Acquisitions and spin-offs dominated headlines in 2019 and the tone was set very early with Bristol-Myers Squibb acquiring

New Jersey-based cancer drug company Celgene in a US$ 74 billion deal announced on

January 3, 2019. After factoring

in debt, the deal value ballooned to about US$ 95 billion, which according

to data compiled by Refinitiv, made it the largest healthcare deal on

record.

In the summer, AbbVie Inc,

which sells the world’s best-selling drug Humira, announced its acquisition of Allergan Plc, known for Botox and other cosmetic

treatments, for US$ 63 billion. While the companies are still awaiting

regulatory approval for their deal, with US$ 49 billion in combined 2019

revenues, the merged entity would rank amongst the biggest in the industry.

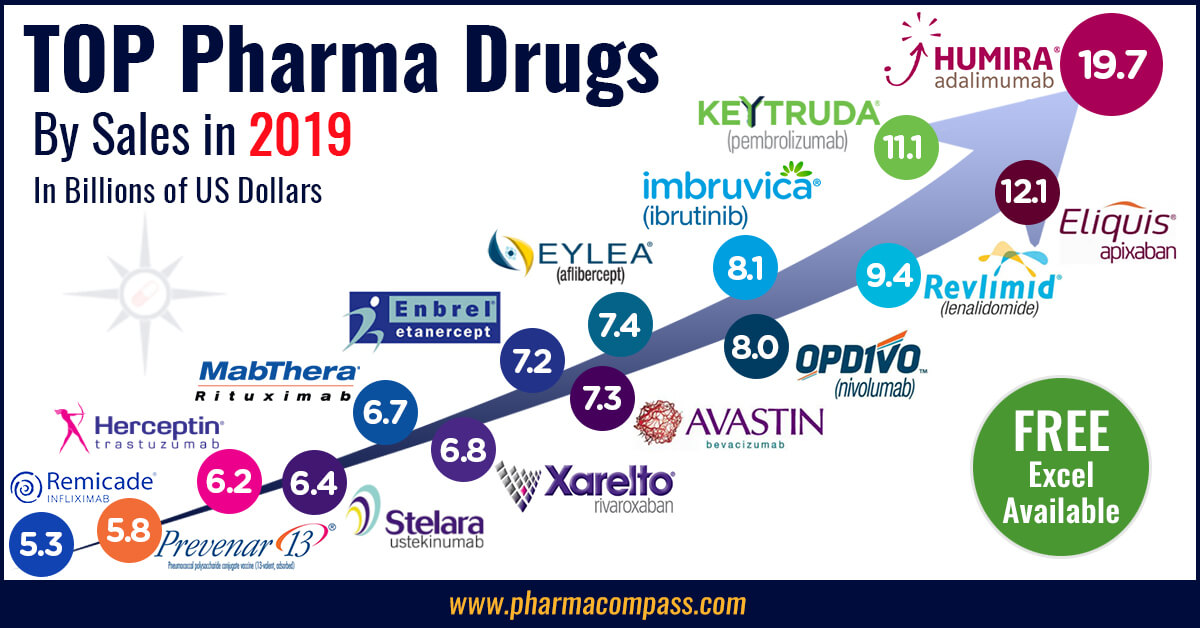

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

The big five by pharmaceutical sales — Pfizer,

Roche, J&J, Novartis and Merck

Pfizer

continued

to lead companies by pharmaceutical sales by reporting annual 2019 revenues of

US$ 51.8 billion, a decrease of US$ 1.9 billion, or 4 percent, compared to

2018. The decline was primarily attributed to the loss of exclusivity of Lyrica in 2019,

which witnessed its sales drop from US$ 5 billion in 2018 to US$ 3.3 billion in

2019.

In 2018, Pfizer’s then incoming CEO Albert Bourla had mentioned that the company did not see the need for any large-scale M&A activity as Pfizer had “the best pipeline” in its history, which needed the company to focus on deploying its capital to keep its pipeline flowing and execute on its drug launches.

Bourla stayed true to his word and barring the acquisition of Array Biopharma for US$ 11.4 billion and a spin-off to merge Upjohn, Pfizer’s off-patent branded and generic established medicines business with

Mylan, there weren’t any other big ticket deals which were announced.

The

Upjohn-Mylan merged entity will be called Viatris and is expected to have 2020

revenues between US$ 19 and US$ 20 billion

and could outpace Teva to

become the largest generic company in the world, in term of revenues.

