Acquisitions and spin-offs dominated headlines in 2019 and the tone was set very early with Bristol-Myers Squibb acquiring

New Jersey-based cancer drug company Celgene in a US$ 74 billion deal announced on

January 3, 2019. After factoring

in debt, the deal value ballooned to about US$ 95 billion, which according

to data compiled by Refinitiv, made it the largest healthcare deal on

record.

In the summer, AbbVie Inc,

which sells the world’s best-selling drug Humira, announced its acquisition of Allergan Plc, known for Botox and other cosmetic

treatments, for US$ 63 billion. While the companies are still awaiting

regulatory approval for their deal, with US$ 49 billion in combined 2019

revenues, the merged entity would rank amongst the biggest in the industry.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

The big five by pharmaceutical sales — Pfizer,

Roche, J&J, Novartis and Merck

Pfizer

continued

to lead companies by pharmaceutical sales by reporting annual 2019 revenues of

US$ 51.8 billion, a decrease of US$ 1.9 billion, or 4 percent, compared to

2018. The decline was primarily attributed to the loss of exclusivity of Lyrica in 2019,

which witnessed its sales drop from US$ 5 billion in 2018 to US$ 3.3 billion in

2019.

In 2018, Pfizer’s then incoming CEO Albert Bourla had mentioned that the company did not see the need for any large-scale M&A activity as Pfizer had “the best pipeline” in its history, which needed the company to focus on deploying its capital to keep its pipeline flowing and execute on its drug launches.

Bourla stayed true to his word and barring the acquisition of Array Biopharma for US$ 11.4 billion and a spin-off to merge Upjohn, Pfizer’s off-patent branded and generic established medicines business with

Mylan, there weren’t any other big ticket deals which were announced.

The

Upjohn-Mylan merged entity will be called Viatris and is expected to have 2020

revenues between US$ 19 and US$ 20 billion

and could outpace Teva to

become the largest generic company in the world, in term of revenues.

Novartis, which had

followed Pfizer with the second largest revenues in the pharmaceutical industry

in 2018, reported its first full year earnings after spinning off its Alcon eye

care devices business division that

had US$ 7.15 billion in 2018 sales.

In 2019,

Novartis slipped two spots in the ranking after reporting total sales of US$

47.4 billion and its CEO Vas Narasimhan continued his deal-making spree by buying New

Jersey-headquartered The Medicines Company (MedCo) for US$ 9.7

billion to acquire a late-stage cholesterol-lowering

therapy named inclisiran.

As Takeda Pharmaceutical Co was

busy in 2019 on working to reduce its debt burden incurred due to its US$ 62

billion purchase of Shire Plc, which was announced in 2018, Novartis also purchased

the eye-disease medicine, Xiidra, from the Japanese drugmaker for US$ 5.3 billion.

Novartis’ management also spent a considerable part of 2019 dealing with data-integrity concerns which emerged from its 2018 buyout of AveXis, the

gene-therapy maker Novartis had acquired for US$ 8.7 billion.

The deal gave Novartis rights to Zolgensma,

a novel treatment intended for children less than two years of age with the

most severe form of spinal muscular atrophy (SMA). Priced at US$ 2.1 million,

Zolgensma is currently the world’s most expensive drug.

However,

in a shocking announcement, a month after approving the drug, the US Food and

Drug Administration (FDA) issued a press release on

data accuracy issues as the agency was informed by AveXis that

its personnel had manipulated data which

the FDA used to evaluate product comparability and nonclinical (animal)

pharmacology as part of the biologics license application (BLA), which was

submitted and reviewed by the FDA.

With US$

50.0 billion (CHF 48.5 billion) in annual pharmaceutical sales, Swiss drugmaker

Roche came in at number two position in 2019

as its sales grew 11 percent driven by

its multiple sclerosis medicine Ocrevus, haemophilia drug Hemlibra and cancer medicines Tecentriq and Perjeta.

Roche’s newly introduced medicines generated US$ 5.53 billion (CHF 5.4 billion) in growth, helping offset the impact of the competition from biosimilars for its three best-selling drugs MabThera/Rituxan, Herceptin and Avastin.

