Acquisitions and spin-offs dominated headlines in 2019 and the tone was set very early with Bristol-Myers Squibb acquiring

New Jersey-based cancer drug company Celgene in a US$ 74 billion deal announced on

January 3, 2019. After factoring

in debt, the deal value ballooned to about US$ 95 billion, which according

to data compiled by Refinitiv, made it the largest healthcare deal on

record.

In the summer, AbbVie Inc,

which sells the world’s best-selling drug Humira, announced its acquisition of Allergan Plc, known for Botox and other cosmetic

treatments, for US$ 63 billion. While the companies are still awaiting

regulatory approval for their deal, with US$ 49 billion in combined 2019

revenues, the merged entity would rank amongst the biggest in the industry.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

The big five by pharmaceutical sales — Pfizer,

Roche, J&J, Novartis and Merck

Pfizer

continued

to lead companies by pharmaceutical sales by reporting annual 2019 revenues of

US$ 51.8 billion, a decrease of US$ 1.9 billion, or 4 percent, compared to

2018. The decline was primarily attributed to the loss of exclusivity of Lyrica in 2019,

which witnessed its sales drop from US$ 5 billion in 2018 to US$ 3.3 billion in

2019.

In 2018, Pfizer’s then incoming CEO Albert Bourla had mentioned that the company did not see the need for any large-scale M&A activity as Pfizer had “the best pipeline” in its history, which needed the company to focus on deploying its capital to keep its pipeline flowing and execute on its drug launches.

Bourla stayed true to his word and barring the acquisition of Array Biopharma for US$ 11.4 billion and a spin-off to merge Upjohn, Pfizer’s off-patent branded and generic established medicines business with

Mylan, there weren’t any other big ticket deals which were announced.

The

Upjohn-Mylan merged entity will be called Viatris and is expected to have 2020

revenues between US$ 19 and US$ 20 billion

and could outpace Teva to

become the largest generic company in the world, in term of revenues.

Novartis, which had

followed Pfizer with the second largest revenues in the pharmaceutical industry

in 2018, reported its first full year earnings after spinning off its Alcon eye

care devices business division that

had US$ 7.15 billion in 2018 sales.

In 2019,

Novartis slipped two spots in the ranking after reporting total sales of US$

47.4 billion and its CEO Vas Narasimhan continued his deal-making spree by buying New

Jersey-headquartered The Medicines Company (MedCo) for US$ 9.7

billion to acquire a late-stage cholesterol-lowering

therapy named inclisiran.

As Takeda Pharmaceutical Co was

busy in 2019 on working to reduce its debt burden incurred due to its US$ 62

billion purchase of Shire Plc, which was announced in 2018, Novartis also purchased

the eye-disease medicine, Xiidra, from the Japanese drugmaker for US$ 5.3 billion.

Novartis’ management also spent a considerable part of 2019 dealing with data-integrity concerns which emerged from its 2018 buyout of AveXis, the

gene-therapy maker Novartis had acquired for US$ 8.7 billion.

The deal gave Novartis rights to Zolgensma,

a novel treatment intended for children less than two years of age with the

most severe form of spinal muscular atrophy (SMA). Priced at US$ 2.1 million,

Zolgensma is currently the world’s most expensive drug.

However,

in a shocking announcement, a month after approving the drug, the US Food and

Drug Administration (FDA) issued a press release on

data accuracy issues as the agency was informed by AveXis that

its personnel had manipulated data which

the FDA used to evaluate product comparability and nonclinical (animal)

pharmacology as part of the biologics license application (BLA), which was

submitted and reviewed by the FDA.

With US$

50.0 billion (CHF 48.5 billion) in annual pharmaceutical sales, Swiss drugmaker

Roche came in at number two position in 2019

as its sales grew 11 percent driven by

its multiple sclerosis medicine Ocrevus, haemophilia drug Hemlibra and cancer medicines Tecentriq and Perjeta.

Roche’s newly introduced medicines generated US$ 5.53 billion (CHF 5.4 billion) in growth, helping offset the impact of the competition from biosimilars for its three best-selling drugs MabThera/Rituxan, Herceptin and Avastin.