Novartis, which had

followed Pfizer with the second largest revenues in the pharmaceutical industry

in 2018, reported its first full year earnings after spinning off its Alcon eye

care devices business division that

had US$ 7.15 billion in 2018 sales.

In 2019,

Novartis slipped two spots in the ranking after reporting total sales of US$

47.4 billion and its CEO Vas Narasimhan continued his deal-making spree by buying New

Jersey-headquartered The Medicines Company (MedCo) for US$ 9.7

billion to acquire a late-stage cholesterol-lowering

therapy named inclisiran.

As Takeda Pharmaceutical Co was

busy in 2019 on working to reduce its debt burden incurred due to its US$ 62

billion purchase of Shire Plc, which was announced in 2018, Novartis also purchased

the eye-disease medicine, Xiidra, from the Japanese drugmaker for US$ 5.3 billion.

Novartis’ management also spent a considerable part of 2019 dealing with data-integrity concerns which emerged from its 2018 buyout of AveXis, the

gene-therapy maker Novartis had acquired for US$ 8.7 billion.

The deal gave Novartis rights to Zolgensma,

a novel treatment intended for children less than two years of age with the

most severe form of spinal muscular atrophy (SMA). Priced at US$ 2.1 million,

Zolgensma is currently the world’s most expensive drug.

However,

in a shocking announcement, a month after approving the drug, the US Food and

Drug Administration (FDA) issued a press release on

data accuracy issues as the agency was informed by AveXis that

its personnel had manipulated data which

the FDA used to evaluate product comparability and nonclinical (animal)

pharmacology as part of the biologics license application (BLA), which was

submitted and reviewed by the FDA.

With US$

50.0 billion (CHF 48.5 billion) in annual pharmaceutical sales, Swiss drugmaker

Roche came in at number two position in 2019

as its sales grew 11 percent driven by

its multiple sclerosis medicine Ocrevus, haemophilia drug Hemlibra and cancer medicines Tecentriq and Perjeta.

Roche’s newly introduced medicines generated US$ 5.53 billion (CHF 5.4 billion) in growth, helping offset the impact of the competition from biosimilars for its three best-selling drugs MabThera/Rituxan, Herceptin and Avastin.

In late 2019, after months of increased

antitrust scrutiny, Roche completed

its US$ 5.1 billion acquisition of Spark Therapeutics to strengthen its presence in

gene therapy.

Last year, J&J reported almost flat worldwide sales of US$ 82.1 billion. J&J’s pharmaceutical division generated US$ 42.20 billion and its medical devices and consumer health divisions brought in US$ 25.96 billion and US$ 13.89 billion respectively.

Since J&J’s consumer health division sells analgesics, digestive health along with beauty and oral care products, the US$ 5.43 billion in consumer health sales from over-the-counter drugs and women’s health products was only used in our assessment of J&J’s total pharmaceutical revenues. With combined pharmaceutical sales of US$ 47.63 billion, J&J made it to number three on our list.

While the sales of products like Stelara, Darzalex, Imbruvica, Invega Sustenna drove J&J’s pharmaceutical business to grow by 4 percent over 2018, the firm had to contend with generic competition against key revenue contributors Remicade and Zytiga.

US-headquartered Merck, which is known as

MSD (short for Merck Sharp & Dohme) outside the United States and

Canada, is set to significantly move up the rankings next year fueled by its

cancer drug Keytruda, which witnessed a 55

percent increase in sales to US$ 11.1 billion.

Merck reported total revenues of US$ 41.75 billion and also

announced it will spin off its women’s health drugs,

biosimilar drugs and older products to create a new pharmaceutical

company with US$ 6.5 billion in annual revenues.

The firm had anticipated 2020 sales between US$ 48.8 billion and US$ 50.3 billion however this week it announced that the coronavirus pandemic will reduce 2020 sales by more than $2 billion.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Humira holds on to remain world’s best-selling drug

AbbVie’s acquisition of Allergan comes as the firm faces the expiration of patent protection for Humira, which brought in a staggering US$ 19.2 billion in sales last year for

the company. AbbVie has failed to successfully acquire or develop a major new

product to replace the sales generated by its flagship drug.

In 2019, Humira’s US revenues increased 8.6 percent to US$ 14.86 billion while internationally, due

to biosimilar competition, the sales dropped 31.1 percent to US$ 4.30 billion.

Bristol Myers Squibb’s Eliquis, which is also marketed by Pfizer, maintained its number two position

and posted total sales of US$ 12.1 billion, a 23 percent increase over 2018.