In late 2019, after months of increased

antitrust scrutiny, Roche completed

its US$ 5.1 billion acquisition of Spark Therapeutics to strengthen its presence in

gene therapy.

Last year, J&J reported almost flat worldwide sales of US$ 82.1 billion. J&J’s pharmaceutical division generated US$ 42.20 billion and its medical devices and consumer health divisions brought in US$ 25.96 billion and US$ 13.89 billion respectively.

Since J&J’s consumer health division sells analgesics, digestive health along with beauty and oral care products, the US$ 5.43 billion in consumer health sales from over-the-counter drugs and women’s health products was only used in our assessment of J&J’s total pharmaceutical revenues. With combined pharmaceutical sales of US$ 47.63 billion, J&J made it to number three on our list.

While the sales of products like Stelara, Darzalex, Imbruvica, Invega Sustenna drove J&J’s pharmaceutical business to grow by 4 percent over 2018, the firm had to contend with generic competition against key revenue contributors Remicade and Zytiga.

US-headquartered Merck, which is known as

MSD (short for Merck Sharp & Dohme) outside the United States and

Canada, is set to significantly move up the rankings next year fueled by its

cancer drug Keytruda, which witnessed a 55

percent increase in sales to US$ 11.1 billion.

Merck reported total revenues of US$ 41.75 billion and also

announced it will spin off its women’s health drugs,

biosimilar drugs and older products to create a new pharmaceutical

company with US$ 6.5 billion in annual revenues.

The firm had anticipated 2020 sales between US$ 48.8 billion and US$ 50.3 billion however this week it announced that the coronavirus pandemic will reduce 2020 sales by more than $2 billion.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

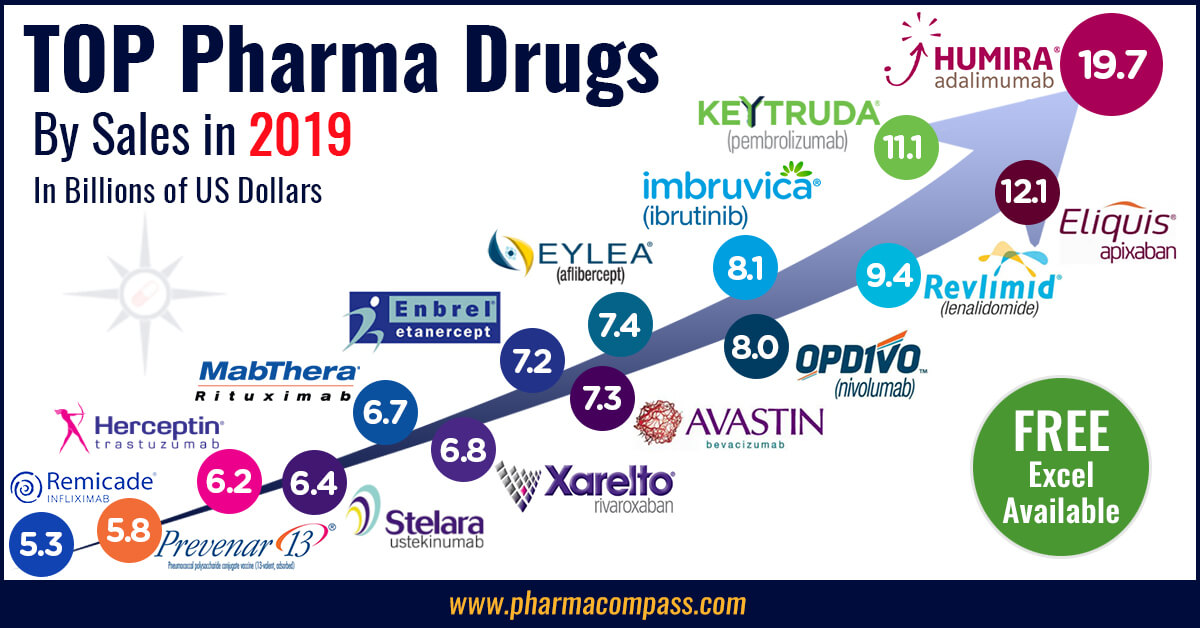

Humira holds on to remain world’s best-selling drug

AbbVie’s acquisition of Allergan comes as the firm faces the expiration of patent protection for Humira, which brought in a staggering US$ 19.2 billion in sales last year for

the company. AbbVie has failed to successfully acquire or develop a major new

product to replace the sales generated by its flagship drug.

