Acquisitions and spin-offs dominated headlines in 2019 and the tone was set very early with Bristol-Myers Squibb acquiring

New Jersey-based cancer drug company Celgene in a US$ 74 billion deal announced on

January 3, 2019. After factoring

in debt, the deal value ballooned to about US$ 95 billion, which according

to data compiled by Refinitiv, made it the largest healthcare deal on

record.

In the summer, AbbVie Inc,

which sells the world’s best-selling drug Humira, announced its acquisition of Allergan Plc, known for Botox and other cosmetic

treatments, for US$ 63 billion. While the companies are still awaiting

regulatory approval for their deal, with US$ 49 billion in combined 2019

revenues, the merged entity would rank amongst the biggest in the industry.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

The big five by pharmaceutical sales — Pfizer,

Roche, J&J, Novartis and Merck

Pfizer

continued

to lead companies by pharmaceutical sales by reporting annual 2019 revenues of

US$ 51.8 billion, a decrease of US$ 1.9 billion, or 4 percent, compared to

2018. The decline was primarily attributed to the loss of exclusivity of Lyrica in 2019,

which witnessed its sales drop from US$ 5 billion in 2018 to US$ 3.3 billion in

2019.

In 2018, Pfizer’s then incoming CEO Albert Bourla had mentioned that the company did not see the need for any large-scale M&A activity as Pfizer had “the best pipeline” in its history, which needed the company to focus on deploying its capital to keep its pipeline flowing and execute on its drug launches.

Bourla stayed true to his word and barring the acquisition of Array Biopharma for US$ 11.4 billion and a spin-off to merge Upjohn, Pfizer’s off-patent branded and generic established medicines business with

Mylan, there weren’t any other big ticket deals which were announced.

The

Upjohn-Mylan merged entity will be called Viatris and is expected to have 2020

revenues between US$ 19 and US$ 20 billion

and could outpace Teva to

become the largest generic company in the world, in term of revenues.

Novartis, which had

followed Pfizer with the second largest revenues in the pharmaceutical industry

in 2018, reported its first full year earnings after spinning off its Alcon eye

care devices business division that

had US$ 7.15 billion in 2018 sales.

In 2019,

Novartis slipped two spots in the ranking after reporting total sales of US$

47.4 billion and its CEO Vas Narasimhan continued his deal-making spree by buying New

Jersey-headquartered The Medicines Company (MedCo) for US$ 9.7

billion to acquire a late-stage cholesterol-lowering

therapy named inclisiran.

As Takeda Pharmaceutical Co was

busy in 2019 on working to reduce its debt burden incurred due to its US$ 62

billion purchase of Shire Plc, which was announced in 2018, Novartis also purchased

the eye-disease medicine, Xiidra, from the Japanese drugmaker for US$ 5.3 billion.

Novartis’ management also spent a considerable part of 2019 dealing with data-integrity concerns which emerged from its 2018 buyout of AveXis, the

gene-therapy maker Novartis had acquired for US$ 8.7 billion.

The deal gave Novartis rights to Zolgensma,

a novel treatment intended for children less than two years of age with the

most severe form of spinal muscular atrophy (SMA). Priced at US$ 2.1 million,

Zolgensma is currently the world’s most expensive drug.

However,

in a shocking announcement, a month after approving the drug, the US Food and

Drug Administration (FDA) issued a press release on

data accuracy issues as the agency was informed by AveXis that

its personnel had manipulated data which

the FDA used to evaluate product comparability and nonclinical (animal)

pharmacology as part of the biologics license application (BLA), which was

submitted and reviewed by the FDA.

With US$

50.0 billion (CHF 48.5 billion) in annual pharmaceutical sales, Swiss drugmaker

Roche came in at number two position in 2019

as its sales grew 11 percent driven by

its multiple sclerosis medicine Ocrevus, haemophilia drug Hemlibra and cancer medicines Tecentriq and Perjeta.

Roche’s newly introduced medicines generated US$ 5.53 billion (CHF 5.4 billion) in growth, helping offset the impact of the competition from biosimilars for its three best-selling drugs MabThera/Rituxan, Herceptin and Avastin.

In late 2019, after months of increased

antitrust scrutiny, Roche completed

its US$ 5.1 billion acquisition of Spark Therapeutics to strengthen its presence in

gene therapy.

