Acquisitions and spin-offs dominated headlines in 2019 and the tone was set very early with Bristol-Myers Squibb acquiring

New Jersey-based cancer drug company Celgene in a US$ 74 billion deal announced on

January 3, 2019. After factoring

in debt, the deal value ballooned to about US$ 95 billion, which according

to data compiled by Refinitiv, made it the largest healthcare deal on

record.

In the summer, AbbVie Inc,

which sells the world’s best-selling drug Humira, announced its acquisition of Allergan Plc, known for Botox and other cosmetic

treatments, for US$ 63 billion. While the companies are still awaiting

regulatory approval for their deal, with US$ 49 billion in combined 2019

revenues, the merged entity would rank amongst the biggest in the industry.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

The big five by pharmaceutical sales — Pfizer,

Roche, J&J, Novartis and Merck

Pfizer

continued

to lead companies by pharmaceutical sales by reporting annual 2019 revenues of

US$ 51.8 billion, a decrease of US$ 1.9 billion, or 4 percent, compared to

2018. The decline was primarily attributed to the loss of exclusivity of Lyrica in 2019,

which witnessed its sales drop from US$ 5 billion in 2018 to US$ 3.3 billion in

2019.

In 2018, Pfizer’s then incoming CEO Albert Bourla had mentioned that the company did not see the need for any large-scale M&A activity as Pfizer had “the best pipeline” in its history, which needed the company to focus on deploying its capital to keep its pipeline flowing and execute on its drug launches.

Bourla stayed true to his word and barring the acquisition of Array Biopharma for US$ 11.4 billion and a spin-off to merge Upjohn, Pfizer’s off-patent branded and generic established medicines business with

Mylan, there weren’t any other big ticket deals which were announced.

The

Upjohn-Mylan merged entity will be called Viatris and is expected to have 2020

revenues between US$ 19 and US$ 20 billion

and could outpace Teva to

become the largest generic company in the world, in term of revenues.

Novartis, which had

followed Pfizer with the second largest revenues in the pharmaceutical industry

in 2018, reported its first full year earnings after spinning off its Alcon eye

care devices business division that

had US$ 7.15 billion in 2018 sales.

In 2019,

Novartis slipped two spots in the ranking after reporting total sales of US$

47.4 billion and its CEO Vas Narasimhan continued his deal-making spree by buying New

Jersey-headquartered The Medicines Company (MedCo) for US$ 9.7

billion to acquire a late-stage cholesterol-lowering

therapy named inclisiran.

As Takeda Pharmaceutical Co was

busy in 2019 on working to reduce its debt burden incurred due to its US$ 62

billion purchase of Shire Plc, which was announced in 2018, Novartis also purchased

the eye-disease medicine, Xiidra, from the Japanese drugmaker for US$ 5.3 billion.

Novartis’ management also spent a considerable part of 2019 dealing with data-integrity concerns which emerged from its 2018 buyout of AveXis, the

gene-therapy maker Novartis had acquired for US$ 8.7 billion.

The deal gave Novartis rights to Zolgensma,

a novel treatment intended for children less than two years of age with the

most severe form of spinal muscular atrophy (SMA). Priced at US$ 2.1 million,

Zolgensma is currently the world’s most expensive drug.

However,

in a shocking announcement, a month after approving the drug, the US Food and

Drug Administration (FDA) issued a press release on

data accuracy issues as the agency was informed by AveXis that

its personnel had manipulated data which

the FDA used to evaluate product comparability and nonclinical (animal)

pharmacology as part of the biologics license application (BLA), which was

submitted and reviewed by the FDA.

With US$

50.0 billion (CHF 48.5 billion) in annual pharmaceutical sales, Swiss drugmaker

Roche came in at number two position in 2019

as its sales grew 11 percent driven by

its multiple sclerosis medicine Ocrevus, haemophilia drug Hemlibra and cancer medicines Tecentriq and Perjeta.

Roche’s newly introduced medicines generated US$ 5.53 billion (CHF 5.4 billion) in growth, helping offset the impact of the competition from biosimilars for its three best-selling drugs MabThera/Rituxan, Herceptin and Avastin.