In late 2019, after months of increased

antitrust scrutiny, Roche completed

its US$ 5.1 billion acquisition of Spark Therapeutics to strengthen its presence in

gene therapy.

Last year, J&J reported almost flat worldwide sales of US$ 82.1 billion. J&J’s pharmaceutical division generated US$ 42.20 billion and its medical devices and consumer health divisions brought in US$ 25.96 billion and US$ 13.89 billion respectively.

Since J&J’s consumer health division sells analgesics, digestive health along with beauty and oral care products, the US$ 5.43 billion in consumer health sales from over-the-counter drugs and women’s health products was only used in our assessment of J&J’s total pharmaceutical revenues. With combined pharmaceutical sales of US$ 47.63 billion, J&J made it to number three on our list.

While the sales of products like Stelara, Darzalex, Imbruvica, Invega Sustenna drove J&J’s pharmaceutical business to grow by 4 percent over 2018, the firm had to contend with generic competition against key revenue contributors Remicade and Zytiga.

US-headquartered Merck, which is known as

MSD (short for Merck Sharp & Dohme) outside the United States and

Canada, is set to significantly move up the rankings next year fueled by its

cancer drug Keytruda, which witnessed a 55

percent increase in sales to US$ 11.1 billion.

Merck reported total revenues of US$ 41.75 billion and also

announced it will spin off its women’s health drugs,

biosimilar drugs and older products to create a new pharmaceutical

company with US$ 6.5 billion in annual revenues.

The firm had anticipated 2020 sales between US$ 48.8 billion and US$ 50.3 billion however this week it announced that the coronavirus pandemic will reduce 2020 sales by more than $2 billion.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

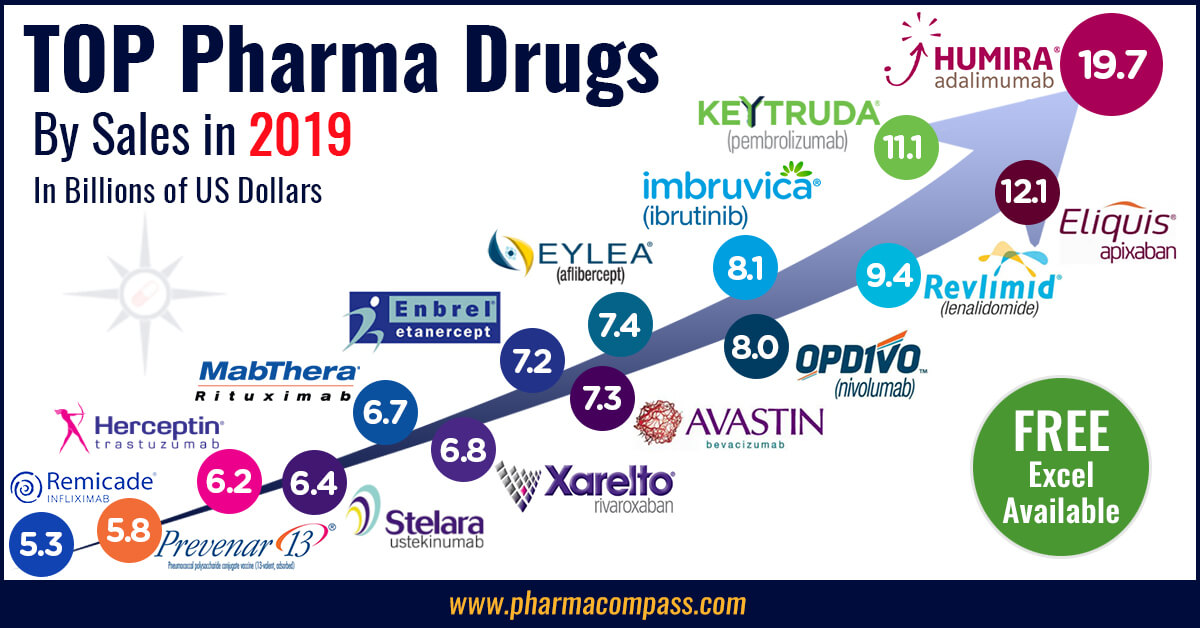

Humira holds on to remain world’s best-selling drug

AbbVie’s acquisition of Allergan comes as the firm faces the expiration of patent protection for Humira, which brought in a staggering US$ 19.2 billion in sales last year for

the company. AbbVie has failed to successfully acquire or develop a major new

product to replace the sales generated by its flagship drug.