Last year, J&J reported almost flat worldwide sales of US$ 82.1 billion. J&J’s pharmaceutical division generated US$ 42.20 billion and its medical devices and consumer health divisions brought in US$ 25.96 billion and US$ 13.89 billion respectively.

Since J&J’s consumer health division sells analgesics, digestive health along with beauty and oral care products, the US$ 5.43 billion in consumer health sales from over-the-counter drugs and women’s health products was only used in our assessment of J&J’s total pharmaceutical revenues. With combined pharmaceutical sales of US$ 47.63 billion, J&J made it to number three on our list.

While the sales of products like Stelara, Darzalex, Imbruvica, Invega Sustenna drove J&J’s pharmaceutical business to grow by 4 percent over 2018, the firm had to contend with generic competition against key revenue contributors Remicade and Zytiga.

US-headquartered Merck, which is known as

MSD (short for Merck Sharp & Dohme) outside the United States and

Canada, is set to significantly move up the rankings next year fueled by its

cancer drug Keytruda, which witnessed a 55

percent increase in sales to US$ 11.1 billion.

Merck reported total revenues of US$ 41.75 billion and also

announced it will spin off its women’s health drugs,

biosimilar drugs and older products to create a new pharmaceutical

company with US$ 6.5 billion in annual revenues.

The firm had anticipated 2020 sales between US$ 48.8 billion and US$ 50.3 billion however this week it announced that the coronavirus pandemic will reduce 2020 sales by more than $2 billion.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

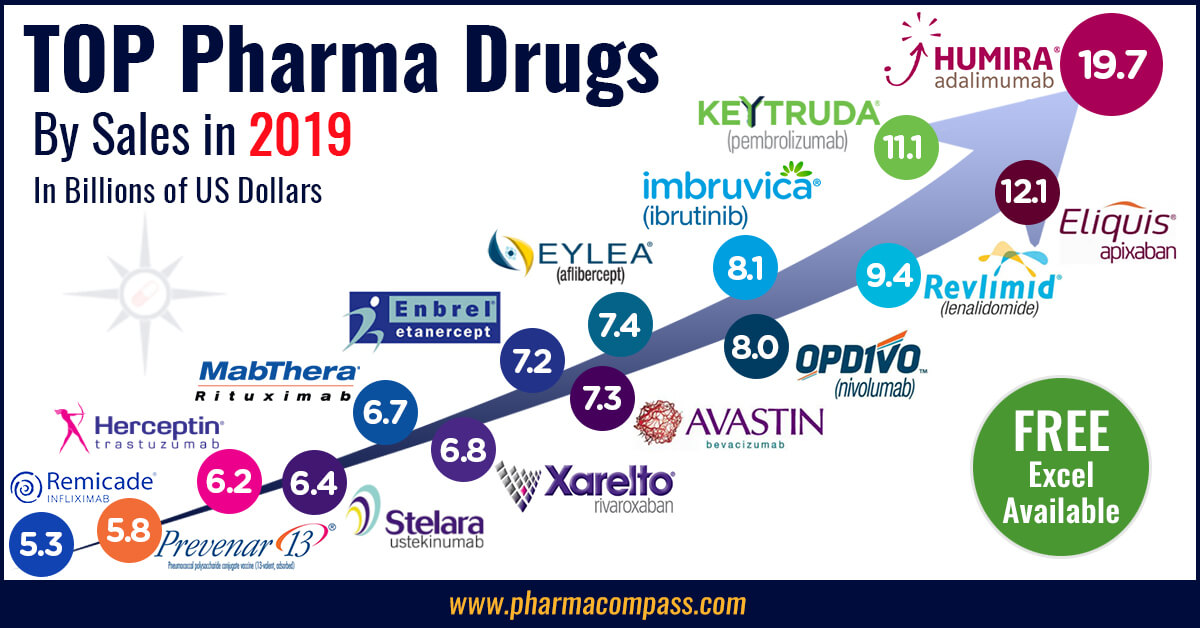

Humira holds on to remain world’s best-selling drug

AbbVie’s acquisition of Allergan comes as the firm faces the expiration of patent protection for Humira, which brought in a staggering US$ 19.2 billion in sales last year for

the company. AbbVie has failed to successfully acquire or develop a major new

product to replace the sales generated by its flagship drug.

