By PharmaCompass

2025-09-04

Impressions: 6197

In August, the global pharmaceutical industry witnessed several regulatory upheavals and policy shifts in the US. The month began with the US President Donald Trump announcing that planned tariffs on drug imports into the US may reach 250 percent within 12 to 18 months.

In the last days of July, Vinay Prasad, the head of the US Food and Drug Administration’s Center for Biologics Evaluation and Research (CBER) had stepped down (reportedly under pressure). On August 12, Prasad was back at CBER as its head. Then, around the month end, the White House fired Centers For Disease Control and Prevention (CDC) director Susan Monarez after a clash with Health and Human Services (HHS) Secretary Robert F. Kennedy Jr. Four senior CDC officials resigned soon after.

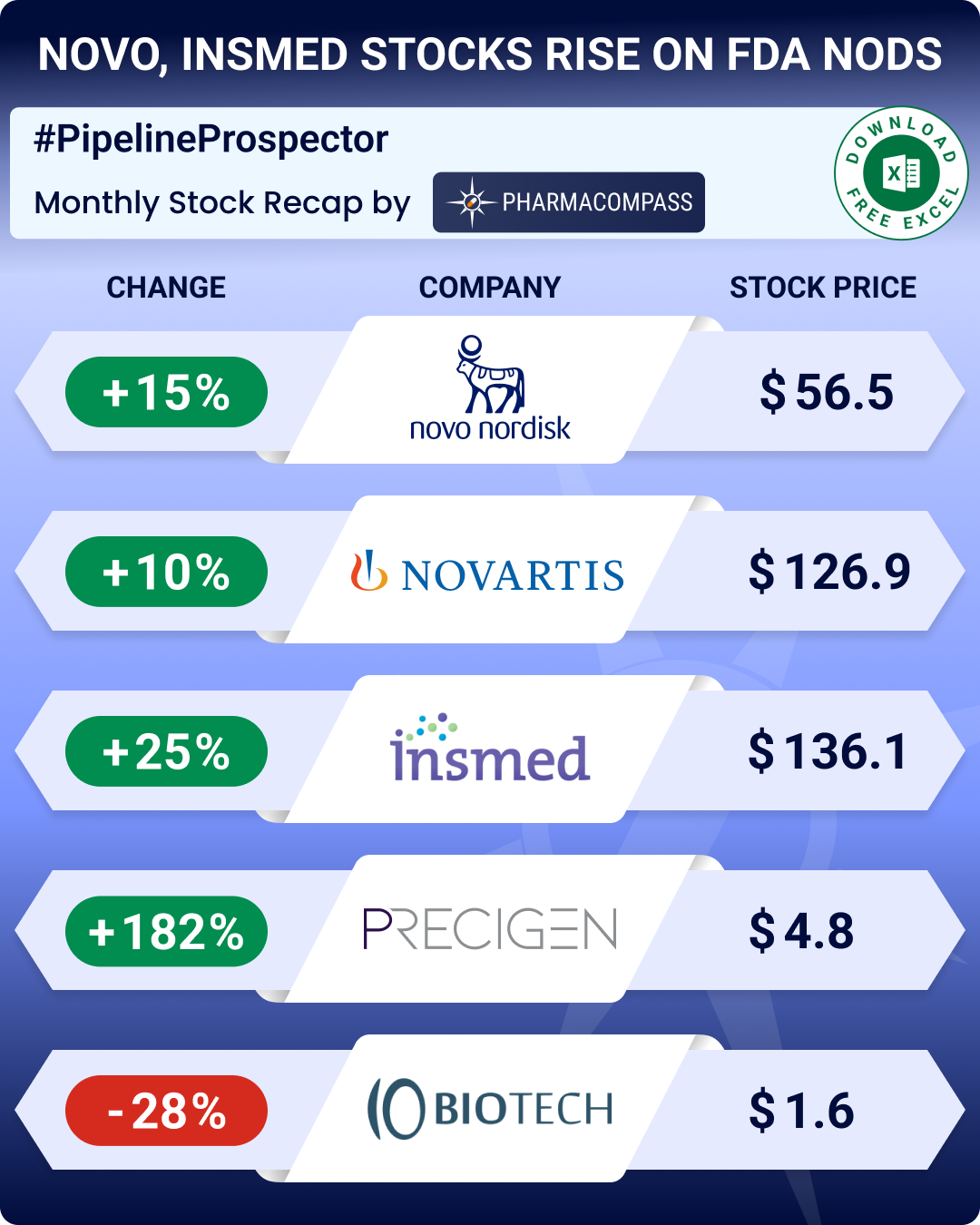

Despite this chaos, the pharma indices showed resilience and climbed upwards. The Nasdaq Biotechnology Index (NBI) rose 5.22 percent from 4,445.39 to 4,677.63. The SPDR S&P Biotech ETF (XBI) gained 5.92 percent from 84.83 to 89.85. And the S&P Biotechnology Select Industry Index (SPSIBI) climbed 4.9 percent from 6,671.56 to 6,998.36.

Access the Pipeline Prospector Dashboard for August 2025 Newsmakers (Free Excel)

Novo’s Wegovy gets approved for MASH; Precigen’s Papzimeos okayed for rare respiratory condition

The FDA granted accelerated approval to Novo Nordisk’s Wegovy (semaglutide) for treating metabolic-associated steatohepatitis, or MASH — a progressive liver disease linked to obesity. MASH causes inflammation and scarring of the liver. This approval makes the blockbuster obesity drug the first glucagon-like peptide-1 (GLP-1) receptor agonist approved for this condition.

The US regulator also granted an accelerated approval Hernexeos (zongertinib), a new drug from Boehringer Ingelheim, for adults with advanced non-small cell lung cancer (NSCLC) with specific HER2 mutations who have undergone prior treatment. In studies, the drug helped 75 percent of patients who had chemotherapy see their cancer shrink or disappear completely.

