By PharmaCompass

2023-09-28

Impressions: 4264

This week, PharmaCompass analyzes the market for excipients, or inactive ingredients used in pharmaceuticals. Excipients don’t have a therapeutic effect, but serve various purposes. They are used in drugs as fillers, diluents, binders, suspending and viscosity agents, coating agents, flavoring agents, sweeteners, disintegrates, preservatives etc. Some excipients also help in drug delivery.

The overall pharmaceutical excipient market is expected to grow at a compounded annual growth rate of 7.93 percent to touch US$ 13.49 billion by 2028, from US$ 9.21 billion in 2023.

Excipients are of two types — organic and inorganic. Organic chemicals are compounds with carbon-hydrogen bonds (such as starch, cellulose, povidones) and inorganic chemicals are derived from minerals, metals, or other non-living sources (such as metallic oxides, calcium sulfate).

The organic category dominates the market with the largest market share driven by robust demand from oral pharmaceuticals.

Popular organic excipients used in pharmaceuticals are microcrystalline cellulose (MCC), lactose monohydrate, povidones, starch, and mannitol. MCC is excellent for tablet and capsule compressibility, while lactose serves as a binder and diluent. Povidones function as tablet binders and enhance viscosity in liquid forms. Starch serves as a diluent, disintegrate or binder and mannitol enhances the stability, taste, and quality of drugs.

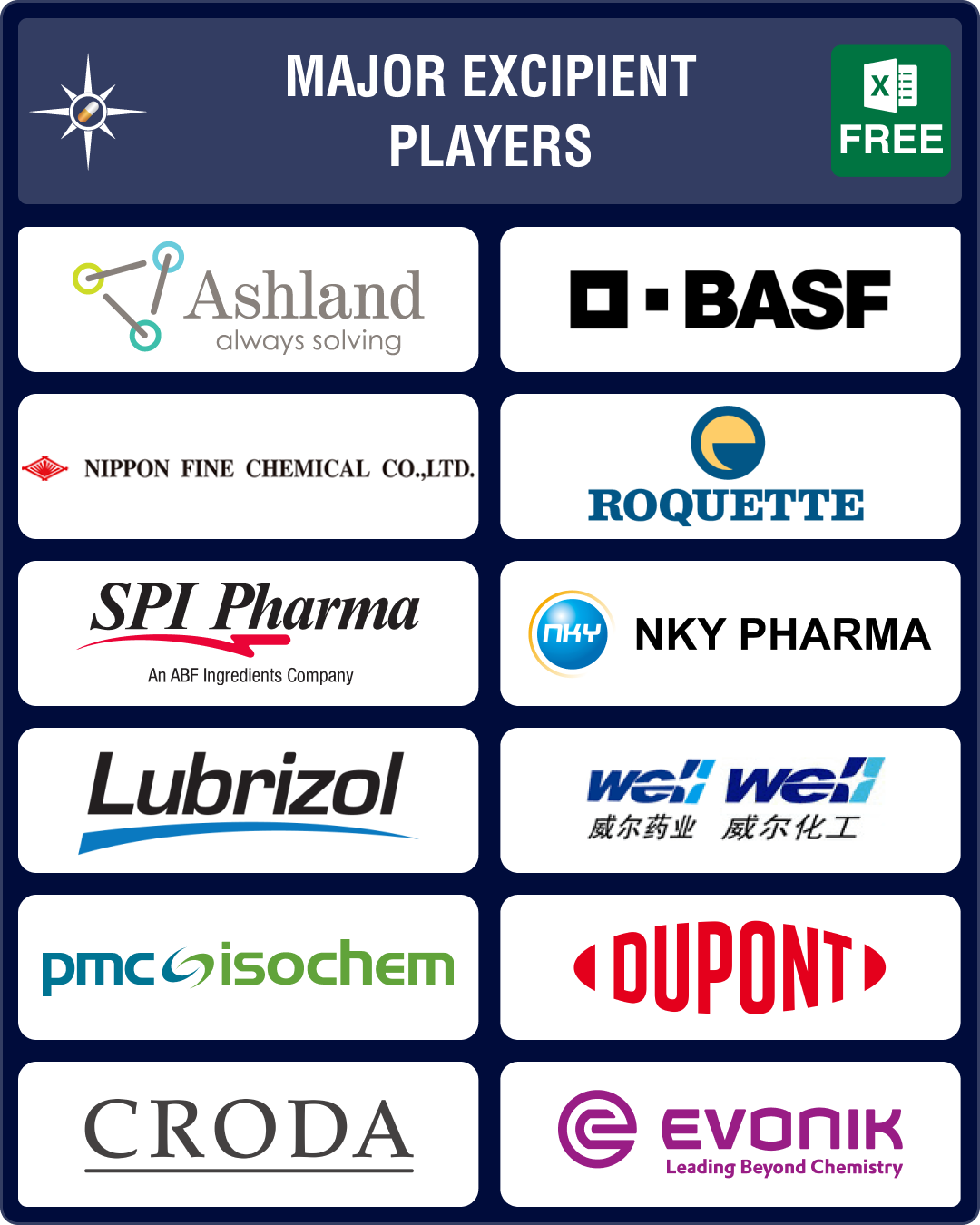

Major excipient manufacturers are Ashland Global, BASF, Evonik, DuPont, Roquette Frères, SPI Pharma, Croda International, Lubrizol, Boai NKY Pharmaceuticals, Nanjing Well Pharmaceutical, PMC Isochem, Nippon Fine Chemical, and Seqens.