In 2019, Humira’s US revenues increased 8.6 percent to US$ 14.86 billion while internationally, due

to biosimilar competition, the sales dropped 31.1 percent to US$ 4.30 billion.

Bristol Myers Squibb’s Eliquis, which is also marketed by Pfizer, maintained its number two position

and posted total sales of US$ 12.1 billion, a 23 percent increase over 2018.

While Bristol Myers Squibb’s immunotherapy treatment Opdivo, sold in partnership with Ono in Japan, saw sales increase from US$ 7.57 billion to US$ 8.0 billion, the growth paled in comparison to the US$ 3.9

billion revenue increase of Opdivo’s key immunotherapy competitor Merck’s Keytruda.

Keytruda took the number three spot in drug sales that

previously belonged to Celgene’s Revlimid, which witnessed a sales decline from US$ 9.69 billion to US$ 9.4 billion.

Cancer treatment Imbruvica, which is marketed

by J&J and AbbVie, witnessed a 30 percent increase in sales. With US$ 8.1

billion in 2019 revenues, it took the number five position.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Vaccines – Covid-19 turns competitors into partners

This year has been dominated by the single biggest health emergency in years — the novel coronavirus (Covid-19) pandemic. As drugs continue to fail to meet expectations, vaccine development has received a lot of attention.

GSK reported the highest vaccine sales of all drugmakers with

total sales of US$ 8.4 billion (GBP 7.16 billion), a significant portion of its

total sales of US$ 41.8 billion (GBP 33.754 billion).

US-based Merck’s vaccine division also reported a significant increase in sales to US$ 8.0 billion and in 2019 received FDA and EU approval to market its Ebola vaccine Ervebo.

This is the first FDA-authorized vaccine against the deadly virus which causes

hemorrhagic fever and spreads from person to person through direct contact with

body fluids.

Pfizer and Sanofi also reported an increase in their vaccine sales to US$ 6.4

billion and US$ 6.2 billion respectively and the Covid-19 pandemic has recently

pushed drugmakers to move faster than ever before and has also converted

competitors into partners.

In a rare move, drug behemoths — Sanofi and GlaxoSmithKline (GSK) —joined hands to develop a vaccine for the novel coronavirus.

The two companies plan to start human trials

in the second half of this year, and if things go right, they will file

for potential approvals by the second half of 2021.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Our view

Covid-19 has brought the world economy to a grinding halt and shifted the global attention to the pharmaceutical industry’s capability to deliver solutions to address this pandemic.

Our compilation shows that vaccines and drugs

for infectious diseases currently form a tiny fraction of the total sales of

pharmaceutical companies and few drugs against infectious diseases rank high on

the sales list.

This could well explain the limited range of

options currently available to fight Covid-19. With the pandemic currently infecting

over 3 million people spread across more than 200 countries, we can safely

conclude that the scenario in 2020 will change substantially. And so should our

compilation of top drugs for the year.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Impressions: 54752

