Acquisitions and spin-offs dominated headlines in 2019 and the tone was set very early with Bristol-Myers Squibb acquiring

New Jersey-based cancer drug company Celgene in a US$ 74 billion deal announced on

January 3, 2019. After factoring

in debt, the deal value ballooned to about US$ 95 billion, which according

to data compiled by Refinitiv, made it the largest healthcare deal on

record.

In the summer, AbbVie Inc,

which sells the world’s best-selling drug Humira, announced its acquisition of Allergan Plc, known for Botox and other cosmetic

treatments, for US$ 63 billion. While the companies are still awaiting

regulatory approval for their deal, with US$ 49 billion in combined 2019

revenues, the merged entity would rank amongst the biggest in the industry.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

The big five by pharmaceutical sales — Pfizer,

Roche, J&J, Novartis and Merck

Pfizer

continued

to lead companies by pharmaceutical sales by reporting annual 2019 revenues of

US$ 51.8 billion, a decrease of US$ 1.9 billion, or 4 percent, compared to

2018. The decline was primarily attributed to the loss of exclusivity of Lyrica in 2019,

which witnessed its sales drop from US$ 5 billion in 2018 to US$ 3.3 billion in

2019.

In 2018, Pfizer’s then incoming CEO Albert Bourla had mentioned that the company did not see the need for any large-scale M&A activity as Pfizer had “the best pipeline” in its history, which needed the company to focus on deploying its capital to keep its pipeline flowing and execute on its drug launches.

Bourla stayed true to his word and barring the acquisition of Array Biopharma for US$ 11.4 billion and a spin-off to merge Upjohn, Pfizer’s off-patent branded and generic established medicines business with

Mylan, there weren’t any other big ticket deals which were announced.

The

Upjohn-Mylan merged entity will be called Viatris and is expected to have 2020

revenues between US$ 19 and US$ 20 billion

and could outpace Teva to

become the largest generic company in the world, in term of revenues.

Novartis, which had

followed Pfizer with the second largest revenues in the pharmaceutical industry

in 2018, reported its first full year earnings after spinning off its Alcon eye

care devices business division that

had US$ 7.15 billion in 2018 sales.

In 2019,

Novartis slipped two spots in the ranking after reporting total sales of US$

47.4 billion and its CEO Vas Narasimhan continued his deal-making spree by buying New

Jersey-headquartered The Medicines Company (MedCo) for US$ 9.7

billion to acquire a late-stage cholesterol-lowering

therapy named inclisiran.

As Takeda Pharmaceutical Co was

busy in 2019 on working to reduce its debt burden incurred due to its US$ 62

billion purchase of Shire Plc, which was announced in 2018, Novartis also purchased

the eye-disease medicine, Xiidra, from the Japanese drugmaker for US$ 5.3 billion.

Novartis’ management also spent a considerable part of 2019 dealing with data-integrity concerns which emerged from its 2018 buyout of AveXis, the

gene-therapy maker Novartis had acquired for US$ 8.7 billion.

The deal gave Novartis rights to Zolgensma,

a novel treatment intended for children less than two years of age with the

most severe form of spinal muscular atrophy (SMA). Priced at US$ 2.1 million,

Zolgensma is currently the world’s most expensive drug.

However,

in a shocking announcement, a month after approving the drug, the US Food and

Drug Administration (FDA) issued a press release on

data accuracy issues as the agency was informed by AveXis that

its personnel had manipulated data which

the FDA used to evaluate product comparability and nonclinical (animal)

pharmacology as part of the biologics license application (BLA), which was

submitted and reviewed by the FDA.

With US$

50.0 billion (CHF 48.5 billion) in annual pharmaceutical sales, Swiss drugmaker

Roche came in at number two position in 2019

as its sales grew 11 percent driven by

its multiple sclerosis medicine Ocrevus, haemophilia drug Hemlibra and cancer medicines Tecentriq and Perjeta.