Insmed (stock up 25 percent in August) secured FDA approval for its med Brinsupri (brensocatib). This is the first treatment for non-cystic fibrosis bronchiectasis, a chronic lung disease that leads to persistent cough, recurring infections, and damage to the airways.

Maryland-based biotech Precigen bagged FDA approval for Papzimeos (zopapogene imadenovec-drba), making it the first treatment for recurrent respiratory papillomatosis. This is a rare condition that causes benign growths in the airway and voice box. Patients often require multiple surgeries each year to remove these growths, and until now there was no approved drug for this condition. Precigen saw its stock shoot up 182 percent during the month.

Access the Pipeline Prospector Dashboard for August 2025 Newsmakers (Free Excel)

Ionis’ Dawnzera becomes first RNA-targeting therapy for angioedema; Tonix’s fibromyalgia med okayed

Ionis Pharmaceuticals gained FDA approval for Dawnzera (donidalorsen), the first RNA-targeting preventive therapy for hereditary angioedema. This rare genetic disorder causes sudden and unpredictable swelling that can be life-threatening if it affects the airway.

New Jersey-based biotech Tonix Pharmaceuticals received approval for Tonmya (cyclobenzaprine), the first new fibromyalgia treatment in over 15 years. Fibromyalgia is a chronic disorder that causes widespread pain, fatigue, sleep problems, and memory issues.

Teva Pharmaceuticals won an expanded indication for Ajovy (fremanezumab) to prevent migraines in children between six and 17 years old.

Jazz Pharmaceuticals reported a mix of clinical and regulatory developments. Its drug Modeyso (dordaviprone) received accelerated approval for diffuse midline glioma, a rare and aggressive brain tumor that occurs in both children and adults. Jazz also strengthened its pipeline by licensing SAN2355, an epilepsy drug candidate, from Danish biotech Saniona.