In late 2019, after months of increased

antitrust scrutiny, Roche completed

its US$ 5.1 billion acquisition of Spark Therapeutics to strengthen its presence in

gene therapy.

Last year, J&J reported almost flat worldwide sales of US$ 82.1 billion. J&J’s pharmaceutical division generated US$ 42.20 billion and its medical devices and consumer health divisions brought in US$ 25.96 billion and US$ 13.89 billion respectively.

Since J&J’s consumer health division sells analgesics, digestive health along with beauty and oral care products, the US$ 5.43 billion in consumer health sales from over-the-counter drugs and women’s health products was only used in our assessment of J&J’s total pharmaceutical revenues. With combined pharmaceutical sales of US$ 47.63 billion, J&J made it to number three on our list.

While the sales of products like Stelara, Darzalex, Imbruvica, Invega Sustenna drove J&J’s pharmaceutical business to grow by 4 percent over 2018, the firm had to contend with generic competition against key revenue contributors Remicade and Zytiga.

US-headquartered Merck, which is known as

MSD (short for Merck Sharp & Dohme) outside the United States and

Canada, is set to significantly move up the rankings next year fueled by its

cancer drug Keytruda, which witnessed a 55

percent increase in sales to US$ 11.1 billion.

Merck reported total revenues of US$ 41.75 billion and also

announced it will spin off its women’s health drugs,

biosimilar drugs and older products to create a new pharmaceutical

company with US$ 6.5 billion in annual revenues.

The firm had anticipated 2020 sales between US$ 48.8 billion and US$ 50.3 billion however this week it announced that the coronavirus pandemic will reduce 2020 sales by more than $2 billion.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

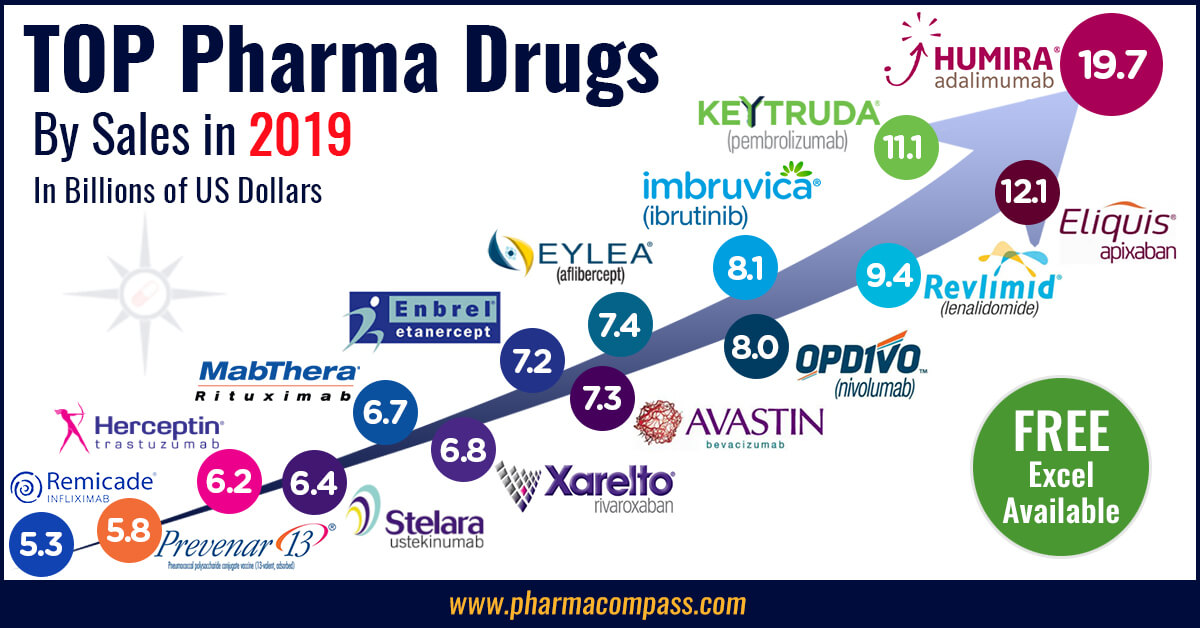

Humira holds on to remain world’s best-selling drug

AbbVie’s acquisition of Allergan comes as the firm faces the expiration of patent protection for Humira, which brought in a staggering US$ 19.2 billion in sales last year for

the company. AbbVie has failed to successfully acquire or develop a major new

product to replace the sales generated by its flagship drug.