Roche’s newly introduced medicines generated US$ 5.53 billion (CHF 5.4 billion) in growth, helping offset the impact of the competition from biosimilars for its three best-selling drugs MabThera/Rituxan, Herceptin and Avastin.

In late 2019, after months of increased

antitrust scrutiny, Roche completed

its US$ 5.1 billion acquisition of Spark Therapeutics to strengthen its presence in

gene therapy.

Last year, J&J reported almost flat worldwide sales of US$ 82.1 billion. J&J’s pharmaceutical division generated US$ 42.20 billion and its medical devices and consumer health divisions brought in US$ 25.96 billion and US$ 13.89 billion respectively.

Since J&J’s consumer health division sells analgesics, digestive health along with beauty and oral care products, the US$ 5.43 billion in consumer health sales from over-the-counter drugs and women’s health products was only used in our assessment of J&J’s total pharmaceutical revenues. With combined pharmaceutical sales of US$ 47.63 billion, J&J made it to number three on our list.

While the sales of products like Stelara, Darzalex, Imbruvica, Invega Sustenna drove J&J’s pharmaceutical business to grow by 4 percent over 2018, the firm had to contend with generic competition against key revenue contributors Remicade and Zytiga.

US-headquartered Merck, which is known as

MSD (short for Merck Sharp & Dohme) outside the United States and

Canada, is set to significantly move up the rankings next year fueled by its

cancer drug Keytruda, which witnessed a 55

percent increase in sales to US$ 11.1 billion.

Merck reported total revenues of US$ 41.75 billion and also

announced it will spin off its women’s health drugs,

biosimilar drugs and older products to create a new pharmaceutical

company with US$ 6.5 billion in annual revenues.

The firm had anticipated 2020 sales between US$ 48.8 billion and US$ 50.3 billion however this week it announced that the coronavirus pandemic will reduce 2020 sales by more than $2 billion.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