While Bristol Myers Squibb’s immunotherapy treatment Opdivo, sold in partnership with Ono in Japan, saw sales increase from US$ 7.57 billion to US$ 8.0 billion, the growth paled in comparison to the US$ 3.9

billion revenue increase of Opdivo’s key immunotherapy competitor Merck’s Keytruda.

Keytruda took the number three spot in drug sales that

previously belonged to Celgene’s Revlimid, which witnessed a sales decline from US$ 9.69 billion to US$ 9.4 billion.

Cancer treatment Imbruvica, which is marketed

by J&J and AbbVie, witnessed a 30 percent increase in sales. With US$ 8.1

billion in 2019 revenues, it took the number five position.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Vaccines – Covid-19 turns competitors into partners

This year has been dominated by the single biggest health emergency in years — the novel coronavirus (Covid-19) pandemic. As drugs continue to fail to meet expectations, vaccine development has received a lot of attention.

GSK reported the highest vaccine sales of all drugmakers with

total sales of US$ 8.4 billion (GBP 7.16 billion), a significant portion of its

total sales of US$ 41.8 billion (GBP 33.754 billion).

US-based Merck’s vaccine division also reported a significant increase in sales to US$ 8.0 billion and in 2019 received FDA and EU approval to market its Ebola vaccine Ervebo.

This is the first FDA-authorized vaccine against the deadly virus which causes

hemorrhagic fever and spreads from person to person through direct contact with

body fluids.

Pfizer and Sanofi also reported an increase in their vaccine sales to US$ 6.4

billion and US$ 6.2 billion respectively and the Covid-19 pandemic has recently

pushed drugmakers to move faster than ever before and has also converted

competitors into partners.

In a rare move, drug behemoths — Sanofi and GlaxoSmithKline (GSK) —joined hands to develop a vaccine for the novel coronavirus.

The two companies plan to start human trials

in the second half of this year, and if things go right, they will file

for potential approvals by the second half of 2021.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Our view

Covid-19 has brought the world economy to a grinding halt and shifted the global attention to the pharmaceutical industry’s capability to deliver solutions to address this pandemic.

Our compilation shows that vaccines and drugs

for infectious diseases currently form a tiny fraction of the total sales of

pharmaceutical companies and few drugs against infectious diseases rank high on

the sales list.

This could well explain the limited range of

options currently available to fight Covid-19. With the pandemic currently infecting

over 3 million people spread across more than 200 countries, we can safely

conclude that the scenario in 2020 will change substantially. And so should our

compilation of top drugs for the year.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Impressions: 54752

This week, Phispers ferrets out global pharma news to bring you the latest on a drug for bipolar disorder, news about two Indian drug makers being put on import alert for refusing an FDA inspection and how GSK’s supply snags in Italy are hurting Denmark Former hedge fund

manager who paid an FDA official for tipoffs found deadLast week, a hedge fund manager – Sanjay Valvani (44) – was indicted for allegedly paying a former US FDA official for inside information on product approvals. On June 20, he was reportedly found

dead. According to a news report, Valvani was found by his wife at

his Brooklyn, New York, home with a neck wound. A suicide note and a knife were

also recovered from his home.Valvani had worked at Visium Asset Management. During 2005 to 2011, he had allegedly paid a monthly sum to Gordon Johnston, who once worked as a deputy director of the FDA’s Office of Generic Drugs, for tips. Indian pharma majors

among 200 under scrutiny for quality of drugs sold For the first time in India, the Drug Controller General of

India (DCGI) has launched inspections against 200

drug makers, including pharmaceutical biggies like Cipla and Pfizer, for

allegedly selling poor quality medicines and for not complying with manufacturing

norms. An official of the DCGI told a newspaper that the regulator

has already inspected 36 drug manufacturing plants over the last three months. In the second phase, the DCGI will inspect 20 more

facilities. Notices have also been sent to Cipla and Pfizer informing them of

the impending inspection and the violations found in their products. Cipla

maintained it has not received any intimation so far, while Pfizer did not

comment. Phalanx Labs and

Cheryl Labs refuse FDA inspection, put on the Red List The US Food and Drug Administration (FDA) banned two Indian drug manufacturers – Cheryl