In 2019, Humira’s US revenues increased 8.6 percent to US$ 14.86 billion while internationally, due

to biosimilar competition, the sales dropped 31.1 percent to US$ 4.30 billion.

Bristol Myers Squibb’s Eliquis, which is also marketed by Pfizer, maintained its number two position

and posted total sales of US$ 12.1 billion, a 23 percent increase over 2018.

While Bristol Myers Squibb’s immunotherapy treatment Opdivo, sold in partnership with Ono in Japan, saw sales increase from US$ 7.57 billion to US$ 8.0 billion, the growth paled in comparison to the US$ 3.9

billion revenue increase of Opdivo’s key immunotherapy competitor Merck’s Keytruda.

Keytruda took the number three spot in drug sales that

previously belonged to Celgene’s Revlimid, which witnessed a sales decline from US$ 9.69 billion to US$ 9.4 billion.

Cancer treatment Imbruvica, which is marketed

by J&J and AbbVie, witnessed a 30 percent increase in sales. With US$ 8.1

billion in 2019 revenues, it took the number five position.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Vaccines – Covid-19 turns competitors into partners

This year has been dominated by the single biggest health emergency in years — the novel coronavirus (Covid-19) pandemic. As drugs continue to fail to meet expectations, vaccine development has received a lot of attention.

GSK reported the highest vaccine sales of all drugmakers with

total sales of US$ 8.4 billion (GBP 7.16 billion), a significant portion of its

total sales of US$ 41.8 billion (GBP 33.754 billion).

US-based Merck’s vaccine division also reported a significant increase in sales to US$ 8.0 billion and in 2019 received FDA and EU approval to market its Ebola vaccine Ervebo.

This is the first FDA-authorized vaccine against the deadly virus which causes

hemorrhagic fever and spreads from person to person through direct contact with

body fluids.

Pfizer and Sanofi also reported an increase in their vaccine sales to US$ 6.4

billion and US$ 6.2 billion respectively and the Covid-19 pandemic has recently

pushed drugmakers to move faster than ever before and has also converted

competitors into partners.

In a rare move, drug behemoths — Sanofi and GlaxoSmithKline (GSK) —joined hands to develop a vaccine for the novel coronavirus.

The two companies plan to start human trials

in the second half of this year, and if things go right, they will file

for potential approvals by the second half of 2021.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Our view

Covid-19 has brought the world economy to a grinding halt and shifted the global attention to the pharmaceutical industry’s capability to deliver solutions to address this pandemic.

Our compilation shows that vaccines and drugs

for infectious diseases currently form a tiny fraction of the total sales of

pharmaceutical companies and few drugs against infectious diseases rank high on

the sales list.

This could well explain the limited range of

options currently available to fight Covid-19. With the pandemic currently infecting

over 3 million people spread across more than 200 countries, we can safely

conclude that the scenario in 2020 will change substantially. And so should our

compilation of top drugs for the year.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Impressions: 54752

In Phispers this week, there is news on how alternatives to Mylan’s EpiPen have eaten into its US sales. Warning letters posted by the FDA revealed that it considers seven of Wockhardt’s sites out of compliance and there is more trouble in the works for the former Ranbaxy promoters. And, Novartis faces punitive action in South Korea. Read on.

Mylan’s EpiPen sees drastic drop in market share in Jan-Feb 2017

Last year, Mylan was in

the news for hiking the price of EpiPen by

500 percent. At that time, there were no generic avatars of the

life-saving anti-allergy medicine available in the US market. But now, the

scenario has changed. Data from athenahealth network shows that prescriptions for alternatives of Mylan’s EpiPen have “quadrupled since the beginning of 2017”.