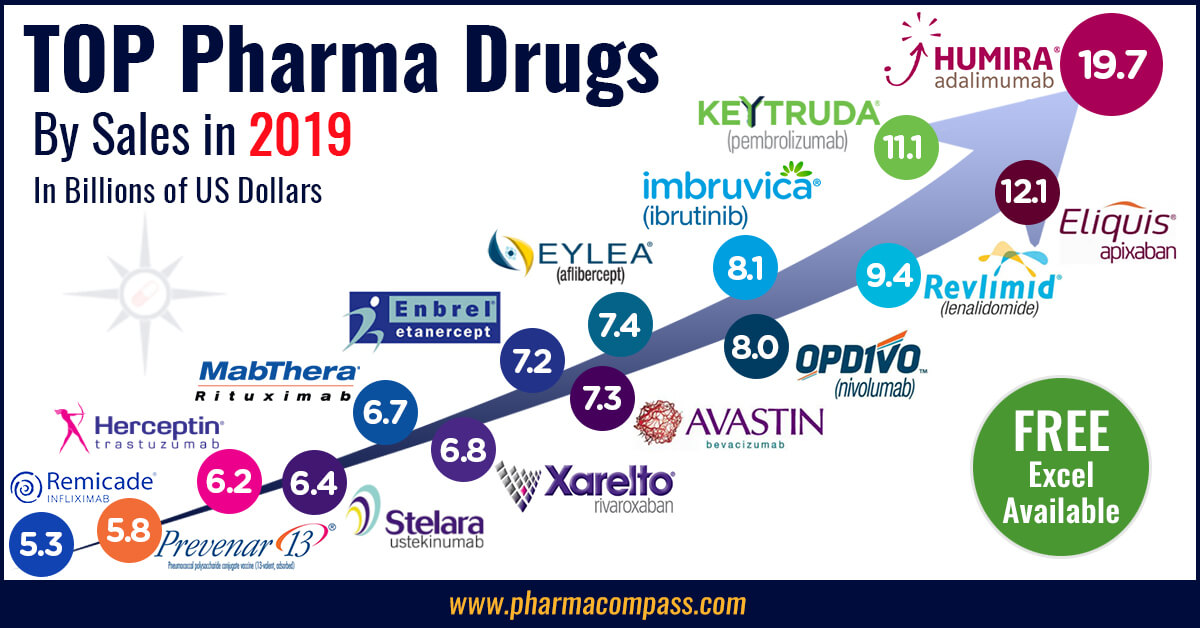

Humira holds on to remain world’s best-selling drug

AbbVie’s acquisition of Allergan comes as the firm faces the expiration of patent protection for Humira, which brought in a staggering US$ 19.2 billion in sales last year for

the company. AbbVie has failed to successfully acquire or develop a major new

product to replace the sales generated by its flagship drug.

In 2019, Humira’s US revenues increased 8.6 percent to US$ 14.86 billion while internationally, due

to biosimilar competition, the sales dropped 31.1 percent to US$ 4.30 billion.

Bristol Myers Squibb’s Eliquis, which is also marketed by Pfizer, maintained its number two position

and posted total sales of US$ 12.1 billion, a 23 percent increase over 2018.

While Bristol Myers Squibb’s immunotherapy treatment Opdivo, sold in partnership with Ono in Japan, saw sales increase from US$ 7.57 billion to US$ 8.0 billion, the growth paled in comparison to the US$ 3.9

billion revenue increase of Opdivo’s key immunotherapy competitor Merck’s Keytruda.

Keytruda took the number three spot in drug sales that

previously belonged to Celgene’s Revlimid, which witnessed a sales decline from US$ 9.69 billion to US$ 9.4 billion.

Cancer treatment Imbruvica, which is marketed

by J&J and AbbVie, witnessed a 30 percent increase in sales. With US$ 8.1

billion in 2019 revenues, it took the number five position.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Vaccines – Covid-19 turns competitors into partners

This year has been dominated by the single biggest health emergency in years — the novel coronavirus (Covid-19) pandemic. As drugs continue to fail to meet expectations, vaccine development has received a lot of attention.

GSK reported the highest vaccine sales of all drugmakers with

total sales of US$ 8.4 billion (GBP 7.16 billion), a significant portion of its

total sales of US$ 41.8 billion (GBP 33.754 billion).

US-based Merck’s vaccine division also reported a significant increase in sales to US$ 8.0 billion and in 2019 received FDA and EU approval to market its Ebola vaccine Ervebo.

This is the first FDA-authorized vaccine against the deadly virus which causes

hemorrhagic fever and spreads from person to person through direct contact with

body fluids.

Pfizer and Sanofi also reported an increase in their vaccine sales to US$ 6.4

billion and US$ 6.2 billion respectively and the Covid-19 pandemic has recently

pushed drugmakers to move faster than ever before and has also converted

competitors into partners.

In a rare move, drug behemoths — Sanofi and GlaxoSmithKline (GSK) —joined hands to develop a vaccine for the novel coronavirus.

The two companies plan to start human trials

in the second half of this year, and if things go right, they will file

for potential approvals by the second half of 2021.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Our view

Covid-19 has brought the world economy to a grinding halt and shifted the global attention to the pharmaceutical industry’s capability to deliver solutions to address this pandemic.

Our compilation shows that vaccines and drugs

for infectious diseases currently form a tiny fraction of the total sales of

pharmaceutical companies and few drugs against infectious diseases rank high on

the sales list.

This could well explain the limited range of

options currently available to fight Covid-19. With the pandemic currently infecting

over 3 million people spread across more than 200 countries, we can safely

conclude that the scenario in 2020 will change substantially. And so should our

compilation of top drugs for the year.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Impressions: 54752

This week in Phispers, we analyze the

situation at AstraZeneca, where its much anticipated lung cancer drug failed in

clinical trials. In the US, there are reports that various generic players are

looking to enter into M&A deals in order to safeguard themselves against

regulatory crackdown on prices. The tension along the India-China border may

lead to cancellation of the Fosun-Gland deal by the Indian government and in

the US, the FDA is looking to cut nicotine in cigarettes to ensure they are

non-addictive.