In 2019, Humira’s US revenues increased 8.6 percent to US$ 14.86 billion while internationally, due

to biosimilar competition, the sales dropped 31.1 percent to US$ 4.30 billion.

Bristol Myers Squibb’s Eliquis, which is also marketed by Pfizer, maintained its number two position

and posted total sales of US$ 12.1 billion, a 23 percent increase over 2018.

While Bristol Myers Squibb’s immunotherapy treatment Opdivo, sold in partnership with Ono in Japan, saw sales increase from US$ 7.57 billion to US$ 8.0 billion, the growth paled in comparison to the US$ 3.9

billion revenue increase of Opdivo’s key immunotherapy competitor Merck’s Keytruda.

Keytruda took the number three spot in drug sales that

previously belonged to Celgene’s Revlimid, which witnessed a sales decline from US$ 9.69 billion to US$ 9.4 billion.

Cancer treatment Imbruvica, which is marketed

by J&J and AbbVie, witnessed a 30 percent increase in sales. With US$ 8.1

billion in 2019 revenues, it took the number five position.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Vaccines – Covid-19 turns competitors into partners

This year has been dominated by the single biggest health emergency in years — the novel coronavirus (Covid-19) pandemic. As drugs continue to fail to meet expectations, vaccine development has received a lot of attention.

GSK reported the highest vaccine sales of all drugmakers with

total sales of US$ 8.4 billion (GBP 7.16 billion), a significant portion of its

total sales of US$ 41.8 billion (GBP 33.754 billion).

US-based Merck’s vaccine division also reported a significant increase in sales to US$ 8.0 billion and in 2019 received FDA and EU approval to market its Ebola vaccine Ervebo.

This is the first FDA-authorized vaccine against the deadly virus which causes

hemorrhagic fever and spreads from person to person through direct contact with

body fluids.

Pfizer and Sanofi also reported an increase in their vaccine sales to US$ 6.4

billion and US$ 6.2 billion respectively and the Covid-19 pandemic has recently

pushed drugmakers to move faster than ever before and has also converted

competitors into partners.

In a rare move, drug behemoths — Sanofi and GlaxoSmithKline (GSK) —joined hands to develop a vaccine for the novel coronavirus.

The two companies plan to start human trials

in the second half of this year, and if things go right, they will file

for potential approvals by the second half of 2021.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Our view

Covid-19 has brought the world economy to a grinding halt and shifted the global attention to the pharmaceutical industry’s capability to deliver solutions to address this pandemic.

Our compilation shows that vaccines and drugs

for infectious diseases currently form a tiny fraction of the total sales of

pharmaceutical companies and few drugs against infectious diseases rank high on

the sales list.

This could well explain the limited range of

options currently available to fight Covid-19. With the pandemic currently infecting

over 3 million people spread across more than 200 countries, we can safely

conclude that the scenario in 2020 will change substantially. And so should our

compilation of top drugs for the year.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Impressions: 54754

In October

2016, the US Food and Drug Administration (FDA) inspected a facility in India

belonging to Granules India that manufactures pharmaceutical

formulation intermediates (PFIs) and finished dosage forms (FDFs). The FDA had

no observations.

Three months later, Portugal’s health authority — INFARMED — inspected the same site and detected non-conformities in good manufacturing practices (GMPs).

According to an alert published

on the INFARMED website, the observations were related to granulation and

primary packaging of tablets in batches of drugs related to paracetamol and metformin supplied by Granules to Mylan, Bluepharma and Sandoz. The agency recommended the

suspension and recall of certain batches from the market in Portugal.