More than 60,000 prescriptions

for epinephrine auto-injectors, written for 50,000 patients by more than 1,400

healthcare providers in the US, were evaluated by researchers at athenahealth

between January 2016 and February 2017. The share of alternatives to

EpiPen have significantly increased in the last two months, as opposed to the

end of 2016.

“At the end of 2016, EpiPen alternatives made up only 5.3 percent of prescriptions for epinephrine auto-injectors. By the last full week of February, that figure had grown to 28.9 percent,” athenahealth said.

The key reason for this sudden and significant shift is the lower price tags of the EpiPen alternatives. Most of these alternatives are priced at a fraction of the cost of Mylan’s EpiPen. Moreover, insurers could also be affecting the prescription patterns. In January this year, health insurance company Cigna began to cover only generic options to EpiPen.

Seven of your facilities are out of compliance, FDA tells

Wockhardt

This week, US FDA posted

the warning letter issued to Wockhardt's US-based Morton Grove facility. The concerns raised by the investigators ranged from Wockhardt's “investigations into out-of-specification (OOS) test results” that were found to be neither thorough, nor timely, nor based on scientific rationales” to the “original results” that were “invalidated without scientific justification under the protocol and only re-test results were reported as part of batch release decisions.”

Of serious concern is the fact that in the warning letter the FDA has said: "At this time, seven Wockhardt facilities (including Morton Grove) are considered out of compliance with cGMP. These repeated failures at multiple sites demonstrate your company’s inadequate oversight and control over the manufacture of drugs. In your responses to the various actions listed above, including during multiple meetings with FDA, you have repeatedly discussed and promised corporate-wide corrective actions. Yet, when FDA inspects or returns to other Wockhardt facilities, similar violations are shown to persist.”

Second FDA warning letter to Megafine over "calibration records in trash”

Megafine

Pharma received its second

FDA warning letter in less than a year for its facility which manufactures active pharmaceutical ingredient (API) intermediates. The Megafine plant in Vapi (Gujarat) was inspected last September and once again data

integrity was the primary cause of concern raised by the FDA.

The facility was “issuing analysts with blank controlled document forms that had already been approved and signed”. Moreover, FDA investigators found torn, partially complete Quality Assurance-signed calibration records in the trash and saw QA staff shredding documents without reason.

In another observation, "analysts reprocessed data up to 12 times, and only included the final result in the report for review by Quality Assurance. Your Deputy Manager, Quality Control stated that it is common practice to ‘play with parameters’ to get the proper integration."

FDA investigators also noticed that the interior surfaces of the

drug manufacturing equipment were not as clean as required.

Megafine's API plant in Lakhmapur, Nashik, was placed on FDA's Import

Alert list in 2015.

Ghosts of Ranbaxy continue to haunt Singh brothers

Former promoters of Ranbaxy — Malvinder and Shivinder Singh — were directed by the Delhi High

Court to seek its permission before selling any of their unencumbered assets. This puts in jeopardy reported plans of the brothers to sell their stakes in companies like Fortis Healthcare and Religare, although the court hasn’t passed an outright injunction against such an exercise.

The Singh brothers have also

been directed to furnish details of all unencumbered assets in order to ascertain

that they have enough funds to cover an arbitration payment of more than US$

3.74 billion (Rs 250 billion) granted to Daiichi Sankyo by a Singapore tribunal

last year.

The brothers have been engaged

in a legal battle with Daiichi Sankyo, which bought out Ranbaxy in 2008 for US$

4.1billion. Daiichi had accused the Singh

brothers of misrepresenting the problems facing Ranbaxy when it acquired the

firm. In 2014, Daiichi sold Ranbaxy to Sun Pharma.