AstraZeneca’s key lung cancer drug fails in first stage trial; gets investors worried

The year 2017 was supposed to be a pivotal year for AstraZeneca.

The firm was supposed to display new marvels from its laboratories and march

towards annual revenues of US$ 45 billion by 2023. This target was set when Pfizer’s

takeover offer was rejected in 2014.

But so far, the year has turned out horribly for AstraZeneca. Its key lung cancer drug — Imfinzi — flopped in clinical trials.

Known as the ‘Mystic’ study, this was the most anticipated clinical experiment in the pharmaceutical industry this year. The study was key to proving the value of the group’s new drug pipeline, after it rejected a US$ 118 billion takeover bid by Pfizer in

2014.The news crashed the share price of

AstraZeneca by 15 percent.

Imfinzi, an immuno-oncology drug, was said to be a potential replacement for chemotherapy. However, all is not lost yet. The first stage of the trial merely measured the drug’s ability to prevent a cancer from becoming worse. The second stage, which looks at survival rates, is said to be more important.

But for Pascal Soriot, AstraZeneca’s CEO, this came as an embarrassment. He faced a barrage of questions from analysts about future payouts of the company. He was forced to defend the company’s dividend strategies at post-result meets last week. Fears for AstraZeneca’s dividend were driven by the failure of the lung cancer.

But there is hope for Astra in the future — another lung cancer pill, Tagrisso,

has produced good data. And AstraZeneca is partnering with Merck on another

immuno-oncology drug, Lynparza.

Another downside for Astra in 2017 has

been the uncertainties faced by the company regarding its top executives. It

began in January this year, when Luke Miels, the head of AstraZeneca’s European operations, announced he is quitting the company to join GlaxoSmithKline. Recently, there were speculations regarding Soriot

considering an offer to join Israeli drugmaker Teva as its head.

He is learnt to have turned down the offer.

Bleak US generics market forecast has

drug makers scrambling for deals

In the US, generic drug makers are turning to M&As in order to safeguard themselves against a concerted

effort by regulators to crack down on the steep prices of drugs.

According to a Reuters report, Impax Laboratories,

Perrigo and Alvogen have been

talking to advisers about various strategic options for their generics

businesses. These options range from acquisitions,

as well as outright sale.

Earlier, Reuters had reported

that Mallinckrodt,

one of the largest producers of the generic opioid painkiller oxycodone, has been exploring a sale of its specialty generics unit. In May, the CEO of Impax, which makes a generic version of the EpiPen allergy injection, said it was looking at deals.

The US generics market is getting

increasingly competitive. Last month, Novartis reported that sales at its Sandoz generics

unit were down 4 percent.

Generic drugs are cheaper versions of brand-name drugs. In the US, the

government is targeting generics to cut the cost of prescription drugs.

According to a 2016 report by the Journal of the American Medical Association,

US consumers spend more than twice as much on drugs per capita compared to

other industrialized nations.

In order to bring down the prices of

drugs, the US Food and Drug Administration (US FDA) has committed to

eliminating the backlog of drug applications awaiting its approval. This could

mean nearly 4,000 new drugs will come onto the market over the next few years,

based on FDA estimates.

Even today, small and mid-sized drug

makers are under pressure as consolidation among generic drug distributors has

made it less profitable for them to sell their drugs.

India-China border skirmish may impact Fosun-Gland deal

The heightened tensions along the

India-China border are likely to impact business. In the pharmaceutical

industry, the Cabinet Committee on Economic Affairs (CCEA) in India is likely to reject Shanghai Fosun Pharmaceutical Group’s US$

1.3 billion acquisition of Hyderabad-based Gland Pharma Ltd, says a Bloomberg

report.