In 2019, Humira’s US revenues increased 8.6 percent to US$ 14.86 billion while internationally, due

to biosimilar competition, the sales dropped 31.1 percent to US$ 4.30 billion.

Bristol Myers Squibb’s Eliquis, which is also marketed by Pfizer, maintained its number two position

and posted total sales of US$ 12.1 billion, a 23 percent increase over 2018.

While Bristol Myers Squibb’s immunotherapy treatment Opdivo, sold in partnership with Ono in Japan, saw sales increase from US$ 7.57 billion to US$ 8.0 billion, the growth paled in comparison to the US$ 3.9

billion revenue increase of Opdivo’s key immunotherapy competitor Merck’s Keytruda.

Keytruda took the number three spot in drug sales that

previously belonged to Celgene’s Revlimid, which witnessed a sales decline from US$ 9.69 billion to US$ 9.4 billion.

Cancer treatment Imbruvica, which is marketed

by J&J and AbbVie, witnessed a 30 percent increase in sales. With US$ 8.1

billion in 2019 revenues, it took the number five position.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Vaccines – Covid-19 turns competitors into partners

This year has been dominated by the single biggest health emergency in years — the novel coronavirus (Covid-19) pandemic. As drugs continue to fail to meet expectations, vaccine development has received a lot of attention.

GSK reported the highest vaccine sales of all drugmakers with

total sales of US$ 8.4 billion (GBP 7.16 billion), a significant portion of its

total sales of US$ 41.8 billion (GBP 33.754 billion).

US-based Merck’s vaccine division also reported a significant increase in sales to US$ 8.0 billion and in 2019 received FDA and EU approval to market its Ebola vaccine Ervebo.

This is the first FDA-authorized vaccine against the deadly virus which causes

hemorrhagic fever and spreads from person to person through direct contact with

body fluids.

Pfizer and Sanofi also reported an increase in their vaccine sales to US$ 6.4

billion and US$ 6.2 billion respectively and the Covid-19 pandemic has recently

pushed drugmakers to move faster than ever before and has also converted

competitors into partners.

In a rare move, drug behemoths — Sanofi and GlaxoSmithKline (GSK) —joined hands to develop a vaccine for the novel coronavirus.

The two companies plan to start human trials

in the second half of this year, and if things go right, they will file

for potential approvals by the second half of 2021.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Our view

Covid-19 has brought the world economy to a grinding halt and shifted the global attention to the pharmaceutical industry’s capability to deliver solutions to address this pandemic.

Our compilation shows that vaccines and drugs

for infectious diseases currently form a tiny fraction of the total sales of

pharmaceutical companies and few drugs against infectious diseases rank high on

the sales list.

This could well explain the limited range of

options currently available to fight Covid-19. With the pandemic currently infecting

over 3 million people spread across more than 200 countries, we can safely

conclude that the scenario in 2020 will change substantially. And so should our

compilation of top drugs for the year.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Impressions: 54752

In 2019, concerns over quality of medicines continued to dominate news headlines. The ‘sartan’ recall saga, which was triggered in July 2018 after

the European Medicines Agency (EMA) began reviewing medicines containing valsartan, for the presence of the carcinogenic impurity N-nitrosodimethylamine (NDMA),

continued well through the year and had a major impact on the global

pharmaceutical industry.

View our Interactive 2019 cGMP Compliance Recap Dashboard (Free Excel Available)

In 2019, French drugmaker Sanofi announced

it would recall popular heartburn medicine Zantac in the United States and Canada, after medicines containing the active ingredient ranitidine were also linked with the presence of NDMA.