Investors demand cut in new GSK CEO’s prospective pay package

A number of investors in Britain’s largest drug company — GlaxoSmithKline (GSK) — are reportedly putting pressure on its board to reduce a proposed multi-million pound pay deal for its

new CEO, Emma Walmsley. They want Walmsley’s package to be sufficiently lower than the one awarded to her predecessor — Sir Andrew Witty — who is slated to retire later this month. His base salary is US$ 1.34 million (£1.1million) a year, while Walmsley’s proposed base salary is US$ 1.22 million (£1 million) a year, said news reports.

Some shareholders don’t think her proposed pay package fits Walmsley’s work experience. She is set to become Big Pharma’s first female CEO. But her resume is heavily tilted towards consumer products. Till recently, she was heading GSK’s consumer health joint venture. And prior to 2010 (a year when she joined GSK), she spent 17 years at cosmetics company — L’Oreal.

GSK is in “active consultations with shareholders” and is “acutely aware of the need for a balanced and responsible approach to remuneration,” a spokesperson said.

Children with AIDS write to India’s PM about Cipla’s Lopinavir

When the Indian government

failed to clear its dues, Cipla — the only manufacturer of Lopinavir syrup (a child-friendly HIV drug) — stopped

production of the drug. As a

result, children living with HIV (CLHIV) have written to Prime Minister

Narendra Modi for help.

The letter dated March 4 is

signed by 637 children ranging from ages three to 19. “The pharmaceutical company Cipla has in various forums cited delay in payments by the national program for the HIV medicines by several years and even non-payment of its dues in many cases. Profits on child doses of HIV medicines are small and delayed payments are having a chilling effect on the ability of the National AIDS Control Organization (NACO) to convince the company to participate in the bids it invited annually,” the letter said.

Cipla is the dominant player in

the Indian market across the HIV segment. Even though the Indian government has

failed to pay Cipla for consignments it had sent back in 2014, the company has

not stopped participating in government tenders.

The Health Ministry, on the other hand, says it has instructed State AIDS Control Societies (SACS) to purchase the drug from local markets. “An emergency tender has been placed but we have instructed SACS and state governments to purchase from local markets,” Arun Panda, Additional Secretary, Health Ministry, said.

Novartis faces drug ban in

South Korea over bribe issue

Novartis is

due to face additional

punitive measures from the health

ministry of South Korea later this month for allegedly providing illegal bribes

to local doctors in exchange for prescribing its drugs.

Last week, the Korean Ministry

of Health and Welfare said it is reviewing its own administrative actions

against Novartis Korea, which could take the form of a fine or a lifting of

insurance benefits on drugs sold by the company in South Korea. Novartis is

headquartered in Basel, Switzerland.

Last week, the Korean Ministry

of Food and Drug Safety had slapped Novartis Korea with a fine of US$ 174,937 (200 million won) and a three-month sales ban on 12 drugs, including variations of the company’s flagship dementia drug Exelon.

According to

the ministry, this 200 million-won fine is equivalent to a three-month ban on 30

drugs, including Novartis’ top-selling diabetes drug — Galvus.

Korea’s punitive measures against Novartis Korea have come a year after Seoul prosecutors began a probe into a massive bribery scam that involved the company’s executives and employees.

In August last year, six former and current Novartis employees in South

Korea were indicted over illegal practices to boost sales of the company's

drugs.

Samsung Bioepis wins high-stakes case against AbbVie’s Humira

There is more news from South

Korea. The Seoul-headquartered Samsung Bioepis, a biopharmaceutical company, won a high-stakes court case last week against US drug firm AbbVie for a biosimilar of the world's best-selling drug — Humira.

Samsung

is keen to sell a version of this

arthritis treatment in Europe sometime early next year. The biosimilar version

of Humira is pending approval by the European Medicines Agency (EMA).

This ruling of the England and Wales High Court Chancery Division of the Patents Court, while determining that the two patents covering AbbVie’s Humira are invalid, also said that AbbVie's indications pertaining to rheumatoid arthritis, psoriasis and psoriatic arthritis were unpatentable.

The other

claimant in this case is Tokyo-based Fujifilm Kyowa Biologics. In 2015, Humira

displaced Pfizer’s anti-cholesterol drug Lipitor by crossing US$ 14 billion in

sales.

Impressions: 3064