Last week, based on “General GMP Observations” of “regulatory partner(s)”, Health Canada placed Granules India’s facility located in Gagillapur (near Hyderabad) on its inspection tracker. Health Canada’s inspection tracker provides updates on the actions the regulator is undertaking to assess and manage potential risks arising from inspections of drug manufacturing facilities.

According to

Granules, their facility in Gagillapur contributes over 50 percent to their revenues and “has the world’s largest PFI capacity along with an industry-leading batch size of six tons. In addition, the Gagillapur facility has one of the largest single-site finished dosage capacities in the world for their respective products.”

In a recent

interview, C. Krishna Prasad, managing director of Granules India, said there

were no issues related to data integrity and INFARMED is scheduled to re-inspect

the Gagillapur facility this week.

Data

integrity concerns at ACS Dobfar’s

Italian facility

The FDA’s April 2016 inspection of ACS Dobfar’s

operations in Brazil — Antibioticos do Brasil (ABL) — led to the issuance of a warning letter in December. Among other observations, the FDA investigators found that the filling zone for sterile injectable product was not sufficiently robust. Therefore, it didn’t protect the drugs being manufactured there (such as during the times when operators entered the final filling area).

Almost immediately after the warning letter was issued, an inspection of the same facility by the Italian Regulatory Agency (AIFA) found it not-compliant for the manufacture of the active ingredient — Cephalexin Sodium Sterile. AIFA also recommended the

suspension of the Certificate of Suitability issued for ceftazidime pentahydrate with sodium carbonate for injection.

The inspectors

found ABL failed to ensure a good level of maintenance and cleaning of the

final crystallization area and there was a poor level of training, low

knowledge and awareness of good manufacturing practices (GMP) along with lack of supervisory

control.

The

non-compliance report also mentions that some non-authorized and fraudulent

activities were stopped before inspectors entered certain manufacturing areas.

Fraudulent activities were not limited to Brazil, as ACS Dobfar’s Italian drug manufacturing facility — FACTA Farmaceutici SpA — had FDA investigators uncover data-integrity violations during a January 2016 inspection.

The warning

letter issued to FACTA mentions that for multiple lots of sterile drug product,

where the original data showed failing results, the data reportedly showed

passing results.

The company was found storing original data in an “unofficial” and uncontrolled electronic spreadsheet on a shared computer network drive. The analyst told investigators that original data was first recorded in the “unofficial” spreadsheet and later transcribed to an “official” form.

Investigators also observed many

copies of uncontrolled blank and partially-completed cGMP forms and also

documented that employees at FACTA used paper shredders to destroy critical

laboratory and production records.

It is worth mentioning that FACTA’s EU GMP certification was renewed by the Italian regulators after an inspection that was conducted at the same time as the FDA inspection.

Data integrity concerns confirmed at Divi’s Laboratories in India

Divi’s Laboratories’ Unit-II situated in Visakhapatnam, Andhra Pradesh — one of the biggest manufacturing facilities for the major producer of active pharmaceutical ingredients (APIs) — was inspected by the US FDA from November 29 to December 6, 2016.

The regulators

issued a Form 483 with five observations.

While data integrity concerns had been widely reported in news media,

Health Canada confirmed the violations by placing the company on its inspection

tracker last week.

FDA’s warning letter comes to haunt Dr. Reddy’s

South Korean biotech firm — Mezzion Inc — filed a suit for damages

against Dr. Reddy’s in New Jersey state court alleging that it hid “significant deficiencies in its FDA cGMP practices” and misrepresented its compliance.

Mezzion has stated in its suit that “Dr. Reddy's repeatedly represented to Mezzion that it was compliant with FDA regulations” whereas the FDA issued a warning letter to Dr. Reddy's.

During an FDA inspection at Dr. Reddy's facilities in India, the FDA identified numerous data integrity violations and also uncovered a previously unknown and uncontrolled “Custom QC laboratory” (CQC), which engaged in a “practice of substituting repeat tests after failing results.”