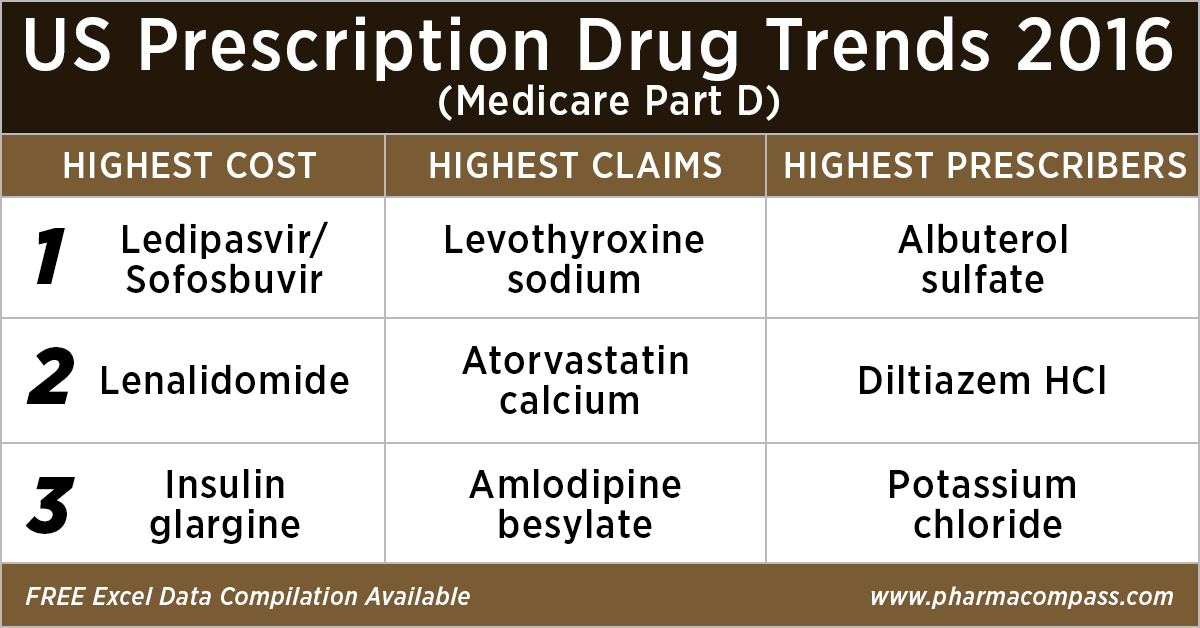

This week, PharmaCompass

reviews the recently released data on prescription drugs paid for under the

Medicare Part D Prescription Drug Program in the United States in calendar year

2016.

But first, let’s understand what is Medicare.

Medicare is the federal health insurance program in the US. In 2017, it covered 58.4 million people — 49.5 million aged 65 and older, and 8.9 million disabled.

Prescription drug coverage under this

program was started in 2006, and is known as Medicare Part D.

As part of this

coverage, the Centers for Medicare & Medicaid Services (CMS) contracts insurance

companies and other private companies, known as plan sponsors, that offer

prescription drug plans to their beneficiaries with varying drug coverage and

cost-sharing requirements.

In

2017, the Congressional Budget Office (CBO) had estimated that spending on

Medicare Part D would reach US$ 94 billion, or about 16 percent of all Medicare

expenditures for the year.

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

According

to the CBO, Medicare Part D is the most significant expansion of the Medicare

program since it was created by Congress in 1965.

With

more than 1.48 billion claims from beneficiaries enrolled under the Part D

prescription drug benefit program under its umbrella, our analysis of Medicare

Part D provides valuable insights into how elderly Americans use prescription

drugs.

Top 10 drugs by

cost: The ones that bore the highest cost burden for Medicare

As in 2015, in 2016

too Gilead’s Hepatitis C treatment — Ledipasvir/Sofosbuvir (Harvoni) — remained the single drug highest payout under the Medicare Part D Prescription Drug Program with a total cost of US$ 4.4 billion.

As Gilead continued

to face competition from AbbVie and Merck in the Hepatitis C space, the spending on Harvoni was down

37 percent from US$ 7.03 billion in 2015.

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Celgene’s cancer treatment, Lenalidomide (Revlimid), Sanofi and Merck’s diabetes treatments and AstraZeneca’s Crestor (Rosuvastatin Calcium) for

cholesterol followed Harvoni. All together, they cost the Medicare program over US$ 10 billion.

Generic Name

Number of Medicare Part D Claims

Number of Medicare Beneficiaries

Number of Prescribers

Aggregate Cost Paid for Part D

Claims (In USD)

LEDIPASVIR/ SOFOSBUVIR (HARVONI)

141,665

52,782

12,097

4,398,534,465

LENALIDOMIDE

239,049

35,368

10,382

2,661,106,127

LANTUS SOLOSTAR (INSULIN

GLARGINE, HUM.REC.ANLOG )

5,028,485

1,075,248

245,447

2,526,048,766

SITAGLIPTIN PHOSPHATE

4,742,505

864,442

206,223

2,440,013,513

ROSUVASTATIN CALCIUM

6,012,444

1,560,050

249,981

2,322,724,007

FLUTICASONE/SALMETEROL

5,194,391

1,196,007

275,442

2,319,808,482

PREGABALIN

4,940,115

852,497

267,532

2,098,953,250

RIVAROXABAN

4,403,332

807,820

252,141

1,954,748,890

APIXABAN

4,455,782

826,969

231,631

1,926,107,484

TIOTROPIUM BROMIDE

4,153,162

903,494

235,564

1,818,857,361

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Top 10 drugs by claims: The most commonly

used drugs of 2016

With 46.6 million claims, the thyroid hormone deficiency treatment — Levothyroxine Sodium — retained its position of being the most claimed product under Medicare’s Part D Prescription Drug Program in 2016.