Several generic drugmakers followed suit

and as concerns mounted over cancer-causing impurities in commonly used antacid, diabetes and blood pressure medicines, the EMA’s human medicines committee (CHMP) requested that marketing authorization holders (MAHs) for human medicines containing chemically synthesized active substances review their medicines for the possible presence of nitrosamines and test all

products at risk. The review will include all generics and over-the counter

(OTC) products.

View our Interactive 2019 cGMP Compliance Recap Dashboard (Free Excel Available)

In Spain, a drug mixup caused children to develop a form of werewolf

syndrome (a rare and curious condition that causes excessive hair growth) after

they were given a wrong medication to treat heartburn.

Swiss drugmaker Novartis battled data manipulation allegations involving

its US$ 2.1 million gene therapy Zolgensma and a new book titled ‘Bottle of Lies’,

by investigative journalist Katherine Eban revealed how quality and efficacy of

generic drugs is being compromised by companies in India and China, the two

main countries that produce these drugs for the US consumer.

The book release sent the FDA in damage control mode, with senior officials issuing statements supporting the agency’s generic drug framework.

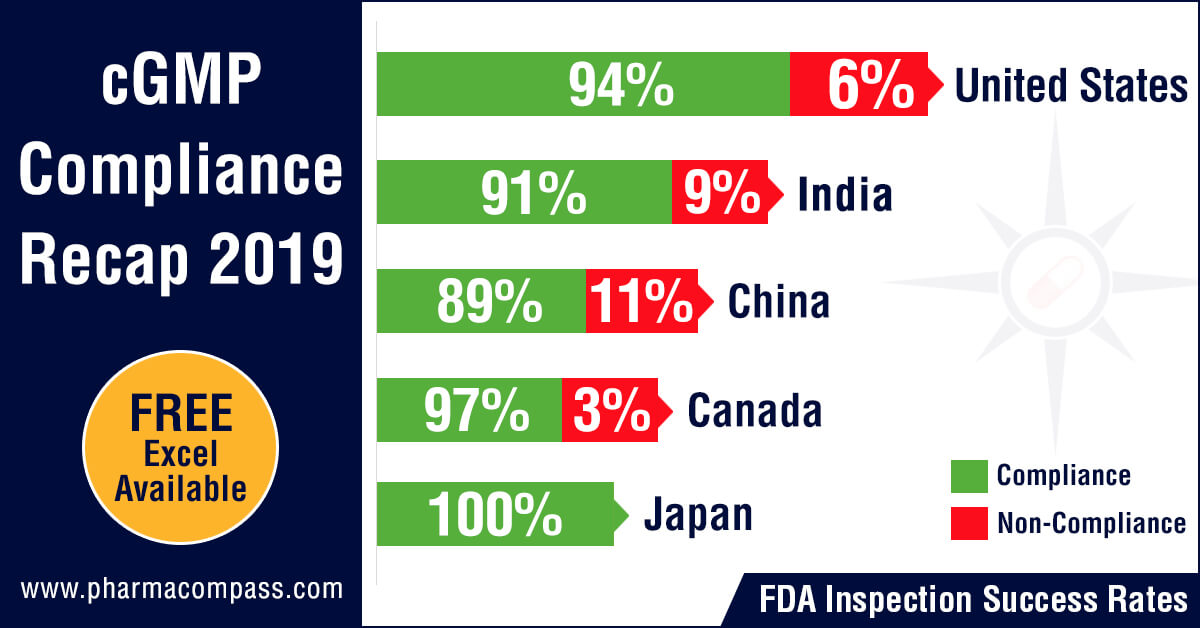

Inspection statistics

PharmaCompass reviewed the FDA and EDQM’s inspection statistics for the calendar year 2019 and found that the FDA’s Drug Quality Assurance division conducted 1,138 inspections with 2,280 inspections being performed by the member states of the EDQM.

The FDA was the most active in the United

States with 478 inspections followed by India where the inspection count was

193 and then in China where the count stood at 117.

With regard to non-compliance, there were 73 inspections which were classified as OAI (6.4 percent of the total number of inspections) by the FDA while the EDQM issued 20 non-compliance reports (0.87 percent of all inspections).