Mezzion further states: “Dr. Reddy’s misconduct was the sole reason given by the FDA to deny approval of Mezzion’s new drug application (NDA) for udenafil for the treatment of erectile dysfunction (ED)”. As a result, Mezzion has incurred delays and was forced to seek new manufacturers and suppliers for udenafil and the udenafil finished product, in order to resubmit its udenafil New Drug Application (NDA) to the FDA for approval.

FDA’s warning letters to

manufacturers in UK and India

Porton Biopharma, UK: A

warning letter was

issued to the UK-based Porton Biopharma by the US FDA for manufacturing violations related to Erwinaze (asparaginase Erwinia chrysanthemi) — an orphan biologic which was developed by Porton and licensed to Jazz Pharmaceuticals.

According to the warning letter, the FDA had previously performed an inspection of Porton’s facility in January 2015 and found similar concerns. The inspection between March 7 and 18, 2016,

which triggered the warning letter,

had FDA investigators observe continued deficiencies, including metal particles

which penetrated a few batches of Erwinaze, another batch containing paper or

cardboard fibers and a possible microbial contamination.

While Porton

believed that vial stoppers were the source of the metal scraps, the FDA

investigators were not convinced.

Erwinaze

generated around US $ 43 million in the third quarter for Jazz Pharmaceuticals, accounting for more than 10 percent of the company’s revenues.

CTX Life Sciences, India: The FDA issued a warning letter to CTX Life Sciences in India after making observations of rust, insects, damaged interiors, and/or drug residues in pieces of manufacturing equipment identified as “clean”.

Investigators also found that the API were released without testing because the necessary laboratory equipment was out of order. While the company had decided to release batches “on conditional basis and as soon as UV maintenance issue rectified analysis shall be performed” the investigators could find no trace of the testing.

Our view

Last week, in

our compliance round up, we had reported the shredding of documents at Hetero Labs in India. And this week, similar issues have surfaced in

Italy.

It’s clear that corrupt practices of data integrity are spreading across the industry and are no longer confined to a region.

At the same time, while both European and US regulators reached a similar outcome on the compliance status of Antibioticos do Brasil, the divergent views at Granules India and FACTA Farmaceutici indicate the urgency for regulators to establish a consistent global evaluation standard for pharmaceutical manufacturing.

Impressions: 9420

This week’s Phispers takes you through pharmaceutical news from across the globe – from Joe Biden’s computer aided cancer moonshot to AbbVie’s second largest venture capital buyout in history and a lot more. After GMP troubles,

migraine patch gives Teva a fresh headacheLast week, Phispers carried news on Teva’s facility

in Hungary, which was placed on the US Food and Drug Administration’s import alert list. The FDA inspection had found the plant not conforming to the current good manufacturing practices (GMPs). This week, there is more bad news for Teva Pharmaceuticals. The company had bought NuPathe in early 2014 for about US $ 114 million. Through this acquisition, Teva had got its hands on the only migraine patch approved in the US – known as Zecuity. The patch first hit the market in September 2015. However, in less than a year of its launch, Teva's Zecuity

is under

the FDA radar for concerns over “serious” adverse events including burning and scarring. Moreover, a large number of users have also reported other problems, such as severe redness, pain, skin discoloration, blistering and cracked skin, the FDA said. Britain’s Patel brothers do a Martin Shkreli on drugs needed by NHSWhile America’s Martin Shkreli faced additional

criminal charges this week of conspiracy to commit securities fraud during

his tenure as the CEO of Retrophine (2012 to 2014), Britain saw its own avatars of Shkreli. Millionaire brothers Vijay and Bhikhu Patel, also known as ‘Bollygarchs’ – have been accused of being part of a group of businesses that hike up prices of common drugs needed by the National Health Service (NHS), the publically-funded healthcare system for England. The Patel brothers have allegedly exploited a loophole in NHS’ pricing system. Today the four businesses, including two with past and present links to the Patel siblings, have allegedly hiked the price of common drugs by up to 12,500 per cent. The unreasonably high prices have cost the NHS an additional £ 262 million (US $ 381 million) a year. This sum has conveniently gone into the pockets of the Patel siblings and their associates. Cancer treatment

least affordable in India and ChinaWhile we all know that Americans pay the highest prices in

the world for cancer drugs, a new study highlights how cancer treatments are

least affordable in lower income countries. The study – presented at the annual meeting of the American Society of Clinical Oncology in Chicago – looked at the prices of cancer drugs in seven countries, while not taking into account discounts or rebates. The lowest drug prices were found in India and South Africa.