However, a report in The Economic

Times says the proposal was listed for CCEA’s consideration two weeks back. But the CCEA is yet to take a call on the Gland Pharma-Fosun

deal.

“It is wrong to say that the deal has been rejected,” the official said. The Gland Pharma-Fosun deal had been approved by the now-abolished Foreign Investment Promotion Board (FIPB) in March this year. And Fosun was to acquire 86 per cent stake in the injectable drugmaker.

According to IndiaSpend, China is today the 17th largest foreign direct investor in India, an

improvement on the 36th rank it held in 2010.

CRO Consolidation: LabCorp buys

Chiltern, Evotec acquires Aptuit

Consolidation in the CRO industry

continued unabated last week. LabCorp bought Chiltern for US$ 1.2 billion last week. Two years back, LabCorp had bought Covance for US$ 6.1

billion. The acquisition of Chiltern will add another 4,500 clinical

outsourcing workers around the globe to its employee roster.

Another CRO that made an acquisition last week was Germany’s Evotec. It bought out its rival Aptuit for US$ 300 million in cash. And the

deal will add hundreds of scientists to its organization along with facilities

in Basel, Oxford and Verona.

Evotec has earned a large number of

clients on both sides of the Atlantic. Evotec says most of Aptuit’s

750 employees are scientists. Last year, Aptuit reportedly handled 1,000

projects for some 400 companies.

The CRO business has been

consolidating for years, with private equity groups leading the way to build up

these global organizations. Leading the pack is Thermo Fisher,

which had made acquisitions worth US$ 22 billion in the last five years. Three months back, Thermo Fisher Scientific acquired Patheon NV for US$ 5.2 billion while INC Research Holdings merged with private-equity owned CRO — inVentiv Health.

FDA to cut nicotine in cigarettes to non-addictive levels

Last week, the US government proposed cutting nicotine in cigarettes to “non-addictive” levels in order to move smokers towards potentially less harmful e-cigarettes. The FDA Commissioner Scott Gottlieb said the agency will study regulating nicotine levels with a view towards the “FDA’s potential to render cigarettes minimally addictive or non-addictive.”

“Nicotine itself is not responsible for the cancer, the lung disease and heart disease that kill hundreds of thousands of Americans each year,” Gottlieb said. “It's the other chemical compounds in tobacco and in the smoke created by setting tobacco on fire that directly cause illness and death,” he added.

The FDA cannot reduce nicotine levels

to zero, nor can it ban cigarettes. However, after this announcement by

Gottlieb, shares of major tobacco firms in the US and UK slumped.

Analysts said they expect regulators

in Europe to study similar actions on nicotine products. This action shakes up

a public health debate on whether e-cigarettes represent a health risk or a

potential benefit.

NotPetya cyber attack hits Merck’s profits

Merck is the latest in a string of

companies that have disclosed that their operations were significantly

disrupted by the NotPetya attack, which devastated businesses and government

agencies in Ukraine in June and has gradually spread around the globe.

According to a Reuters report, Merck said it had been a victim of an international cyber

attack in June 2017, due to which the company had to halt production of drugs.

As a result, its profits for the rest of the year have been hit.

The company, however, said it is yet

to know the magnitude of the impact as it is in the process of restoring

manufacturing operations.

Merck had disclosed the attack last month, but did not disclose the manufacturing shutdown at the time. The company said it was confident that it will be able to maintain a continuous supply of its top-selling and life-saving drugs, such as cancer drug Keytruda, diabetes drug Januvia and hepatitis C drug Zepatier.

However, there maybe temporary delays in delivering some other products, which

the company did not identify.

“Full recovery from the cyber-attack will take some time, but we are making steady progress,” CEO Ken Frazier said. At least four other major US and European firms have also experienced massive outages due to NotPetya.

Impressions: 2564