Laboratories and Phalanx

Labs – from shipping products to the US after both the firms refused to allow FDA teams to visit their manufacturing sites for an inspection. Both the firms were put on FDA’s import alert list, also known as the Red List. According to the FDA policy: “The refusal to permit inspection of a foreign facility or provide reasonable access to FDA’s

inspectional personnel, combined with other evidence, provides an appearance

that the firm’s products are manufactured, processed, or packed under insanitary conditions.” Cheryl Laboratories stopped FDA inspectors from visiting its

facility in Navi Mumbai, while Phalanx did not let inspectors visit their site

in Visakhapatnam. Cheryl makes creams, ointments, liquid pharmaceutical, antiseptic products and gels from its Navi Mumbai facility. Phalanx’s Vizag facility produces 15 active pharmaceutical ingredients (API) – including erectile dysfunction drugs, ulcer medications and anticoagulants – and chemical intermediaries. Eli Lilly loses

patent infringement case in ChinaLast week, China’s apex court rejected the appeal of US pharmaceutical company Eli Lilly

against Jiangsu-based Changzhou

Watson Pharmaceutical in a long-standing patent infringement case.Eli Lilly and Changzhou Watson have been involved in patent infringement disputes for over a decade over Changzhou Watson’s production of olanzapine,

an anti-psychotic drug. The court also overturned a previous ruling on patent infringement in favor of Eli Lilly, that had ordered Changzhou Watson to pay Eli Lilly millions in compensation. The investigators concluded that “the alleged infringement does not fall into the scope of patent protection in the case.”This is the first time that the apex court in China has

designated technical investigators in a lawsuit to help clarify the technical

details of the case. Using old compounds

to create new drug for bipolar disorderBack in 2010, a group at the University of Oxford was

looking for ways to treat

bipolar disorder by using lithium. Though the drug is known to work well in

bipolar disorder, it also has side effects. Therefore, the group – headed by a young physicians called Grant Churchill – asked a physician Justyn Thomas to screen all 450 compounds in the US National Institutes of Health (NIH) Clinical Collection, a library of drugs that had passed safety tests in humans but, for various reasons, had never reached the market. Thomas experimented with these compounds. What took birth was a drug called ebselen, which showed the same benefits as lithium. Churchill’s group did a small trial and found that ebselen could be used safely in healthy volunteers. The University of Oxford has now teamed up with a

pharmaceutical company to run clinical trials of ebselen for bipolar disorder. Former CEO of Warner

Chilcott acquitted in kickback caseLast week, the US federal court jury acquitted

W. Carl Reichel – a former Warner Chilcott executive – of paying bribes to doctors to lure them to boost prescriptions. The decision is being seen as a setback for the US

government which has initiated a new effort to hold high-ranking executives at

pharma and other companies accountable for such activities. Federal prosecutors charged Reichel with crafting a strategy

to give doctors money, free meals, and phony speaking fees in exchange for

writing prescriptions of Warner-Chilcott drugs between 2009 and 2012. He was also charged with providing sales representatives

with unlimited expense accounts in order to wine and dine with doctors. GSK’s supply snag in Italy creates drug shortage in DenmarkGlaxoSmithKline

had temporarily suspended manufacturing at its Parma

site in Italy that manufactures sterile products, to investigate

environmental monitoring.This has led to shortages of commonly used opioid anesthetic

in Denmark. The factory has now recommenced manufacturing. However, a small

number of countries have experienced shortages of certain products since April.

In Denmark, doctors said they were also running out of the anesthetic

Ultiva,

which is preferred by patients since they wake up quickly after surgery. The Parma factory also manufactures GSK’s new injectable drug Nucala

for severe asthma and Benlysta for lupus. However, these were reportedly not in

short supply. Zydus buys two ANDAs

from Teva; Cipla heads to RussiaIndia’s Zydus

Cadila has strengthened its US portfolio by acquiring two abbreviated new

drug applications (ANDAs) from Israel's Teva.

The divestiture by Teva is in line with a precondition to its acquisition of Allergan’s generic business. The ANDAs have been acquired by Zydus

Cadila’s 100 percent subsidiary Zydus Worldwide DMCC and the transaction will be financed through the group's internal accruals. The estimated market size of the two ANDAs is around US $ 200 million.Meanwhile, another Indian company – Cipla – has

entered into an

alliance with Russia’s National Immunobiological Company (Nacimbio) for

innovative antiviral medical products for HIV and hepatitis C treatment and

technology transfer and API manufacturing. As a part of this agreement,

Nacimbio, along with Cipla, will set up a manufacturing facility in Russia for

antiretroviral drugs.