But then, when adjusted for the cost of living, cancer drugs appeared to be

least affordable in India and China. The study only strengthens the case for politicians,

healthcare providers, doctors, insurers and patients, who have been opposing

the high prices commanded by modern cancer drugs. Drug companies justify the

high prices, citing the high cost of drug research and the need to make profits

to continue spending on research and drug development. Sun Pharma sells two

US facilities to Frontida BioPharmaSun

Pharmaceuticals – India’s largest drug maker – is

selling off two oral solid dosage manufacturing plants in the US to

Frontida BioPharm Inc. (a part of Frontage

Pharma). The sell-off is part of Sun Pharma’s plans to consolidate its manufacturing facilities in the US. The plants are situated in Philadelphia and Illinois. Sun Pharma earns about half of its total revenues from the

US. And this is the drug maker’s second divestment in the US in the last six months. In December, it had divested

its manufacturing plant in Ohio to Nostrum

Laboratories. The company is also looking to sell facilities and business

units from the Ranbaxy

portfolio. In September 2015, it put

a plant in Ireland on the block to optimize its overall manufacturing base and

also sold

the central nervous system business (of erstwhile Ranbaxy) to Strides

Shasun for INR 1.65 billion (US $ 24.8 million). China’s Fosun leads the race for India’s Gland Pharma with US $ 1.27 billion bidLast week, Hong Kong-listed Shanghai

Fosun (Fosun Pharma) revised its offer to buy KKR-backed Gland

Pharma to US

$ 1.27 billion, the highest so far.

American healthcare company Baxter

International and private equity fund Advent made their offers in May. The frontrunner for Gland Pharma, until recently, was Baxter

with its bid at US $1.1 billion, a news report said. Fosun Pharma is part of Chinese billionaire Guo Guangchang’s extensive business empire. Fosun is believed to have completed its due diligence on Gland Pharma sometime last week. Final negotiations are planned for next week, and we hope to hear a formal announcement on Gland Pharma sometime in the third week of June. Joe Biden launches

open-access cancer database as part of the Cancer Moonshot InitiativeOn Monday, American Vice President Joe Biden announced the

launch of an open-access

cancer database that will allow researchers to better understand cancer and

develop more effective treatments. This first of its kind database, a part of the National

Cancer Moonshot initiative, known as the Genomic Data Commons (GDC), contains

the raw genomic and clinical data of 12,000 patients. The database has detailed

analyses of the molecular makeup of cancers and information on which treatments

were used and how patients responded. The database will encourage the much-needed collaboration

among scientists in different disciplines to research important aspects of

cancer and find new ways to help patients, Biden told doctors. Medicines containing

aspirin can cause stomach bleeding, warns FDAAspirin-containing

medicines to treat heartburn, sour stomach, acid indigestion, or upset stomach

can cause stomach or

intestinal bleeding, warns the USFDA. Since aspirin thins the blood, FDA believes the aspirin in

these combination medicines is contributing to major bleeding events. The

instances of bleeding, however, are rare. In 2009, FDA had issued a warning about serious stomach bleeding risk with aspirin and other non-steroidal anti-inflammatory drugs (NSAIDs). When FDA reviewed its Adverse Event Reporting System database, it found eight new cases of serious bleeding caused by aspirin-containing antacid products since the 2009 warning. Some of those patients required blood transfusion. “Take a close look at the Drug Facts label, and if the product has aspirin, consider choosing something else for your stomach symptoms,” an FDA official said. AbbVie blockbuster

buyout disappoints investorsOn Sunday, AbbVie began

explaining why it paid a whopping US $ 5.8 billion upfront – with US $ 4 billion reserved for milestones – for biotechnology company Stemcentrx and its cancer drug Rova-T (rovalpituzumab tesirine). AbbVie’s acquisition of Stemcentrx is the second largest venture-capital backed startup acquisition in history, after Facebook paid

