manufacturing problems found at its partner, Celltrion. Celltrion is the sole supplier of the ingredient for fremanezumab. Therefore, Teva can’t easily switch to another manufacturer.

Fremanezumab is one of the two drugs Teva hopes will help it in returning to growth in the future. Teva said it is in active dialogue with the FDA to maintain its priority approval date for the drug.

The Israeli generic drug giant also said its 2018 results would be weaker than expected. Teva is facing price erosion, fierce competition for its blockbuster drug Copaxone and a consolidating customer base, particularly in the US. Teva CEO Kare Schultz attributed half of the expected revenue decline in 2018 to Copaxone, which began to face competition last year. Novartis has also won the FDA nod for its generic Copaxone.

Sanofi cuts its drug pipeline; its specialty care unit axes

130 jobs at US plant

Sanofi rang in the new year with two big takeover deals when it agreed to buy US group Bioverativ for US$ 11.6 billion and Belgium’s Ablynx for US$ 4.8 billion.

However, news this week suggests that all news from Sanofi is not good news, as it cut down its drug pipeline and laid off employees in the US.

Sanofi Genzyme — a specialty care global business unit of Sanofi focused on rare diseases, multiple sclerosis, oncology and immunology — is laying off 130 employees at its manufacturing facility at Allston Landing in Boston (USA) in order to reduce costs and simplify its operations.

The French drugmaker has also cut its pipeline by dropping an anticancer antibody-drug conjugate (ADC) it licensed from ImmunoGen. Sanofi had gained full control of this drug as part of a recent deal but has now removed the asset from its pipeline.

The ADC is one of seven drugs ditched by Sanofi in its latest quarterly results, although in several cases the company had already disclosed its plan to walk away from the assets.

Meanwhile, a CNBC story said Sanofi expects 2018 to mark a return to growth on the back of two recently announced acquisitions and a revamped pipeline, after it posted fourth-quarter profits slightly below expectations.

Now,

Indoco’s solid orals plant gets FDA’s Form 483; no observations for Cadila

The US FDA inspected the solid orals manufacturing facility (Plant I) of Indoco Remedies in Goa during January 15 to 19, 2018. The company received a Form 483 from the FDA with eight observations.

The Form 483 covered systems like production, lab controls and facilities and equipment. The concerns raised by the FDA relate to laboratory records not including complete data, electronic records not being trustworthy and reliable and lapses in quality control.

Indoco was in news even last year for receiving a warning letter from the FDA on March 27, 2017 for its Plants II and III, also situated in Goa. In the warning letter, the FDA had mentioned that the firm received numerous (approximately 1,500) consumer complaints related to leaking, empty, and under-filled sterile solution bottles between January 2012 and August 2016.

Meanwhile, India’s Cadila Healthcare Limited announced that the USFDA inspected its Moraiya facility from February 5 to 9, 2018. At the end of the inspection, no observation (483) was issued.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Phisper Infographic by PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”