Access the Pipeline Prospector Dashboard for August 2025 Newsmakers (Free Excel)

Novartis’ Sjögren’s disease med posts trial win; IO Biotech’s melanoma vaccine faces phase 3 setback

Novartis reported success for its investigational monoclonal antibody ianalumab in a phase 3 study in patients with Sjögren’s disease. This is a chronic autoimmune condition in which the body’s immune system attacks its own moisture-producing glands, leading to dry eyes, dry mouth, and other complications. Similarly, Regeneron announced positive results for cemdisiran in generalized myasthenia gravis, a rare condition that causes muscle weakness.

In negative news from trials, IO Biotech announced results from a late-stage trial of its experimental melanoma vaccine in combination with Merck’s Keytruda (pembrolizumab). Melanoma is a serious form of skin cancer. The vaccine’s benefits were not statistically significant. This setback dragged IO Biotech’s stock down by 28 percent over the month. The company still plans to file for FDA approval.

Allogene reported a patient death in a phase 2 trial on its CAR-T cancer therapy — cemacabtagene ansegedleucel. And Agios Pharmaceuticals disclosed that four patients taking its anemia drug Pyrukynd (mitapivat) had died, according to FDA’s Adverse Event Reporting System (FAERS) database.

Valneva faced a different kind of setback — FDA suspended the use of its chikungunya vaccine Ixchiq after 21 hospitalizations and three patient deaths, including one linked to encephalitis, a type of brain inflammation. With Ixchiq off the market, Bavarian Nordic’s Vimkunya is now the only chikungunya vaccine available in the US.

Access the Pipeline Prospector Dashboard for August 2025 Newsmakers (Free Excel)

Merck KGaA-Skyhawk in US$ 2 bn neurology deal; AbbVie acquires Gilgamesh’s psychedelic drug

Merck KGaA struck a strategic research deal worth more than US$ 2 billion with Massachusetts-based Skyhawk Therapeutics to develop RNA-targeting small molecules for neurological conditions. The deal, valued at over US$2 billion, includes upfront and milestone payments as well as tiered royalties on future product sales. Under the agreement, Skyhawk will lead discovery and preclinical work, while Merck KGaA will assume development and commercialization.

The month saw several sub-US$ 2 billion deals. Bayer signed a US$ 1.3 billion agreement with California-based Kumquat Biosciences to develop a cancer drug targeting KRAS mutations. These mutations are among the most common in cancer and occur in roughly 25 percent of cases.

Eli Lilly entered a US$ 1.3 billion partnership with Boston-based Superluminal Medicines, an artificial intelligence firm. The collaboration aims to identify small-molecule drugs for obesity and metabolic diseases.

Jazz Pharmaceuticals also licensed an epilepsy therapy from Denmark-based Saniona in a deal that could reach US$ 1 billion in value. And AbbVie acquired rights to Gilgamesh’s experimental psychedelic drug for depression for up to US$ 1.2 billion.

Moreover, there were reports of Novartis planning to acquire San Diego-based Avidity Biosciences in early August. Avidity is valued at about US$ 5.8 billion.

Access the Pipeline Prospector Dashboard for August 2025 Newsmakers (Free Excel)

Our view

While it may seem like it’s business as usual in the global biopharma industry, the recent slowdown in big-ticket M&A deals suggests undercurrents of caution. Innovation and strong pipelines are keeping the momentum alive, but escalating geopolitical tensions, drastic cuts in federal funding in the US and, a rise in protectionism the world over are forcing companies to rethink their risk appetite. This conservative shift, though understandable, also signals that innovation and global collaboration may stand to suffer.

Access the Pipeline Prospector Dashboard for August 2025 Newsmakers (Free Excel)

Pharma & Biotech Newsmakers in August 2025

| Company | Country | Currency | Market Cap (Bn) | Change In Market Cap (M) | Stock Price | Change In Price |

|---|

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : NOVO, INSMED STOCKS RISE ON FDA NODS by PharmaCompass license under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”