The highest number of facilities which failed to meet FDA’s standards were in the United States (29), followed by India (18) and then China (13). From an inspection success rate perspective, firms in the United States passed 94 percent of their inspections while the success rates in India and China were 91 percent and 89 percent respectively.

View our Interactive 2019 cGMP Compliance Recap Dashboard (Free Excel Available)

FDA investigators have identified persistent challenges while conducting foreign inspections, raising questions about the equivalence of foreign to domestic inspections. For example, while domestic inspections are almost always unannounced, FDA’s practice of pre-announcing foreign inspections up to 12 weeks in advance gives manufacturers the opportunity to fix problems.

A US Government Accountability Office preliminary analysis of FDA data revealed that from fiscal year 2012 through 2016, the number of foreign drug manufacturing establishment inspections increased. However, from fiscal year 2016 through 2018, both foreign and domestic inspections decreased—by about 10 percent and 13 percent, respectively. FDA officials attributed the decline, in part, to difficulty

in filling jobs abroad and on

the paucity of inspectors.

View our Interactive 2019 cGMP Compliance Recap Dashboard (Free Excel Available)

While the FDA is

actively working on increasing the number of inspectors, according to FDA

officials, it could take two to three years before the new staff is experienced

enough to conduct foreign inspections.

Concerns over

manufacturing quality in India re-emerge

In 2019, there was a surge of OAI

classifications and FDA warning letters issued to the manufacturing sites of

many major Indian pharmaceutical companies. The FDA issued warning letters to Aurobindo Pharma, Cadila Healthcare, Emcure Pharmaceuticals, Glenmark, Indoco Remedies, Jubilant, Lupin, Mylan, Strides and Torrent Pharmaceuticals.

There are more warning letters expected

as Form 483s issued after inspections at the facilities of Sun Pharma, Cipla and Lupin continue to reveal problems.

View our Interactive 2019 cGMP Compliance Recap Dashboard (Free Excel Available)

The Form 483 issued by the FDA, following the inspection at Sun Pharma’s Halol facility, highlighted that

Sun “failed to establish and implement controls which ensure data integrity” while Cipla’s finished

pharmaceuticals manufacturing facility in Goa got classified as Official Action Indicated (OAI) by the FDA following a September

2019 inspection in which the FDA investigators had issued a 38-page Form 483.

Regulatory actions lead to potential supply disruptions into

US

These regulatory actions have now begun to impact the supplies of

generic pharmaceuticals into the United

States. Injectable drugs, which constantly feature on the drug shortage list,

had Cadila and Pfizer announce the discontinuation of their supplies to the United States. Following FDA’s warning letter to Cadila, the firm informed the FDA that it would permanently cease production of injectable drug products for the United States.

In

2019, Pfizer announced that two manufacturing sites in India, which

it had acquired

through its US$ 17 billion acquisition of Hospira, will cease manufacturing operations.

The sites located near Chennai (Irungattukottai) and Aurangabad employed 1,700

people.

View our Interactive 2019 cGMP Compliance Recap Dashboard (Free Excel Available)

The

Irungattukottai site received an FDA warning letter in 2013

and in 2016, Pfizer halted production at the plant after a PIC/S (short for Pharmaceutical Inspection Convention and Pharmaceutical Inspection Co-operation Scheme) joint inspection with regulators from four international agencies — MHRA (Medicines and Healthcare products Regulatory Agency of the UK), USFDA (United States Food and Drug Administration), TGA (Therapeutic Goods Administration of Australia) and Health Canada — found various quality control problems.

Firms like Vital Laboratories and Alchymars ICM SM Private Limited, which had been issued warning letters in the past, were placed on import alert

by the FDA.

Concerns over

operations at firms responsible for valsartan recalls

The FDA

and EDQM both raised concerns over the operations at Lantech Pharmaceuticals Limited, a firm which undertakes contract solvent recovery for valsartan API manufacturing operations. Solvents recovered by Lantech and samples collected from Lantech’s equipment were found to contain mutagenic impurities.