$19 billion to buyout WhatsApp. However, the first set of data provided by AbbVie disappointed investors. Although the drug’s performance against small cell lung cancer, a disease which has not seen a change in survival rates since the 1970s, showed that 68 percent of the patients achieved a clinical benefit, the expectations from the investor community were much higher.Rova-T targets a protein called “DLL3 that is normally found only deep inside cells. But DLL3 winds up all over the outside of some types of cancer cells. Rova T pairs an antibody, which detects DLL3, with a powerful chemotherapy that kills the cells the antibody detects.” Major fire at Nectar

Lifesciences plant in Punjab, IndiaOn June 3, a fire

broke out in Unit-II of Nectar

Lifesciences Limited, a leading pharmaceutical company, in India. Huge

stocks of pharmaceutical products, chemicals and goods were destroyed in the

fire. However, no loss of human life was reported. The fire broke out around 9.15 pm at the solvent recovery

plant and spread to the other sections of the unit and caused damage. Fire tenders

had to be arranged from neighboring cities to douse the flames.Nectar Lifesciences is a manufacturer of both active

pharmaceutical ingredients and finished formulations with a focus on

antibiotics like Cefixime, Cefpodoxime

Proxetil, Ceftazidime

etc.

Impressions: 2092

Each year,

the US Food and Drug Administration (FDA) approve hundreds

of new medications. A small subset of approvals, classified as novel drugs, are considered to

be truly innovative products that often help advance clinical care.

In 2015, the

FDA approved 45 novel drugs, an all-time record high. PharmaCompass has compiled a list of novel drugs approved by the FDA in 2015.The FDA also approved new dosage forms of existing products in the market (email us if you would like a copy), like the 3D printed version of anti-epilepsy drug, Spritam (Levetiracetam).

This week, PharmaCompass focuses on the new dosage

forms of existing drugs that got approved last year.

Modified blockbusters

Improving the delivery form of a blockbuster drug is something that not only helps patients but often successfully extends the patent life of the cash-generating drugs for Big Pharma. Here are some blockbuster drugs that saw their modified versions being launched in 2015:

Jadenu (deferasirox): With

almost a billion dollars in revenues in 2015, Exjade (deferasirox) was approved in 2005 as a

tablet for use in a suspension. Novartis, the innovator,

got approval in March 2015

for Jadenu, a once-daily oral tablet. Jadenu (deferasirox), a new formulation

of Exjade, is the only once-daily oral tablet for iron chelation. Jadenu has

simplified daily treatment administration for patients with chronic iron

overload.

Nexium

24HR (esomeprazole magnesium): Also

known as the Purple Pill, Nexium – Astra

Zeneca’s blockbuster drug for acid reflux that generated annual sales in America of more than US $ 3 billion – went generic in 2015. In order to extend Nexium’s market, Pfizer and AstraZeneca came together to promote an over-the-counter (OTC) version of Nexium. A capsule version of OTC Nexium was approved in 2014 and is known as

Nexium 24HR. Last year, the FDA granted approval to the tablet form of the

drug.

Iressa

(gefitinib): AstraZeneca re-introduced Iressa in

the US market in 2015. The

FDA had approved Gefitinib in May 2003 for non-small cell lung cancer. Approved

as a third-line therapy, in 2010 the FDA requested AstraZeneca to voluntarily withdraw Iressa tablets

from the market, as post-marketing studies had failed

to verify and confirm clinical benefit. Iressa (gefitinib) is now back in the US as a first-line therapy for a type of lung cancer. However, the patent protection is limited – only one listed patent in the Orange Book which expires next year, and five US Drug Master Files already submitted.

Onivyde (irinotecan): Liposomal formulation of anti-cancer

drugs have been in vogue for some time. Merrimack Pharmaceuticals got its novel encapsulation of Irinotecan in a liposomal formulation approved for the

treatment of patients with metastatic pancreatic cancer, sold under the brand

name Onivyde.