View our Dashboard to know more about Leading Excipient Companies (Free Excel Available)

Demand for MCC surges post pandemic; Asahi Kasei, Nitika invest in new plants

Since the start of the pandemic, we have seen a surge in demand for drugs, and this has significantly boosted the demand for MCC. In January 2023, Asahi Kasei completed the construction of a ¥13 billion (US$ 98 million) pharma excipient manufacturing plant in Japan. This is Asahi’s second plant dedicated to manufacturing MCC under the Ceolus brand.

This month, India-based Nitika Pharmaceutical unveiled an MCC manufacturing plant, which is India’s largest and most advanced facility with an installed capacity of 1200 metric ton.

In a strategic investment, France-based Roquette acquired India-based Crest Cellulose, a manufacturer of excipients like MCC and magnesium stearate. This acquisition will help Roquette meet the increasing global demand for high-quality plant-based excipients. And in March 2023, SPI Pharma secured sole distribution rights for Cellets (MCC pellets) and TAP (tartaric acid pellets) from Switzerland-based Ingredientpharm.

View our Dashboard to know more about Leading Excipient Companies (Free Excel Available)

Evonik, Croda address delivery of biologics by investing in lipid-based excipients

Apart from these traditional inactive ingredients, the market is witnessing an increase in adoption of lipid-based excipients that address the challenge of delivering biopharmaceuticals. Many drugmakers are actively exploring lipid nanoparticles (LNPs) as a safe and effective means of delivering biologics into target cells.

The growing focus on biologics is spurring increased investments in biologic excipients.

In March 2023, specialty chemicals company Evonik opened a new facility for pharmaceutical lipids at a site in Hanau, Germany. During the same month, Evonik announced it has begun construction of a US$ 220 million plant in Indiana, United States. These facilities are crucial as they will produce essential lipid-based excipients used in the manufacturing of a wide range of messenger RNA and gene therapy products. In 2022, Evonik had bolstered the global supply of pharma-grade, plant-derived cholesterol (PhytoChol), to be used in mRNA vaccines and gene therapies.

In July 2023, UK-based Croda completed the acquisition of Solus Biotech. With this buyout, Croda has acquired a portfolio of phospholipids. In May 2023, Croda invested in a new 23,680 square-foot facility in Clinton County, Pennsylvania, to manufacture ingredients for drug delivery systems used in novel therapeutic drugs (mRNA vaccines and gene editing therapies). Last year, the company received around US$ 92.5 million from the UK and US government to expand its manufacturing capacity for lipid systems.

In June 2023, Seqens revealed its commitment to invest € 15 million (US$ 15.85 million) in expanding its production capabilities for pharmaceutical polymers and lipids at its Aramon plant in France. This facility is poised to meet the increasing demand for lipid-based RNA delivery.

View our Dashboard to know more about Leading Excipient Companies (Free Excel Available)

Roquette launches excipient to stabilize probiotics; Lubrizol in deal with Welton

In May 2023, Roquette launched its novel excipient – Pearlitol ProTec — to protect and stabilize moisture sensitive active ingredients such as probiotics. Back in November 2022, the company had also launched two groundbreaking excipients, Pearlitol CR-H and Pearlitol 200 GT, designed to address formulation challenges.

In June 2023, Lubrizol announced it has licensed its novel solubility-enhancing, parenteral excipient, Apisolex, to Welton Pharma for the formulation of its pipeline drug SN-38, intended for the treatment of colorectal and related gastrointestinal cancers. Apisolex was launched in May 2022.

Meanwhile, ANP Technologies' innovative nano-encapsulating polymer-based drug excipient, ANP001B, has received DMF (drug master file) acceptance. ANP001B has been effectively employed to enhance drug delivery in Fulgent Pharma’s pipeline product, FID-007 (polyethyloxazoline encapsulated paclitaxel), intended for the treatment of solid tumors in cancer patients who have undergone prior treatments.

View our Dashboard to know more about Leading Excipient Companies (Free Excel Available)

Post cough syrup deaths, WHO updates guidelines; FDA revises regulation

In March 2023, the World Health Organization (WHO) had proposed updated good manufacturing practices (GMPs) to assist pharmaceutical manufacturers in assessing the quality of excipients. This proposal comes after episodes of cough syrups containing excipients that were contaminated with diethylene glycol (DEG) and ethylene glycol (EG), causing over 300 deaths in three countries (The Gambia, Indonesia, Uzbekistan) last year.The US Food and Drug Administration (FDA) has also undertaken significant changes in the regulation of excipients over the past three years. These revisions began with adjustments to the inactive ingredient database as part of the Generic Drug User Fee Amendments (GDUFA) reauthorization for fiscal years 2018-2022. Additionally, in 2021, FDA launched its first pilot program to evaluate the quality and toxicological data associated with novel excipients before their inclusion in drug formulations.

View our Dashboard to know more about Leading Excipient Companies (Free Excel Available)

Our view

Innovation and rising demand for pharmaceuticals has led to growth in the market for excipients. However, post the cough syrup deaths caused by contaminated excipients, there is pressure on manufacturers to improve quality control. This week, Reuters carried news that FDA has reprimanded 28 companies for failing to prove adequate test of ingredients used in over-the-counter drugs and consumer products for EG and DEG. With new excipients entering the market, stricter regulations will ensure that growth of these inactive ingredients comes with better quality.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Explore Top Excipient Companies by PharmaCompass license under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”