Inspections at Lantech revealed that the firm failed to implement a procedure for investigating unknown peaks in recovered solvent chromatograms observed during analytical testing — an oversight which had led to the cancer-causing impurities not being detected in the ‘sartan’ APIs.

View our Interactive 2019 cGMP Compliance Recap Dashboard (Free Excel Available)

The FDA also raised data-integrity concerns at the facility as it was “routinely deleting recovered solvents gas chromatography (GC) data older than three months permanently, without any backup” and adequate controls.

As a fallout of the “sartan” recall, warning letters were issued to Mylan and Jubilant over their valsartan manufacturing operations.

Novartis’ data manipulation scandal

In a shocking announcement, the US Food

and Drug Administration (FDA) issued a press release on data accuracy issues with Novartis’ gene therapy — Zolgensma.

Zolgensma was acquired by Novartis in April 2018 when in a bid to secure its

leadership position in gene therapy, Novartis struck a deal to acquire Illinois-based AveXis Inc for US$ 8.7 billion.

The gene therapy, intended to treat children less than two years of age

with the most severe form of spinal muscular atrophy (SMA), is priced at

US$ 2.1 million, making it the world’s most expensive drug.

View our Interactive 2019 cGMP Compliance Recap Dashboard (Free Excel Available)

On May 24,

2019, the FDA approved Zolgensma and a month later, on June 28,

the agency was informed by AveXis (the product's manufacturer) that its personnel had manipulated data from an in-vivo

murine potency assay.

The FDA used this information to evaluate

product comparability and nonclinical (animal) pharmacology as part of the

biologics license application (BLA), which was submitted and reviewed by the

FDA.

According

to information shared by the FDA, the product that was administered in the

Phase 1 clinical trial was manufactured by a different process than the product

that was administered in the Phase 3 clinical trial and the animal toxicology studies.

Because

the manufacturing processes were different, interpretation of the overall

clinical trial and nonclinical study results depends on understanding the

characteristics of the Phase 1 version of the product in relationship to the

characteristics of the Phase 3 version of the product.

View our Interactive 2019 cGMP Compliance Recap Dashboard (Free Excel Available)

AveXis’ investigation report revealed that the firm became aware of

the data manipulation as early as on March 14, 2019, more than two months prior

to the BLA approval. However, AveXis did not inform the FDA of the issue until

over a month after the BLA approval. If AveXis had informed FDA of this issue

prior to the BLA approval, there was a possibility that the approval would have been delayed beyond the PDUFA goal date

of May 31, 2019.

The FDA

assessment, however, stated that although the BLA would have eventually been

approved, it is carefully assessing this situation and remains confident

that Zolgensma should remain on the market.

While managing the crisis, Novartis CEO Vas

Narasimhan acknowledged that the company could have handled the furor surrounding Zolgensma better.

Novartis’ AveXis fired its former chief scientific officer Brian Kaspar in connection with the data manipulation scandal, although Kaspar’s lawyer said he did nothing wrong and is ready to

defend his name as needed.

The Swiss

drugmaker could face possible civil or criminal penalties, the FDA has said.

Our view

Over the past years, PharmaCompass has

provided on-time coverage of quality concerns that have emerged at

manufacturing operations around the world. With the widespread use of generic

drugs and the majority of them being manufactured in India and China,

data-integrity within manufacturing operations and assurance of product quality

continue to remain key concerns.

View our Interactive 2019 cGMP Compliance Recap Dashboard (Free Excel Available)

While streamlined, compliant operations still seem like a

distant dream, in 2019, the former promoters of Ranbaxy, the Singh brothers

were finally arrested for misappropriating funds. The legal action was in

connection with their

stake sale in the Indian drug behemoth to Japanese drugmaker Daiichi Sankyo for US$ 2.4 billion.

The sale took place in 2008, months before the US Food and Drug Administration

(FDA) banned imports from two of Ranbaxy’s Indian plants as a result of widespread

data falsification by the firm. That was the start of troubles for the duo, as

Daiichi later took them to court for allegedly suppressing

and misrepresenting facts at the time of sale.