Vivlodex (meloxicam): In October 2015, the FDA approved 5 mg and 10 mg (administered once daily) doses of Vivlodex™ (meloxicam) capsules, a nonsteroidal anti-inflammatory drug (NSAID) used for the management of osteoarthritis pain. The previously approved doses for meloxicam capsules were 7.5mg and 15mg. Vivlodex uses a proprietary SoluMatrix Fine Particle Technology™, which contains meloxicam as submicron particles that are approximately 10 times smaller than their original size. The reduction in particle size provides an increased surface area, leading to faster dissolution.

Kalydeco (ivacaftor): A cystic fibrosis drug from Vertex Pharmaceuticals – Kalydeco – has been making headlines

because of its high price (more than US $ 300,000 a year). Price concerns

aside, 2015 saw the launch of a pediatric version of the drug as a ‘weight-based oral granule formulation of Kalydeco that can be mixed in soft foods or liquids’.

Extended release versions

Many of

the approvals granted by the FDA last year were to extended release

formulations (a pill formulated so that the drug is released slowly) of

existing drugs.

Kremers Urban’s

extended release version of Methylphenidate

capsules made headlines last year because of a reclassification of the drug by

the FDA. Under the new classification rating, methylphenidate hydrochloride extended-release tablets can be prescribed but may

not be automatically substituted for J&J’s reference drug Concerta (methylphenidate hydrochloride). Kremers Urban was almost sold last year. But due to this reclassification, investors aborted their US $ 1.53 billion buyout. Kremers Urban was later acquired by Lannett Company Inc.

In

addition, extended-release versions of Aspirin, Carbidopa/Levodopa, Paliperidone Palmitate, Tacrolimus

and Morphine Sulphate also received green signals for a market launch.

First generic opportunities

Last year, PharmaCompass

shared the names of some drugs which had no generic competition and were also

not protected by patents. (Read: “Litigation Free, first generic opportunities list”).

Deferiprone (a drug that chelates iron and is

used to treat iron overload in thalassemia major) met the criteria. But it still

has no generic competitor and is now available as a new dosage form.

Amedra Pharmaceuticals, now owned by Impax Laboratories, has enjoyed the rights to sell Albendazole tablets for almost two decades

without generic competition in the US. Albendazole is a medication used for the

treatment of a variety of parasitic worm infestations. In 2015, patients were

provided access to chewable tablets of Albendazole.

New combinations at work

The FDA also approved

multiple combination drugs where the individual active ingredients had been brought

to market previously.

Most of the combination drugs

approved belong to major pharma players like Novartis, Novo Nordisk, Bristol Myers etc.

Boehringer’s diabetes treatments – Jardiance (empagliflozin) – approved in 2014 and

Tradjenta (linagliptin) approved in 2011, were

combined and the combination drug product Glyxambi was approved in 2015. Another

combination of empagliflozin, with metformin – Synjardy – was also approved in August last

year.

Lesser known companies also

got combination drugs approved. UK-based

development company Vernalis got approval for its cold-cough treatment, Tuzistra XR – an extended release suspension of codeine polistirex and chlorpheniramine

polistirex.

Similarly, US-based biopharmaceutical startup, Spriaso LLC, also

working in the cold and cough therapeutic area, got an extended release tablet

containing codeine phosphate and chlorpheniramine maleate approved.

Symplmed, a company which is

developing various forms of Perindopril, got approval for Prestalia (a

combination of perindopril arginine and amlodipine besylate) for the

treatment of hypertension.

Our view

Each year, the FDA approves several

pharmaceutical drugs in order to improve patient care; and often versions of

these drugs are marketed and distributed across the globe.

PharmaCompass’ list of drugs approved in 2015 is now available – just email us for your copy.

Accelerate your drug development

PharmaCompass has also launched

the Drug Development Assistance tool on its platform.

Simply search for the drug or the active ingredient of your interest, click on the Drug Development icon on the left menu bar and you can see the inactive ingredients used to formulate

the various drug products approved in the United States.

Impressions: 5419