The number of

Medicare Part D claims includes original prescriptions and refills.

Following Levothyroxine Sodium was the lipid-lowering agent — Atorvastatin Calcium — which had 44.5 million Medicare Part D claims that

were filed by almost 9.4 million beneficiaries.

Generic

Name

Number

of Prescribers

Number

of Medicare Part D Claims

Number

of Medicare Beneficiaries

LEVOTHYROXINE SODIUM

669,999

46,617,109

8,091,785

ATORVASTATIN CALCIUM

494,973

44,595,686

9,435,633

AMLODIPINE BESYLATE

497,017

39,913,468

7,802,905

LISINOPRIL

490,452

39,469,840

8,009,954

OMEPRAZOLE

492,951

32,909,236

7,001,160

METFORMIN HCL

611,700

31,007,932

6,394,014

SIMVASTATIN

380,560

29,687,947

6,201,911

HYDROCODONE/ACETAMINOPHEN

660,617

28,595,150

7,265,882

FUROSEMIDE

488,352

27,878,243

5,421,598

GABAPENTIN

555,997

27,627,466

5,363,382

Click here

to access the compilation of Medicare Part D Prescriber Summary Report

Top 10 drugs by prescribers: Medicines that were most popular with

doctors

Among the prescribers, albuterol sulfate (salbutamol) and Diltiazem had

over 900,000 unique providers (or

doctors) prescribing the drug.

Albuterol (salbutamol) is

used to provide quick relief from wheezing and shortness

of breath while Diltiazem is used to prevent chest

pain (angina).

Also

on the list of popular drugs with prescribers is Hydrocodone-Acetaminophen.

With more doctors prescribing Hydrocodone-Acetaminophen (an

opioid) than commonly used antibiotics, such as Cephalexin, Ciprofloxacin and Amoxicillin, the

series of new FDA initiatives to combat the epidemic of opioid misuse and abuse

should change the position of opioids in the top 10 drugs by prescribers in the

coming years.

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Generic

Name

Number of

Prescribers

Number of

Medicare Part D Claims

Number of

Medicare Beneficiaries

ALBUTEROL SULFATE

985,427

13,100,354

5,417,718

DILTIAZEM HCL

931,159

8,142,004

1,982,550

POTASSIUM CHLORIDE

879,491

18,945,969

4,278,000

PEN NEEDLE, DIABETIC

677,210

5,281,778

1,795,046

LEVOTHYROXINE SODIUM

669,999

46,617,109

8,091,785

HYDROCODONE/ACETAMINOPHEN

660,617

28,595,150

7,265,882

METFORMIN HCL

611,700

31,007,932

6,394,014

CEPHALEXIN

597,647

5,603,879

3,933,373

CIPROFLOXACIN HCL

594,129

7,000,081

4,851,657

AZITHROMYCIN

591,028

7,958,625

5,734,122

What does the

future hold?

Although the Part D Prescriber PUF (public use file) has a wealth of information on payment and utilization for Medicare Part D prescriptions, the dataset has a number of limitations. Of particular importance is the fact that the data may not be representative of a physician’s entire practice or all of Medicare as it only includes information on beneficiaries enrolled in the Medicare Part D prescription drug program (i.e., approximately two-thirds of all Medicare beneficiaries).

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Last

month, the Office of the Inspector General (OIG)

reviewed

the Part D claims data for the years 2011 to 2015 for brand-name drugs.

The OIG’s report found that the total reimbursement for all brand-name drugs in Part D increased 77 percent from 2011 to 2015, despite a 17-percent decrease in the number of prescriptions for these drugs.

With soaring drug prices being an issue for

regular debate in the Unites States and President Trump announcing that his

team will use strategies to strengthen the negotiating powers under

Medicare Part D and Part B, it remains to be seen how the data on prescription drugs paid for under

the Medicare Part D Prescription Drug Program will change in the coming years.