Impressions: 2173

With almost 30,000 Drug Master Files (DMFs) submitted to the

FDA, reviewing the filings of only the first quarter of 2015, provides an

indicator on the current areas of focus of generic pharmaceutical companies. A

detailed evaluation of the 241 filings for active pharmaceutical ingredients only,

made us find some interesting trends worth sharing.

European Blockbuster

battle!

Of the 241 DMFs, 21 APIs had more than one DMF filing and

accounted for 25% of the total filings. Interestingly, 20 DMFs were for only three APIs:

AstraZeneca’s blood thinner Brilinta® (Ticagrelor), with 2014 sales of $476

million, already had DMF filings from Dr. Reddy’s, Mylan,

Polpharma and

Zhejiang Hisun at the end of last year. With a maximum of 9 new filings from players

like Teva,

Alembic, Lek and

others, AstraZeneca

should brace itself for some serious generic onslaught.

While the 9 filings for Ticagrelor were the most for any

single compound, not far behind is Bayer’s own blood thinner: Xarelto® (Rivaroxaban). With 7 submissions, the

focus of the generic companies is understandable as Rivaroxaban had sales in

excess of $3 billion and year-on-year growth in excess of 70%. However, patents

currently protect the product till 2020, so patience is needed before generics can

access this golden opportunity.

Interestingly, 4 filings for Linagliptin (Boehringer’s antidiabetic Tradjenta®) make it yet another European pharma giant lead the list of products being subjected to generic competition, and make us wonder why European blockbusters are preferred over others?

Exclusive but not

patented

There are products, which have no patent protection, but the

market is protected by FDA granted exclusivities (learn more on patents

and exclusivities from the FDA website).

An opportunity for generic companies to gain significant

market share of a multi-hundred million dollar market, without any litigation

risk or cost is something companies dream about.

As the time of exclusivity expiry nears, Clobazam, Tetrabenazine,

Hydroxyprogesterone Caproate, Deferiprone

and Trypan Blue

will all see increased generic activity as their Drug Master Files have been

submitted.

Fragmented Activity

More than 80% of the DMF submissions were made by companies

who filed only a single product. While the products varied from simple compounds

like Sodium Chloride to biologics like Plasmid DNA, over 140 companies filed DMFs in

the first quarter with almost 30 submitting a DMF for the first time.

An expanding list of suppliers who support DMFs increases

options for sourcing managers. However,

a fragmented supplier base limits the industrial scale companies can achieve and

raises concerns regarding how many can successfully sustain compliance standards

under increased regulatory scrutiny?

The Next Generic Wave

Blood thinners are an opportunity few generic companies wish to pass on. Boehringer’s (Dabigatran Etexilate), Bristol-Myers Squibb’s (Apixaban) and Bayer’s (Rivaroxaban) are novel compounds in this category which had combined sales in excess of $5 billion last year.

While Dagibatran saw a flurry of activity over the last two

years with almost 15 DMF filings, there were no additional filings this year.

On the other hand, Apixaban, which generated $774 million

for Bristol-Myers Squibb in 2014, has only one DMF filing at the moment and that too was done

over a year ago. The export data out of India, reviewed on PharmaCompass, for

Apixaban, indicates that product development is already complete so it is just

a matter of time before the filings begin.

Conclusion:

Product and supplier selection is a critical component of every generic company’s strategy. The PharmaCompass database is designed to assist professionals in business development, marketing and sourcing to take more informed decisions.

If you would like us to share our shortlist of 241 DMFs, we will be happy to send it to you by email (click here). You can also access our compilation of the 2014 annual reports of

major pharmaceutical companies to review the various products along with their

revenues (click here):

Table: Products with more than one DMF filing in Q1 2015

PRODUCT NAME

DMF FILINGS

TICAGRELOR

9

RIVAROXABAN

7

LINAGLIPTIN

4

APREPITANT

3

CINACALCET HYDROCHLORIDE

3

ATAZANAVIR SULFATE

2

ATORVASTATIN CALCIUM TRIHYDRATE

2

CLOBAZAM

2

CLOFARABINE

2

DEFERASIROX

2

DIMETHYL FUMARATE

2

EZETIMIBE

2

ICATIBANT ACETATE

2

LURASIDONE HYDROCHLORIDE

2

MELPHALAN HYDROCHLORIDE

2

OLANZAPINE

2

OLMESARTAN MEDOXOMIL USP

2

PRASUGREL HYDROCHLORIDE

2

RIVASTIGMINE USP

2

ROSUVASTATIN CALCIUM

2

SOLIFENACINE SUCCINATE

2

Impressions: 8782