We hope there is a lesson in this for the industry so that

companies improve their practices of falsifying data and the focus shifts

towards patient safety rather than minimizing cost and maximizing profit.

View our Interactive 2019 cGMP Compliance Recap Dashboard (Free Excel Available)

Impressions: 12573

This week, Phispers has lots of interesting pharma news from the across the world, including an analyst’s take on why Pfizer should not split, Elder Pharma’s COO being caught bribing a government official and how Teva’s entry into PhRMA is being resented by other players. And, don’t miss the news on next-generation women who are changing the face of pharma and healthcare in India. GSK’s uses Apple’s ResearchKit, while Roche and Valeant face problems with clinical trials When it comes to clinical trials, this was certainly a week

of action. First, Swiss drug maker Roche reported that a late-stage clinical trial showed its new blood cancer drug – Gazyva – failed to deliver significant improvements over its older Rituxan

medicine. And then there was news regarding suicide risks linked to an experimental

Valeant

Pharmaceuticals drug used to treat psoriasis. The US Food and Drug Administration (FDA)

reviewers raised concern over

the suicide risk. This news followed similar news about the FDA

allowing

Juno Therapeutics to resume its clinical trial after the death of three patients.When it comes to clinical trials there was some exciting

news from GlaxoSmithKline

last week. GSK announced it is taking the next-generation approach to clinical trials by initiating a study on rheumatoid arthritis using Apple’s ResearchKit.

This is the first time a drug maker is using the health system for the iPhone

to conduct clinical research.GSK intends to record the mobility

of 300 participants over three months. The company will also ask these

patients to input both physical and emotional symptoms, such as pain and mood. The application created by GSK using ResearchKit comes with a guided wrist exercise that uses the phone’s sensors to record motion. This gives the drug company a standardized measurement across all users. The company will use the results to help design better clinical trials. GSK’s bulk drug plant in UK receives FDA’s warning letter for making contaminated drugs While still on GSK, there was some bad news too for the

British drug maker. FDA investigators at GSK’s API manufacturing facility in Worthing, UK, found penicillin

in non-penicillin manufacturing areas approximately 69 times in 2012, 72 times

in 2013, 30 times in 2014, and 16 times through July 7, 2015.Contamination of non-beta-lactam drugs with beta-lactam

drugs (such as penicillin) presents great risks to patient safety, including

anaphylaxis and death. There is no safe level of penicillin contamination, as

no level has been determined to be tolerable risk.As a follow up to the FDA inspection, GSK had to recall

various lots of Bactroban® (mupirocin calcium) products due to potential contamination with penicillin and foreign substances such as glass, paint fragments, and fibers.This is not the first time a facility has had manufacturing compliance issues. In late 2015, a European regulatory body suspended marketing of its drug – Zantac – across Europe for not dealing with a decade-old problem of manufacturing the drug at this facility. To split or not to split – that may no longer be the question before PfizerThere has been a lot of talk around Pfizer executives indicating that the American pharmaceutical bigwig may be split into different companies in order to bolster

shareholder value. This talk gathered momentum three months back, when it

scrapped the US $ 160 billion deal to acquire Allergan.However, the idea to split Pfizer was floated five years ago. It was intended to create two different companies – one would produce older drugs, while the other would focus on newer medicines. While a decision on splitting Pfizer is likely to be taken

later this year, one Wall Street analyst questioned whether the big drug maker should

actually be split. In a note to investors, Sanford

Bernstein analyst Tim Anderson suggested a split may not unlock “substantial additional” value for shareholders. Anderson forecasts a value of about US $ 36 a share, which

is roughly in line with the current stock price. And unlike in 2011, when

growth prospects seemed fuzzy, Pfizer seems to be in a better position today. Competitors resent Teva’s entry into trade associationTeva – the world’s largest generics player – was made a member of the Pharmaceutical Research and Manufacturers of America (PhRMA) last week. The trade association announced it had admitted

Teva along with rare-disease manufacturer Alexion

and specialty pharma Jazz.