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Impressions: 2500

This week, Phispers brings you news on J&J’s plans to acquire Actelion and Teva’s new medical cannabis inhaler due for launch in Israel. There are pharma deals from across the globe, such as Roche’s decision to sell its South Carolina plant and Catalent’s acquisition of Accucaps.M&A Compass: Roche sells API plant; Catalent laps up

Accucaps; Teva

announces layoffsSwiss drug maker Roche is selling its

active pharmaceutical ingredients (API) plant in South Carolina (US) to Patheon NV, a

leading global provider of high-quality drug development and delivery solutions

to the pharmaceutical and biopharma sectors. The deal will save 200 jobs in South Carolina. Patheon has also

entered into a multi-year supply arrangement with Roche. Meanwhile, Catalent, Inc has acquired Accucaps Industries Limited, a Canada-based developer and manufacturer of over-the-counter (OTC), high potency and conventional pharmaceutical softgels. The acquisition is subject to approval by the Canadian government. It will substantially complement Catalent’s global OTC and prescription pharmaceutical softgel capabilities and capacity.While Patheon and Catalent are making acquisitions, Teva

announced layoffs, and Pfizer cancelled its expansion plans in Ireland. Two

ministers of Malta announced that Teva

Pharmaceutical Industries will be laying off over 200 workers before the end of 2017.

Earlier this year, Teva had acquired Actavis Generics and recently informed the government of its decision to start “consolidating production” around its 30 plants in Europe and that it would also lay off workers in Malta.Meanwhile, Pfizer has cancelled a planned US $ 425 million

expansion of its Grange Castle plant in Dublin, a development which would have

led to permanent employment for 350 people and 1,250 jobs during construction.Pfizer is one of Ireland’s largest private sector employers. It had sought permission earlier this year for a major extension to the plant. However, the plans have been shelved due to failure of a high-profile, late-stage pipeline drug to lower cholesterol.Teva to market medical

cannabis inhaler in Israel

For the first time, the medical cannabis sector managed to comply with the pharmaceutical standards for inhalation. Israel’s Teva Pharmaceuticals has partnered with Tel Aviv-based Syqe Medical to market medical cannabis in Israel for pain management. The dose is administered with the help of an inhaler — the most efficient means of administering cannabis.Teva will be the exclusive marketer and distributor of the inhaler in Israel. The inhaler, which is pending approval from Israel’s ministry of health, will be available for home use.J&J approaches Actelion for acquisition; Actelion says no

guarantee of the deal

Last week, Switzerland’s leading biopharmaceutical company — Actelion Ltd — confirmed that it has been approached by the US healthcare titan Johnson & Johnson for a possible takeover. Actelion is focused on the

discovery, development and commercialization of innovative drugs, and is a

leader in the field of pulmonary arterial hypertension (PAH).However, Actelion said there is no guarantee of the deal. Actelion chief executive Jean-Paul Clozel desires

to keep the company independent after building it from scratch. And news

reports say J&J will have to pay a steep premium if a takeover is to

succeed.Actelion's rare-disease focus makes it an attractive target,

since its drugs face less price pressure than other more widely used medicines.

There are other reasons why the takeover looks improbable. First, Actelion’s market capitalization far outstrips its net present value. Second, President-elect Donald Trump’s proposed repatriation holiday may come in the way of J&J making the acquisition.Drugs in India fail quality standards; Vietnam bans major

Indian manufacturersThis was a bad week for Indian pharma. Drug regulators of seven

Indian states alleged that 27 medicines — sold by 18 major drug companies — are of “substandard” quality. These were cited with false labelling, wrong quantity of ingredients, discoloration, moisture formation, failing dissolution test and failing disintegration test.The tests on the 27 medicines were done by drug regulators of

Maharashtra, Karnataka, West Bengal, Goa, Gujarat, Kerala and Andhra Pradesh.

The drug makers include Abbott India, GSK India, Sun Pharma, Cipla and Glenmark Pharma, Alkem Labs, Cadila Healthcare, Emcure Pharma, Hetero Labs, Morepen Labs, Macleods Pharma, Wockhardt Pharma and Zydus Healthcare.The drug brands alleged to be substandard are: antipsychotic drug

Stemetil

and antibiotic drug Pentids

from Abbott India, anti-bacterial medicine Althrocin

by Alembic Pharma, migraine medication Vasograin by Cadila Pharma, cough syrup Ascoril by Glenmark Pharma, worm infection drug Zentel

by GSK India, arthritis medication Hydroxychloroquine

(HCQS) by Ipca Labs, anti-inflammatory medication Myoril

by Sanofi Synthelabo, and Torrent Pharma’s hypertension drug Dilzem.In Parliament, the minister of state for health said that drugs,

which are banned in other countries, have been allowed to be sold in India subject to

certain provisions. The drugs which have been allowed in India are nimesulide, analgin and pioglitazone. What was worse, Vietnam blacklisted 39 Indian drug companies,

including Aurobindo Pharma, Cadila and Macleods Pharmaceuticals for

quality standard violations. The Vietnamese drug regulator has also banned

companies in Bangladesh and South Korea. The regulator has listed the names of

blacklisted companies on its website.FDA’s quality metrics programme to be voluntary till 2018Last week, the US Food and Drug Administration (FDA) released a revised version of its proposal to

collect quality metrics data from drug manufacturers in response to protests

from the industry.As per the revised draft, the program will begin with a voluntary

phase that will run into 2018, after which the FDA intends to make the program mandatory.The revised draft guidance also narrows the scope of the program by

cutting the number of metrics the agency plans to ask for. It also grants more

flexibility with quality metrics to drug companies that are reporting by both

product and site."The revised draft guidance includes the following changes

from the earlier draft guidance: Adoption of a phased-in (voluntary) approach,

reduction in the number of data elements requested (i.e., reduction in

reporting burden), support for both product reports and site reports,

modifications to the quality metrics data definitions, addition of clarifying

examples for the definitions, addition of comment fields, and clarification of

special considerations for non-application and OTC (over-the-counter) product

reporting," the FDA said.EMA publishes results of two more clinical studiesThe European Medicines Agency (EMA) has published clinical data for two more medicines — Armisarte and Caspofungin — on its clinical data website. The clinical data website was launched on October 20, 2016, when the EMA had added clinical data for Kyprolis

and Zurampic.

The website is in line with the EMA’s policy on the publication of clinical data.Armisarte,

a hybrid product (a product that is similar to its reference product but is

available in a different pharmaceutical form), is indicated for the treatment

of malignant pleural mesothelioma lung cancer and advanced non-small-cell lung

cancer.Caspofungin Accord, a generic product, is indicated for the

treatment of invasive candidiasis, invasive aspergillosis and other fungal

infections when the patient is febrile and neutropenic.Pharmaceuticals most counterfeited category, says reportA new report cites pharmaceuticals as the most targeted category for

counterfeiting. Globalization and the booming use of the internet is giving a

boost to counterfeiting.The report has been launched by online brand protection firm, NetNames. Titled The Risks of

the Online Counterfeit Community, the report looks at online

counterfeiting. It warns that no brand can afford to underestimate the

sophistication of fraudsters in the digital world.The size of the counterfeit market for pharmaceuticals is

estimated at US $ 200 billion, followed by electronics (US $ 169 billion) and

food (US $ 49 billion). According to NetNames, one in six products bought online is fake. And one-third

of all counterfeit seizures in the EU are linked to internet distribution

channels.According to NetNames, there are up to 50,000 internet pharmacies

in operation. Around 95 per cent of

these do not comply with laws and industry standards. Meanwhile, 90 per cent of

drugs purchased online come from a different country than what the website

claims. According to the report, the internet provides counterfeiters

with anonymity, virtually no barriers to entry, low overheads, easier

distribution with more frequent, smaller consignments sent by mail, and fewer

risks of being caught. And the desire by consumers to seek out big brands

online at discount prices, is providing counterfeiters with a ready target

audience and the opportunity to further the fraudsters' reach and potential

profitability.Trump announces Tom Price as health secretaryThis week, America’s President-elect Donald Trump announced Republican US Representative Tom Price as his Health and Human Services

Secretary. Price is an orthopedic surgeon from Georgia.Seema Verma, the founder of a health policy consulting company,

will lead the Centres for Medicare and Medicaid Services, which is part of

Health and Human Services (HHS).Meanwhile, Trump is expected to name Steven Mnuchin, a former Goldman Sachs partner and Hollywood financier, as his nominee for the post of Treasury Secretary. Mnuchin, who spent 17 years at Goldman Sachs before leaving in 2002 to launch a hedge fund, served as Trump's campaign finance chairman. Billionaire investor Wilbur Ross, known for his investments in distressed industries, is expected to be named Commerce Secretary.

Impressions: 3282