AMAG

Pharmaceuticals and Horizon

Pharma also became full members, transitioning from research

associates.However, Teva’s peers are not exactly happy that the Israeli drug maker has joined their exclusive club. For instance, AbbVie argued against letting the copycat giant in. AbbVie claimed that by admitting Teva into PhRMA, the association would dilute its “emphasis on innovation” and spur “internal conflicts” between Teva and companies whose patents it seeks to invalidate.Apart

from being a top generics player, Teva is also into branded sales, thanks to multiple

sclerosis blockbuster drug Copaxone,

and to a lesser extent, the brands it acquired in its Cephalon

buyout. Teva had acquired the generics business of Allergan last year for US $ 40.5 billion. As a result, it is selling generic brands in the United States and Europe. In fact, all generic majors – including Dr. Reddy’s, Impax,

Mayne, Zydus Cadila,

Aurobindo,

Intas

and Torrent – have queued

up to acquire a band of products put on the block by Teva in Europe. FDA puts four companies that didn’t pay GDUFA fee on import alert. Over the last two years, companies like China’s Jiangsu

ZW Pharmaceuticals and Wuxi

Kaili Pharmaceutical Company, and India-based Fleming

Laboratories and Sharon

Bio-Medicine had received warning letters from the

FDA for failing to pay the GDUFA (Generic Drug User Fee Amendments) fees.This week, for the first time, the FDA used the authority provided by the Congress to enforce GDUFA’s user fee provisions and placed these firms on import

alerts. The FDA added the four companies (mentioned above) to a list

of generic drug facilities that are banned

from shipping products to the US since they have not paid the GDUFA fee and

have failed to meet identification requirements stipulated in the GDUFA of

2012. Next-generation women

in Indian pharma and healthcareIndia’s pharmaceutical and healthcare industry has traditionally been a male bastion. This is true of many other countries as well. However, according to a news

report published this week, a big change is sweeping across this immensely

technical and challenging business landscape. And a new crop of business

leaders has emerged in India that is coming up with game-changing ideas. “These women have added tremendous value in shaping these organisations,” says the news report.The story profiled five next-generation women – Namita Thapar (39), CFO of Emcure

Pharmaceuticals, Zahabiya Khorakiwala (33), Managing Director of Wockhardt

Hospitals, Tara Singh Vachani (29), CEO and Managing Director of Antara Senior

Living, Ameera Shah (36), Managing Director of Metropolis Labs and Samina

Vaziralli (37), Executive Director of Cipla. Elder Pharma’s COO bribes government official for preventing SFIO probeWhile the next-generation women are busy adding value to

their pharma business, another next-generation promoter of a pharma company was

indicted for bribing a government official.

Last week, the Central Bureau of Investigation arrested

a senior Ministry of Corporate Affairs (MCA) officer – B K Bansal – in Delhi for allegedly taking a bribe of Rs 9 lakh from Anuj Saxena, COO of Elder

Pharma, through a middleman for preventing a Serious Frauds Investigation

Office (SFIO) investigation pending against the company.Bansal was director general of MCA. At first, Bansal

demanded Rs 50 lakh, but later settled for Rs 20 lakh to prevent the investigation.

He was caught accepting the second tranche of the payment. Elder Pharma has been going through a crisis recently, after

the MCA red-flagged several discrepancies in its finances. The company had only

recently sold a major stake in the company. India’s pharma exports to US, Europe decline by 7 percent in Q1Over the last several months, we have been reading a lot of

news regarding compliance issues being faced by Indian pharma companies. Well,

all those compliance issues have begun to have a bearing on the financials of

Indian pharmaceutical companies. According to figures released by the Pharmaceuticals Export

Promotion Council (Pharmexcil),

the exports of Indian pharmaceuticals to Europe and the US witnessed a negative

growth of 6 to 7 per cent in the April to June quarter this year.Pharmexil will organise an interactive meeting with the joint

secretary of the Department of Commerce (DoC) to discuss the reasons behind this

decline in exports.Says P V Appaji, director general of Pharmexcil: “Though the Indian pharma exports performed well last year, we have seen a decline in pharma exports, particularly to the US market, in last three months.”

Impressions: 4545